Towards a Covid-19 National Budget

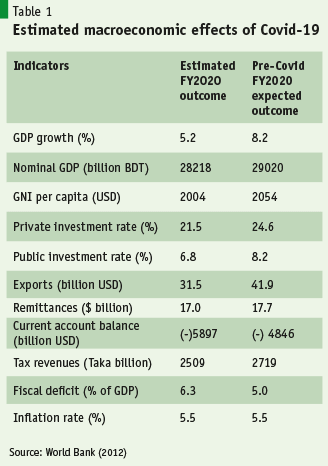

By

The global Covid-19 pandemic has terrorized the world, unleashing huge number of infections and sad loss of lives. According to the Johns Hopkins Covid-19 database, as of 21st June 2020, reported number of global infections were about 8.9 million and deaths climbed to almost 468 thousand. Bangladesh has not been spared either, reporting about 112 thousand infections and 1464 deaths. On March 23, the government imposed a lockdown that lasted until May 30, 2020. On the economic front, the adverse economic effects are still evolving. The estimated losses based on available data as of May 31 are indicated in Table 1. The loses on account of GDP, investment, exports, remittances and tax revenues are substantial. Since the pandemic is still moving ahead furiously global and especially in Bangladesh, where the infection curve is on the upswing, the adverse effects will intensify further and spill over to FY2021.

The government has taken a series of measures to reduce the spread of the infection and announced several relief and stimulus packages, estimated at 956 billion BDT (3.3% of GDP), to help the needy and stem the downward spiral of economic activities.

Even as the Covid-19 pandemic continues to take its human and economic toll, the government is in the process of preparing the FY2021 National Budget. This is an extra-ordinary period for budget formulation in the face of falling revenues, declining rates of GDP growth, declining exports and external remittance earnings, and growing demand for financial stimulus, healthcare spending and social protection support. To respond to this challenge, the budget formulation needs extra-ordinary leadership and the business as usual approach will not do. The Budget must also be honest and upfront based on realistic assumptions of the likely economic and financial costs of the pandemic and reflect the government’s thoughtful and informed approach to fight that with a view to containing the loss of lives and livelihoods.

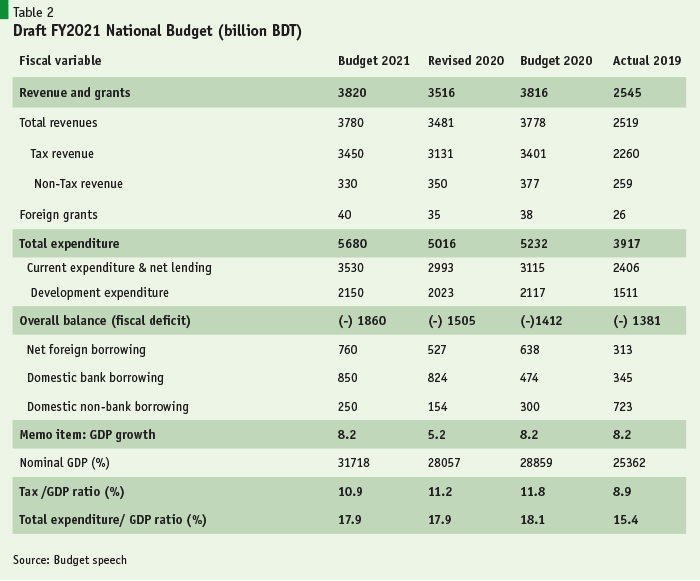

As a first step in the budget making process, the government announced its proposed draft FY2021 Budget on June 11. The highlights of the budget are shown in Table 2.

On the surface it looks like a beautiful budget. The message conveyed to the people by this budget is that don’t worry about Covid-19. It will soon go away on its own. The economy will recover rapidly and achieve 8.2% growth as in FY2019. The government will substantially increase its total expenditure by 1763 billion BDT (45%) over what it spent in FY2019 and that will take care of all the Covid-19 losses. The government will finance most of this increased expenditure by increasing tax revenues by 1190 billion BDT (53%) over what was possible in the normal fiscal year of 2019. There will be a minor blip in fiscal deficit 0.4% of GDP) that can be easily financed through additional foreign and domestic borrowing. Bank borrowing will be contained at around 3% of GDP, which will not compromise the government’s commitment to price stability and credit growth for private sector.

Taken at face value and if it were indeed possible to realize this “dream budget”, we will all take a sigh of relief. But when the assumptions of the Budget are examined, it looks like similar to what Alice felt when she reached her Wonderland. Every time, she saw something out of the ordinary, she exclaimed “it is getting curiouser and curiouser”. The realism of the budget hinges on two critical assumptions: First is the projected GDP growth rate for FY2021 and the second is the projected growth of tax revenues. If these two critical anchors of the budget could be salvaged, the rest of the budget would could be repaired by changing some of the underlying expenditure priorities and the strengthening implementation capacity.

