Macroeconomic Management in a Post-Covid Globally Uncertain Environment

By

A. Post Covid-19 Recovery

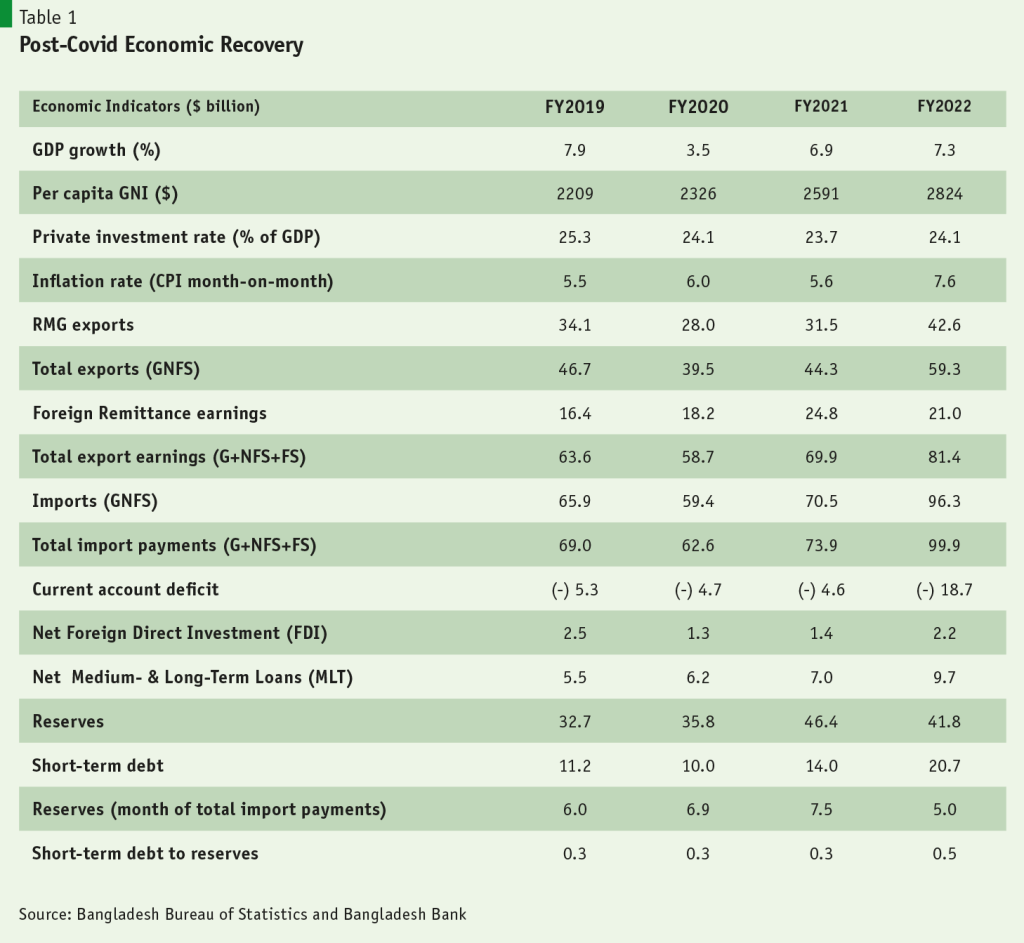

Following excellent progress with development since independence, Bangladesh like other countries of the world was hit by the Covid-19 pandemic in early 2020. Remarkably, through the implementation of a series of timely health and economic stimulus packages, Bangladesh recovered swiftly and by August 2021, there were encouraging signs that the economy was well poised to return to the pre-Covid growth path (Table 1).

B. Heightening Global Uncertainties

Since then, a combination of global inflationary pressure, supply disruption owing to the Ukraine War, a rising US dollar, increasing international inflation rates, and the emergence of recessionary fears in advanced economies has created a very hostile global economic environment that threatens the prevalence of stagflation in both advanced and developing economies (Tables 2 and 3).

As a result, Bangladesh is facing some serious macroeconomic challenges reflected in high inflation, balance of payments pressure causing loss of reserves and foreign currency shortages, and fiscal pressures indicated by a severe revenue constraint and rising fiscal deficits. These macroeconomic imbalances must be addressed swiftly to prevent hurting medium to long-term growth. Growth prospects in FY2023 have already been hurt owing to import controls, higher cost of production and serious energy shortages.

C. Adequacy of Government Policy Responses

Policymakers have responded by imposing trade tariffs and import controls to lower imports; subsidising energy products and fertiliser to reduce inflation and cutting development and social protection spending to reduce budget deficits. Efforts to increase tax revenues have been half-hearted with no serious tax reforms proposed in the FY2023 Budget. Control over interest rates remains in place.

Import controls have lowered imports but the rundown of reserves continues and there is a serious shortage of foreign exchange that has constrained new LCs. Owing to control over the exchange rate, remittances have slowed. Growth of exports has also slowed owing to a slowdown in global economic activities. Global price pressures, the rising value of the US Dollar, and rising international interest rate continues to increase the cost of imports and trade financing.

On the inflation front, while there is some softening of price increases, at around 9% inflationary pressure remains substantial. Control over lending rates through the 6/9 interest rate policy has made the real lending rate zero or negative and contributed to a rapid growth in total and private sector credit. This has contributed to demand pressure on the balance of payments and inflation.

