Is the telecom regulator on a path to kill the golden geese?

By

Introduction

Telecom sector has been the fastest growing sector in Bangladesh in terms of telecom and internet penetration and paying taxes to the government. Bangladesh’s telecom sector has leaped frogged to reach the high penetration level comparable to many upper middle income countries and in terms of technology platform with its rapidly expanding 4G network the state of technology is comparable to the levels of industrial countries. Through increased competition and better technology, the sector is able to offer telecommunication and internet services at the cheapest rates when compared globally. Despite regulatory bias in favor of the public sector mobile company Tele Talk, this sector is dominated by the foreign private sector operators in terms of ownership structure and foreign capital investment.

Notwithstanding these important achievements of the telecom sector led by the private telecom operators, the sector has been burdened with excessive taxation and the relationship between the telecom operators and the regulator has recently become very acrimonious to the point that Bangladesh Telecommunication Regulatory Commission (BTRC) has served show-cause notices why the licenses of the two largest operators would not be suspended and the telecoms had to seek protection from the court against the notices sent by BTRC on the ground of non-payment of taxes and penalties based on BTRC/NBR audit reports. The two telecoms however strongly contested the findings of the audit and asked for appropriate arbitration for settling the dispute. The dispute has unsettled the telecom sector, slowed down investment in the sector and depressed the stock prices of the largest telecom operator Grameenphone (GP).

Against this background, this paper reviews the recent developments in the telecom sector, and underscores the importance of healthy and constructive engagement between the regulator and the operators for further development of the sector. The relationship between the regulator and the major operators have now reached to such a low point that, if allowed to persist, it would not only seriously undermine future investment and development of the telecom sector but also vitiate the overall perception about foreign direct investment (FDI) in Bangladesh. The paper also looks at the current taxation structure of the telecom sector which is considered to be the most burdensome from a global perspective. A number of practical suggestions are offered to resolve the outstanding disputes and address the tax policy induced distortions which are likely to undermine future investment and growth of this sector.

Against this background, this paper reviews the recent developments in the telecom sector, and underscores the importance of healthy and constructive engagement between the regulator and the operators for further development of the sector. The relationship between the regulator and the major operators have now reached to such a low point that, if allowed to persist, it would not only seriously undermine future investment and development of the telecom sector but also vitiate the overall perception about foreign direct investment (FDI) in Bangladesh. The paper also looks at the current taxation structure of the telecom sector which is considered to be the most burdensome from a global perspective. A number of practical suggestions are offered to resolve the outstanding disputes and address the tax policy induced distortions which are likely to undermine future investment and growth of this sector.

Recent Developments in the Telecom Sector

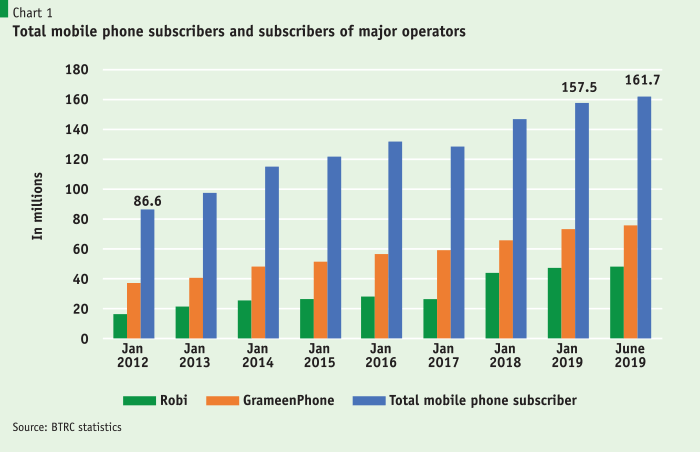

The telecommunication sector has played the major and leading role in the realization of Bangladesh’s vision of achieving ‘Digital Bangladesh’. Since the industry started to grow, the mobile subscriber base has grown by 82%, from 86.6 million in 2012 to 161.2 million active subscribers in 2019, as shown in Chart 1 below. The country’s active mobile subscriber penetration reached a substantial 93.4% from a meager 30.6% in 2008. The telecom sector is increasingly turning out to be an important sector in terms of economic growth, foreign investment, development of mobile financial institutions, and human development in Bangladesh. The country is now the eighth-largest mobile market in the world in terms of unique subscriber base and is contributing almost 1.8% of total GDP. The telecom companies currently provide two major services- voice calls and internet services with revenue from voice calls still being the major source although since the launch of 3G network services, the revenue from data services are on the rise exponentially.

