The State of the Economy 2020-21: Challenged yet resilient on road to recovery

By

The pandemic onslaught

For the world population, the year 2020 will be marked in history as the year of living dangerously. Covid-19 pandemic shook the world in early 2020 as a “Black Swan” event – unpredictable, with high impact. The killer virus is still on the loose gouging lives and livelihoods across the globe, as of this writing. Though promising developments on the vaccine front are on the horizon, it will not be before spring-summer 2021 that the world’s general population finally has an effective defence regime against the pandemic. Only then can we all breathe a sigh of relief and hope that life and economic activity returns to normalcy.

The magnitude of economic disruption and lives lost makes it a once-in-a-century event, parallels being drawn with the 1918 flu. The fallout is a global health-cum-economic crisis that has profound implications for Bangladesh’s short-, medium-, and long-term economic prospects. Arguably, financial and economic globalization and the inter-connectedness of peoples across the world have a role to play in making this a global pandemic, rather than just a regional or national outbreak. Never in history was there such a wholesale suspension of physical movement of people across borders – by land, sea and air. Within borders, country after country had to take the extreme measure of wholesale lockdown and suspension of regular economic and social activities; what humanity took for granted.

As the year 2020 comes to a close, the pandemic persists with another surge in the making. Globally, nearly 60 million cases have been recorded with over 1.5 million deaths and counting. Astonishingly, the richest and scientifically the most advanced nation in the world, the United States, leads the world in the number of infected cases as well as deaths: 12.7 million infected and 260,000 deaths, respectively, and counting. In Bangladesh, official reports on the magnitude of the crisis borders on incredulity.

Fortunately, help is on the way. Thanks to advancement in modern medical research – the new messenger RNA technology — effective vaccines are on the horizon in record time, to be widely available to the world population by spring-summer 2021. The speed with which preventive vaccines were developed against the model corona virus (Covid-19) is unprecedented in history. The expectation is that by the second half of 2021, much of the world community might be able to resume normal lives again and economies could be on the path to recovery. A global effort is under way to control the epidemic. Because of the airborne nature of the virus that can spread easily across borders, only a global coordinated effort can bring a halt to the pandemic. This is one crisis that requires the global community to work together. That is because Covid-19 anywhere could lead to Covid-19 everywhere, say leading infectious disease experts.

Global economic slowdown under the grip of Covid-19

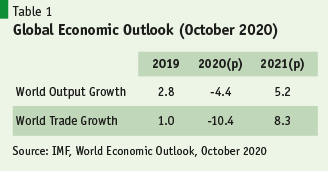

There is broad consensus that the pandemic must be brought under control for economic recovery to take place. Testing and contact tracing, mandating masks, social distancing, lockdowns where necessary, are being invoked to reign in the spread of infections. Economic costs of these measures in terms of output and job loss are immense, yet necessary. Consequently, according to the IMF’s October 2020 World Economic Outlook, the world economy is poised for a slow recovery out of the depths of the output and trade shock caused by the pandemic. The report is that China, the source of the pandemic, has recovered faster than most economies affected. In light of the faster-than-anticipated recovery during the third quarter of 2020, IMF has presented an optimistic scenario for developed economies. Notably, most of the OECD countries went for further monetary easing and fiscal stimulus to prop up economic activity without much regard to fiscal prudence considerations.

It is worth noting that the world economy had not fully recovered from the aftermath of the Global Financial Crisis (GFC) of 2008-09 when the Covid-19 pandemic hit. Most analysts recognized broad-based weakness in the global economy during 2018-19 with sluggish growth being declared as the “new normal”. Accommodative policy stances became the staple of macroeconomic policies in the developed world. In this scenario, trade growth continued to lag behind output growth – a new phenomenon of the post-financial crisis global economy.

It is in this backdrop of sluggish global output and trade growth that the Covid19 pandemic hit the world economy, delivering a major blow and further debilitating the decade old post-GFC recovery. According to IMF’s October 2020 World Economic Outlook, the global economy is estimated to contract by -4.4% in 2020 while the negative trade shock is expected to be -10% (Table 1). The impact has been especially hard in some countries such as neighbouring India facing a 10% decline in GDP in 2020. It is not just a healthcare challenge of gigantic proportions, but it has brought on the kind of economic crisis this interconnected world has never seen. The expected decline in trade volumes largely reflects weak final demand from consumers and firms in the synchronized global downturn. Contrary to expectations, IMF finds that trade restrictions (e.g. on medical supplies and knee-jerk protectionist moves) and supply chain disruptions are expected to play limited roles in accounting for the collapse. However, counting on the good performance of economies during the 2nd and 3rd quarter of 2020, the projection for 2021 is optimistic with 5.2% growth expected in global output and 8% growth in trade. Given the global nature of the shock and common challenges across countries, what is self-evident is that this health-cum-economic crisis is a multilateral phenomenon that calls for multilateral solutions. Hopefully, this might trigger a resurgence of the Bretton Woods phenomenon, to restore some of the fading tryst with globalism and multilateralism during the past decade.

What has indeed become clearer as we grapple with the pandemic is the likelihood of emergence of a new post-Covid-19 world order, in terms of geopolitics and geoeconomics. The pandemic will have intensified forces of change that were already playing on the world economy – positive and negative forces – accelerating changes in trade integration, technological transformation and connectivity, global financial architecture, and economic policy. The age of “hyper-globalization” that brought huge dividends for Bangladesh economy and society may be all but over. Leading trade economists believe that the pandemic will not end globalization but will definitely lead to reshaping of the inexorable path to global integration. These developments will have impacts on Bangladesh’s trade and economic prospects in the foreseeable future.

The world better take notice of the emergence of a powerful regional economic bloc in East Asia– Regional Comprehensive Economic Partnership (RCEP) – made up of 10 ASEAN members plus the economies of China, Japan, Australia and New Zealand. Following 8 years of protracted negotiations, these 15 nations signed a free trade agreement creating the largest economic and trading bloc in the world, comprising a third of world GDP and also a third of the world’s population. This regional grouping is now larger than the EU or any other existing trading bloc. It is not far-fetched to infer that several geopolitical trends must have precipitated this development not the least of which is the Trumpian retreat from global leadership giving way to China for having a larger role at least in Asia (This could change in the post-Trump world order in light of new leadership in Washington). The fact that it comes on the heels of US withdrawal from the Trans Pacific Partnership (TPP) and the signing of Comprehensive and Progressive TPP (CPTPP), which excludes China, is the notable factor that could have driven China to coalesce with this bloc of disparate nations of East Asia and the Pacific. Some RCEP members also belong to CPTPP, so the regional arrangement is not either/or. Still, the new bloc accounts for almost double the CPTPP’s annual trade value and combined GDP, its combined market size is five times that of CPTPP countries, and it could account for 50% of global output by 2030. Most importantly, it is a recognition of the tremendously beneficial and productive economic interdependence among these Eastern nations, a long-term development that promises to replace Europe and North America as drivers of Asian prosperity in the future.

The global trade order was unquestionably under strain well before the Covid-19 crisis struck the world economy. Arguably, global trade has become the biggest casualty of the pandemic, far more than global output. No doubt recovery of trade will be the key driver of post-pandemic global economic recovery. In the middle of all this is the fate of the multilateral trade institution, World Trade Organization (WTO), which would have to play a catalytic role in rejuvenating the global economy via expansion of trade flows. Unwilling to see the discomfiture of WTO’s crown jewel, the dispute settlement mechanism, Mr. Azevedo, Director General of WTO, abruptly resigned in May 2020, setting off a global search for his replacement. As of this writing, the search and appointment process remain in limbo following the US veto against the majority choice of Nigerian Dr. Ngozi Okonjo. It is well known that the WTO decision making process is unwieldy, to say the least, members are not known to cooperate with each other, and the DG appointment process reveals more about the prevailing discord in the trading system than harmony. But there seems to be a glimmering of hope in the near term. Recent change of leadership in the USA could be the silver lining that restores sanity and pragmatism to the approach of overhauling or reforming one of the most consequential post-WWII institutions – the multilateral trade regime. President-elect Biden could be the right man to offer global leadership of the kind needed to change the fragmentary direction in which multilateralism was headed.

Be that as it may, what is now certain is that the negative shock to global output and trade is going to be deep and widespread in 2020 with lasting adverse impacts for Bangladesh exports. The crisis has hit hardest regions that are our leading export destinations – USA, EU. Our exports are already down 17% in FY2020, though merchandise trade (export and import of goods) is down only 2%, after reaching a record total of about USD 200 billion in FY2019. There is too much uncertainty riding on our expected recovery in FY2021.

The crisis has hit hardest regions that are our leading export destinations – USA, EU. Our exports are already down 17% in FY2020, though merchandise trade (export and import of goods) is down only 2%, after reaching a record total of about USD 200 billion in FY2019. There is too much uncertainty riding on our expected recovery in FY2021.

