Tax properties and corporate income tax

By

Introduction

As in all relevant matters of public economics, two basic questions should be addressed in dealing with the broad issue of tax policy. One is the tax burden we want to have, and the other one is the particular combination of tax bases and tax rates leading to the desired level of tax collection. Numerous hypotheses and explanations can be put forward to interpret the stylised facts of the existing tax models in each different country. All of them though can be framed in the context of two broad paradigms. One is the so-called “normative approach”, thereby public economics intends to give technical recommendations based on evidence or even judge. However contestable and widely diverse, these judgements are inspired on the assumption of a “benevolent dictator” type of government, which is committed to maximise some kind of social welfare function. Standard normative theory acknowledges that tax policy must comply with three fundamental properties. One is “efficiency”, which is meant to minimise negative effects of taxes on the allocation of resources induced by either consumers or producers. Under the assumption that market prices do contain the information needed for economic agents to take efficient decisions, taxes are usually considered a non-desirable interference which distorts the price information map.  Despite this being an appealing argument, it often collides with a world in which market imperfections are common and some taxes may even rectify non-desirable situations. Negative externalities are a case in point, as Pigouvian taxes may internalise external effects to the firm or individual consumers in the case some costs (benefits) are not fully accounted for. A second characteristic is that of “equity”. While various definitions of said concept have been made, a good starting point is the so-called ability-to-pay-principle, thereby those who can pay more must also contribute more. Even though we usually take for granted that income is a good measurement of that ability-to-pay, it should be borne in mind that this is only a good proxy, as there might be individuals and firms that produce a relatively low income (revenue), although they are capable of having a higher one if they decided to do so. Nonetheless, above principle collides with the “benefit principle” developed by Wicksell, thereby “just taxation” is best achieved by making public goods beneficiaries to directly pay for their use. A third property of the tax system is that of “simplicity”. Complex systems, in which different types of taxpayers are treated differently, are more difficult to administer and may lead to more tax elusion. Despite the need of tax collection being “sufficient” to cover actual government expenditures is often added as a relevant property, this is indeed exogenous to the tax policy itself, and may be conceived as a fiscal policy principle instead.

Despite this being an appealing argument, it often collides with a world in which market imperfections are common and some taxes may even rectify non-desirable situations. Negative externalities are a case in point, as Pigouvian taxes may internalise external effects to the firm or individual consumers in the case some costs (benefits) are not fully accounted for. A second characteristic is that of “equity”. While various definitions of said concept have been made, a good starting point is the so-called ability-to-pay-principle, thereby those who can pay more must also contribute more. Even though we usually take for granted that income is a good measurement of that ability-to-pay, it should be borne in mind that this is only a good proxy, as there might be individuals and firms that produce a relatively low income (revenue), although they are capable of having a higher one if they decided to do so. Nonetheless, above principle collides with the “benefit principle” developed by Wicksell, thereby “just taxation” is best achieved by making public goods beneficiaries to directly pay for their use. A third property of the tax system is that of “simplicity”. Complex systems, in which different types of taxpayers are treated differently, are more difficult to administer and may lead to more tax elusion. Despite the need of tax collection being “sufficient” to cover actual government expenditures is often added as a relevant property, this is indeed exogenous to the tax policy itself, and may be conceived as a fiscal policy principle instead.

Even though we usually take for granted that income is a good measurement of that ability-to-pay, it should be borne in mind that this is only a good proxy, as there might be individuals and firms that produce a relatively low income (revenue), although they are capable of having a higher one if they decided to do so.

The alternative view is the one developed by the Public Choice School, which stresses the fact that policymakers and politicians alike follow the same rational maximisation pattern of any rational agent. In this view, the State can be conceived as a “Leviathan” whose primary target is to extract rents from taxpayers. More recently, the so-called New Political Economy can be said to have renewed that paradigm by stressing the fact that pressure groups and political institutions play a major role in the way those kinds of private optimisation behavior works. In particular, well-designed institutions are meant to protect taxpayers from the Leviathan, leading to better collective decisions on tax policy matters. In this regard, the way in which members of parliament are elected, the presidential versus parliamentary nature of the country in question, the autonomy given to state organisms such as the Central Bank and the degree of fiscal decentralisation – among other features, are key factors in the establishment of sound tax policies.

