Deemed Exports: Import Substitution par excellence

By

In the 1950s and 1960s a new paradigm of industrialization and development had taken developing countries by storm – import substituting industrialization (ISI). That was however soon overtaken in the 1970s and beyond by the open trade export-led growth strategy that led to the tremendous economic success of East Asian economies, followed by that of China until the Global Financial Crisis (GFC) of 2008. Bangladesh took the leap of faith in export-led growth in the 1990s that produced both double digit export growth, led to job creation, accelerated GDP growth and rapid poverty reduction. Soon the export-oriented readymade garment (RMG) industry evolved into the industrial icon of Bangladesh economy, based on the nation’s comparative advantage in cheap low-skilled labor, capturing a notable share of the global export market. In doing so, it has had the effect of opening up sectors inter-linked to the final export product, a process called backward linkage.

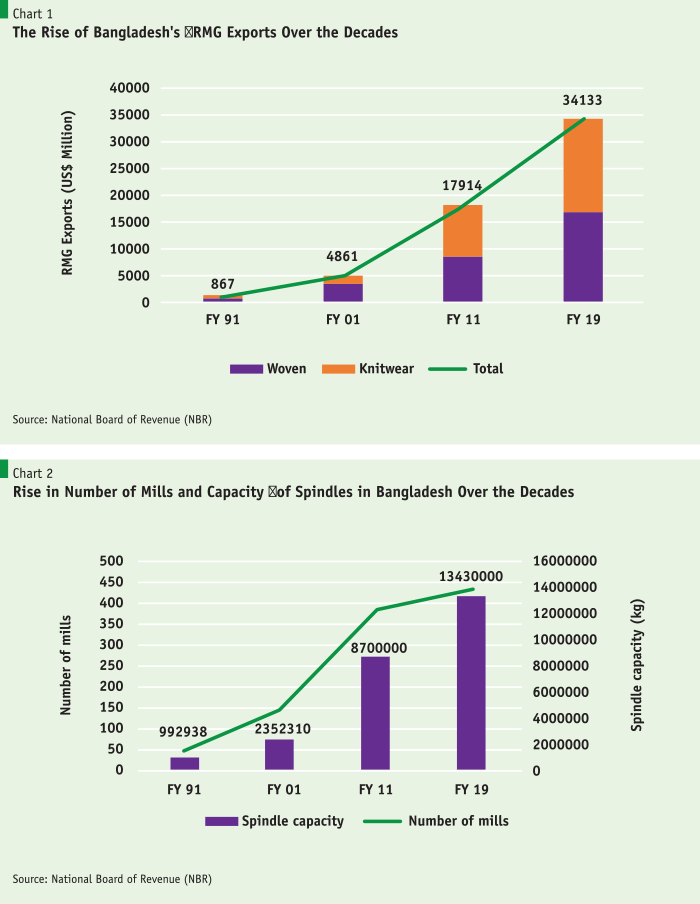

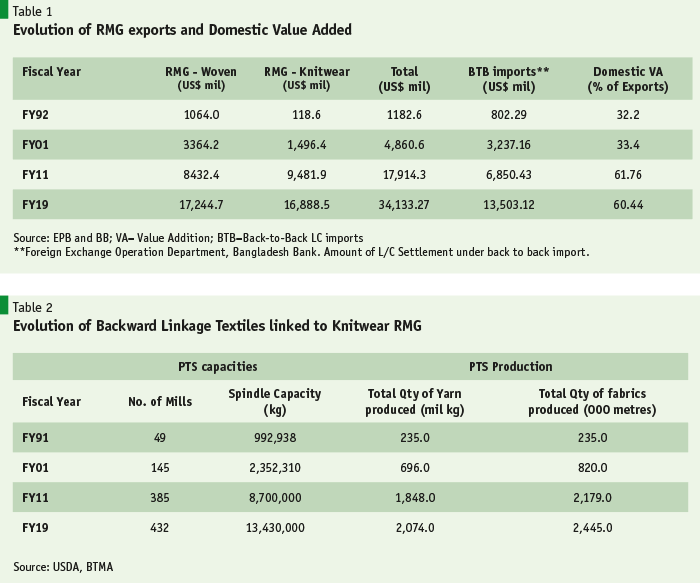

The rapid expansion of export-oriented primary textiles is a major development in Bangladesh’s economic landscape. A large industry has grown over the past three decades supplying intermediate inputs to the leading export sector of Bangladesh – readymade garments. This is clearly a new phenomenon in the Bangladesh economy – called “deemed exports” in local official jargon. Backward linkage industries to the RMG sector is another popular way of describing this industrial development. They supply yarn, fabrics, and accessories to the RMG export industry comprised of knit and woven garments (Fig.1-2). RMG accounted for 84% of the $40 billion exported in FY2019 (Fig.1). Over time, RMG has been relying less and less on imported inputs resulting in rising value addition based on domestic content (Table 1).

Typically, RMG firms import inputs under the system of back-to-back (BTB) which allows them to pay for imported inputs from export proceeds. Table 1 reveals that over the years a smaller proportion of RMG exports were being imported under BTB system, with the domestic vale added content rising from 32% in FY92 to 60% in FY2019. Increasing supplies from backward linkage industries made this possible.