Despite being the fifth largest market in Asia Pacific region, real industry penetration is still half of the country’s population implying healthy growth potential. The telecom industry in Bangladesh has scaled up rapidly over past decade having a total of 161.7 million active subscription and more than 85 million unique subscribers. Unique subscriber penetration in Bangladesh rose to almost 55% by 2018 from only 1% in 2003 due to rapid adoption of mobile telecommunication services. The industry has turned out to be fifth largest market in Asia Pacific Region, according to GSMA. However, about half of the entire population are yet to be connected with the mobile telecommunication network, also indicating that there is enormous room to grow. The real market penetration remained steady in the last three years as mandatory bio-metric SIM reregistration has slowed down the pace of new customer acquisition.

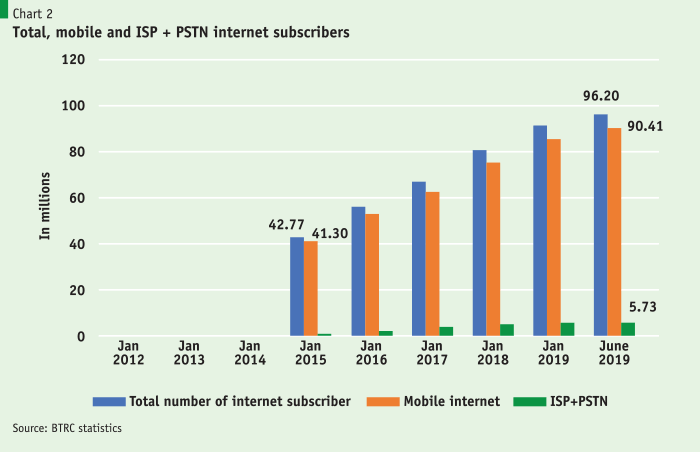

Along with stable voice traffic growth, market for mobile internet is enjoying hefty growth driven by high subscriber addition and increased penetration. However, data penetration is still far below than other countries in the region. According to GSMA, only around one-in-five Bangladeshi’s are subscribed to mobile internet connection in 2017. As of December, 2018 there are around 85.6 million mobile internet connection in Bangladesh i.e., 54.5% of mobile users are now using internet with cellular phones. This significant deviation between mobile data connection penetration and mobile data user penetration is due to having multiple number of connections by the same users. The total number of Internet Subscribers has reached 91.348 million at the end of December, 2018. Of the total connections, 93.7% are through the mobile network, 6.3% through the internet service providers (ISP & PSTN) and only 0.06% through WiMAX that is available in cities.

The 4G/LTE spectrum auction took place in the beginning of 2018 and 4G service was formally launched on February 19, 2018 by the three leading market players and state-run Teletalk also launched the service in December 2018. Since its first commercial launch in 2009, 4G has become the fastest developing system in the history of mobile communication in the world. However, even after launching 4G technology in Bangladesh, 3G coverage still dominates while 2G still poses handsome market share. The internet users in the country grew considerably in 2013 when the 3G internet service was launched.

However, the number of internet subscribers grew slowly in 2018 despite the launch of faster internet service, 4G. High prices of 4G enabled devices, lower network coverage, and poor service quality are the reason for slow growth in 4G. Earlier, the regulator provided 3G license to 4 operators on 8th September 2013 under the 3G auction. Although, state owned operator Teletalk has been providing 3G services in Bangladesh since October 2012. Since the roll out of 3G in Bangladesh, cellular phone based data service has been enjoying robust growth. As per the BTRC’s latest statistics, the number of 4G and 3G subscribers reached 11.7 million and 63.5 million respectively at the end of December, 2018 meaning only 13.7% of the country’s mobile internet users are using the fourth generation (4G) mobile phone service even after ten months of the launch of the service while 74.2% mobile data users using 3G internet and rest 12.1% using 2G internet. However, according to the leading mobile operator GP, the 3G data volume consumption was witnessing significant growth after launching of 4G by the operator even though 3G subscriber count witnessed a de-growth due to upgradation to 4G.

Currently Robi is leading the 4G/LTE in terms of capacity and coverage with spectrum band flexibility while GP is leading in terms of subscriber count. Robi has 4.2 million unique 4G subscribers and 3.4 million active 4G users as on October 2018. The 4G subscriber base of GP hit 5 million active subscribers in November 2018 (3.8 million in September 2018).

