NAVIGATING AN ECONOMY ON EDGE: State of the Bangladesh Economy

By

Defying a Perfect Economic Storm

From the start, the year 2023 was beset with macroeconomic challenges of the worst kind. The troika of macro indicators – inflation, exchange rate and foreign exchange reserves – showed signs of volatility that lasted for much of the year and remained unresolved, albeit on the mend. The long period of macroeconomic stability, both internal and external, that characterised the Bangladesh economy for over twenty-five years seems to have petered out in 2023. Challenges have emerged on multiple fronts: a spike in domestic prices of essential food products, depletion of foreign exchange reserves, massive exchange rate depreciation, deficits in the financial account of the balance of payments (BOP) resulting in overall BOP deficits, conflicts in fiscal and monetary policy coordination in taming inflation and so on.

This is nothing short of a perfect economic storm for the Bangladesh economy, unprecedented in scope and intensity of the problems. Add to that the cloud of political bickering interspersed with often violent disruptions to production and overall economic activities via hartal and aborodh that preceded the January elections. An undercurrent of uncertainty looms on the horizon. The economic ramifications of the combined effect of these developments could not be more acute and wide-ranging. Such confluence of political and economic challenges in a trade-integrated middle-income economy like Bangladesh breeds capital flight, of which there are many indications.

That said, this is hardly the time to give doomsayers the upper hand. On the positive side, we have the Padma Bridge – the longest river bridge in the country – now in full operation (rail and road links), implemented within a reasonable time frame and cost. The first undersea tunnel in South Asia – the Bangabandhu Tunnel in Karnafuli – is now open to traffic, a project that was completed in record time. Dhaka Metro Rail now links Uttara with Motijheel slashing travel time to 31 minutes in place of 2-3 hours typical journey on a Dhaka workday. Finally, the country is now fully connected – East, West, North, South – by road network, with full rail connectivity imminent. These transformative megaprojects and more that became operational in 2023 will have game changing impacts with profound efficiency dividends – in terms of time and cost reduction –for the society and economy. Precise quantitative estimates will have to be worked out but suffice it to say that it will be substantial and could add up to 1% to GDP growth over the medium- to long-term.

Our history is replete with disruptions of hartal and aborodh kind – even worse –that were eventually overwhelmed by positive forces that ensured the continuation of the steady-state momentum of a growing economy. These are outmoded approaches to political resistance that can no longer be effective means of disrupting the wheels of a dynamic economy. The resilience of the human spirit runs through our economic corridors to sustain the onward trajectory of progress, not decline. History of the past fifty years is a testament to the unbound survival spirit of Bangladeshi people. The country, its people and the economy are on an advancing path. There is no scope for going back.

Global Economic Outlook and Deglobalising Trends

The world economy is experiencing a geopolitical firestorm, with two regional wars raging with full fury, while the world economic order gets increasingly fragmented into regional or allied groups. Particularly over the past 30 years Bangladesh’s economy has become increasingly more integrated with the global commodity and financial markets. Trends in the global economy therefore leave a significant imprint on the domestic economy – through domestic prices, export performance and movements in exchange rate and balance of payments. The latest IMF assessment of the near-term outlook signals a ‘soft landing’ rather than a recession in developed economies that matter. Nevertheless, there are strong indications that the international trading system of the past 75 years is under attack. And the immediate casualty is its ‘efficiency dividend’.

Developments in the global economy over the past year did not leave much to cheer. After an initial period of supply chain disruption following the outbreak of the Russia-Ukraine war, commodity prices moderated somewhat but volatility remains. The evolving geopolitical scenario signals the reconfiguration of global alliances with a significant impact on the world economic order that has prevailed for the past 75 years. Vulnerabilities and uncertainties in the world economy appear ascendant with the sinister rise of economic nationalism, unilateralism and protectionism in those countries that were the original protagonists of free trade and globalisation. The glossary of economic terms is being enriched by newly coined expressions like ‘homeland economics’, de-risking, reshoring, friend-shoring, strategic autonomy, and the like. In essence, these are expressions to describe the emerging trend toward greater protectionism as more and more developed economies resort to ‘industrial policies’ with various forms of competing support or subsidies to domestic production. Finally, there is the US-China decoupling scenario gathering momentum by the day which promises to leave a fractured world market under a de-risking scheme of ‘China+1’. The principal casualty is the efficiency dividend of globalisation and its pivotal offshoot – global value chain (GVC) integration. Trade multilateralism is under threat like never before since the creation of the post-war economic order.

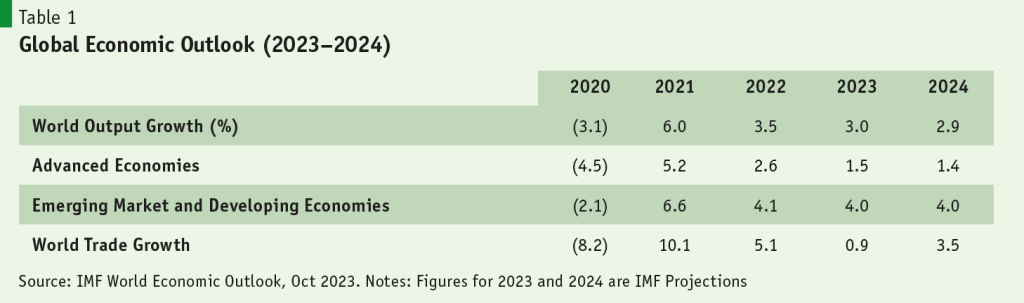

The most eagerly watched indicator of the global economy comes out of IMF’s World Economic Outlook (WEO) which is regularly updated roughly twice every year. Coming out of the recent IMF-World Bank meetings in Washington the latest edition of the WEO gave us a flavour of what is to come in the world economy in the year 2024, after a rather muted assessment of the 2023 world economy. What is clear is that the fast-paced recovery from the Covid-19 pandemic blowout is petering out with prospects of slower growth in the current (3%) and next year (2.9%). The projections remain below the historical (2000–2019) average of 3.8%. The slowdown appears to be more pronounced for developed economies than for developing and emerging market economies (Table 1). However, what appears to be most disconcerting is the rate of trade growth which appears to have plummeted to 0.9% in 2023 but is expected to pick up above world output growth in 2024. That is a good sign for Bangladesh’s export prospects.

Thankfully, IMF assessment suggests that inflation-related policy tightening in major economies is only leading to a ‘soft landing’ without the much talked about impending spectacle of recession in developed economies. Finally, the rise of Asia is noticeable with roughly one-half of global growth now accounted for by Asian economies.

For the Bangladesh economy and its export prospects, global output growth of around 3% should not be a matter of much concern as our export performance remained resilient throughout the recovery period following the global financial crisis (GFC-2008) when growth was well under 3% for nearly a decade. Bangladesh’s share in world apparel exports is at 8%, but miniscule in case of non-RMG exports. Slower growth in OECD countries may only marginally impact RMG demand which should be compensated by redirection of orders away from China. Demand for our non-RMG exports (barely 16% of our export basket) should remain unaffected provided export diversification measures are actively implemented. What is more concerning is the persistence of inflation (albeit lower than in 2022) and prospects of interest rate hikes in major economies where the saying goes that interest rates are going to be ‘higher for longer’. In addition, if all the actions towards China decoupling and homeland economics protectionism come to roost this could result in inflation being ‘higher for longer’, that might not augur well for the world economy nor for developing economies like Bangladesh.

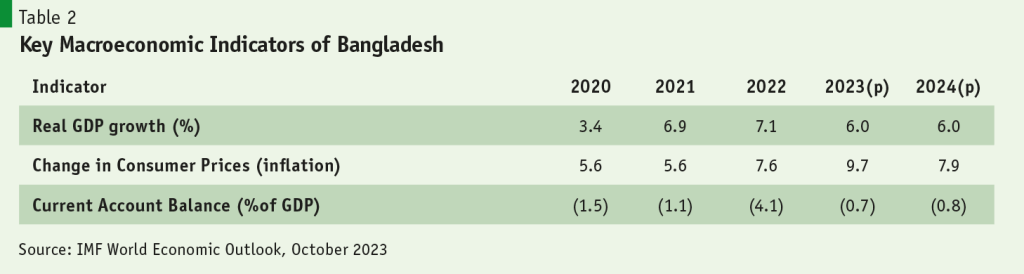

IMF’s latest WEO also makes assessment and projection of key macroeconomic indicators of the Bangladesh economy (Table 2), where growth projections appear significantly below official estimates, but inflation and balance of payments data are consistent with official figures.

