THE RISE OF READYMADE GARMENT INDUSTRY Still a Beacon of hope for Bangladesh

By

The rise of the readymade garment (RMG) industry in Bangladesh reflects the triumph of human potential. When a BBC reporter recently asked Professor Nurul Islam, head of Bangladesh Planning Commission in post-independent Bangladesh, whether they had visualized Bangladesh becoming No.2 exporter of RMG in the world, he replied in the negative simply because it was not something on the radar at all. Back in the 1980s readymade garment production was not even remotely a thrust (priority) sector. Cotton-producing economies with large textile industries, like Egypt, Pakistan and India, appeared to have a clear advantage in becoming major garment exporters. Instead, two decades down it was Bangladesh’s turn to show the world what its workers and entrepreneurs, with the right policy support, can achieve in global competition. The upward march continues as garment production and exports rise year after year.

Triumph of Comparative Advantage

True, Bangladesh’s export success has been limited to one manufacturing product group – readymade garments (RMG) – but that is in itself a major transformation for an economy that began exporting only primary products like jute, tea, and shrimps in the 1970s. Putting a densely populated developing economy on the world map of manufacturing exports was itself a validation of the fundamental proposition in international trade – gains from trade based on a nation’s comparative advantage which in turn is driven by factor (resource) endowments. It was strong confirmation of the time-tested principle of comparative advantage laid out by classical economists Simth-Ricardo-Mill1. Apparel/garment making was a labor-intensive activity and Bangladesh’s abundant cheap low-skilled labor was just the resource needed to produce and exchange competitively in the world market. But that also needed creation of a level playing field in the world marketplace. That is where multilateralism and Bangladesh’s trade regime comes into play.