Shortfall on the revenue front owing to the absence of a credible tax reform program and growing subsidy bill has constrained development spending. For example, in FY2022 health spending was a mere 0.5% of GDP; education spending was 1.5% of GDP; and social protection spending excluding civil service pensions was only 0.8% of GDP. The prospects for increases in these spending in FY2023 are dim as revenue constraints and further increases in subsidy bills severely restrict the fiscal space. Even so, the fiscal deficit continues to rise as a percentage of GDP, adding to demand pressure.

D. The Way Forward

Given this situation, there is a need to rethink policies to stabilise the macroeconomy. The macroeconomic imbalances have emerged from three sources: inflationary pressure; the balance of payments pressure, and fiscal pressure. Addressing these issues requires the use of at least three policy instruments that best relate to each of these areas: monetary policy instruments to ease the inflationary pressure; exchange rate policy to ease the balance of payments pressure; and tax/expenditure policy measures to ease the budgetary pressure. Their combined use as a coordinated set of policy actions can help avoid the bluntness of any single instrument and reinforce the effectiveness of each of the policy reforms.

Restoring macroeconomic stability

A combination of flexible management of the exchange rate, some tightening of credit growth and judicious use of tax and expenditure measures are required to support the adjustment agenda.

A combination of flexible management of the exchange rate, some tightening of credit growth and judicious use of tax and expenditure measures are required to support the adjustment agenda.

Bangladesh took the first positive step to make the exchange rate flexible, but it abandoned it quickly fearing political backlash from a downward trend in the exchange rate. This was a costly reversal and contributed to a further loss of reserves. The problem the government faced with exchange rate flexibility is that it did not combine this flexibility with demand management. Rapid credit growth and growing fiscal deficit undermined the flexibility of the exchange rate. The adoption of a uniform and market-based exchange rate is an essential element of the policy package that is needed to restore the balance of payments stability while promoting export and remittance growth to support investment and GDP growth. But this must be combined with proper demand management policies to reduce demand pressures on the foreign exchange and domestic markets.

Regarding demand management, the 6/9 interest rate policy makes monetary policy ineffective in increasing the market interest rate that is required to lower the demand for credit. The removal of the 6/9 interest rate policy is necessary to reduce pressure on BOP and domestic inflation.

Regarding fiscal policy, the government has been unable to take adequate tax reforms necessary to increase revenue that is required to lower the fiscal deficit while expanding critical public spending to support the adjustment and growth agenda. Fiscal deficit continues to rise, adding to demand pressures. The tax reform challenge is a big endeavor and involves major structural and institutional reforms that cannot be addressed through ad-hoc tax measures at the time of the budget. For example, separating tax policy from tax collection and substantially reforming NBR are critical institutional reforms needed to boost tax revenues.

On the expenditure front, the attempt to lower inflation by trying to insulate the international price increases in energy and fertiliser from affecting domestic prices has basically taken away the flexibility to protect the income of the poor through increases in public spending on health, education, and social protection. Subsidies have also increased because of incentives for exports and remittances. These incentives will not be needed if the exchange rate is freed up. In the absence of tax measures, a good policy reform would be to cut back the large 1.9% of GDP subsidy bill to a modest level and use the savings to increase spending on social protection and reduce the budget deficit.

In the absence of tax measures, a good policy reform would be to cut back the large 1.9% of GDP subsidy bill to a modest level and use the savings to increase spending on social protection and reduce the budget deficit.

Restoring the growth momentum

Regarding the growth momentum, it is a medium-to-long-term development agenda that must be steadily pursued. In the near term, there might be a tradeoff between growth and stability. Restoring stability requires a cutback in demand that will likely have a dampening effect on GDP growth. This is inevitable and it is best to recognise this upfront and moderate the GDP growth target somewhat. A 6% GDP growth target for FY2023, as projected by the IMF in the October 2022 Global Economic Outlook, is very healthy and is by no means a signal of defeat or retreat. But if macroeconomic stability is not restored, the balance of payments deficit and inflation could hurt growth over the medium-to-longer term which can be far more costly.

Since inflation hurts the poor and the low-income group relatively more than the rich, an important fiscal policy measure would be to put priority to spending on health, education, and social protection to support the income of the poor and the vulnerable. Acceleration of income-transfer programs to the poor and vulnerable will be a strong policy move to protect the poor from the adverse effects of inflation. In health, the most urgent reform is the introduction of universal health care through government-funded health insurance schemes for the poor.

The medium-term growth agenda requires substantial reforms outside fiscal policy. These relate to the improvement of the investment climate through a reduction in the cost of doing business, strengthening of trade logistics, improvement of energy and transport services, investment in R&D and development of skills.

The medium-term growth agenda requires substantial reforms outside fiscal policy. These relate to the improvement of the investment climate through a reduction in the cost of doing business, strengthening of trade logistics, improvement of energy and transport services, investment in R&D and development of skills.

Within fiscal policy, the implementation of the 8th Five Year Plan (8FYP) Fiscal Policy Framework is essential to restore the growth momentum to the PP2041 growth path. Among other fiscal reforms, it calls for tax to GDP ratio to grow from 8% of GDP in FY2020 to 12% of GDP by FY2025. Bangladesh is way, way behind on this. This ought to be a top policy priority. An expert Tax Reform Commission might be helpful to develop a sound tax reform program that is not diluted by vested interests. India, for example, benefited substantially from an independent Tax Reform Commission.