Strategy for attracting FDI in Bangladesh – Should we look East?

By

Despite very similar and humble beginnings for both countries in terms of exports in early 1990s, the single most important factor contributing to the vastly different outcomes between Bangladesh and Vietnam in recent years was FDI. Vietnam’s success in attracting FDI in much larger amounts in a broad range of industries/sectors contributed to its export basket with wide varieties of products of different degrees of complexities/sophistication. The experience of export-led growth strategies with diversified export baskets in Korea, Taiwan, and China also attests to the importance of FDI in their formation years.

The article builds on the premise that creating the proper investment climate and the right ecosystem will help increase FDI in all possible sectors, including to RMG backward linkages.

I. Bangladesh’s Unimpressive Performance in Attracting FDI, Sources and Uses of FDI

1. Overall FDI Performance and Relative to Other Developing Countries

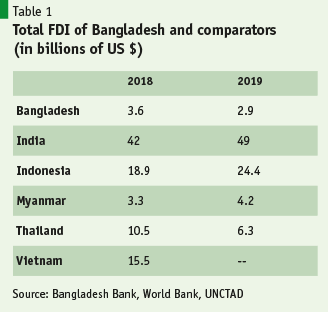

Bangladesh has always been struggling in terms of attracting FDI all through its history. Only temporarily it crossed 1% of GDP in 2018 due to one large deal involving $1.5 billion acquisition of Dhaka Tobacco by Japan Tobacco. The amount of inflows came back to below 1% of GDP in 2019, registering a decline of more than 19% in dollar terms.

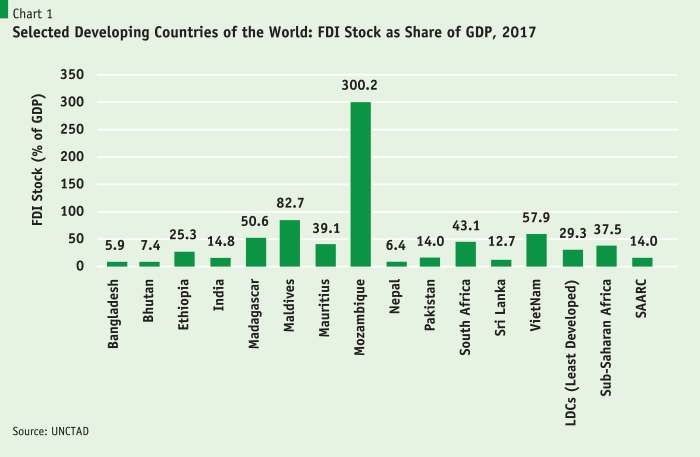

It is disturbing to note that Bangladesh has been behind every country in South Asia and Africa in terms of the stock of FDIs as shown in the Chart based on UNCTAD data (Table 1 and Chart 1).

The situation has not changed much even in the most recent year (2019), based on the World Investment Report of UNCTAD (Box1).

FDI Inflows to South Asia – Bangladesh’s Performance was Disappointing in 2019

While India and Pakistan Performed Well

FDI to South Asia grew 10 per cent to $57 billion in 2019. The growth was driven largely by a rise in investment in India, which further relaxed investment barriers in mid-2019 (including in retail, insurance and downstream coal processing).

FDI to India increased by 20% to $51 billion, sustaining the country’s upward FDI trend. Most of the FDIs were in the information and communication technology (ICT) and the construction industry. ICT investments into India have evolved from information technology services for global companies to the rapidly growing local digital ecosystem, with many local and regional digital champions, particularly in e-commerce (such as Flipkart and Zomato), attracting international investment.

A number of megadeals also contributed to M&A activity. These included investments in internet companies, which amounted to $2.7 billion, as well as the $7 billion acquisition of Essar Steel (India) by a Japanese-Indian joint venture.

Inflows to Bangladesh, in contrast, fell by 56 per cent to $1.6 billion according to UNCTAD. The figure was somewhat higher at ($2.8 billion) if we use Bangladesh Bank data. The decline reflects an adjustment for the one time acquisition of Dhaka Tobacco by Japan Tobacco in 2018. The export-oriented apparel industry remains an important FDI recipient, with major investors from the Republic of Korea, Hong Kong and China.

In Pakistan, FDI recovered in 2019, growing by 28% to $2.2 billion after a deep fall of 30 per cent in 2018 as the country faced balance-of-payment challenges. The growth was driven by equity investments in the energy, financial, and textiles industries, with major investors from China and the United Kingdom.