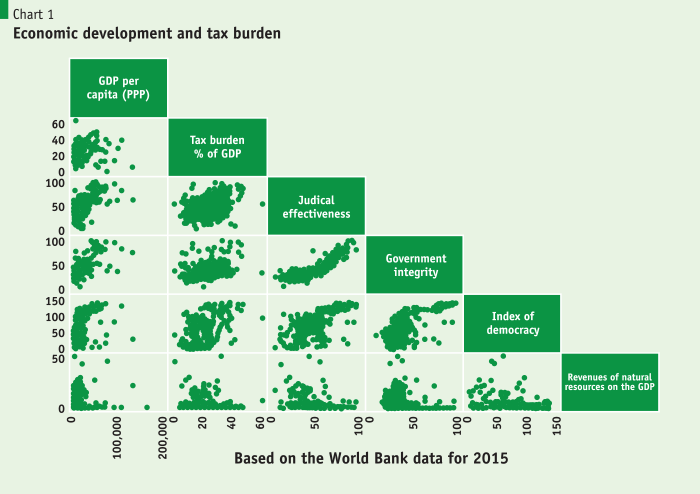

Aggregate tax burden

We may hypothesise that country’s tax burden is related with at least four aggregate variables. One is the GDP per head, which is meant to proxy an ample array of country´s characteristics. In particular, we may expect that as the GDP per head raises, the set of political preferences change as well, making public goods more intensively demanded. At very early stages of development, demand for food and shelter is likely to be prioritised, they being typical private goods. At the other end, residents of developed countries are more likely to demand more services, such as education, health and culture, all of which contains an important public good component. In this regard, it comes to no wonder that a positive trend exists between the GDP per head and tax burden. Expectedly though, this relationship is conditioned upon other factors, which determine the extent to which the country´s constituency can freely express its willingness to pay taxes. This is likely to depend on various factors. First, it depends on the width and depth of democracy, as this is the mechanism that captures people preferences. Second, collective action critically depends on trust, as only a reliable and well-functioning State will make tax paying worth the money. We examine three indexes that condition that trust. They are “property rights”, “judicial effectiveness” and government integrity”, all of them being positively related to tax burden. Regardless of country´s institutional development, a feature worth considering is the extent to which governments can easily generate revenues from specific sources. This is usually the case of natural resources, as they may are often exploited by State run companies and/or provide a large share of tax revenues. The abundance of natural resources may lead to some degree of tax laziness, which reflects in a rather negative effect on tax burden. Chart 1 presents the basic stylised facts on the way all these variables relate to each other, and provides prima facie evidence on the hypotheses above.

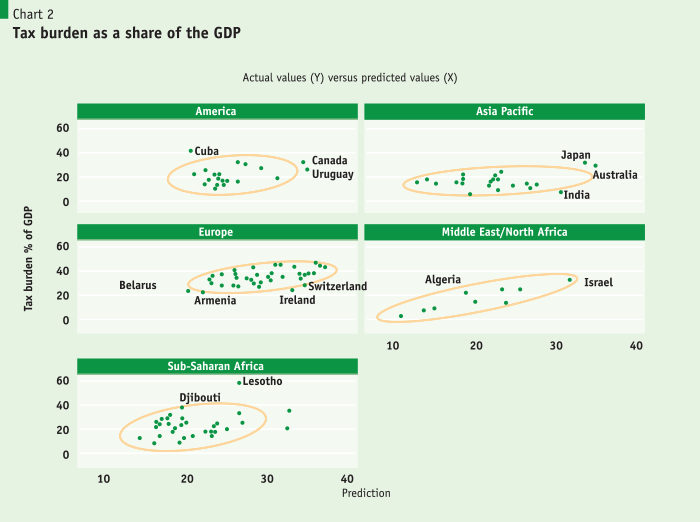

If purely normative principles depicted above were to predominate, all countries at the same level of development would converge on a similar tax policy and tax burden. However, some role should be given to history, to country´s idiosyncratic background and even more importantly, to the so-called ‘political economy’ of taxation. History is full of specific events, some of which change people preferences about taxation or even deviate fiscal policies from the choice of the median voter. This is the case of natural disasters, wars, economic and political crises and the like. As for ‘culture’, this is said to be a difficult to change institution, which creates a significant path dependency. Regarding the political economy factor, this hinges upon the role played by private interest groups in the making of the current fiscal and tax policies. To some extent, we may expect that both the tax burden as well as the tax structure will respond to the relative strength of private interests, as they may lobby MPs and the government itself to make tax policies more akin to their particular interest. It follows that, even beyond variables considered in Chart 1, across country differences will persist regardless of the GDP per head and other fundamental factors.

