Is trade policy in South Asia in the right direction?

By

Trade policies comprise of the standards, goals, rules, and regulations which guide trade relations among countries. Trade policies involve taxes imposed on import and export, inspection regulations, and different non-tariff issues. Trade brings the efficiency of the global economy by ensuring different economies specialize in areas of their relative strengths, instead of producing all goods. Trade is also argued to be a means for ensuring sustainable and inclusive development. Trade liberalization, in general, is argued to have positive effects on economic growth. Trade liberalization may boost technical progress which, in turn, may enhance long-run growth prospects. Technical progress can be achieved through a rise in capital goods imports, improvements in the transfer of technology, and increased foreign direct investment. However, there are now strong arguments that trade liberalization is effective in boosting economic growth when it comes hand in hand with other complementary policies directed towards the financing of new investment and raising the quality of institutions.

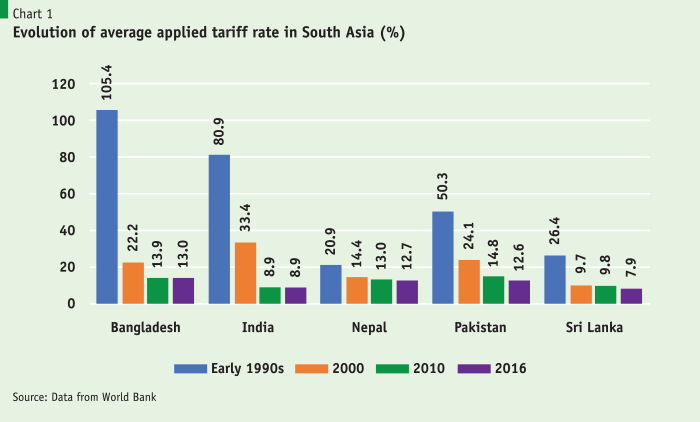

Most of the South Asian countries followed inward-looking trade policies during the 1960s, 1970s, and 1980s. The inward-looking trade policies aimed at protecting domestic industries through import-substitution strategies with the hope of rapid industrialization, growth and job creation. Export controls, tariffs and quantitative restrictions (QRs) on imports, and overvalued exchange rates were put in place. Since the late 1980s, most of the countries in South Asia had embarked on employing different trade policy reforms, though Sri Lanka was the exception who set sail for it in the late 1970s. Chart 1 presents the evolution of the average tariff rate in South Asia since the early 1990s to 2016. Among the South Asian countries, during the early 1990s, Bangladesh had the highest average tariff rate of more than 100%, followed by India’s average tariff rate of over 80%. During that time, the lowest average tariff was of Nepal’s (around 21%). Pakistan’s and Sri Lanka’s average tariff rates were 50% and 26.4% respectively. In 2016, Sri Lanka had the lowest average tariff rate of 7.9% followed by India’s 8.9%. The corresponding charts for Bangladesh, Nepal, and Pakistan in 2016 were 13%, 12.7%, and 12.6%. In general, it seems that despite a rapid reduction in tariff rates during the 1990s, the pace of tariff liberalization slowed down quite significantly in all these countries over the past one decade or so.

Most of the South Asian countries followed inward-looking trade policies during the 1960s, 1970s, and 1980s. The inward-looking trade policies aimed at protecting domestic industries through import-substitution strategies with the hope of rapid industrialization, growth and job creation. Export controls, tariffs and quantitative restrictions (QRs) on imports, and overvalued exchange rates were put in place. Since the late 1980s, most of the countries in South Asia had embarked on employing different trade policy reforms, though Sri Lanka was the exception who set sail for it in the late 1970s. Chart 1 presents the evolution of the average tariff rate in South Asia since the early 1990s to 2016. Among the South Asian countries, during the early 1990s, Bangladesh had the highest average tariff rate of more than 100%, followed by India’s average tariff rate of over 80%. During that time, the lowest average tariff was of Nepal’s (around 21%). Pakistan’s and Sri Lanka’s average tariff rates were 50% and 26.4% respectively. In 2016, Sri Lanka had the lowest average tariff rate of 7.9% followed by India’s 8.9%. The corresponding charts for Bangladesh, Nepal, and Pakistan in 2016 were 13%, 12.7%, and 12.6%. In general, it seems that despite a rapid reduction in tariff rates during the 1990s, the pace of tariff liberalization slowed down quite significantly in all these countries over the past one decade or so.