Even if the moderate projected improvement in global economic outlook in 2020-21 remains true, it is definitely not evenly shared across the globe. The ascent out of this deep economic swamp due to the global pandemic has varied across countries. For instance, India has done far worse in FY2020 than what was originally anticipated in WEO April edition, contracting by more than 10% in one fiscal year. China, on the other hand, has performed much better than what was originally anticipated – both in terms of containing community transmission of the virus and re-triggering economic growth, already up 4.9% in the 3rd quarter 2020. This uneven economic recovery across the global economic order is also likely to further worsen the prospects of global convergence in income levels – and it calls for contextualized policy responses in each country to address their respective economic and health fallout.

While considerable uncertainties prevail, it is universally expected that the Covid-19, like other historical pandemics, will be tamed eventually. Several vaccines — and therapeutics — are already in advanced stages of regulatory approval and distribution. On the economic front the main implication of Covid-19 is the slowdown in GDP across the globe growth during calendar year 2020 over the March to December period. The current expectations, according to IMF, are that global recovery will happen from calendar year 2021. What is striking is the huge projected recession in the US, Europe and India in 2020.

Most importantly, if anything has become vividly clear over the last one year after the outbreak of the global pandemic, it is the sheer lack of effectiveness of a one-size fits all recipe for both containing the virus and the associated economic fallout.

Most importantly, if anything has become vividly clear over the last one year after the outbreak of the global pandemic, it is the sheer lack of effectiveness of a one-size fits all recipe for both containing the virus and the associated economic fallout. Economists and public health experts are likely to be on their toes for the next few months till more clarity is attained concerning when the world can return to the “old normal”. The silver lining has already emerged as pharmaceutical giants one after another are announcing that effective vaccines are on the horizon and should be widely available around the globe by spring-summer 2021. Reports suggest that vaccine distribution – such that it is widely and equitably distributed around the globe – could pose the next headache. Hopefully, that should be a lesser challenge than the act of inventing and manufacturing the vaccine just in time. Return to normality – in human life and economic activity – is around the corner.

Bangladesh’s growth trajectory takes a dip

Growth and trade have been at once the cause and consequence of the 2020 global catastrophe that has come to be known as the Covid-19 pandemic. As Covid-19 swept across borders, like most economies – developed and developing — Bangladesh economy was pummeled by the output and trade shock that reverberated across the globe. The economy experienced the severest shock during the second quarter of FY2020, impacted by the cessation of cross-border movement of goods and people, and domestic lockdowns.

Until the pandemic hit in March 2020, the Bangladesh economy was chugging along at an accelerated pace of 7–8% GDP growth during most of the decade of the 6th FYP and 7th FYP, between FY11 and FY19. Global analysts monitoring Bangladesh’s growth acceleration noted that its growth rate was not only rising but was the most stable among the developing world. Covid-19 crisis drilled a crack in that stability. Like so many other nations the Bangladesh economy was not spared the eviscerating onslaught of the Covid-19 pandemic. It was a combination of demand and supply shocks that ravaged the length and breadth of the economy leaving few if any sectors of activity unscathed. Economic activity literally came to a halt as the entire country had to be put under lockdown for a specified period of time. Annual GDP growth dipped for the first time in years becoming a casualty of the pandemic.

To its credit the government took swift actions to control the Covid-related damage to life and livelihoods. As an immediate first step to contain the spread of the virus, the government imposed a 3-month lockdown on March 23. The economy has opened up since then, but the government has adopted a cautious approach balancing the risks of virus spread with the need to restore economic activities. On the economic front, the adverse economic effects of the pandemic are still evolving. For a short period, many economic activities, especially in the urban areas, came to a grinding halt; tax revenues, earnings from exports and investments have fell precipitously during the March-June 2020 months. To cope with the immediate fallout, the government embarked on an economic stimulus package comprising a series of measures (a) to reduce the spread of the infection and (b) to help the needy and stem the downward spiral of economic activities with supporting fiscal and monetary stimulus packages, estimated at BDT 1.1 Trillion (approximately 4% of GDP). The economy has essentially recovered from the initial impact of the domestic and global lockdowns combined with suspension of cross-border travel of people but the medium- to long-term implications are still evolving.

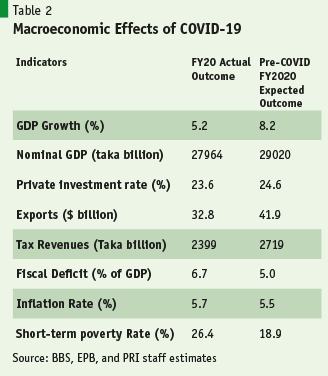

The macroeconomic effects of Covid-19 are still unfolding as the pandemic continues to take its toll on human lives, health and wellbeing. Based on available evidence, the main macroeconomic effects for FY2020 outcomes are summarized in Table 2. The effects were severe with substantial losses in GDP growth, exports, investment and tax revenues. Although firm data are still evolving, in the short-term open unemployment rate is likely to have risen, while poverty incidence is projected to have surged especially as most of the near-poor (1.25 times the poverty line) fell back into poverty owing to the income loss effects of the pandemic. This rise in poverty is an estimated short-term increase in the second quarter of calendar year 2020 (April-June 2020) over the rate prevailing in the first quarter of FY2020 (January-March 2020). This increase would likely fall as income transfer measures take hold and employment is restored.

The measures taken by the government to stem the tide of the downturn in the domestic economy will take time to unfold until such time that the health effects of Covid-19 become manageable, workers return to the work place, and people resume their normal activities so that the demand for services like transport, hotels and restaurants, tourism, beauty care, education, personal services all return to normal levels. Importantly, the recovery of earnings from exports will depend upon how quickly the global economy gets back to normal. To be sure, the recovery of both domestic activity and global economy is predicated upon the discovery of cure or vaccines for Covid-19. The best expectations today are that global recovery could be under way in early 2021.

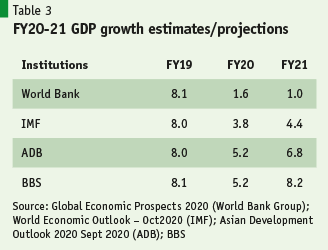

Given this backdrop, development partners have made their own assessments of the magnitude of output shock faced by the Bangladesh economy and, in light of the emergency stimulus package and observed recovery of external trade and remittance inflows, they have indicated disparate GDP growth rates for FY20 and FY21 (Table 3). Whereas the leading multilateral agencies, WB, IMF, ADB, made growth projections for FY19 that were close approximations of the official estimate of 8.1%, that unanimity is understandably missing in the current projections because of the disruptions and consequent delays in collating data and the prevailing uncertainty reigning over domestic and global landscape. Only ADB estimate conforms to the official figure of 5.2% GDP growth for FY20 but projects a lower than official rate for FY21. Both WB and IMF are far more modest in their estimates and projections, with the WB being highly pessimistic, though unrealistic, regarding the Bangladesh economic recovery.

Taking into account the latest available estimates of major macroeconomic indicators, PRI estimates conform to those of BBS for FY20, at 5.2%, but deviate from the rather optimistic official projection of 8.2% GDP growth for FY21. The official growth projection presupposes a robust export-driven recovery (V-shaped) that will have to be predicated on (a) continued record remittance inflows, (b) swift recovery of global demand for Bangladeshi exports, supported by (c) robust domestic market rebound. While remittance inflows have reached record levels in the short-term, export recovery relies on how we revamp our export-oriented trade policy in the post-Covid phase as the status quo is unlikely to produce results. Another possibility regarding the shape of recovery is the K-shaped variety, where some sectors – large-scale manufacturing enterprises, RMG enterprises, etc. – recover to pre-Covid levels but SMEs and informal service sectors lag because they are the worst affected yet unable to access adequate resources from government’s stimulus package. Consequently, the adverse employment effect of Covid-19 is substantial and employment experts suggest that in Bangladesh home-based work account for barely 10% of employment and is no solution to the vast swath of informal employment that predominates. Under this Covid-19 driven landscape, PRI’s judgmental projection for FY21 GDP growth lie in the range of 5.5-6%, which is somewhere between the IMF and ADB projections for FY21 (4.4-6.8%).

However, in light of inconsistencies between macroeconomic fundamentals, many analysts feel that both Bangladesh’s growth estimates and growth prospects have become less robust in recent years where growth seems to be driven mainly by domestic consumption. To sustain credible high growth, the economy must experience expansion in private sector credit, exports, revenue, remittance, and manufacturing employment, not all of which have moved in tandem in recent times. Government policies – fiscal, monetary and exchange rate, tariff policies, investment regulations, education policy – will all need strengthening. Finally, our national income estimates need to be improved.

