Linking stimulus to demand, investment, and employment for an inclusive and dynamic recovery

By

Background: Economy still far from securing pre-pandemic vibrance

The Coronavirus pandemic has inflicted twin crises over the past year- massive toll on health and human lives across the world and severe negative impact on the global economy. The World Bank (2020a) predicted that most countries would plunge into a recession in 2020, leaving lasting scars on the economic and financial indicators of the global economy. The International Monetary Fund (IMF) reported that the world economy contracted by 3.5% in 2020. The detrimental effects of the pandemic were felt all across the board with advanced economies contracting by a whopping 4.9%. The global economy is also facing its fastest and steepest downturn in terms of growth since the 1990s. The World Trade Organization (WTO) projected that the slump in international trade could be between 13 to 32 percent. This will have severely affected all the export-oriented businesses and the small factories catering to them locally. The ILO has forecasted that 25 million people would lose their jobs around the world due to the Pandemic.

The pandemic has forced governments across the world to step in and undertake massive monetary and fiscal interventions in their respective economies. The Government of Bangladesh has been no exception, and has taken steps to counter the backward slide. It has initiated 23 stimulus packages worth about Taka 124,053 Crore in total, accounting for 4.4 percent of Bangladesh’s GDP. These packages were designed to help the export-oriented industries, shipment credit, agricultural sector, and low-income groups, including farmers and micro and small enterprises to survive. The bulk of the support is disbursed in the form of working capital loans.

One year since the lockdown and more than six months into gradual reopening, Bangladesh has somewhat cushioned the blow of the pandemic and has been able to register a respectable growth rate compared to the dire state of the global economy a year ago. Efforts by the Government in the form of a stimulus package, backed by the nuances in monetary and fiscal strategies, and assistance from multilateral banks and bilateral partners have provided much needed support for the Bangladesh economy. Additionally, record remittances this year have provided vital assistance to family members teetering on the poverty line in the pandemic. The UK-based Centre for Economics and Business Research states that Bangladesh managed to avoid the contraction most other economies encountered. This sentiment was also echoed by IMF who said that despite the pandemic, Bangladesh is set to post the third-highest growth in the world and the highest in Asia in 2020.

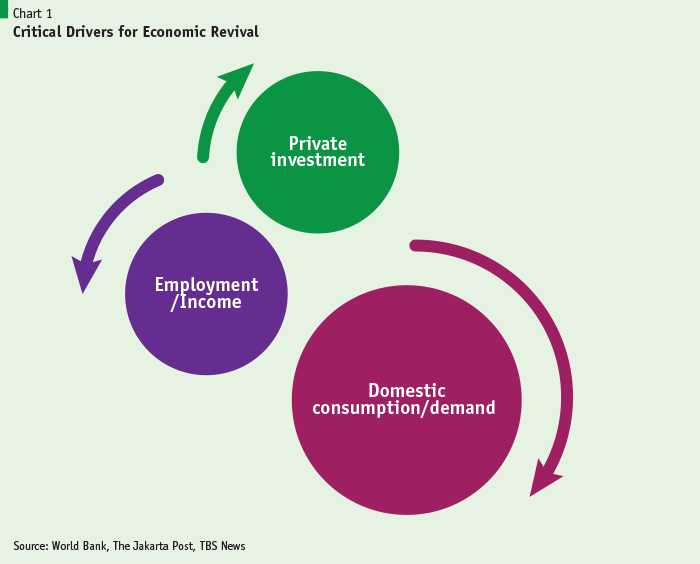

While the economy continues to perform better than anticipated, primarily building on stimulus and remittance led liquidity, it is still far from securing pre-pandemic vibrance in domestic demand, consumption, jobs, and particularly investment. The RMG sector and large businesses have been able to make good use of the packages, while orders have also picked up recently. However, stimulus payments to non-RMG and small businesses have been slow, and rather inadequate. Micro, Small and Medium Enterprises (MSMEs) have not largely benefitted due to their lack of capacity in influencing the disbursement by the banks, and a lackluster incentive for banks to reach out to them due to the ceiling on lending rates. A particular concern is the rise in unemployment and poverty, which has created an atmosphere of depressed demand and low business confidence for investment. Trade and Commerce has not returned to pre-pandemic level, as signified by the low revenue collection. It is vital to increase domestic demand and employment which is the major driving force behind the economy. Policy has to be steered towards increasing private investment, consumer demand to continue the growth trajectory of the past two decades.

While the economy continues to perform better than anticipated, primarily building on stimulus and remittance led liquidity, it is still far from securing pre-pandemic vibrance in domestic demand, consumption, jobs, and particularly investment.

