Bangladesh Post-Election Reform Priorities

By

Development Context

Over the decade of FY2009-FY2019, Bangladesh experienced unprecedented acceleration of annual GDP growth that has transformed the Bangladesh economy in several meaningful ways.

First, it has helped Bangladesh to climb from the list of poor countries to the group of Lower Middle-Income Country (LMIC) as defined by the World Bank. Bangladesh crossed this threshold in 2015, well ahead of the target date of 2021 set under the Perspective Plan 2011-2021 (PP2021)

Second, in 2018 Bangladesh crossed another global milestone by becoming eligible to graduate from the UN defined list of least developed countries (LDCs). This graduation uses more stringent criteria than income only. LDC graduation requires progress with income (per capita GNI), Human Asset index (HAI) and Economic Vulnerability Index (EVI).

Third, Bangladesh secured remarkable progress with poverty reduction as measured by the headcount index using both lower poverty line (extreme poverty) and upper poverty line (moderate poverty).

Fourth, Bangladesh registered impressive gains in human development indicators, especially in life expectancy. Many of the human development indicators are better than most LMIC and make Bangladesh a positive outlier when human development is measured against countries with similar per capita income.

Research shows that many factors contributed to this development progress. In particular macroeconomic stability, expansion of investment rate funded by growing national savings rate, export orientation of the economy, and strong agriculture with focus on food self-sufficiency contributed handsomely to this progress.

Armed with this outstanding development performance, the Bangladesh government has strived to climb taller mountains. In 2020 the government adopted the Perspective Plan 2021-2041 that set several ambitious targets including securing Upper-Middle Income Country (UMIC) status and eliminating extreme poverty by 2031 and reaching High Income Country (HIC) status by 2041.

External Shocks

In the two years between March 2020 and March 2022, Bangladesh and the rest of the world experienced a series of external shocks that threatened to derail national and the global economies. The first shock emerged from the Covid-19 global pandemic starting in March 2020. Covid-19 witnessed a massive loss of lives, livelihoods, productivity and GDP growth. Even as the world started its recovery process, a second wave of shock emerged from global inflation starting in early 2021 linked to covid-19 global supply-chain disruptions and the pressure of excess demand emerging from the massive injection of money from the various stimulus packages. The global inflationary pressures were further intensified in February 2022 when Russia invaded Ukraine, leading to economic sanctions and supply disruptions for critical commodities like oil, gas, fertilizer, wheat and edible oil.

The combined effects of these three shocks have been severe for Bangladesh. The GDP growth has fallen while serious macroeconomic imbalances have emerged reflected in higher inflation, balance of payments difficulties, tax revenue shortages, loss of reserves, growing shortage of foreign exchange, and the rapid depreciation of the Bangladesh taka. The deterioration in macroeconomic environment has in turn lowered business confidence, reduced the flow of foreign capital including FDI and trade credit, and hurt investment.

Effects on Macroeconomic Stability

The external shocks impacted most severely on the macroeconomic stability.

First, owing to global inflation the value of imports surged by an unprecedented 18% in FY2022, leading to a large trade and current account deficits. Along with a sharp slowdown in the availability of trade credit and private foreign loans, there was a huge pressure on reserves. The government was unwilling to let the exchange rate take the burden of the import demand pressure. As a result, there was a substantial loss of reserves. Subsequently as import controls were imposed, the inflow of imports slowed considerably in FY2023 and beyond. Nevertheless, between August 2021 and November 2023, Bangladesh lost some USD23 billion of reserves, falling from USD48 billion in August 2021 to USD24.9 billion in November 2023 (44% of reserves in August 2021)1.

Second, even with the imposition of import controls and tariff escalation, the government could not stem the loss of reserves and was forced to let some of the adjustment happen through the exchange rate. As a result, the taka depreciated by 30% between August 2021 and November 2023 (from BDT 85.2/USD to BDT 110.5/USD).

Third, Bangladesh annualized rate of inflation surged from 5.9% in January 2022 to 9.9% in August 2023. The inflation rate has been around 10% since August 2023. While the inflationary pressures were ignited by external shocks, mainly the surge in oil and other commodity prices, the fundamental reason for the persistence of inflation has been excess demand pressure emanating from domestic credit growth and the financing of budget deficits with money creation.

Fourth, domestic revenue growth was adversely affected by the external shocks, but no serious effort has been made to reverse the effects of these shocks and increase the tax to GDP ratio for over a long period of time. The external shocks increased budget subsidies, which have also not been tackled with domestic reforms. While energy prices were partially increased, the main fiscal adjustment has been to cut development spending and spending on social protection. The budget deficit has not been lowered to reduce excess demand pressures. Instead, the budget has further contributed to inflationary pressures and pressure on the foreign exchange through use of borrowing from the Bangladesh Bank for deficit financing.

