COVID 19 Impacts on Generational Economy in Bangladesh: An Application of National Transfer Account

By

Introduction and Background

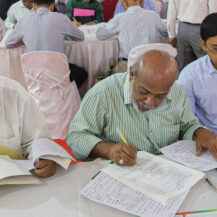

Almost all socio-economic impact assessments of Covid-19 used the economywide modeling approach (such SAM and CGE supplemented with employment matrix and poverty module) to examine effects on: (1)GDP (macro and sectors); (2) job losses and unemployment rates (by types of labour categories and locations); and (3) poverty rate and new poor (by representative households and locations). Majority of the governments have also proposed stimulus package to counter the negative impacts of Covid- 19. The impacts of stimulus have also been assessed using the economywide modeling approach (such Social Accounting Matrix (SAM) and Computable General Equilibrium (CGE model).

However, no attempt has been found to assess the impacts of Covid-19 and the proposed stimulus from the perspectives of generational economy as captured in the National Transfer Accounts – from the perspectives of economic security, generational equity, gender equality, public finance, and numerous other critical public policies thus establishing linkages between population dynamics and development.

Considering this gap in assessment, we propose to combine the economywide modeling approach with generation economy approach to provide deeper understanding of the Covid-19 impacts. Such an approach may also help to dissect the shortcomings (or gaps) of the currently proposed stimulus and thus design more effective stimulus considering macro, sectoral and generational perspectives. Combination of economywide and generational economy approach (EWAGE) would also help us to assess the impacts (of Covid-19) as well as the stimulus from the following the perspectives of generational accounts.

Results

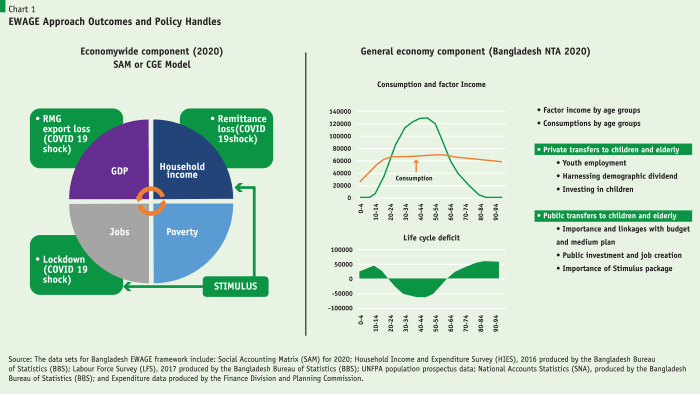

First, a simulation was carried out with Bangladesh Computable General Equilibrium (CGE) 2020 to assess the economic impacts of Covid- 19. The simulation considered a 15 % reduction in RMG exports; 3.7% reduction in foreign remittances and 8 weeks lockdown of the domestic economy. Overall household income declined by about 13 % in the post-Covid 19 period compared to the pre-Covid-19 period. The reductions in income by the five age groups classified in the CGE model are shown the chart 1 above.

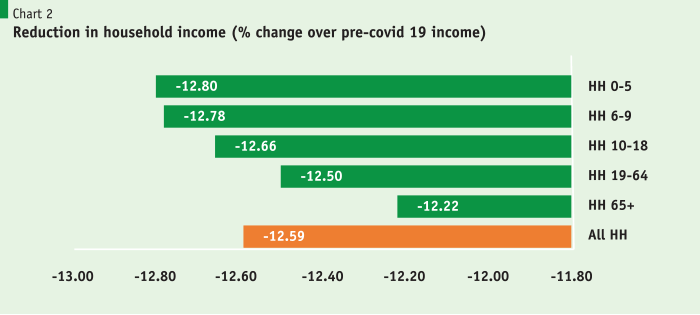

Second, the household level income reductions are linked to the Bangladesh NTA 2020 to assess impacts on the generational economy – in particular income, consumption and life cycle deficit (LCD) by the 20 generational accounts (i.e. age groups). Panel A captures the income and consumption impacts by the generational accounts. As expected, both income and consumption declined across all generational accounts in the post-Covid -19 period in comparison to the pre-Covid-19 period.