That being said, it should be noted that BBS alone has the wherewithal and comprehensive raw data to compute GDP estimates. Domestic and foreign institutions can only make judgment calls on GDP and its growth rate based on movements of macroeconomic indicators that are components of GDP or have direct or indirect impacts on its magnitude.

The government has received budget support amounting to USD 1.0 billion from ADB, AIIB and WB in FY2019-20. Payment support amounting to USD 732 million was received from IMF. Additional USD 2.0 billion of budget support is expected in FY2020-21 from Japan, ADB, EU, Germany and EDCF of South Korea.

Short-term growth prospects notwithstanding, there is some encouraging development on the external aid front. The government had requested for budget and balance of payments (BoP) support from major development partners. Multilateral institutions have been forthright in mobilizing emergency funds to cope with the global crisis. Bangladesh deserves a good chunk of this finance which is still cheap by global capital market standards. It is a good sign that, to ease the fiscal crunch, development partners like the World Bank, IMF, ADB, and others who are closely monitoring the evolving global economic crisis, have offered to come up with billions of dollars of development aid and balance of payments support. The government has received budget support amounting to USD 1.0 billion from ADB, AIIB and WB in FY2019-20. Balance of Payment support amounting USD 732 million was received from IMF. Additional USD 2.0 billion of budget support is expected in FY2020-21 from Japan, ADB, EU, Germany and EDCF of South Korea. Together, these aid funds, if properly prioritized, could be the catalyst for forging a stronger recovery for Bangladesh.

Covid-19 crisis triggers joblessness and augments poverty

While economic recovery is under way the human toll of the pandemic is not to be ignored. The combination of demand and supply shocks that are the outcome of lockdowns and work stoppages, at home and abroad, has left its mark on the employment situation with concomitant accentuation of the poverty problem. A negative feature of our labour market lies in the fact that 85% of our employment comes from the informal sector, one half of which are low-skilled, casual work on a daily or weekly basis, located in small and medium enterprises (MSMEs) or in agriculture, whose very sustainability is affected by a major crisis of the Covid-19 variety.

In 2020, of the 67 million workforce, only about 3 million (4% approximately) were expected to be counted as unemployed. Preliminary PRI research on Covid-19 impact indicates that joblessness rose to an average of 13% adding nearly 10 million to the jobless group who would then move from the near-poor to becoming poor, if they have not received the government’s stimulus package containing cash transfers and other social protection measures. A recent report in the Financial Express suggest (a) unskilled workers are the ones affected disproportionately – job loss rates among them being 2-4 percentage points higher compared to skilled workers, and (b) industrial workers suffer highest job losses – about 3-5 percentage points above overall job loss rates.

While poverty outcomes in Bangladesh were improving in tandem with acceleration of moderately inclusive growth over the past two decades, the pandemic stifled expected progress in poverty reduction in 2020. BBS had projected headcount poverty rate to drop to 18.9% in 2020, with extreme poverty dropping to 9.4%. That scenario now changes as PRI simulations of Covid-19 impact show substantial rise in poverty to 26.4% in FY20, suggesting that as many as 12.8 million people may slip back into poverty, if support measure did not reach the new jobless. At the same time, another 10 million could join the ranks of the extreme poor.

BBS had projected headcount poverty rate to drop to 18.9% in 2020, with extreme poverty dropping to 9.4%. That scenario now changes as PRI simulations of Covid-19 impact show substantial rise in poverty to 26.4% in FY20, suggesting that as many as 12.8 million people may slip back into poverty, if support measure did not reach the new jobless. At the same time, another 10 million could join the ranks of the extreme poor.

To conclude, joblessness and poverty impacts of the Covid-19 pandemic could be alarming, if not handled expeditiously and adequately. And the problem is not going away anytime soon. Experts suggest that some jobs could have been lost for good and may not return even after the pandemic is a thing of the past. Research on the poverty outcome of Covid-19 crisis suggests that gains in poverty reduction (including extreme poverty) during the past decade could be lost in one stroke. This perhaps also points to the fragile nature of poverty reduction in Bangladesh: far too many families are just about non-poor and vulnerable to shocks. A pandemic of the kind we face today is enough to push them back into poverty.

External trade takes major hit from Covid-19 pandemic

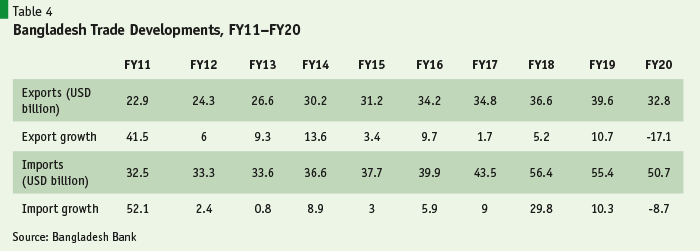

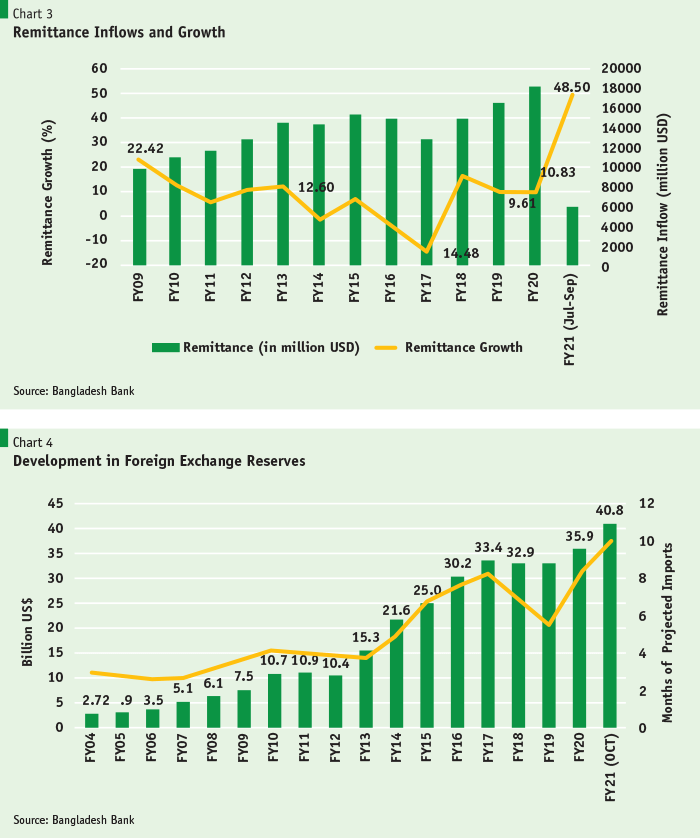

Until the pandemic hit in March 2020, the Bangladesh economy was chugging along at an accelerated pace of 7–8% GDP growth during most of the decade of the 6th FYP and 7th FYP, between FY11 and FY19. Merchandise exports, led by readymade garments (RMG), recorded double-digit growth of 11–12% per annum for two decades (FY90 through FY11) but slowed to about 6–7% thereafter. For the past 20 years, merchandise trade (exports and imports) has been growing at an accelerated pace. It more than tripled in the first 10 years of the 21st century, from USD 15 billion in FY01 to USD 55 billion in FY11, and then approached the historic milestone of USD 100 billion in FY19 (Table 4). Covid-19 shock in FY20 was a setback to these promising trends in the trade scenario.

What is now certain is that the negative shock to global output and trade is going to be deep and widespread in 2020 and there is a lot of uncertainty as to how rapidly the world economy would recover in 2021. Global trade volume is expected to decline by about 10%, according to IMF. The crisis has hit hardest regions that are our leading export destinations – USA, EU Trade policy needs to be revamped to gain any traction in export recovery in 2021 and beyond.

