Why exports are under-performing

By

The bull run may be over

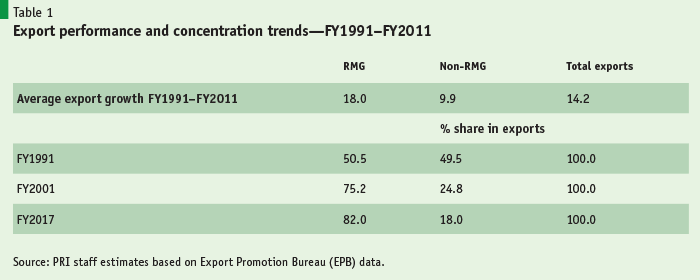

For two decades, from 1991 to 2011, Bangladesh’s exports were growing at a double-digit average annual rate of 14%. Ready-made garment (RMG) exports led the pack, averaging 18% growth in the period. Economists monitoring this performance were confident that finally Bangladesh had got a good handle on competing in global markets and our entrepreneurs were second to none. That period now looks like it was a bull run for exports. Since FY2012, this kind of export dynamism has given way to what analysts would consider very moderate performance, of barely 7% average growth. The latest figures for FY2018 are in, and the data is not flattering at all: total exports of $36.7 billion and growth of 5.8% over FY2017, with RMG growing at 9% and non-RMG exports declining 9%. What has gone wrong, if anything?

The latest figures for FY2018 are in, and the data is not flattering at all…

Table 1 reviews the data on export performance and growing export concentration. For 20 years from 1991, RMG exports growth averaged 18%, with non-RMG exports lagging behind with barely 10% growth. The result was more export concentration in RMG. Export diversification was stalled, if not stymied. This is not the kind of export growth that the Sixth and Seventh Five-Year Plans (FY2011–FY2015 and FY2016–FY2020) stipulate as the basis for rapid export-oriented manufacturing development that will lead to accelerated growth in gross domestic product (GDP) to reach 8% by 2020. Given the past two decades of stellar growth performance, the two Five-Year Plans have taken double-digit export growth with diversification for granted. It has not happened that way, and it is important to find out why.

Several questions come to mind. What happened? Has the bull run ended? What can be done? One thing is sure: the current state of our export performance should be a wake up call. Let us not waste time looking for the silver bullet; there is none. We need to let the facts speak for themselves.

Export under-performance

Two recent events have done much to dampen buyer interest in Bangladesh’s RMG: the Rana Plaza collapse and the Holey Artisan Café episode. Although it is to be hoped that these episodes are behind us, no one doubts they had a deleterious effect on our RMG exports, much worse than the global financial crisis of 2008.

Thanks to the combined efforts of the government, RMG entrepreneurs and two buyer initiatives on Fire and Building Safety (Accord) and Worker Safety (Alliance), though, we now have some of the most compliant RMG factories in the world, not to mention many of the top eco-friendly apparel factories. According to the US Green Building Council, Bangladesh’s RMG sector now has 67 Leadership in Energy and Environmental Design green factories, with 13 in the platinum category, the highest number in the world. This clearly bodes well for the future, though in the short term the sector has lost some cost competitiveness through making high-cost investments in order to go compliant. Some 1,000 factories are still considered non-compliant (fire and worker safety issues) and remain closed, costing jobs.

Is the slow global economic recovery to blame? Not any more, particularly as one of our main competitors, Vietnam, has shown stellar export performance in the past five years, clocking average growth of 13% compared with our 7% (Table 2). Vietnam’s total exports surpassed $227 billion in 2017, in an economy with a GDP of $223 billion! World Bank data reveals that Vietnam with $31 billion of apparel exports (HS61–62) in 2017 topped Bangladesh’s exports of $28 billion in FY2017 and $30 billion in FY2018. And Vietnam’s exports are diversified enough to include substantial exports of electronic goods (mobile phones), machinery and electrical products, footwear and agricultural products. The prospect of a US-led Trans-Pacific Partnership that included Vietnam was a disaster for Bangladesh, which ranks third in apparel exports to the USA after China and Vietnam. Even without this, Vietnam (now part of the less consequential Comprehensive and Progressive Agreement for Trans-Pacific Partnership) is growing its market share in the USA while Bangladesh’s clothing market share of 6% remains steady.

What has propelled Vietnam ahead in apparel exports when export destinations and buyers (brand name companies) are about the same? There is one striking difference between Bangladesh and Vietnam: the presence of foreign direct investment (FDI) in the economy. FDI has averaged 6% of GDP in Vietnam in the past five years ($14 billion in 2017) compared with barely 1% ($1.7 billion) in Bangladesh. Besides bringing capital, technology and management, FDI opens foreign markets and creates jobs. Vietnam’s apparel sector is largely FDI-driven, accounting for 60% of the industry; Bangladesh’s apparel industry comprises predominantly domestic investors (except in Export Processing Zones, EPZs). Given Vietnam’s positive experiences, it is high time to explore how to increase FDI in Bangladesh’s RMG industry, particularly outside the ambit of EPZs. Without this, Vietnam’s apparel exports appear poised to capture a greater share of markets in the USA and Europe, perhaps at the expense of Bangladesh.