Source: World Investment Report 2020, UNCTAD

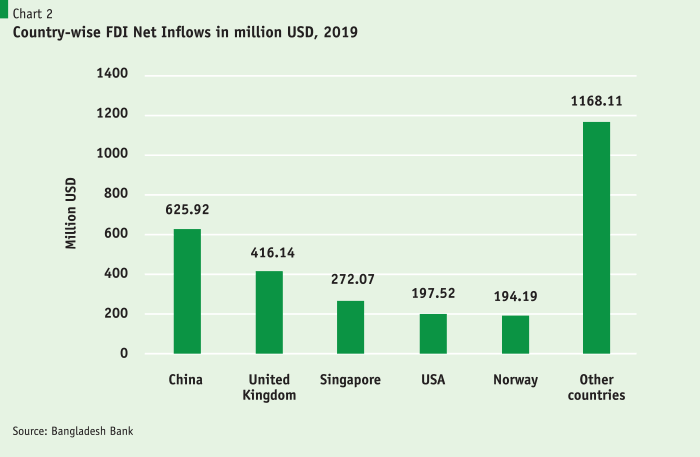

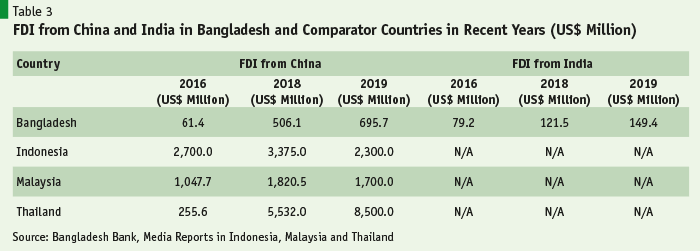

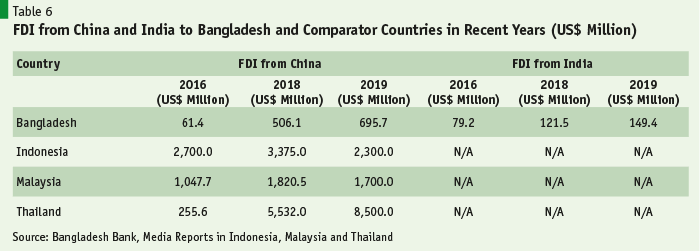

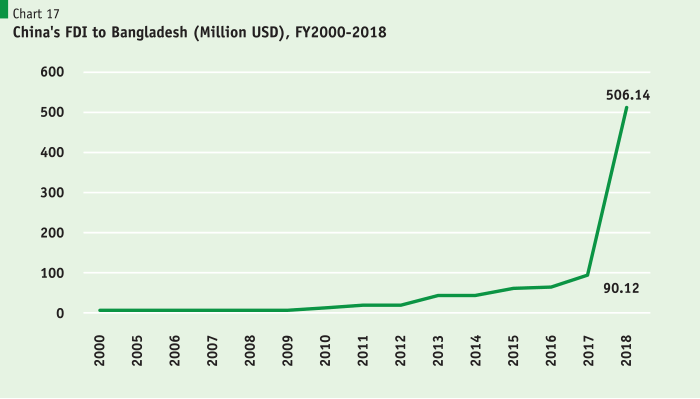

China is becoming a major source of FDI for Bangladesh, somewhat along the lines it has been observed in other regional countries. In 2018 and 2019, China ranked top among the FDI source countries investing in Bangladesh. However, this surge in Chinese investment in Bangladesh is a very recent phenomenon. It primarily started beginning in 2018, but may continue in the coming years if fostered appropriately. FDI from China until 2018 was below $100 million per year, and crossed half a billion mark for the first time in 2018. For other Asian countries investment from China has always been quite significant.

2. Where Are the FDI Inflows into Bangladesh Going?

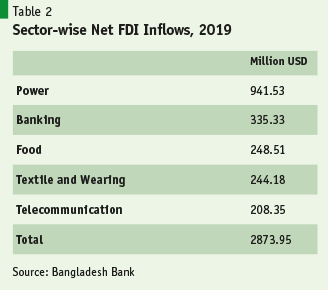

A large Part of FDI in Bangladesh went to domestic market focused utilities like Power and Telecommunications, both of which are highly capital intensive and create less direct employment opportunities (Chart 2) . Another large part goes to banking and food processing. Export oriented textiles and apparel sector accounted for less than 8.5% of FDI.

The very large inflow to the power sector is largely attributable to the very lucrative power purchase terms offered by the Power Development Board along with full adjustments for any input cost including movements in international price of fuels and guaranteed minimum rate of return, making the investments in power sector virtually risk free.

The very large inflow to the power sector is largely attributable to the very lucrative power purchase terms offered by the Power Development Board along with full adjustments for any input cost …

Investment in telecommunications has slowed down somewhat reflecting the adversarial relationship between the telecommunication operators and the Bangladesh Telecommunication Regulatory Commission (BTRC).