The quantum of these domestic supplies is no longer insignificant as BKMEA representatives indicate knitwear exporters source some 80% of their input of yarn from local textile producers. The number of yarn manufacturing mills have more than doubled, from 200 in 2000 to 433 in 2019, while spindle capacity has tripled to 13.5 billion kg of yarn (Table 2). Much of this growth could be attributed to the rapid expansion of knitwear exports which rose from $1.5 billion in FY2001 to $16.9 billion in FY2019 with somewhat lesser demand pull coming from woven RMG exports of $17.2 billion.

Woven garments still need to rely on imports of wide variety of fabrics, though local production has made strong inroads into the export-oriented market. 800 fabric manufacturing mills produce 3.8 billion metres of fabric, which is processed for dyeing, printing, and finishing, for exports as well as domestic sales. Denim production is an entirely export-oriented activity. 60% of the annual denim requirement of 840 million yards is supplied by 32 denim mills that have cropped up in the past 20 years or so. In addition, other cotton-based fabrics and those from man-made fiber (MMF) are increasingly catching up with demand to meet some 40-45% of requirement by woven garment exporters.

60% of the annual denim requirement of 840 million yards is supplied by 32 denim mills that have cropped up in the past 20 years or so. In addition, other cotton-based fabrics and those from man-made fiber (MMF) are increasingly catching up with demand to meet some 40-45% of requirement by woven garment exporters.

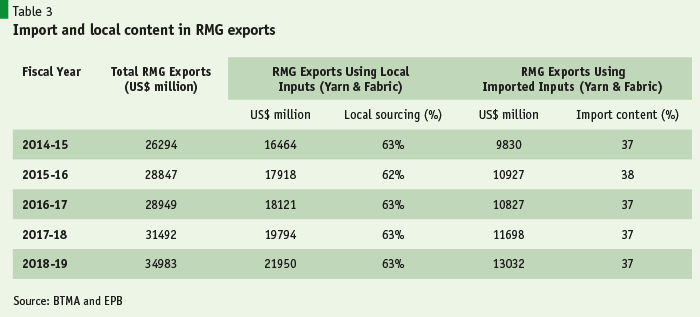

Given these estimates of domestic content in RMG production that will bring domestic production of deemed textile exports to around $21+ billion, or 63% of RMG exports, up from under 5% when the RMG sector started its export journey in early 1980s. Back-to-back L/C settlement data from Bangladesh Bank also show B-T-B imports of RMG intermediate inputs are now down to 40% of RMG exports, suggesting domestic value addition to have risen to 60% of exports in FY2019. With all this happening the structure of manufacturing sector is transforming. Together with RMG, well over half of Bangladesh’s manufacturing sector is now geared to export production.