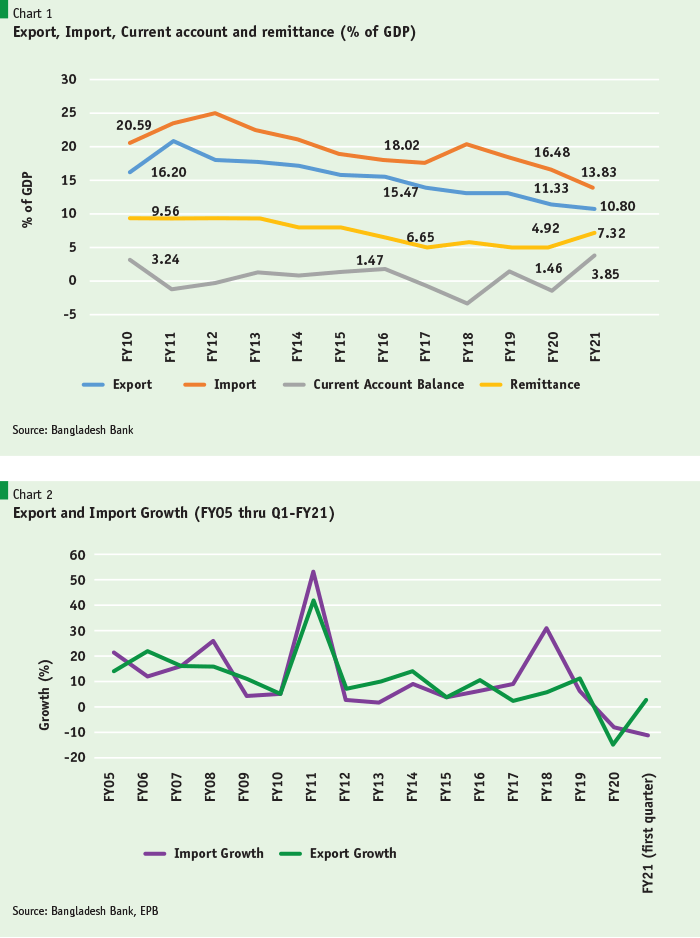

Trade has been an engine of growth and major source of job creation for Bangladesh. Ever since the trade liberalisation episode of the early 1990s, both trade and GDP growth, along with poverty reduction, have experienced a secular improvement decade after decade. Trade openness, measured by the share of imports and exports to GDP, climbed up substantially since the trade liberalization policies of early 1990s. Consequently, Bangladesh today is far more integrated with the world economy than it was in the early 1990s. COVID-19 came as a shock to exports as importing nations came under lockdown, and retail outlets and buyers started cancelling export orders of about USD 3 billion by April 2020. Fortunately, BGMEA reports that much of the cancelled orders have been restored.

Thus far, Bangladesh’s Covid-19 impact on exports appears muted, as the export slump in the initial months of the Covid-19 onslaught was not persistent to cause any serious damage to foreign exchange earnings, thanks to revival of cancelled export orders, import slowdown and record remittance inflows, all contributing to a comfortable level of foreign exchange reserves. However, that should not lead to any complacency with regard to the need for vigorous efforts to set the house in order in order to take up the challenges that post-Covid-19 world economy will be posing for Bangladesh. The sluggish import performance will rebound, and exports need to grow on a diversified product basis to provide support to the acceleration of manufacturing growth and employment.

Indeed, this crisis could be the shock that becomes the trigger for some structural reforms that have become due in the trade area, particularly to address the challenges of global competitiveness on the one hand and domestic trade policy conflicts that creates anti-export bias sapping incentives for non-RMG exports with consequent lack of export diversification.

Exports hit hard by Covid-19 pandemic

As Covid-19 swept across borders, like most economies – developed and developing — Bangladesh economy was pummeled by the output and trade shock that reverberated across the globe. The economy experienced the severest shock during the second quarter of FY2020, impacted by the cessation of cross-border movement of goods and people, and domestic lockdowns. Following sluggish growth for five years, FY20 was already showing an export decline of about 6% by March 2020. COVID-19 came as a shock to exports as importing nations came under lockdown, and retail outlets and buyers started cancelling export orders of about USD 3 billion by April 2020. That month exports slumped to a mere USD 500 million, followed by three more months of slumping exports. Bangladesh Bank estimates exports for FY20 to be down 17% from FY19 level, at about USD 32.8 billion. However, with imports also declining by 8.7% year-on-year, and remittance recording a healthy 10.9% growth (USD 18.2 billion), the current account balance is expected to remain at sustainable levels.

To put the Covid-19 impact on external trade and payments in perspective the following charts (Chart1-4) give an overall picture of trade and payments developments, including the state of official foreign exchange reserves, over the past decade leading up to Covid-19 crisis.

Trade policy: Trends in Tariff and protection

Trade policy reforms of the 1990s that introduced trade openness and export orientation yielded rich dividends for a quarter century in terms of double digit export growth and steady import growth to export development and supplying intermediate inputs and consumer goods to the rapidly growing domestic economy. But progress in trade performance appears to have stalled since about 2015 as trade-GDP ratio declined to 35% in FY20 from a high of 45% in FY12. Export performance was particularly weak during this period. Stasis in trade policy was partly responsible for the lackluster export performance during much of the 7th FYP period.

High protective tariffs that were in place in the first decade of the 21st century showed no sign of being scaled down. Whatever reduction was achieved in custom duties (CD) since the early 1990s seemed to have been duly overturned by matching rise in para-tariffs made up of supplementary (SD) and regulatory duties (RD). Nominal protection rates (NPR) showed no signs of declining over time as one would expect for an economy aiming at dynamic export performance. PRI research has confirmed that the persistent high protective tariffs created anti-export bias in incentives (which favored import substitute production) and undermined both export performance and its diversification. Despite the Covid19 crisis, tariff and protection policy remained virtually unchanged in FY21 Budget. Unless this trend in tariffs and para-tariffs is reversed post-Covid19 economic recovery could be stymied as protective tariffs could serve as a drag on any export opportunities, particularly for non-RMG products.

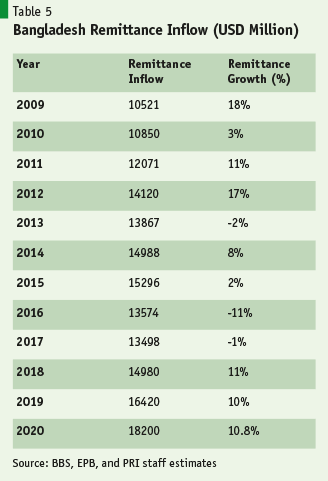

Remittance inflows hit record amidst Covid-19 pandemic. Remittance, the income and savings of migrant workers, is unquestionably a strong driver of growth via its impact on consumption and investment spending as well as its singular contribution to Bangladesh’s sustainable current account balance in the wake of rising demand of foreign exchange for import of goods and services to meet development requirements.

Remittance inflows arise from export of factor services. After merchandise exports, remittance inflows make up the second largest foreign exchange source for Bangladesh. Migrant workers (under Mode 4 of GATS) and their remittances have played a pivotal role in reducing poverty as well as fueling growth in Bangladesh. The Ministry of Expatriate’s Welfare and Employment estimates that 12% of our labor force (about 8 million) of 65 million are employed abroad. One estimate by the RMMRU (Refugee and Migratory Movements Research Unit) puts the current stock of Bangladeshi migrants worldwide at 11.5 million.

After RMG exports, remittances bring home the maximum amount of foreign exchange, rising to USD18.2 billion in FY20 (Chart 3 and Table 5). As of February 2020, a major uptick in remittance inflows was evident in consequence of the 2% cash incentive offered to migrant workers remitting through legal channels. Then Covid-19 pandemic struck, along with a collapse of oil prices, causing host countries in the GCC to shed migrant workforce. But that failed to stem the rising tide of remittance inflows through official/banking channels contributing to accumulation of official foreign exchange reserves. Hopefully, the Covid-19 impact on employment of migrant workers will be a temporary shock. As oil prices rise, the prospect of retrenched migrant workers returning to employment in the GCC countries appear brighter.

Steady flows of remittances from migrants have had important stabilizing effects on the balance of payments. Despite chronic trade deficits, the current account balance of Bangladesh has turned positive with the rise of remittances. Remittances have contributed significantly to the sustainability of our external balance with accumulation of foreign exchange reserves hitting a record USD 40 billion by end October 2020.

Foreign exchange reserve accumulation hits record. One notable development in this crisis atmosphere is that official Foreign Exchange Reserves are in record territory having reached historically highest levels, crossing USD 40 billion for the first time in October 2020 (Chart 4). The import coverage of the reserves, which was 8.6 months at end June 2020 has increased further to 10 months and appears adequate for Bangladesh to cope with its import bills in these trying times. Soaring inflow of remittances and rising exports in July 2020 with moderating import growth has reversed a falling trajectory for foreign reserves in Bangladesh’s favor. To keep the exchange rate from appreciating Bangladesh Bank has had to intervene to buy foreign exchange from the market, thus leading to a significant increase in the foreign exchange reserves.

…trade performance in the first quarter of FY21 shows remarkable resilience in foreign exchange earnings, contrary to various pessimistic forecasts. Reports from BGMEA indicate that much of the cancelled orders were eventually restored, USD 500 millions of PPEs were exported, and export growth was up 2.5% despite the global trade slowdown. Thanks to the 2% cashback provision along with tripling of the ceiling to USD 5000, remittance for the quarter was up a record 48%, at USD 6.7 billion compared to USD 4.5 billion in FY20.

What is notable is that trade performance in the first quarter of FY21 shows remarkable resilience in foreign exchange earnings, contrary to various pessimistic forecasts. Reports from BGMEA indicate that much of the cancelled orders were eventually restored, USD 500 millions of PPEs were exported, and export growth was up 2.5% despite the global trade slowdown. Thanks to the 2% cashback provision along with tripling of the ceiling to USD 5000, remittance for the quarter was up a record 48%, at USD 6.7 billion compared to USD 4.5 billion in FY20. Indeed, bucking recent trends, current account was in surplus as imports remained sluggish, while exports, remittances, and aid inflows remained buoyant. Given the first quarter performance, there is reason for optimism about the resilience of the domestic economy to cope with the oncoming challenges from global developments.

