Good Capitalism, Bad Capitalism

By

In the first two decades of the 21st century, capitalism has become the dominant economic system in the world and, yet, increasingly contentious. In one or another form, private enterprise, property, and markets are the central institutions of economic life worldwide except in one or two rare exceptions such as North Korea or DPRK. The other notable holdout, Cuba, has announced in February 2021 it will allow private sector activity in more than 2000 sectors, which is, more or less, its entire economy. The global sway of capitalism, however, is not without challenge. Rising inequality, unending wars, terrorism, an inadequate response to accelerating global warming, a disastrous financial crash 10 years ago that destroyed the jobs and savings of millions, and a slow recovery that excluded millions have led to widespread populist backlashes against this system. These backlashes have sometimes mutated into support for authoritarian politicians and economic nationalism. As if these challenges were not enough, a pandemic came out of nowhere in 2020 to cause widespread disease and death and knocked the global economy backward.

So, is capitalism good or bad? A good economist will reply: “it depends.” It depends, first, on what is the alternative to capitalism. As we just discussed above, the institutions of capitalism in one form or the other now dominate the world. There are not, at this point, different economic systems from which to choose. The one major exception to the global sway of capitalism, North Korea, is an economic disaster. The choice of the alternative then becomes a choice between good and bad capitalism.

The choice between these two, in turn, depends on how governments manage capitalists, regulate markets, provide essential public goods and services that markets cannot supply at all or supply adequately, and without which markets cannot function properly. When managed well, history makes it clear that capitalism is the most productive and creative economic system, one that has lifted the vast majority of the world population out of poverty in the last two centuries, more than 1 billion people in the previous 30 years alone. A free economy not only leads to prosperity, but it also supports flourishing democracies and human rights, as seen most brightly in Western Europe. On the other hand, if not done well, capitalism leads to deeply unequal societies and political capture by the economically powerful who use the State to advance their benefits excluding and suppressing the rest of the population. At its worst, capitalism has led to colonialism, the slave trade, dictatorships, fascism, and wars of unparalleled violence and destruction.

The rest of this article explores two related themes: first, what are good capitalism and bad capitalism? Second, what are the conditions under which capitalism can be good or bad?

Good Capitalism: The Benefits of Mixed Economies

It is useful to get some definitions clear. What is capitalism? First, the capitalist system is where private individuals, their privately or jointly owned companies and corporations own capital and produce most of the goods and services in the economy. Capital includes both physical – land, buildings, machinery, technology – and financial capital, i.e., financial assets that can command physical capital. Second, it is an economic system run mainly by markets where buyers and sellers meet voluntarily to exchange products, goods, and services. Buyers and sellers, mostly, freely carry out these activities without interference by the State.

There is no such thing as pure capitalism. Instead, what we have are mixed economies, where governments take an active role. In Europe and North America’s advanced economies, governments can tax as much as 35 to 45 percent of what the economy produces every year and spend even more through its borrowing from the private sector. They run more than a third of all economic activities, including providing vital public goods and services such as law and order, education, health, infrastructure, defense, etc. Second, critically, only governments have the authority to issue fiat money. Third, governments have the power to regulate private sector activity and use it extensively.

It is this mixed economy capitalism that has delivered unprecedented economic and social progress in the world in the last 200 years. To keep the discussion concise, let us focus on three related indicators of progress: people’s health, which is the most summary indicator of their welfare; second, their incomes; and third, their escape from poverty.

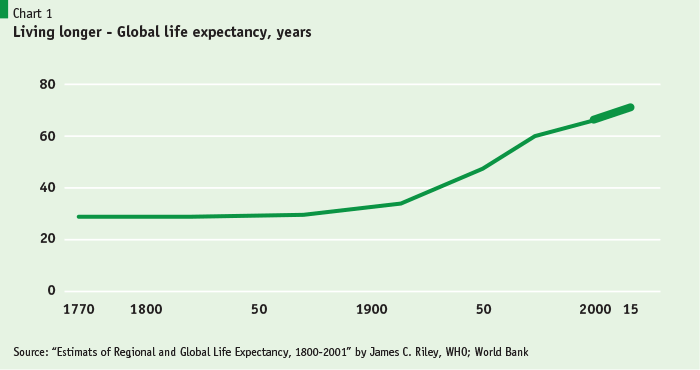

Take first the case of health. Perhaps the best summary measure of social health is population size: in the initial stages of development, when people become healthy and prosperous, populations grow. According to the US Census Bureau’s summary of research, the world population hung by a thread for most of human history: anywhere from 1 million at most a few million. Even after food supply became more reliable when agriculture came about 12,000 years ago, the global population was at best 10 million and increased very slowly. It took all that time since then to reach the 1 billion people at the beginning of the 19th century, when science, the industrial revolution, and capitalism began to reign. In the next 200 years, the world population has increased by more than seven times to reach 7.8 billion people. A related indicator is that, for most human history, average human life expectancy has hovered around 30 to 35 years until the beginning of the 20th century. Average life expectancy has since then more than doubled to 72 years in 2020.

