Bangladesh’s Tax Paradox Low Efforts but High Expenditures

By

Introduction

A persistent paradox marks Bangladesh’s fiscal landscape. Despite having one of the lowest tax-to-GDP ratios in developing economies, which is around 6.6% in the FY2025, Bangladesh continues to provide substantial tax expenditures in the form of exemptions, rebates, and concessions. According to a recent National Board of Revenue (NBR) report (NBR, 2023), the revenue forgone (i.e. only direct tax) as a percentage of GDP accounts for 3.6%, which suggests that 46.5% of total tax revenue. A higher trend of tax expenditure would constrain the fiscal limit to utilize the tax potential, indicating the inefficiency of the tax policy and tax administration capacity for domestic resource mobilization. Although this significant amount of revenue forgone (tax expenditure) reveals a justification as tools to facilitate investment, support priority sectors, and provide a solid ground of tax equity, this tax policy stances for allowing a significant amount of tax expenditure come at a high cost by narrowing the effective tax base and eroding revenue capacity (Feldstein, Martin, 2008, Altshuler, R., & Dietz, R. 2011 and Beer, et.al., 2022).

Tax expenditures are not inherently problematic if they yield measurable returns in growth, employment, or equity…

Tax expenditures are not inherently problematic if they yield measurable returns in growth, employment, or equity (Bratíc, V.,2006 and Heady, C., & Mansour, M. 2019). However, in Bangladesh, the benefits are often diffuse, poorly targeted, and weakly monitored, while the fiscal cost is significant and rising. Thus, tax policies leaning toward high tax expenditure would create a fundamental contradiction: a government struggling to mobilize sufficient domestic resources simultaneously surrenders a significant portion of its potential revenue through generous tax concessions (Beer, et.al., 2022 and Khan, M. et. al. 2022). The outcome is a tax system characterized by low compliance, weak enforcement, and a heavy reliance on indirect taxation, which further exacerbates inequity. For a country aiming to meet its development financing needs and achieve the persistent long-term economic growth, this paradox raises critical policy questions. This article examines the implications of high tax expenditures, their relationship with tax effort, and the scope for reform to strengthen Bangladesh’s revenue mobilization.

A Low Tax Effort with Significantly Higher Growth

Bangladesh is at a crossroads on various fronts. One of the key economic challenges facing the interim government country is to revamp the revenue mobilization system. Revenue efforts (i.e., revenue generated from the national income or Gross Domestic Product (GDP), which is defined as the revenue-to-GDP ratio) have historically been low in Bangladesh. The outcome of the low revenue efforts has been constraining public expenditure. In particular, low revenue effort has severely constrained ability of the Government of Bangladesh (GoB) to finance much-needed expenditures on physical infrastructure, human development, and pro-poor spending. Low revenue efforts have constrained the government’s ability to improve infrastructure, which in turn limits economic growth and employment. It has also put a strain on the government’s ability to fund programs that provide benefits for people experiencing poverty, such as the social sector spending (including social protection programs). Thus, raising more revenue is of paramount importance to Bangladesh government as the expectations for meaningful and positive changes are enormous.

Low revenue efforts have constrained the government’s ability to improve infrastructure, which in turn limits economic growth and employment. It has also put a strain on the government’s ability to fund programs that provide benefits for people experiencing poverty, such as the social sector spending…