Effects on GDP Growth

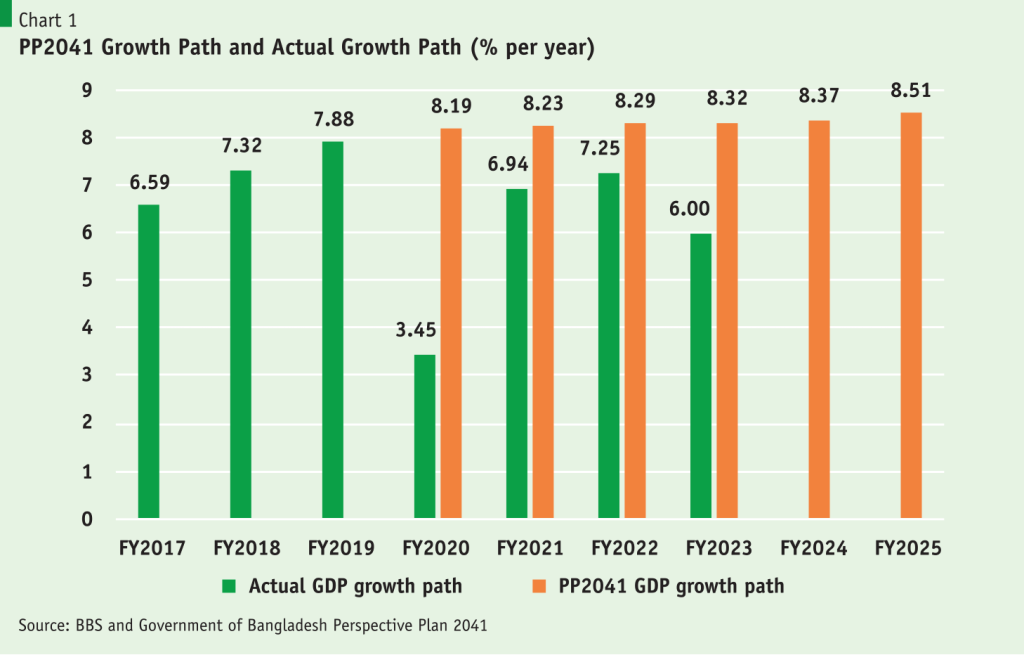

The developments on GDP growth front are illustrated in chart 1. As noted, the acceleration of GDP growth prior to Covid-19 has been a major positive feature of Bangladesh development. Covid-19 put a brake on this trend and GDP growth plummeted in FY2020. There was an encouraging recovery in FY2021 and FY2022, although the growth rates were still below the PP2041 growth path. The GDP growth rate faltered further in FY2023. While projections beyond FY2023 are premature at this stage given large global uncertainties and the current very difficult macroeconomic environment, it is most likely that GDP growth in FY2024 will slip below the level achieved in FY2023. The manufacturing growth has slowed owing to import controls, power cutbacks, energy shortages and increasing production costs. Growth of exports slowed in FY2023 and in the first half of FY2024.

The uncertainties in the global economy caused by the prolonged Russia-Ukraine War and the most recent Israel-Hamas conflict can cause further disruptions to the global supply chain, especially oil, the price of which has started climbing up again. At home in Bangladesh the political standout between the major political parties linked to the 2024 National Elections can be problematic and lead to serious disruption in the national economy. Economic reforms are also standing still in the wake of the National Elections. So, the most likely outcome would be a further slowdown in GDP growth in FY2024.

Clearly, the slowdown in the growth momentum over the past 4 years has caused a substantial divergence of the actual growth path from the growth path envisaged under PP2041 as an instrument to secure UMIC status by 2031 and HIC status by 2041. Whether or not these ambitious milestones can be reached, all out efforts are needed to restore the growth momentum through proper policy reforms immediately after the planned National Elections in January 2024.