Regarding income, Germany’s University of Groningen provides the best estimates of historical income levels by updating the late British economist Angus Maddison’s work. About 2000 years ago, the average per capita income in the world was generally uniform across civilizations at about $800-900 in today’s prices, and there it remained for 1000 years. Albeit imperial capitals and commercial centers such as Rome, Baghdad, Damascus, Istanbul, Delhi, Xian, and Beijing were much more prosperous. However, prosperity was concentrated in the elite and transient because a broadly based vibrant private sector could not emerge under absolute rule.

Incomes started rising in a sustained way only after the advent in Western Europe of mercantilism, the first age of capitalism, in the 17th-century. With its independent companies and joint-stock corporations, the birth of the scientific age, and the rapid growth of world trade, per capita income in Western Europe and America jumped to about $1300. The rest of the world stagnated.

Western Europe became more prosperous when the rest of the world stagnated because of enlightenment, rationality, science, and institutions that prevented despotic rule and allowed the private sector to flourish. However, there is a dark social and immoral side in the story of Western Europe and America’s rise during this period. We take this up in the next section.

In the event, at the beginning of the 19th century, when the first Industrial Revolution arrived, capitalism harnessed entrepreneurs, technology, and trade together in an explosive growth of productivity and rising incomes. Western and North American income crossed $2500. Latin Americans also joined the growth race soon. For most of the next 200 years, income and living standards mainly grew in North America, Western Europe, and Japan increasing to more than $40,000. East Asia joined that global capitalist trade from the 1960s, while the rest of Asia and Africa joined later. On average, world per capita income has increased by more than ten times since the Industrial Revolution.

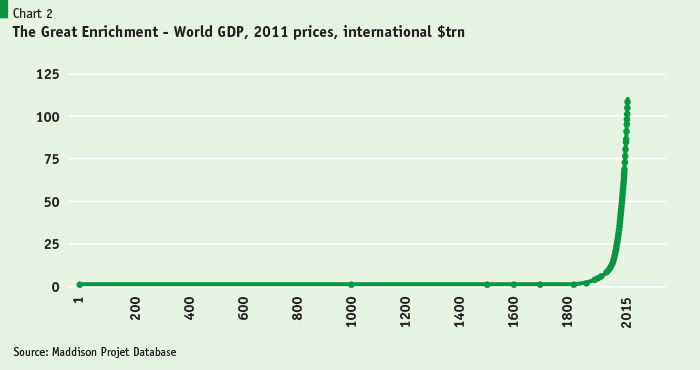

The explosive rise in per-capita incomes in Europe from early 19th century, 1820 to be exact from the potent combination of capitalism, entrepreneur and industrial revolution technology was enough to finally raise global GDP in an exponential way. As the diagram below shows, global GDP barely rose before the beginning of the 19th century – rising by less than 10 times from year 1 to year 1800. – i.e., a growth rate of 0.12 percent a year. Since 1800, however, aided by industrial revolutions, technological progress, world trade and a more educated labor force, world GDP has grown 234 times – i.e., a growth rate of nearly 2.75 percent p.a. That is, the world economy grew 22 times faster from the 19th century onwards.

The spectacular rise in incomes also enabled the great escape from poverty. Using the definition of extreme poverty threshold of a daily consumption level of $ 1.90, global poverty has declined from 80 percent of the world’s population at the start of the 19th century, to less than 10 percent in 2019. The decline in poverty has been particularly spectacular in the last 30 years, when massive economies such as China and India, and middle-size ones in Asia such as Bangladesh and Vietnam, joined global markets. About 1.2 billion people have escaped poverty in these Asian countries in the last 30 years, thanks to international trade and integration.

Bad Capitalism in History: War Capitalism

As noted, there is a dark social and immoral side in the story of Western Europe and America’s rise both during the mercantilist period that started in the 15th century and afterward. This period of the slave trade and brutal colonial expansion have been termed “war capitalism.” The traders and merchants of Portugal, Spain, and England took ruthless advantage of other countries’ institutional and technological backwardness to engage in a deadly, rapacious Atlantic Triangle Trade. They carried manufactured goods, primarily textiles, for sale in Africa, and on their return voyage, they purchased slaves from African and Arab slave catchers and transported them to the Americas. These European shippers transferred about 12 million slaves from West Africa to North America, the Caribbean, and the Spanish and Portuguese colonies in South America. Most of the slave trade was carried out by the Portuguese and the English. The estimate is that about 1.5 million slaves died during the voyage due to inhuman conditions.

