Public pensions: A ticking time bomb?

By

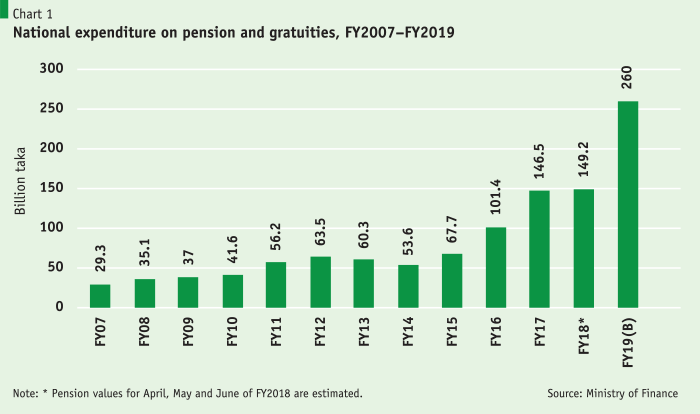

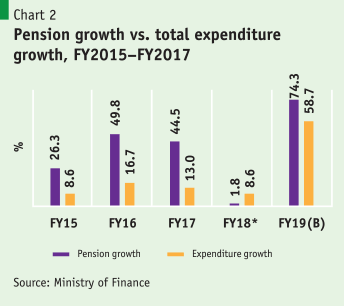

The component in the FY2019 budget that shows the fastest growth is government outlays on pensions and gratuities for retiring government employees. The increase has been a hefty 74.3% in one year, but there was not much discussion of this in the budget speech. Is this increase a one-time phenomenon? Certainly not. Since FY2007 there has been an almost nine-fold, or 800%, increase, and the past four years have seen a hefty 284% rise.

Since FY2007 there has been an almost nine-fold, or 800%, increase, and the past four years have seen a hefty 284% rise.

Neither gross domestic product (GDP) nor the government budget has increased at a rate anywhere near this. During the most recent three years (FY2015–FY2017) for which actual fiscal expenditure data are available from the Ministry of Finance website, the average annual increase in pension outlays was 40.9%, compared with an average annual increase in total expenditure of 12.8%. Clearly, such a lopsided increase in pension outlays in recent years and continued upward pressures in the coming years will create problems with regard to budget management as well as fiscal sustainability.

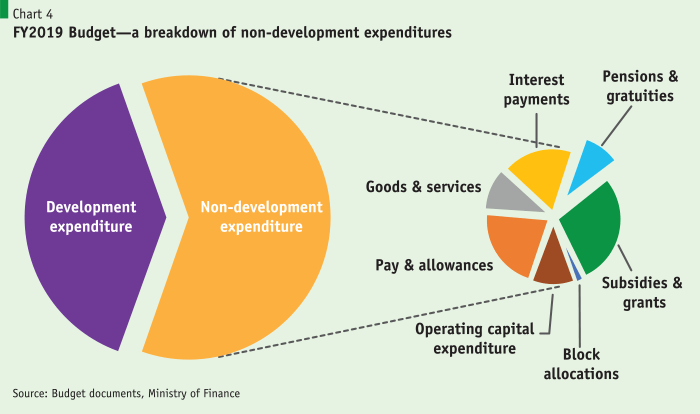

Pension expenditure for FY2019 accounts for almost half of total pay and allowances in the budget. This is disturbing because this component of the budget is likely to increase much faster than pay and allowances and the overall budget. Given impressive increases in average life expectancy in Bangladesh—the average life expectancy being about 72 years and that for government service holders generally significantly higher than this—the government is heading towards a major fiscal problem in the medium and long term. The unfunded nature of the government pension system in Bangladesh, the early retirement age for military and civilian government staff and the manner in which pension benefits are calculated without regard for the long-term implications are likely to pose serious problems with regard to fiscal sustainability.

