Reflections on Banking Ethics in Bangladesh

By

Ethics and Banking

One might wonder since ethics is important for all business and personal dealings, why single out banking? The short answer is unlike other business, the very foundation of banking business is based on trust. When a license is given to a bank or a non-bank financial institution to mobilize deposits, the Bangladesh Bank and the government are essentially certifying that they have confidence and trust that the enterprise will safeguard the citizen’s money it has mobilized through deposits. When this trust is broken or even weakened, the stability of the banking system will suffer. So, essentially, ethics is a core element of the banking business.

Bangladesh Banking Sector Has Progressed Well

The banking sector in Bangladesh has progressed well since independence. Following the initial debacles and governance challenges in managing a publicly owned banking system, the banking sector witnessed great progress following a series of reforms starting in 1998. These reforms deregulated the banking industry and sharply strengthened the supervision and implementation of prudential norms.

The reforms greatly improved the quantity and quality of banking services in Bangladesh, thereby contributing handsomely to the Bangladesh development progress. The progress is most advanced in urban areas that is now well served by a vibrant and competitive banking sector owing to the emergence of many private banks. The quality of banking service has vastly increased, reflected in easy access to banking, availability of many banking products and the emergence of digital banking that has lowered transaction costs.

The rural areas are increasingly coming under the spread of commercial banking, supplemented by the growth of microfinance institutions. A growing number of unbanked rural population is being serviced through mobile financial services.

