Reducing Inflation in Bangladesh

By

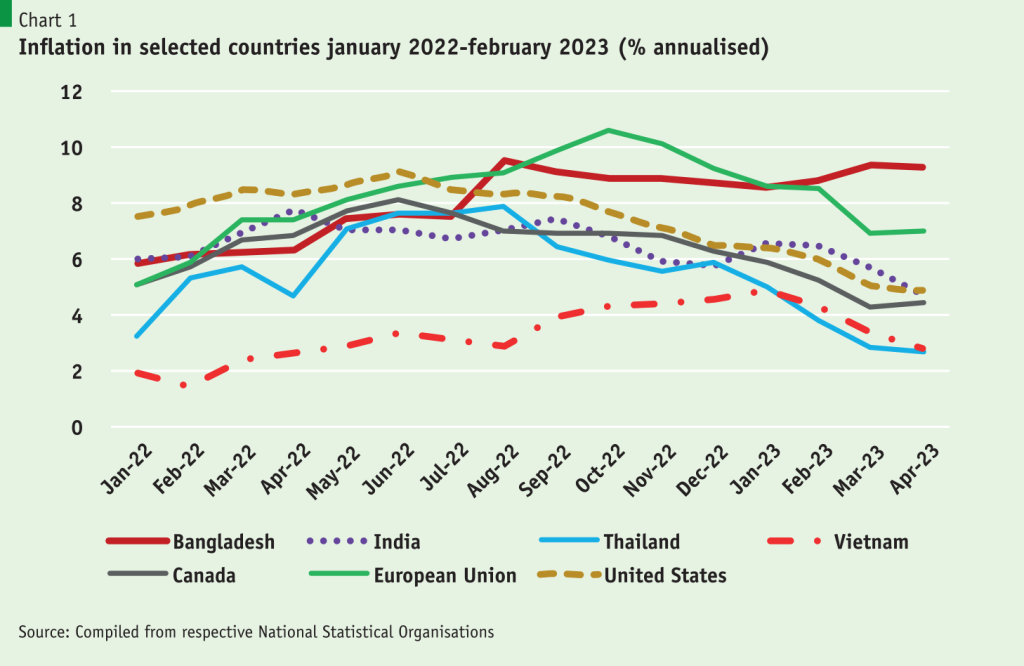

The combined effects of supply shortages from Covid-19 and the Ukraine War and demand pressures from the anti-Covid stimulus packages in USA and Europe created large global inflationary pressures in 2022. In USA, inflation on an annualised basis shot up to 9.1% in June 2022, up from only 1.4% in January 2021. The inflation rate surged to 10.6% in European Union countries in October 2022, rising from 1.9% in June 2021. The Canadian inflation rate spiked from 1.0% in January 2021 to 8.2% in June 2022. In Thailand inflation increased from 3.2% in January 2022 to 7.9% in August 2022. In India the inflation rate accelerated from 4.4% in September 2021 to 7.8% in April 2022. Bangladesh was no exception. The inflation rate climbed from 5.9% in January 2022 to 9.5% in August 2022.

Different countries reached inflationary peak at different pace and in different months based on the specific country environment and prevalent policy framework. Inflationary pressures were most intense in the advanced economies of USA, Canada and EU, where the normal inflation rate is around 2% owing to strict low-inflation tolerance policy guidelines adopted by the respective Central Banks. These countries also faced the most intense public backlash from inflation acceleration. Nevertheless, public unhappiness over rising inflation was registered in all countries in varying degrees including India, Thailand and Bangladesh.

The policy response to inflation has been fairly swift and firm in countries that have achieved success in arresting the inflationary surge. Although much of the origin in inflationary spike came from supply crunch and based on a surge in commodity prices, especially for energy products, policy makers were quick to realise that without concerted actions to curb demand, inflation would not likely fall. Monetary authorities in United States, Canada and European Union quickly adopted an aggressive demand management policy by tightening credit growth through interest rate hikes. These hikes happened in stages and were synchronised with data on the pattern of demand.