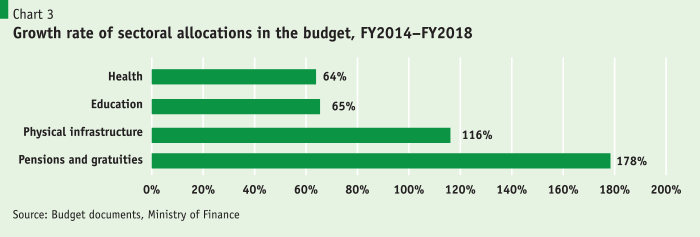

Bangladesh needs to invest more and at a faster rate in health, education and physical infrastructure. However, when we review growth rates in major categories of outlay, that of payments associated with pensions and gratuities over the recent four-year period (FY2014–FY2018) (175%) far outstrips those of health, education and physical infrastructure. Bangladesh needs to spend more on social infrastructure (health and education) and on physical infrastructure in order to attain higher levels of economic growth and so it can become an upper-middle- and then high-income country. But we are spending disproportionately more on the unproductive pension system.

As improved living standards and health care facilities have resulted in higher life expectancy, pensions have become a source of annuity for the elderly, increasing the burden not only on the government but also on tax-payers. Historical trends and projections on elderly people as a share of the total working-age population indicate an upward movement. At present, 7.4% of the population is elderly; in 30 years, the figure will be more than double, at 16.6%. Under the current pension system, today’s generation is paying for the retirement benefits of the previous generation. The question is, will the future generation of workers be able to bear the much higher pension burden of the current generation of civil and military personnel?

The pay-as-you-go pension system

Bangladesh follows the traditional pay-as-you-go (PAYG) pension scheme, whereby a pension is granted to a government servant (civil or military) on his/her retirement from the public service on the basis of the length of qualifying service and a certain percent (60–90%) of the last basic salary drawn for the rest of his/her life. In case the pensioner dies, his dependants (wife or dependant and disabled children) are generally entitled to have a part of the pension as a family pension. Sometimes, the pension period of the employee is more than the service period, particularly for military pensioners, who tend to retire early in their career and generally have longer life expectancy. This is an un-funded pension system, in which the government pays its former (retired) employees mainly from the budgetary revenue the government collects.

The PAYG system is generally very popular in developing countries like Bangladesh with the younger population/workforce. However, for most such countries, as the economy matures, and with new generations getting to pension age, the PAYG system starts to generate a fiscal burden. Bangladesh will see continued large-scale and rapid retirement in the coming years. Unlike many other countries, Bangladesh has not set aside resources to fund the future pension liabilities of its government employees. Countries usually start with a PAYG system but over time change to make the system fully funded.

Unlike many other countries, Bangladesh has not set aside resources to fund the future pension liabilities of its government employees.

Drawbacks of a PAYG scheme

- Current workers contribute to pay current retirees in return for a promise that the future generation will contribute for them. However, the funds are not used to accumulate assets for use in paying benefits. The burden relies solely on the taxpayers.

- PAYG enhances the fiscal liabilities of the government and can lead to adverse consequences if the labour force begins to shrink and the growth in tax revenue starts slowing down.

Pension systems in selected countries

Most rich countries have moved to a funded pension system, whereby a pension committee collects money from both the employer (including the government) and the employee and invests these contributions in a pension fund, which in turn invests in income-earning assets like bonds, stocks and other financial and non-financial assets, which generate an income/return for future payments to retirees. These pension systems can be defined-benefit or defined-contribution based on the terms of the contract. The pension committees that manage the pension funds also evaluate these at particular intervals to check their performance, so as to ensure maximum returns for pensioners.

The US follows both defined-benefit and defined-contribution pension plans for retired public officials, depending on how benefits are determined; in most states, the latter is more common. The defined-contribution plan is employer-sponsored, with an individual account for each participant. The accrued benefit from such a plan is attributable solely to contributions made into an individual account and investment gains on these funds, less any losses and expense charges. The contributions are invested (e.g. in the stock and bond markets) and the returns on the investment are credited to or deducted from the individual’s account. Upon retirement, the participant’s account is used to provide retirement benefits, often through the purchase of an annuity. The participant is responsible for selecting the types of investments in such plan.