Stimulus utilization and progress: Large and Export-oriented Businesses Benefitted, while Smaller Firms Struggle

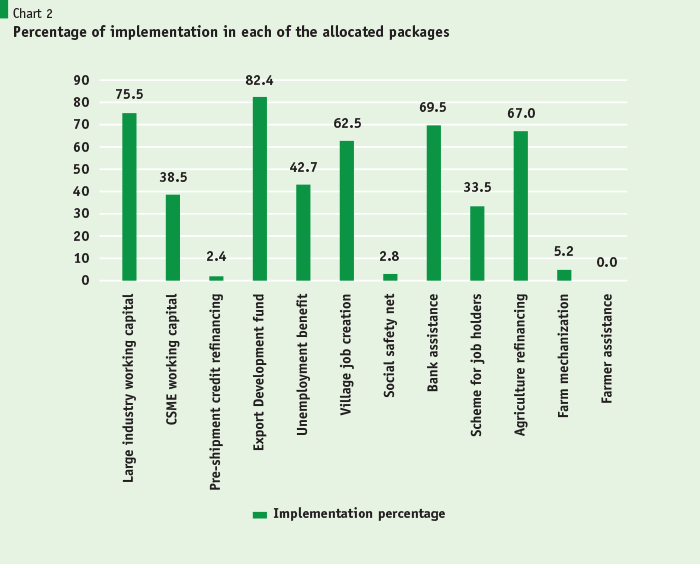

Despite having formulated stimulus packages to aid the ailing economy, the rollout of the said packages hit a plateau. As of February 2021, approximately 42% of the earmarked aid remained undisbursed.

The central bank’s updates on stimulus disbursement draw the grim picture marred by uneven treatments. Big businesses were at the forefront of the stimulus receipts, having availed most of the amount reserved for them. According to Bangladesh Bank, 3,046 big enterprises borrowed Tk25,411 crore as working capital from the Tk33,000 crore package announced for them. The Export Development Fund which offers loan at 2%, was increased further to $5 billion, out of which majority has been disbursed. On top of this, the export-oriented garments got Tk2,263 crore loan in June and Tk2,534 crore in July last year as staff salaries. As the amount fell short, Tk3,000 crore was added up with the amount in July for the ready-made garment industry.

With large firms soaring high on stimulus fuel on the road to recovery, smaller firms were left behind. CMSME faced many difficulties in availing the packages, from documentary to capacity issues, with banks being increasingly risk-averse in disbursing loans. A significant portion, BDT 20,000 crores, had been devised to be issued as working capital loans, which was later increased to 20,000. However, till January 2021, only BDT 11,564 crores (57.82 %) have been disbursed. This lack of disbursement is also present in the aid for affected job holders, as only 30% of the package made its way to them.

Meanwhile, financial institutions have not been successful in lending to various sectors while their disbursement target was Tk1,135 crore. The Bangladesh Bank had approved the only Tk214 disbursement against the package. The Department of Financial Institutions and Markets returned the remaining Tk921 crore to the central bank’s Banking Regulation and Policy Department to be disbursed by the banks. To aid farmers bear the storm, BDT 5000 crores have been set aside as an agriculture refinancing scheme, of which BDT 3465 crores have already been disbursed as loans, providing good support to one of the pillars of the economy.

In addition to monetary support, the fiscal aid through various stimulus-cash-food support packages were rolled out, albeit with some irregularities and inefficiencies. A total of 3.54 crore people has received assistance from various packages over the period. The government distributed five lakh tonnes of rice and one lakh tonnes of wheat among 2.54 crore people in 496 municipalities and upazilas. The government also helped nearly 18 lakh families in the urban areas to buy rice at Tk 10 per kg.

Analysis of Economic recovery Post Stimulus

Since the reopening of the economy, backed by the government’s 120 thousand -crore stimulus package, Bangladesh began its journey towards recovery. Agricultural sector and the farmers remained the bedrock, as they continued to feed the country. The strong influx of remittance lifted the country’s foreign exchange reserves to record highs and put the country on a firm footing. Bangladesh’s GDP growth dropped to 5.2 percent in 2020, compared to 8.2 percent in the previous year. Despite the fall, it is quite remarkable how the economy has turned around, as Bangladesh is set to post the third-highest growth in the world and the highest in Asia in 2020, according to the International Monetary Fund.

In line with the reopening of Bangladesh’s major export destinations, Bangladesh’s export rose 0.6% to $3.9 billion in July, after plummeting 83% in April. This was mostly driven by apparel exports, which totaled $5.7 billion in July and August. The working capital support by the Government, and government initiative focused on employee retention went a long way. The rise in economic activity is further evident from energy usages over the last few months, which is a key parameter to economic growth. Use of electricity returned to a pre-pandemic level of 700 crore kWh in July, and later surpassed it. The use of gas too surpassed the pre-pandemic level of 250 crore cubic feet in October and continued till November. However, since then, it has once again dipped due to the renewed restrictions worldwide due to the second wave.