GDP growth

By its own admission, the government estimates that Bangladesh would lose at least 3 percentage point of GDP growth rate in FY2020 owing to Covid-19 adverse impact (Table 1). But then it assumes by magic Covid-19 will disappear and the growth momentum will be restored in FY2021. This aspiration is understandable because unless the growth momentum is restored, the increase in unemployment and loss of income of the urban poor, who will be hit the hardest by the slow-down of the economy, will tend to wipe off much of the hard-earned gains in poverty reduction achieved over the years. But Covid-19 is a force majeure and not a fault of the government. The top responsibility of the government is to take all humanly possible measures to help the poor with income transfers and health care measures to restore human health and confidence. And alongside, steps should be taken to restore production, investment and economic activity. A full health recovery and restoration of people’s safety-risk concerns will partly depend upon the easing of the Covid-19 infections and partly when a cure or vaccine is available. Global efforts are underway and the best hopes are positive results in calendar year 2021.

Given this reality, OECD countries have declared that their economies are in recession and will likely stay that way for the rest of the calendar year 2020. In USA, which has moved most aggressively with stimulus package pumping in some 3 trillion USD in April 2020, unemployment has soared to 15-20% and GDP growth is in deep negative territory. What countries are realizing is that stimulus packages alone will not restore the growth momentum until health of people recover and their confidence returns through improved health care and Covid-19 testing, social distancing and thoughtful and careful re-opening. Workers hit by unemployment require income transfers to buy food and medical care. But the problem for economic growth recovery is that people who have enough income are not spending money other than to buy food and medical care. So, most people are staying away from all kinds of travel, especially air, rail, bus and ship; are not going out on vacation; are not buying new cars, new homes, clothing’s or furniture; are not going out to restaurants, theaters and movie halls; schools and universities are closed; and even non-Covid-19 doctor visits have taken a hit. In this environment stimulus packages by themselves will not restore economic growth until people feel secure health wise and their confidence returns.

What countries are realizing is that stimulus packages alone will not restore the growth momentum until health of people recover and their confidence returns through improved health care and Covid-19 testing, social distancing and thoughtful and careful re-opening. Workers hit by unemployment require income transfers to buy food and medical care.

Bangladesh imposed a hard lockdown on March 23 that continued until end of May. Officially therefore most businesses reopened from June 02. However, experience shows that while the rural economy is active, most of the urban economy has responded hesitantly, as elsewhere globally and justifiably slow. The Covid-19 infection curve based on testing data is showing a steep upward push as reported in the Johns Hopkins database for Bangladesh last visited on June 21, 2020. Like in other parts of the Covid-19 infected world, manufacturing and service-related activities are highly sluggish. Bangladesh is additionally hurt by the slump in global demand for its largest manufacturing activity, RMG. The export losses reported in Table 1 will likely spill over to at least the first half of FY2021. Remittance inflows will likely take a further hit in the First half of 2021 in view of the slump in economic activities in the Middle East countries. Domestic demand for major industrial products and services will slowdown in the first half of FY2021 as in other countries owing to health concerns as people stay sheltered at homes to avoid the Covid-19 virus spread.

Given this realism and using the most recent IMF global GDP projections that assume global economic recovery starting in January 2021, the GDP is projected to grow by 5% in FY2021. This is a healthy growth in the current circumstances. Economic activities will remain constrained in the first half of FY2021 (July-December 2020) owing to COVID-19, but will likely recover in the second half (January-June 2021). Overall, for the full fiscal year 2021, the 5% GDP growth is predicated on continued robust agricultural performance and steady state in the rural economy, the recovery of exports and investments in the second half of FY2021, and the resumption of most urban activities to their normal level by January 2021. Growth will be lower if these assumptions do not materialize.

Revenue projections

The most critical assumption is the tax revenue target for the FY2021 Budget. In FY2020, the actual tax collection up to February 2020 was 1374 billion BDT. Normally there is a large seasonality effect because many tax payments come in the April-June months. For FY2019, the seasonality coefficient was 1.81, that is actual tax revenues were 81% higher for the full fiscal year as compared with inflows until February. Applying this seasonality multiplier, in the absence of Covid-19, the NBR would have likely collected 2487 billion BDT in tax revenues. Once we allow for the Covid-19 impact that has disrupted economic activity, sharply lowered imports, which is a major tax base for VAT and custom duty revenues, and also forced the government to announce various duty reductions and tax deferments, achieving 2487 billion BDT is an impossible target. Our best estimate at this time is an NBR tax revenue of 2250 billion BDT in FY2020, which is 34% lower than the government’s revised budget estimate of 3003 billion BDT. We believe that even the 2250 billion BDT estimate is on the optimistic side.

