Monetary policy challenges for Bangladesh Bank

By

On January 30, 2019 the Bangladesh Bank (BB) announced its Monetary Policy Statement (MPS) for the second half of FY2019. The statement reflects the Central Bank’s commitment to coordinate its policies in line with the government’s agenda for sustaining real economic growth with continued macroeconomic stability. In addition to standard commitment for maintaining price stability, the MPS also aimed to create jobs for the growing young population by supporting micro, small and medium enterprises (MSMEs) which operate in stable macroeconomic environment with greater access to bank financing.

Taking into consideration lessons from other developing and emerging markets and its own convictions, BB has made a number of statements in the MPS, such as: (i) allowing the rate of interest to be determined by the market forces of demand and supply; (ii) allowing the exchange rate of the US Dollar to the Bangladeshi Taka to be determined by the market forces of demand and supply; (iii) keeping the rate of interest to a level which is tolerable; and (iv) create conditions for private sector credit growth to expand by 16.5% in FY2019. These statements are consistent with sound financial management in support of the government’s growth objectives. The objective of this article is to evaluate these statements made in the MPS taking into consideration the ground reality and the challenges which BB will continue to face in the coming months on the domestic and external fronts.

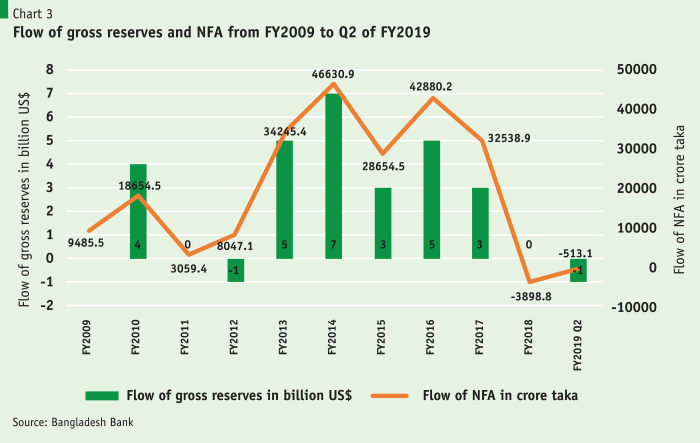

There are tensions in the domestic money market in terms of tightening liquidity in the banking system and supply of foreign exchange in the interbank foreign exchange market is also getting tighter due to continued weakness of the balance of payments (BoP) in recent years. The external current account balance (CAB) has improved somewhat in FY2019 compared with the last year, but it is still registering large deficits every month and BB’s gross official reserves have continued to decline in nominal terms at a moderate pace. According to revised BB figures, the CAB in FY2018 was an all-time-record deficit of $9.78 billion. The condition got slightly better in the provisional figures for the CAB in the early months of FY2019, although it still recorded a deficit of $4.3 billion in the seven months of FY2019.

The external current account balance (CAB) has improved somewhat in FY2019 compared with the last year, but it is still registering large deficits every month and BB’s gross official reserves have continued to decline in nominal terms at a moderate pace.

