Post-Pandemic Challenges for Revival of Bangladesh RMG Sector

By

I. Background and Introduction

Due to the ongoing pandemic that is wreaking havoc all over the world, the RMG industry in Bangladesh is facing a dire challenge. According to the BGMEA, as of March 31, 2020, 2.87 billion dollars of orders had been canceled/suspended and it had already effected 2.09 million workers over 1,048 factories. In the first two weeks of April, RMG exports declined by almost 84% and the situation is likely to remain negative in the coming months with IFC study indicating reduction in future orders by 20-30 percent due to constricted demand and radical shifts in consumer taste. Hundreds of factories have remained shut since the lockdown imposed in April, and a lot of them may have to close down completely due to lack of orders and developments in the global value chain. For a sector which employs millions of workers and enables them to survive just above the poverty line, these developments will surely have undesirable consequences. The poverty level in Bangladesh is likely to have sharply increased to about 35% as direct impact of Covid-19.

While these developments have heightened and opened up the long-existing wounds and vulnerabilities, the current situation is unlikely to change to pre-crisis normal levels even after the global economy stabilizes in post Covid-19 situation. The challenges faced by the industry goes far beyond the pandemic and overcoming them will require all stakeholders to work collectively with even more urgency to prepare the ground for establishing a more competitive, sustainable and resilient industry. However, at first, it helps to get a deeper understanding of the root of the problem.

II. Challenges

Concentration issues

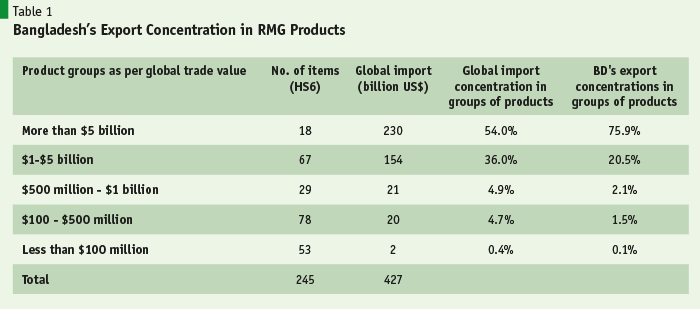

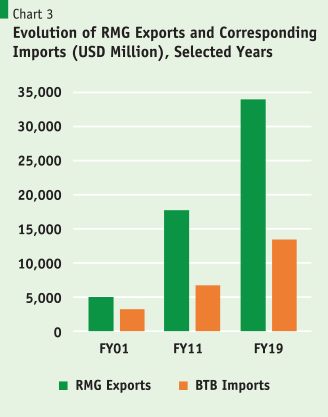

Bangladesh RMG has grown considerably in recent decades—increasing from $120,000 in FY85 to about $34 Billion in FY19, making Bangladesh the second largest RMG exporter in the world, after China. However, all that growth came with massive over-concentration in a few products and on a few markets. Five basic items (T-shirts, trousers, jackets, sweaters and shirts) account for 73% of Bangladesh RMG exports. These products also belong to the low unit value market segment, in which the global import share is 54% compared with Bangladesh’s export share of 76% (Table 1).

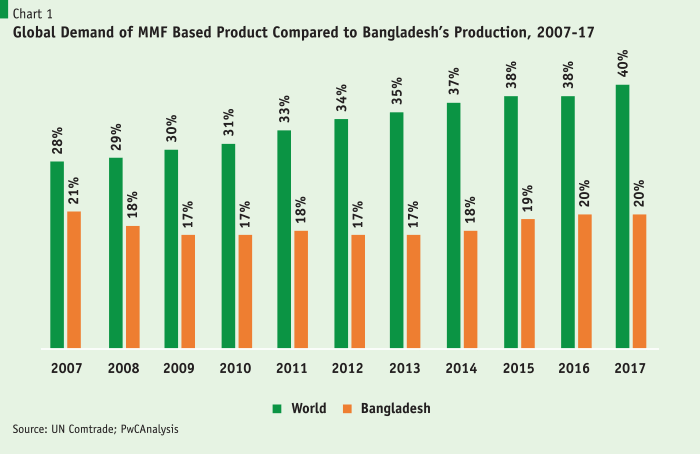

A particular reason for the recent loss in unit value and a key future challenge is Bangladesh’s over concentration and dependence in cotton-based apparel. Cotton-based exports account for 74% of Bangladesh’s entire RMG basket, and there are currently 403 cotton spinning mills in the country compared to only 27 synthetic and acrylic ones. As a result, Bangladesh’s exports of manmade fiber (MMF) products accounted for only 20% of RMG exports in 2017 and the share has been declining in recent years. In contrast, the global share of MMF products in the total RMG basket was 40% in the same year and the trend was upward as shown in Chart 1.