For FY2021, a critical policy need is for the government to bite the bullet and introduce some important tax reforms. With good policy reforms that requires a real effort to introduce the VAT 2012 Law in its original form and make some important changes on the income tax front including digital online tax filing and tax submissions, selective and productive audits, and the simplification of the income tax law, it may be possible to increase NBR tax revenues by 20% to 2700 billion BDT. This is also optimistic but feasible with strong political support and solid implementation. Along with other tax revenues collected by local government entities, total tax collection is not likely to exceed 2851 billion BDT in FY2021.

What are implications of this realistic tax revenue estimate compared with the draft government Budget estimate in Table 2? Even with an optimistic tax projection of 2851 billion BDT for FY2021 that is underpinned by substantial tax reforms, the tax revenue collection will likely be at least 600 billion BDT lower (17% lower) than assumed by the government. In the absence of an announced strategy regarding how this 600 billion BDT revenue deficit will be spread across various expenditure items, the spending proposal of the government Budget become non-transparent. Some 75% of the current spending is a part of the committed budget since it comprises of civil service salaries, pensions, defense spending, interest cost and purchase of supply and materials. So, the three items that will face cutbacks are transfers through social protection, proposed new increases to health care budget, and the ADP programs. Given this uncertainty, it is near impossible to make meaningful statements about the government’s expenditure priorities and relevance to COVID-19 since the budgeted expenditure items beyond those that are fixed (as noted above) are unreliable and subject to cutbacks from revenue shortfalls.

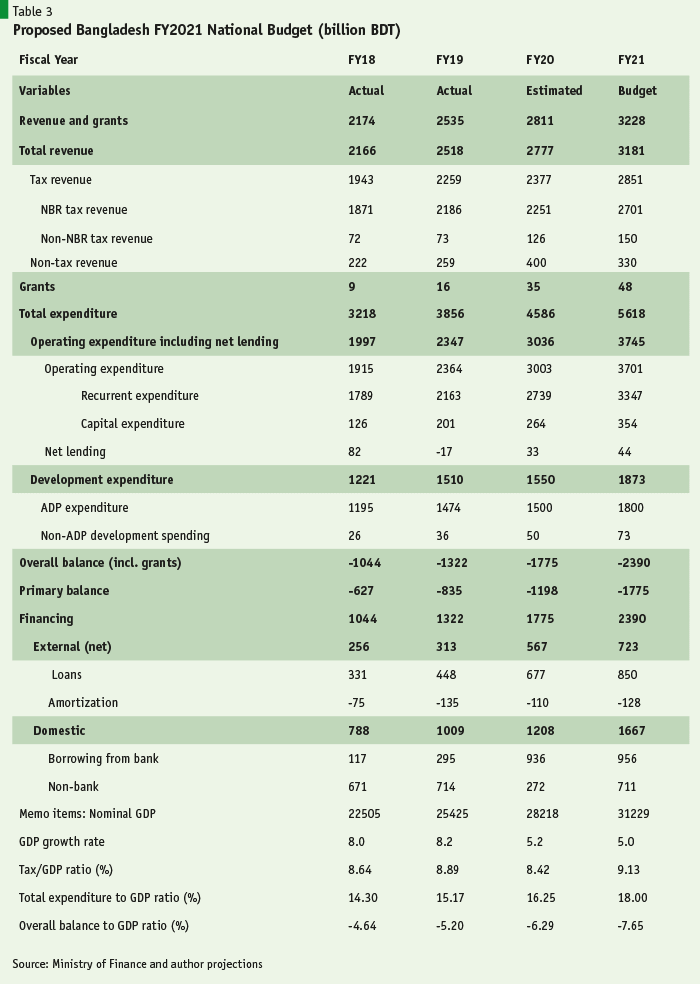

A Covid-19 proposed Budget: Based on the above realities for the recovery of GDP growth and tax revenue constraints even with substantial tax reforms, Table 3 illustrates a picture of what might constitute a realistic budget for FY2021. The proposed budget differs from the government budget in three major ways.

First, it makes realistic GDP growth assumption, 5% as compared with 8.2%. From the budget point of view, the two main implications of a lower and more realistic GDP growth rate concern the recovery of revenues, and the need for income transfers and funding for employment creation. In the environment of lower GDP growth, the automatic recovery of tax revenues without policy measures will not happen. So, some minimum critical tax reforms are essential, which are missing from the government draft Budget. Furthermore, the government cannot assume that growth recovery will restore employment and income of the poor and near poor. Instead, the government will need to further increase its planned spending on income transfers through the social protection program and put greater emphasis on job creation and provide funding for that.