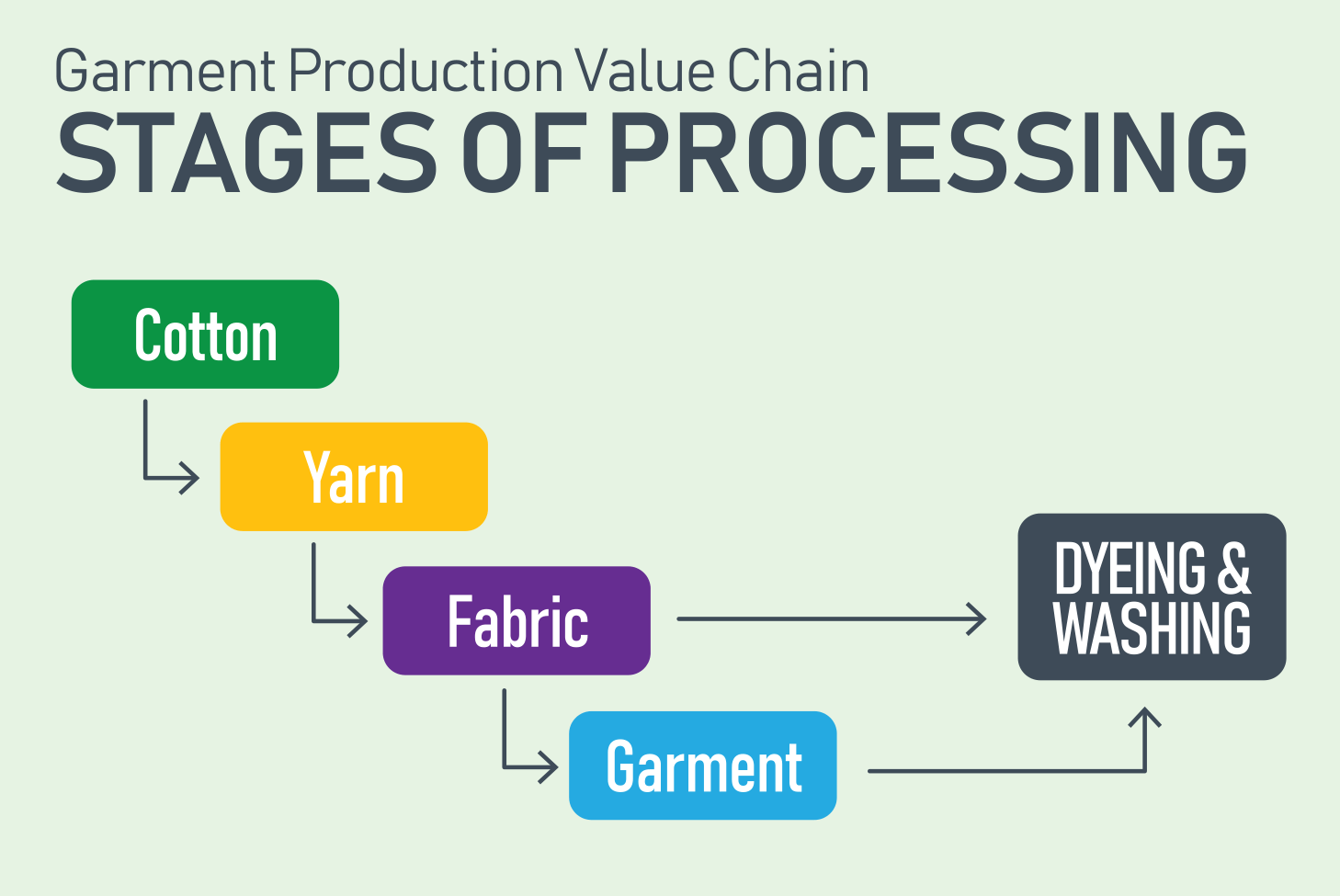

To be sure, technological transformation is under way which could in the distant future alter the labor-intensity or capital-intensity of garment production but, for now, the final stage of garment processing remains labor-intensive, to Bangladesh’s advantage.

Policy innovation to note

Nevertheless, the emergence of our RMG industry must be cited as a case of policy innovation within an overwhelmingly high-tariff import-substituting regime. Reminiscing a bit of history is instructive at this point. In the late 1970s, a South Korean company, Daewoo, saw immense opportunities in partnering with a Bangladeshi firm, Desh Garments, in manufacturing readymade garments for export to the global market. Apart from training Bangladeshi workers, Daewoo brought the knowledge of creating free trade passage for export production in the form of bonded duty-free imports of inputs in a high-tariff and restrictive import regime. Given the Bangladesh scenario, they realized that exports cannot take off unless it has access to world-priced (duty-free) inputs in order to be on a level-playing field with global competitors. Because, unlike domestic import substitute industries which can be compensated for duty-paid inputs through tariff protection to their output, export production faces zero protection in foreign markets and paying duties upfront on imported inputs undermines its competitiveness. It goes to the credit and farsightedness of Bangladeshi policymakers in those early days to embrace such a unique and unfamiliar policy of special bonded warehouse (SBW) for export. Yet, they took that leap of faith which has eventually produced an industry that Bangladesh can be proud of.

What is not readily apparent to many is that RMG’s success is also the success of a unique policy that produced phenomenal results by global standards – 4 million direct jobs and another 4 million in linkage industries today and providing livelihood for some 10 million people in a poverty-stricken country. In view of this exemplary record, it seems paradoxical that policymakers would not draw the lessons from RMG success and try to replicate it in other export sectors.

What is not readily apparent to many is that RMG’s success is also the success of a unique policy that produced phenomenal results by global standards – 4 million direct jobs and another 4 million in linkage industries today and providing livelihood for some 10 million people in a poverty-stricken country. In view of this exemplary record, it seems paradoxical that policymakers would not draw the lessons from RMG success and try to replicate it in other export sectors. It is often argued that it would be practically impossible to monitor SBW facilities in firms that are not 100% export-oriented. Would that be a fair argument in this day and age of electronic/digital record-keeping and monitoring?

Trade policy dualism in Bangladesh

Exporters of Bangladesh are governed by different sets of rules depending on whether they belong to the 100% export-oriented RMG sector or the rest. The provision of special bonded warehouses (SBW) for stocking duty-free imported inputs, back-to-back letter of credit (LC) mechanism that facilitates imports of inputs on credit against master export LCs, and ‘green channel’ import-export customs clearance make RMG sector operate in something of a “free trade enclave” in an otherwise high-tariff and restrictive import regime. While quotas under the now defunct Muti-Fibre Arrangement (MFA) gave Bangladesh RMG producers initial market access, that is not the whole secret of RMG success. I would argue, based principles of trade theory and policy, that it was the free trade arrangement that provided the right impetus for global success in an industry that fitted squarely with Bangladesh’s competitive advantage in low-skill intensive manufacturing. Other exporters (who are not 100% export-oriented) are not so privileged and must plough their way through the cumbersome tariff and duty-drawback regime often coupled with many burdensome regulations as well.