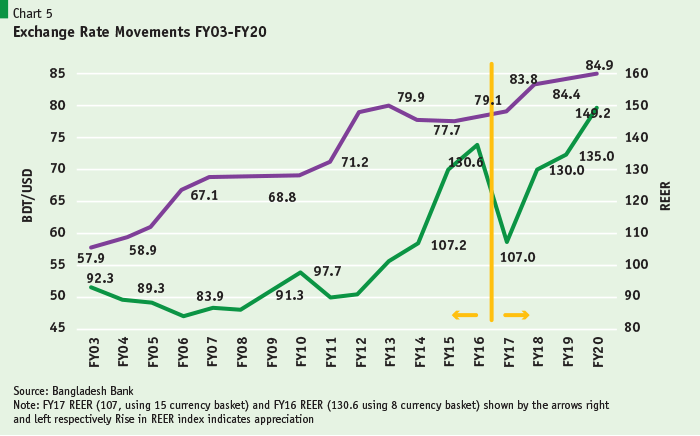

Exchange rate appreciation will undermine export performance during recovery

The system of fixed exchange rates has long been abandoned around the world shifting in favour of flexible exchange rates. Economies that have achieved export success have all shown one common trait – they strictly avoided overvaluation of their currencies and often chose to keep their exchange rates depreciated. Bangladesh moved from fixed to flexible exchange rates in early 1990s, then adopted a floating regime (managed float) in 2004. Although BB has by and large deftly handled the exchange rate and ensured stability of the nominal exchange rate, recently the real effective exchange rate (REER) – a key measure of export competitiveness — has shown signs of significant appreciation over the past several years, which undermines export competitiveness (Chart 5).

The graph shows two trends of the REER based on the number of currencies entering the basket. The first basket comprising of 8 currencies and using a base of 2001 shows a substantial appreciation of the REER between FY06 and FY17, amounting to an average real appreciation of 5% per year. This constitutes a huge tax on exports and a subsidy to imports. Following a readjustment of the REER weights (from 8 to 15 currency baskets) the revised REER again confirmed significant appreciation of the REER index from 107 in FY17 to 149 in FY20, which amounts to an annual average appreciation of the REER of 12% per year. Such an appreciation is clearly unsustainable for export diversification and must be reversed quickly via at least a moderate depreciation of the nominal exchange rate. PRI research has also shown the way to counterbalance any inflationary effects of such a depreciation (the major argument against depreciation), by structured downward adjustment of tariffs without affecting customs revenues.

There is no way that export performance could return to pre-2015 levels burdened by an appreciating real exchange rate in such large amounts. Indeed, the import slowdown and record remittance inflows have contributed to reserve accumulation that is putting further appreciation pressure on REER, prompting BB to intervene with episodic purchase of foreign exchange from the market. But that is hardly a panacea. To ensure competitiveness, there is an immediate need to depreciate the Taka-dollar exchange rate by 5-10%. The good news is that the Covid-19 crisis has not led to a major drawdown of official foreign exchange reserves. The bad news is that reserves have reached record levels nearing USD 40 billion (or 10 months of projected imports) by end October 2020, and still rising, with appreciation pressure mounting. This unusual phenomenon, if left unattended, threatens to create the infamous “Dutch disease” syndrome – exchange rate appreciation driven by remittance inflows undermining competitiveness of exports — that could severely hurt RMG exports in the coming months and post-Covid export recovery and export diversification could be seriously weakened. In the past year or so, most of Bangladesh’s competitors as well as trading partners have had to depreciate their currencies to maintain export competitiveness in the international market. Bangladesh can ill afford to let its REER continue to appreciate in the course of a post-Covid recovery. Under the circumstances, at a minimum a modest depreciation appears to be the right strategy for export-push in a slowly recovering global economy.

Based on the available evidence, the conclusion is that the large anti-export bias of trade protection and the additional substantial loss in export competitiveness owing to the appreciation of the real exchange rate basically rendered the cash subsidies and other fiscal incentives for exports as ineffective instruments of export growth and diversification. Export growth has been sluggish since FY17 and was yet to recover its long-term trend when the Covid-19 pandemic struck. Proper management of the exchange rate to boost exports will have to be a major policy focus during the post-Covid recovery.

Fiscal Policy at a Crossroads: A Time for Consolidation

Covid-19 crisis has strained Bangladesh’s otherwise sustainable fiscal balance. A sound fiscal policy framework has been the cornerstone of Bangladesh’s well admired development achievements. Low government deficits, relatively low public debt and debt servicing, avoiding inflation and exchange rate volatility, providing financial resources for private investment, public expenditures on primary education and preventive health, rural development and infrastructure all enabled growth and human development and the rise of a dynamic private sector.

Fiscal policy was under strain in Bangladesh in FY19 and FY20 before the Covid-19 Pandemic struck. As growth sharply decelerated in FY20, because of the pandemic, the fiscal outlook has become even more challenging. The time has now come for consolidation and a rebooting of fiscal policy on both revenue and expenditure sides.

A sound fiscal policy aims to achieve three objectives. First, it ensures good aggregate budget management of relatively low deficits, which can be financed by domestic and foreign sources in a sustainable manner. The second objective is to finance public goods and services in the areas of health and education, law and order, national security, sectors that because of market failures the private sector does not supply adequately. The third related objective here is to ensure that government expenditures are effectively spent both in terms of sectoral priorities and obtaining value for money.

Historically, Bangladesh has performed well in achieving the first objective, with mixed results in achieving the third objective. Fiscal deficits had been kept low at between 3.5-5% of GDP. These low deficits kept inflation and exchange rates relatively stable and public sector debt to GDP ratio low at around 35%, providing space for private sector financing and investment to grow to 23% of national income. Concerning the third objective, expenditures have focused appropriately on primary education and health, rural development and infrastructure; but recently, the rapid increase in public investment has been straining implementation capacity while rising interest payments, subsidies and public consumption have been crowding out critical expenditures. Finally, performance in achieving the second objective have been highly inadequate. Not only has revenue collection been grossly inadequate compared to needs and targets set under the 7th Five Year Plan (FY 2016-20), taxes have been distortionary with excessive reliance on foreign trade taxes that has created an anti-export bias slowing industrial and export growth diversification.

Higher Deficits and Domestic Financing

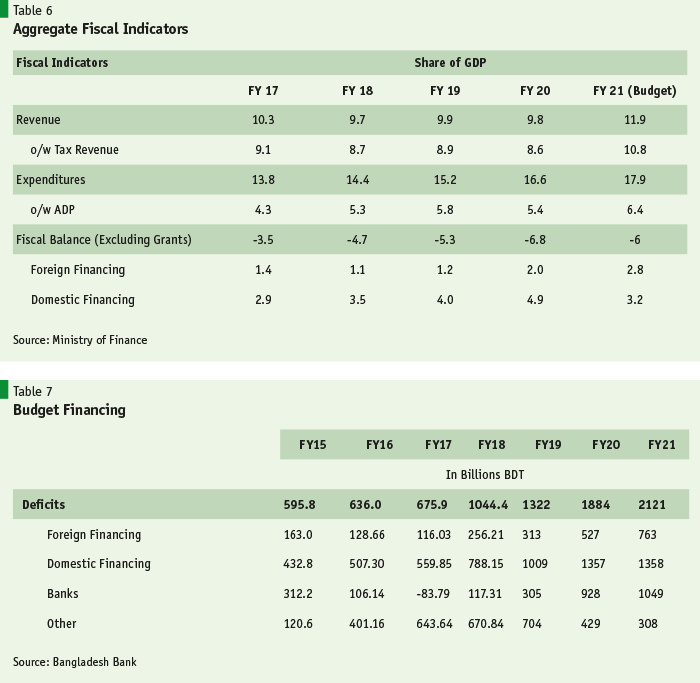

In recent years, Bangladesh aggregate budget management has been strained by a marked rise in deficits and a much higher recourse to domestic financing. As Table 6 shows, in the four years between FY17 and FY20, deficit as a share of GDP has grew from about 3.5% to 5.3%, with domestic financing rising from 2.9% to 4.9%. In FY20, after Covid-19 came in March, GDP growth sharply decelerated and revenues, which had already been performing weakly, plummeted even further. As a result, budget deficits increased to an unprecedentedly high 6.8% of GDP.

The Covid-19 impact has contributed to higher deficits in FY20 and FY21, but only partially. A revenue slump since April of 2020, caused by Covid-19 accentuating the problem. In fact, if needed higher Government spending on stimulus, health care and social safety programs can be justified.

