Accounting for climate change

By

Introduction

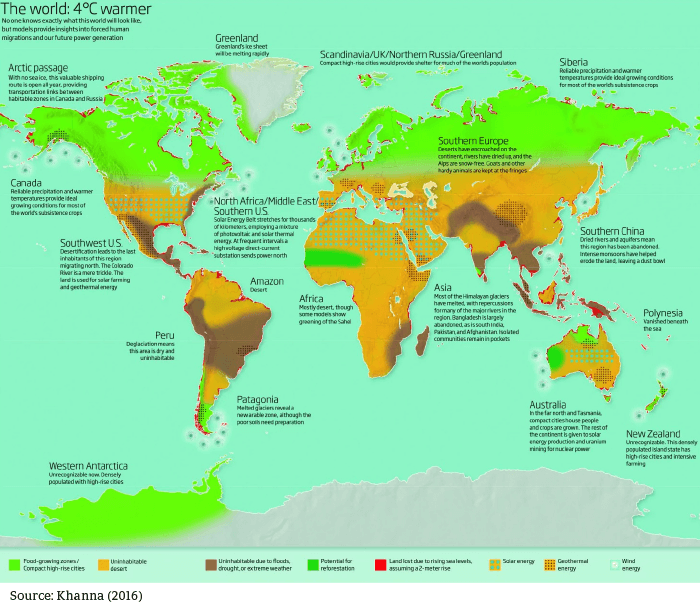

Unprecedented heatwaves around the globe this summer have started to sway some climate deniers to consider the possibility that climate change may be real. As the planet warms, and the very existence of human life is threatened, a concerted effort from professionals from a diverse array of backgrounds and with varied skills will be required to design and implement necessary adaptation and mitigation strategies in response to this global threat. Scientists, politicians, mathematicians, psychologists, economists and even accountants must learn to speak a common language and collaborate to tackle climate change without delay. If not, the preoccupations of their individual professions will pale in comparison with the prospect of a planet that is 4° C warmer.

As the planet warms, and the very existence of human life is threatened, a concerted effort from professionals from a diverse array of backgrounds and with varied skills will be required to design and implement necessary adaptation and mitigation strategies in response to this global threat.

Attribution science: the threat is real

The mainstream media is full of reports of this summer’s global heatwave, which has indiscriminately affected Europe, the US and Japan, among other areas. Extreme heat warnings have been issued for Europe, the likely hottest reliably measured temperature on record was recorded in Africa (Samenow, 2018) and the death toll continues to climb in Japan. However, a recent study of 127 news segments covering the heatwave found only one actually mentioned climate change (Stover, 2018). Ground-breaking work on attribution could well change that. Friederike Otto, a climate modeller at the University of Oxford, UK, is part of a team that has just published an attribution analysis of the heatwave in northern Europe (World Weather Attribution, 2018). This concludes that the probability of a heatwave was over twice as high as a result of human-induced climate change. In a podcast interview, Otto states, ‘We are able to quantify the effect of climate change in a specific location at a specific time of year… In the same way that you can say smoking causes cancer, we can say this heatwave was caused by climate change.’ Researchers have published more than 170 studies examining the role of human-induced climate change in 190 extreme weather events. A comprehensive analysis in Nature: International Journal of Science of these studies finds that several of these extreme weather events, notably heat, drought and rain/flooding, were made more severe or likely to occur by human influence (Schiermeier, 2018).

The ability to quantify and attribute extreme events to climate change is a significant step forward in uniting the efforts of a global community in combating this threat. Such attribution places responsibility for this summer’s extreme heat squarely on the shoulders of emitters of greenhouse gases and fossil fuel-burning nations. Attribution paves the way for the establishment of loss and damage mechanisms, which seek to apportion responsibility for the adverse effects of climate change and allocate financial compensation to those bearing this burden. This is a pressing area where finance professionals can contribute to the discussion and add value.

Climate financing in Bangladesh

Bangladesh is one of the most vulnerable countries in the world to the effects of climate-induced extreme weather events such as floods, flash floods, cyclones, storm surges, salinity intrusion and drought. For this reason, the country has long been ahead of the curve when it comes to acknowledging and understanding the impacts of climate change. The Bangladesh Climate Change Strategy and Action Plan (BCCSAP) was developed in 2009 by a team of national experts, and is a comprehensive document covering food security, social protection, disaster management, infrastructure, research, mitigation and capacity-building.

In order to finance the strategy outlined in the BCCSAP, the domestic Bangladesh Climate Change Trust Fund (BCCTF) was established in 2010. Allocations are made from the national budget to the BCCTF, which then disburses funding to climate-specific projects. The BCCTF has benefited from Tk 3,200 crore (almost $400 million) up to FY2018 approved a total of 560 projects to December 2017, according to a 2018 Ministry of Finance (MoF) report.