Only BBS has the capacity and paraphernalia for estimating national accounts and determining official figures of GDP and its growth rate. Nevertheless, leading multilateral agencies maintain the practice of making estimations and projections based on whatever high frequency macroeconomic and sectoral data is available in Bangladesh. Their estimates are still useful (with significant margin of error) as guidance about the state of the economy and its overall performance in the global context. BBS has recently announced that it has experimentally computed quarterly GDP estimates for the last five years, as one of the commitments under the IMF credit program. Once finalised, this would fulfil a long-felt need for more credible annual GDP estimates.

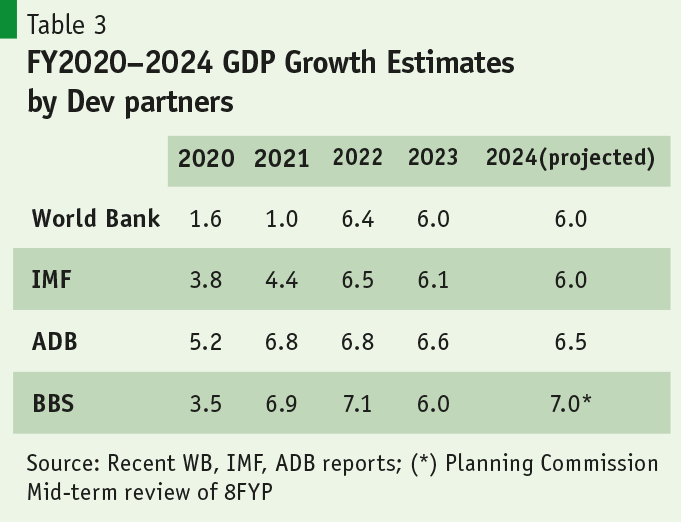

Given the backdrop of moderate growth in the global economy, leading multilateral agencies, WB, IMF, ADB, made growth projections for FY2023 that are close approximations of the official estimate of 6.0%, though projections for FY2024 diverges from the BBS official estimate (Table 3). ADB appears to be most optimistic during the current period (FY2023–2024) while official estimates for FY2024 were revised downwards to 7.0% in the mid-term review of the 8th FYP in light of prevailing macroeconomic challenges, particularly the impact of import compression practised by Bangladesh Bank to restore BOP stability and defend foreign exchange reserve position.

Bangladesh Economy FY2023

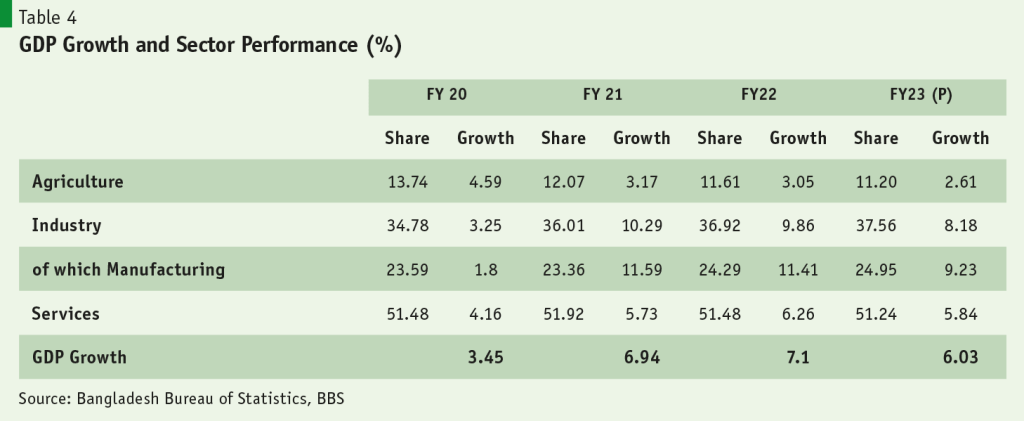

Since the years of heady growth which spiked at 8.1% in FY2019, GDP growth has moderated since the downward shock of Covid in FY2020 when Bangladesh economy was among few economies that experienced positive but historically low growth of 3.5% (Table 4). After the strong post-Covid recovery produced GDP growth of 6.97.1% in FY2021–2022, in view of the aftermath of Russia-Ukraine war FY2023–2024 growth has been officially estimated at 6-7%, although development partners are less optimistic about 7% growth in FY2024, given the political climate and prevailing mismanagement of the macroeconomic and balance of payments challenges.

Manufacturing, export-oriented manufacturing in particular, is a key driver of rapid growth. Manufacturing growth rate, in the double digits for FY2021–2022, is expected to moderate in FY2023 to 9.2%, resulting in lower but decent GDP growth of 6%, a rate that leading multilaterals also find acceptable in their projections. We are waiting with bated breath to see the latest BB measures to become effective to rope in remittance through formal channels, exchange rate volatility tapering off and official foreign exchange reserves stabilising at comfortable levels and domestic inflation moderating. Only then can we expect GDP growth rates of 78% to resume.

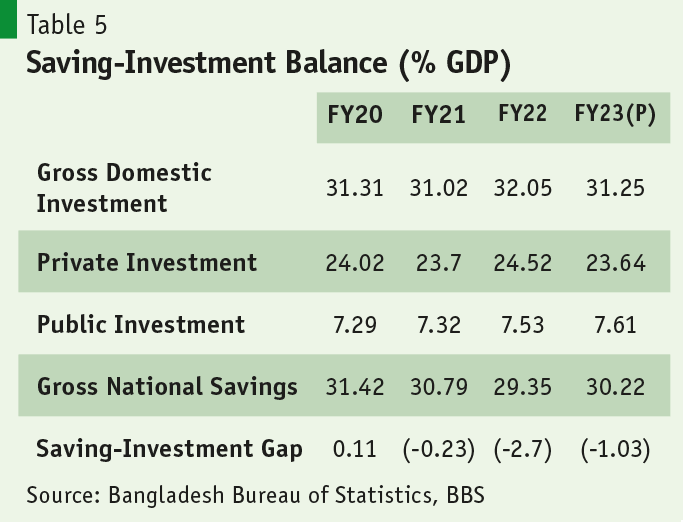

Growth in the Bangladesh economy is still driven by investment, not consumption. Higher growth requires higher investment, both private and public. GDI has been hovering around 31% of GDP (Table 5) which is barely enough to generate GDP growth of about 7%, given an incremental capital-output ratio (ICOR) of around 4.5. So higher growth will require boosting investment rate to 35-36% on a sustained basis, which looks like a tall order now, given that private investment appears to be stalling for the past few years and higher investment would have to come from public investment that is also constrained by low domestic resource mobilisation. The savings-investment gap continues to be modestly negative implying that the economy is investing more than its savings thus driving capital accumulation via foreign savings (mostly concessional loans).

Bangladesh’s Strong External Balance under Stress

For over 20 years Bangladesh has been accumulating foreign exchange reserves through modest surpluses in its overall BOP, thanks to robust double digit export performance and rising remittances, supplemented with moderate level of official development assistance (ODA, at 2-3% of GDP), which more than compensated for rising trade deficits in a growing economy. That comfort zone in external balances is now ruptured, first, on account of supply chain disruptions from the Russo-Ukraine war and, second, due to volatility in the exchange rate plus dwindling foreign exchange reserves, events partly due to ad hoc-ism and episodic handling of complex interlinked issues of domestic inflation, foreign exchange rate depreciation, and depletion of foreign exchange reserves. The general impression of analysts is for the crisis to intensify in the short run before it gets resolved in the medium- to long-term. Add to this the tense political climate, you now have the recipe for wide speculation about the direction of the economy in the near-term. One key indicator of the persistence of speculation is exchange rate volatility and the general sense that the central bank is falling short in its ability to tame the speculation geni which is out of the bottle.