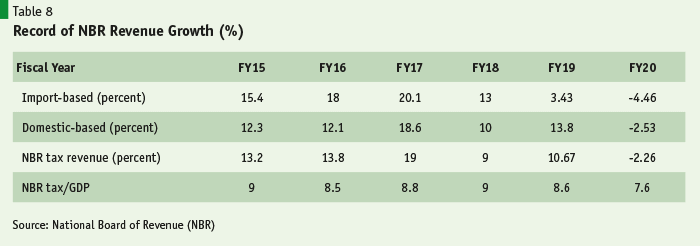

Because the Bangladesh economy has grown larger, where in internationally comparable PPP dollars, it is the 32nd largest economy in the world, increasing deficits mean large needs for financing. However, foreign financing has not grown at the same rate. In the past five years, as a result, domestic financing has tripled from BDT 433 billion in FY15 to BDT 1,357 billion in FY21 (Table 7). Another adverse implication of the large size of domestic financing is that for the last four years the Governments has depended heavily – from 70% to more than 100% of all domestic financing in recent years – on expensive non-Bank financing sources such as the open-tap national savings certificate schemes. Between FY15 to FY19, financing from these sources increased by nearly six times from BDT 120.6 billion to BDT 704 billion in FY19. It is only in FY20, the Government switched most of domestic financing from national savings certificate to the Banking system. Any significant economic recovery in FY21 will require a vigorous private sector rebound and need for bank financing.

Fiscal policies need to be corrected at their source through two structural policy measures that need to be taken to reduce deficits and domestic financing. These include making a strong push on revenue collection for which both policies and implementation arrangements need to be strengthened. Increasing revenue collection is not only important for the medium-term; Bangladesh’s long-term growth prospects will hinge on its ability to markedly increase its domestic resource mobilization capacity. The second major policy correction will need to improve expenditure allocation and implementation. We will turn to these two issues next.

Need to Address Faltering Revenue Collection

Revenue collection in Bangladesh has been faltering for the past three years and Covid-19 has made the situation worse. In the short run, Covid’s impact can be seen in the negative revenue growth in FY20 Whereas the revised target for the NBR revenue collection by the end of June 2020 was around 3 trillion, the actual revenue collection turned out to be only 2.18 trillion, which is even lower than the previous fiscal year. The adverse impact has continued into the current fiscal year as indicated by the minimal 1.1% revenue growth in the first four months of FY21 compared to the first four months of the last fiscal year.

As noted, revenue collection has been a longstanding problem, predating Covid-19. A comparative look at other countries highlight’s Bangladesh poor revenue performance. Bangladesh’s current per capita income measured by internationally comparable dollars is PPP USD 5200. When Asian economies on average had a similar per capita income on average in 2007, their revenue to GDP ratio stood at 19%. Another way to look at the shortfall in revenue performance, is that in both FY19 and FY20 had a revenue to GDP outcome of 9% and 8% well short of the 14% revenue to GDP target at the 7th FYP for FY 2020. Not only that, these revenue to GDP shares in FY19 and FY20, were well below revenue collection in the first half of the decade when the revenue to GDP share was 11.3. If the Government could have maintained revenue collection as in the first half of the decade then an additional BDT 450 billion could have been collected now. These additional resources would have more doubled the budget’s allocation for capital expenditures on projects or the expenditures in any sectors.

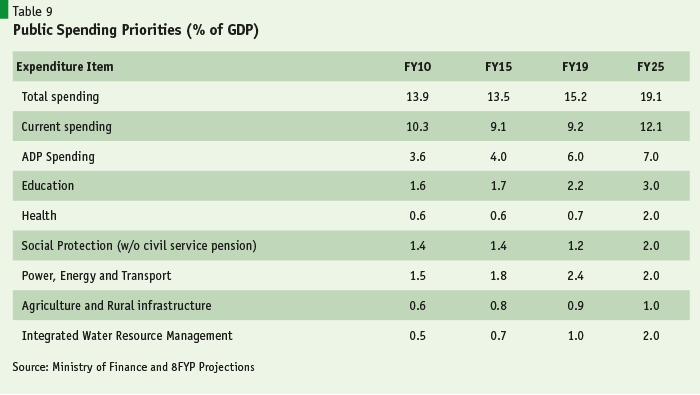

The sharp decline in revenue performance in the last few fiscal years is brought up clearly in Table 8 below. Overall growth in revenues collected by the national board of revenue, that accounts for 85% of all tax revenues, has declined from 17% in FY17 to about 10% in the next two years and before declining in absolute terms in FY20.

In addition to having low rates of revenue collection, another significant problem is that the dependence on trade taxes that account for nearly one-fourth of all tax revenue collection. Such dependence means that consumers bear the burden of high prices on one hand, and on the other hand, these trade taxes create an anti-export bias in Bangladesh’s trade regime, lowering Bangladesh’s competitiveness and economic diversification prospects. Thus, not only do revenues have to be increased, revenues from trade neutral taxes such as the value-added taxes must increase even more to replace the trade dependent taxes.

A major reason for the revenue shortfall however is the implementation of a faultily designed value-added tax in FY19. The VAT design had four VAT rates where good practice suggests that there should be one rate and, if at all needed, a maximum of two rates. Further, several exemptions and a few even specific rates have been introduced. The record keeping and compliance monitoring burden on both firms and tax officials as part All these increased administrative complexities, the costs of compliance to firms, the incentives to evade taxes and opportunities for corruption. The firm size threshold for VAT compliance has also been raised. Unsurprisingly, this has resulted in a jump in the number of firms claiming to fall below the higher threshold.

Revenue collection has remained weak. When the government of Bangladesh set a revenue growth target of 49% in FY20 when nominal GDP was supposed to grow about 13%, the targets lost all credibility. Such unrealistic targets had two-way adverse impacts. It placed both undue burden on NBR officials from which taxes were to be collected and it may have undermined the morale and efforts of NBR officials as the targets set them up as designed to fail. Unfortunately, the situation continues with FY21 budget when the Government has set up a revenue growth target of nearly 40% based on a real GDP growth target of 8 percent and a nominal GDP growth target of 14%.

In addition to the policy design there were also significant organizational failures. The new Act had also aimed to improve the ease of doing business in Bangladesh through fully automated taxpayer friendly system of tax administration, registration, and payment systems. In the event initially automation was introduced only on a partial basis where firms could submit only the registration forms for the VAT. As the Chairman of the National Board of Revenue has rightly stated, the automated system was only partially introduced without adequate training of tax officials. In these circumstances, it is not surprising that revenue collections faltered significantly in FY19.

Improving Expenditure Allocation and Effectiveness

Bangladesh’s constrained fiscal space becomes evident when we look at historical experience of other countries. When the average Asian emerging economy had a similar per capita income level of PPP USD 5200 in 2007, their public expenditures were more than 20% of national income. This means that Bangladesh public expenditures are about 5 to 6% below what is needed. This massive shortfall in public spending has resulted extremely low public expenditures health, education, water resources, environment, social protection and agriculture spending.

Because there are binding revenue constraints that limit fiscal space, proper management of public expenditures become especially important. Two issues dominate. The first is to ensure optimum public expenditure allocations across not only of sectors but also economic activities. The second issue to make public expenditures effective and get the best value for money. There is a third, related, issue which has been long ignored in Bangladesh: how should expenditure assignments be made across different tiers of government.

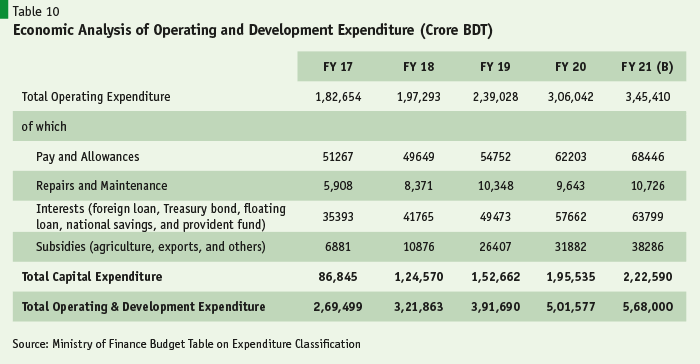

Within its limited constraints, Bangladesh does reasonably well in allocating its expenditures at a sectoral level. In FY19, a priority was given and budgets to education, infrastructure, agriculture, and social protection (Table 9). The health sector was relatively deprived. Given the paucity of resources, it is not truly clear how sector wise allocation can be improved. Another important improvement in recent years has been the rise of public investment in the Annual Development Program.

However, allocation across economic classifications raises significant issues. Interest expenditures have nearly doubled in the past three years, it become the single largest expenditure item across sectors. Expenditures on subsidies have tripled over the past four years. While there is nothing intrinsically wrong with providing some subsidies, the sharp increase means that private recipients who received these subsidies are getting priority over public spending that provide public goods and services in education, health and infrastructure.