II. Bangladesh Needs to Look East for its FDI Efforts

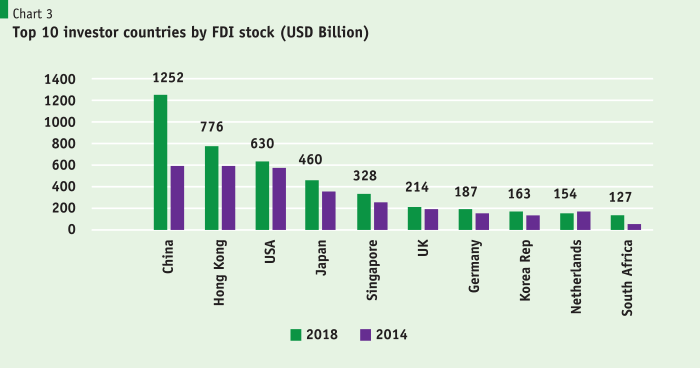

Globally dominant FDI exporting countries in terms of stocks are located in Asia; 4 out of top 5. These five countries/territories include China, Hong Kong, the USA, Japan and Singapore (Chart 3). China and Hong Kong together accounts for more than $2 trillion in FDI investments abroad, which is more than 3 times that of the USA and 4.5 times the outstanding foreign investment by Japan.

Although China and Japan invest a lot in the western industrial countries, they are also major investors in the region. For example, every year Chinese firms invest billions of dollars to East Asian countries like Indonesia, Thailand, Malaysia, Myanmar and Cambodia (Table 3).

Chinese investors are looking at Bangladesh only recently, and still became the number one investor in the country for the recent two years (2018 and 2019). Chinese companies have shown interest in power sector projects and financial sector companies. Investment in Payera coal-based power plant, Baropukuria coal mining and power plant, Dhaka Stock exchange and bKash are some of the important and strategic investments by Chinese firms.

III. Bangladesh Needs to Develop its Trade Investment Relations With Asian Nations

Two way trade flow is a healthy sign of trade, investment and value chain integration. As shown in Table 4, every country other than BD enjoys two-way trade flows. While all East Asian counterparts have large trade imbalances with China, in none of those countries the export to import ratio is so low as it is for Bangladesh (about 5%). This is because Bangladesh is not yet a part of the Asian Value Chain.

Countries well connected with the Asian value chain have a very large proportion of trade in intermediate products, an area where Bangladesh is conspicuously absent and FDI may play an active role in this segment.

It is interesting to observe that the countries where we have good two-way trade relations, built over many decades including from the colonial times, have the highest amounts of FDI in Bangladesh. The country exports a lot to the USA, UK and to the EU economies and has a healthy bilateral trade relation with these western economic powers. Thus it is no surprise that investors from those countries/economies have invested in Bangladesh. This picture may however be changing fast as FDI flows from China and other regional countries like Singapore, Japan, Korea and India are increasing at a faster pace. Bangladeshi exporters must also divert their attention to the development of stronger trade relations with the Asian economic power houses and economic blocks (like ASEAN). These markets together will be close to the combined EU and USA markets by 2025, and it will be suicidal not to focus on the fast growing markets in the backyard while depending on the slowing economic powers of the West.

These markets together will be close to the combined EU and USA markets by 2025, and it will be suicidal not to focus on the fast growing markets in the backyard while depending on the slowing economic powers of the West.

Most of Chinese investments into BD were also in the Power sector. Investment in textiles and apparel—despite being the largest manufacturing sector—was very modest. The recent positive change in BGMEA’s position coupled with exodus of firms from China as part of global realignment of sourcing in the aftermath of Covid-19 pandemic should encourage many Chinese and other international firms to relocate to other countries including Bangladesh, provided its SEZs are ready to offer space and conducive environment.

IV. Promotion of RMG Backward Linkage Should be a Selling Point for Promoting FDI in Bangladesh

Bangladesh RMG sector needs backward linkage industries in areas such as MMF (spinning and fabric), chemicals used in RMG industries, and spare parts to support the massive RMG industrial base. Bangladesh needs massive amounts of investment in these backward linkage industries where it has only 17 synthetic spinning mills and depends on imports for more than 60% of synthetic and other mixed fabrics.

The potentials which remain within the RMG sector include Woven Fabric (Backward linkage) 60%-65% of which are imported currently. Total amount of synthetic yarn and fabric imports amounted to several billion dollars every year, providing an excellent opportunity for FDI to be attracted in this backward linkage RMG segment.

Other potential areas of backward linkage categories include domestic production of: the top 27 widely used spare parts used in the RMG sector which are currently imported in the amount of $1.6 billion in FY19; and textile chemicals, which are expected to grow to $1.38 billion by FY24.

Another area of diversification and investment potential in the RMG/textile area is recycling of 400,000 tons of leftovers that can be recycled for making yarns and garments worth $4 billion. At present customs tariffs are imposed at high rates on imported leftovers which is detrimental to developing a sustainable RMG recycling industry in Bangladesh. Give the EU legal requirements to recycle a certain proportion of cotton and synthetic fiber clothes within the next few years, Bangladesh RMG sector must invest in recycling of old clothes and leftovers to maintain its access level in the EU market.

V. Lack of Fully Serviced Land was a Major Constraint for FDI and the Situation Needs to Change Urgently

SEZ’s Can Play Important Roles in Attracting FDIs in Bangladesh

SEZs remain an important instrument to attract FDI due to the relative ease of implementing business reforms through SEZs, the perceived low cost of establishing SEZs, and increased competitive pressure. SEZs are used by more than 140 economies around the world, including almost three quarters of developing economies and almost all transition economies. Their number has grown rapidly in recent years, and at least 500 more are in the pipeline. In SEZs, investors are often fully or partially exempt from various tariff and non-tariff requirements. Zone users may also benefit from trade facilitation through, e.g., expedited customs clearance procedures or the possibility to store items in special warehouses.