However, care has to be taken to not conflate the rise of capitalism and slavery. Slavery is a far more ancient institution than capitalism. Second, the link between involvement in slavery and the slave trade, and success as capitalist power, is weak. Historically, Portugal, by far the most significant slave trader and colonies dependent on slavery, such as Brazil, also had the least success in capitalist development. The same applies to Brazil, where slavery persisted until the late 19th century.

Conversely, major capitalist powers such as Germany, Switzerland developed without connection to slavery. Other major European economic powers such as Holland and France played a relatively minor role in the slave trade. The French Revolution of 1789 banned slavery and made Africans citizens. While English shippers and traders in early capitalism took advantage of the slave trade, England ultimately took forceful actions to stop the slave trade in the early 19th century.

Finally, capitalism’s advance led to the abolition of slavery in most parts of the world. That happened through the war starting in 1807, when the British navy seized slave trading ships, and then again in the 1860s, when the industrial and capitalist northern states of the United States abolished slavery through a bloody civil war. It also happened because slavery is fundamentally antithetical to capitalism’s fundamental basis, the voluntary and free exchange of goods and services, including one’s labor. Slavery and serfdom are better suited for low-technology plantation agriculture than for urban industrial societies.

Capitalism’s role is more intricate in another dark history of this time: colonialism and the brutal suppression, and sometimes, extermination of indigenous people in the Americas. Early-stage capitalist development was fueled by searching for raw materials and minerals and the need to have markets. The logical end of this was the conquest and emasculation of the conquered economy – what Lenin summarized in his book’s title as Imperialism – the Highest Stage of Capitalism. Thus, the British East India Company had a systematic policy of destroying the world-famous Indian textile industry, especially those in Bengal; they also imposed ruinous taxation on farmers and forced them to cultivate commercial crops instead of cereals. A tragic outcome of this was periodic famines in Bengal starting from 1769, only 12 years after conquering Bengal. That ended with the 1943 famine, where between two to three million Bengalis perished. Another infamous example of colonial commercial rapacity was the Opium Wars. In 1839, the British East India Company waged war against China when its government, seeking to stop addiction, banned opium that the Company exported from India to China with significant profits.

The violence that accompanied colonial capitalism’s search for resources and markets led ultimately to the two bloodiest wars in human history, World War I and World War II. Germany and Japan’s interest in getting natural resources and colonies were perceived by them to be thwarted by the other capitalist powers. That led to the two wars that took nearly 100 million lives. Undoubtedly, Nazi Germany had more demonic, racial impulses. Still, they, too, were searching for colonies, what Hitler called lebensraum or “living space” for Germans, and the Caspian’s oil resources, that spurred the German offensive on the East.

However, the final word is capitalism’s prosperity depends less on war and colonies and far more on peace and global trade. The greatest prosperity in the world happened after World War II ended, when the global community set up orderly and liberal trading systems to peacefully accomplish the goals that colonialism sought to achieve by war. Measured by global average per-capita income increase from 1400, more than 80 percent of average per capita income growth has taken place since World War II (De Long, 1998) after the end of the age of colonialism. The ability to redesign capitalism after World War II has led to an unprecedented increase in prosperity without the need for colonies and wars.

Measured by global average per-capita income increase from 1400, more than 80 percent of average per capita income growth has taken place since World War II (De Long, 1998) after the end of the age of colonialism.

Technology or Capitalism?

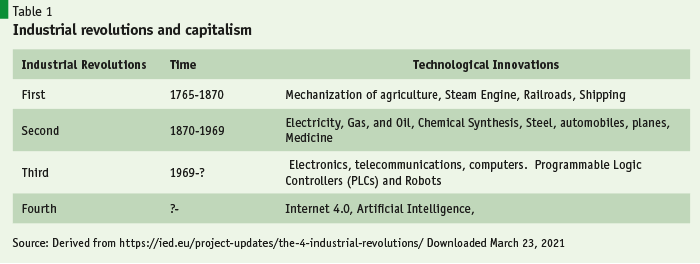

How do we know that capitalism, and not technology, enabled explosive income growth, poverty reduction, and global prosperity? That fact is a series of industrial revolutions (see Table 1) created a tremendous burst of productivity under capitalism from the late 18th century to our current period.