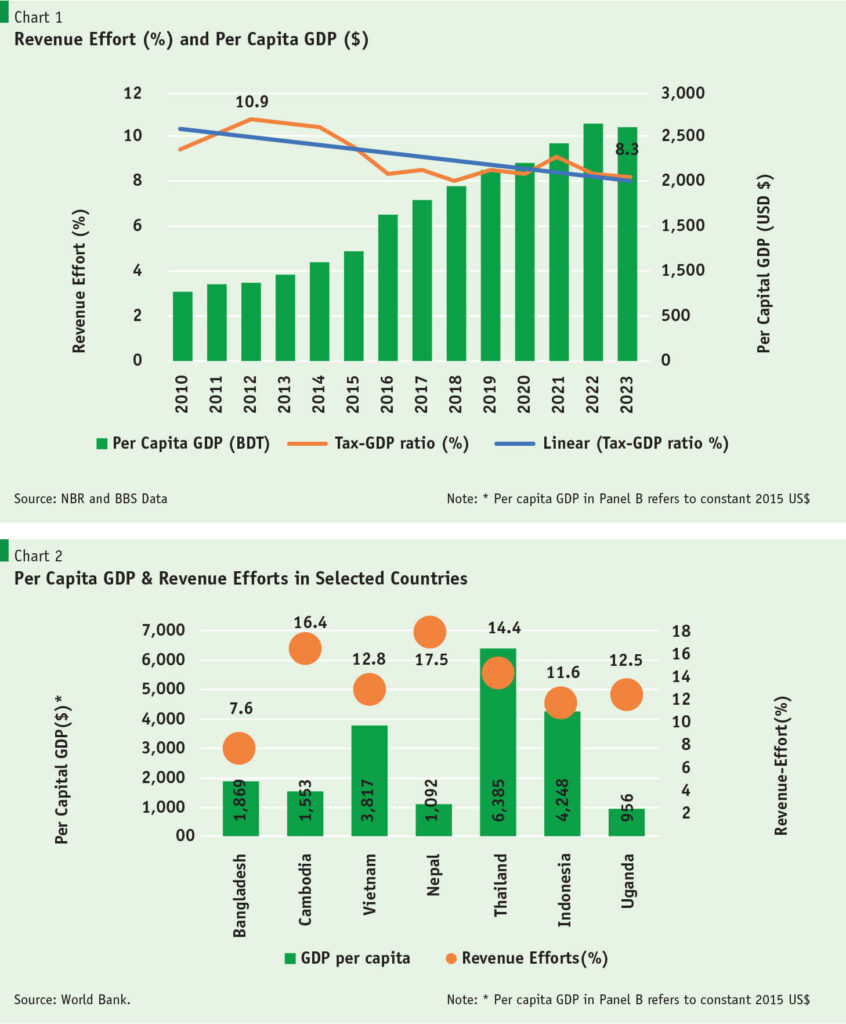

Generally, there is a positive relationship between the expansion of income (i.e., per capita GDP) and revenue mobilization in a country. Chart 1 illustrates the contrast between revenue efforts and per capita GDP from 2010 to 2023. The trend in per capita GDP is increasing – suggesting that the incomes (or broader tax base) are rising – leading to more revenue generation (even when the tax rates remain the same). Contrary to this association, the falling revenue-effort trend (i.e., the linear trend line) suggests an inefficient revenue system in Bangladesh. Revenue efforts, which were around 11% in 2011, declined to 8.3% in 2023 – implying a 2.7 percentage point drop over the 12 years, during which per capita GDP increased by about 200%. Such a significant negative association between per capita income increase and revenue efforts is unacceptable and untenable.