Data on production capacity of the Primary Textile Sector is also available from BTMA, also compiled by the US Department of Agriculture (USDA). In addition, assessments about the sector’s size and input contribution come from broad brush judgments made by experienced BTMA leaders and some BGMEA/BKMEA members who are involved in RMG exports as well as running of composite mills (i.e. production of yarn to apparels in the same factory set up). All said, backward linkage or domestic content production geared towards RMG exports is now a major export-oriented manufacturing activity. It is time to treat this large industry as a thrust sector as much as RMG.

The backward linkage challenge starts with the RMG journey itself – early 1980s. True, the final stage of processing readymade garments was and still is a labor-intensive activity, quite in line with the source of Bangladesh’s comparative advantage. The onset of globalization, fragmentation of production processes, and cross-border value chain integration, all of these made it possible for Bangladesh to take a leap of faith and embark on a journey of exporting readymade garments made up of largely imported yarn, fabrics, and accessories, which were imported duty-free under special bonded system. If produced competitively, market access was ensured by the Multi-Fiber Arrangement (MFA), an international agreement that limited textile exports from few developing countries while opening up scope for others. That agreement could not have been more propitious for Bangladesh. Thus, our first generation RMG entrepreneurs were among the early proponents of cross-border value chain integration, a phenomenon that became the fastest growing component of international trade in the past 25 years – trade in intermediate goods. Yet, given the level of efficiency of our import-export clearance mechanism, issues related to lead time, and the enormous convenience of sourcing intermediate inputs locally, the backward linkage advantage was there to be exploited by another group of first generation entrepreneurs in the textile industry – the one geared to the export market, not the old-generation textile mills catering to domestic demand of basic clothing, under high protection from competing imports. Thus emerged an internationally competitive sub-sector of backward linkage industries whose size grew in proportion to the expansion of RMG exports. Once the wheels of backward linkage industries were set in motion, their expansion would only be limited by the size of its downstream industry, the $34 billion RMG industry.

So, over the past 25 years, the economy has generated another $21+ billion industry group whose contribution to the economy and jobs can no longer be ignored. This is no mean achievement, and can no longer be relegated to just a sideshow to RMG. It is a major success story in backward linkage, the evolution of a new internationally competitive textile industry, unlike the old textile sector that still caters to domestic demand for basic clothing but is not competitive enough to play the export card. What is notable is that this deemed export sector represents import substitution, exports, and export diversification, all rolled into one. Here is why.

First, the import substitution part. As the RMG industry grew from a $600 million industry in 1990 to the $34 billion industry now, the demand for imported yarn, fabrics, and accessories grew by leaps and bounds. It was a growing opportunity our entrepreneurs would not miss for the world. Textiles, the production of yarn and fabrics, is a relatively capital intensive industry. But they are part of the backward linkage industries’ expansion with the sole objective of substituting for the massive amounts of imported yarn and fabrics, demanded as inputs by the $34 billion RMG sector. And to feed a globally competitive RMG sector with intermediate inputs means they have to be globally competitive too. This is import substitution at its best. We can describe the phenomenon in the following terms, “from import substitution to deemed exports”. In such a situation a dollar saved by import substitution is equivalent to a dollar earned through exports. If the entire import substituting backward linkage sector is saving say $21+ billion, it means we are importing $21+ billion less than what would have been imported by the RMG sector. Based on the report that Knit RMG uses 80% local sourcing of yarn and fabrics, and Woven RMG uses 45% local sourcing of fabrics, the percentage share of local content comes to 63%, with 37% of RMG exports relying on import content (Table 3). Absent these deemed exports, hypothetically, our imports in FY2019 would have been $80 billion instead of $60 billion. It is also possible to think of our complete export basket in terms of actual exports plus “deemed” exports, which then would have totaled $60 billion instead of $40 billion in FY2019.

