Budget FY22-Meeting the revenue challenge

By

The Finance Minister has presented an ambitious and expansionary budget for 2021, with a 6 % deficit financing — one of the largest ever budgeted in Bangladesh’s history. It is likely appropriate given the need to extricate the economy out of a pandemic-induced slowdown. There are some strengths as well as significant issues in the budget. Corporate tax rates for both the listed and non-listed companies have been reduced by 2.5%, and the tax rate for the newly introduced One-Person-Companies aligned with the highest individual tax rate of 25%. As suggested by some experts, given Bangladesh’s absence of wealth tax, the wealth surcharge on the better-off taxpayers has been enhanced and consolidated to pay for the pandemic-related expenses. Lowering the alternative minimum tax on turnover from 0.50 to 0.25% will provide relief in the short term and help with pandemic recovery. However, the rate needs to be revisited and restored perhaps a year or so later, and its administration made more equitable. Currently, some of the large corporations are avoiding this tax altogether by litigation. That needs resolving.

While these are good moves, they are tinkering in the margin of one of the most serious issues confronting Bangladesh: the extreme shortfall in revenue. As it happens, a few months ago, Finance Minister Mr. Mustafa Kamal made a profoundly correct observation that unless Bangladesh is able to raise revenues significantly, the dream of Bangladesh becoming a high-income country would remain only a dream. He was responding to the news of the anemic growth in revenues far short of the 40% growth that he had set in the budget. Most independent projections suggest that revenues will be about 25% less than originally budgeted.

The revenue collection challenge is more accurately illustrated by the pre-Covid-19 normal years. The FY 2018-19, for instance, had a revenue to GDP (Gross Domestic Product) outcome of 9%, well short of the 14% revenue to GDP target at the 7FYP for FY 2020. Moreover, annual growth in revenues collected by the National Board of Revenue, which accounts for 85% of all tax revenues, had declined from 17% in FY 2017 to about 10% in FY 2019 before falling in absolute terms in FY 2020.

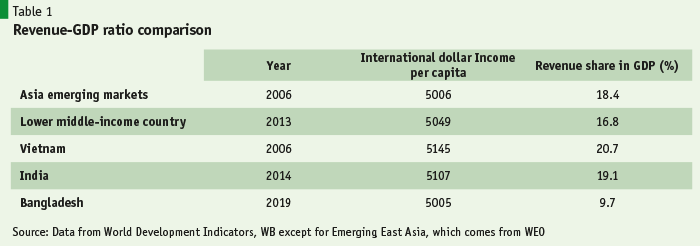

A comparative look at other countries and regions highlights Bangladesh’s revenue shortfall, as shown in the table above. Bangladesh’s current per capita income measured by internationally comparable dollars was PPP USD 5005 in 2019. How does Bangladesh’s revenue collection compare to countries when they had a similar per capita income? As the table shows, when they had the same income as Bangladesh now, the average revenue to GDP ratio of Asian emerging markets (China and Southeast Asian economies in 2005), lower middle-income countries (the group that Bangladesh now belongs to in 2013), similar countries and competitors such as Vietnam in 2006 and India in 2014 were much higher – by 7 % of GDP to 11% of GDP. For example, when Vietnam had the same per capita income in 2005 as Bangladesh had in 2019, it collected nearly 21% of its GDP in taxes compared to about 10% in Bangladesh. This finding on Bangladesh’s poor performance in revenue collection is supported by some simple but robust econometrics.

We predict Bangladesh’s revenue to GDP ratio based on a tight relationship between per capita income and revenue to GDP share from 30 years’ data on more than 100 countries, small, medium, large countries. We find that Bangladesh’s revenue to GDP ratio is expected to be about 19% of GDP. Straightforwardly, this means revenues could be about twice what it was in 2019 – nearly about BDT 2.5 lac crore higher. Even if we cut that number by half, Bangladesh would have additional BDT 1.25 trillion of potential revenues available – as per the 7th Five Year Plan.

What can we do to reach Bangladesh’s revenue potential? In this column’s space, we can only sketch out some ideas. As is true everywhere, there are two parts to raising revenues: improving tax policy and tax administration.