Banking Ethics Has Also Improved by Historical Standards

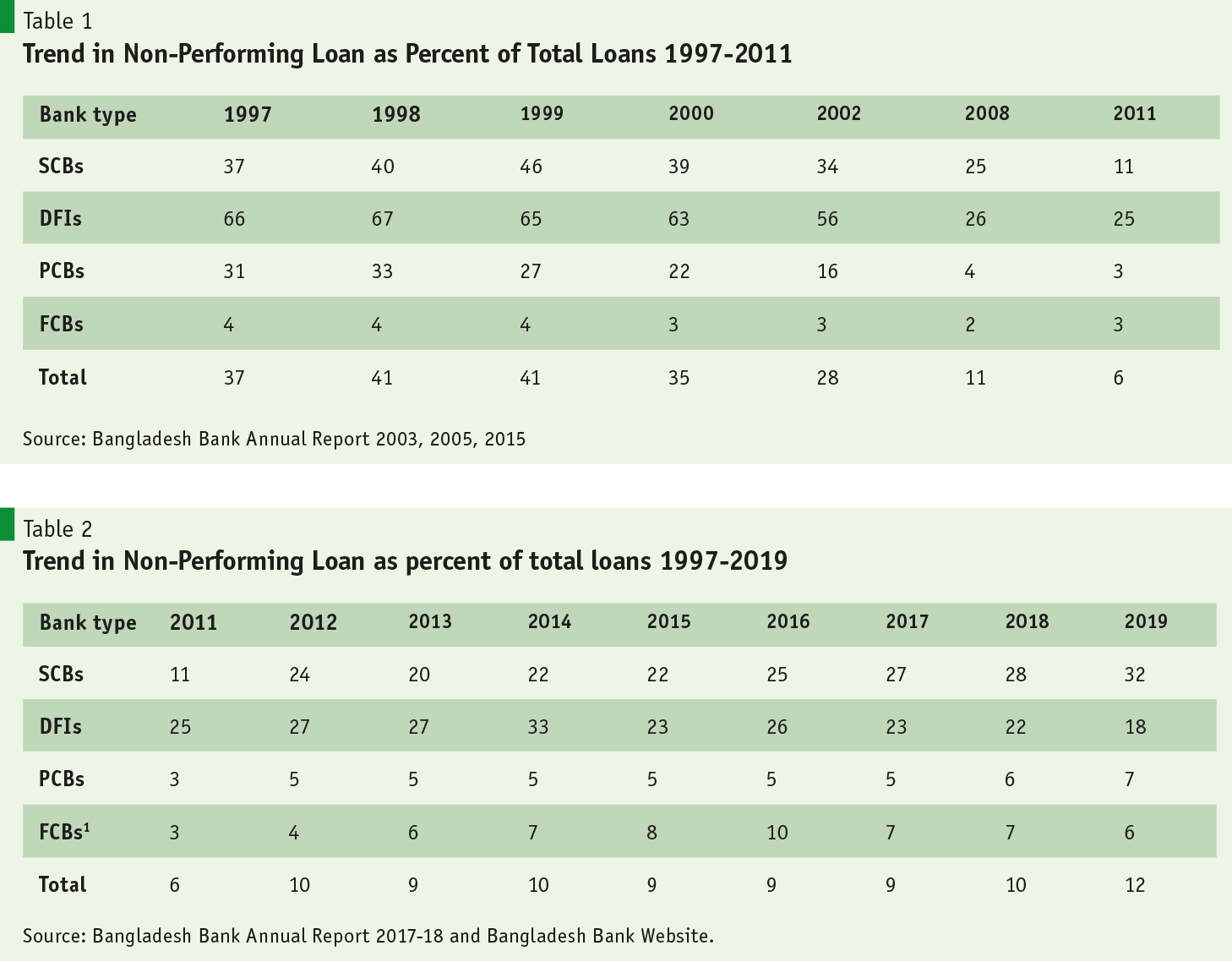

There are several dimensions of ethics in banking. The most important aspect is banking governance. Prior to the reform program initiated in 1998, banking sector governance was very weak. Even as late as 1997, the banking sector was dominated by corrupt and inefficient public banks, accounting for 67% of total deposits and 63% of total loans. Many of the loans of these banks were non-performing owing to weak discipline and inefficient management. Loan and interest recovery culture was lax. In summary, banking ethics was weak. Thus, in 1998, some 41 percent of the total loan portfolio of the banking sector was officially classified as non-performing loans (NPL). This was mostly due to the infected portfolio of the public banks that dominated the banking sector. For example, 40% of the loan portfolio of state-owned commercial banks (SCBs) and 67% of the portfolio of the state-owned development finance institutions (DFIs) were classified as NPLs. The DFIs were essentially bankrupt and survived through financial support from the Treasury. The financial health of the state-owned commercial banks was also weak and required frequent equity support from the Treasury to stay afloat.

The reforms of the post 1998 period largely restored much of the banking sector governance and ethics. As a result of deregulation, reforms in the management of public banks and implementation of prudential norms, the overall health of the banking sector improved considerably. By 2011, the private banks became the dominant players in banking sector causing the public bank’s market share for deposits and loans to fall to a mere 20%. Combined with strengthened prudential norms and reforms in public banks, the total NPL came down sharply to 6% (Table 1). The portfolio of public banks also improved considerably contributing to this progress.

Another dimension of this strengthened governance is the increase in capital adequacy of the banking sector. Overall capital adequacy grew from 7.5% in 1997 to 11.4% in 2011. This was an important dimension of progress in strengthening the safety of the banking sector.

Along with better governance, another improvement in banking ethics happened in the area of access to banking services. A combination of supportive policies from the Bangladesh Bank and the Ministry of Finance contributed to this. These include the spread of microfinance institutions, spread of rural commercial banking, special credit programs for small enterprises, and the spread of mobile financial services. It is important to note though that the equitable access agenda is still substantially unfinished.

Yet Recent Events Have Shown the Fragility of the Progress in Banking Ethics

The banking sector has continued to do well in several dimensions after 2011. Financial deepening has increased further reflected in the rising GDP shares of total deposits and credits. Interest rates have come down in both nominal and real terms, and access to banking has continued to increase. There is no doubt that these factors have played a major development role in spurring GDP growth, investment, and exports. So, there is much to celebrate.