To see this in closer inspection, we must ‘control’ for all measureable variables that explain tax burden and then compare predicted values with the real ones of countries in the sample 1. Chart 2 below shows the outliers of all countries being grouped by area. While the actual tax burden is measured in the vertical axes, its predicted values are measured in the horizontal axes. All countries being singled out report a special situation relative to the other cases within the group. Because of historical reasons, Cuba is expected to exhibit a high tax burden. Similarly, Canada and Uruguay have a well-known record of relatively high taxes as compared with similar countries in the group. Japan and Australia have a significantly higher GDP per head within the Asia-Pacific group, the opposite case being India. The case of Africa deserves separate mention, as some countries have a significant underground economy, which makes it likely for them to exhibit a high tax burden on the recorded share of the GDP. This is likely to be the case of Lesotho.

Equity and simplicity

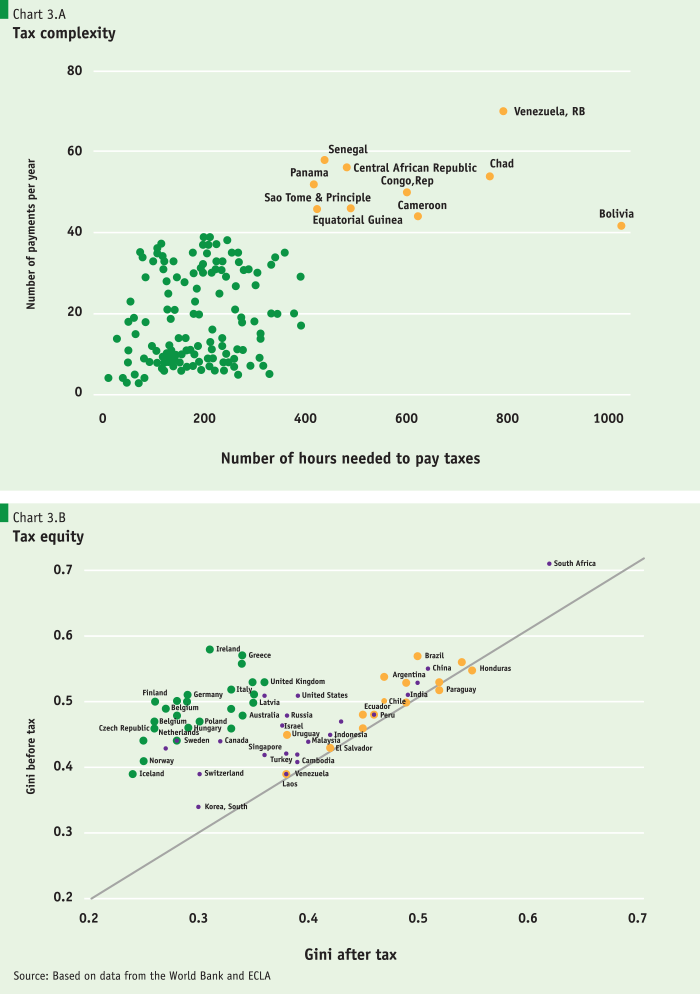

Charts 3 (A and B) stand for two of the properties referred to above. Two proxies of complexity are depicted in Chart 3A. They are the ‘number of hours needed to pay taxes’, and the ‘number of payments per year’. We observe great variation across countries. While this should have some effect on tax evasion and economic performance, this is difficult to detect from the data, as many other variables are involved. Nonetheless, all top of the list countries within the ‘tax complexity area’ have a relatively low GDP per head and a general poor economic performance over recent years, as is the case of Venezuela and Bolivia.

A weak redistribution through taxes might be complemented with a strong equity oriented government´s expenditure, so that low income tax payers can be more than compensated by better pensions, better public education and more accessible health care systems, among other benefits.