To be fair, there has been modest progress in granting SBW facility to some firms that produce both for exports and the domestic market. However, that is not treated as a rule but as an exception. Instead of accepting and embracing SBW in a high tariff regime as a cardinal principle for export success, the tendency to cling to a dysfunctional duty-drawback system in the hope of protecting revenue remains a major barrier to non-RMG export success and, hence, export diversification. Bangladesh could benefit hugely from a radical change in this policy area. Why?

High and persistent tariff protection is the problem. Trade economists have long argued that export performance and tariff protection are not mutually exclusive. Tariffs on import substitute production are indirect subsidies that undermine support to exports and create anti-export bias. Having carved out a virtually free trade regime for the 100% export-oriented RMG sector, by ensuring world-priced inputs through the SBW System, there seems to be too much internal resistance to the replication of this regime for the non-RMG exports. A trade economist would argue that the protectionist lobbies appeared insurmountable to create an RMG-like regime for some 1400 (HS-6-digit) non-RMG export products that Bangladesh exported in 2018 and continue to do so thereafter. Consequently, despite evidence of potential comparative advantage, non-RMG exports got no traction, continuing to remain in the shadows of RMG exports that continues to dominate the export basket (84% of exports). The evidence is strong that these non-RMG exports which are not 100% export-oriented — in the sense that its producers cater to the domestic as well export markets — find profitability from the highly protected domestic markets relatively higher. Simple rule: if export price of a pair of shoes is lower than its price in the domestic market, the producer will not be interested in exporting. This principle holds for so many consumer products that are produced domestically but are protected by high tariffs that lead to higher prices well above international prices. Thus export diversification remains stalled on the anvil of anti-export bias of the protection regime. Result: with all its flaws our claim to export success is built on the record of the readymade garment industry.

The enclave system

How come RMG is not affected by anti-export bias? The fact is Bangladesh’s leading and most successful export sector – RMG – is virtually unaffected by the anti-export bias of the tariff regime. Why? From the very beginning, RMG industries evolved within a sort of “free trade enclave” that essentially neutralized an otherwise high tariff regime through the institution of SBW to ensure duty-free imported inputs. Supporting facility of back-to-back LC system provided much needed access to working capital in foreign exchange. Later, once RMG became the leading export, it was given high priority for port clearance and other administrative processes. RMG industry thus developed as a 100% export-oriented sector, not in competition with other manufacturing geared to domestic sales. However, other exports were not as privileged as they had to cope with the high tariff regime while importing required raw materials and intermediate or capital inputs. The dysfunctional duty drawback system was no match to the SBW facility. Neither were export subsidies (5-25%) in comparison to high protective tariffs (56-113%), which were tantamount to indirect subsidies to import substitutes. So when non-RMG manufacturing producers compared relative incentives between exports and domestic sales, they found relatively higher profits in domestic sales. That meant that whereas processing margins were close to free trade margins for exports, they were significantly higher for sales in the domestic market. This is how the trade policy regime reveals an anti-export bias for non-RMG exports thus discouraging emergence and expansion of new products in Bangladesh’s export basket.

The sooner we can make our tariff structure reflective of a dynamic export-oriented economy the better our chance of diversifying our exports and fueling post-Covid economic recovery with a bustling diversified export-driven manufacturing sector that creates jobs and income to win the war on poverty. This is exactly the strategy laid out in the Government’s 8th Five Year Plan (FY21-25). The good news is there are promising developments in the concerned ministries for rationalization and modernization of Bangladesh’s tariff structure to bring it in tune with the dynamics of competitive global trade.

There is a widespread notion that the Government provides so much support to the RMG industry but others get nowhere near as much policy support. The fact is what RMG gets is exactly what is needed for any export industry: to be able to compete on a level playing field. Neutralizing import tariffs through SBW to ensure world-priced inputs is the first step in this exercise. All exports to succeed can rightfully claim this measure. PRI research confirms that despite the widespread presumption that export is highly incentivised by cash subsidies and other support measures, high tariff protection given to import substitute production raises profitability of domestic sales well above incentives given to exports. Result? The price an exporter receives for his/her product is much less than what the domestic market has to offer. That indeed is the crux of the trade policy dilemma in Bangladesh.