Despite the surge in July-August, overall export earnings fell in the July-January period of this fiscal year, compared to a period a year ago. Merchandise export fetched $22.6 billion in seven months up to January 2021, down 1% from the same period of fiscal 2019-20. The decline, though marginal, is steeper than the figure was in December, a month back, where the total export decline of the first six months was 0.36%, which shows a declining trend. Overall export in January 2021 fell 5% from the same period last year and stands at $3.43 billion. Frozen food, leather, agriculture, and plastic, all posted negative growth.

State of Consumer Demand: Slow and Uneven Recovery as Low-income Majority Yet to Recover

With the reopening and as economic activities gained traction after the first three months since lockdown, there was resurgence in consumer spending as the economy started gaining traction. Sales of high-end products have recovered 80% of normal times, which includes washing machines, ovens, refrigerators and computers. Car sales have not yet gone up to pre-pandemic level, but has shown encouraging signs in recent times, as suggested by a few industrial insiders. Demand has been high for pharmaceutical products, as expected. Companies too have thus increased import of raw materials for medicine production. People spending online and with credit cards has also shown positive signs, as such transactions have returned to the level of pre-Covid-19 times, and further gone up. Demand has been high for pharmaceutical products, as expected. Companies too have thus increased import of raw materials for medicine production. People spending online and with credit cards has also shown positive signs, as such transactions have returned to the level of pre-Covid-19 times, and further gone up. Consumer loans have grown 12% y-o-y in the July -September quarter, while loan repayment has also increased to 90%, signaling some business recovery.

The statistics above, despite showing some positivity, do not present the entire picture, as problems still persist in reality. According to the WBG survey (2020), only 38 percent of the households surveyed confirmed receipt of government assistance, while 42 percent relied on their own savings and have been struggling to get by. A socio-economic impact assessment undertaken by Human Development Research Center (HDRC) on the urban poor estimates that 2.9 million people have recently been pushed into poverty. 69.3% of the respondents could not afford to pay house rents over that period, and there was an overall 81% reduction in the average amount of savings among the respondents. Four-fifth of the respondents had to resort to their saving to cope with the crisis, which they spent only on extreme needs, given 9 out of 10 households were food deficient (HDRC, 2020). This dire state of sheer inability to consume is observable when it comes to general commodity, where the sales recovery has only been 60% so far, compared to pre- Covid-19 times.

The unwillingness of people to spend as freely as before is reflected by the record high rate of savings in September. Total deposits increased by around Tk1 lakh crore in the six months from March to September this year, up from Tk 70,000 crore last year. Such low demands have had a detrimental impact on small businesses, who are suffering from cash crunch and low revenues.

State of Small Businesses: Lags Overall Recovery and In Need of Fresh and Tailor-made Policy Support

While some large firms in pharmaceuticals, electronics, construction, and plastic industries have overcome the initial hurdles and already passed break-even, most small firms are yet to access the government stimulus packages allocated for them. The cash shortage, and low revenue has caused many to close business altogether. Only 58% of the funds allocated for SMEs have been disbursed so far, compared to bigger firms who have used up more than 90% of the working capital support presented, who have further benefited from the strong supply chain system, marketing network, recognition and bargaining power. The unequal recovery is not only a concern for healthy competition in the future, but a question of the small firms’ survival as SMEs’ capacity to absorb shock is limited, and any disruptions in production, sales, and cash cycle beyond a few weeks can wreak havoc to these firms’ capacity to survive. Like many already have, prolonged constraints in demand and supply will lead to further shut downs, escalating the unemployment problem.

According to a BIDS report, there has been an overall decrease in revenue in the SME sector of about 66 percent (FY 2019-20). In a recent UIU survey, SMEs have reported that they are facing a severe liquidity crisis and are even failing to meet their day to day operational expenses. Additionally, the survey outcome demonstrated that about 33% of SMEs are facing overflows of inventory and hence are incurring additional costs. In terms of SME workforce, the survey findings show that 39 percent of the SMEs have cut down their salary costs by 25-20 percent. This alludes to the fact that SMEs have laid off employees in order to keep afloat.

Current State of Employment: Missed Out on Stimulus Kick-start

For a country already burdened with 2 million new entrants into the labor force every year and faced with the risk of losing many jobs to global mechanization and changing dynamism, additional unemployment due to economic shocks is a huge area of concern. As firms seek to go lean and close off unproductive avenues of business, many workers were shown the door at the face of low revenues. This further brought down demand and consumption, having a spillover effect on many small firms over the economy. ILO and ADB stated that around 1.12 million to 1.68 million youths in Bangladesh became unemployed in 2020.