The Bangladesh Climate Change Resilience Fund (BCCRF) was established in 2010 to accept donor funds from a number of development partners. This has disbursed over $71 million to December 2016 on six large-scale projects. In an effort to mainstream climate change mitigation and adaptation, several government ministries are now allocating a portion of their annual budget to climate-related spending, totalling an estimated $1 billion per year (or 6–7% of the annual government budget).

The role of the accountant

With such significant sums invested in tackling this complex issue, it is imperative that proper governance is in place to oversee the management and use of these funds. There are four key areas where finance professionals, such as accountants, can play a role:

Accountability for expenditure

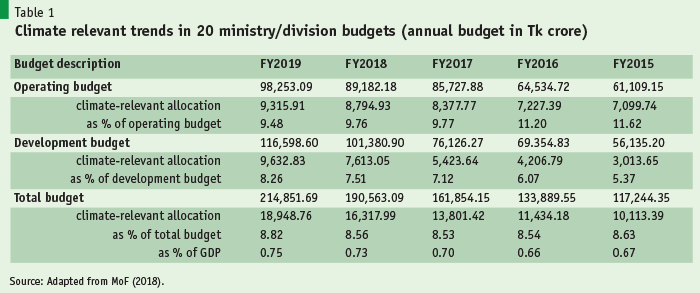

The MoF’s 2018 Budget Report, on ‘Climate Financing for Sustainable Development’, tracks ‘climate change relevant allocations’ from the budgets of 20 ministries/divisions for the 5-year period from Y2015 to FY2019 total of 8.82% of the budget allocations from these 20 ministries/divisions are considered climate-relevant, representing an increase of 0.19% over the 5-year period and an absolute increase of Tk 8,835.37 crore. Two questions immediately spring to mind: is this allocation sufficient for a country so inextricably affected by the threats of climate change, and, if so, how is such budgeted expenditure monitored and governed?

As Bangladesh faces significant climate-related threats from adverse events such as floods, cyclones, droughts, sea level rise and increasing salinity, expenditure on adaptation and, to a lesser extent, mitigation should be a priority for ministries concerned with environmental issues. Ministries included in the analysis include, among others, Agriculture, Water Resources, Disaster Management and Relief, Environment and Forests, Fisheries and Livestock, Food and Land: all are responsible for overseeing activities directly affected by the threats listed above. The climate-relevant expenditure budgeted for FY2019 for the 20 ministries/divisions outlined in the MoF report amounts to just 0.75% of gross domestic product (GDP), which seems a minimal amount considering the climate-related threats to GDP. As an example, rice is a significant economic driver in Bangladesh, providing 48% of rural employment, half of agricultural GDP and a sixth of national income. However, the floods in the Haor area in 2017 destroyed over 6 lak tonnes of boro rice, forcing Bangladesh, ordinarily a self-sufficient rice producer and exporter, to turn to neighbouring Myanmar for imports. The ability of one significant adverse event to threaten food security so dramatically is undeniable evidence that the Ministries of Agriculture, Disaster Management and Food should not underestimate the importance of mainstreaming climate-related expenditure into their budgets.

The MoF report also details an improved public finance tracking methodology that has been used to compile the analysis; however, this tracks budget data rather than actual expenditure. A budget-to-actual analysis of final government expenditure for each of the years covered by the report would be invaluable in identifying ministries/divisions that did not meet their targeted climate-relevant expenditure. Frequent and transparent budget-to-actual analysis throughout the fiscal year would enable the timely identification of lagging areas of expenditure, allowing for corrective action prior to the end of the budget cycle. A governance mechanism to track, monitor and enforce commitments to climate-relevant expenditure is an imperative tool for accountability; otherwise budget targets may remain simply that.

Establishment of a national loss and damage mechanism

As a world leader in climate adaptation and mitigation measures, Bangladesh is uniquely positioned to develop the first national loss and damage mechanism. Such a mechanism would determine the compensation to be allocated to those impacted by both slow-onset events, such as sea level rise, salinisation, desertification, increasing temperatures, land and forest degradation, loss of biodiversity, glacial retreat and ocean acidification, as well as extreme events, including storm surge, tropical cyclone, drought, flood and heatwave, whether for economic or non-economic losses. Economic losses comprise loss of income from business operations, agricultural production and tourism, as well as loss of physical assets such as infrastructure and property; non-economic losses can be defined at an individual level as life, health and human mobility, at a societal level as territory, cultural heritage, indigenous knowledge and societal/cultural identity and at an environmental level as biodiversity and ecosystem services. A national loss and damage mechanism would be based on the ‘polluter pays’ principle, allocating financial compensation to those suffering losses.