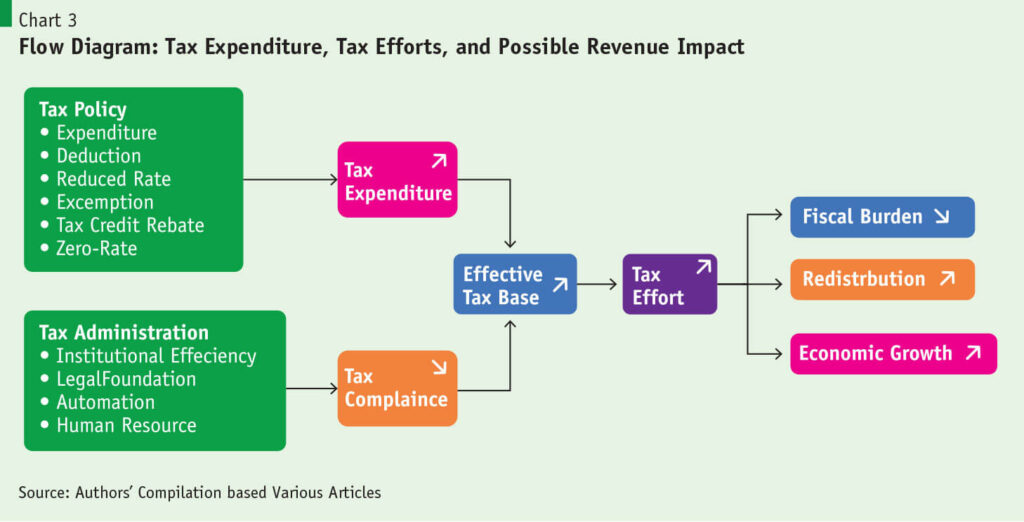

Furthermore, Bangladesh’s performance in mobilizing revenue is pathetic when compared to its peer countries. With a lower per capita GDP compared to Bangladesh, both Nepal and Cambodia have scored significantly high on revenue efforts (i.e., their revenue efforts were more than double our revenue efforts of 7.4%). Even Uganda, with half of Bangladesh’s per capita GDP, has been able to raise 12.5% of its revenue, 5.1 percentage points higher than Bangladesh’s revenue efforts. These comparative measures again highlight a highly inefficient revenue system in Bangladesh.

A Conceptual Framework: Tax Expenditure and Tax Efforts

The schematic diagram in Chart 3 illustrates the association among tax policy, tax administration capacity, and tax efforts, highlighting the fundamental channels through which the components of tax expenditure and tax compliance contribute to the effective tax base, given the applicable tax rates.

The above diagram shows that tax policies prioritizing significant tax concessions —exemptions, deductions, rebates, and allowances, as well as reduced and zero rates —fuel an increasing tax expenditure, which would erode the effective tax base. Thus, a significant amount of tax expenditure reduces the effective tax base, indicating that, along with the low-tax base rate, the effect is very minimal, which supports the classical tax Laffer Curve effect (Bratíc, V. 2006). On the contrary, the tax administration capacity channel would influence the tax compliance. This channel suggests that a higher compliance ratio would expand the effective tax base, which ultimately boosts tax efforts at the given tax rates due to the more substantial base effect (Bratíc, V. 2006). Therefore, reducing the tax expenditure and modernizing the tax administration through implementing various tax reforms would buoyant the effective tax base and increase the tax efforts, which can create of ample opportunities for reducing fiscal burdens, improving redistribution, and boosting the economic growth through productive public expenditures.

A significant amount of tax expenditure reduces the effective tax base, indicating that, along with the low-tax base rate, the effect is very minimal, which supports the classical tax Laffer Curve effect.

Is High Tax Expenditure A Paradox?