Since the government allocated a package of working capitals were not largely linked towards employment retention, the constriction of apparel demand worldwide was expected to have an adverse impact on workers and small businesses catering to them. A recent study by SANEM suggests that 8% RMG workers had been laid off as another ILO study confirms that factories are operating at a reduced capacity.

Given the Implementation of the stimulus package intended for SMEs, farmers and small firms were surprisingly low, the reach of the package to employees of those sectors were incomplete too. CPD estimates, only 8% of the employees were reached and were benefited from the packages, which would have been 12% if full implementation was possible. The low reach potential shows how the design of the stimulus was not SME and employment friendly. IFC (2020) found that 76% of MSMEs were unaware of the packages, while the remaining 24% failed to avail any support. The cautionary stance of the lenders to give out loans to SMEs and the Bangladesh Bank not providing refinancing facilities for SME loans without collateral over Tk. 5 lakh were significant barriers to this initiative.

Employment generation also remained an area of concern, as firms withheld from making new investments and taking the risk, depicting the low demand and poor business confidence, shadowed by fear and overall risk aversion. This is greatly alarming, as 38.6 percent of recent graduates were already unemployed in 2019 before the pandemic hit globally (BIDS 2019). The new overseas employment too has fallen to 0.4 lacs in July- December FY 21, from 3.5 lacs in the same period last year, according to BMET. Overall, creating new pathways to employment and livelihood for the unemployed is a surmounting challenge going forward.

State of Private Investments

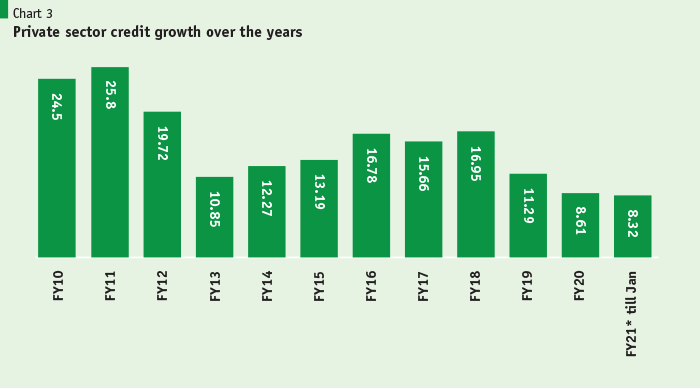

With the view to steering the economy away from a steep downturn, Bangladesh Bank rolled out a vastly expansionary monetary policy for fiscal 2020-21 in July last year, which flooded the market with liquidity. However, despite the low interest rate, facilitating policy measures and high liquidity, private sector credit growth stood at 8.2% in November, which is the lowest in recent years. In December, it rose slightly to 8.37% which was still short of the allocated target of 11.5%, before falling again in January 2020, to 8.32%.

The pandemic has hit the import of raw materials for capital machinery and industry. Compared to the same period of 2019, in July-December last year, LC openings and their settlements in the sector decreased a lot, which signifies the low level of investments being made. Overall imports dropped 13 percent y-o-y to $15.8 billion in the first four months of fiscal 2020-21. This is in-line with the disbursement of industrial loan, which dropped about 12.9 percent y-o-y in September of the same quarter. Although the 27.7% rise in July-September period from the previous quarter shows some recovery, the y-o-y decrease shows that firms are withholding from investing due to low demand, both home and abroad. Consumers are holding back from spending, and only opting for the necessities.

In such a situation, the government’s borrowing from them would have helped, but that too has waned extraordinarily. In the first six months of fiscal 2020-21, the government’s net borrowing from the banking system stood at Tk 2,203.85 crore, which was only 2.59 per cent of the target set for the full year, according to data from the central bank.

The low dynamism gets worrying when looked upon from the perspective of employment creation needs and prospect, for the 2 million youth entering the job market every year. Furthermore, instead of creating new jobs, the low demand might enforce further job crunches in the economy as firms adapt to the new situation, shrinking consumption further.

Lessons from the first Stimulus package and Global measures for a Robust Next Round of Support

A year on from the first recorded case of COVID-19, many countries have taken comprehensive programs to cushion the blow of the pandemic and tackle the economic downturn. Looking into the measures some of the countries have taken, particularly to retain jobs and consumption to previous levels, and promote investment helps drive lessons for future support programs if need be, while putting things into perspective.

Most countries had provided cheap working capital support and loan moratoriums for varying periods to hard-hit businesses to reduce some pressure during times of low revenue, However, some unique, inclusive and wholesome measures were taken in some countries, particularly for the most vulnerable, alongside common measures such as reducing the Re-Po Rate and Credit Reserve Ratio (CRR) for banks, reduction of the interest rate to wither the pandemic.