PRI research confirms that despite the widespread presumption that export is highly incentivised by cash subsidies and other support measures, high tariff protection given to import substitute production raises profitability of domestic sales well above incentives given to exports. Result? The price an exporter receives for his/her product is much less than what the domestic market has to offer. That indeed is the crux of the trade policy dilemma in Bangladesh.

But all is not lost in a global economy that is constantly evolving. First, for non-RMG exports of Bangladesh, where export market shares are infinitesimal, demand is not a constraint, ensuring export incentives and competitiveness are. Second, many of the non-RMG exports are just as labor-intensive as RMG and research shows several of them (e.g. footwear, agro-processing, plastics, etc.) are quite competitive (relative to close competitors) in the world market. Third, China has offered duty-free access to Bangladesh for over 90 percent of tariff lines with similar facilities already in Canada, Japan, Australia and New Zealand. East Asia and Pacific, with a market size of USD 22 trillion (larger than EU or USA) is now an export destination to fight for. RMG and non-RMG exports should be destined for this market in the near and distant future.

RMG prospects remain bright but export concentration creates vulnerability

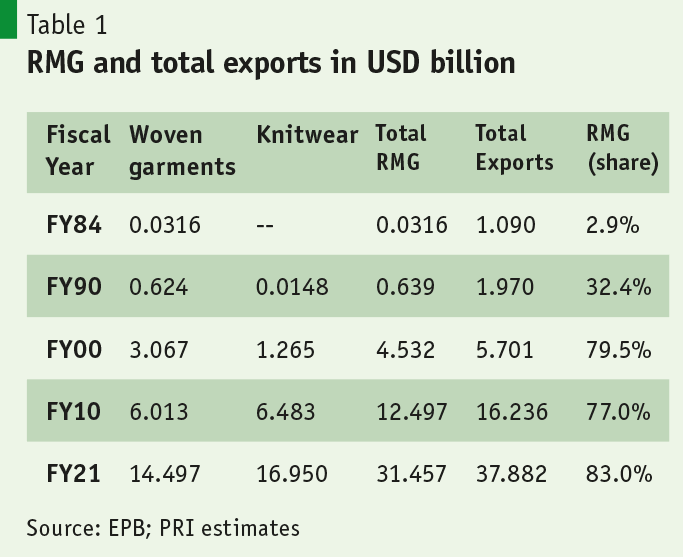

Some might think we have come a long way since the early years of 1980s and it would be a good time to wind down the RMG industry and move to other sectors. That would be reckless as this industry still has a long way to go. True, starting with baby steps of a few million USD of exports in the early 1980s (only USD32 million in FY84), RMG exports have grown by multiples every year, and now rises roughly three times every decade (e.g. USD 4.3 billion in FY00, USD 12.5 billion in FY10, and USD 31.5 billion in FY21), with an average annual growth of double digits since 1990 (Table 1). Within the textile and garment sector, there are two developments to take note: (a) whereas knitwear was a small player until 2009, its share has risen to about equal with the woven garment exports; (b) a strong export-oriented (deemed export) backward linkage spinning and weaving textile industry (plus packaging and accessories) has emerged on the back of garment exports currently supplying about $20 billion worth of yarn, fabrics and accessories to the RMG industry.

Existing RMG production capacities (4000 factories in operation or idle) are second only to China. With the exception of a few down years, double digit RMG export growth continues and is likely to continue for at least another decade, despite technological evolution, given the fact that our export share is barely 6.5% of the global RMG export market of USD 500 billion. Global demand for apparel is one demand that will continue to grow in tandem with global income growth. There are no two things about it.

For most developing countries, with limited domestic markets, export growth can be the key driver of GDP growth. Bangladesh, which began its journey as a densely populated but resource-poor small economy, is a good example of how trade opened up markets, fostered growth, created jobs, and bolstered poverty reduction.