Vietnam aside, doing nothing is no longer an option. Our frequent claim to be a ‘model of development’ is at stake. So are many of the ambitious development goals in our Perspective Plan 2021 and Sixth and Seventh Five-Year Plans. In case we are missing the point, robust export performance, dynamic export-oriented manufacturing development and accelerated GDP growth—the three principal targets of all our development plans—are closely interlinked and interdependent; one cannot be achieved without the others. Sadly, this strong message of interlinkage and interdependence is not getting through to where it is needed. We are being lulled into complacency by the repeated disclosure of high GDP growth, year after year, in spite of relatively weak export performance. The argument made by some is that domestic rather than external demand (from exports) is sustaining this higher GDP growth. If this is so, it would be another first for Bangladesh, as historical or cross-country evidence does not validate anything like this.

Lurking export dualism

PRI research has clearly demonstrated why, to come to terms with the new reality, we need to look at RMG and non-RMG exports differently. It is important to recognise the clear dichotomy in our export scenario. RMG is on a different track altogether as far as production structure, global demand and domestic policies are concerned. Non-RMG exports are a different kettle of fish, subject to a different policy regime at home and some variation in market access issues.

To be sure, the RMG sector has matured. Many other labour-intensive exports are waiting to take off. And nobody should write Bangladesh off in terms of global competitiveness. Analysts have recognised that we have the cheapest and hardest-working labour force (compensating for any productivity shortfalls), and some of the most dynamic first generation entrepreneurs, in the world. Adequate access to finance and sound trade infrastructure should propel Bangladesh’s exporters to seize a greater market share in leading and emerging world markets for the next decade as the country prepares to graduate out of least developed country status. Wages remain competitive, yet RMG exports still have room to grow, as the global market is vast and increasing. Australia, Canada and Japan have given us duty-free access, and emerging economies like China and India are also opening up their markets.

RMG is on a different track altogether as far as production structure, global demand and domestic policies are concerned.

In theory as well as in practice, with Bangladesh being a small exporter in the world market, external demand is not a major issue in the growth of RMG exports or exports in general. Our RMG exports make up barely 6% of the global market share. Meanwhile, a sizable market is emerging as China vacates its part of labour-intensive garment exports. The latest round of tit-for-tat tariffs between China and the US could help. Capturing 10% of China’s garment exports would more than double Bangladesh’s total exports and absorb almost all the new entrants into the labour force over the next decade. Bangladesh needs to act soon, though, as other competitors are already working aggressively to seize this market.

The stepchild of exports… non-RMG

Imagine for a moment our export basket devoid of RMG. That would leave our exports at only $6 billion in FY2018, with few sparks to show. As already described, non-RMG exports have been growing at an anaemic rate. Exports of non-RMG products as a group lagged well behind RMG for two decades from 1991, thus Bangladesh showed little or no progress in export diversification, despite ostensible commitment by all and sundry. We did, in FY2018, export some 1,350 distinct products (at HS six-digit level) to over 100 countries. Of the 2,500 tradable products produced domestically, more than 1,000 have been exported every year since FY2001. However, none of these rose in export volume to come even close to RMG. Export products that have recently crossed the $1 billion threshold include footwear and leather goods, home textiles and jute manufactures. The one policy support meted out to a selected number of non-RMG products a cash subsidy ranging from 5% (jute yarn and twine) to 20% (frozen vegetables). This practice of giving cash subsidies to selected exports has existed for decades (e.g. frozen shrimps) but there is no evidence to show that the share of concerned products has risen to become significant in the export basket. Research evidence across economies confirms this: subsidies are ultimately ineffective in boosting exports.

So what is keeping non-RMG exports from increasing their share in our export basket? The standard explanation is the economy’s ‘supply-side constraints’, such as its trade infrastructure (e.g. port inefficiency and congestion, poor road and rail transport infrastructure, power and gas shortages) and the generally high cost of doing business, which undermine the cost competitiveness of our exports. This is enough to take away the edge we gain from our labour cost advantage in the global market in labour-intensive products. While the ‘trade costs’ argument is a valid one, it must be noted that it adversely affects our export performance in general—both RMG and non-RMG—although, in the competition for infrastructure and other trade services, RMG exports receive preferential treatment, being the established export leaders by a long way. Even imports face these so-called ‘supply-side constraints’, raising trade costs in general, which ultimately undermines export competitiveness.

One economy, two trade regimes

This basic argument is not enough to justify the divergent growth rates of RMG exports vis-à-vis non-RMG exports. A close examination of the policy regimes to which the two export groups are subject reveals the real reason for the divergence. The RMG sector is the beneficiary of an exclusive trade regime (duty-free import of inputs under a bonded system; back-to-back Letter of Credit system where export receipts cover the cost of imported inputs; and tax-free exports), which is almost equivalent to a free trade regime. The system of duty-free imported inputs is not a policy support or incentive but a policy requirement for all exports in a regime of non-zero tariffs. The objective is to provide world-priced inputs in order to level the playing field in the global marketplace. If history is any guide, this has been the single most effective policy regime in making Bangladeshi garments price-competitive enough to capture the largest apparel markets in the world—Europe and the US. Markets are now opening up in the East (Australia, China, India, Japan) and in other emerging market economies in a global apparel export market that has a worth approaching $500 billion.