A new expression, ‘dollar shortage’, has gained currency over the past year. In essence it implies that the demand for the greenback is well in excess of supply. Exports, remittances and official development assistance (ODA) along with a modicum of FDI, generates the supply of dollars in the market as well as official FE reserves with Bangladesh Bank (BB). Demand for the greenback comes from imports of goods and services. As long as the perception of dollar shortage persists in the foreign exchange market, speculative behaviour will have the upper hand. The only way to dowse the fire of speculation is to create adequate supplies of dollars by roping in export and remittance inflows (plus as much ODA as possible).

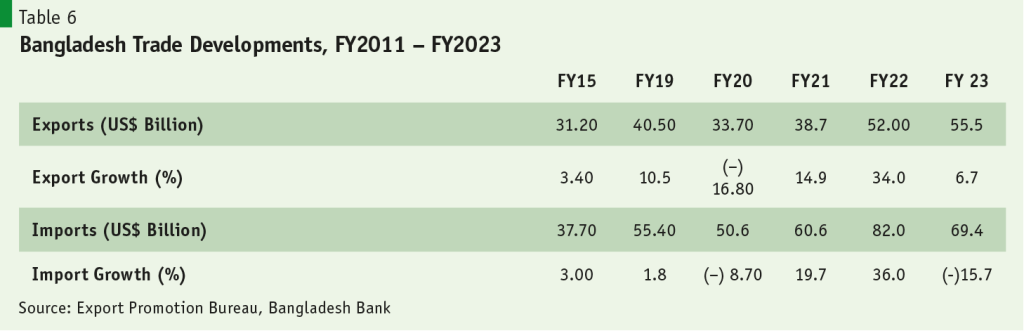

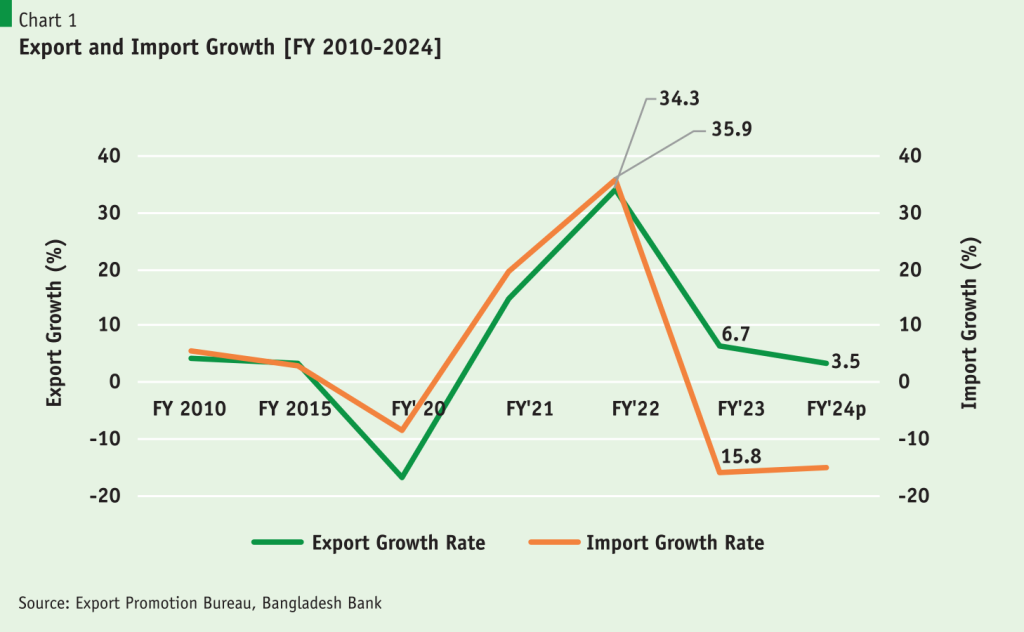

Severe import compression implemented by BB last year brought imports sharply down 15.7% (Table 6), thus resolving the gaping current account deficit (CAD) of FY2022, but the move was neutralised by unprecedented deficit in the financial account of the BOP, something that did not occur in the past 25 years. Even the IMF was surprised at this development as they had projected the usual surplus in the financial account based on past trends. In hindsight, the IMF’s quantitative target of USD 24.5 billion Net Official Reserves appears quite unrealistic. BB focused on getting the CAD under control, which they did, but in the meanwhile the financial account moved from a surplus of USD 13 billion to a deficit of USD 2 billion, thus leaving an overall BOP deficit of USD 8 billion which depleted FE reserves further.

Export-import and remittance trends indicate that it is possible to restore stability in the BOP provided export receipts and inflow of remittances are effectively captured in BB’s FE reserves. In FY2023, exports, remittances, ODA, brought in USD 88 billion (USD 7.5 billion/month), which should rise to about USD 95 billion in FY2024, even assuming a modest growth of exports (Chart 1). If imports (goods and services) could be held to USD 80 billion (a modest increase over FY2023), the pressure on FE reserves as well as the exchange rate should ease, unless this trend is hobbled by unexpected rise in trade credit in the financial account. A caveat that needs to be added here is this scenario could be upset by unforeseen events related to the forthcoming elections and the persistent speculative behaviour in the FE market that could undermine inflows of remittance and even some export proceeds (potential capital flight).

Balance of Payment Management

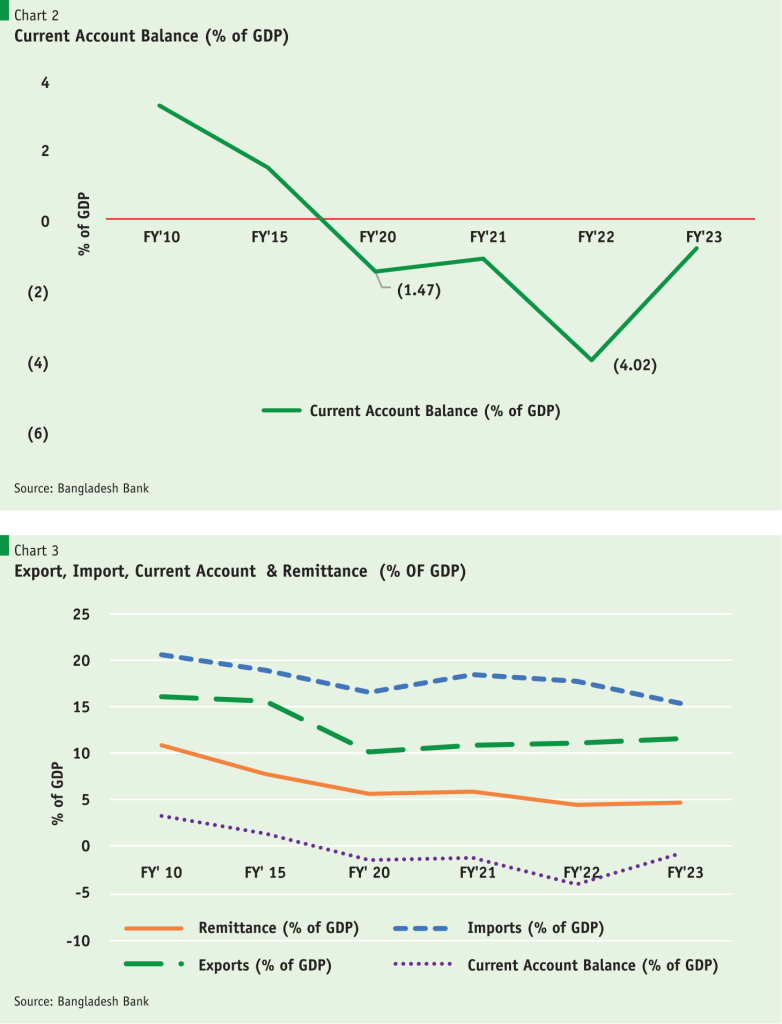

Deft macroeconomic management is warranted in the current state of BOP stress that emerged in the closing months of FY2022 but continues as of this writing due to what may be construed as mismanagement. Thanks to Bangladesh Bank’s policy of import compression by strict administrative measures, the current account deficit returned to moderate levels (under 1% of GDP) and even turned positive in the first quarter of FY2024 (Charts 2–3). Though this was a remarkable turnaround for a pivotal trade indicator, since it came about through severe import compression could have dire consequences for the productive sector of the economy including overall GDP growth. It is time to let the market determine import levels which will be constrained anyway due to the massive exchange rate depreciation which significantly raised import prices.