The area I feel less comfortable is concerning the slide in banking ethics. The most powerful indicator of this is the resurgence of the incidence of non-performing loans. The rise in NPLs has happened in both public and private banks, although NPL incidence continues to be mostly concentrated in public banks. The incidence of total NPLs doubled between 2011 and 2019, surging from 6% in 2011 to 12% in 2019 (Table 2). The NPL incidence in state- owned commercial banks increased from 11% to 32%; in private banks it increased from 3% to 7%.

At this point, one might want to pause and ask why a rising NPL reflects poor banking ethics? Surely, in a market economy, enterprises do fail due to market conditions from fall in demand, rise in commodity prices, political turmoil like hartals, and natural disasters including COVID, which could cause loan defaults. It is true that adverse market conditions can cause temporary payment problems in enterprises. Some blip in NPLs can happen, as for example during the first year of the COVID incidence. But persistent and rising NPLs over a prolonged period is a clear indicator of serious governance problems facing the banking sector.

It is true that adverse market conditions can cause temporary payment problems in enterprises. Some blip in NPLs can happen, as for example during the first year of the COVID incidence. But persistent and rising NPLs over a prolonged period is a clear indicator of serious governance problems facing the banking sector.

Another indicator is the NPL incidence by groups of banks. BB data clearly show this. Historically, public banks have shown high and growing incidence of NPLs while private banks have shown much lower incidence. Within private banks, well-managed banks show much lower NPL than poorly managed and weak governance-infected private banks. Perhaps, the best illustration of this point is the NPL incidence of private foreign banks. These banks are largely free from domestic governance problems and political interventions. They are supervised by international head-offices. Management is selected and rewarded based on performance. Overall, banking ethics environment in these banks is highly positive. Therefore, it is hardly surprising that they have shown very low and stable NPLs in the 2-3% range. They also have substantially larger capital adequacy ratio.

The governance environment and ethics problem are most challenging for SCBs and DFIs. These public financial institutions are basically government run and carry huge political mandates that are not financially and economically viable. The most notable example of such lending operations is the financing of poorly performing state owned enterprises. Furthermore, in many cases loans are provided to private sector based on connections rather than economic and financial viability. It is not surprising that most DFIs have now gone bankrupt and have ceased to operate. Corrupt practices are also more dominant in public banks. Most prominent examples of such corrupt practices are the infamous Sonali Bank fraud between 2010-2012 involving the Hallmark group and the Basic Bank fraud between 2009-2013.

A major conclusion of a 2003 research was that in countries with poor governance environment as in South Asia, government ownership of banks is bound to create serious ethical problems leading to very weak portfolios (Ahmed, Uy and Ramachandran, 2003). This is because even with sound regulations and strong supervisory norms, in practice it is near impossible to rein in state-owned banks that are patronized by politically powerful forces.

Domestic private banks typically face a better governance environment than state-owned banks. So, overall banking ethics is better but varies considerably by banks. The bank board quality is uneven, insider lending transactions are prevalent and banking norms can be bypassed through political connections since many private banks are owned by political leaders. The rising NPLs in domestic private banks is the result of the uneven application of banking ethics and sound banking practices among different banks.

There has been a slight downward trend in the incidence of NPLs since 2018. But this is not based on any meaningful reform and therefore does not reflect an improvement in the financial health of the banking sector or improved banking sector ethics. Most unfortunately, the government has chosen not to face the challenge of the worsening loan portfolio of the banking sector by introducing sustainable reforms but has opted for cosmetic actions to hide the magnitude of the real problem. The actions to address the NPLs has mainly involved relaxation of the loan classification norms, restructuring of large loans, and extensive loan write offs. These policies have lowered somewhat the stock of NPLs but the fundamental problems that cause NPLs – the bad loan decisions and the weakness of loan recoveries process – remain virtually untouched. So, while the stock of NPLs is being lowered cosmetically, the flow of new bad loans keeps growing. This flow problem has been further aggravated by the onset of COVID-19.