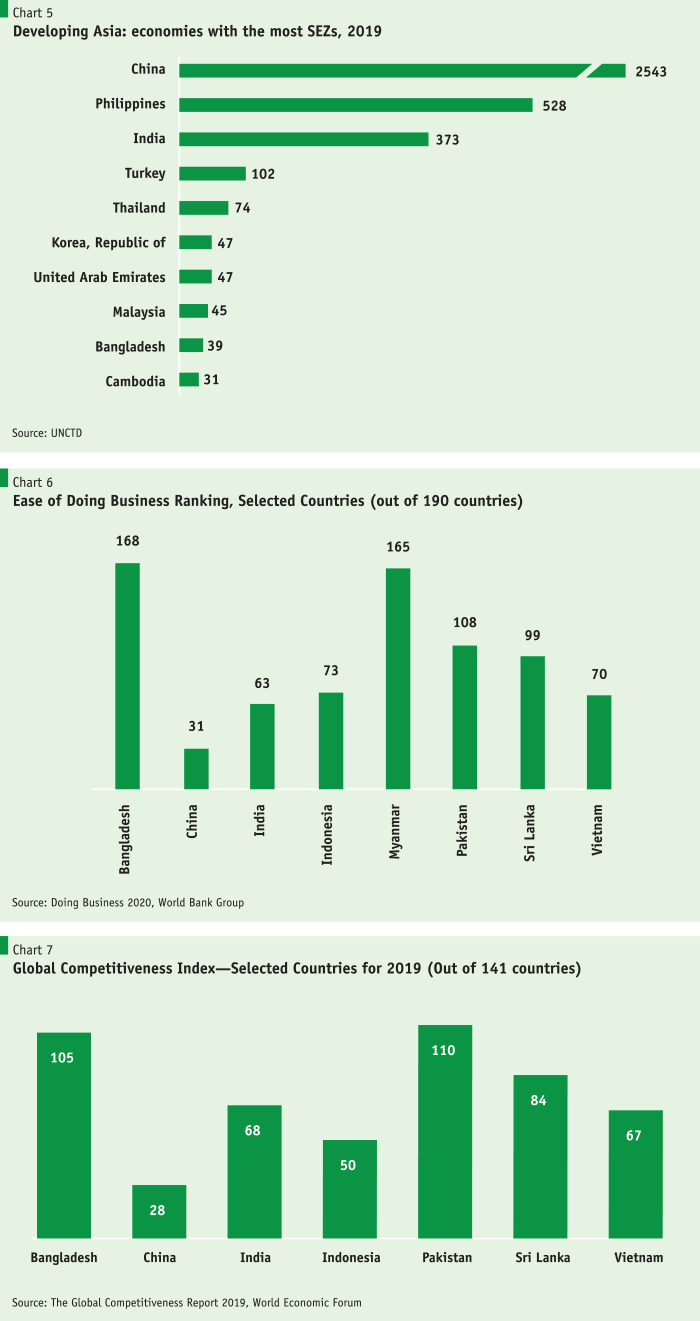

Although SEZs are widely used, a handful of economies account for the majority of them. China alone hosts over half of all SEZs in the world. Other countries with high numbers of SEZs include India, the United States and the Philippines. Zone concentration is also observed at the regional level.

Some economies have relatively low SEZ densities, for instance the developed economies where the business environment is considered sufficiently attractive, second, economies that face particular geographical challenges have limited resources to create zones and economies with insufficient resources or relatively weak institutional or governance capabilities also tend to have fewer SEZs.

SEZs can make important contributions to growth and development. They can help attract investment, create jobs and boost exports – both directly and indirectly where they succeed in building linkages with the broader economy. Zones can also support global value chain (GVC) participation, industrial upgrading and diversification.

Future Direction of Special Economic Zones

SDG model zones adopt the highest international standards, set the benchmark and act as catalysts for improvements across all zones through innovation and experimentation with new approaches. SDG model zones could, for example, be designed for zero emissions and minimum waste (aspirational targets that would require complex, closed Circle designs).

SDG model zones sould also explicitly and demonstrably operate under the highest standards of governance by involving a broad range of stakeholder groups, allowing for the generation of new ideas for initiatives that would benefit the local community, the broader economy or the environment. For example, they could facilitate women’s employment in the zones, instating anti-discrimination rules, providing child care infrastructure, protection and training, and promoting women entrepreneurship.

VI. Bangladesh Ranks Poorly in Terms of All Major Indicators Used Globally from Investment Climate Perspective

Bangladesh needs to improve its ranking in terms of the important indices (Charts 6 to 8) by addressing the underlying factors over a certain defined period of time. Despite some improvements, Bangladesh ranks very poorly in terms of all three major indicators and sustained efforts will be needed on multiple fronts to improve the ranking.