In the case of Bangladesh, the working capital support and the overall design of the packages lacked incentives for employers to sustain employment. More than half of the stimulus packages had no mention of employment protection/ retention in their objectives. Most economic stimulus packages announced in countries in Asia and beyond include incentives that will help/incentivize employers not to retrench employees. For instance, in India, the government will pay both employers’ and employees’ contribution to the Employee Provident Fund (EPF) for next three months, covering 48 million employees. Singapore will pay up to 75% of local employees’ salaries, and the USA will provide tax credit for up to $5000/employee for employers who retain their employees. Germany’s well-established short-term work subsidy, ‘Kurzabeit’ has played a critical role in job retention; and contributed to Germany’s remarkable labor market resilience during the global financial crisis and is proving critical during the pandemic by preserving jobs and stabilizing incomes. China further provided refunds of unemployment insurance premiums for companies who retained their employees, Germany also made proper utilization of its fiscal place by refunding 75% of average revenue to sectors which were completely ravished during the lockdowns. They also provided funds to ensure a paid leave to the workers during lockdown, in the hard-hit areas.

The design of the packages is not adequately inclusive in nature, as it does not consider the challenges and needs of small entrepreneurs. SMEs had a general lack of awareness of the packages available for them in addition to the low technical capacity and documentary constraints. The collateral and guarantor requirement alongside Banks’ low risk appetite has further prevented new and small entrepreneurs from accessing the packages. They are thus facing a severe liquidity crisis, additional costs due to overflows of inventory and less consumer demand and are struggling to stay afloat. Most firms have had to resort to employee retrenchment as a means of staying alive, while many have already completely shut down, having a detrimental impact on the millions of people who are directly reliant on SMEs for their livelihood. Of the 8.8 million industrial units in Bangladesh, 99.8% fall under the CMSME category, being majorly responsible for most of the informal jobs in Bangladesh.

Bangladesh’s stimulus packages were more of liquidity support and less of fiscal stimulus compared to advanced economies. Of the total stimulus packages unveiled so far 80.7 percent (3.5 percent of GDP) is liquidity support and credit-based, where the government is provided interest-rate subsidy. This put the onus of mobilizing funds on commercial banks by stipulating that the banks will have to use their own funds to finance this component of the stimulus. The guidelines also create greater risk-aversion by banks which is somewhat inevitable economic crisis/slowdown, thereby creating risk of cherry picking in selecting loan candidates. Given business/market/credit risks amplify significantly during any economic slowdown, banks take more stringent measures to analyze credit applications than they do during normal economic settings.

Even though all countries had some sort of direct cash transfers to the marginalized and vulnerable population, the amount in Bangladesh was very low compared to the USA and Germany, who furthermore had other support mechanisms such as unemployment benefits and child support in place. Very recently, Taka 101 crores of the cash aid for the poor has been returned to the government as those pandemic affected people could not collect the assistance due to identification issues (PINs inactive). A total of 32,23,132 accounts got the aids, which however, was tainted with many counts of fraud and targeting problems. Furthermore, the Taka 3000 fiscal support per family was simply not enough to boost domestic consumption to desirable levels, as shown by the demand recovery of general commodities, which has only recovered to a mere 60% of pre-Covid levels in contrast to the recovery of cars and other high-end products. The lack of demand in general commodities has severely impacted the SMEs which cater to the low-income group and has deterred them from retaining employees and making further investments.

The lack of demand in general commodities has severely impacted the SMEs which cater to the low-income group and has deterred them from retaining employees and making further investments.

Conclusion

One year since the lockdown and more than six months into gradual reopening, Bangladesh has somewhat cushioned the blow of the pandemic and perform better than anticipated. However, it is still far from securing pre-pandemic vibrance in domestic demand, consumption, jobs, and particularly investment. Micro, Small and Medium Enterprises (MSMEs) have not largely benefitted due to their lack of capacity in influencing the disbursement by the banks, and a lackluster incentive for banks to reach out to them due to the ceiling on lending rates. A particular concern is the rise in unemployment and consequent poverty due to most firms settling for employee retrenchment to keep costs low, leading to a state of depressed demand in the economy. It is thus vital to increase domestic demand and employment which is the major driving force behind the economy. Policy has to be steered towards retaining employment and increasing consumer demand and private investment to continue the growth trajectory of the past two decades.