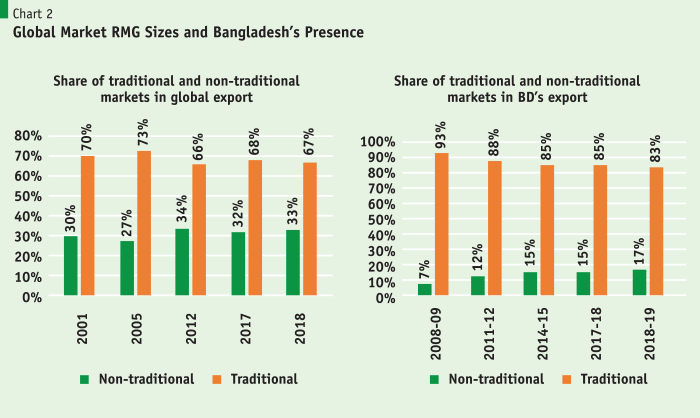

In terms of market concentration, Bangladesh is too reliant on traditional markets— the European Union and North America together accounting for 77% of total exports. Even though the share of non-traditional markets has improved considerably since 2008, in part due to the introduction of the 5% cash incentive for exports to non-traditional markets, the 17% share of Bangladesh is very low considering the 33% of RMG imports the non-traditional markets attract each year globally.

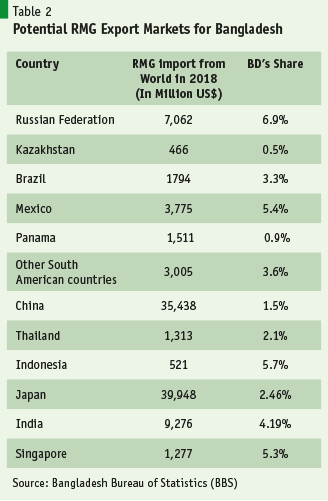

However, all these concentrations, albeit worrisome, also provide opportunities to grow further. Increased focus on greater access to Asian economies like China, Japan and India and some other Latin American nations would go a long way toward sustaining future growth. Finally, comes the issue of sector concentration. Roughly accounting to 83% of Bangladesh’s total export earnings, the country is very much reliant on RMG industry still. Even though RMG grew in value terms, the complete lack of spinoff effect has been a paradox, with entrepreneurs and manufacturers not spreading out to other sectors and broadening their scope. Globally, RMG is seen as the first step of the development ladder, with close ties to manufacturing. It is expected that within decades, a country moves to and takes off at industries with higher skillset and value. In case of Bangladesh, moving to higher steps in the RMG value ladder itself remains a challenge.

Backward linkage industries

Importance of backward linkage industries to create domestic supply chain and thereby shorten the current value chain and lead time for processing orders significantly is paramount for the country going forward. Being too focused and specializing only in the assembling of finished apparel products has made the sector extremely vulnerable. For an industry which contributes 83% of the nation’s total exports, it must look to move to tier 2 and if possible, tier 3. The backward linkage industries in Vietnam and Cambodia had served as fuels to their sustainable growth and broad-based diversification. Going forward, Bangladesh certainly needs to reduce its over-dependence on China and other countries for more efficient and shorter value chains. Bangladesh has missed out on a lot of GSP opportunities too for not having met a lot of criteria on efficient supply.

There has been a considerable success in case of knitwear exports, where roughly 80% of the inputs are supplied locally, as per BKMEA estimates. The number of yarn manufacturing mills have more than doubled, from 200 in 2000 to 433 in 2019, while spindle capacity has tripled to 13.5 billion kg of yarn. However, home grown supplies to Woven garments fall very short in comparison, as it still relies heavily on imports of wide variety of fabrics. Homemade fabrics meet only 40-45% of demands, with 800 fabric manufacturing mills producing 3.8 billion meters of fabric, which are then processed for dyeing and printing. The share of inputs falls even short when MMF is separated entirely, with only 27 mills operating in that front. This is a concern, which needs major attention, as global demand is shifting towards MMF-based fabric.

As it can be clearly seen in Chart 3, there is major room for improvement in backward linkage in woven products, as roughly 40% of sourcing, which amounts to $13.5 billion are imported from elsewhere.