Second, the budget revenue target in Table 3 is based on a realistic assessment of what would likely be mobilized during FY2020. The government draft Budget in Table 2 uses a revised tax revenue figure that has zero realism and is therefore fictitious in nature. This makes it possible for the government budget to avoid the need for tax reforms and assumes that this fictitious revenue base along with the optimistically high projected GDP growth will yield the projected tax revenue. By using a realistic tax base for FY2020 and assuming a realistic GDP growth target, the proposed budget in Table 3 dramatically exposes the absurdity of the tax target in the government’s proposed budget. It postulates an increase from 2377 billion BDT in FY2020 to 3450 billion BDT in FY2021, which is an absurd 45% increase that has never been possible in the history of Bangladesh tax collection even with the best of economic condition and with substantial tax reforms.

Third, the expenditure level in the proposed Covid-19 budget is fully financeable through a combination of realistic tax increases and increase in fiscal deficit. Remarkably, the proposed total expenditure in both budgets are reasonably similar, but there are major differences in expenditure priorities and the financing plan. The proposed Covid-19 budget in Table 3 allows for a much larger increase in current spending by incorporating larger amounts for social protection transfers, healthcare funding and interest subsidy on employment program loans, and reduces spending on capital intensive long-term infrastructure projects that can be postponed until normalcy returns. On the financing side, it assumes realistic tax revenues but allows for an additional 490 billion BDT financing from the non-bank domestic sources. This can be done either through greater use of the national saving certificate as but with lower interest rate (7% tax free) or through the floating of a new Covid-19 recovery saving certificate at 7% tax free interest rate.

Core Covid-19 expenditure priorities

The Covid-19 has exposed some of the major structural weakness in our spending priorities that will need to be addressed in the FY2021 Budget along with the adoption of a medium-term expenditure reform program during the 8FYP. From the Covid-19 perspective, two most critical reforms are discussed in the following paragraphs.

First, is the dismal state of our national healthcare system. This needs a major overhaul and a medium-term action plan. For the FY2021 National Budget, two key reforms are the introduction of an Universal Health Care System, drawing from the experience of Thailand; and increase in budget spending on healthcare from 0.7% of GDP to at least 1.2% of GDP, with a medium-term target of reaching 3% of GDP by the end of the 8FYP (FY2025).

For the FY2021 National Budget, two key reforms are the introduction of an Universal Health Care System, drawing from the experience of Thailand; and increase in budget spending on healthcare from 0.7% of GDP to at least 1.2% of GDP, with a medium-term target of reaching 3% of GDP by the end of the 8FYP (FY2025).

Second, our social security system is broke and needs substantial revamping along the lines of the NSSS approved by the government in 2015 but never implemented. The major medium-term reforms include consolidation of the multitude of small and often overlapping programs into the 5 core Life-Cycle based programs advocated in the NSSS; establishing an online database of all eligible beneficiaries; conversion of all programs to cash basis; all transfers should be made online using G2P approach; increase in social protection spending excluding civil service pension from 1.2% of GDP to 2.0% of GDP in FY2021 and growing to 3.0% of GDP by FY2025 (end of 8FYP).

Addressing the unemployment challenge

The Covid-19 will create a major unemployment problem in the short term owing to the disruption of non-farm informal activities, cutbacks in formal employment, especially in RMG, and the cutbacks in overseas employment. The only viable solution to this would be to push the growth of micro and small enterprises (MSEs). These MSEs employ some 21 million people and need financial support to resume and expand business. The government’s stimulus package includes additional financing schemes for MSEs, but they fall short of demand. Importantly they will not reach the bulk of the MSEs because of current credit practices that require tax registration, collateral support, and high transaction costs. Solutions must be found to offset these constraints, including the use of smart technology to simplify credit applications, approval and loan disbursements all done online and in real time.

ADP spending and fiscal deficits

Given revenue constraints and the need to increase the healthcare spending and social security transfers, the short-term fiscal adjustment should be shared between cutbacks in ADP and increase in fiscal deficit. The government’s concern to maintain fiscal discipline is admirable. It has rightly sought to increase external borrowings and cutback ADP. In Table 3, we propose a deeper cut in ADP than shown in the government’s budget in Table 2 and a higher fiscal deficit financed from a combination of bank and non-bank domestic borrowing. The resulting fiscal deficit and the financing plan is fully consistent with debt sustainability and money growth targets to keep inflation under control and without jeopardizing the required growth of private credit to finance the economic recovery.