Social Cost of NPLs

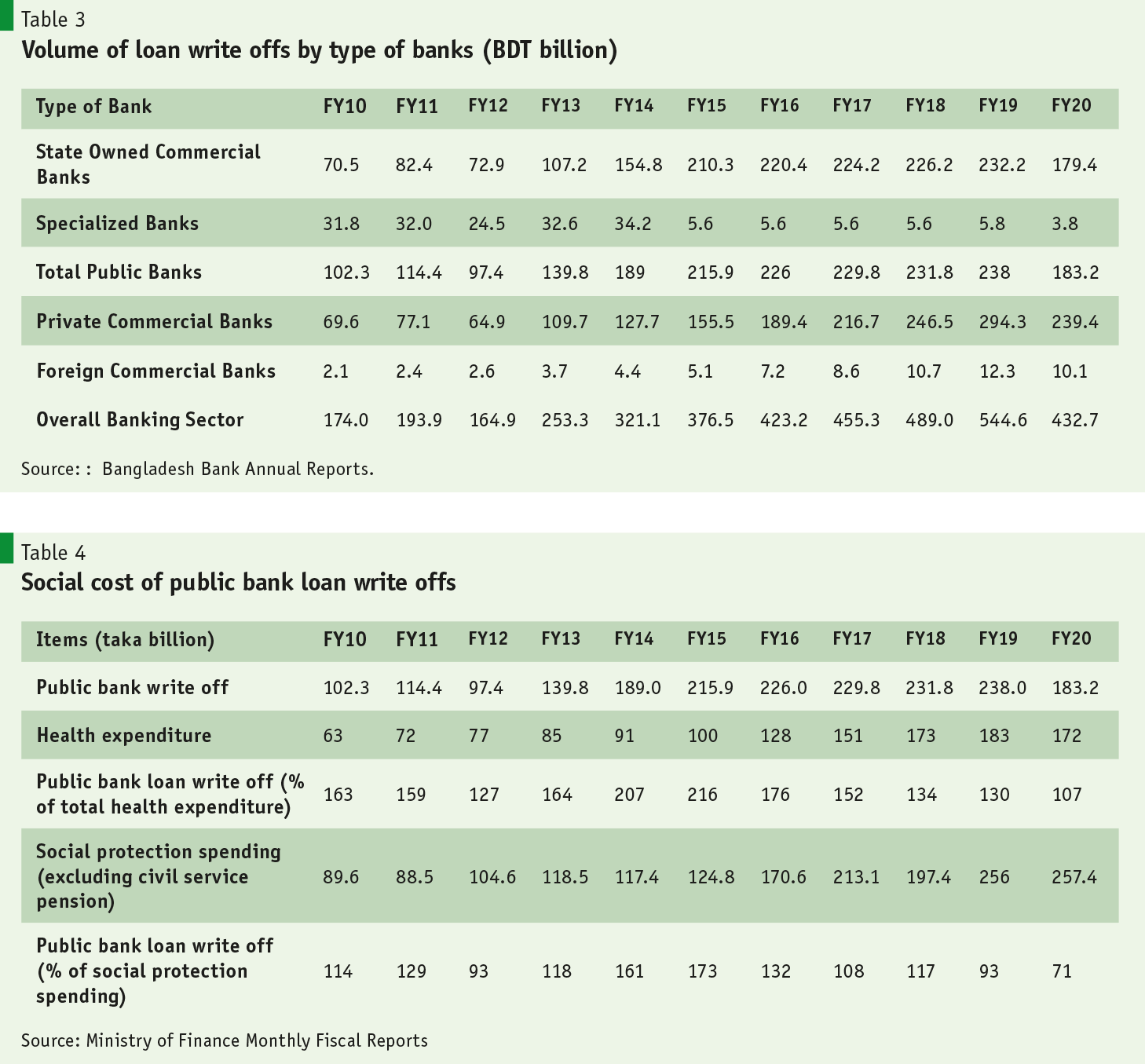

The social cost of NPLs is best understood by looking at their magnitude. The value of NPLs surged from BDT 226 billion in 2011 to BDT 961 billion in 2020. One particularly damaging element of the cosmetic approach to lowering the stock of NPLs is the issue of loan write offs. While this might appear to be the right thing to do to keep the banking sectors books clean since these loans would never likely be recovered, it is not obvious that the government has paid enough attention to the social cost of this policy. Data for the past 11 years shows that the amount of annual loan write offs has grown progressively owing to rising NPLs (Table 3). The loan write-offs continued to be dominated by public sector banks well until 2017. Since 2018, private banks account for a higher share of total loan write offs reflecting the growing portfolio problems of private banks.