ICT In the context of Knowledge Economy

In this 21st century knowledge has emerged as a leading determinant of economic growth and human welfare. At the economy level, knowledge is transforming ways that new technology is developed and adopted to enhance productivity and reduce cost. At the individual level, the speed and ease by which an economic agent acquires and absorbs relevant knowledge to inform the underlying economic decision conveys a huge competitive edge. Knowledge is also transforming people’s welfare by facilitating advances in medical sciences that is contributing to increased life expectancy and health quality through preventive, diagnostic and curative measures. Accordingly, the focus on strengthening the Knowledge Economy (KE) is an integral part of any development strategy.

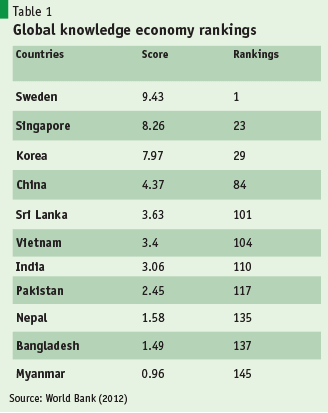

An effective Information Communications Technology (ICT) helps transfer knowledge and facilitate transactions. Bangladesh KE is lagging behind globally and against competitors. As a young economy Bangladesh is still a long way to catching up to the standards of the global KE. The latest available ranking of the Knowledge Economy Index (KEI) prepared by the World Bank puts Bangladesh at the low end of 137 out of 146 countries (Table 1). Other South Asian countries and competitors, like Vietnam and China, are ranked higher.

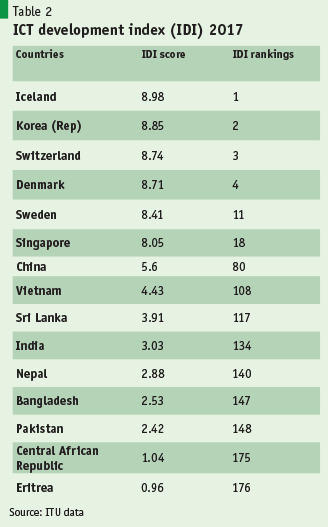

Bangladesh has made important strides in the area of ICT over the past few years. Nevertheless, Bangladesh is still lagging behind in ICT development, despite past progress, in the global context. This is reflected in the global rankings of the ICT development index done by the International Telecommunications Unit (ITU).

The rankings show that as of calendar year 2017, Bangladesh ranks at a low of 147 out of 187 countries compared (Table 2). A decomposition of the IDI shows that Bangladesh is lagging in the sub-index relating to the actual use of ICT services, notwithstanding past progress. This suggests that most countries of the world are moving faster than Bangladesh in making ICT services available to the citizens.

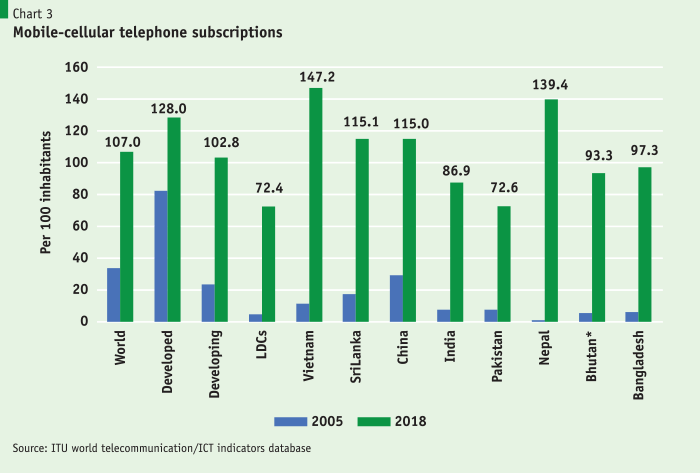

The progress with the spread of the ICT revolution can be measured in terms of three indicators: the mobile subscriptions per 100 people; the number of internet users per 100 people; and the percent of bandwidth subscription. Expansion of mobile phone subscriptions has been enormous, growing from a mere 6.4 subscriptions per 100 people in 2005 to 97.3 subscriptions per 100 people in 2018 (Chart 3). This is a remarkable progress over a thirteen-year period. Only a few years back Bangladesh was significantly lagging behind most of the regional comparators like Pakistan, Bhutan and India. However, the number of unique mobile subscribers is still quite low and there is still a huge population that presently does not have mobile phone access.