Chart 3B shows the effect of taxes and transfers on the original value of the GINI coefficient, which measures the income-based equity by country 2. Interestingly, the difference between ‘after’ and ‘before’ taxes value of the GINI coefficient is quite small for most Latin American countries and some of the Asian countries being reported. This tells us something about the technical and political factors behind the effort to make the tax system more equitable. Generally, high GDP per head countries appear to make an extensive use of taxes to improve income distribution. The question remains as to whether this reflects a political option being freely taken by local constituencies, or it is the result of a different set of restrictions being faced by countries at different levels of development. If this were the case, the political economy of taxation is likely to play a key role in understanding tax burden and tax policies. While some evidence suggests that tax reforms are usually triggered by economic crises, international influences and ideological factors, this same evidence suggests that a combination of weak institutions and strong pressure groups may have a significant effect on the way tax policies are designed 3. From a purely normative point of view, it has been argued that the use of taxes to redistribute income is not an efficient policy option. A weak redistribution through taxes might be complemented with a strong equity oriented government´s expenditure, so that low income tax payers can be more than compensated by better pensions, better public education and more accessible health care systems, among other benefits. The case of Chile is a good example in this regard. Despite taxes have no significant effects on the distribution of income, government´s expenditure has been much focused on those who need it the most, the result being a dramatic decline in the poverty rate over the last 30 years.

Corporate income tax

A key tax policy question refers to why private legal entities should actually pay taxes. No clear-cut reasons exist for that, as these entities are owned by individual taxpayers who pay taxes on their own personal income. It follows then that legal entities should be waived from paying taxes. Two reasons can be put forward to contest that view. First, private companies are said to make a more intense usage of public services as compared with individual taxpayer. Most of the state run regulatory systems that oversee environmental problems, non-competitive practices and a wide range of labor related matters are mainly focused on the current functioning of private enterprises. As this generates significant costs, a basic Wicksellian principle suggests that legal entities should also pay taxes. Second, the market value of a business is highly sensitive to public investment on basic infrastructure. An improvement in the access to local services commonly used by local commercial activities, such a better public transportation and/or better access to basic services in general may have an important effect on the present value of revenues generated by firms. It follows that said type of improvements are likely to generate radical and sudden changes in the distribution of wealth, which are difficult to tax. A small bakery shop may experience variations on its market value that go far beyond its capacity to pay a ‘fair’ tax on the corresponding public-induced capital gain. Since most small and very often medium sized businesses have little or even no access to the capital market, the only way to give back some of the benefit from this public service betterment is through a tax on profit.