The social cost of loan write offs is substantial, but these costs differ between public and private banks. For public banks, the social cost of loan write offs is huge as it amounts to either a diversion of taxpayer revenues or loss of revenues for the Treasury from public banks. Fundamentally, the loan write offs of public bank is simply a reflection of the shifting of the burden of bad loans to the Treasury, which then finances the loan write offs from taxpayer resources or by foregoing income transfers from public banks. These divert resources from high-priority spending like health, education, and social protection to the borrowers of these funds from the public banks.

This critical point is highlighted in Table 4, which tells a very sad story. Annual public bank loan write offs have substantially exceeded the total spending on health in all years from FY2010 to FY2020. In most years they have also exceeded the amount spent on social protection (excluding civil service pension). The social cost of public bank loan write offs is obviously very high. These resources could have been well used to improve the health outcome of the Bangladeshi population and to reduce poverty through income transfers to the poor and vulnerable. Instead, the money went primarily to the pockets of the rich and powerful borrowers from public sector banks who took the money and never paid back interest or principal or both. This practice is highly unethical and socially harmful and must be stopped.

The social cost of private bank loan write off is less devastating but also harmful. High NPLs and associated loan write offs tend to increase the cost of financial intermediation that invariably puts pressure on interest rates as banks try to recoup income through higher lending rates and lower deposit rates. They also hurt the quality of banking services through cutbacks in administrative costs.

Improving Ethics in Banking: Addressing the Cancer of NPLs

As noted earlier, it is no accident that private foreign banks have the best loan portfolio because lending decisions are primarily based on client quality considerations. On the other hand, public banks have the worst quality portfolio while a growing number of weak and poorly managed private banks have also been experiencing growing portfolio problem. A common element for these banks is bad lending decisions owing to poor governance. The only sustainable way to scale back loan write offs is to stem the tide of bad loan decisions through sharp improvements in banking governance where lending decisions are guided by project quality and not political or business connections. Loan recovery process similarly should be guided by sound business norms and not connections.

How does one bring about this massive improvement in banking governance? Let me first talk about the persistent use of some of the cosmetic solutions in practice today and then move on to the long-term and sustained solution to the NPL problem.

a) Portfolio Reclassification: The softening of NPL definition as has happened in recent months is not a recommended option. This bandage type solution to a serious cancer problem is neither helpful nor sustainable. Bangladesh Bank is commended for moving forward with internationally recommended norms of loan portfolio classification and measurement of capital adequacy ratios. They must maintain this discipline and resist political pressure to soften the application of prudential norms. The long-term interests of Bangladesh are best served by staying on track with the application of internationally approved prudential norms for the supervision of the banking sector and certifying its health.

b) Loan Restructuring: In a market economy some loan restructuring is inevitable. The Bangladesh Bank developed a large loan restructuring policy (LLRP) in January 2015, aimed at reducing these transaction costs and facilitating an orderly restructuring process for large loans of enterprises that are under temporary financial stress. This is a facility available to all business irrespective of their political affiliation and based only on the merits of the business case. The LLRP was developed with scrutiny by the BB Board and drew on the good practice examples from Asian countries. Attention was given to ensuring that only a genuine business enterprise with evidence-based restructuring proposal duly certified by a pre-qualified accounting firm is eligible. The LLRP requires that individual banks must own and approve the restructuring proposal based on strictly business considerations, but it also provides prudential limits on the generosity of the restructuring terms. This means a bank, especially state-owned commercial bank, cannot just decide to forego its earnings based on political pressures. The LLRP was never intended to bail out persistently poor-performing enterprises or to reward them with lower loan terms for bad behavior. So, this is not an instrument for managing NPLs and should not be provided to known loan defaulters.