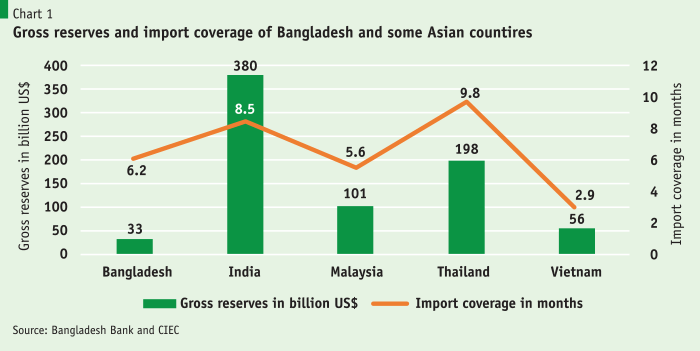

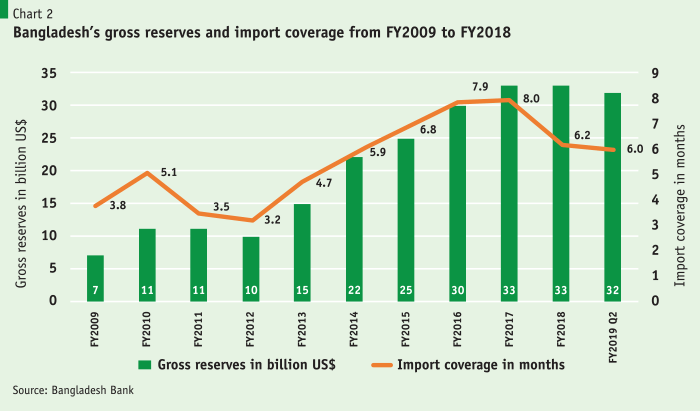

The weakening of the BoP has contributed to exchange market instability. During FY2019 (so far), the exchange rate of Bangladesh Taka vis-à-vis the US Dollar has depreciated from a high of Tk. 83.11 per $1.0 to a low of Tk. 85.31. BB had been trying to stabilise the exchange rate by intervening in the foreign currency market by selling $1.3 billion till January 27, 2019. However, it is not possible to intervene indefinitely.  Moreover, some banks are refusing to open LCs on behalf of their clients due to shortage of foreign exchange in the interbank market at the BB dictated rates. In the last four years, the gross official reserve did not increase in dollar terms whereas there has been a significant increase in imports. Thus, the reserve coverage for import payments has fallen significantly and likely to fall further. At six months of reserve coverage, the level of reserves is still comfortable and compares well relative to its comparators (Chart 1). However, since it declined by two months (from eight months to six months within a period of 15 months, Chart 2) and this kind of rapid fall cannot continue for long, market-based flexible exchange rate management is the way forward.

Moreover, some banks are refusing to open LCs on behalf of their clients due to shortage of foreign exchange in the interbank market at the BB dictated rates. In the last four years, the gross official reserve did not increase in dollar terms whereas there has been a significant increase in imports. Thus, the reserve coverage for import payments has fallen significantly and likely to fall further. At six months of reserve coverage, the level of reserves is still comfortable and compares well relative to its comparators (Chart 1). However, since it declined by two months (from eight months to six months within a period of 15 months, Chart 2) and this kind of rapid fall cannot continue for long, market-based flexible exchange rate management is the way forward.

Gap between the MPS and policy operations

There is obviously a wide gap between what BB has stated in the MPS with regard to exchange market operations, and what it is still practicing. Since the statement in the MPS with regard to market-based exchange rate determination is widely supported, an actual change in BB’s exchange rate policy at the operational level is expected, particularly after the national elections. But that is yet to take place. Such a move would certainly lead to a further depreciation of Taka against the US dollar, but that would be in line with the appreciation of the dollar against all major currencies in the global exchange market. This kind of adjustment would also help boost exports and contain pressures for excessive growth in imports, thereby helping restore BoP equilibrium and a resumption in building up of BB’s foreign exchange reserves. Bangladesh needs to increase or at least maintain its reserve coverage (in months of imports) at the current level and also increase liquidity in the money market. But these objectives can only materialise if the level of gross official reserves increase steadily along with growth in import payments.

BB’s credit and Interest rate policies should not be viewed independently from the ongoing tightening of liquidity in the banking system. This liquidity problem has pushed up the interest rate structure of the banks in 2018, and this did not happen overnight.

The problem over liquidity in the banking system has been intensifying over the last several years due to a number of factors:

- One major source of liquidity for the banking sector is the inflow of Net Foreign Assets (NFA) though the BoP. During the period from 2012 to 2016, large current account surpluses and finance account surpluses contributed to a sharp increase in the overall surplus of the BoP and the corresponding build up in foreign exchange reserves of BB (Chart 3). The resulting expansion of the NFA was a major source of liquidity injection into the banking system in those years. Simply put, for every US dollar of increase in the NFA, domestic liquidity/broad money expanded by about Tk. 80. Accordingly, the large surplus positions in the NFA amounting billions of US dollars every year contributed to the corresponding 80-fold increase in the amount of liquidity in the banking system in terms of Taka. As the BoP has weakened since FY2018 and became negative, a large amount of liquidity has drained out of the banking system.