Effects on the Banking Sector

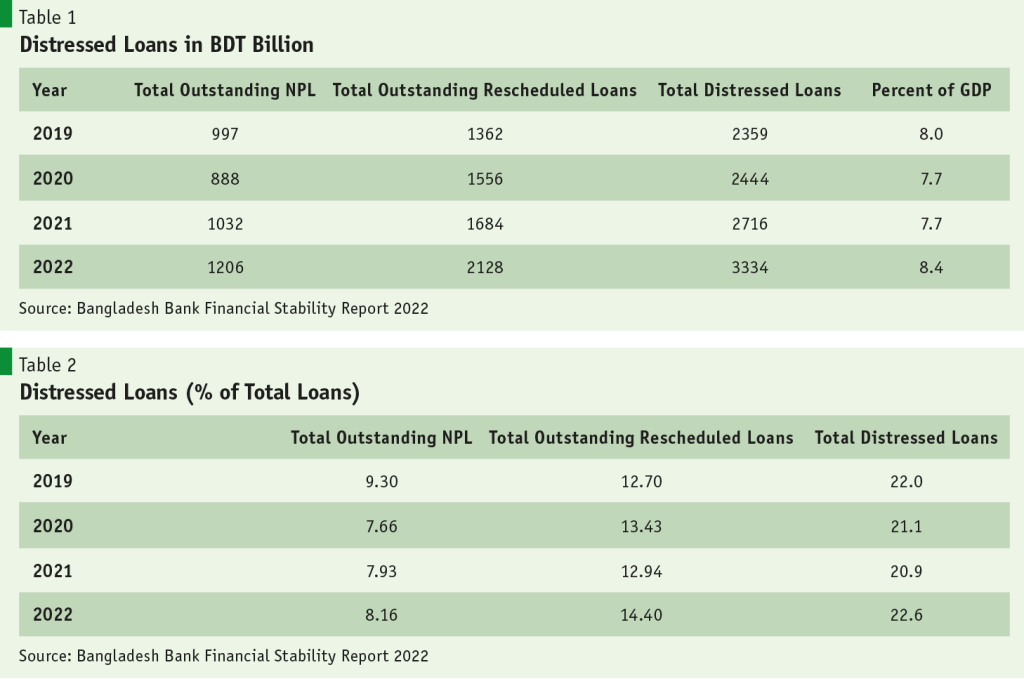

The external shocks, especially Covid-19, put additional adverse pressure on the already fragile and deteriorating banking portfolio. The Bangladesh Bank relaxed prudential supervision norms on bank loan repayments and loan classifications to accommodate the adverse consequences of Covid-19 on business. It also relaxed loan restructuring policies. Even so, the share of distressed loans comprising of non-performing loans (NPL) and restructured/rescheduled loans has been rising as a share of total loans (Tables 1 and 2). In taka terms the total outstanding distressed loans reached BDT 3334 billion (8.4% of GDP) in 2022. The portfolio quality is expected to have worsened further in 2023 since many of the forbearance measures lapsed in December 2022.

The banking sector has been the most important source of low-cost financing for private investments, working capital and trade financing, which has served as a major enabler of private investments, exports and imports. Consequently, the banking sector has contributed handsomely to supporting the acceleration of growth over the FY2009-FY2019 periods. The growing fragility of the banking sector has raised important concerns about the ability of the banking sector to continue to support the growth momentum moving forward.

Adequacy of Government Policy Responses

Policy makers have responded by imposing trade tariffs and import controls to lower imports; subsidizing energy products and fertilizer to reduce inflation and cutting development and social protection spending to reduce budget deficits. Efforts to increase tax revenues have been half-hearted with no serious tax reforms implemented. Although the Bangladesh Bank (BB) has declared its intention to lift the controls over interest and exchange rates from July 2023, these reforms have been hesitant. The controversial “6/9” interest rate policy was eliminated, and interest rates have been gradually moving up, but the control over the exchange rate continues to prevail. As a result, the gap between the official exchange rate (BDT 110.5/USD) and the market exchange rate (BDT 125/USD in end December 2023) has continued to widen.

Import controls have lowered imports substantially but the rundown of reserves continues and there is a serious shortage of foreign exchange that has constrained the opening of new LCs. Owing to control over the exchange rate, remittances have slowed. Growth of exports has also slowed owing to a slowdown of global economic activities and the continued lack-luster performance of non-RMG exports. Global price pressures, the rising value of the US Dollar, and rising international interest rate have increased the cost of imports and trade financing.

The exchange rate was initially set at 4 levels but was unified in July 2023. The BB also announced that henceforth the exchange rate will be market determined. While the exchange rate has continued to depreciate slowly since August 2021, the exchange rate is still much below the market clearing rate due to BB interventions. This is reflected by the fact that there is substantial excess demand for USD at the officially sanctioned exchange rate and the gap between the official unified rate and the open market rate is as high as BDT 14 per USD (12% premium) even with substantial trade controls in place.