1. Doing Business Ranking and Underlying Factors

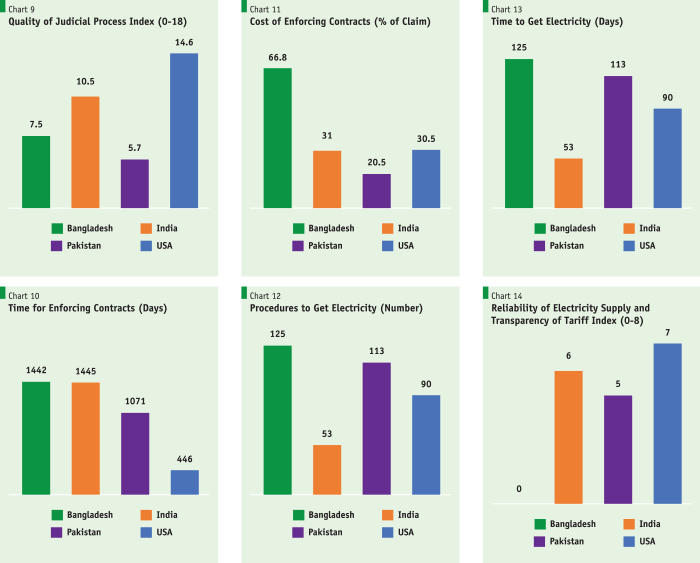

Some of the areas which will require special attention include improvements in judicial process and enforcement of contracts, electricity connection and reliability, poor transport logistics etc. (Charts 9-14). Time needed for enforcing contracts is too long and uncertain and the average cost of enforcing contracts at 66.8% of the claim is essentially prohibitive and discouraging for foreign and domestic investors.

Even after massive investments in power generation and significant improvements, there are procedural delays and long time required for getting electricity. Bangladesh’s performance is dismal when it comes to reliability of electricity supply and transparency in setting electricity tariffs.

2. Global Competitiveness Index (GCI)

In its Global Competitiveness Report for 2019, the World Economic Forum (WEF) ranked Bangladesh 105th out of 141 economies (scoring 52.1 out of 100). One of the 12 pillars that add up to a country’s competitiveness in the GCI is skills. Scores for that pillar itself are based on benchmark performances of the (i) Current workforce; (ii) Skills of current workforce; (iii) Future workforce; and (iv) Skills of future workforce.

In the GCI, a country’s weaknesses can be identified by looking at its scores for different components of the index. For example, Bangladesh’s scores were below 50 for (i) Mean years of schooling (6.1) for the current workforce (40.4) ; (ii) Digital skills among active population (42.5); (iii) Ease of finding skilled employees (44.5); (iv) Pupil-to-teacher ratio (30.1) in primary education (49.9). Scores were below 40 for (i) Extent of staff training (38.7); (ii) Quality of vocational training (39.4); (iii) Skillset of graduates (39.9); and (iv) Critical thinking in teaching (31.5).

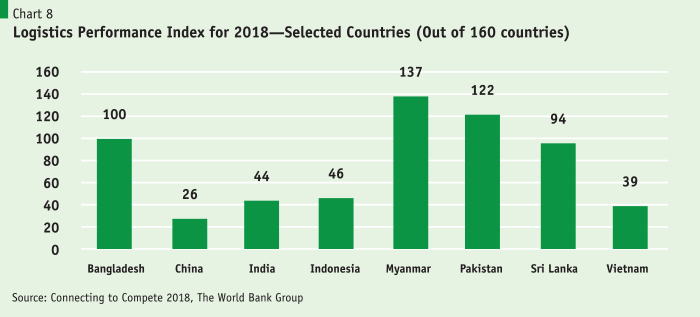

3. Logistics Performance Index (LPI)

The last report on the LPI and Its Indicators were published by the World Bank Group in 2018. There, Bangladesh was ranked 100th out of 160 economies (lower bound of 68th and upper bound of 134th) with a score of 2.58 out of 5 (lower bound of 2.34 and upper bound of 2.82). Amongst regional countries, Bangladesh was ahead of Nepal (114th), Pakistan (122nd), Myanmar (137th), Bhutan (149th) and Afghanistan (160th). The country’s score was 49.2% of the highest performer, Germany (4.20 out of 5). Bangladesh’s ranks and scores for different indicators of the LPI were: (i) 121st and 2.30 for Customs; (ii) 100th and 2.39 for Infrastructure; (iii) 104th and 2.56 for International shipments; (iv) 102nd and 2.48 for Logistics quality and competence; (v) 79th and 2.79 for Tracking and tracing; and (vi) 197th and 2.92 for Timeliness. Amongst these ranks and scores, the indicator which requires particular attention of the policymakers and stakeholders is the Customs.