In contrast, in a defined-benefit (or pension) plan, benefits are calculated using a fixed formula that typically factors in final pay and service with an employer, and payments are made from a trust fund specifically dedicated to the plan. Separate accounts for each participant do not exist. In other words, the plan defines the amount of benefit to be paid on retirement. Defined-benefit plans may be either funded or unfunded. In a funded plan, contributions from the employer and participants are invested into a trust fund dedicated solely to paying benefits to retirees under a given plan. In an unfunded plan, no funds are set aside for the specific purpose of paying benefits. The benefits to be paid are met immediately by means of contributions to the plan or general assets. There is a third category of pension plan, called the hybrid and cash balance plan, which combines features of both defined-benefit and defined-contribution plans. As with defined-benefit plans, the investment risk is borne largely by the plan sponsor and the benefits are expressed in terms of cash balances on termination of employment.

Workers in the UK are now automatically enrolled into a workplace pension scheme or into the National Employment Savings Trust (NEST) pension plan. The NEST is a defined-contribution workplace pension scheme that was set up to facilitate automatic enrolment as part of the government’s workplace pension reforms under the Pensions Act 2008. Pensions in the UK fall into three major divisions—state pensions, occupational pensions and individual/personal pensions—and seven sub-divisions, including both defined-benefit and defined-contribution. As in the US, UK employers have been moving towards defined-contributory pension arrangements in recent years, whereby the employer (and sometimes also the employee) makes regular payments (typically a percentage of the salary) into a pension fund and the fund is used to buy a pension annuity when the employee retires. As such, the pension amount depends on a number of factors, including the accumulated amount of the fund; interest rates or returns on assets; and projected mortality rates at the time the individual retires.

Chile: Chile revolutionised its pension systems in 1981 by transforming the defined-benefit PAYG contributory system into a privately managed fully funded defined-contribution scheme. Chilean workers’ yearly contributions in the current pension fund amount to 3.2% of GDP. The establishment and operation of the private pension funds are regulated by law, under supervision from a government regulatory body.

The pension system has three components/pillars:

- A redistributive/poverty prevention first tier;

- A mandatory individual accounts second tier (10% contribution);

- A voluntary third tier.

The government guarantees a minimum pension to all citizens who have contributed to a fund for at least 20 years. The government pays the difference between the minimum pension and the pension entitlement from the investment fund. If a pension fund is unable to generate a defined minimum profit, it will be liquidated and the collected assets will be transferred to another fund. In this case, the government solves the assets gap. In case of bankruptcy of a pension fund, the government pays out the pensions as public expenses. The government pays a fixed amount as social assistance for those citizens who are not even entitled to a minimum pension. Under the mandatory contribution pillar, employees are required to contribute 10% of their wage to an individual account and choose a private sector pension fund administrator to manage the account. When members retire, they receive a pension based on the level of their individual account. Employee contributions are tax-deferred in that contributions and earnings are tax-exempt until withdrawal. However, retirees pay regular income tax on their pension income.

India’s National Pension Scheme (NPS) is a voluntary defined-contribution pension system whose overall structure is similar to the defined-contribution pension plans of the US. NPS came into force in January 2004, initially incorporating pension benefits for government employees and then opening up in 2009 to all citizens of India between the ages of 18 and 60 years. In case of government pension fund, the contribution from the employee’s side is 10% of the basic salary plus dearness allowance with exactly the same contribution from the employer. Administered and regulated by the Pension Fund Regulatory and Development Authority, only 0.25% of the investment is paid to the intermediary as a fund management fee. The minimum yearly contribution is INR 6,000, which can be paid either in one go or in monthly instalments of at least INR 500. Only 20% of the contribution can be withdrawn before the participant reaches 60 years of age; 80% must be used to buy annuity from a life insurer.