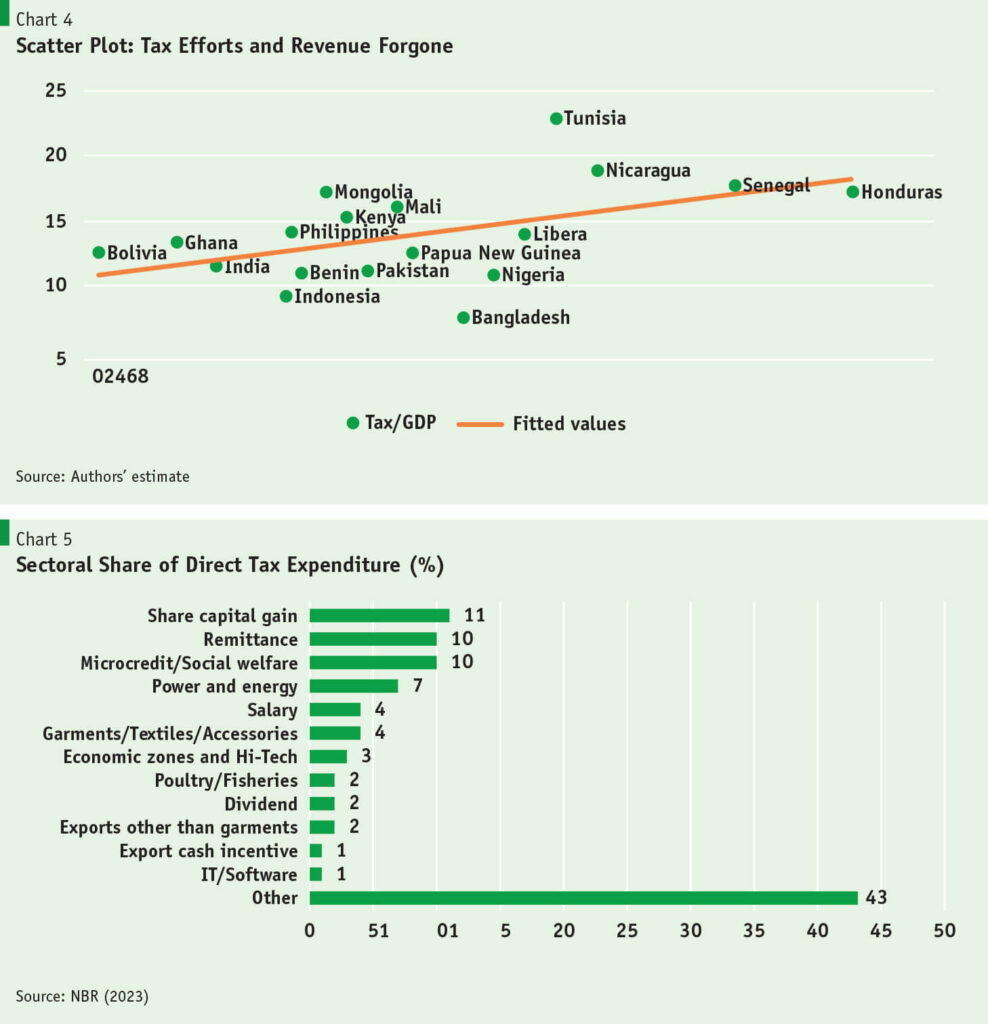

When examining the relationship between tax revenue efforts and tax expenditures, it is worth noting that Bangladesh’s direct tax expenditures (i.e. provided on only the direct tax component) are relatively high. In fact, it accounts for almost 46% of the total tax revenue, a figure that is significantly higher than the average of around 26% for other lower-middle-income countries (GTED, 2024). Bangladesh’s position (lower-bottom left) in the scatter plot provides adequate support for this paradoxical argument, as the tax system combines low tax effort with high forgone revenue, making exemptions and deductions much more damaging than in advanced economies. One of the valid justifications for allowing tax expenditure is to prioritize specific growing economic sectors for boosting investment and economic growth (Chart 4). In addition, some level of deductions and exemptions is allowable to encourage taxpayers to comply with taxes on time. However, almost 46% of revenue forgone (RF) reveals a paradox, which suggests that the highest level of tax inefficiencies accompanies lower tax revenue efforts. It is crucial to address these inefficiencies to ensure a more effective tax system.

…some level of deductions and exemptions is allowable to encourage taxpayers to comply with taxes on time. However, almost 46% of revenue forgone (RF) reveals a paradox, which suggests that the highest level of tax inefficiencies accompanies lower tax revenue efforts.

The composition of the direct tax expenditure (Chart 5) is also problematic as almost half of total direct tax expenditure (i.e. 43%) falls under the ‘other’ category – justification for granting revenue foregone is unclear – perhaps motivated by non-economic reasons.

Scopes for Tax Reforms and Expected Gains

As mentioned above, Bangladesh’s development is severely constrained by low tax/revenue effort. Thus, tax/revenue reform is one of the topmost priority of the country. The reform must be attained through a number of channels – such as limiting the tax expenditure, full realizing of tax mobilisation from the domestic sources. The tax potential of the tax mobilisation from the domestic sources needs modernization of tax system by, which includes increasing the tax nets, automation of the tax administration, implementing the new VAT law, and rationalizing the non-tax revenue. Some of the proposed reforms may take time, it is believed that tax-expenditure reform may be achieved within a short time. It is argued that tax-expenditure reform is likely to raise revenue, redirect resources to better use and thereby trigger salutary effects on the economy. A simulation exercise has been carried out to illustrate the argument.