History answers this question in a relatively straightforward fashion. Technological advances have taken place earlier, even in ancient times – long before the birth of capitalism. During the Roman empire, Alexandria of Egypt was the center of mechanical innovation. As economist William Baumol writes, “by the first century B.C. , that city knew of virtually every form of machine gearing that is used today, including a working steam engine. But these seem to have been used only to make what amounted to elaborate toys. The steam engine was used only to open and close the doors of a temple.” Another example is the watermill, the first revolutionary energy-saving technology of its time, also invented in the first century. However, evidence suggests this technology was first used several centuries later and was most widely used a thousand years later, from the 11th to the 13th centuries.

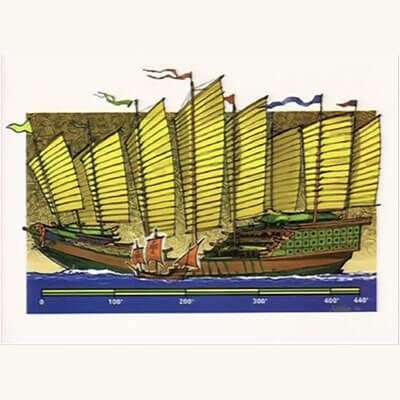

The most dramatic examples of unexploited available technology come from China. As widely known, for most of world history until about 500 years ago, China had the most advanced technology in a wide range of areas: paper, (perhaps) the compass, waterwheels, sophisticated water clocks, and gunpowder. Less well known is China’s prowess in maritime technology. The ships of 15th century China’s Muslim-born Admiral Zhang He, which sailed nearly a century before Columbus, were almost five times larger than the ships Columbus sailed, as depicted in the diagram.

Not only Admiral He’s ships, his fleets, too, were far larger than anything European powers could mobilize at that stage. He commanded a fleet of 317 ships carrying 28,000 crew members during the first expedition in 1405. During his seven voyages, his fleets visited Brunei, Java, Thailand in Southeast Asia, India, the Horn of Africa, and Arabia, dispensing and receiving goods along the way. Compare this to the three small ships of Columbus and less than 100 crewmen who sailed for India, but instead discovered America.

But then the unimaginable happened, the next Ming dynasty Emperor stopped the voyages during his short reign because he did not see any value in China having contact with the wide world. So, the voyages of the Chinese fleets ended, and, at the Emperor’s orders, the ships were deliberately destroyed or left to rot.

Thus, historian Balazs writes that “what was chiefly lacking in China for the further development of capitalism was not mechanical skill or scientific aptitude, nor a sufficient accumulation of wealth, but scope for individual enterprise. There was no individual freedom and no security for private enterprise, no legal foundation for rights other than those of the state, no alternative investment other than landed property, no guarantee against being penalized by arbitrary exactions from officials or against intervention by the state”. In sum, China could not use its technology to bring sustained economic prosperity and growth for its people. The absolute and despotic rule of Chinese emperors prevented the rise of an independent commercial class and entrepreneurship that could use this technology to increase productivity.

The highly centralized communist experiments in the Soviet Union, China, and Vietnam provide profound lessons in our time. These countries did a magnificent task in providing basic needs to the people and even became victorious military powers. The Soviet Union defeated Nazi Germany, Mao’s China’s defeated the far larger forces of right-wing Kuomintang, and Vietnam defeated, one after the other, three imperial powers: Japan, France, and the United States. Ultimately, however, despite having access to the best technology and tremendous organizational skills, their centralized command economic systems failed to grow and bring prosperity. When China and Vietnam adopted markets and private sector-led economies, i.e., mixed-economy capitalism, spectacular success followed in the growth of income and poverty reduction.

Why Mixed Economies Work – Adam Smith

What enabled mixed economy capitalism to achieve these results? Interestingly, the fundamental insights still come from Scottish moral and political economy philosopher and University of Glasgow Professor Adam Smith. His history-altering work, “An Inquiry into the Wealth of Nations,” was published in 1776, the same year as the declaration of American independence. While Smith was fully aware of altruism’s moral benefits, he suggested that economic welfare was best achieved when human beings pursued their own interests. In his famous words, “It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest.” Second, he pointed out that productivity increased manifold when there was a division of labor. It is common sense to understand that everyone cannot produce everything. But Smith went beyond that; citing the example of a pin-maker, he suggested that specialization in tasks of even such a small manufacturer increased productivity.