But the financial account continues to haunt the central bank. The financial account deteriorated substantially as import and exchange controls lowered foreign and domestic private investor confidence, which caused a drying up of private foreign credit, constrained the inflow of FDI and even contributed to capital flight. Overall balance, however, incurred a lower deficit during July-Sep of FY2024 compared to that of FY2023. The surplus in current account balance partially offset the deficit in the financial account of USD 3.9 billion resulting in this lower deficit in overall balance during the period under review. If this trend could be maintained, end year FY2024 BOP might return to its positive trajectory.

Foreign Exchange Reserves and Exchange Rate Management

The two are intricately related. Maintaining a level of FE reserves requires a policy of exchange rate flexibility. Thankfully, BB has realised the folly of running a scheme of multiple exchange rates that made matters worse but movement towards uniformity still remains incomplete. Instead of letting the exchange rate find its own level we observe ad hoc and episodic interventions continuing to the detriment of the FE reserve situation. You can’t have it both ways: i.e. maintain a FE reserve level and also keep the exchange rate fixed! Exchange rate flexibility is what prevents FE reserve level from depleting.

After futile attempts to hold on to an exchange rate of BDT 85 per US dollar, the Bangladesh Bank had to let go in April-May 2022 resulting in depreciation that has reached 30% (BDT.112/USD) without showing signs of settling down. The divergence between the kerb market rate and bank rates remains substantial (over 5-6%) and volatile, signifying instability in the foreign exchange market that prompts (i) inflows of remittance through unofficial channels (hundi), and (ii) persistent speculation in the market about prospective rate hikes.

To shore up official FE reserves while preventing the exchange rate from moving to its market equilibrium rate seems to be an exercise in futility.

One thing to note, an exchange rate depreciation is inflationary. An exchange rate shock of the kind witnessed is even more inflationary when coupled with a spike in import prices. The price impact feeds through all traded and tradable goods in the domestic market and, eventually, fuels rise in price of non-traded goods (and services). The national inflation rate which was 6.2 per cent in March 2022 has approached 9.3% as of Oct2023. A major part of this sharp rise in inflation can be attributed to the exchange rate shock.

By the end of June 2023, compared to June 2022, BB intervened and injected a total of 13.39 billion USD to prevent further depreciation of the exchange rate. Notwithstanding BB’s effort to prevent the exchange rate from depreciating by injecting dollars from reserves, it has progressively depreciated with needless loss of reserves that could have been protected by letting the exchange rate be market-determined and using demand management to stem the slide in the exchange rate. One more approach to compress imports by administrative controls is also turning into an exercise in futility. With 30% depreciation, imports are pricey enough to be contained by the market mechanism, not by administrative fiat (such as controlling LC opening).

The IMF Program and FE Reserves

In the post—Covid19 world, IMF identified at least 53 most vulnerable economies, some of them on the verge of, if not already, approaching sovereign debt default. Ghana, Sri Lanka and Pakistan were in that group, not Bangladesh. Thanks to three decades of prudent macroeconomic management that ensured macroeconomic stability, the IMF found Bangladesh to have low risk of debt distress with adequate capacity to repay the Fund which came up with a USD 4.7 billion support over a period of 42 months. The IMF spokesman confirmed the support was not a rescue mission as in the case of Pakistan or Sri Lanka but meant to provide a buffer to achieve a comfort zone in Bangladesh’s FE reserves.

To be sure, the loans come with a reasonable agenda of reform efforts that have been mutually agreed between the IMF and the Government (via an agreed Memorandum of Economic and Financial Policies (MEFP)). As economists we look at this as an opportunity for undertaking much needed structural reforms that would have positive long-term impacts to cope with the impending graduation from LDC status along with the nation’s goals for reaching Upper Middle-Income Country (UMIC) status by 2031.

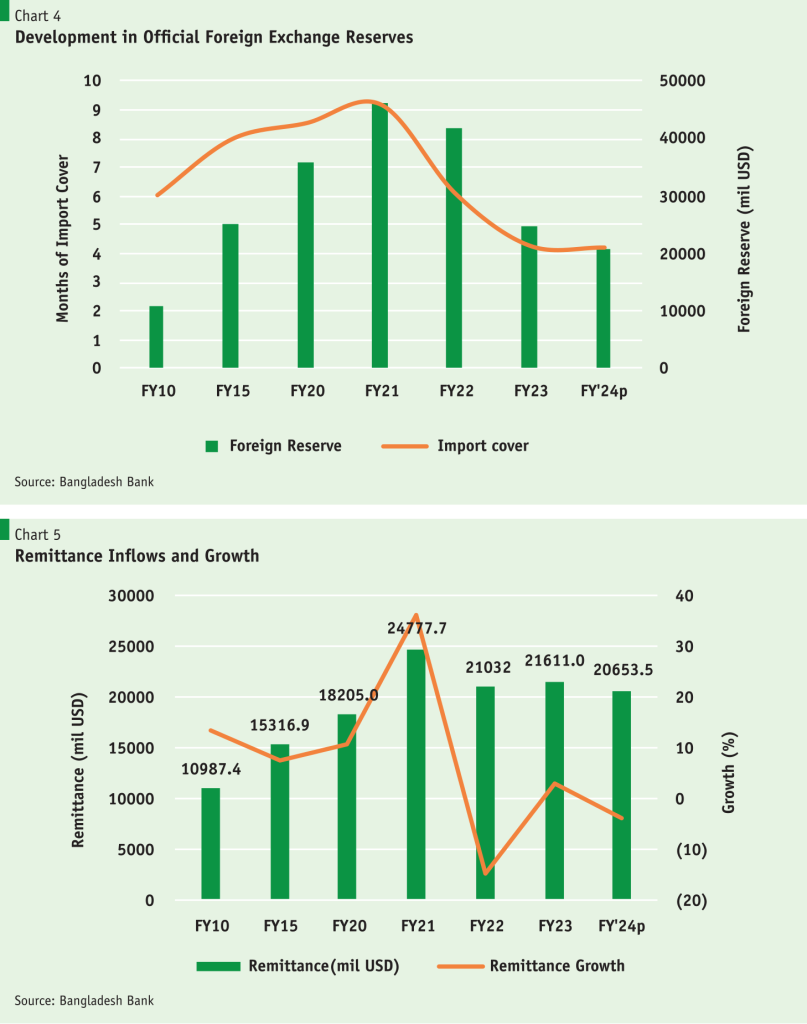

BB now computes the gross forex reserve following the BPM6 manual, excluding a number of components including the export development fund (EDF) from computation. So, the gross FER (BPM6) stands at USD 20 billion as of Sep 2023 and net reserve is below USD 18 billion, which falls short of IMF’s program requirement of maintaining a net forex reserve of USD 24.4 billion. That places our reserve import cover at about four months if we use the IMF’s definition or five months if we use the government’s definition (Chart 4). Bangladesh Bank has to take corrective measures to regain lost reserves and letting the exchange rate adjust/float to market developments is the only viable option for them. Be that as it may, the second tranche release of about USD 650 million should in all likelihood come through shortly on the basis of justified ‘waivers’.