Tax Policy

There are several challenges in tax policy that need to be addressed. The first and major one is the overly complex value-added tax introduced in FY 2019. The VAT design has four central rates (5, 7.5, 10, and 15%), and several minor slabs – altogether eight slabs – and exemptions. On the other hand, good practice suggests that there should be one rate and, if needed, a maximum of two rates, aside from the zero rates. 90% of countries that introduced the VAT from 2000 to 2015 had a single VAT rate.

Second, the firm size threshold for VAT compliance was also increased beyond its original design. Unsurprisingly, this resulted in a jump in the number of firms claiming to fall below the higher threshold. On the other hand, the input credit system for registered firms may also mean that firms that small scale industries that are unregistered may be at a disadvantage as large firms may not want to procure from them as they will be deprived of the tax credit. In sum, Bangladesh’s VATs complexity makes the input credit system extremely difficult to administer, significantly increases the cost of record keeping and compliance for firms, creates incentives to evade taxes and opportunities for corruption, and may hurt small businesses. Thus, the VAT design hurts the economy through lower revenues and the costs it imposes on firms.

…the input credit system for registered firms may also mean that firms that small scale industries that are unregistered may be at a disadvantage as large firms may not want to procure from them as they will be deprived of the tax credit. In sum, Bangladesh’s VATs complexity makes the input credit system extremely difficult to administer, significantly increases the cost of record keeping and compliance for firms, creates incentives to evade taxes and opportunities for corruption, and may hurt small businesses. Thus, the VAT design hurts the economy through lower revenues and the costs it imposes on firms.

Third, unrealistic budgets based on aspirational growth targets lead to extremely optimistic revenue projections. For example, when the Government of Bangladesh set a revenue growth target of 49% in FY 2020 when nominal GDP was supposed to grow about 12%, the targets lost all credibility. In the event, revenues declined when Covid hit. Unfortunately, this practice continued with FY 2021 budget when the government set a revenue growth target of more than 50% based on a real GDP growth target of 7% and a nominal GDP growth target of 14%. Such unrealistic targets had two-way adverse impacts. First, it placed NBR officials in an impossible position, undermining their morale as the targets set them up as designed to fail. Second, it also created pressure on them to place undue, sometimes even extortionary, pressure on firms.

Fourth, besides having low revenue collection rates, another significant problem is the dependence on trade taxes that account for nearly one-fourth of all tax revenue collection. Such reliance means that consumers bear the burden of high prices on one hand. And, on the other hand, these trade taxes create an anti-export bias in Bangladesh’s trade regime, lowering Bangladesh’s competitiveness, economic diversification, and growth prospects. Thus, not only do revenues have to be increased, revenues from trade neutral taxes such as the value-added taxes must increase even more to replace the trade-dependent taxes.

Fifth, tax expenditures – revenues lost due to exemption or ad-hoc reductions in rates — need to be reduced. A recent estimate from an NBR report is that Bangladesh loses about 7 per cent of GDP due to these tax expenditures. A closer look suggests that this estimate is an overestimate. About 60 per cent of these losses are due to bonded warehouse imports by exporters. But these are bona fide transactions so that we do not burden our exporters who have to compete internationally. While abuses need to be stopped, a reversal of this policy would create great harm. Another 20 per cent comes from lower taxes on capital goods and raw materials, a policy that helps our industries.

That said, there is undoubtedly an issue with significant losses from tax exemptions. A simple exercise on the transport sector suggests staggering revenue losses: according to the NBR about Tk. 894 crores were collected as income taxes from the transport sector in Fiscal 2016-17, or less than 1 per cent of the transport sector’s GDP. Another example comes from the policy in recent years to offer tax evaders the opportunity to declare their income later at lower rates of 10 per cent. That is an outright invitation to evade taxes. Ethics aside, the policy says that it pays to avoid taxes. Businesses can be allowed to declare their incomes at a later year, but with a penalty, or at least at standard rates. The current budget has also provided tax holidays to promote local industries, including automobiles. This policy is, at best, misguided as there is little evidence that such tax holidays, per se, help industrialisation. On the other hand, Bangladesh’s industries show promise, such as IT-enabled services or mobile telephony have received no such support. These policies suggest an ad hoc origin. That leads us to our next topic.