Whereas single generalist, operating without specialised equipment, “could scarce, perhaps, with his utmost industry, make one pin in a day, and certainly could not make twenty,” employing 10 specialists the factory could be producing 48,000 pins a day. Fourth, there was his unifying insight of the “invisible hand” of competitive markets that would coordinate economic activities. Much of modern economics’ task has been to extend and drill down rigorously into the ideas of Smith, rightly regarded as the founder of economics.

Although Adam Smith was a champion of markets, he was more cautious about capitalists. In the Wealth of Nations, Smith warned that, given an entirely free hand, merchants would be driven by “mean rapacity,” use “interested sophistry,” and build “oppressive monopolies.” He was concerned about inequality: “whenever there is great property, there is great inequality.” Further, Smith, the advocate of the division of labor, was deeply concerned that such division of labor and repetitive work in a factory may lead to “the torpor of his mind” and “be at the expense of intellectual, social, and martial virtues” of workers. He was aware of the plight to which the laboring poor would “necessarily fall, unless government takes pains to prevent it.” And how to prevent it? By providing compulsory State-supported education, especially for poor children.

Smith’s appreciation of the State’s critical role was not merely academic. As the former Commissioner of Customs for Scotland, he helped raise Britain’s revenues. It is worth mentioning that Great Britain was the leader in tax collection throughout most of modern economic history. Two hundred years ago, the British government collected 11 percent of national income as taxes, more revenue than what Bangladesh collects today.

The fundamental insights of Adam Smith have tested well in history. Capitalism works when institutions adequately govern it by providing justice, law and order, good public education and health, infrastructure, and regulations to support well-functioning, competitive, free markets.

Capitalism works when institutions adequately govern it by providing justice, law and order, good public education and health, infrastructure, and regulations to support well-functioning, competitive, free markets.

Corrections to Capitalism and Market Failures

What did Adam Smith miss? He missed how capitalism would need well-functioning cities. Capitalism had led to rapid urban growth; the share of the world’s population living in cities has increased from 8 percent in 1800 to 53 percent today. Writing his opus in the age of mercantilism, at the dawn of the first industrial revolution, Smith did not foresee the explosive productive power of the first, second, and third industrial revolutions in the next two centuries. These technologies would give birth to the large and massive-scale factory production that would create cities not just as marketplaces but also as production centers. Modern economics goes further – It recognizes the importance of cities as more than the location of production: it sees cities as unleashing the productive power of agglomeration of industries, workers, and people. By bringing people and firms together and creating economic density, cities create not only efficiencies of large-scale production attracted to large markets but also knowledge, exchange of ideas, and cultural riches.

However, cities are not naturally created by markets. Developing and managing thriving cities requires high-quality urban planning, infrastructure and public services, and coordination. They need good local governance to carry out these activities. Because these elements in most emerging market economies are missing, urban development and good capitalism fail to be achieved. Nearly 1/3 of the world’s urban population live in slums, often lacking essential public services such as drinking water, schools, healthcare.

Further, these cities often fail to provide the most essential ingredient, jobs. That is, not enough investment takes place in the cities to create good jobs. Much of the migration into these cities happens because of “push” factors, out of distress, instead of “pull” factors that draw workers into cities because jobs offer higher wages. As a result, in recent decades, urban growth in South Asia and Africa have been accompanied by high urban poverty. Unless governments can provide effective local governance and leadership to develop cities properly, capitalism will not deliver its benefits.

Modern economics, expectedly, also has a much deeper understanding of what it calls “market failures” that lead to inefficient and unjust outcomes and “bad capitalism.” In these cases, the government needs to step in to correct these failures.

First among these failures is when markets fail to balance supply and demand at the national level. When demand for goods and services falls below supply, national income falls, and the economy goes into recession. Demand can decline due to a range of factors: fall in earnings from exports and remittance; increase in interest rates driving investment down; the falling value of assets make consumers feel poorer; and, most broadly, because consumers and investors lose confidence and cut back on spending. All this sets into motion a downward spiral of incomes and employment: producers cut down production, decrease their demand for raw materials and intermediate goods, and lay off workers. Because income falls, there is then another round of decline in demand. The most extreme example was the great depression of the 1930s that swept through the United States and Europe, sometimes leaving one in four workers jobless. Even before the great depression, recession and the cycle of booms and busts were frequent occurrences causing unemployment and suffering. British economist John M. Keynes’s seminal contribution was to point out that the Government’s task during a recession is to raise expenditures to stimulate demand and the economy.

However, it is important to stress that this problem of falling demand and excess supply is mainly a problem of higher-income and upper-middle-income economies with excess capacity. For lower-income economies, the challenge is to adequately save and invest in humans and physical capital to raise capacity. Only by doing so can these countries increase the ability to supply goods and services for their population.