Using import compression by administrative means is not going to solve the problem but will impart damage to the productive sector of the economy. It is time to let the exchange rate float and compensate for any inflation-triggering depreciation by reducing tariff rates (e.g. remove the 3% regulatory duty to start with, as an emergency measure) without any revenue loss (explained later).

In addition to exports of goods and services the other major source of foreign exchange and a key driver of the Bangladesh economy, including poverty reduction, is remittance from migrant workers. In essence, remittance is another form of exports – of factor services. Most migrant workers toil hard in foreign lands and send the bulk of their earnings home which in turn shores up official FE reserves, to the extent these come through formal channels. Hundi, the informal channel, remains alive at all times, and is particularly dominant when there is money to be made from the divergence between official and kerb market exchange rates, something that has been persisting with wide margins for the past 18 months or more. If current trends in the inflow of remittances continue, we can only hope to rope in remittances about the same as in FY2023, about USD 22 billion (Chart 5). Sadly, with 1.4 million migrant workers leaving the country in FY2023 (almost a 50% spike in migrant numbers), remittance inflows should have been at least USD 10–15 billion higher. We await with bated breath to see what innovative ways BB is resorting to in order to get more remittances into the official net. As long as the divergence between official and kerb market rates remains what it is, all the exercise we hear about will be futile.

On 12 December 2023 the IMF approved the release of the second tranche of ECF/EFF and RSF arrangement of USD 682 million (approx..) after granting waiver of the QPC on Net International Reserves. Note that GOB did not have to request the QPC waiver, but IMF acknowledged the severity of the problem, including the unanticipated turn in the financial account of the BOP which IMF had not anticipated. The IMF advised that to restore near-term macroeconomic stability, monetary policy should be further tightened, supported by neutral fiscal policy and greater exchange rate flexibility, policies PRI has been strongly advocating for the past year.

What is notable is that the WB-IMF Debt Sustainability Analysis (DSA) that accompanied the Article IV Consultation report once again confirmed that Bangladesh has a low risk of external and overall debt distress. Finally, the report concluded, Bangladesh’s capacity to repay the Fund is adequate and the authorities’ track record of servicing IMF debt remains strong

Export Diversification Stalls due to Unfriendly Protection Regime

Before leaving the trade section of this report it is important to highlight the findings of a recent PRI research on export diversification challenge. One of the key drivers of the Bangladesh economy for the past decades has been the RMG industry. Taking advantage of the various facilities from the government including back-to-back letter of credit and duty-free bonded warehouse, the industry has turned out to become an export behemoth for the economy. Although the success of the RMG sector is commendable, being a one-track pony may not take Bangladesh very far and keep the engine of the economy running for too much longer. After graduating from the LDC status, Bangladesh will lose a large chunk of the preferential benefits that it now gets in the western markets, especially in the EU (albeit with a 3-year lag). That could potentially undermine dynamism in RMG exports for the future. That calls for renewed focus on building export-oriented industries for other types of products – a priority government agenda.

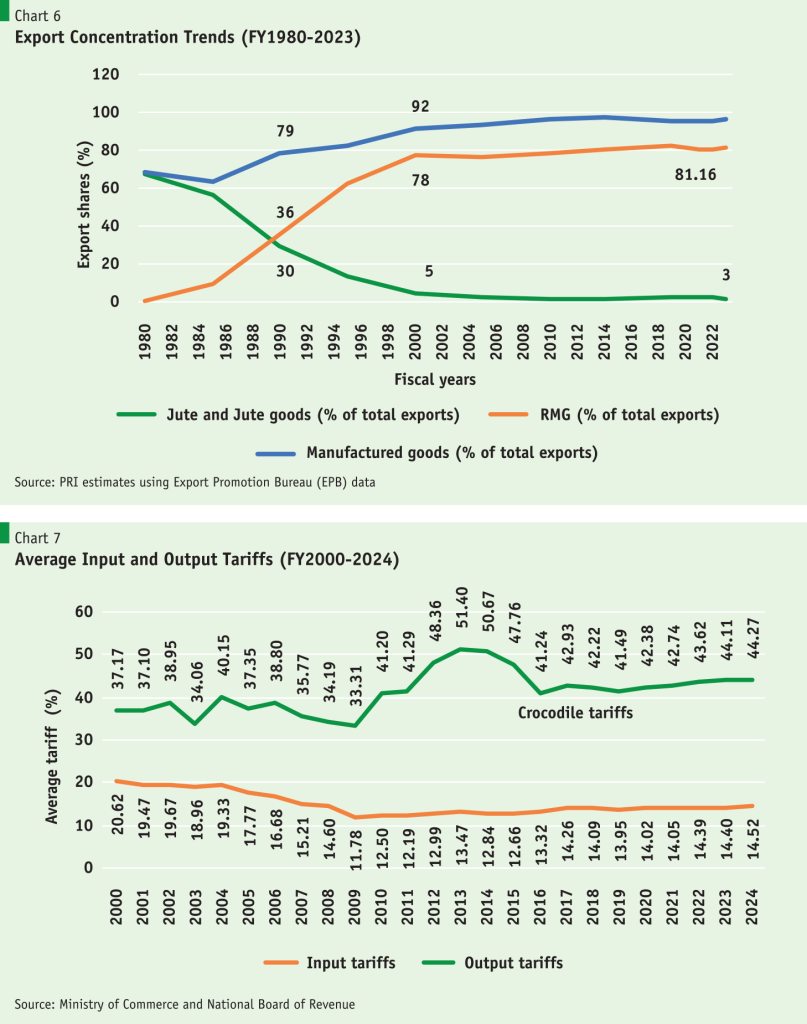

Chart 6 captures the trend of export concentration in RMG over time. The share of RMG exports has risen from 30% in 1990, to 78% in 2000, and is now at 82-84% in 2022. This trend towards concentration continues unabated. The share of RMG exports could hit 90% over the next five years, if this trend is not reversed by higher growth in non-RMG exports.

Bangladesh has a long and persistent history of protectionism in the tariff regime. As an LDC, Bangladesh has long stalled the rationalisation of the tariff regime which is riddled with numerous WTO non-compliant para-tariffs. Apart from the initial wave of rationalisation during the 90s, the tariff regime has been persistent on a protective stance since. Chart.7 shows how the average input tariffs have remained consistently lower than the average output tariffs, which in effect provides massive effective protection. This divergence in the average input and output tariffs give rise to Anti-export bias— the economic phenomenon where a country’s domestic economic policies and environment discourage exports in favour of sales in the domestic market. The principal source of this is the highly persistent tariff protection to import substitute industries. Tariffs on import substitute production are indirect subsidies that undermine exports. This subsequently makes domestic sales/import substitution more profitable. Recent PRI research has shown that the products of the RMG sector do not suffer from Anti-export bias, whereas the non-RMG products show evidence of high anti-export bias. This is because the RMG sector operates in a ‘free trade enclave’ due to the Special Bonded Warehouse (SBW) system. Other exports do not operate under the same principle, thus giving rise to ‘trade policy dualism’. As long as domestic import substitution remains more profitable than exports in the case of non-RMG products, export diversification is unlikely to materialise. Therefore, the tariff regime acts as a binding constraint to export diversification.

With the launch of the new National Tariff Policy 2023, there is hope for a second wave of reforms in the tariff structure following WTO protocol. This new policy is going to introduce time-bound protection for identified high potential sectors rather than indiscriminate protection to the so-called infant industries. The idea of time-bound protection is appropriate with impending LDC graduation since the only way to ensure that our industries become competitive over time is by gradually reducing protective tariffs and increasing import competition thereby. The NTP 2023 is also introducing a scheme where all firms that produce for exports as well as sales in the domestic market will be able to import inputs (meant for exports) duty-free, by posting 100% bank guarantee against such imports, up to 70% of export value. As a result, this scheme will be the equivalent of Special Bonded Warehouse (SBW) granted to RMG exporters, something non-RMG exporters have been yearning for decades.