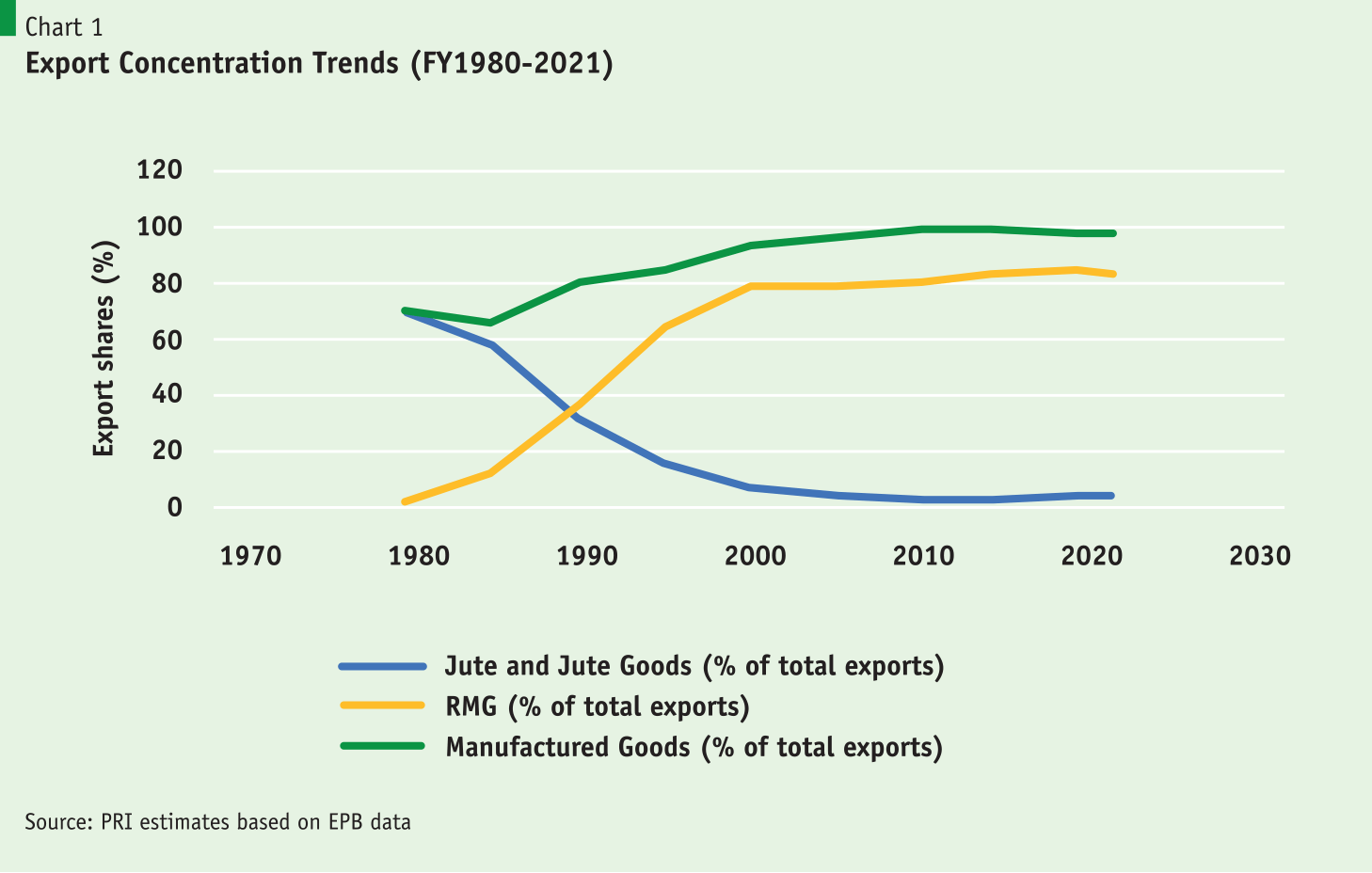

For most developing countries, with limited domestic markets, export growth can be the key driver of GDP growth. Bangladesh, which began its journey as a densely populated but resource-poor small economy, is a good example of how trade opened up markets, fostered growth, created jobs, and bolstered poverty reduction. Bangladesh was heavily dependent on its exports of jute and jute products (Chart 1) and has been successful in diversifying vertically towards the exports of readymade garments emerging as one of the leading exporting countries of RMG. Within the garment sector Bangladesh has gained strength in the low-end segment, out-performing the cost escalating competitors in China and India and is slowly making some inroads in the high-end segment of name-brand products.