Despite all the export promise that we see in other labour-intensive items that are domestically produced, there is no similar policy regime for non-RMG exports, which means the incentive environment is not conducive to dynamic export performance. If export-oriented manufacturing development were the primary objective of policy-makers, we had right before us a policy regime that was working superbly, to adapt for all current and potential exports. But it seems we have chosen not to do this, ostensibly because we might lose revenue. For all the progress that has been made in ensuring duty-free imported inputs for non-RMG exporters, the policy regime is still discretionary and compares poorly with the RMG free-trade enclave. For instance, footwear exporters are selectively granted bonded facilities but with a host of conditions that deviate from the conditions that prevail for RMG. The labour cost competitive advantage of non-RMG exports thus remains significantly curtailed.

This is not all that hinders non-RMG exports. Domestic policies of industrial protection via high tariffs present a built-in anti-export bias that affects non-RMG exporters, as they have a choice to produce for export or sell in the domestic market. Protective tariffs are equivalent to subsidies on domestic import substitute production. And they tilt the balance of incentives in favour of domestic sales, because high protection and policies to ensure export competitiveness are not mutually exclusive. To the extent that protection raises the profitability of domestic sales over exports, it also results in perverse incentives and deters export diversification. Given that domestic producers (exporters and import substitute producers) have come to expect the prolonged existence of protective tariffs, it has become increasingly difficult to dismantle the protective structure. Export performance, particularly of non-RMG products, continues to flounder, as export markets appear less profitable than domestic markets.

Export demand is not a constraint

Bangladesh is a small player in the global export market. There is no dearth of demand for the labour- intensive manufactures that the country can produce competitively. And, of course, we can become even more cost-competitive through improvements in our trade infrastructure. But to establish a link between buyers in the global marketplace and our exporters, we need to access the multinational companies that are looking around the globe for suitable producers. This is how markets work these days. We can thus identify two more inter-linked reasons for the under-performance of exports, particularly in non-RMG: lack of value chain integration and limited FDI.

Fragmentation of production and vertical integration across countries through trade in intermediate goods is fast becoming the dominant trading pattern. With growing cross-border inter-industry linkages, called ‘value chain integration’, trade in intermediate goods has been the fastest-growing segment of international trade in the past 25 years or so. East Asian countries are known to be the biggest beneficiaries of this development, which is also driven by FDI from transnational corporations (TNCs). TNC presence through FDI and joint ventures is all over East Asia and the Association of South East Nations countries. TNCs effectively locate the production of parts and components of products from the cheapest and most efficient source. Bangladesh is not new to such global value chain integration. The RMG industry evolved through such inter-industry incorporation: initially, much of the yarn, fabrics and accessories in apparels had to be sourced from other countries, with the final fabrication (cutting and making) taking place domestically. Though much reduced, this interdependence still exists in RMG. But Bangladesh has been slow to pick up this predominantly export-oriented production feature in the non-RMG sectors.

The non-RMG export sector in Bangladesh therefore lacks both FDI and cross-border value chain integration, again unlike the RMG sector.

The non-RMG export sector in Bangladesh therefore lacks both FDI and cross-border value chain integration, again unlike the RMG sector. Bangladesh’s manufacturing industry is concentrated mostly in consumer goods, with policies favouring final consumer goods rather than intermediate goods. This all means there is no diversified intermediate goods industry, which would be the driver of value chain interdependence. It has also been repeatedly pointed out that the investment climate is still not welcoming for FDI, despite the liberal investment regime on paper. More than capital, FDI brings technology, management and market access. FDI inflows into some non-RMG sectors, like footwear and leather goods, could be the conduit to break into foreign markets in a big way.

Retail markets around the world are dominated by brand name products. To access these markets with any new products, it is not enough to be cost-competitive: you have to have the right partners (or buying houses of brand names) to open markets (e.g. for footwear, toys or electronics). So, for non-RMG exports to kick off in the world market in a big way, we need to do what we have done in the RMG sector. We have all the export success lessons right at our doorstep—but we constantly find reasons not to adopt these. This policy intransigence continuously saps our export performance.

So what are the takeaways from the latest export performance figures? First, the policy regime for the RMG sector is by and large on the right track and must be sustained. Second, RMG export dynamism can be restored, but with more FDI inroads into this leading sector. Third, the RMG policy regime (in particular duty-free bonded imports of intermediate inputs) must be given to ALL non-RMG exporters, small, medium and large. Fourth, we need to rationalise the protection regime to make non-RMG exports relatively more profitable than domestic sales. Fifth, trade facilitation must be geared up through improvements in soft and hard trade infrastructure (e.g. ports, customs, regulatory compliance, etc.) to ensure the cost competitiveness of our exports in a global market where demand is not a constraint. Finally, we can use the good name generated by the RMG success story as the capital in an all-out effort to woo TNCs for FDI and joint ventures in non-RMG sectors.

If these actions are done fast and done right, many more export success stories are bound to emerge.