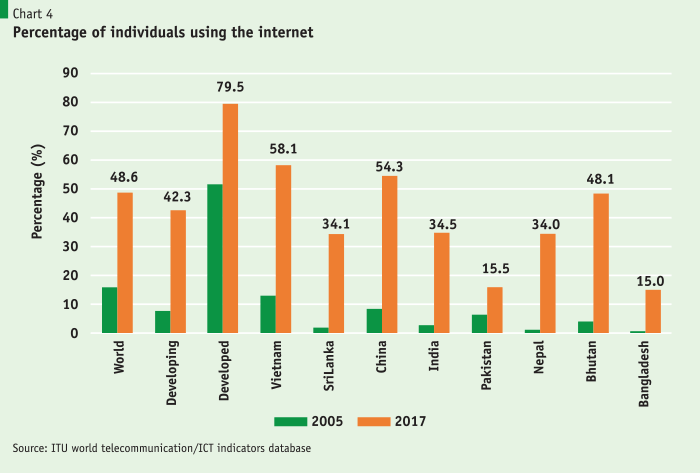

Starting almost fresh with only 0.24 users per 100 people in 2005, the use of internet has steadily expanded reaching about 15 % of the population in 2017. This is still way too low and puts Bangladesh at the near bottom of the global list of countries. Clearly, further strong effort will be needed to catch up on this front.

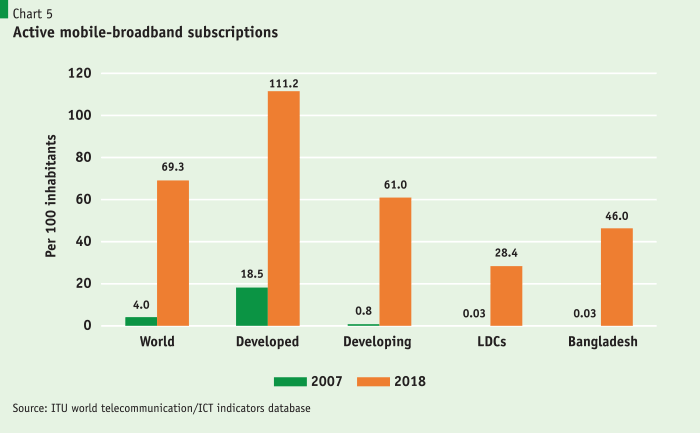

South Asia in general is way behind on bandwidth subscription. They started late and continue to lag behind. Nevertheless, Bangladesh has done well relative to the least developed countries as a group but still significantly behind the average for developing countries (Chart 5). In 2005, there were no bandwidth subscribers in Bangladesh. In 2013, the subscription level reached a mere 1% of the population, but the situation changes remarkably with the adoption of 3G and 4G mobile broadband technology. Active mobile broadband subscription jumped to 46% of population by 2018 from the 1% level in 2013. Although still behind the average of 61.6% for the developing countries, the rate of expansion in Bangladesh has been much higher than in most other countries and are likely to grow further in the coming years.

South Asia in general is way behind on bandwidth subscription. They started late and continue to lag behind. Nevertheless, Bangladesh has done well relative to the least developed countries as a group but still significantly behind the average for developing countries (Chart 5). In 2005, there were no bandwidth subscribers in Bangladesh. In 2013, the subscription level reached a mere 1% of the population, but the situation changes remarkably with the adoption of 3G and 4G mobile broadband technology. Active mobile broadband subscription jumped to 46% of population by 2018 from the 1% level in 2013. Although still behind the average of 61.6% for the developing countries, the rate of expansion in Bangladesh has been much higher than in most other countries and are likely to grow further in the coming years.

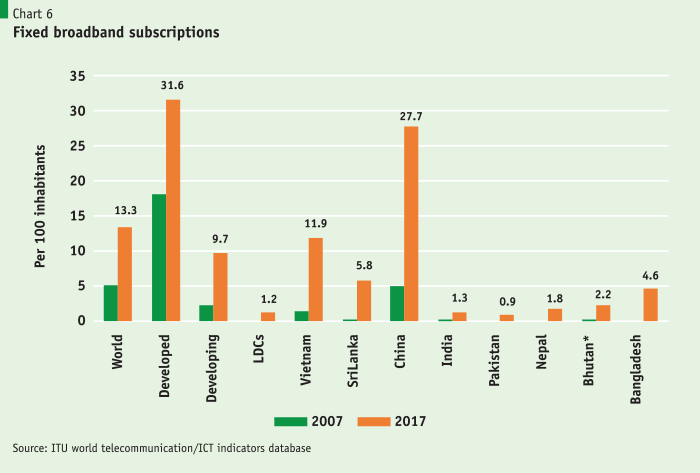

Bangladesh’s fixed broadband subscriptions have also been impressive in recent years, although not as fast as the mobile based broadband subscriptions. At 4.6 per 100 inhabitants, Bangladesh significantly outperforms other South Asian countries India (1.3%) and Pakistan (0.9%). However, compared to countries like China and Vietnam, Bangladesh has a long way to go.