A second critical failure is that markets fail to account for how their transactions affect third parties and society. Thus, leather manufacturers can profit by making their customers happy; but if they do not treat their waste and contaminate the water supply, the community suffers. Broadly, this explains capitalism’s grand failure to curb pollution and damage to the environment. Another example, from the positive side, is that education and good health benefit not only individuals, but also society at large. Because markets, per se, cannot value this, the private sector can never provide education and health care to the extent society needs, and the government must step in to provide these public goods.

Modern economics also appreciates the profound importance of information and knowledge and how access to them determines market outcomes. On one side, this insight is precisely the reason decentralized markets work so well. Because the market processes an inconceivable amount of information every hour it works, centralized bureaucracies and governments – even with all the Computing Power at their disposal – can perhaps never successfully replace markets. In the 1970s and 1980s, when computing power was growing, some economists thought that maybe computers could play the role of markets in a socialist economy. That hope or fear, depending on the point of view, proved to be wildly inaccurate.

This insight, however, also leads to the third market failure: When access to information is unequal, i.e., sellers know more than buyers, or vice versa, then one of the parties can become victims of fraud. And if parties are aware of that, markets will have fewer transactions and, in the extreme, even become “missing.” That is why policies are needed to ensure greater transparency and access to information in markets.

The fourth market failures arise out of the human inability to protect their interests in market transactions. This inability may arise out of what has been called the mental “bandwidth” problem. It is most obvious in the case of economically struggling people who can be too harried to have the ability to make the right decisions, such as people struggling to pay the rent, educate their children, and even find drinking water, as it happens in urban slums. In that case, they will be too distracted and unable to bargain correctly with their customers, landlords, or employers. Wealthier people engaging in a complex financial or legal agreement may be unable to understand the fine print. The second kind of human inability arises from psychological weaknesses that can make them victims of private-sector greed: viz. through the sale of tobacco, liquor, and drugs. Public policies are needed to make corrections in these cases.

Fifth, market failures occur when market capture by large businesses, oligopolies, and oligarchs leads to less competition and lower efficiency. Advanced capitalist countries employ a host of regulations to guard against collusive and monopolistic practices. Laws and agencies protect against anti-competitive practices and mergers and acquisitions of firms to prevent market dominance. The United States, the heartland of capitalism, even has a history of trust-busting and breaking up the large railroad, steel, and banking corporations since the late 19th century. Even in the last few decades, it has broken up mammoth entities such as IBM, AT&T, and Microsoft. Even so, the concern is growing in the United States about growing dominance of large corporations. Recent research, summarized by economist Thomas Philippon in his insightfully titled book The Great Reversal: How America Gave Up on Free Markets, shows how market concentration – the share of markets captured by a few firms – has dramatically increased in critical sectors in the United States. He further documents how this decreased competition in critical sectors has led to more expensive services and, unsurprisingly, markedly lower and declining investment rates in the last 20 years to almost half of what they were in the 40 years between 1960-2000. Instead of investing, large corporations are using their high rates of profits to buy their stocks (stock buybacks) to drive up the prices and the earnings of both shareholders and management.

Finally, unregulated capitalism and markets do not guard against extreme inequality. A certain amount of inequality is necessary: if markets did not reward hard work, education, savings, investment, and risk-taking by investors, there would not have been the economic progress the world has seen. However, if wealth and capital are too unequally distributed, to begin with, markets can quickly increase inequality. As that has harmful consequences for social stability and economic performance, governments use tax, spending, and welfare policies to reduce inequality.

Good Capitalism and Democracy

Modern economics also has a better understanding of political economy and rent-seeking. Capitalists will try to use state power to their advantage – and extract excess, “monopoly” profits and rents, when possible. Because industrialists’ power was unchecked during the early industrial revolution in England, working people – from young children to the aged – worked in dreadful conditions in factories and mines. It fell upon the German Friedrich Engels, then managing his family’s factory there, to write about this in the The Condition of the Working Class in England and draw Karl Marx’s attention. The rest is history.

To paraphrase Adam Smith, it was not to the benevolence of the capitalists we owe the progressive, shared benefits of capitalism that we best see in Western Europe. Instead, we owe it to the political and social uprising and revolutions that swept across Europe and the USA in the past two centuries. We also owe it to the rise of the powerful working class, trade union movements that persisted through the 20th century and sometimes exercised political power through revolutions or the ballot box. Only these countervailing powers of working-class and trade union movements and state intervention on their behalf enabled the gains of capitalism to be shared widely. Fascinatingly, this historical perspective is also found in the writings of American Nobel Laureate Simon Kuznets, the father of the much criticized but indispensable national income accounting methods.