Second, the export part. Quite logically “deemed” exports of yarn and fabrics (and accessories) are considered to be indirect exports, as they are exported as components of the final export product, knit or woven garments. They are “embedded” exports just like what international economists are now describing digital or IT services that are increasingly becoming sizable inputs into finished products that are traded across borders. Trade in these value added services is another rapidly growing component of international trade. Under this reformulation of trade in components of finished products, our deemed exports are nothing but exports. It is now time to think of them as the next largest export category, after RMG.

Third, the export diversification part. The need for export diversification is recognized by all and sundry, but progress has been slow, if any. Quite apart from the standard constraints to exports – viz. poor quality trade infrastructure, weak governance, high cost of doing business, etc. – PRI research has identified the fundamental policy conflict between high tariff protection and export orientation. Non-RMG exporters, who produce for the domestic market as well as exports, lack the drive and enthusiasm for exports as the protected domestic market yields significantly higher profit margins than exporting activity. That is not to say that we lack competitiveness in export products other than RMG. Of the 292 non-RMG products (at HS-6 digit) of more than $1 million each that we exported in FY2019, PRI research found that 40% were highly competitive with other exporting countries to the same destination markets. But, except for jute and jute goods, footwear and leather goods, and home textiles, there are hardly any other product showing promise of rapid growth. Somewhat less encouraging was the situation with the remaining 1100 HS-6 products (below $1 million) that we exported in the same year. Our conclusion: though potential comparative advantage exists for vast numbers of non-RMG and labor-intensive export products, the inherent policy conflict identified above makes export diversification a dead horse. Furthermore, these non-RMG exporters, most of whom are SME entrepreneurs, rarely get special bonded warehouse (SBW) facility for duty-free import of inputs. Without that facility, non-RMG exports are doomed to extinction in a high tariff regime.

…though potential comparative advantage exists for vast numbers of non-RMG and labor-intensive export products, the inherent policy conflict identified above makes export diversification a dead horse. Furthermore, these non-RMG exporters, most of whom are SME entrepreneurs, rarely get special bonded warehouse (SBW) facility for duty-free import of inputs. Without that facility, non-RMG exports are doomed to extinction in a high tariff regime.

But deemed export of primary textiles (yarn and fabrics) supplemented with garment accessories production is another matter. These are the principal inputs for the apparel industry. Success of RMG has driven this sector’s rapid growth. Here is the rise of a non-RMG sector with indirect exports, but exports nevertheless. We can call it export diversification of the Bangladesh kind. And this has come to stay as long as we have a share in the global apparel market. This export-oriented primary textile sector is now the predominant part of the textile industry. A much smaller domestic market (estimated by BTMA at $8 billion) is still catered to by the less competitive textile mills from old times that only survive under high tariff protection to meet local demand for basic clothing.

Arguably, a nascent export-oriented textile sector deserves policy support and protection. That justifies the support this sector has received from the government in terms of tax exemptions, subsidies, duty-free bonded imports, or concessional credit. To ensure sustainability and lasting competitiveness it is just as important to put some limits to the support measures, by making them time bound and performance based. Also note that cash subsidies to backward linkage industries will be regarded as “domestic content” subsidies by the WTO and will become prohibitive for Bangladesh once it graduates out of LDC status in 2024. These are the plus and minus points to be reckoned with by all stakeholders in this dynamically growing and thriving sector.

Arguably, a nascent export-oriented textile sector deserves policy support and protection. That justifies the support this sector has received from the government in terms of tax exemptions, subsidies, duty-free bonded imports, or concessional credit. To ensure sustainability and lasting competitiveness it is just as important to put some limits to the support measures…

To conclude, we have come a long way since the days when RMG exports used to raise the specter of a highly import-intensive activity generating very little foreign exchange net of import content. The strategy of developing backward linkage to the dynamic RMG sector has produced results – another feather in the Bangladesh policy cap. No longer can the primary textile sector be dismissed as a non-competitive domestic market-oriented industry. It is now predominantly an export-oriented sector with a smaller part dedicated to catering domestic demand. This is import substitution par excellence based on comparative-advantage-following (CAF) approach of protection – that is, import substitution leading to export orientation. This is exactly the protection outcome trade economists have been looking for.