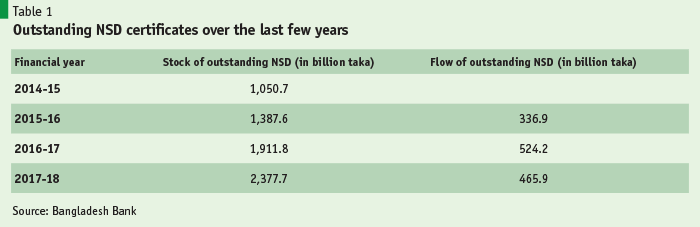

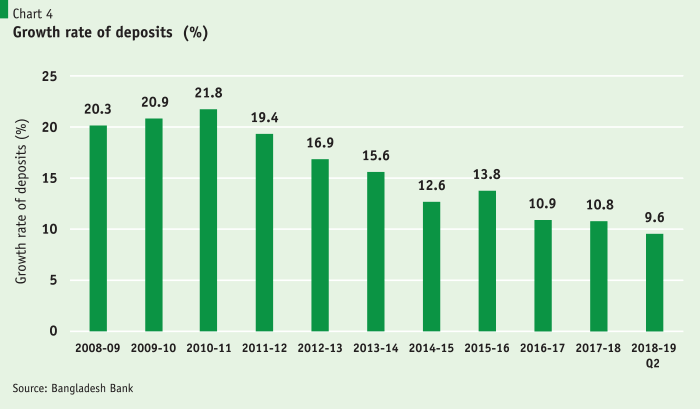

- The other major source of monetary expansion in the banks has been the deposit growth of households/account holders out of their financial savings. As the households were attracted by the higher interest rates of the National Savings Directorate (NSD) instruments, a large part of the financial savings moved away from the banking system into the non-bank and non-tradable instruments like the ones issued by the NSD (Table 1).

- In addition, the sizeable intervention in the foreign exchange market by BB also reduced liquidity in the banking system. For every US dollar that BB sold, it effectively withdrew Tk. 80 from the banking system, thereby contributing to further tightening of liquidity in the banking system.

- Finally, many banks were engaged, particularly the new ones, in excessive lending beyond the limits established through macroprudential conditions imposed by BB. In some cases, banks’ loans to deposits ratio exceeded even 100%, violating BB’s requirement limiting lending to a maximum of 84% of deposits. As BB started to enforce this regulatory requirement, which it should have done even earlier, many banks had to stop lending and even had to recall some of their earlier loan commitments. This resulted in the tightening of lending in general, pushing up the interest rate structure in early 2018. BB’s intervention should not be blamed for this increase, which some quarters do. The problem lies with the liquidity situation and aggressive lending by certain banks violating macro-prudential conditions.

Against this background, the deposit growth rate in the banking system slowed down from a healthy rate of about 20% to less than 10% in FY2019 (Chart 4). Banks started to compete for funds, and they had no option but to offer rates to depositors which were close to the NSD’s rates, leading to a sharp increase in deposit rates across the whole banking system. Given the average spread in lending and deposit rates of about 4.5%, the lending rate also increased significantly.

…in its own projection BB is stating that the NFA will be negative in the 2nd half of FY2019 which is not at all conducive to the monetary management point of view.

Given the slower deposit growth, banks were also not able to expand private sector credit as per the MPS of BB. Last year, the target was 16% but the achievement was 13%. As the deposit growth is still subdued or even decelerating further, the banks’ ability to expand credit has been correspondingly limited.

What can BB do in this situation? It must address the fundamentals- not superficially but at the core issues- which contributed to the decline in liquidity. For that to happen BB should work on all three fronts listed below:

- Improve the Balance of Payments (BoP) by increasing the inflow of NFA. However, in its own projection BB is stating that the NFA will be negative in the 2nd half of FY2019 which is not at all conducive to the monetary management point of view. This is a reflection of the business as usual scenario or unchanged policy setting. What is needed includes proactive exchange rate management and export policy to restore BoP equilibrium with positive growth in gross and net reserves of BB.

- To ensure a healthy growth in bank deposits from the household side, the spread between NSD interest rates needs to be adjusted with market rates. This high rates of interests on NSD instruments is not helping the situation and until the rates are brought in line with the market, the banks are going to suffer from slower deposit growth and the consequent tightened liquidity, limiting their capacity to expand credit.

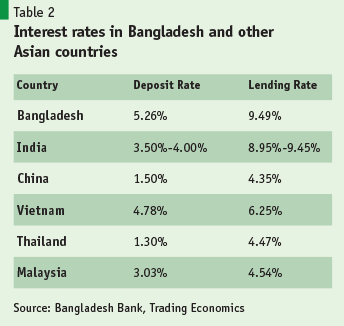

Bangladesh has a history of high interest rates compared to its comparator countries (Table 2).

This makes our economy inherently less competitive. We need to understand what makes our interest rates high.

- If the deposit rate is high, the lending rate will always be correspondingly high, and the higher deposit rate is the result of the government’s own policy of giving over-attractive interest rates on NSD instruments. No country in the world provides such high interest rates on government bonds which are non-tradable and risk-free.

- As the spread between lending and deposit rate is high in Bangladesh, which at about 4.5% is considered the highest among comparator countries, the lending rate is correspondingly higher compared with comparators.

- The combined effect of higher deposit rate and higher interest spread puts Bangladeshi entrepreneurs and exporters at serious disadvantage of three to five percentage points in financing their investment and business activity. Bangladeshi entrepreneurs will always be at a relative disadvantage in terms of loss of profitability or competitiveness.

Addressing this problem of high spread will require:

- A significant reduction in the loan loss provisioning by strengthening the quality of assets of banks. Currently the non-performing assets of the banking system stand at about 11%. Addressing loan loss can help reduce spread by one percentage point.