Issues hindering further growth potentials of the telecom sector

While public investment provides the fixed telecoms infrastructure and supportive R&D expenditure, much of the supply of ITC services comes from the private sector. The private sector response to the deregulation of the ITC sector has been highly positive with considerable foreign investment. This response has been the key to the rapid expansion of tele-density and mobile digital services in Bangladesh. Owing to stiff competition and high taxation, mobile phone profitability has been eroded over time. Except GP all other mobile operators are running at losses. Service providers have raised serious concerns regarding the level of taxation of the ITC industry. Independent research shows that these concerns are valid and require urgent policy response.

Taxation of the telecom/ICT sector

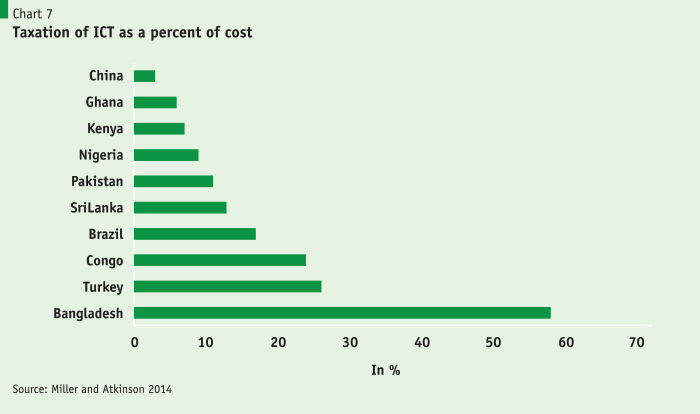

Telecom sector is highly taxed in Bangladesh. A study by Miller and Atkinson under the auspices of the International Technology Information Foundation (ITIF) shows that Bangladesh has the highest rate of taxation of ICT among the 125 countries reviewed in the study (Chart 6). The primary basket of ICT goods and services used in the study consists of taxes and customs duties on the following: basic mobile phones, smart phones, computers and other digital products like digital cameras and digital audio devices. Taxes are computed as a percent of cost of service provided. China imposes the lowest taxation (3%) while Bangladesh the highest (an astounding 58%). The second highest taxation is in Turkey, at 26% is less than half of Bangladesh. Taxes in 40 of the countries in the study are in the low range of 3%-5% and taxes in the remaining others are mostly in the 5%-20% range. In the global context, Bangladesh is clearly an outlier in the matter of high ICT taxation.

The Miller and Atkinson study also looks at price elasticities of ICT demand and concludes that this elasticity is quite high for Bangladesh. This is a very worrisome finding and raises serious concerns about the Government’s priority given to the spread of the ICT revolution. Indeed, the high taxation issue has now come to a fore and foreign investors are reluctant to further invest in new mobile network or acquire additional radio spectrum in Bangladesh in view of low profitability.

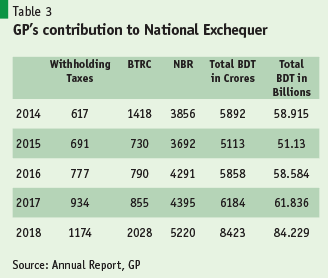

Telecom sector has already become the largest productive taxpaying sector in Bangladesh. It is also contributing to government revenue at the fastest pace among all sectors of the economy. GP alone has paid more than one billion dollars in taxes and fees of various forms, which was almost 4% of NBR’s total tax revenue collection in FY19. (Table 3).

Conflict between BTRC and the two major operators

The recent spat between BTRC and the two major telecom operators has been lingering for several years due to audits undertaken by BTRC and NBR which allegedly uncovered underpayment or avoidance of taxes and fees by GP and Robi. The amount including interest and taxes amounts to Tk. 125.79 billion against GP and Tk. 8.67 billion against Robi. Both companies however have strongly objected against the claims, consider the claims to be completely unjustified and sought recourse through international arbitration. As multinational companies following international best practices, GP and Robi are of the view that they are following the best accounting standards and given the good governance standards that they follow they are fully compliant with Bangladesh laws and regulations.