4. One Stop Service (OSS) for Investors

The aim of providing One-Stop Service in the Bangladesh Investment Development Authority (BIDA) is to provide all investment related services to the investors at one place and within the shortest possible time. This involves continuous seamless interactions with various government agencies for services like: ensuring Trade Licenses and registration of companies with the Registrar of Joint Stock Companies and Firms (RJSC) within 48 hours; completing the registration with BIDA within a day; facilitating electricity connections within 10 days; and assisting and supporting the acquisition of land, environment clearance, gas connection and tax matters.

BIDA is still working on expanding the scope of its online OSS facility. Additional 11 services have been added to the online OSS system, to raise the total number of services offered to 29. Ten more MOUs have been signed with Government agencies, whose services will be added to the OSS platform of BIDA, with a target of providing 150 services from 35 government agencies in the near future.

While the improvements and expansion of the OSS platform and interoperability will go a long way in improving the factors underlying the Ease of Doing Business (EDB), there is need for continuous customer feedback to ensure that the partner agencies were indeed following up on their commitments under the signed MOUs. The process of improving Ease of Doing Business has started but still not completely automated across the numerous agencies due to lack of interoperability among various government agencies.

The process of improving Ease of Doing Business has started but still not completely automated across the numerous agencies due to lack of interoperability among various government agencies.

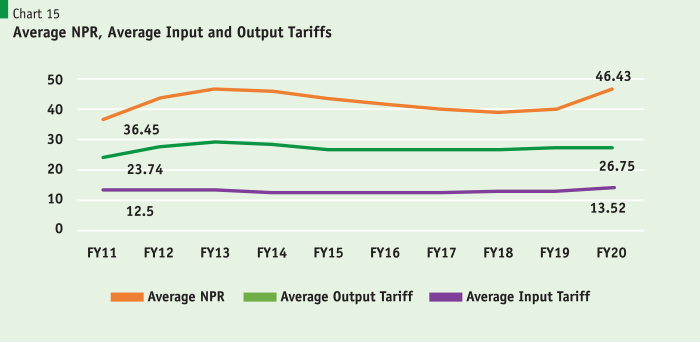

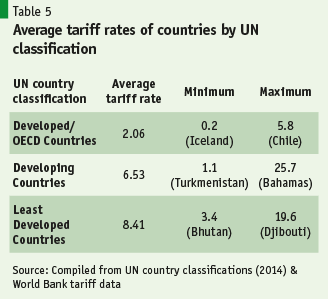

VII. Bangladesh’s High Protective Tariff Structure Must Be Lowered for Effective Resource Allocation and For Successful Trade Negotiation in Future

1. High Tariff Barrier

Bangladesh has one of the highest protective tariff rates in the world. While significant progress was made in 1990s, when Bangladesh was ahead of India and many other comparable countries in undertaking tariff reforms, in the new millennium under pressure from the domestic protectionist groups the tariff structure has become highly protective—going against the global trend. At present the average nominal protection in Bangladesh is 26.75%, which is very high by global standard.

In contrast, the average tariff rate for the developed countries is about 2%, for developing countries as a group, the average tariff rate is 6.5% and the same for LDCs is 8.4% (Table 5).

The high protective tariff rates create an anti-export bias diverting firms to go for inefficient domestic manufacturing lured by higher rate of return in the domestic market. Much of Bangladesh’s consumer goods are supported by the high protective walls for decades and more. The investments which could go to more productive export sectors are being diverted to less efficient but highly profitable domestic industries.

The high protective tariff rates create an anti-export bias diverting firms to go for inefficient domestic manufacturing lured by higher rate of return in the domestic market.

2. High Tariff is a Problem in Trade Negotiations

Bangladesh needs to increase its market access in the post LDC graduation period. Foreign investors will look into the market access issue before committing much investments in Bangladesh under the current circumstances. Successful negotiation of bilateral and free trade agreements with other countries and economic blocks will be virtually impossible unless the protection issue is resolved. Currently Bangladesh is enjoying duty and quota free market access to most industrial countries (except the USA) and also to many developing countries including China and India due to its LDC status.

Most of Bangladesh’s competitors in terms of exports and attracting FDI are either members of ASEAN economic block (Myanmar, Vietnam, Cambodia, Indonesia and the Philippines), which in itself is a sizable market and has a much lower common tariff barrier. Countries like Vietnam have bilateral trade arrangements with the USA, Japan, China and Korea. It also negotiated a free trade agreement with the EU. India is also negotiating a trade agreement with the EU and have trade arrangement with ASEAN besides having a large domestic market.

Bangladesh need to initiate bilateral trade arrangements with large and medium sized markets across the globe. The government has to seriously look into its current tariff structure and undertake a 3-5 year policy to bring the tariff wall down to around 10%-12% NPR level.

Currently WTO is not looking into the issue. But once Bangladesh graduates from its LDC status, WTO will seriously examine Bangladesh’s protective structures and ask for dismantling these barriers. We should start doing this ahead of time before being forced to do so.