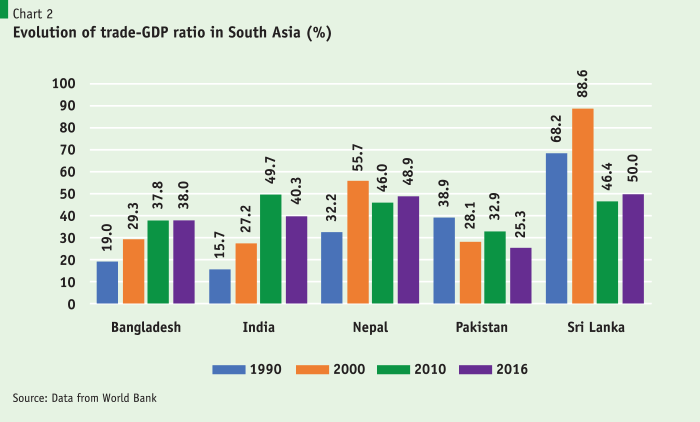

Chart 2 illustrates the evolution of trade orientation (trade GDP ratio) of five South Asian countries over the period between 1990 and 2016. Both in 1990 and 2016, Sri Lanka had the highest trade-GDP ratio among the five countries. However, in general, Bangladesh is the only country in South Asia who has been able to consistently raise the trade-GDP ratio since 1990, whereas all other South Asian countries experienced significant fluctuations. In 2016, Sri Lanka had the highest trade-GDP ratio of 50% followed by Nepal’s 48.9%. In contrast, Pakistan had the lowest trade-GDP ratio of 25.3%. India’s and Bangladesh’s trade-GDP ratios in 2016 were 40.3% and 38% respectively.

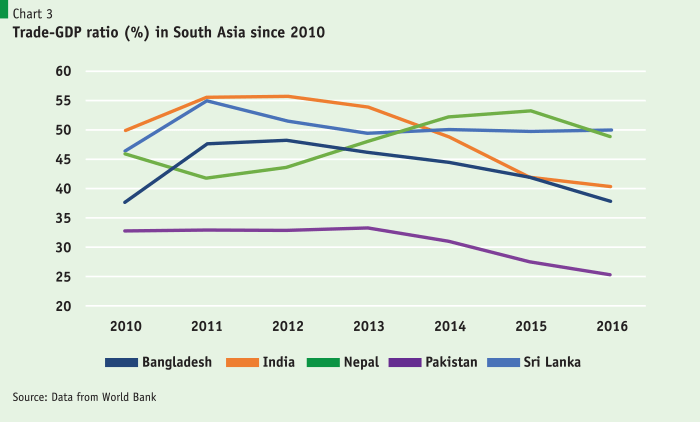

However, one major concern is that, in recent years, most of the South Asian countries have been experiencing a falling trade-GDP ratio (Chart 3). Especially, for Bangladesh and India, the fall in trade-GDP ratio has been much sharper than other countries. It is important to mention here that, given the on-going crisis in the global trade regime, associated with the escalated trade war between USA and China, the risk of a forthcoming depressed global trade regime is high, which can further affect South Asian countries trade-orientation in the days to come.

However, one major concern is that, in recent years, most of the South Asian countries have been experiencing a falling trade-GDP ratio (Chart 3). Especially, for Bangladesh and India, the fall in trade-GDP ratio has been much sharper than other countries. It is important to mention here that, given the on-going crisis in the global trade regime, associated with the escalated trade war between USA and China, the risk of a forthcoming depressed global trade regime is high, which can further affect South Asian countries trade-orientation in the days to come.

We have explored the economy-wide effects of unilateral trade liberalization in five South Asian countries (Bangladesh, India, Nepal, Pakistan and Sri Lanka) using Social Accounting Matrices (SAM) and the Computable General Equilibrium (CGE) models of these countries. The CGE framework captures the impact of unilateral trade liberalization on macro-economy, trade, employment and household welfare in the selected countries by tracing the price effects of exogenous shocks, where the variations in prices lead to the re-allocation of resources among competing activities, which may alter the factorial income and, hence, the distribution of household income.