Finally, a critical shortcoming of Bangladesh’s expenditure allocation is the extremely meagre amount allocated for repair and maintenance expenditures (Table 10). Whereas public investment programs are now standing close to BDT 2,225 billion, the amount allocated for repairs and maintenance is only about BDT 107 billion. This amount is massively below requirements. Conservatively, using estimates from an IMF data base, Bangladesh’s publicly owned capital stock should be around BDT 14,450 billion in 2017 prices. Maintenance costs will differ according to the type of infrastructure, but it will range between 5% to 7% of replacement costs. That translates into the repairs and maintenance requirement allocation of BDT 1011 billion annually or seven to eight times what has been allocated in the budget. More research is needed, but evidence from Roads and Highways survey from FY19 suggests that only 50% of the roads are in good conditions and while their maintenance needs were around BDT 107 billion but were provided only BDT 25 billion for that purpose. As it is widely discussed in the press, such lack of maintenance has led to rapid deterioration of road conditions in both highways and rural areas. Similarly, while data is absent in the power sector, if the rapid expansion of generation capacity is not matched by maintenance expenditures for the power grid or for aging substations electricity supply will remain unsatisfactory for growth and development. Thus, Bangladesh is at a point where even though it has 10,000 MW in excess capacity, it is unable to transmit the power within the country and thus forced to import power from neighboring India. Absent adequate repairs and maintenance allocation, the public infrastructure will depreciate an accelerated way lowering the rate of returns expected from it.

Monetary policy has been on a tight-rope walk especially due to the pandemic

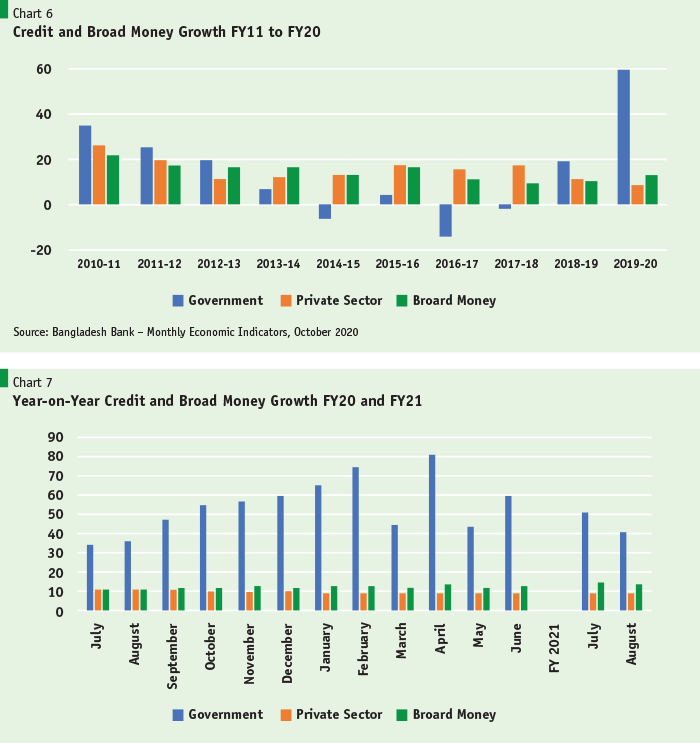

The effects of rising fiscal deficits and domestic borrowing had a significant impact on monetary and banking developments in FY20. Monetary policy also had to bear the main responsibility of providing stimulus lending to offset the impact of Covid-19 and economic slowdowns. On the positive side, at the end of the Fiscal Year in June 2020, the year-on-year growth of Broad Money (M2) stood at 12.6% just above the nominal GDP growth of about 11%. This has been a welcome change from developments in preceding years when broad money growth had dipped below 10%, lower than nominal GDP growth. Broad money share in GDP fell after FY in two consecutive years after FY17 and even though the share of broad money growth has increased in FY20, it remains below that of FY17. Such a financial shallowing is unexpected in fast growing economy.

However, it is not only the rebound of monetary growth that matters, but the source of this growth also remained a matter of concern. The increase in net domestic assets, which accounted for 84 % of broad money, M2 growth, however, was driven heavily by government borrowing from the banking system. Government borrowing accounted 44% of broad money growth, more than two-fold jump compared to government’s share of 17% in broad money increase in FY 2019.

Stimulus Packages Through the Banking Sector

One factor affecting monetary growth were the introduction of stimulus packages to respond to the Covid-19. Most of these stimulus packages were bank lending programs, some of which were subsidized through lower interest rates, with the Government bearing the subsidy costs. Nearly a third of higher growth of broad money came from lending through the eight stimulus packages announced by the government which were to be channeled through loan from the banking system. These loans were targeted to export-oriented industry and services, for small and medium enterprises, export development and for paying salaries for workers in the export-oriented industries. Although the targeted stimulus loans amount was BDT 857 billion, or about 3% of GDP, actual disbursements have been just over half, around 54% or BDT 452 billion. In particular, disbursement for SMEs, agriculture, small farmers, and business have lagged at around 35% or less. This is unfortunate because most workers tend to be employed by small-scale manufacturing and business enterprises. Thus of the Taka 30 billion allocated for low-income professionals, farmers and marginal businesses, only Taka 5.5 billion worth of loans have been disbursed so far to 57,977 clients and 57 MFIs (although there are 180 MFIs who are capable of taking loans).

In addition to lending programs, the Government also announced several policy measures to help stimulate the economy. On April 1, the Cash Reserve Ratio (CRR) was reduced from 5.5% to 5%. Two weeks later, on April 15, it was reduced further to 4%. It was expected that this reduction in the CRR would free up Taka 171 billion in the banking sector. At the same time, the Advance-to-Deposit Ratio (ADR) was increased from 85% to 87% for the conventional banks – while it was increased from 90% to 92% for the Islamic banks. It was expected that this increase in the ADR would free up Taka 228 billion for the sector. A few days earlier on March 23, the Repo Interest Rate was reduced from 6% to 5.75%. 3 weeks later, on April 12, the rate was reduced further to 5.25%. The aim of this decision was to try and ensure adequate liquidity in the financial system. On May 13, the Bangladesh Bank also introduced a Long-Term Repo with a tenure of 360 days – in contrast to the previous maximum of repo with 28 days of tenure. At the same time, the margin of borrowing has been fixed at 5% for the Treasury Bonds and 15% for the Treasury Bills. Proceeds from the borrowings can be used for the implementation of the stimulus packages which have been announced by the Government.

The effectiveness of these measures is unclear as private sector borrowing has remained subdued. This may, in part, have been the result of a sharp increase in Government borrowing from the banking system.

Sharp Increase in Public Sector Borrowing Before Covid-19

Although stimulus lending accounted for a significant share of the increase in money supply, Government borrowing shot up sharply in FY 2020 (Fig.6) even before these packages were introduced. Even before the Covid-19 stimulus packages, domestic borrowing from by Banking system by the Government had already increased markedly. By March 2020 Government borrowing had increased by 45% over the previous year while the Broad Money growth had grown by 12% (Chart 7). To some extent this represented an improvement in Government policy as it now had access to cheaper bank loans as opposed to borrowing from expensive national savings NSD certificates where interest rates were 11 percent or are even higher. However, some borrowing continued and the outstanding stock of NSD Certificates increase from BDT 2,877 billion at the end of FY19 in June 2019 into BDT 3,021 billion at the end of FY20 in June 2020.

As government borrowing increasingly relied on domestic banks, there were indications of a liquidity crisis in Banks and the growth of credit to the private sector declined to 8.6 percent in 2019-20, compared to 11.3% in 2018-19 (Figure V.2). The emergence of liquidity crisis has required domestic banks to adjust their loan-deposit ratio contributing to the slow disbursement of loans to the private sector.

Non-performing loans and liquidity constraints in banking sector threaten stability

The other serious factor creating liquidity shortages were concerns about the health of banks as it became clear that nonperforming loans continued to rise significantly. The sector is still struggling to recover from the recent setbacks caused by large financial frauds in several state-owned and private commercial banks. The problem seems to be compounded by recent changes in the tenure and family membership of bank boards. This reflects severe weak regulation and governance in the banking sector and means that family ownership will have greater control in banks with the possibility of erosion of corporate governance. Banking supervision, which had improved significantly over the past two decades, is showing signs of deterioration.

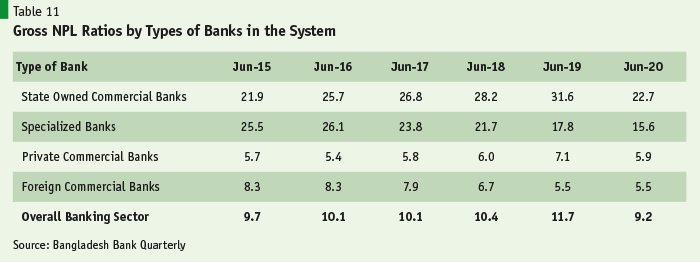

While non-performing loans continued to increase, the share of gross Non-Performing Loans (NPL) in all loans of the overall banking sector marginally decreased from 11.7% at the end of FY19 in June 2019, to 9.16% as of the end of FY20, in June 2020 (Table 11). The banking sector has continued to bleed from bad loans for years now and the worsening trend has been affecting the banks’ profit margins, scope of business expansion and the plan for job creation.