This policy is a step in the right direction since it will provide a level playing field for the non-RMG exports and help them gain market presence on a global scale. Besides the already established export-oriented RMG sector, if we can manage to find some other sectors focused exclusively on exports, our growth path following LDC graduation will be much smoother. Amid the impending reduction of preferential treatment in the western markets after LDC graduation, it is important for us to diversify beyond RMG as well as find new markets for our products.

Inflation Must be Tamed

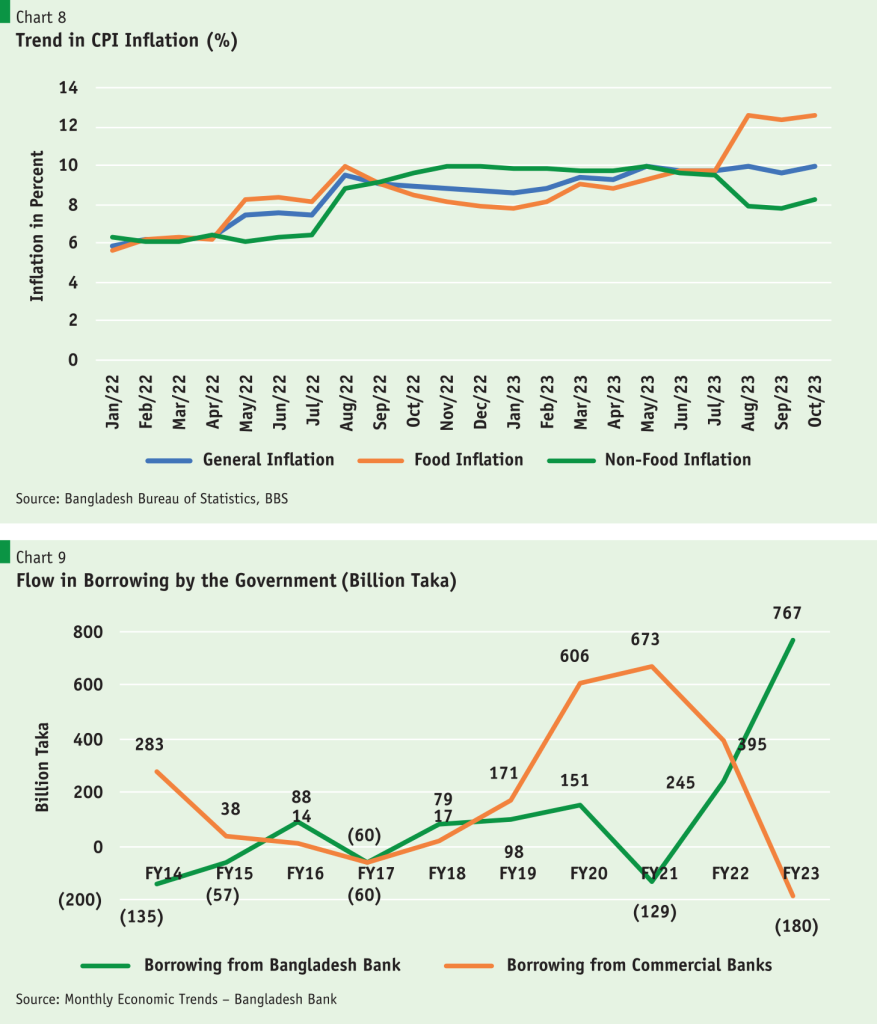

Inflation is now a problem to be reckoned with. The general rise in domestic prices was triggered by two simultaneous events in 2022: (i) the supply chain disruption of the Russo-Ukraine war that caused a spike in commodity prices, that is, the 3Fs: food, fuel and fertiliser; (ii) the sharp depreciation of the Taka against the US dollar (nearly 30% as of Sep 2023). Though international commodity prices have abated somewhat, the second-round effects of the two price triggers are having their impacts. Add to that the 50% hike in fuel prices by the Government in August 2022. General inflation as of Oct 2023 is at 9.3%, with food inflation at over 12% (Chart 8). Suffice it to say that inflation, which is equivalent to a regressive tax, is hurting a wide swath of society, but its impact is more pronounced on the poor. It must be tamed, sooner rather than later.

Long ago, the father of monetary economics, Milton Friedman, said that ‘inflation is always a monetary phenomenon’. That means, inflation is always associated with a rise in money supply. That view has been modified over time. Inflation can seldom be explained by demand-pull factors only, like rise in money supply, but includes cost-push factors like rise in input prices. Typically, inflation is the result of both demand and supply shocks, as is the case in Bangladesh. The impact of supply chain disruption and exchange rate depreciation was a supply shock that triggered inflation which was reinforced by monetary expansion. The latter has now been reversed by BB through the standard prescription of monetary contraction and interest rate hikes (modest). Also, the tendency to finance the budget deficit through borrowing from BB (which is pure inflationary money creation) has also been suspended (Chart 9) as of July 2023.

In the Bangladesh context, the preceding standard prescription may only restrict demand but does not do anything to counter the supply shock emanating from import price hike plus depreciation. Indeed, the severe import compression imposed on the economy by BB is likely to raise import costs (scarcity driven) thus becoming a cost-push factor of inflation. This is where our current tariff structure presents a uniquely Bangladeshi opportunity to counter the inflationary effect of depreciation through an approach that can be described as ‘compensated depreciation’.

An illustration follows. Since May 2022, Bangladesh Taka has depreciated more than 30% against the US dollar.

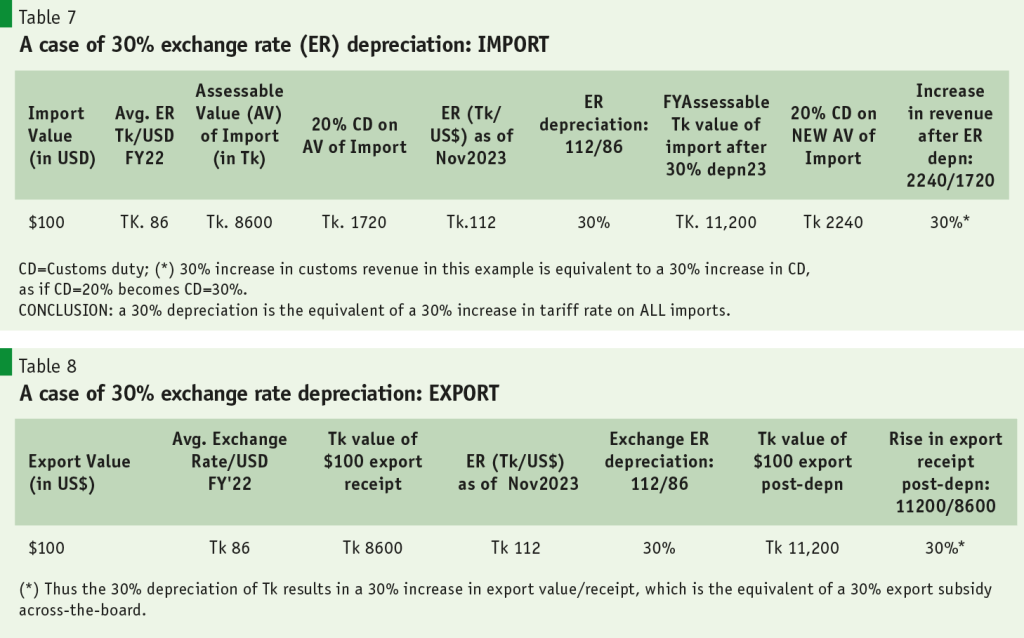

The substantial inflation-trigger prompted by the massive depreciation sustains inflation as no compensating countermeasures are in sight nor even talked about. What goes unnoticed is its effect on exports, imports and inflation. Below (Tables 7-8) is a simple illustration of the depreciation impact on export receipts, import tariffs and domestic inflation.

- The 30% depreciation that occurred over FY2022–2023 has resulted in a 30% subsidy on ALL exports and a 30% increase in Tariff rate on ALL imports.

- The subsidy effect on exports will give a boost to all exports. However, the higher cost of imported inputs will somewhat moderate the subsidy impact, primarily on non-RMG exports.