Global push for superior sustainability and quality

The tremendous bounce back since the Rana Plaza tragedy and continuous strides towards workers’ safety, water and energy sustainability has been highly appreciated globally. However big buyers and EU delegates continue to express the high importance of proper workers’ insurance, wage and livelihood standards, which needs tremendous improvement. Bangladesh remains a very unappealing market in terms of sustainability due to poor working condition and wage standards. Continuing to focus on fast fashion with price as the only value proposition, is simply not enough for the rising sophisticated and eco-conscious end consumers of Europe.

It is true that the recovery stage during and post Covid-19 period will be about crisis management and contingency planning clouded by low consumer spending and decreased demand throughout the value chain, with many brands having cancelled 75% of the orders due to a 50%-90% reduction in sales. However, as confirmed by an EU market analysts (Thomas Klausen. CEO of DM&T) in a recent IFC and PRI dialogue, the attention of global brands has been steadily shifting towards sustainability and clean/fair procurement of high quality products. The new business models in the USA and EU, which experienced higher growth in the pre-Covid-19 period were also based on much better-quality products at higher prices. Future trends, despite the pandemic, is shifting toward durable and better quality products–away from Fast Fashion where Bangladesh is more focused–in both fabric and sewing quality. The use of technology will also be prominent in reducing and eliminating some stages of the value chain (such as 3D prototyping for sampling) and such innovations will be the key going forward, alongside having a clean and sustainable footprint.

EU legislations for better sourcing and collection of used textiles which could be in effect as early as 2023, to achieve circular design and material usage, increased recycling capacity and waste management, would further make it practically impossible for Bangladesh RMG to survive in the EU market.

Poor FDI performance

FDIs from leading RMG producing nations like Japan and South Korea have not only brought in capital, but extensive knowledge, technology and management standards which have been keys to Vietnam’s spectacular success in the last two decades. In 2018, Vietnam’s apparel and textile exports amounted to $36 billion, 65% of which came from foreign companies. The enabling infrastructure (with several hundred Special Economic Zones in operation), tax incentives and access to important free trade markets have been major factors contributing to massive inflows of FDI in Vietnam. Top RMG producers from Japan, Taiwan, Singapore and Korea with investment over $19.5 billion over the last 30 years, have helped their domestic RMG industry integrate with the global supply chain and expand to foreign markets.

Bangladesh is getting a small fraction of FDI relative to its comparator countries, and the performance has been quite poor, attracting FDI worth less than 1% of GDP in general. The investments had peaked in 2018 when it crossed the 1% mark with $3.6 billion in FDI but fell down again in 2019 to $2.9 billion. Over the same period, even Myanmar had better FDI inflow, let alone countries like Thailand, Vietnam and Indonesia, all of which made great technological strides with investments flowing in.

An area of concern is Bangladesh’s failure in providing a better business climate. It has consistently ranked poorly in all major indicators used globally from investment climate perspective, which serves as a major red flag for investors in their decisions. It ranks 168 out of 190 countries in the World Bank Ease of Doing Business index, 105 in the Global Competitive Index out of 141 nations, and 100 in the Logistical Performance Index. Comparative countries like Vietnam and Sri Lanka have significantly better investment climate, and even Pakistan in terms of some indices.

Documentary and Border Compliance in Bangladesh, along with Contract Enforcement and Quality of Judicial Process in the EDB index were some indicators which require quick addressing. In particular, the long time needed for enforcing contracts (1442 days) and the very high cost of enforcing contract, which stands at 66.8% of the claim, is unacceptable. Pakistan had a much more efficient system in place in these regards, with the cost of enforcing standing just at 20.5% and requiring 1071 days to enforce. Even in case of Electricity, after massive investments in capacity and infrastructure improvements, Bangladesh’s performance is dismal with systemic backlogs and inefficiency leading to procedural delays and long time required to get electricity. Nine procedures are needed compared to 4 in India to get Electricity, which amounts to 125 days on average to get connection after applying. After which comes the reliability of the supply and transparency of the tariff structure, where Bangladesh’s performance is worst at 0 out of 8. All these factors combined add up to the poor ranking in the Ease of Doing Business and Global Competitiveness Index. Bangladesh needs to seriously improve its position in terms of these indices and address the key factors which makes up the indices, bringing significant changes and reforms where necessary.