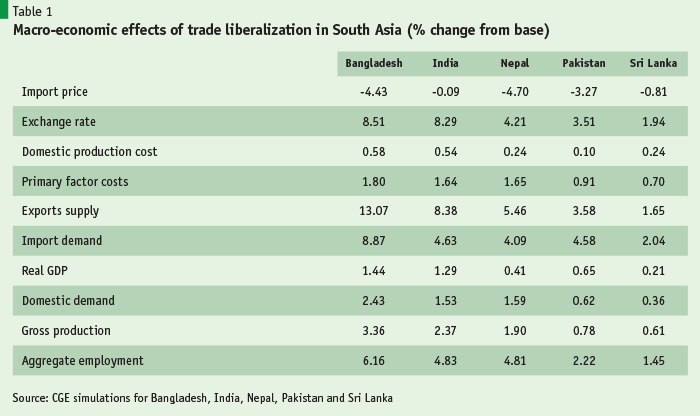

The macroeconomic effects of the tariff liberalization simulation for the five South Asian countries suggest (Table 1) that the price of imports in local currency falls by larger margins in Bangladesh and Nepal. Bangladesh experiences the largest rise in total demand for imports followed by India. Total domestic demand increases most in Bangladesh, followed by Pakistan. The average cost of domestic production increases in all countries due to the rise in primary factor costs. India has the highest rise in nominal return to capital, followed by Bangladesh. The real exchange rate depreciates in all countries with the largest depreciation in Bangladesh. The real exchange rate depreciation makes exports more competitive in the world market. Hence, exports expand and the largest positive effect on exports is found in Bangladesh. Higher exports pull up economy-wide gross production for all five countries with the largest positive effect on Bangladesh. The largest positive effect on real GDP is seen for Bangladesh and the least for Sri Lanka. Also, the largest positive effect on employment is observed for Bangladesh.

It should, however, be mentioned that the aforementioned gains of trade liberalization, as reported by the CGE model simulations, can be substantially undermined by a number of supply-side and institutional constraints in the South Asian countries. These constraints are directly associated with the domestic production and investment environment and include weak physical infrastructure, access to finance, inefficient ports, high transport costs, shortage of skilled workers, technological bottlenecks, and high costs of doing business. Furthermore, domestic capacities of the exporters in most of the South Asian countries, need to be improved to meet different international standard requirements in the form of non-tariff measures. This is important to diversify exports and become competitive in the regional and international markets.

It should, however, be mentioned that the aforementioned gains of trade liberalization, as reported by the CGE model simulations, can be substantially undermined by a number of supply-side and institutional constraints in the South Asian countries. These constraints are directly associated with the domestic production and investment environment and include weak physical infrastructure, access to finance, inefficient ports, high transport costs, shortage of skilled workers, technological bottlenecks, and high costs of doing business. Furthermore, domestic capacities of the exporters in most of the South Asian countries, need to be improved to meet different international standard requirements in the form of non-tariff measures. This is important to diversify exports and become competitive in the regional and international markets.

Despite a strong demand for a deeper regional integration in South Asia, progress has been slow. The implementation of agreements often does not match the declared ambitions, and in this context, tariff and non-tariff barriers, lack of political will and leadership, institutional weaknesses and low capacity, and resource constraints have been argued to be the major impeding factors. Non-tariff barriers and associated procedural obstacles are exacerbated further by lack of trade facilitation and cumbersome customs procedures at the land border ports. The largest export market in South Asia is the Indian market, followed by Pakistan, Bangladesh, and Sri Lanka. However, while India has already provided almost full duty-free, quota-free market access to exports from South Asian least developed countries (LDCs), Bangladesh, Nepal, and Bhutan are facing escalating challenges to secure and increase their exports to India. These challenges are related to their limited export capacities, lack of diversification of their export baskets, and various non-tariff barriers and procedural obstacles they face both at home and in the Indian market. To address these challenges related to tariff and non-tariff barriers and lack of trade facilitation in South Asia, there is a need to re-orient the trade policies of the South Asian countries. Deeper regional integration in South Asia also requires clear and visible leadership from the political elites in the region, especially from India, to move the regional integration agenda forward.

Promotion of intra-regional investments and attracting extra-regional FDI in the goods and services sectors in general, and energy and infrastructural sectors in particular, should be closely linked to the trade policies. Failure to do so results in the weak integration of South Asian countries in the regional and global value-chains.

One important drawback of trade policies of most of the South Asian countries is the failure to promote trade and foreign direct investment (FDI) nexus. Promotion of intra-regional investments and attracting extra-regional FDI in the goods and services sectors in general, and energy and infrastructural sectors in particular, should be closely linked to the trade policies. Failure to do so results in the weak integration of South Asian countries in the regional and global value-chains.

In sum, given the emerging challenges and complexities in the global trading regime, there is a need for re-thinking in the trade policies in the South Asian countries. Three major areas need to be focused on. First, the effort for further trade liberalization needs to be continued with the aim of effective integration with the regional and global value chains. Second, the trade policy needs to present an action plan to deal with the non-tariff barriers, trade facilitation and supply side issues both at home and in export destination countries. And, third, the trade policy needs to be pro-active to effectively engage with multilateral, regional and bilateral trading arrangements.

Photo credit by Bernard Spragg