This history leads us to the profound linkage between good capitalism and democracy. Capitalism works best when governed by political competition and democratic rights of the people. The people’s needs are best met when they have a voice in choosing accountable governments and policies at both the national and local levels. Such a system can ensure over the long run that the benefits of capitalist prosperity are widely shared. And in a virtuous cycle, when the benefits of capitalism are shared, democracy is also most robust and sustainable.

On the other side, there is a vicious cycle that connects bad capitalism and authoritarian rule. When the capitalists have too much power through the “elite-capture” of the state, capitalism’s benefits are not widely shared. Moreover, such “elite-capture” often degenerates into crony capitalism and rent-seeking. Instead of investments to increase productivity, capitalists focus on obtaining favors and extracting wealth and rent from the country’s natural resources and public funds. Ultimately, however, the only way for such inequality and rent-seeking to sustain itself is an authoritarian rule. But there is a fundamental conflict here: authoritarian and dictatorial rule, by its very nature, weakens justice, erodes the rule of law, creates conflict and uncertainty. Private enterprises cannot thrive under such conditions. Capital and people flee, economies and societies stagnate. That is the story of large parts of the developing world.

That is why while many countries can become middle-income countries, very few countries – only 15 in the last 60 years – manage to become a high-income country. The rest fall into the middle-income trap. Because these countries could not build the institutions of competitive markets and accountable governments, they stagnated and sometimes even regressed. In 1900, Argentina had about the same per capita income as France, Germany, and a tad less than the United States. The other countries became global economic powers. Argentina, which failed to escape the grip of its capitalist oligarchs and landed elites, fell far behind.

…while many countries can become middle-income countries, very few countries – only 15 in the last 60 years – manage to become a high-income country. The rest fall into the middle-income trap. Because these countries could not build the institutions of competitive markets and accountable governments, they stagnated and sometimes even regressed.

Good Capitalism: The End of History or Profound Challenges?

In 1992, American political scientist Francis Fukuyama wrote his book “The End of History and the Last Man.” The Berlin Wall had fallen, and the Soviet Union had disintegrated, and “communism” collapsed. So, Fukuyama rashly sanguinely suggested that human beings’ ideological journey had ended with the triumph of Western liberal democracy and, by implication, market capitalism. The never-ending wars of the last two decades, the great financial crash of 2008, the rising tide of authoritarian – populist – economic nationalism, and the continuing ravaging by the coronavirus pandemic has made clear how premature and rash Fukuyama’s expectation had been.

Human society and its predominant economic system, mixed-economy capitalism face profound challenges. This article is not the place to delve into these in-depth. But perhaps their listing can be helpful.

Some of these challenges are well known. First, human beings now face major natural disasters that are mainly human-made, or what scientists call anthropogenic in their origins. These include global warming-induced climate change that will increase extreme weather events: tornadoes, floods, sea-level rise. That will be happening because of the “mother of all market failures,” the inability of governments across the world to cooperate and implement policies to limit carbon emissions. That may remain the most existential challenge. A second natural disaster challenge will arise from pandemics: human encroachment into natural and animal space has been too intrusive. One recent estimate is that between 631,000 and 827,000 viruses exist in nature that could make the zoonotic leap to humans.

On the economic front, there are at least three significant challenges. The first major challenge will be to sustain the last few decades’ progress in reducing poverty and raising incomes in developing countries and reducing international inequality. A related challenge will be to reduce inequality within countries where it has markedly increased in the last few decades, including countries such as the United States and China. Meeting these twin challenges will require appropriate domestic policies and institutions that encourage investment, job creation, productivity growth, and more equitable income and wealth distribution. However, as the second step, providing these elements will also require restoring international economic cooperation. That brings us to the second challenge.

The second challenge will be to preserve and strengthen global and regional economic cooperation institutions that encourage the exchange of goods and services. These institutions have frayed after the great financial crisis of 2008 and the anti-globalist, populist economic nationalist political movements in different countries. As a result, reversing the trend of decades, the growth of trade has decelerated. In the developing world, there needs to be the realization that increased globalization, trade and export helped raise income, and reduce poverty and global inequality in an unprecedented way. If international trade had been more open, allowing higher agricultural exports from developing countries to the wealthier advanced economies, there would have been more prosperity and poverty reduction. The advanced economies need to appreciate the gains they obtained from trade and migration of skilled and unskilled labor to their economies. They need to make more public investment in their own labor force’s education and skills to meet the challenge of higher technology and global competition.