- Operating cost is the most important component of any bank in any country. In Bangladesh the operating costs are also high due to proliferation of banks contributing to higher overhead expenses. Reducing the operating cost can also help reduce the spread. This can be achieved through efficiency in administration, automation and containment of overhead costs. Many banks in Bangladesh—particularly smaller ones—have been suffering from large overheads relative to their asset base because of:

- Fixed expenditures which any bank irrespective of asset size must undertake, such as the positions of the senior staff (MD, DMD, SVP, treasury management, internal control, etc.). In a market which suffers from the lack of quality staff, the large number of banks has pushed up the remuneration and benefit packages of senior bank staff compared to senior staff of other industries.

- Head office cost, which is high because most banks’ head offices are located in costly commercial parts of Dhaka and irrespective of their asset base. Smaller banks have to incur the high cost of their head offices despite their small asset base.

- Most importantly, the costs of automation and cyber protection, which are hugely increasing due to adoption of modern automated platforms for speedy financial transactions and the threats of cyber-attack. For many banks, these costs have already skyrocketed and those which have not yet undertaken significant automation would need to implement projects to do so with large cost implications. For small banks, such costs may easily inflate their overhead expenditure relative to their asset base.

The only way to contain or reduce or generate savings on these major overheads to levels comparable with those in other countries is to reduce the number of banks by consolidating the banking system through mergers and acquisitions of weaker banks with stronger ones.

- Countries which have lower interest rate structures generally also enjoy lower inflation rate. Bangladesh can reduce the deposit rate if the inflation rate comes down. For example, if the inflation rate is 2.5% (like in China), banks can offer 3% deposit rate, still providing positive real interest rates to depositors (from our current level of 5.5% to 6%). This essentially implies that BB/the government should not be complacent about Bangladesh’s inflation performance and continue to aim for a lower inflation target.

Challenges in achieving market-based interest rates

BB is right in stating its desire to maintain market-based interest rates in its MPS. The statement is essentially reassuring because we consider it as moving away from the earlier stated policy of fixing the maximum interest rates at 6% and 9% for deposit and lending, respectively. However, for market-based interest rates to come down to a level which will make Bangladesh more competitive and support investment and growth objectives will require much deeper level of policy undertakings along the lines described above.

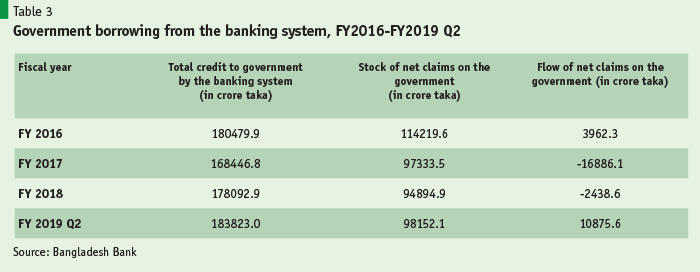

Banks cannot expand lending without a commensurate growth in deposit base while adhering to macroprudential requirements of BB. If the current anaemic deposit growth rate is sustained because of the factors discussed above, there is no way that private sector credit will expand by 16.5% as envisaged in the MPS in support of the government’s growth target. Another complicating factor is also emerging. Until FY2019, because of much larger (well above the budget targets) borrowing through issuance of NSD instruments, government borrowings (net) from the banking system were negative indicating that the government was repaying the banking system on a net basis. However, this situation has changed and despite continued heavy borrowing from the NSD, the government is also borrowing heavily from the banking system in FY2019.

The growing recourse to bank financing by the government- despite another record level of borrowing through NSD instruments- is attributable to the very weak revenue performance of the National Board of Revenue (NBR).

This unfavourable turnaround in government borrowing is a matter of concern. The growing recourse to bank financing by the government- despite another record level of borrowing through NSD instruments- is attributable to the very weak revenue performance of the National Board of Revenue (NBR). In the first seven months (July-January) of FY2019, the NBR’s tax revenue only increased by less than 7% compared with a target of 43%. This huge shortfall in projected revenue is likely to cause crowding out of loanable funds of the banking system by the government to finance budgetary outlays. In this situation, credit expansion to the private sector is likely to be much more limited than in recent years. Such an outcome—which is currently in the making—will not be conducive to sustaining real economic growth at above 8% rate.

Concluding observations

The statements/commitments made in the MPS regarding the four points stated above are to be fully supported. The challenging money market and the difficult BoP situation will require BB to work on multiple fronts to ease liquidity in both money and exchange markets and create the environment for bringing down the interest rate structure in a sustained manner. It is now important that BB adopts defined action programs outlined above in support of the positive statements made in the MPS.