VIII. Bangladesh Needs to Optimize on its Geographical Location, Demographic Dividend and Planned Urbanization to Capture Agglomeration Effect

1. Geographic Dividend

Many countries in the world and in our region have used strategic locations of their sea ports to develop themselves as a regional trading hub with massive benefits in terms of port activities, trade facilitation activities, and massive transport networks. Major ports in Dubai, Singapore, Djibouti, Colombo, and Hong Kong clearly demonstrate that major ports help in promoting investment, trade and infrastructure development in those countries and territories. Bangladesh has so far failed to capitalize on this natural dividend and alternate arrangements are being set up in nearby Myanmar by setting up a deep sea port there at the initiative of both China and India, which may lead to virtual bypassing of Chittagong port by major users. Bangladesh authorities need to make a very decisive strategic decision on this issue by linking Chittagong port with the region through proper road and rail networks and by constructing a deep sea port without further delay.

The way to move forward would be to push for regional initiatives like BCIM, BIBN, BIMSTEC, and BRI. The challenge is in both diplomatic and economic fronts, given the regional geo-political situation driven primarily by the rivalry between China and India. Bangladesh has to play this diplomatic game very skillfully keeping in mind the best interest of Bangladesh and realizing that continuing inaction on critical issues is not in the best interest of Bangladesh.

The challenge is in both diplomatic and economic fronts, given the regional geo-political situation driven primarily by the rivalry between China and India. Bangladesh has to play this diplomatic game very skillfully…

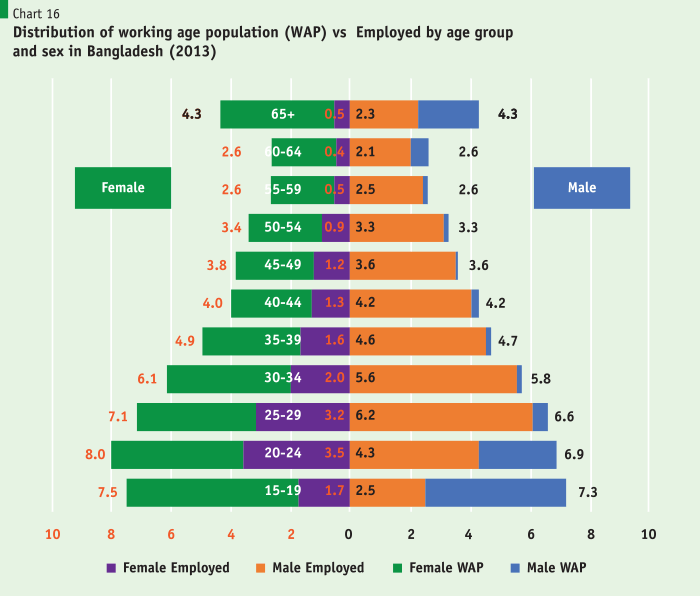

2. Demographic Dividend

Demographic dividend is the economic growth potential that can result from shifts in a population’s age structure, mainly when the share of the working-age population (15 to 64) is larger than the non-working-age share of the population (14 and younger, and 65 and older). Bangladesh’s demographic dividend will be available till 2042. The current level of social spending on education and health are to be increased significantly to realize the demographic dividend. A sizeable increase in production-efficiency has been achieved in recent years. Structural shift from agriculture (low productivity) to industry, which is already happening, is an encouraging sign for reaping demographic dividend but much more needs to be done along the lines of East Asian experience.

Evidence of the demographic dividend from East Asian countries is compelling. Those countries benefitted from the knowledge, experience, and technology of other countries which had already passed through the demographic transition. The Asian Tigers were able to take advantage of the demographic dividend because of their appropriate social and economic policies — including openness to trade and foreign investments, and flexible labor markets — and substantial and continued investments in human capital, including education and public health.

About one-third of economic growth between 1965 and 1990 in the East Asian countries was attributed to demographic dividends. Empirical growth studies suggest that, in general, for fast-growing Asian countries, capital deepening and improvements in production efficiency were the two main sources of growth. Indonesia and Korea relied much more on capital deepening. Bangladesh also needs to embark on similar strategies.

3. Urbanization Effect

Urbanization and the resulting agglomeration effect is considered to be a major driving force for sustainable economic growth. Bangladesh is experiencing rapid urbanization, but the process has been extremely unplanned and inefficient. With clogged roads, lack of civic amenities including water and sewage management, inadequate public healthcare, unhealthy living conditions in vast slums, wasted time in commuting are major problem areas undermining the potential agglomeration effect from urbanization in Bangladesh. Bangladesh needs massive investment and political focus to improve management of the inevitable urbanization process through proper urban planning including housing for the growing number of urban residents, efficient urban transportation and other necessary infrastructure (sewage and drainage systems, public health care and educational institutions). Investments in the form of PPP including FDI would help alleviate the situation.

IX. Look East Policy

Trade and international cross-border investment are intertwined. As discussed in various forum and also in the IFC study on the RMG sector in Bangladesh, the RMG export potential in the Asian countries by 2025 would be as big as the market size of the EU and North America combined. This is also true for most other products and that is why most East Asian countries are well embedded in the Asian value chain and most of their trade takes place within the East Asia region.