Recommendations

Adequate and Timely Health Initiatives for Safeguards Against Health-led Economic Disruptions

a. Make sure most of the population is vaccinated to prevent another large Covid outbreak and prevent the need for further restrictions. Although there is hope of economic recovery around the world with the arrival of vaccines for Covid-19, the fact remains that a significant portion of the global population are yet to be vaccinated and thus still remain vulnerable to the Virus. Here in Bangladesh, the minimum age for receiving the vaccine is still 40 years. In this context, the Government must keep in mind the socioeconomic impacts of the vulnerability on the population that has not been vaccinated, and increased infection rates.

b. Ensuring at least 2% of GDP is allocated as Investments in the Health Sector: The Government must make heath sector – a priority sector – to contain the crisis as much as possible. Given the health crisis is intimately intertwined with the economic crisis, keeping the pandemic under control will be fundamental to reopening the economy. In this context, the Government must use the upcoming National Budget FY21-22 to mobilize higher resources for the health sector.

c. Broaden the Health Coalition to Involve Non-government/Private Sector Actors: The Government should consider involving greater number of private hospitals and NGOs in its current COVID response framework, so that their capacities can be used to deal with the patients. The Government should also involve the NGOs to identify the poorest families, informal sector workers and enterprises so that a better framework of targeting guides its distribution of relief and aid.

Re-adjusting Stimulus for Quicker Turn Around of Domestic Demand

For the unemployed, poor, and the under-privileged

a. Government can consider sanctioning larger payments as social security (1% of GDP) on a monthly basis for the next few months. Higher amounts will help to keep demands high and support consumption to keep the economic wheel moving, facilitate a high demand for the lower class of products and spur investments. People can only buy products when they have enough to spend, and given demand is in such a depressed condition deters firms from expansion, while many struggle to survive, which is creating further unemployment and retrenchment.

b. Leveraging business associations for rapid data collection on informal firms and workers. It was recorded that some of the social security and digital cash payments to the vulnerable were transferred to the same mobile number more than once resulting in disproportionate distribution of allowance. Thus, having a more robust and accurate data collecting system and infrastructure in place to record important data and efficiently analyze them is key for a more targeted response. Through leveraging industry associations like BGMEA, secured database can be maintained with further crosschecks and validation, to avoid selection errors.

c. Introduction of Unemployment benefits for carefully selected people, who had been recently unemployed due to the pandemic. Whereas the health risks of the Pandemic seem to be coming to manageable proportions, the economic disruptions caused by the Pandemic still remain at play in the form of higher unemployment when compared to the pre-Pandemic days. Higher unemployment means that the level of demand is low, resulting in lower investment in the economy. The Government can thus consider the introduction of Unemployment Benefits for the next 3 years, in order to keep the levels of demand in the economy high and encourage investment.

d. The GoB could consider a massive re-skilling initiative of workers involved in sectors with export potential and for the migrant returnees from the middle east. For those who had been recently unemployed due to the economic shock caused by the Pandemic, this provides a great opportunity of integrating them back into employment of the future, making them more resilient and future-proof, while improving the overall competitiveness of the sectors and country. Skilled and capable labor has been at large very scarce in Bangladesh, and improving the skill-level will spur more private investments and FDI.

e. Considering the ground realities in Bangladesh, it is important for the Government to ensure transparency during the steps of registration for and disbursement of social welfare benefits. It is crucial to use modern techniques like the Single-Registry MIS to identify and prevent duplication, in addition to ensuring an efficient Monitoring & Evaluation (M&E);

f. A small amount could be provided as incentive, as part of the Social Security payments to those who complete the above-mentioned training/ re-skilling initiative. This will help provide incentive, but also ensure a transparent and efficient targeting mechanism of the selected beneficiaries, who will have to take part in the trainings to be eligible.

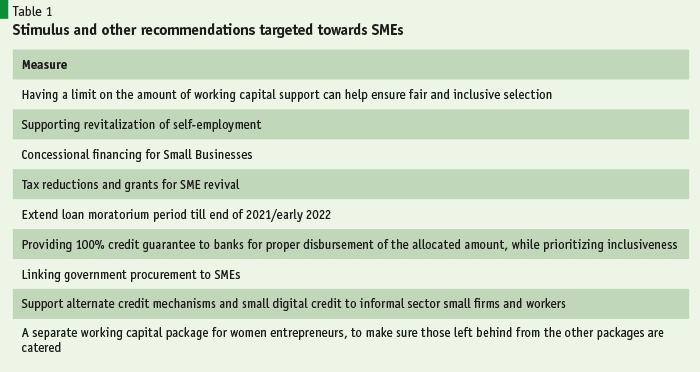

Small and medium firms

g. Having a limit on the amount of working capital support can help ensure fair and inclusive selection. In the USA, the loans disbursed are typically 2.5 times the applicant’s average monthly payroll costs. This helps maintain a fair system of allocation and inclusive use of the funds available, making sure medium sized firms do not take sole advantage of the allocated support to SMEs, while leaving plenty behind for the smaller firms.

h. Supporting revitalization of self-employment: A significant number of Bangladeshi working age population are engaged in self-employment activities. While many of them are micro and informal, hard to target through business support stimulus, there are many who operate self-employment activities through formal channels. Currently, the package does not include any support for such group. Several economic stimuli around the globe are offering such support e.g. USA providing deferral of social security tax, Singapore providing upto S$ 9000 over nine months to each such self-employed individuals. Cash and non-cash fiscal support for self-employed merits strong attention in order for the package to support this important group in the workforce.