The exchange rate was initially set at 4 levels but was unified in July 2023. The BB also announced that henceforth the exchange rate will be market determined. While the exchange rate has continued to depreciate slowly since August 2021…

On the inflation front, at around 10% annualized rate the inflationary pressure remains substantial. Control over lending rates through the 6/9 interest rate policy made the real lending rate zero or negative and contributed to a rapid growth in total and private sector credit. This contributed to demand pressure on the balance of payments and inflation. BB relaxed the interest rate policy on deposits in early 2023. The lending rate was also relaxed in July 2023 through the adoption of a new policy by which the lending rates were linked to the six month moving average of the T-bill rate (SMART) plus a margin of 3-3.75%. The flexibility of the interest rate policy has been very late but nevertheless is a smart policy decision. This should help lower domestic credit growth and reduce demand pressure on inflation and bop.

Shortfall on the revenue front owing to the absence of a credible tax reform program and growing subsidy bill has constrained development spending. For example, in FY2022 health spending was a mere 0.5% of GDP; education spending was 1.5% of GDP; and social protection spending excluding civil service pensions was only 0.8% of GDP. The prospects for increases in these spending in FY2023 and FY2024 are dim as revenue constraint and further increase in subsidy bill severely restrict the fiscal space. Even so, the fiscal deficit continues to rise as a percentage of GDP, adding to demand pressure. However, in August 2023 the BB took a good policy decision to stop financing the budget deficit from its resources. This is also a smart policy move. If sustained, this will help reduce inflation.

Post Election Reform Agenda

Given this situation, there is a need for the new government to rethink policies to stabilize the macroeconomy and resume the growth momentum. The macroeconomic imbalances have emerged from three sources: inflationary pressure; the balance of payments pressure, and fiscal pressure. Addressing these issues require the use of at least three policy instruments that best relate to each of these areas: monetary policy instruments to ease the inflationary pressure; exchange rate policy to ease the balance of payments pressure; and tax/ expenditure policy measures to ease the budgetary pressure. Their combined use as a coordinated set of policy actions can help avoid the bluntness of any single instrument and reinforce the effectiveness of each of the policy reforms. Restoration of macroeconomic stability will allow a resumption of the growth momentum.

Restoring Macroeconomic Stability

As noted, a combination of flexible management of the exchange rate, tightening of credit growth and a judicious use of tax and expenditure measures are required to support the macroeconomic adjustment agenda. This is the most fundamental reform challenge facing the new post-election government.

Regarding the exchange rate, Bangladesh Bank took an important first positive step to unify the exchange rate and make it more flexible, but it abandoned the idea of making the exchange rate market based fearing political backlash from a downward trend in the exchange rate. This was a costly reversal and is contributing to continued bop difficulties. The problem the government has faced with exchange rate flexibility is that it did not combine this flexibility with adequate demand management. Rapid credit growth and growing fiscal deficit have undermined the flexibility of the exchange rate. The adoption of a uniform and market-based exchange rate is an essential element of the policy package that is needed to restore the balance of payments stability while promoting export and remittance growth to support investment and GDP growth. But this must be combined with proper demand management policies to reduce demand pressures on the foreign exchange and domestic markets.

Concerning demand management, the abandonment of the 6/9 interest rate policy has made monetary policy more effective in increasing the interest rate that is required to lower the demand for credit. However, the interest rate policy should be made more flexible by basically targeting the desired inflation rate and allowing the lending rate to continue to rise in the short term until demand for credit has fallen adequately to reduce inflation and pressure on foreign exchange. Once inflation is reduced to 5-6% rate, the pressure on interest and exchange rates will likely subside.

Regarding fiscal policy, the government has been unable to take adequate tax reforms necessary to increase revenues that is required to lower the fiscal deficit while expanding critical public sending to support the adjustment and growth agenda. Fiscal deficit continues to rise, adding to demand pressures. The tax reform challenge is a big endeavor and involves major structural and institutional reforms that cannot be addressed through ad-hoc tax measures at the time of the budget. Critical reforms of the tax system include: (i) separating tax policy from tax collection; (ii) strengthening the new tax policy institution with professional staff and technology; (iii) selecting the heads of the tax policy and tax collection units on a professional basis with a minimum term of 4-5 years; (iv) strengthening the tax collection agency with institutional autonomy, professional tax staff, and proper technology; (v) eliminating all interface between taxpayer and tax collector through instituting a comprehensive online system for tax filing and tax payments; (vi) simplifying tax forms including elimination of the requirement to balance income, expenditure and wealth; (vii) instituting a proper system of property taxation with proceeds directed to local government institutions; (viii) instituting a computer-based audit system focused on highly selective and productive audits conducted by specialized and trained auditors; (ix) adopting and implementing the 2012 VAT Law in its original form; and (x) substantially strengthening the autonomy and quality of the Tax Appeals System with professional staff and technology.