Proposed reforms—benefits and ways to go

The Bangladesh government must start thinking about a contributory and fully funded pension system, in view of the country’s emerging demographic transition and the growing burden of pension liabilities. The pension system needs to be contributory by both the government and employees. Although the PAYG system initially helped the government in terms of pension payments, its burden has increased quite significantly in recent years and, if this is not addressed, it will be fiscally unsustainable over time. Given rapidly declining mortality and fertility rates in Bangladesh, in 20–30 years’ time the number of retired government servants will be disproportionately high compared with the number of active duty public servants. The unfunded system will mean that the share of pension and gratuities will be too high relative to the government’s wages and salary bill, seriously limiting the budget’s fiscal space.

The current government pension system in Bangladesh is the worst possible combination since it is a defined-benefits plan and at the same time PAYG. The current practice of calculating lifetime future pension benefits based on last month’s salary encourages institutions to promote staff or put them on a higher scale just before retirement. The global practice is to link pension benefits to the last two- or five-year average salary before retirement so that the last month’s salary will have a marginal impact on the overall level of the pension.

The current retirement age of 59 for civil servants is unusually low and inefficient from a public administration and national economy point of view. For military service, the retirement age is even earlier, implying a greater burden on the government. In industrial countries, the retirement age is generally 67 years, and there is talk of a further increase in this regard. Through early retirement, the government is also losing experienced and technically skilled staff. Under the current system, the Bangladesh government does not undertake periodic actuarial determination of its completely unfunded pension liabilities. If such an exercise is undertaken, total unfunded liability (in discounted present value terms) is likely to be in trillions of taka, and may even exceed outstanding public debt. In order to determine how unfunded pension liabilities are increasing over time, comprehensive actuarial assessments should be undertaken once every five years.

It is high time for the Bangladesh government to initiate reform of its public pension system. The working-age population in the country is growing, including in the public service, so this is the best time to undertake such a reform. In view of political economy considerations, existing public sector employees should be grandfathered or protected/ring-fenced under the current system and the reformed system should start with new entrants to the public sector. This group should be made to contribute to their own retirement scheme alongside the government contribution, so that when they retire (after 30–35 years) all pensions will be fully funded and there will be no burden on future generations. By that time, the population dividend will have ended and Bangladesh will be more capable of dealing with the ageing of the population in the post-demographic dividend era.

In good systems, the government or employers generally pay between 50% and 66% of the total/combined pension contribution and employees pay the remainder (50% to 33%). However, there may be flexibility in determining the contribution rates for employees and the government depending on the financial position of the government, since there is no proven hard-and-fast rule on the mix. The Bangladesh government has been thinking about introducing a ‘universal pension system’ covering both private and public sectors. In this, it could follow neighbouring India’s contributory NPS for both private and public employees, with a view to reducing the risk related to future financing.

In the process, the government will create a huge pension fund of trillions of taka, which its managers can invest in long-term financial instruments to support infrastructure development in the country and create demand for long-term bonds. This will help create a sustainable bond market for long-term financing of projects (such as infrastructure) at market interest rates. The formulation of the new pension system has to be part of the broader social protection strategy adopted by the government, especially for public employees.

If this situation continues for another decade, the Bangladesh government will lose its fiscal space to undertake discretionary spending and, over time, fiscal sustainability will be undermined.

There will of course be a transition cost in moving from PAYG to a fully funded pension system. This cost will be in the form of the government’s part of the pension contribution in addition to normal pension payments to retired employees. However, over time, as the pool of ring-fenced existing government employees decreases in size—new entrants being outside the pool—the additional burden will decline rapidly.

Bangladesh’s fiscal management is at a crossroads. On the one hand, it is suffering from anaemic performance in terms of revenue mobilisation, with the tax/GDP ratio hovering at only about 10% for almost a decade. On the other hand, non-discretionary outlays such as pension payments and interest payments on domestic debt are growing rapidly. If this situation continues for another decade, the Bangladesh government will lose its fiscal space to undertake discretionary spending and, over time, fiscal sustainability will be undermined. All these issues are pressing. We need to make strong efforts to disarm all three ticking time bombs, including the growing burden of the current pension system.