Bangladesh, by all accounts, is a nano-emitter (on both an absolute and a per capita basis) of greenhouse gases; does it therefore follow as logical that the country should bear the brunt of the costs of adaptation?

Accountants can play a role in assisting with the design and implementation of such a mechanism, including quantification and verification of losses, as well as identification of the trigger for pay-outs. The ground-breaking work on attribution referenced above could also play a critical role in determining the influence of climate change on loss and damage; however, apportioning responsibility for the effects of climate change is tricky. Bangladesh, by all accounts, is a nano-emitter (on both an absolute and a per capita basis) of greenhouse gases; does it therefore follow as logical that the country should bear the brunt of the costs of adaptation? Many believe that climate change is a global phenomenon, and hence its impacts should be addressed internationally. Article 9.1 of the Paris Agreement states, ‘Developed country Parties shall provide financial resources to assist developing country Parties with respect to both mitigation and adaptation in continuation of their existing obligations under the Convention.’ The use of the word ‘shall’ rather than ‘should’ implies a firm legal obligation for developed countries to provide financial support. Such contributions could form the basis for a loss and damage fund, further complemented by national sources, which could be used to finance the disbursement mechanism. Important questions remain unanswered, however, over the calculation, verification and timing of such contributions from developed countries. These are likely to be heavily contested, requiring input from both lawyers and accountants alike.

Forecast-based financing

Forecast-based financing (FbF), also known as forecast-based action (FbA) or early action, is an innovative mechanism that unlocks vital capital to catalyse critical action in the crucial days before the onset of a predicted climatic event or disaster. The main components are 1) triggers, 2) selection of actions and 3) a financing mechanism, which are summarised in Standard Operating Procedures (SOPs) (German Red Cross, 2017). There is typically a window of time for preparedness action before the onset of an extreme event, which can greatly reduce losses when the event occurs. However, such action is often hampered by a lack of access to finance. FbF aims to address this gap. As forecasting capacity improves, suffering and loss from disasters can be reduced, with money and resources also saved. As funding is provided in advance, FbF can be more cost-effective than relief efforts alone, particularly given exploitative, escalating market prices for necessities such as food, transport and fodder during a disaster.

There are a number of FbF pilot projects in Bangladesh, operated by organisations such as the International Red Cross and Red Crescent Movement, the START Network and the World Food Programme (WFP). WFP is implementing FbF in nine countries, including Bangladesh.

The Red Cross EU Office outlines the key steps of the process as follows:

- Understanding risk scenarios by including historical impact data and levels of vulnerability;

- Identifying available forecasts and using national and international data;

- Formulating early actions, such as awareness-raising or strengthening houses;

- Identifying danger levels;

- Creating an SOP, which includes the trigger, the pre-defined early actions, responsibilities, when to act, where to act and the funds to make available;

- Validating the SOP with key actors;

- Monitoring hydro-meteorological forecasts and assessing whether the danger level is exceeded, in which case early actions should be implemented according to the SOP.

FbF, then, could play an important role in mitigating the impact of climate shocks on those affected by extreme climate events in Bangladesh, such as floods, droughts and storms. The ability to unlock critical capital prior to such disasters occurring would built greater resilience to withstand loss and damage from these climate-related incidents. Early warning of impending disasters from reliable meteorological forecasts, coupled with an efficient funding mechanism to release timely disbursements based on pre-defined trigger events, would empower individuals and communities to take preventative measures to minimise the adverse impacts of such climate-induced hazards.

The development of FbF requires a collaborative effort to bridge the current gap between scientists developing forecasts and those responsible for action on the ground. Stakeholders can be associated with four main tasks: generating and disseminating forecasts (e.g. the Bangladesh Meteorological Department (BMD) and the Flood Forecasting and Warning Centre); developing triggers and identifying beneficiaries (e.g. research organisations); delivering early action (e.g. microcredit providers who have widespread last mile distribution networks); and providing financing channels (e.g. such as the UN Central Emergency Response Fund, the EU and the German Development Bank). Accountants can play a role in operationalising financing mechanisms, calculating allocations and disbursements and potentially linking development of a national FbF mechanism to the loss and damage framework described above.