Furthermore, Asian countries are the major sources of FDI outflow globally and also regionally. Out of the top five countries/territories in the world, Asia accounts for four. Thus, countries like Bangladesh should primarily focus on East and North Asian countries to attract FDI. China (including Hong Kong) has been the largest exporter of FDI to the rest of the world and in particular to the Asian countries. Their position has improved over time (Chart 3).

Out of the top 10 investor countries in the world, the first and second positions are held by China and Hong Kong, China. Together the outstanding FDI of the two amounts to more than $2 trillion, far exceeding the amounts invested by the USA, Japan, UK, and other European or western industrial countries. The USA is a distant second with the outstanding investment from the USA in 2019 being at $630 billion. Japan and Singapore are the two other countries holding the fourth and fifth positions, with outstanding stocks at $460 billion and $328 billion, respectively.

In the regional context, China has also been a very important FDI source country for many years, while for Bangladesh it is a very recent phenomenon. The figures in Table 6 below refers to PRC and does not include investments out of Hong Kong.

Historically Bangladesh did not receive much of Chinese investment. Only since 2018 China is investing a significant amount in Bangladesh. The perception of Chinese investors about Bangladesh has been changing over time, as reflected in their high profile strategic investments in the Dhaka Stock Exchange and in bKash, the leading mobile financial institution of Bangladesh.

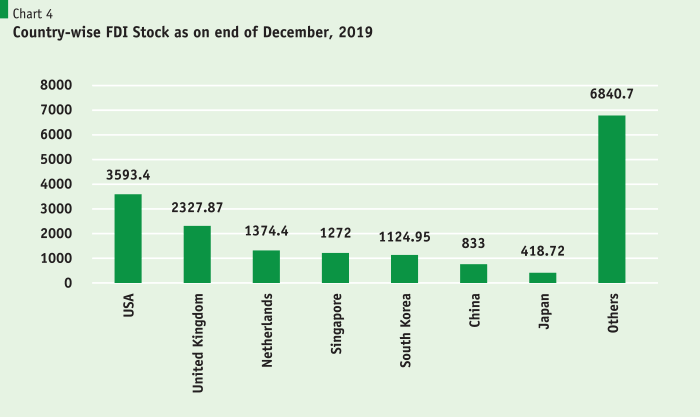

Absence of Bangladesh in the Chinese investment radar is clearly visible in Chart 17. Even until now, despite the recent surge, the stock of FDI in Bangladesh is dominated by traditional industrial countries like the USA, UK, and Netherlands in the top three. Regional players like Singapore, South Korea and China being recent additions.

One of the major reason for the lower FDI flows to Bangladesh from China was the limited trade flows between Bangladesh and China compared with other East Asian countries. In particular, most East Asian countries have a significant two-ay trade flows, while Bangladesh used to have a virtual one-way trade flow clearly indicating that Bangladesh was really not integrated with the Asian value chain with sizable cross border inter-industry flows.

This concentration of FDI inflows into the power sector has also been reflected in the sectoral distribution of FDI from China. It is quite apparent that much of the increase in FDI inflows from China was attributable to power sector projects offering very attractive terms without any risk. The largest export sector RMG attracted very little FDI from China, indicating that Chinese sunset textiles firms migrating out to different countries due to higher and increasing labor costs in China are not relocating to Bangladesh.

X. Concluding Observations

There is no single silver bullet to successfully attract FDI in a massive scale in Bangladesh. The government and the private sector need a multi-faceted approach and build a conducive ecosystem. Changing the eco system will require:

• Improvements in areas which would contribute to effective improvements in Doing Business Indicator, productivity index, logistic index etc.

• Make a few SEZs operational very quickly to serve as models to demonstrate to potential investors. Should not divert limited resources and expertise/capacity to a large number of SEZs all across the country at the moment. Focus on large SEZ projects in Chottogram and Dhaka.

While improvements in the investment climate including one-stop service, EDB, SEZ and other infrastructure improvements would go a long way to create the FDI friendly ecosystem, ultimately perceptions of existing foreign and domestic investors operating in the country go a long way in encouraging new investors to the country. Thus, Bangladesh should avoid confrontations with major foreign investors like Grameen Phone, Robi, and avoid discriminatory treatment between foreign telecoms and publicly owned Tele Talk. Furthermore, the long simmering problem with Korean Private EPZ, and the recent departure of a number of foreign investors from Bangladesh, do not give right signals to the international investor community.

Trade and investment are interrelated. When two countries have strong trade relations, generally they also have solid investment relations. We did not observe that happening in Bangladesh. We do not observe many joint-ventures between big Bangladesh business houses and their foreign counterparts which should have been a natural phenomenon. Our business houses should change their mindset. Most major foreign investments in South East Asia, China and India are joint ventures with large local business houses..

Government and the Private Sector must Look East, a policy originally proposed by the Japanese Prime Minister Abe when he was visiting Bangladesh. China (including Hong King), Japan, Singapore and Korea are major regional and global investors. The Asian consumer markets are also expanding rapidly. Our government and private sector must take these facts into account and outlook in formulating their trade and investment initiatives.