- This subsidy also applies to all remittances which should get a tremendous boost. Yet HUNDI remains widely prevalent due to the divergence between bank and kerb market rates.

- The higher tariff impact on ALL imports is real. It has raised the price of ALL imports by roughly the amount of the depreciation with consequential impact on customs revenue. However, the total impact on NBR customs revenue from the upward price effect will depend on how much import demand will be reduced on account of higher import price. Nevertheless, it creates the unprecedented scope for tariff remission without revenue loss.

- The upward import price effect of the depreciation will obviously raise the cost of imported inputs and affect profitability of production for the domestic market.

- The rise in import price due to depreciation has fuelled domestic inflation which is stubbornly holding at around 9-10%.

A downward shock to inflation could be brought about by a downward tariff adjustment – described as ‘compensated depreciation’. Any downward tariff adjustment would partly neutralise the price or inflationary impact of depreciation – swiftly and sharply. This would be a radically and uniquely Bangladeshi approach to counter inflationary impact of depreciation, if the objective is to tame inflation swiftly and sharply. The argument that tariffs cut will cause loss of revenue is not valid in this case as ALL tariffs have increased 30% across-the-board due to depreciation. Furthermore, using exchange rate depreciation as a strategy for revenue mobilisation cannot be a valid tax effort. Tariff remission of 5-10-15% (from existing rates) will have immediate effect on domestic prices of imports as well as import substitutes and costs of production. This is one great opportunity to remove Regulatory Duty (RD), as an emergency measure to control inflation. More can and should be done in the next Budget FY2025.

Inflation and Food Security

The role of agriculture cannot be underestimated, though its share in GDP has been falling. Its contribution to our food security is critical.

Bangladesh began its journey in 1971 as a food deficit country with 70 million mouths to feed, with 10 MMT of rice production which was 10% short of domestic requirement. The deficit was met with food aid and imports. Food aid is now history having disappeared from the radar in the 1990s.

In the past five decades, both rice output and productivity (MT/ha) quadrupled. Rice (the staple food) production has quadrupled to over 40 MMT in 2023 while the population rose 2.5 times to 170 million, making the country nearly self-sufficient in food.

Since 2001, the government has proactively maintained the per capita availability of rice above the required levels, ensuring an adequate quantity in storage to address emergencies. As a result, per capita availability has consistently exceeded requirements indicating robust food security, in terms of availability.

Nevertheless, access to food (i.e. the second dimension of food security) may be impeded by the emergence of ‘entitlement failure,’ a concept defined by Nobel laureate Amartya Sen. Entitlement failure can occur despite an adequate supply of food due to lack of purchasing power of marginalised groups. If the current rate of inflation persists, it could cause slippage of large numbers into poverty thus creating conditions of entitlement failure. Taming inflation swiftly has therefore become a national imperative.

Other dimensions, such as optimal food utilisation (i.e. minimising post-harvest losses and reducing food waste, efficient and effective food processing techniques) and reliable food stability (such as maintaining stockpiles to address short-term disruptions like natural disasters or emergencies), also contribute to overall food security.

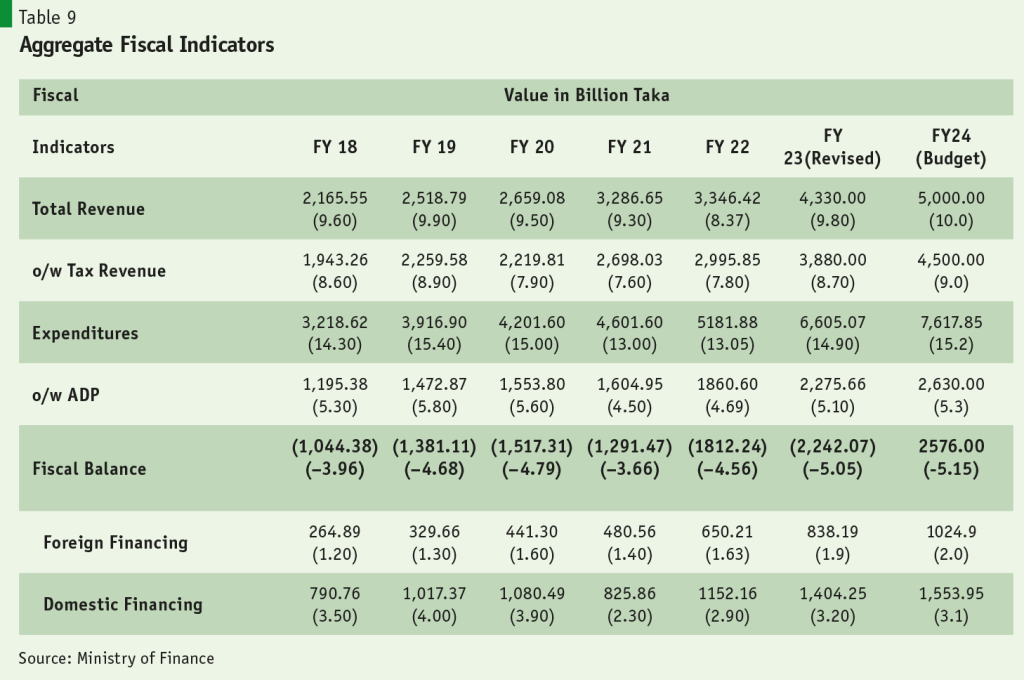

Fiscal Restraints and Revenue Mobilisation Challenge

Macroeconomic stability alongside fiscal prudence has long been the hallmark of Bangladesh’s fiscal policy in the sense that despite weak revenue mobilisation effort, public expenditures have stayed within the resource constraints to deliver budget deficits averaging 3.9% of GDP until FY2019 – a highly sustainable fiscal indicator. That situation changed only modestly rising to 5.1% in FY2023 (Table 9). Inflation and BOP stress have recently put internal and external macroeconomic stability on the dock. Restoration of macroeconomic stability is partially tied to the formidable challenge of enhancing revenue mobilisation. Historically, our revenue mobilisation effort has not kept pace with economic expansion. It was always a policy debate on how we could increase our resource mobilisation and improve the tax-GDP ratio. The recent IMF loan programme has also emphasised domestic revenue mobilisation putting key quantitative requirements for increases in revenue mobilisation efforts with additional 0.5% of GDP annually in FY2024 and FY2025 and 0.7% of GDP in FY2026.

Fiscal deficits are a part and parcel of any developing economy. Thankfully, Bangladesh has been investing fiscal resources generated through these deficits as shown by the striking equality of ADP with fiscal deficits, year after year. Therefore, understanding and managing sustainable fiscal policies involves paying close attention to two key factors: the size of the fiscal deficit and how it’s being funded. The least cost option is foreign financing (typically kept at 40% of the deficit, with 60% coming from domestic sources). As for size, deficits of under 5% of GDP are recognized as sustainable. A particular concern is the potential inflationary impact and the risk of crowding out private economic activities resulting from fiscal deficits. When funded through increased bank borrowing, the impact is inflationary (more so if financed through borrowing from BB), while financing through private sources (e.g. shanchaypatra) may constrict the accessibility of bank credit causing crowding out of private investment. To avoid these negative impacts – inflation and lower investment – it is imperative to enhance tax effort and raise the tax-GDP ratio, as the IMF program entails.

Recently, the tax earnings from both import-based and domestic-based taxes have consistently increased in absolute amounts due to the higher exchange rate, and inflation. The latest trends also indicate the prospect of higher revenue mobilisation in the current fiscal year. The National Board of Revenue (NBR) demonstrated an impressive performance in revenue collection, the government fell short of the IMF target by a margin of only BDT 66 billion (2% shortfall). The absolute earnings from both non-NBR and non-tax revenue are expected to grow compared to the last fiscal year, assuming there is return to normalcy post-election.