The Vietnam Experience

Vietnam, ranking 67 in WEF’s global competitive index and 70 in the World Bank’s Doing Business Index, is a very well-diversified nation in terms of export. Contributing to less than 20% of its export share, textile and apparels sector employs around 3 million people, equivalent to 25% of total industrial sector employment.

With annual RMG export very close to the level of Bangladesh, Vietnam aspires to achieve RMG export target of $60 billion by 2025 and further to $100 billion by 2030. While aiming to reach the stated export targets, Vietnam intends to do so through increased labor productivity and production efficiency so that the total number of workers in the sector remains unchanged at about 2.5 million. The policy entails introduction and effective application of smart and resource efficient industrial machineries and processes to ensure that the RMG sector does not pull resources (including labor) from other important products in Vietnam’s well diversified export portfolio. As part of its green strategy, Vietnam strives to reach its environmental sustainability goals while improving the working environment, quality of life, and income for workers.

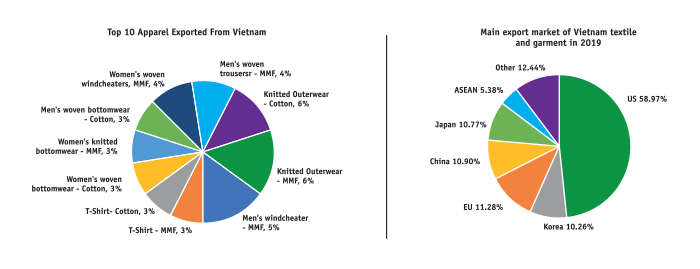

Vietnam also had a well-diversified RMG sector in terms of export markets and products. The top 10 RMG products (windcheater, trousers, shirts, bottom-wears etc.) exported have pretty much even shares. In line with recent global trend, MMF based apparel comprised 55% of its RMG exports. Vietnam’s export markets are also very well diversified and forward looking due to its numerous bilateral and regional trade agreements with various countries and regional economic blocks.

Vietnam has developed concrete plans for uplifting the sector to a different level, sees this covid-19 crisis period as an opportunity for reassessing and upgrading the value chain, while filling supply chain gaps sustainably for long term growth. While efforts are being taken for better branding of local Vietnamese brands globally, Vietnam also seeks to be more proactive in raw material production, which are mostly imported and took a big hit when global supply chain was disrupted due to outbreak of corona virus in China. The RMG sector in Vietnam is also firmly committed to a more environmentally sustainable supply chain development, which besides helping the environment, would provide a major marketing boost for Vietnamese RMG products globally specially in the EU market. As part of this strategy, the RMG sector in Vietnam has taken the following initiatives: using robots and smart control in hazardous workplaces; sourcing 10% electricity from renewable sources; recycling at least 20% of polyester fiber and 15% of organic cotton by 2025; reducing energy consumption by 30%; and improving water consumption reusing capabilities.

Key incentives provided-

- From July 2020, the income tax for small and micro enterprises will be reduced to 15-17%, instead of the current rate of 20%. In particular, household businesses newly established will be exempt from 2 years of business income tax since they make profits.

- Low Corporate Income Tax (10% – 15% instead of 20%) for 15 years or for the entire life depending on specific industries.

- For production of exportable items.exemption in land rental fees for the whole life of the project based on the type and location of the project.

III. Policy Roadmap

Planned growth and diversification

The planned implementation of Vietnam’s strategy for growth and diversification is something Bangladesh can learn from. The near perfect synergy in the share of MMF to cotton in line with the global trends, while also keeping an even share between the major products of its basket and export destinations, is remarkable. The commitment towards providing better lifestyle and pay to the workers while reaching tremendous level of environmental sustainability, shows how Vietnam has already pledged and entailed to a wider view of overall sustainability.

The planned implementation of Vietnam’s strategy for growth and diversification is something Bangladesh can learn from. The near perfect synergy in the share of MMF to cotton in line with the global trends, while also keeping an even share between the major products of its basket and export destinations, is remarkable.

Besides the duty-free access, firms in Vietnam enjoy numerous trade partners, tax incentives and free land provided by the government which all have played major roles in the development of the sector in a focused/planned way. Bangladesh too can emulate similar incentives, and more given the urgency of the situation, to rapidly develop the MMF industry, where only 27 synthetic and acrylic producers operate. The benefits provided to the cotton mills could be revised, so that the less efficient ones are forced to shift to other industries in line with the global trend. The incentives to MMF in the FY21 budget is a step in the right direction.