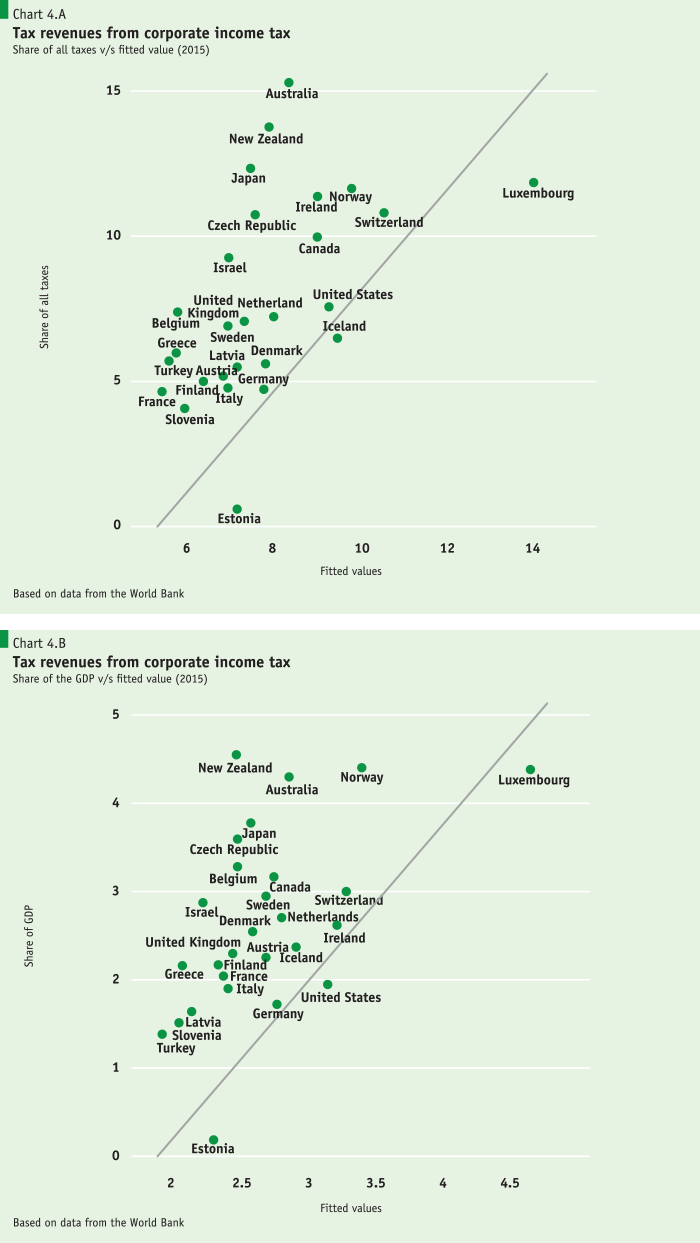

Chart 4A and 4B show the relationship between actual revenue collection from the corporate income tax (vertical axis) versus the expected value of that same variable based upon a set of related variables that might explain this share (fitted values) . Countries far apart from the diagonal line exhibit a significant deviation of this source of taxation relative to the expected (fitted) value 4. While Chart 4A refers to the CIT as a share of all tax revenues, Chart 4B shows the same as a share of the GDP. Several reasons may explain the difference between actual and fitted values. First, businesses usually pay other taxes other than the corporate income tax, such as social security contribution and other related charges. To this must be added that several rebates and tax holidays may lead businesses of all sort to pay more (less) than expected.

Two aspects of the CIT deserve special attention. The first one relates to the so called ‘integration’ of this tax with the personal income tax. While some countries like Australian, Estonia, Canada and Chile do have some type of integration, many others do not, which severely affects competitiveness and blurs the relationship between the tax rate which is paid de jure, and the one which is actually paid. Integration in this case means that taxes being collected from distributed profits are made into a credit on the personal income tax paid by the firm’s owners. In the absence of this integration, owners would pay twice on the distributed profits- once because of the profit being made by the firm itself as a legal entity, and once because of the tax paid on distributed profits by individual taxpayers. In principle, some difference between the two should exist, since the country as a whole should assign a different social valuation to non-distributed profits, and profits being distributed and then used for private consumption. Nonetheless, an imperfect or null integration is likely to lead to a strong disincentive to generate rents out of profits, which might have important effects on private investment.

While some countries like Australian, Estonia, Canada and Chile do have some type of integration, many others do not, which severely affects competitiveness and blurs the relationship between the tax rate which is paid de jure, and the one which is actually paid.

As stated before, retained profits are formally part of the country’s private savings and their use should be devoted to investment, which is a socially desirable aim. Nonetheless, the range of uses that companies can make with this funding is a separate matter, as new capital goods may potentially have a direct (or indirect) benefit to private owners. Under the assumption that such a matter is well regulated, a second consideration has to be made on the extent to which non-distributed profits are given some preferential tax treatment. One feasible formula consists in keeping a low tax rate on non-distributed profits as compared with the personal income tax, which might (or might not) be integrated in the way we defined above. A full integrated system with a low CIT is likely to have significant benefits on private investment. However, several intermedium options may exist. They go from partial integration – thereby only a share of the CIT is used as a credit on the personal income tax, to a scheme in which the potential tax to be paid when profits are fully distributed remains as ‘loan’ given to the firm. While they may pay interests as if it were a regular loan form a bank, this might have subsidised interest rate that rewards retained profits. This is an interesting formula, since in most cases small and medium sized firms in developing countries have no access to the capital market. This being the case, funding investment out of non-distributed profits is a recommendable tax policy option.

Notes

- This stands for running a regression of country´s tax burden on all explanatory variables in Chart 1 and then obtain predicted values from that regression.

- The GINI ranges between 0 (perfect equity), up to 1 (the riches segment of the population gets all the GDP).

- For a comprehensive discussion on the matter see; Letelier L and Davila M. (2015) “The Political Economics of Tax Reform in Chile”, New Political Economy, Vol. 20, N. 6.

- This filled value is based on a prediction from a simple regression whose covariates are; the actual rate of the CIT, the “de jure rate” of the CIT, and the GDP per capital.