Tax administration reforms: a lot but not all is about automation

At least as important as these tax policy corrections is the need to strengthen tax administration to overcome significant organisational failures. Only then can our revenue collection be on a firm footing. We suggest six actions.

First, there is the overarching question of reforming the NBR and tax organisation generally. Providing adequate financial and human resources, infrastructure, and logistical support for tax collection operations will be essential. Even now, many NBR offices lack their buildings. The returns to such investments are enormous, but not unlike those seen in other countries: NBR estimates that every additional Tk 0.66 of expenditures on NBR result in additional Tk. 100 of revenues. We mention these matters only to highlight the urgent importance of the government’s attention to this matter.

Second, the most critical pending reform is NBR’s automation. Unfortunately, this is a nearly two-decade-long tale of ambivalent intentions and missed opportunities. The potential for increasing efficiency and revenue collections through automation remains large and unfulfilled. Whether we can reach this potential depends on political and administrative leadership. Most importantly, there is a remarkably successful model to follow already available in Bangladesh. We will turn to this example in conclusion.

Automation got the first shot in a Large Taxpayer Unit (LTU) for both Income Tax and Value Added Tax, with a supposedly automated tax office at around 2003. The need for computerisation on a large-scale, however, became critical about 2009 when revenue collection was again seen, rightly, as urgent. As a result, the NBR launched a two-pronged plan:(i) enhance public awareness about the importance of taxation and NBR’s efforts; and (ii) reinvigorate automation by creating an automated interface between the tax department and the taxpayers.

The awareness campaign began with the twin-idea of the “self-motivated taxpayer programme” (SMTP) and “tax fair,” which was started in 2010 as a first step to familiarise the taxpayers with the tax filing procedure. The purpose was to create an informed taxpayer class inclusively to make them voluntarily compliant. These initiatives boosted taxpayer compliance programs and new taxpayer registration.

If automation and service delivery could have been better combined, the LTU could have become a role model for tax automation. Sadly, it did not. At present, it collects more than one-third of the yearly income tax revenue of NBR, and it has provided valuable services to its largely satisfied taxpayers. But from the very beginning, automation’s potential remained unfulfilled due to the slow pace of software development and an underdeveloped database. Still, because even the limited LTU’s automation programme had boosted taxpayers’ response, the need for a more comprehensive automated taxation platform became clear.

Toward that end, the NBR started an effective rollout of the Management Information System for Taxation (MIST) in 2011, with the lead role being played by a Bangladeshi firm. The software was tested, almost all officers and staff were provided training, and necessary hardware was procured and installed in all tax offices. During training and feedback, some shortcomings of the software were detected and rectified. But for some unknown reasons, despite remarkable progress, the project was aborted.

And regrettably, despite small successes, this pattern was repeated. A few more initiatives were taken, including one with World Bank financing, but they went in vain for reasons best known to the authorities. As noted, there have been small successes. The E-Tin was successfully launched and is still working relatively well. Introducing tax payments through MFSs like bKash from the last tax fair in 2019 has also been effective. These initiatives have reduced the numerous repetitive workloads of the department and established a system of taxpayer registration, certificate generation, and tax payment without the human input of the respective tax offices. These results speak volumes about the gains that should come with advanced automation.

As Tax Day 2021, the November 30 return filing deadline approaches, the pandemic makes the traditional Tax Fair and person-to-person contact through the STMP programme difficult. Overall, the lack of an automated tax system has seriously handicapped NBR in managing finances to attain Bangladesh’s SDG goals. Moreover, when some foreign tax jurisdictions are contemplating upgrading their tax database system to blockchain technology to enhance speed, security, and efficiency, Bangladesh still does not even have a databased automated platform.

Automation has to be treated with critical urgency and seriousness. As noted, at least two potentially successful initiatives in the past were aborted for unclear reasons. Worse, these past efforts seem now to have been replaced by questionable, unsuccessful attempts. For instance, last year, when online return filing of taxes started – boosted by a BDT 2000 rebate for doing online filing – it was discovered that the online return filing window of the software put in place by a foreign contractor over the past several years failed to function. The contractor had left Bangladesh without handing over the facility to NBR. More alarming, the same contractor will be responsible for delivering the VAT Online project.