Bangladesh’s over dependence on low-unit value market segment must also be reduced and shifted efficiently to other higher end products which captures more value per unit. Out of the 18 low-value products which takes up Bangladesh’s 76% share of the basket, just t-shirts, trousers, jackets, sweaters and shirts occupy a massive 73% share.

And lastly, there should also be a planned diversification in markets, in alignment with the global trends. Globally, 33% of apparel exports are pulled by non-traditional markets, compared to 17% of Bangladesh’s export to these markets. With duty free access to major Asian markets like China and India, Bangladesh RMG exporters should make stronger efforts to penetrate these expanding markets. It is also advisable to look into nations like Thailand, Russia, Mexico and Japan, which have great potential for further market access.

Backward linkage

Another area of prime importance, as underscored by many in recent dialogues, is backward linkage industries to create domestic supply chain and thereby shorten significantly the current value chain and lead time for processing orders. This will add to the value proposition in future, as resources can be efficiently and quickly sourced without having to rely on time consuming and costly imports. Most importantly, development of such industries will give a major employment boost to those who are currently at risk of losing jobs due to business’s inefficiency and inability to keep up with changing market dynamics.

RMG sector produces about 400,000 tons of leftovers which can be recycled to save about $4 billion in new imports and also meet EU conditions for recycling of RMG products. RMG and textiles sector require a whole range of spare parts. It is estimated that import of the top 27 spare parts in FY19 was worth about $1.6 billion. With some efforts, most of these parts can be produced locally contributing to the creation of an ecosystem for light engineering industry in Bangladesh. The market for textile related chemicals in Bangladesh is projected to grow to $1.38 billion by 2024 from $864 million in 2019, registering an annual compound average growth rate of 8% per annum.

In production of materials (knitting, weaving, bleaching, dyeing etc.) and basic ingredients/raw materials Yarn, Dyes, Adhesives etc.), Bangladesh still relies on imports for about 40% of its sourcing demands on average. This reliance on imports increases to around 60% in the case of woven garments, and to almost 80% in the case of MMF-based products. Disappointing and paradoxical as it may be, this is the time to seriously look into these issues and find ways to reduce this dependence on imports through development of backward linkage industries. As in the development of any sector, establishing backward linkage will require huge capital and technical expertise. At the same time, adoption of new technology and building such expertise would take time as most firms learn in the process (learning by doing). Being a medium and long-term process, the government can once again support this process by providing tax benefits and other incentives to investors of domestic and foreign origins, as Vietnam, and facilitate with favorable financing and monitoring the progress closely.

The case for central bonded warehouse

Mobilizing Central Bonded Warehouse (CBW) would not only help the non-RMG sectors which do not get the benefit of back-to-back LC facility, RMG manufacturers may also get a major short-term competitive boost, as many global buyers have expressed concern about current lead time and efficiency in the value chain. Especially with Vietnam and other competitive nations having advanced backward linkage in place, which they have successfully pursued in a planned way over the years, establishment of central bonded warehouses is a viable option for reducing the lead time in the short term, while the industry and government work towards backward integration and reforms in trade documentation and compliance for the longer term solution.

…establishment of central bonded warehouses is a viable option for reducing the lead time in the short term, while the industry and government work towards backward integration and reforms in trade documentation and compliance for the longer term solution.

Under the facility of CBW, the private sector would be allowed to set up the warehouses at the Export Processing Zones (EPZ) and import fabrics, yarns, machineries, and other textile related accessories free of duty in advance. These raw materials could eventually be used by the textile and RMG units on demand. The Bangladesh Garments Manufactures’ and Exporters’ Association (BGMEA) and other manufacturing organizations have been advocating for the establishment of the CBWs for quite a long time arguing that it would facilitate delivering the finished apparels to the global buyers by way of reducing the lead time to as low as 45-60 days. The existing lead time, ranging from 90-135 days, is affecting the growth of the RMG sector since most of Bangladesh’s close competitors are able to ship goods much quicker. The establishment of the CBWs will allow the RMG factories to buy imported raw materials right at home and start producing the finished apparels as soon as the orders are received. There have been multiple studies, which have shown its effectiveness and benefits far outweighing the concerns expressed by the National Board of Revenue.

The need for innovation in the existing industry

There is a growing need for the sector and the relevant stakeholders to shift their focus to durable and high-quality products, using better fabrics, while maximizing efficiency and meet global sustainability standards. Thus this is the time to think long-term and invest heavily in those areas which will be of more value to the brands and end-consumers (better pay, less carbon-emission and waste management, recycling), while pursuing efficiency and optimization in other areas (supply chain, efficient machineries and technology and skilled manpower).