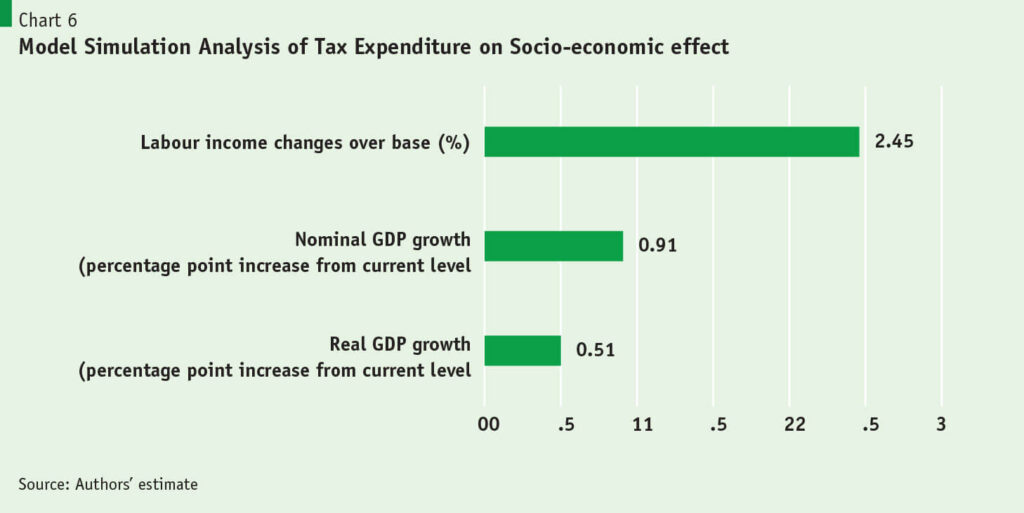

Simulation analysis

A static computable general equilibrium model has been calibrated to the Bangladesh Social Accounting Matrix (SAM) 2023 has been used for the simulations. The simulations were conducted in two steps: (i) in step one tax expenditure has been set to limit to 1.6 per cent of GDP (i.e. from the current level of 3.6% to 1.6%); and (ii) in the second step the 2 percentage points additional revenue gains has been redirected to public expenditure in the following share (i.e. social sector 25%; Social Protection 15%; Infrastructure/construction 30%; Agriculture 10%; and Other government spending 20%). The simulation results in Chart 6 suggest positive economic-social effect in the form of higher growth, and additional labour income. The simulation results suggest that it is beneficial to limit tax expenditure, raise revenue and use them as public expenditure compared to current practice of resorting to high tax expenditure.

Conclusion and Policy Recommendations

Above review and simulation outcomes suggest that current practice of providing high tax expenditure is unjustified in the context of Bangladesh. Thus, GoB should consider following changes in its current practices towards an efficient and transparent system.

GoB may put a cap on the overall size of tax expenditure to maximum level of 1 per cent of GDP for the next two fiscal years.

GoB may form a high-power committee to take decisions on who should be eligible for receiving tax expenditure benefits. The deciding criterion may focus on employment generation, poverty reduction, productivity growth, welfare of women, children and minority groups.

GoB may develop a tool to inform the committee for better decision making. This may be a tool developed in EXCEL to rank all the application using indicators such as revenue generation (or revenue forgone), economic growth, employment generation, poverty reduction, productivity growth, welfare of women, children and minority groups etc.

GoB should earn the right to provide tax expenditure. For instance, NBR/GoB may agree on a formula where additional 0.25 per cent of tax expenditure is provided for every 2 percentage points gain in tax efforts. However, the overall ceiling should be around 2 per cent of GDP.

References:

1. Altshuler, R., & Dietz, R. (2011). Reconsidering tax expenditure estimation. National Tax Journal, 64(2.2), 459–489.

2. Beer, S., D. Benedek, B. Erard, and J. Loeprick. 2022. Tax Expenditure Reporting and Its Use in Fiscal Management: A Guide for Developing Economies. How to Notes. No. 22/05. Fiscal Affairs Department, International Monetary Fund.

3. Bratíc, V. (2006). Tax expenditures: A theoretical review. Financial Theory & Practice, 30(2), 113–127.

4. Feldstein, Martin. Raising Revenue by Limiting Tax Expenditures. National Bureau of Economic Research (NBER) Working Paper No. 13753, January 2008.

5. Heady, C., & Mansour, M. (2019). Tax expenditure reporting and its use in fiscal management: A guide for developing economies. International Monetary Fund.

6. Khan, M. O. F., Chowdhury, K., Bari, M. A., Chowdhury, M. M. I., & Rahman, M. M. (2022). Tax Expenditure Reporting in Developing Countries: A Case Study on Bangladesh. Journal of Tax Administration, 8(1), 104–131.

7. National Board of Revenue, Bangladesh. 2023. Tax Expenditure Report.

8. Redonda, A., C. Von Haldenwang, and F. Aliu. 2022. Global Tax Expenditures Database.