The poor performance of the State-Owned Commercial Banks (SCBs) accounts for most of the non-performing loans which continues to be distressing with little relief in sight. Since the government owns these banks, their managements have no stake in efficiency or profitability of their operations. Subject to political pressures, the management has little incentive to manage these banks on a commercial footing because either the losses can be passed over to the citizens through treasury financing based on tax revenues or as continued accumulation of bad loans (i.e. NPL).

The poor performance of the State-Owned Commercial Banks (SCBs) accounts for most of the non-performing loans which continues to be distressing with little relief in sight. Since the government owns these banks, their managements have no stake in efficiency or profitability of their operations.

The data suggests that there is a concentration of non-performing loans with big corporations and borrowers who wield considerable influence. Government also faces the concerns that these big firms are “too big to fail” given the adverse impact they may have on economy in general and employment. Loan rescheduling or restructuring becomes a fait accompli.

In order to comply with the Government’s desire to help out businesses during these uncertain times of Covid-19, the Bangladesh Bank issued an Order halting the classification of loans by the banks until the end of June. On 15 June, another Order was issued – extending the halt until the end of September. Whereas this was supposed to create a breathing space for the enterprises suffering from downturn, this unfortunately has also created an incentive for the borrowers stop their repayments on the loans which they took – further drying up the flow of funds for the banks during these testing times.

Interest Rate Ceilings send the wrong message

In April, the Bangladesh Bank order imposing a ceiling of 9% interest rates on all loans except credit cards and a ceiling of 6% on deposits became effective. This policy came on the back of long-time demands from the business community that the rates of interest are reduced to a single digit. Previously, interest rates on commercial loans were 10% to 17%. However, this meant that to compensate for the lower interest payments which the banks were getting due to the 9% ceiling – they had to lower the deposit rates as well. This made some people lower their bank deposits, since the difference between deposit rates and the interest rates on NSD Certificates had increased even more.

Another consequence of this cap on interest rates that will likely lead to slower growth in deposits and increased demand for loans is that the commercial banks will need to ration their lending. Thus, they will be more selective in giving out loans due to concerns over credit history, repayment and reputation – with adverse consequences for lending to Small and Medium Enterprises (SMEs). The rise in the cost-income ratio of the SME operations of BRAC Bank from 85% to 130% – turning it into a loss-making center – is a concerning development.

The broader consequence of imposing ceilings on interest rates will be to dampen financial deepening in the economy. Historically, the rise of Private Commercial Banks (PCBs) in the country after 1991 was triggered by removal of interest rates ceilings as part of the economic reforms which were going on at that time. Savers are being penalized by lower interest rates which have dipped below inflation rates. Although not inevitable, this is likely to lead to lower national savings leading to bigger domestic and external imbalances.

The adverse impact of interest rates ceiling will accentuate deep problems in the financial sector. Even before such caps, the presence of significant non-performing loans, accommodative measures such as regular loan rescheduling and lack of punishment for fraudulence in banks have caused uncertainty and decreasing confidence in Banks and a slowdown financial and economic development. To play the larger role of contributing towards a stable and sound macroeconomic foundation in Bangladesh, there is no option but for the banking sector to revert to a market-based system, while undergoing resolution of NPLs in balance sheets. On its part, the Government will need to also implement strict policy, supervisory, and legal measures to prevent a financial shock to the economy.

Epilogue…. 2020-21 and the post- Covid economy

What a year 2020 was. A year of economic stoppages resulting in cascading devastation all around. Lest the world sink into a depression of the 1930s variety, governments and central banks threw every ammunition in their bag at the marauding forces of economic destruction. There were two goals: first, to mitigate the global downturn from getting out of control, and second, to create conditions for a rapid and full economic recovery. We have witnessed swift reactions in leading economies resorting to “whatever-it-takes” and “whole-of-government” policy approach. To their credit, the world has averted a depression but the jury is still out as to whether economic recovery will be robust enough to resume historical rates of trade and output growth. We asses that this is also true about the handling of the Bangladesh economy for now. It is the recovery phase that could pose serious challenges unless we revamp existing policies dealing with international trade and investment on the one hand and put in place better foundations for structurally sound, sustainable, and inclusive growth domestically.

A crisis also creates opportunities. Covid-19 pandemic has set off deeper public-private cross-border cooperation in medical research, technological collaboration, and economic policy coordination. The once floundering state of multilateralism could get a boost from the cooperative efforts to resuscitate the post-Covid-19 global economy. The change in US leadership is already giving the signal that “multilateralism is back”, indicating a more rational approach to addressing multilateralism and its discontents over the next four years.

A crisis also creates opportunities. Covid-19 pandemic has set off deeper public-private cross-border cooperation in medical research, technological collaboration, and economic policy coordination. The once floundering state of multilateralism could get a boost from the cooperative efforts to resuscitate the post-Covid-19 global economy.

A crisis builds resilience and instils fortitude and determination to make changes and seize opportunities. Covid-19 pandemic has delivered a health-cum-economic shock to the Bangladesh economy disrupting, hopefully temporarily, its onward journey towards becoming a Middle-Income Country (MIC) by 2031. But it has also built resilience. The government’s fiscal and monetary stimulus package along with the consolidated FY2021 Budget should provide strong ammunition on the path to economic recovery. Recovery is a gradual and slow process which can be expedited by undertaking favorable trade and growth policy mechanisms that link the global marketplace with our economy. Bangladesh’s strength is its manufacturing strength and potential which needs to be diversified. In the post Covid-19 world, we should continue to harness the positive gains from this global regime through greater trade integration including with markets such as the recently formed RCEP community in the Asia Pacific region. Adopting the open stance of trade policy is and will remain the right approach which should also be acknowledged and endorsed in forthcoming budgets and five-year plans.

To conclude, Bangladesh economy is about to hit several historic milestones. In 2020, Bangladesh crossed the USD 2000 per capita income; 2021 is the 50th year of independence; and in 2024 the economy is expected to graduate out of LDC status. Covid-19 pandemic has struck at a time when the economy was on a stable trajectory of high GDP growth averaging 7-8%. To pull the economy out of the depths of a health-cum-economic shock and restore it to the path of reaching the goal of becoming an upper middle-income country (UMIC) by 2031 as envisaged in the government’s Perspective Plan 2041 (PP2021-41), it will require vision and strong commitment to reforms in order to stay competitive in the world market. It is our understanding that the Government is prepared to take on the challenge in right earnest by framing appropriate strategies into the forthcoming 8th Five Year Plan (2021-25).

In the near term, in 2021, Bangladesh has to be ready to take advantage of the global recovery and emerging opportunities in the world market. If the international vaccination program is well implemented in 2021, it is likely that the world economy will recover rapidly. The recovery of employment in advanced economies that was already underway in 2020 before being disrupted by the latest Covid-19 surge and pent up demand by consumers and investors are likely to unleash a vigorous recovery. In this scenario, their demand for exports from Bangladesh will also grow rapidly. Further, employment prospects for Bangladeshi migrant workers and remittance flows – which has been remarkably robust in 2020 – should be further boosted. In such a scenario, if Bangladesh prepares well to keep supply chains ready in factories, transport, ports, banking and labor markets, our economy should also be able see a strongrebound in the second half of 2021. As in every year, policy to support steady growth in the agriculture, the rural non-farm economy, and the battered MSMEs, will also be critical to improve our growth prospects.

Finally, the strategy of leveraging the global marketplace for manufacturing growth and job creation must be continued. To Bangladesh’s advantage, globalization is alive and kicking. The Covid-19 pandemic was supposed to put the final nail in the coffin of globalization and prompt a retreat into a new era of protectionism. Instead, the crisis has become the Great Accelerator. Global trade finished the year 2020 on a strong upswing.

That brings us to the bottom line of this take on the state of 2020 Bangladesh economy, the prospects for 2021, and associated economic policies. Having managed the immediate economic crisis reasonably well, policy makers must not lose sight of the challenges and opportunities down the road to recovery which could be steep and unrelenting. The oft-quoted line about not letting a crisis go to waste has rarely been more relevant.

Zaidi Sattar and Ahmad Ahsan are, respectively, Chairman and Director, Policy Research Institute of Bangladesh (PRI). Research support was provided by PRI colleagues Ashikur Rahman, Senior Economist, Ziaul Ahsan, Research Fellow, and Sr Research Associates Sabrina Shareef, Nuzat Tasnim Dristy, Promito Musharraf Bhuiyan, and Sumaiya Farah.