But export concentration has emerged as a formidable challenge to address and overcome. Although Bangladesh successfully came out of the early years of primary export concentration in jute and jute products through a process of vertical export diversification, i.e. a process of moving from primary exports to manufactures, the economy seems to have fallen back into the concentration regime with RMG. The fact that over the past 25 years RMG exports have grown at an average annual rate faster than growth of non-RMG exports, — and the trend continues, the result is a secular increase in the share of RMG leading to further concentration of exports. With some four million jobs and 83% of export earnings from the RMG sector, too much of the nation’s fortune is riding on this one sector. Export concentration in readymade garments makes the economy, jobs and income, extremely vulnerable to external shocks arising from changes in global demand for RMG.

Over the years, the government has adopted strategies to facilitate more of the emerging exports, footwear being a notable success. The sectors that have high potential are agro-products and agro-processing products; light engineering products (including auto-parts and bicycles); footwear and leather products; Pharmaceutical products; software and ICT products; home textiles; ocean-going vessels; ceramics and toiletry products. Moreover, the Government has been selectively according bonded import facilities to more emerging exports (e.g. agro-processing, ship building). In future, this facility may not be limited to 100% export-oriented industries only but extended to industries producing for both domestic and export markets. Further, the Duty Drawback Scheme is expected to be revamped to ensure world-priced inputs to exporting firms without long lags and high transaction costs for reimbursements.

Nevertheless, the dominance of RMG exports prevails. Yet there are two positive developments on the diversification front. First, within RMG, there has been growing diversification of products, from lower-end to higher end. And second, the performance of ICT, leather, jute goods and footwear, if sustained over the longer term could provide the basis for strengthening the export base. Nevertheless, this is an area where further efforts are needed.

Some important non-traditional exports like footwear and leather products, light engineering products (bicycle and electronics), pharmaceuticals, ceramics, jute goods, plastics, and some labor-intensive products not yet on the export radar, are likely to grow at a much faster rate if the anti-export bias of trade policy can be removed. Export diversification should be a key objective underlying the strategy for manufacturing growth. Before the emergence of RMG exports, jute and jute goods dominated the export sector for many decades making up 70 percent of exports until 1981. By 1990, RMG exports overtook the traditional export, but its concentration in the export basket, which has risen to 83%, added a new dimension of export vulnerability. Export diversification has become a major challenge for future trade policy. While Bangladesh’s export growth for the last decade and a half could be characterized as robust, a sudden decline in demand for Bangladeshi RMG would send shock waves throughout the economy. Such a prospect can be avoided through the creation of a diversified export basket.

With the labor cost advantage that Bangladesh enjoys, there seems to exist good prospects for extending into exports of labor-intensive products other than RMG such as agro-processed industry, food products, other manufactures (e.g. electronics and auto parts) and assembly operations. By broadening the range of exported items and export destinations, diversification can stabilize and expand export revenues, enhance value added, and boost economic growth.

Bangladesh experienced double digit export growth over the past two decades. Yet this superior performance is overshadowed by the fact that the increase was mostly due to one product group – readymade garments. The empirical analysis of export trends in Bangladesh reveal lack of product diversification which has remained practically unchanged, if not slightly worsened, for the past two decades. This contrasts with progress in export diversification attained by most developing countries. Research suggests that some 60 percent of developing countries managed to diversify their export baskets to some extent over the past 25-30 years.

RMG exports in a strategy for post-pandemic economic recovery.

Bangladesh economy is slowly but surely recovering from the economic shock of the Covid-19 pandemic. Is trade policy up and ready to cope with the trade-related developments and also provide the impetus to fuel rapid economic recovery once we have gotten a handle on controlling the virus and returning life to normalcy?