i. Concessional financing for Small Businesses: Policymakers should support soft loans/working capital loan, so that SMEs are able to survive the crisis. Banks and financial institutions may sanction up to BDT 25 lacs to women entrepreneurs against personal guarantee. Entrepreneurs’ credit limit may be ranged from BDT 50,000 to BDT 50 lacs. However, current stimulus packages that are applicable through banks depend on existing relationships with SMEs, which many of the smaller players will lack.

j. Tax reductions and grants for SME revival: The Government can consider reducing the tax rate and offering grants to businesses in hard-hit sectors in an effort to help reduce costs and boost the bottom line. Moreover, specifically for SMEs, expenses for current and next fiscal year, exemption (or deferral) of withholding tax payments can be a timely initiative.

The Government can consider reducing the tax rate and offering grants to businesses in hard-hit sectors in an effort to help reduce costs and boost the bottom line. Moreover, specifically for SMEs, expenses for current and next fiscal year, exemption (or deferral) of withholding tax payments can be a timely initiative.

k. Furthermore, many entrepreneurs have noted that their lack of business relationship with the bank officials, have deterred them from availing the stimulus, whereas medium firms are breezing through the process. To ensure fairness and inclusive use of the funds, the above-mentioned guideline to only disbursed loans that are 2.5 times the applicant’s average monthly payroll costs, could be brought into play, similar to the US.

l. Extend loan moratorium period till end of 2021/early 2022. In the BUILD survey, an important support asked by most small entrepreneurs was to help ease the pressure of returning the loans, as many are still barely surviving and far from full recovery. As banks still have record-high liquidity, extending the period of moratoriums will not have much of a negative impact on their operations, but help provide necessary breathing space to small firms in such dire times.

m. A separate stimulus package for women entrepreneurs: For further effectiveness and inclusivity of the stimulus allocations, a separate package could be made for women entrepreneurs only. This will help ensure any of those left behind from the SME pool due to various operational and competitive reasons, are served separately, and promote inclusiveness and entrepreneurship. Women entrepreneurs serve an important function in Bangladesh’s robust development, encouraging many others, while providing employment to females which helps in their empowerment.

Other areas and overall

n. Make the current and future working capital support employment linked similar to the US: US’s paycheck protection program provides direct incentive for businesses to retain their employees and have a stable payroll. Large firms have survived and passed through the initial challenge thrown by the pandemic, due to generous support from the government and their own capability. Any future support must incentivize/ensure retainment of employees. The private loans at low rates of interest to pay for their payroll costs, rent, interest, and utilities may be partially or fully forgiven if employee counts remain unchanged, which works as a direct incentive for the firm to retain its workers.

o. Financing the Stimulus Package Through Concessionary Multilateral Borrowing and Re-allocation of Resources in GDP: The Government should seek at least $5 billion of financing from multilateral development partners such as the World Bank, IMF, ADB and JICA to ensure that its stimulus does not create a high domestic debt burden, which is usually more expensive than foreign loans. Bangladesh faces a low public debt to GDP ratio, which gives it some cushion to devise a stronger stimulus. Government must also reallocate resources from development budget by withholding and/or cancelling non-urgent development projects.

p. The policy makers should consider developing appropriate monitoring and feedback mechanism to constantly assess, and if necessary, adjust the design and implementation mechanics of the stimulus package. This is important as the pandemic scenario is still evolving, and so will the economic impact. Many adjustments will have to be made as and when we get clearer sense of the economic shocks. Inclusion of private sector and other relevant stakeholders from outside the government in such institutional mechanism will help policy makers receive timely feedback and pragmatic advice to strengthen effectiveness of the much-coveted stimulus package.

The policy makers should consider developing appropriate monitoring and feedback mechanism to constantly assess, and if necessary, adjust the design and implementation mechanics of the stimulus package. This is important as the pandemic scenario is still evolving, and so will the economic impact.