Recent tax revenue data (as of Sep23) shows promise of higher revenue mobilisation in FY2024, particularly from customs. As mentioned earlier, NBR revenue has received a boost from the massive depreciation of over 30% since May 2022. This is tantamount to a 30% hike in ALL tariffs. However, import compression measures by BB have substantially reduced imports (15% in FY2023), the net result is still positive. In the first quarter of FY2024, NBR collected BDT 767.5 billion tax revenue, while the IMF’s tax revenue target required BDT 615.6 billion. The recent revenue performance of the NBR instils optimism that the government can attain the IMF revenue target for FY2024 through strategic corrective interventions. In this context, it is imperative to implement time-bound policy measures to address persistent revenue challenges, ensuring long-term fiscal sustainability and fostering accelerated economic growth.

Prudent Debt Management thus far

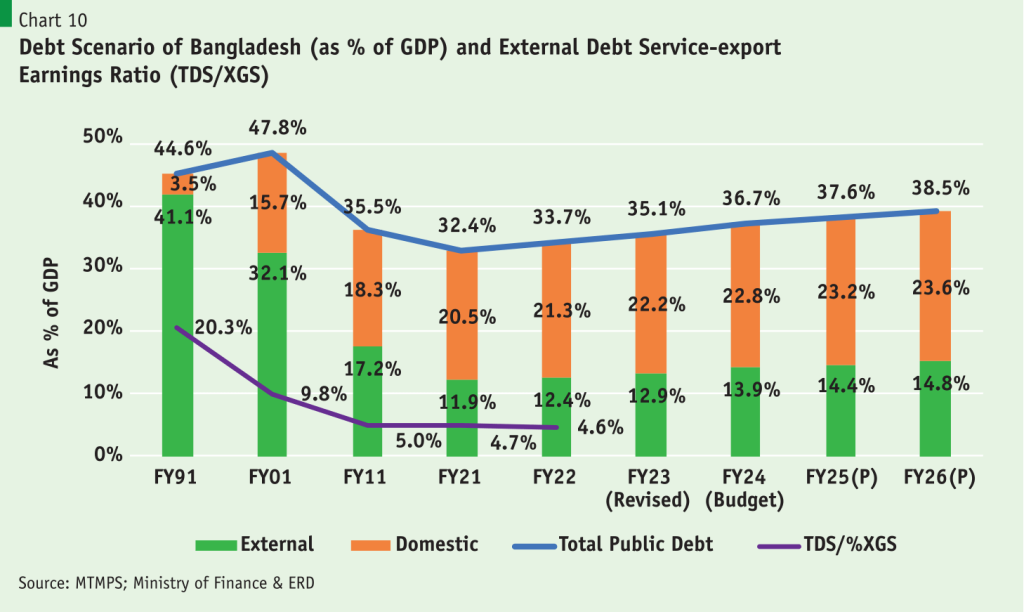

Deficits create public debt obligations. The government has so far managed the budget deficit in a sustainable manner below 5% of GDP, despite the challenge of a low tax-GDP ratio. Consequently, public debt obligations have remained sustainable. It is a good sign that the government regularly increased the budget size without increasing the deficit-GDP ratio. In recent times, various factors have contributed to the modest augmentation of the budget deficit, including the initiation of multiple development and mega projects and the implementation of an expansionary budget to mitigate the aftermath of the Covid-19 pandemic. While these measures have resulted in an increased budget deficit, they have concurrently played a pivotal role in the economic recovery process, fostering overall economic growth.

The government usually borrows from domestic and external sources to finance this budget deficit. Till now, Bangladesh has successfully maintained the public debt-GDP ratio on average around 32% in the last decade, while it was more than 44% in the early 90s. However, it is estimated to go up to 38.5% by FY2026, which is still below the debt sustainability threshold of 55% (Chart.10).

Moreover, there is an observed trend where the proportion of debt sourced domestically (as % of GDP) is expanding faster than the diminishing trajectory of external sources. This has dual implications: firstly, the government’s reduced dependence on external sources, and secondly, the potential crowding out effect on domestic sources, constricting lending alternatives for the private sector. However, the total public sector external debt service to FE earnings ratio has diminished, portraying a better situation at mere 4.6%. Moreover, the public sector external debt approached USD 75 billion, while private sector external debt decreased by USD 4 billion in FY2023 from USD 26 billion in FY2022

The recent depreciation of BDT put pressure on the debt services and repayment. A Finance Division assessment reveals that a 10% depreciation in BDT/USD exchange rates will elevate public debt by BDT 50 billion, reaching BDT 402 billion by the end of FY2024. Additionally, this depreciation amplifies Taka project costs, primarily funded through external borrowing.

However, comparing public and private external debt involves contrasting entities. Most short-term private external debt comes from trade credit, primarily advance payments for export orders, minimally impacting the BOP. No strict rules govern a country’s external debt limits. IMF and World Bank suggestions are not rigid guidelines, allowing countries to establish their own rules, considering these recommendations as a starting point. It all depends on an economy’s growth rate. If the economy is growing fast, taking on more external debt might be okay.

Epilogue: Navigating through Global and Domestic Firestorms

As the sun sets on the year 2023, firestorms are still raging in the domestic as well as the world markets. This calls for the most competent and rigorous diagnosis of the challenges facing the economy and crafting appropriate, even innovative and distinctly Bangladeshi, policies to cope with the situation. The immediate challenge is to restore macroeconomic stability – internal and external – in order to restore the economy’s long run growth trajectory before the troika of inflation, FE reserve depletion and exchange rate volatility turn into a hydra-headed monster. In this regard, as evidence has shown, half-hearted and episodic measures will prove futile. Post-elections, a new and definitive round of holistic economic reforms are long overdue.

Domestically, tax reforms need to be given the highest priority post-elections. The current tax regime is neither pro-business nor revenue enhancing and has proved to be a stumbling block to the dynamism and competitiveness of the economy. There is conclusive research evidence that Bangladesh’s topmost challenge and policy priority – export diversification – is facing a binding constraint from high protective tariffs that instil deep-rooted anti-export bias of incentives. The launch of a National Tariff Policy 2023 is a major step in the right direction whose implementation holds the promise of unleashing the forces of export diversification.

In international trade, a 75-year Bretton Woods era that recognized international trade as a transformative force for global prosperity is perhaps coming to a close. Trade interventions are on the rise, in the form of production subsidies, import restrictions based on national security, export controls to punish geopolitical rivals, and so on. But what is replacing the old economic order does not appear palatable for developing economies like Bangladesh that effectively leveraged the world market for developing an export-oriented manufacturing base creating jobs for the vast reserves of its unemployed labour force, especially women. Rising homeland economics, re-shoring or friend-shoring are but protectionism in different garbs. More bothersome is the tendency for meshing national security (called strategic autonomy) with economic policy. Globalisation that produced efficiency dividends like global value chains (GVCs) might appear to be on the back foot, but, thankfully, recent studies by leading trade economists still confirm that there is no conclusive evidence that international trade is deglobalizing (or declining); only that the era of ‘hyperglobalisation’ is effectively over. In this evolving global landscape, Bangladesh economy has ample potential to thrive.

Then there is China+1 geopolynomics, a de-risking alternative to unbridled GVCs that seeks to limit China’s rise as an economic or technocratic superpower. As the world’s No.2 exporter of apparels after China, this opens opportunities for Bangladesh to seize as some USD 100 billion of apparel orders are expected to shift out of China in the next few years and our RMG industry is well placed to absorb part of this additional demand given its wage competitiveness, under-utilised production capacities, and capable swift-footed first-generation entrepreneurs.

To conclude, what is evolving globally is not the end of globalisation, a phenomenon that has its own inexorable momentum. It is good that globalisation will be changing to become aligned with 21st century world trade in goods and services. Regardless, Bangladesh’s latent potential for economic prosperity will be best harnessed by leveraging the world market via international trade for many years to come.

Members of the PRI Research Team who provided research support to this Report:

Dr Md. Masudul Haque Prodhan (Economist)

Promito Musharraf Bhuiyan (Program Manager)

Karisa Musrat (Senior Research Associate)

Tasdid Mohammed Fayed (Senior Research Associate)

Md. Salay Mostofa (Senior Research Associate)