The entrepreneurs and manufacturers which are unable to meet such expectations of the western brands and consumers or unwilling to invest, can focus on the non-traditional markets with high access potential (China, India, Malaysia, Indonesia, Thailand, Brazil, Mexico) in the short term. China, having the biggest market of them all with $35 billion worth of RMG imports per year can be an important market to focus, given their high demand of fast fashion and the duty-free access to Bangladesh. However, those factories will need to keep in mind that China and other Asian economies are developing very rapidly too, and will demand high-end products eventually.

Vietnam’s government and industry are fully committed to achieving the RMG export target of $60 billion by 2025 through effective application of smart and efficient machineries and processes to increase labor productivity and efficiency. This joint effort would also ensure the industry’s capability to consistently improve its workforce, knowledge, product quality and realize its environmental goals. Improving the ease of doing business and overall climate will encourage young entrepreneurs to come in with exciting ideas and innovation, while low to zero tax in machineries supporting efficiency and sustainability will boost Bangladesh’s position in the global marketplace in the short term as they reap the long-term benefits in the form of knowledge and technology spillover.

Improving the ease of doing business and overall climate will encourage young entrepreneurs to come in with exciting ideas and innovation, while low to zero tax in machineries supporting efficiency and sustainability will boost Bangladesh’s position in the global marketplace in the short term as they reap the long-term benefits in the form of knowledge and technology spillover.

Foreign Direct Investment (FDI)

The government has shown great ambition in constructing 100 special economic zones (SEZs) all over the country. Promising as it may be, it needs to quickly develop few of them to attract FDI as soon as possible by fully committing all their limited resources and capacity to these few SEZs near Chittagong and Dhaka instead of slow development of all simultaneously. The SEZs also need to be forward looking and adopt the highest international standards and strive for long-term SDG compliance from the first go, instead of falling behind comparators and then playing catch up in the future. Having zero emissions, efficient waste disposals and recycling facilities are of prime importance in this regard.

Besides that, to fuel growth and attract FDI, Bangladesh needs to improve connectivity by balanced and prudent diplomatic efforts to take advantage of its Geographic location and invest in regional connectivity like BBIN, SAARC, Belt and Road Initiative and other regional and bilateral initiatives to leverage its geographic location. Chittagong Port is the closest port for Nepal, Bhutan, Chinese province of Kunming, and rapidly developing the SEZ’s around them will be very appealing for international investors.

For improvements in business climate, in particular the Ease of Doing Business index which is the global standard, BIDA and other agencies have been working hard in recent times, and we may see the dividend shortly. However, some of the indicators need to be focused on more than others. Particularly, costs associated with the documentation and compliance associated with export and import related activities and contract enforcement measures are some areas which can be rapidly developed and made more efficient. It takes the longest time for Bangladesh to process import/export documents and other compliances, compared with its competitor countries in all the underlying indicators (an average of 169 hours compared to 37 hours for India and 60 hours for Vietnam) due to old-fashioned border control and tax administration. This increases trade related costs by almost 3 to 4 times that of neighbors, adding to the unattractiveness of investing in Bangladesh.

Improvements in connectivity, transport, logistics and port clearance services together with skill development and improved technical education will enhance FDI flows into Bangladesh. This approach together with flexible management of the exchange rate to enhance export competitiveness will work better than subsidies and tax benefits, which are only a short-term fix and costly for the budget.

The over-valued exchange rate is a much talked about problem which needs to be addressed soon, as well as the over-protective tariff regime, which is one of the highest in the world. It hinders bi-lateral and regional trade negotiation; an area Vietnam is excelling in. Synchronized adjustment in tariff rates may be designed to achieve a significant reduction in the effective protection without undermining the revenue collected at the import stage.

Focus of FDI should be more on specific areas like backward linkage to non-cotton fabrics, MMF as addressed in the budget, and other areas which would support diversification of the sector and help Bangladesh keep up with the emerging global trends.

The welcoming attitude towards FDI is a much-needed change in mindset in the industry, as it brings necessary technical expertise, standards, and supports overall knowledge development. Focus of FDI should be more on specific areas like backward linkage to non-cotton fabrics, MMF as addressed in the budget, and other areas which would support diversification of the sector and help Bangladesh keep up with the emerging global trends. Continued collaboration toward planned development is the only way forward in this challenging time, especially when issues like sustainability and a lack of attention to long-term direction of the industry have been major drawbacks in the past.