c) Addressing the governance problems in public banks: As noted earlier, the evidence is clear that in an environment of country-wide governance challenges, as in Bangladesh and elsewhere in South Asian countries, government ownership of banks is inconsistent with ensuring good ethics in public banks. The first best option is to privatize most public banks while keeping one bank, such as the Sonali Bank, to primarily support Treasury functions. A second-best option is to convert state commercial banks into narrow banks that allows them to take deposits and invest only in T-bills. No lending is allowed, which eliminates the NPL and associated inefficiency and corruption problems at source.

In the current political environment, none of the first two options appear feasible. We then go to the third-best option of improving the management of these banks and requiring them to earn a genuine rather than book- keeping profit. This entails several reforms. First, the banks must be managed by an independent board as in private banks without intervention from the government. The bank management must be professional in nature and certified by the Bangladesh Bank in terms of the fit and proper guidelines applied to the certification of the private bank board. Second, public banks must be fully supervised by the Bangladesh Bank and required to comply with all the prudential norms within a specified timeline. Third, the Treasury must impose a hard budget constraint on these banks so that no Treasury transfers are possible to keep them afloat. They must become financially viable and profitable within a specified timeline. Fourth, bank management must be held accountable by the government for performance including monitoring of NPLs, capital adequacy, and profitability.

d) Addressing the governance problems in private banks: Weak private banks must be given a timeline to perform and fully meet all prudential norms, failing which they become candidates for mergers.

e) Strengthening Loan Recovery and NPL Workouts: The legal framework for loan recovery must be strengthened by focusing on provisions for easier and faster loan recovery. Punitive measures for loan default must be tightened to deter individuals and bank staff abetting such behavior. A proper workout of the stock of NPLs for each bank must be adopted based on international good practice experience2. Technical assistance can be sought from the IMF or the World Bank for this task.

f) Strengthening the Supervision Role of Bangladesh Bank: The Bangladesh Bank as the main banking oversight agency must adopt a swift program to stem the tide of the flow of bad loans through much stronger supervision and disciplinary actions against the management of poorly functioning bank. Due diligence on poorly functioning banks must be strengthened including review of board effectiveness, quality of bank management, quality of lending decisions, and the effectiveness of loan recovery process. Frequent loan write offs and a softening of loan classification must be avoided. The Finance Ministry must not get involved in cosmetic NPL solutions or provide political cover to powerful loan defaulters. Instead, it should strengthen the hands of the Bangladesh Bank by giving them stronger autonomy including the application of full prudential norms for public banks and full pursuit of all legal options against loan defaulters without fear of adverse political repercussions.

Concluding Remarks

The banking sector has played a key role in helping accelerate private investment, export, and GDP growth in Bangladesh. This progress must be preserved and further strengthened as Bangladesh seeks to achieve Upper Middle-Income status by FY2031. The dark clouds looming from a slide in banking governance that is reflected in growing NPLs must be tackled swiftly and firmly through sustainable solutions and not through cosmetic interventions. Strong partnership between the Ministry of Finance and the Bangladesh Bank is essential.

In the end it is very important to note that despite considerable progress, there are still lots of poor and needy people in Bangladesh. It is immoral and unethical for policy making to let a few greedy politically connected ultra-rich people to siphon off depositors’ money and then fill the gap with taxpayer money, thereby depriving critical services to the poor.

References

Ahmed, Sadiq (2020). “The Imperative for Banking Reforms in Bangladesh” BIBM, Bank Parikrama, Volume XLIV and XLV, September 2019-June 2020 (pp 86-113).

Ahmed, Sadiq. Marilou Uy and S. Ramachandran (2003). South Asia banking and finance: Growth with festering problems. South Asia Region Internal Discussion Paper IDP-186, The World Bank: Washington DC.

Bauze, Karlis (2018). “A holistic approach to NPL resolution.” Finsac World Bank Presentation to the Finsac NPL Conference, Austria May 15-16, 2018