Thailand, India and Vietnam, similarly adopted intertest rate hikes to reduce demand and lower inflationary pressures. The only country example used in this analysis that did not adopt a demand management policy is Bangladesh. On the contrary, Bangladesh accentuated demand pressures by boosting the growth of private sector credit and increasing fiscal deficits. The evidence for this was provided in a keynote paper entitled “Macroeconomic Management in a Post-Covid Uncertain Global Environment” presented to the BIDS Annual Development Conference on 1 December 2022 held in Dhaka.

A particularly striking aspect of Bangladesh monetary policy management has been the continued prevalence of the controversial ‘6/9’ interest policy whereby the lending rate is capped at 9% even as inflation has been around 9% over the past 7 months. The zero to negative real interest rate policy has spurred the growth of private credit. Growing fiscal deficit has required considerable resort to bank financing. Government credit has grown by over 30% at an annualised rate over the past 12 months.

The inflation outcome of the varying policy responses is illustrated in Chart 1. The most striking result is that among the 8 countries examined in this research the inflation rate has come down substantially in all countries except Bangladesh where agonisingly the inflation rate is climbing up instead of falling. The sharpest decline in inflation happened in Thailand, followed by the USA. Inflation decelerated by 65% in Thailand, falling from 7.7% in June 2022 to 2.7% in February 2023. In USA inflation plunged to 4.9% in April 2023, down 46% from its peak of 9.1% in June 2022. In EU, inflation came down to 7% in April 2023, declining by 34% from its peak of 10.6% in October 2022. In India inflation fell by 40% between April 2022 (7.8%) and April 2023 (4.7%). In Vietnam, where inflation control is a top policy priority of the Central Bank, inflation rate spike has been successfully curbed and contained in the 2-3% range despite substantial global inflationary pressures through a range of demand management policies including interest rate hikes.

As compared with these successful outcomes of inflation management in other countries, Bangladesh did not achieve any success with inflation control. A slight downward trend in inflation happened between August 2022 (9.5%) and January 2023 (8.6%) owing largely to a slowdown in global commodity prices including food prices. Inflation rate has nudged up again since February 2023 and has climbed up to 9.24%, which is almost the same rate as the peak in August 2022. Generally, it seems that inflation has stubbornly stabilised at around 9% level compared to the trend rate of 5%–6%. between 2015–2021.

The global evidence from inflation management is very clear. The idea that since inflation has originated from abroad and therefore nothing can be done about it does not have any merit. Inflation can and must be brought down with sound demand management policies including curbing the growth of credit through interest rate increases and by restraining fiscal deficits.

The persistent inflation at 9% in Bangladesh over the past 10 months is hurting the poor, the low income and the middle-income groups substantially. This must be tackled upfront without further delay. It is particularly important to lower inflation urgently in an election year. Inflation will not go away on its own and will be especially stubborn if accommodated further with credit growth and bank financing of Treasury deficits as presently.

The persistent inflation at 9% in Bangladesh over the past 10 months is hurting the poor, the low income and the middle-income groups substantially. This must be tackled upfront without further delay.

In all countries, inflation management is the topmost priority for the Central Bank. To depoliticise inflation management, most advanced economies have an independent Central Bank who can control the growth of credit to manage inflation through its interest rate policies. Bangladesh Bank (BB) must act fast and with determination to lower the growth of credit by abandoning the 6/9 interest rate policy and using interest rate flexibly. While it has shown some willingness in recent months to allow deposit rates to exceed 6% and a selective relaxation on the 9% lending ceiling, it must act more forcefully to officially announce the elimination of the 6/9 policy. It should use the interest rate to target domestic credit growth in a way that lowers domestic demand and reduces inflationary pressure.

BB should also fast track the development of a secondary market for T-bills to facilitate interest rate based monetary policy management. The government should support this inflation control strategy by keeping fiscal deficits below 5% of GDP, increasing the tax/GDP ratio, phasing the implementation of large capital-intensive projects, and mobilising low-cost foreign financing for the budget deficit. It should also reduce bank financing of budget deficit by increasing its reliance on market borrowings using the secondary market for T bills.