The BTRC is pointing out that the current law governing BTRC operations does not allow for arbitration and thus making the resolution of problem difficult. In the midst of the ongoing tension, BTRC and the Ministry of Telecommunications started to ratchet up the issue by putting a series of restrictions on the operators listed below:

First, BTRC partially blocked the bandwidth capacity of GP and Robi in July 2019 by directing all international internet gateway operators to slash GP’s bandwidth by 30% and Robi’s by 15% leading to a slowdown in internet speed and increasing the call drop frequency of the two operators. This measure was subsequently withdrawn following the instructions issued by the Hon. Prime Minister’s ICT Adviser after considering the sufferings of the customers.

Second, BTRC (on July 23, 2019) suspended issuing no-objection certificates (NOCs) to the two operators preventing them from importing equipment to run and service their networks in order to pressuring them to pay the disputed amount.

Third, BTRC issued two separate show cause notices to the two operators asking them to reply within 7 days why their 2G and 3G licenses should not be cancelled considering they had violated the licensing agreement by not paying the disputed amounts.

Most recently, BTRC has also threatened to appoint administrators for both entities, which if executed, would entail virtually taking over the control of operations of these telecoms. If this decision executed, it would be an extreme measure undermining seriously the confidence of foreign investors in Bangladesh.

Internationally, it is a cardinal principle that all investors must have the right to international arbitration for resolving disputes of this nature. Denying this fundamental right to telecom operators will be viewed extremely negatively by the international community and will cast a deep shadow on the brightening prospects for foreign direct and other investment in Bangladesh.

Concluding observations

According to an analysis of 120 countries by the World Bank (Qiang 2009), for every 10-percentage point increase in the penetration of mobile phones, there is an increase in economic growth of 0.81 percentage points in developing countries, versus 0.60 percentage points in developed countries. This growth effect of mobile phones is higher than that of fixed-line phones, but less than internet access or broadband. However, since mobile phones have the greatest penetration, the aggregate impact has been highest through mobiles phones until now for countries like Bangladesh. As access to broadband is increasing and gaining momentum, the impact through broadband connection will soon overtake the impact through 2G connectivity.

As a late starter Bangladesh has done well. Progress with expansion of mobile connections is particularly noteworthy. Yet, as evidence suggests, its ICT achievements are still way behind competitors and in comparison with the average for the developing countries as a whole. The development role of knowledge economy through ICT has just started and the returns are already being felt. The future potential is immense and the government needs to adopt consistent strategies and policies to take this forward.

Telecoms companies need to pay a fair cost that includes contribution to fiscal revenues. However, there is a risk that short-term fiscal expediency is receiving greater priority than equipping Bangladesh to compete in the information economy of the 21st century. The global experience with the trade-offs between high telecom taxes and license fees and the extension and modernization of telecom services brings out the issue more clearly. A number of Scandinavian countries and some in East Asia charged a minimal or moderate fees for taxes and licenses, while some West European countries, including Germany and the UK, adopted the more aggressive approach to collecting the highest license fees through competitive auction biddings. Certainly the second group of countries collected more revenue to support their budgets, but the negative impact of that exorbitant level of rent from the sector seriously undermined the health of the telecom sectors in those countries and impeded the sectors growth potential. Thus, revenue objective should not supersede the broader development objectives as developing Bangladesh’s digital infrastructure is no less important than energy or roads and highways for economic development.

The telecoms sector has been our one resounding infrastructure and economic success story in the last decade. Looking forward, two special challenges will be to further increase the mobile tele-density and further expand internet and bandwidth connectivity through investments in network infrastructure and by providing incentives for the unserved population to use these services. The supply expansion and demand increase will both require substantial reductions in ICT taxes and resolution of all remaining disputes without further delay. Unless the ongoing disputes are resolved by following international best practices for dispute resolution, the headquarters of none of these companies will be interested in making substantive new investment in the telecom sector in Bangladesh. Thus reducing the tax burden and resolving the ongoing disputes will be win-win policies because a larger subscription volume will both benefit service expansion and total tax revenues from ICT. The authorities should have more consultations and deliberations with stakeholders on these issues and not put excessive financial pressures on the telecoms in the form of excessive tax incidence and huge license renewal fees. The authorities should also restrain from avoidable confrontations leading to the “killing of the geese that lay the golden eggs”.