Automation has to be treated with critical urgency and seriousness. As noted, at least two potentially successful initiatives in the past were aborted for unclear reasons. Worse, these past efforts seem now to have been replaced by questionable, unsuccessful attempts. For instance, last year, when online return filing of taxes started – boosted by a BDT 2000 rebate for doing online filing – it was discovered that the online return filing window of the software put in place by a foreign contractor over the past several years failed to function.

Third, in line with international experts’ suggestions, we propose contracting out the repetitive non-technical parts of the tax activities as return filing and processing work to private management firms to complement automation. Launching such programmes can be an effective way to run the SMTP and tax-fair dependent tax filers. Also, it will save a massive workload of tax officials, releasing them for other more productive, investigative, audit, and other revenue-yielding technical works.

Along the same lines, the current NID database-linked E-TIN registry can be integrated within one channel to administer taxpayer registration, return filing & processing, and tax payment counter simultaneously. However, a further critical step has to be to uniquely link the income tax TIN to the VAT Business-Identification number. Doing this will enable the two wings of the NBR to share information and increase tax collection effectively.

Fourth, raising tax collection will require building a competent tax compliance and policy research unit at the disposal of the tax authority and the government. Tax policies change every year through Finance Acts. But there is no discussion about the basis for these changes, except suggestions by different lobby groups. There needs to be a group that analyses the impact of policy changes on tax administration, revenue, investment, tax compliance, taxpayer and third-party behaviour and reporting costs, tax authority’s business process, etc.

As economic development progresses, financial transactions become more complex. Increasing cross-border and e-commerce transactions present new challenges before the tax authorities. All these developments and their implications for tax policy need to be researched and findings discussed and implemented. To do so, it is time now to implement a more than 20-year-old government plan introduced in the FY 2000-01 budget: to establish a Tax Policy Research Cell at NBR.

Fifth, to raise tax capacity, we need a modern tax academy to conduct year-round training programmes for the tax officials and other stakeholders. The aim should be to build a tax ecosystem with highly trained tax officials and third-party information reporters. The Research Cell noted above, and the Tax Academy can collaborate on joint projects to generate empirical data and disseminate the findings. The Tax Policy Research Cell, mentioned earlier, can be included as part of The Tax Academy. It can collaborate with research organisations like BIDS, CPD, or PRI to research taxation issues to help formulate appropriate tax policies.

Lastly, we suggest steps to increase the professionalisation of the NBR. For this, we propose reverting the National Board of Revenue to the organisational set up envisaged in Bangabandhu’s Order of 1972 (President’s Order No. 76 of 1972). According to that original order, one of the members of NBR shall be the Chairman of NBR. The point is fundamental: the Chairman of the NBR has to be a professional. Once made Chairman (s)he can be made Secretary to the Government and titled Revenue Secretary. In addition, there can be an independent Advisory Board consisting of professional and academic experts and business representatives to advise the Minister and the Chairman. Another sensible idea discussed during the 2009-12 reform period was to depute senior NBR officials in senior positions of the Internal Resources Division under which NBR operates. This arrangement can help senior tax officials familiarise themselves with policy platforms in other areas and make valuable inputs to policy formulation there. These steps will improve the coordination of tax policies with other policies of the Government.

“Tax administration is tax policy”; if administration suffers, policy implementation will suffer. We have seen earlier that Bangladesh’s revenue potential is considerably higher – by about 5 to 10% of GDP. But this potential cannot be realised without the reforms we have discussed.

Undoubtedly, these reforms will require political and administrative leadership. Such leadership exists in Bangladesh. In particular, tax reforms and automation may take inspiration from the progress with the computerisation of land records and land transactions carried out by the Ministry of Land. Digitising land records is one of the most challenging tasks anywhere, but Bangladesh has made progress there. Given strong political and administrative leadership, Bangladesh can also achieve the same with tax revenues. If Bangladesh wants to become a high-income country or even an upper-middle-income country, it has no choice but to carry out these reforms.