In this backdrop, a revamped trade policy for stimulating post-pandemic economic recovery should take the following route, beginning with the recognition that we have essentially two trade policy tracks, one for RMG exports and another for the rest. RMG operates in a “free trade” enclave (zero tariffs), nearly immune to the high tariff and protection regime that creates significant anti-export bias for non-RMG exports. That is the crux of the problem. This trade policy dualism has got to change. Unless trade policy for non-RMG exports is brought to par with RMG, export diversification has no chance. Until such time as we can unify the two tracks of trade policy, our only option is to revamp the twin tracks of trade policy for post-pandemic recovery, along the following lines:

First, the biggest challenge to export diversification comes from the high protection regime in the domestic economy. The problem with non-RMG exports (firms are not 100 percent exporters), like footwear, plastic, agro-processing products, light engineering, is that domestic tariff-induced protection is so high, making domestic sales so profitable, that exporting is not an attractive option. To get any traction on export diversification, this incentive system must be turned around. The over-arching challenge in future trade policy lies in making ALL exporting activity more attractive than selling in the domestic market. But that is easier said than done.

Second, prepare a vigorous plan for geographical diversification to break into new markets in East Asia and the Pacific (e.g. China, Japan, S Korea, Australia, New Zealand, RCEP countries).

Third, all out measures will have to be undertaken to enhance export competitiveness, based on comparative-advantage-following (CAF) strategies, including improved trade infrastructure, access to finance, ease of doing business, and so on. Until such time as the two trade policy tracks are brought to par with each other, all non-RMG exporters will have to be given bonded facilities to get world-priced (zero-tariff) imported inputs in order to compete on a level playing field.

Fourth, while recognizing that RMG export prospects globally are not fully exhausted, efforts should continue to improve competitiveness by raising quality, efficiency, productivity, and compliance in the RMG sector and its backward linkage industries. Strategies for diversification within RMG industry (e.g. going beyond basic garments to higher value items, expanding man-made fiber (MMF) exports) ought to be pursued with vigor and policy support.

Fifth, as part of the export diversification strategy, diversify into intermediate goods production for exports (e.g. automotive and electronic parts and components) by vigorously seeking FDI to integrate with global value chains (GVC). Emulating Vietnam’s experience would be worthwhile.

Finally, robust export performance requires two common traits for the exchange rate: (a) flexibility, and (b) strict avoidance of overvaluation. Recognizing that it would be well-nigh impossible for the economy to export and grow its way out of the Covid-19 slump with an overvalued exchange rate, the crisis presents a timely opportunity for “compensated” depreciation of the exchange rate (i.e. depreciation associated with complementary measures to neutralize inflationary or other negative effects) to give a boost to post-pandemic export performance and its diversification. One strategy for “compensated” depreciation would be to reduce tariffs by about the same percentage as the central bank lets the exchange rate depreciate in a year (such as a 5% reduction in tariffs equivalent to a 5% depreciation of the exchange rate, an action that will essentially eliminate the inflationary price effects leaving import revenue unchanged).

Concluding observations

The Bangladesh RMG industry has defied many odds and set several remarkable precedents that researchers and policymakers across the globe will have to take note.

• First, it belies the notion that you have to be a cotton-producing and textile weaving nation to develop a booming garment industry. Bangladesh neither grew cotton nor had a competitive textile sector to start with.

• Second, an industry need not start as an import substituting producer to eventually become a robust export industry. RMG started off as a 100% export industry.

• Third, RMG as an export industry created more jobs than all the other import substituting industries put together. There is enough evidence to suggest that job-creating potential of export industries is far greater than import -substituting industries.

• Fourth, in a high tariff trade regime, the sure way to create a level-playing field for global competition is by ensuring world-priced imported inputs to the export industry through zero-tariffs on all imported inputs. SBW regime did just that.

• Fifth, for exports to succeed there should be no anti-export bias of policy incentives between domestic sales and export markets. Being a 100% export industry, RMG was immune to the anti-export bias of Bangladesh’s high tariff protection regime which stifles growth of non-RMG exports.

• Lastly, the robust performance of labor-intensive garment exports from Bangladesh is a resounding validation of the time-tested principle of trade based on specialization according to comparative advantage.

Bangladesh RMG industry has come of age and is now a global player, highly price competitive as well as quality competitive when it comes to basic garments, knitwear, and cotton products. It now has a notable presence in the world market not to be ignored by buyers, retailers and consumers, in Europe, North America and Asia. Rest assured, the game of cutthroat competition will be played out among established exporters and emerging ones, known and unknown, who could send shock waves around the world market of the future. Make no mistake, all exporters will have to be relentlessly on their toes for all the time in order to stay in business. That is the ultimate export challenge.