Garnering Broader Policy Support for Sustained Capacity and Competitiveness

Short-term

a. Maintaining a Budget Deficit of 7 – 8% for FY22 (and even FY23): The forthcoming National Budget will be prepared against the backdrop of two central uncertainties: {i} whether Europe and the US will experience a “V-shaped” economic recovery or not; {ii} in the backdrop of an apparent second wave in since early March 21, how the virus will itself unfold in Bangladesh over the next six months. Consequently, it is prudent to expect weak revenue mobilization performance in FY21 (and even FY22), which necessitates that the GoB relies on bold monetary policy initiatives to support critical fiscal expenditures, such as supporting SMEs, providing income transfer to the poor, and stabilizing the financial sector.

b. The Government can consider immediately starting the implementations of projects which are planned in the next 1-2 years. Although the structural pieces of the Padma Bridge have come together, there is still work to be done. Other infrastructural megaprojects like the Rooppur Nuclear Power Plant, Dhaka Mass Rapid Transit (MRT), Elevated Expressway could be completed faster with higher procurement, to help boost short-term employment and economic activity in those regions. The Government can also undertake new projects to help relieve the country of its infrastructure bottlenecks which has been a major constraint in the countries’ competitiveness.

c. The corporate and income tax rate could be lowered in the short-term, to kick-start investments’ momentum. High tax-rates has been a major constraint in promoting self-employment in the country, which functions as disincentives for many small firms from officially registering with the authorities and banking system. Thus, those firms have missed out from the government stimulus as they do not have the necessary documentation. Reduction of the tax rates will help the NBR to expand its collection pool as many small firms and unregistered businesses will deem it fair and voluntarily join.

d. Linking government procurement to SMEs: Allocating a specific proportion of government procurements from small firms will help provide a valuable market linkage while ensuring a sustainable working capital support and opportunities for learning and growth for the smaller firms, who usually do not have access to such channels. This will also further incentivize firms to register and enter into the formal economy in the medium to long term.

e. Alternate credit assessment and digital credit: Traditionally, large banks have controlled capital investments in Bangladesh. Most financial institutions have been reluctant to lend beyond large corporates. One prevalent reason is complexities associated with assessing the creditworthiness of SMEs. To address this issue -financial sector policy makers could consider introduction of digital methods of credit assessment and disbursement of loans. Many countries have successfully used mobile applications that help gather thousands of data points about a consumer and this allows one to assign a financial identity to an unbanked person, allowing mobile phone or gateway-based money lenders to lend them, often within five minutes of an assessment. Many successful examples now exist in Southeast Asia and in Africa including Philippines, Kenya, and Tanzania, which concerned authorities can explore.

Medium to long term

a. Although mitigating the social economic and humanitarian crisis caused by Covid-19 is of immediate utmost importance, the Government must not forget the fact that mitigating the impacts of climate change remains a long-term challenge for Bangladesh and its people. In line with this challenge, the Government should Promote investment in Green Finance and its infrastructure in technological, sustainability and climate change similar to Germany. The Tk500 crore allocated for startups could be directly linked to those start-ups with new ideas which are forward looking, and help in Climate Change Adaptation, Mitigation and Resilience, and environmental sustainability related clean projects. This can also help create a culture of climate change entrepreneurship and more projects, which can tap into the global Climate Change related funds.

b. Reviving dynamism in employment and exports, diversifying economic base, and provide the much-needed lift to the SMEs, enhancing private Investment, particularly FDI, will be critical: Bangladesh must capitalize on this emerging advantage of many investors contemplating expansion beyond China, and diversification of supply chain – but to do so it requires to put in place a targeted investment promotion strategy and its operationalization at the soonest. Countries such as Vietnam, Indonesia, India, and Philippines are all expected to put in a strong effort. This makes it imperative for Bangladesh government to prepare and position Bangladesh as a strong candidate for hosting the investors. This calls for quick and successful implementation of the reforms undertaken, preparing and implementing a targeted, time-bound, and focused investment promotion plan that will help identification and targeting of the investors group, outreach with Bangladesh’s value proposition, and putting in place an effective investors facilitation and after care process.

c. Improvement in Investment Climate: The business environment in Bangladesh is yet to support its vision for an upper middle-income country by 2021. Despite several recent reform initiatives, Bangladesh continues to secure lower positions in Global Doing Business rankings. In 2019, Bangladesh Enforcing contracts, getting electricity, and registering property remain the most problematic areas followed by trading across borders, getting credit, and resolving insolvency. Modernizing archaic laws such as Companies Act, Bankruptcy Act, improving government service delivery through establishing effective One-Stop-Shop (OSS), strengthening contract enforcement through introduction of Alternate Dispute Resolution (ADR) and faster disposal of commercial cases, and strengthening regulatory governance through the introduction of systematic tools such as Regulatory Impact Assessment (RIA), are some of the critical policy measures to improve the business operating environment of Bangladesh.

d. Strengthening Export Competitiveness : Developing broad-based global value chain capabilities through policy measures such as reducing average rates of protection and harmonizing tariff schedules across all intermediate and final goods, facilitating easier and faster imports for expor¬ters (e.g. through better functioning bonded warehousing schemes), introducing better standards and product market regulations, adopting a national environmental and social compliance framework for high potential export sectors and strengthening trade logistics, developing new ports such as Bay and Patenga Terminals to reduce customs clearance and transit times— are some of the areas where Bangladesh needs a renewed focus to diversify its export base and realize its missing potential.