On the expenditure front, the attempt to lower inflation by trying to insulate the international price increases in energy and fertilizer has sharply lowered the fiscal space. Subsidies have also increased because of incentives for exports and remittances. These incentives will not be needed if the exchange rate is freed up. The government has signaled its intention to introduce automatic price adjustments of energy products with a view to eliminating energy subsidies. The best way to implement this is to take away all government intervention in setting energy prices and instead empowering the Bangladesh Energy Regulatory Commission (BERC) with full autonomy and professional staffing to regulate energy prices based on good practice international experience. The price adjustment mechanism should be widely disseminated, and price adjustment decisions should be posted on the BERC website. A related policy reform should be to deregulate the energy market away from government monopoly to private participation.

The government has invested heavily in state-owned enterprises (SOEs). These enterprises are mostly making losses and are a big drain on the budget. Through corporate governance and pricing policy reforms, the government can mobilize an additional 1.2-1.6% of GDP from the profit of these enterprises. This is another major reform priority for the new government.

Resuming the Growth Momentum

As noted, the prevailing macroeconomic instability has hurt growth. Most of the growth drivers including private investment, public investment and exports have been adversely affected thereby contributing to lower growth. Additionally, the government’s policy response based on import controls has further weakened the growth momentum. Although the resumption of the growth momentum is a medium-to-long-term development agenda, steps must be taken now, and associated reforms must be steadily pursued. Resumption of private investment expansion will benefit from the restoration of macroeconomic stability. But it will also require steps to reduce the cost of doing business through further deregulation of investment climate, reducing the corporate tax rates, simplifying tax compliance procedures, and improving access to electricity and primary energy.

The medium-term growth agenda requires substantial fiscal reforms of the fiscal policy. The implementation of the 8FYP Fiscal Policy Framework is essential to restore the growth momentum to the PP2041 growth path. Among other fiscal reforms, it calls for tax to GDP ratio to grow from 8% of GDP in FY2020 to 12% of GDP by FY2025. Bangladesh is way, way behind on this. This ought to be a top policy priority. The agenda for tax reforms was highlighted above. The implementation of this far-reaching tax reform is the most fundamental reform needed to restore the growth momentum.

Fiscal reforms will help reduce fiscal deficits while also increasing public savings. These savings can be used to increase the public investment rate focused on infrastructure development and human capital. Alongside, strong and effective financial intermediation is necessary to support the growth of national savings and private investment. Mobilization of bank deposits and reduction in NPLs will release the resources needed to finance working capital and private investment at reasonable interest rates. Reduction in inflation and stabilization of the exchange rate will also moderate the increases in domestic interest rates.

The strong and sustained growth of labor-intensive exports provided the backbone to the growth of manufacturing GDP and employment. This momentum needs to be regained through a well-concerted export diversification drive. This export diversification strategy will also help smooth the graduation path from LDC. The export diversification agenda is well known and involves the institution of a market-based exchange rate; sharp reduction in trade tariffs including streamlining of all para tariffs with a view to substantially reducing the anti-export bis of trade policy; providing all RMG facilities to non-RMG exports; lowering the cost trade logistics through deregulation, port upgrading, and management improvements; participating in Free Trade Agreements; participating in global value-chain (GVC) arrangements; upgrading of technology, R&D and labor skills; and substantial promotion of FDI by sharply improving the investment climate as noted earlier.

Helping the Poor

Despite the progress with poverty reduction indicated by the latest HIES 2022, the surge in inflation, especially food inflation, is likely to have caused considerable distress for the poor and the vulnerable sections of the population. These groups need urgent relief. Although the government has an elaborate social security program, growing budgetary constraints have severely undercut the effectiveness of this program. Latest data suggests that government spends a mere 0.8% of GDP on social security excluding civil service pension. Additionally, there are considerable leakages reflected in large percentages of exclusion and inclusion errors. Efforts must concentrate on increasing budgetary allocations to critical life cycle based social protection programs as advocated under the National Social Security System (NSSS) adopted in July 2015. This must be complemented with efforts to improve the delivery system to reduce inclusion and exclusion errors as emphasized in the NSSS. It is also now necessary to initiate the implementation of a universal healthcare (UHC) program. There are good practice examples in several East Asian economies including Thailand and Malaysia and the Bangladesh UHC could be shaped by learning from these experiences.