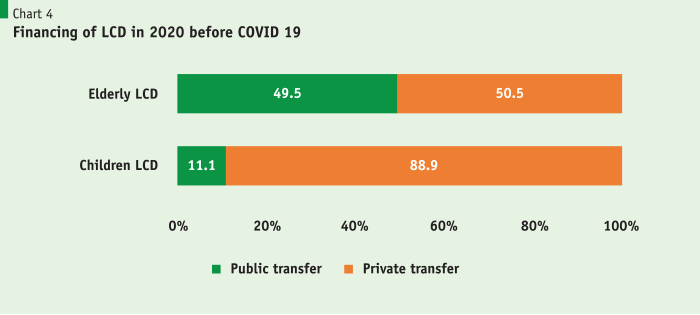

In terms of life cycle deficit, two LCD groups are distinguished – (1) children and (2) elderly – whose consumption and livelihood rely mainly on the surpluses of the working age group. More specifically, two generational accounts whose consumption are 100 % supported by transfers are (a) children in the age cohorts 0 to 9 and (b) persons in the age cohorts 85 to 99. In Bangladesh, as pubic spending including social protection is low, thus, private transfers cover bulk of the LCDs of these two deficit groups. In 2020, public transfers covered only 11% of the LCD of the children and 49% of the elderly. Given the low level of public transfers, the private transfers are the major source of the livelihood of the children. Private transfer is also an important source for the elderly. High, sustained and inclusive GDP growth ensuring productive employment to the working age generations are key to the welfare of the children and elderly in Bangladesh.

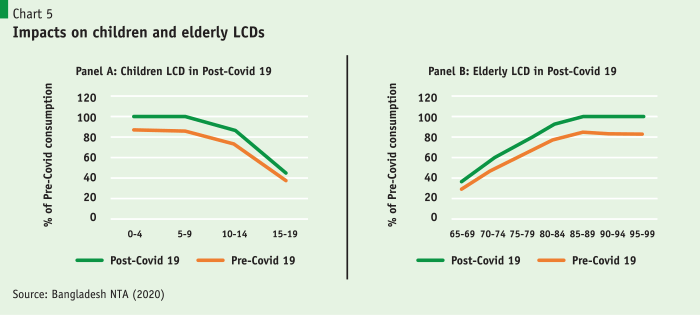

It is difficult to ascertain; how intra-household resource transfers are impacted due to Covid- 19. Assuming that it still follows the pre-Covid-19 patterns – it is found that the LCDs of the deficit generations – children and elderly deteriorated under the post-Covid- 19 due to contraction of the economy and reductions of the factor income (or reduction in the surplus of the working groups). The deteriorations are larger for the early childhood (aged 0 to 9) and persons with age 85 and over generations. If their consumptions are not supported – child and old age mortality may spike, successes on the nutritional front may be lost, and productivity of future generations may be compromised.

Salient Features of NTA

National Transfer Accounts (NTAs) provides a complete accounting of economic flows by age of the residents of a country of how economic resources are produced and consumed, and how each relies on government programs, family systems, and financial markets to achieve the final distribution of these economic resources.

NTAs are organized to underscore the generational economy and its key peculiarities: the monetary life cycle and age reallocations acknowledged by depending on intergenerational transfers and assets. The goal of NTAs is to provide a systematic and comprehensive approach to measuring the economic flows from a generational perspective. According to Mason and Lee (2011) the generational economy is defined as the social institutions and economic mechanisms used by each generation or age group to produce, consume, share and save resources; the economic flows across generations or age groups that characterize the generational economy; explicit and implicit contracts that govern intergenerational flows; the intergenerational distribution of income or consumption that results from the foregoing.

According to the NTA methodology, the life-cycle deficit (LCD) at each age is the superfluous of consumption over labour (including mixed income) income. In all societies, children and the elderly consume more than they produce, acquiring LCD. Working-age population has surpluses in light of the fact that their labour income is generally more than their consumption needs.

One of the major contributions of the National Transfer Accounts is to develop our comprehension of the implications of relations between development and population dynamics. Shift mechanism of economic resources from working ages to dependent ages depends on countries economic, social and other conditions.

Source: National Transfer Accounts Manual: Measuring and Analysing the Generational Economy (United Nations, 2013)

Conclusion:

This paper is a departure from the predominant approach to assess socio-economic impacts of Covid-19. An attempt has been made (to our knowledge the first attempt) to integrate generational economy popularized by the NTA project with the widely used economywide approach to look beyond impacts on macro and sectoral indicators.

The results highlight the financing of the generational deficits – which is predominantly private due to low public expenditures in education, health, nutrition and social protection. Thus, it also re-emphasised the importance of high, sustained and inclusive economic growth to support the generational equity and livelihood in the context of Bangladesh.

The results highlight the financing of the generational deficits – which is predominantly private due to low public expenditures in education, health, nutrition and social protection. Thus, it also re-emphasised the importance of high, sustained and inclusive economic growth to support the generational equity and livelihood in the context of Bangladesh.

The analysis captures the precarious impacts on the consumption of the deficit generations – children and elderly. Private transfers which constitute the main sources of the consumption of the children are under threat and thus call for an effective public transfer in the form of child benefit, social pension or family benefit – as long as economic situation returns to normalcy.

References

1. Mason and Lee (2011), Population Aging and the Generational Economy: A Global Perspective https://www.idrc.ca/en/book/population-aging-and-generational-economy-global-perspective

2. National Transfer Accounts Manual: Measuring and Analysing the Generational Economy (United Nations, 2013) https://www.un.org/en/development/desa/population/publications/pdf/ development/Final_March2014.pdf