The third challenge will be in labor markets arising from the increased use of artificial intelligence (AI) and robotics in economic activity. Historically, more productive labor-saving technology has created far more productive jobs than the less-productive jobs it eliminated. Economists, generally, tend to be sanguine expecting that the past will be repeated. The scientists, more aware of the implications of AI, are less optimistic. Never have estimates of job losses been so dire. The most widely cited McKinsey estimate is that between 400 million to 800 million jobs will be lost globally by 2030. That is, AI will eliminate between 10 to 20 percent of the current global jobs of 4.5 billion. In the United States, the estimate between 16 and 54 million jobs will be lost compared to the existing workforce of 160 million. In Bangladesh, a government-a2i-ILO study projects job loss of about 5.4 million between now and 2040 compared to the current labor force of nearly 60 million.

While these estimates suffer from a lack of benchmarks and counterfactuals, there should be little doubt that significant job losses are likely to occur in the global labor market. That will compound the already precarious situation of more than half a billion underemployed and working poor. Under business as usual, that shock of the large influx of jobless would create a deprived underclass population that will have either withdrawn in despair or be seething with resentment. Not only that, the owners of artificial intelligence and robots will have all the bargaining power over employed workers. Such a scenario can become a violent dystopia.

Another way to look at the impact of AI is that it presents an opportunity, as Bill Gates argues. There will be a massive increase in the labor productivity of workers. The challenge will be to find social systems that can share this productivity gain equitably. One way to achieve this could be to use the current German practice of work-sharing among workers. Another could be to provide shares of public ownership of these highly productive but probably privately managed corporations. Providing universal basic incomes, health care, and adequate pensions for the elderly can be other ways to spread the gains. In this better-arranged world, people with more leisure in their hands could be encouraged to take up creative pursuits or learn and improve their skills through continuing education.

Meeting these goals will require significant institutional rearrangement. Some elements are likely to include more proactive, entrepreneurial, and incentivized state and local governments that bridge workers, firms, employers, and communities. An encouraging thought is that local governments have traditionally played these roles worldwide until countries became more centralized. More recently, local Governments in some East Asian countries continue to play these roles energetically. Second, workers’ political and economic strengths will need to increase, especially in the Anglo-American world where decades of Reagan-Thatcher market extremism have emaciated workers’ power and organizations while providing excessively generous latitude to management and stockholders. Here, in addition to strengthening collective bargaining powers, workers could be made welcome to sit on corporate boards and provided ownership options. A third element will be to boost community and civil society organizations and empowering them with government oversight and “caring economy” – the care of the elderly, the disabled, and the children – responsibilities. These are requirements at the country and community levels. However, as noted earlier, the primary organizational rearrangement needed to meet the profound challenges facing capitalism will be to strengthen the incentives to cooperate and coordinate internationally.

The author, previously a Dhaka University faculty member and a World Bank economist, thanks Prof. Adnan Morshed and his students at the Catholic University of America for inviting him to make some remarks from which this article is drawn. He also thanks the New Age newspaper for publishing an earlier, shorter version of this article. He can be reached at Ahmad.Ahsan@caa.columbia.edu.

References

Balazs, Etienne (1964). Chinese Civilization and Bureaucracy: Variations on a Theme. Yale Univ. Press,

Baumol, W. J. (1990). “Entrepreneurship: Productive, Unproductive and Destructive”, Journal of Political Economy

Coggan, Philip (2020). More: The 10,000 Years Rise of the World Economy, The Economist

De Long, J. Bradford De Long (1998). “Estimates of World GDP, One Million B.C. –

Present” Department of Economics, U.C. Berkeley http://econ161.berkeley.edu/

Engels, Friedrich (1845, 1887). The Conditions of the Working Class in England

Fukuyama, Francis (1992). The End of History and the Last Man, Free Press

Jacobs, Jane (1985). Cities and the Wealth of Nations: Principles of Economic Life, Vintage

Lenin, Vladimir I. (1917). Imperialism the Highest Stage of Capitalism

Norman, Jesse (2018). Adam Smith: Father of Economics, Basic Books

Philippon, Thomas (2019). The Great Reversal: How America Gave Up on Free Markets, Harvard

Rajan, Raghu (2019). The Third Pillar: How Markets and State Leave the Community Behind, Penguin

Smith, Adam (1776, 2000). The Wealth of Nations, Modern Library Classics

Svern, Sven (2014). Empire of Cotton: A New History of Global Capitalism, Penguin

Tirole, Jean (2017). Economics for the Common Good, Princeton

Mimeo, Policy Research Institute of Bangladesh (PRI).