Weather-based index insurance

Commonly called ‘index insurance’, weather-based index insurance is an innovative type of insurance that can reduce the vulnerability of small-scale farmers to the threat of climate change by safeguarding crops and livestock. Insurance pay-outs to farmers are based on an index such as rainfall, temperature, humidity or crop yields, as opposed to an actual loss. For example, payments to farmers who purchase rainfall index insurance to protect against drought would be triggered when the total rainfall over an agreed period between the contracting parties is below a mutually agreed upon threshold. Index insurance is less costly than traditional insurance since individual inspection of loss is not required, thus eliminating the need for expensive and time-consuming verification visits. As such, transaction costs are typically lower, making index insurance financially viable for insurers and, theoretically, affordable for small-scale farmers.

However, in reality, a subsidy (at least initially) may be required to encourage farmers to trial index insurance. The source of financing for such a subsidy remains unclear, as opinions within the government on the efficacy of index insurance vary. Furthermore, there is a moral question mark over whether it is appropriate to charge poor smallholder farmers for insurance to protect themselves from climate-induced effects that are attributable to developed countries. As noted above, the Paris Agreement stipulates that developed countries provide support; therefore, a pooled resource of international contributions could be a potential financing source to subsidise index insurance. Another challenge to the successful implementation of index insurance is the proliferation of microcredit in Bangladesh, as there is minimal incentive to insure crops if loans are freely available in the event of a poor harvest. The microfinance market has, in some ways, become a victim of its own success, as the availability of finance creates a vicious cycle of debt as new loans are drawn down to pay off maturing ones. Responding to successive crop failures with an increasing layer of loans is not sustainable; here, index insurance could provide a viable solution.

In Bangladesh, Pragati Insurance, Syngenta Foundation, the Asian Development Bank, Sadharan Bima Corporation, Green Delta and the International Finance Corporation are undertaking pilot index insurance projects, to determine a suitable, and profitable, model. If a successful, sustainable private sector model can be identified, setting a price point that is affordable to farmers and commercially attractive to insurance companies, this may circumvent the need for provision of a government subsidy. Reform to regulation will be required to implement a specific regulatory framework for index insurance; as such, legal expertise is also critical. In addition to insurance and legal professionals, accountants and actuaries have a role to play in determining trigger thresholds, defining pay-outs for various types of crops and weather events and calculating relevant premiums.

BACS is exactly the type of platform that will allow accountants to work alongside ministerial officials, climatologists, meteorologists, agronomists, academicians, disaster management specialists, researchers, actuaries, lawyers and others, and facilitate the necessary multi-sector collaboration required to tackle the problem of climate change head-on.

Bringing diverse stakeholders together: the Bangladesh Academy for Climate Services

This brief exploration of the role accountants can play in tackling climate change makes it clear that a diverse mix of actors are required to bring about action. As such, there is a need for a forum to unite professionals from a wide range of disciplines and promote cross-collaboration. The Bangladesh Academy for Climate Services (BACS), launched on 5 August 2018 at BMD in Dhaka, has exactly that objective. The academy itself was co-founded by a cross-sectoral partnership between four institutions: the International Centre for Climate Change and Development at Independent University, Bangladesh; the International Research Institute for Climate and Society at Columbia University; the International Maize and Wheat Improvement Center; and BMD. The vision of the academy is to create awareness around the need for better use and understanding of climate and weather information in Bangladesh, thus providing a common platform for various stakeholders involved in the creation, translation, dissemination and use of such information. The academy seeks to bridge the gap between the creators and users of climate information, and will offer a short training course in October 2018 for early to mid-level professionals and students working in diverse fields who are affected by climate problems in their sector.

BACS is exactly the type of platform that will allow accountants to work alongside ministerial officials, climatologists, meteorologists, agronomists, academicians, disaster management specialists, researchers, actuaries, lawyers and others, and facilitate the necessary multi-sector collaboration required to tackle the problem of climate change head-on.

References

German Red Cross (2017) ‘Forecast-Based Financing: A Policy Overview’. Berlin: German Red Cross.

Khanna, P. (2016) Connectography: Mapping the Future of Global Civilisation. London: Random House.

Ministry of Finance (2018) ‘Climate Financing for Sustainable Development. Budget Report 2018–19. Dhaka: Ministry of Finance.

Samenow, J. (2018) Africa May Have Witnessed Its All-Time Hottest Temperature Thursday: 124 Degrees in Algeria’. The Washington Post, 6 July. Accessed 11 September 2018.

Schiermeier, Q. (2018) ‘Droughts, Heatwaves and Floods: How to Tell When Climate Change Is to Blame’. Nature: International Journal of Science, 30 July. Accessed 11 September 2018.

Stover, D. (2018) Global Heat Wave: An Epic TV News Fail’. Bulletin of the Atomic Scientists, 19 July. Accessed 11 September 2018.

World Weather Attribution (2018) ‘Heatwave in Northern Europe, Summer 2018’. 28 July. Accessed 11 September 2018.