Automation, jobs & industrialisation

By

Bangladesh needs to generate 2 million jobs every year to accommodate new entrants to its labour force. More than 40% of people are still in agriculture, whose share in the national economy is already quite small (15%) and is set to shrink further. The country also suffers from a huge underemployment problem, which means that non-farm activities will also have to absorb the influx of labour from agriculture. Productivity growth and a rise in the formalisation of informal activities may exert further pressure on the labour market situation.

Given all this, the challenge of job creation – already daunting – is even more profound than it may seem at first sight. Fortunately, strong economic dynamism, as reflected in the country’s annual average gross domestic product (GDP) growth of above 7%, should be helpful in confronting this task. Growth in the manufacturing sector has been particularly impressive, in a context where the 7th Five Year Plan has set a target of increasing the sector’s share in total employment from 15% to 20% by 2020.

However, recent technological advances in the world economy, alongside emerging evidence on Bangladesh, seem to suggest that manufacturing growth and employment generation may not go hand in hand. This could make the task of formulating an inclusive growth strategy far more difficult than has been perceived.

Caught in premature deindustrialisation?

The world is changing rapidly. Globalisation and technological progress mean that countries are no longer following or replicating the ‘traditional’ development paths. While economic development in most Western developed countries and rapidly industrialising East Asian economies has generally reflected sequential progress from primary and traditional activities to more productive manufacturing to modern services, low-income countries are finding it difficult to embark on or consolidate such forms of transformation. Many are undergoing a phase of premature deindustrialisation – that is, they are becoming services-oriented economies without having any proper experience of industrialisation.

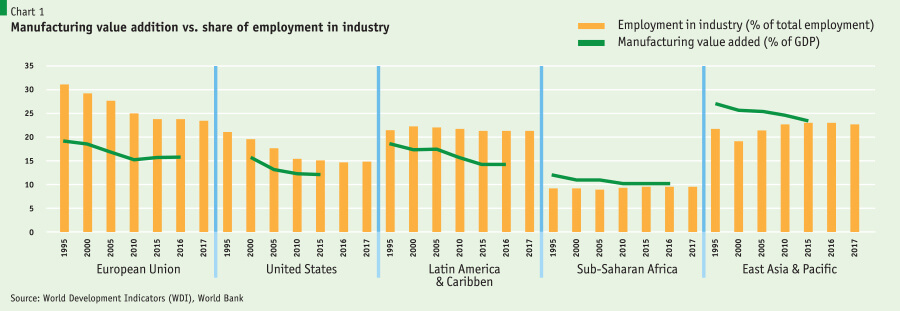

Economist Dani Rodrik alludes to different types of deindustrialisation: 1) a declining manufacturing share in GDP; 2) a falling share of manufacturing employment; and 3) both falling employment and falling output shares of manufacturing. Unlike today’s developed countries, whose manufacturing shares in output and employment peaked at a very high level of per capita income, for developing country groups, except for East Asia, manufacturing employment and/or value added have begun to shrink at much lower levels of income (Chart 1).

In Bangladesh, manufacturing growth has been robust: since 1990, the sector’s output has increased more than six-fold, raising its share in GDP from 13% to 21%. Over the past five years (2013–2017), it has grown at an impressive annual average rate of 10.4% as against GDP growth of 6.6%.

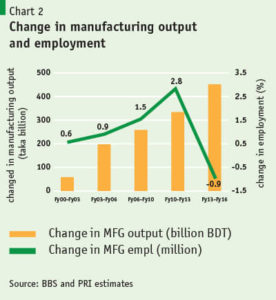

However, in what came as one of the most startling findings by the country’s official statistical agency – the Bangladesh Bureau of Statistics (BBS) – total employment in the manufacturing sector between 2013 and 2016 fell from 9.5 million to 8.6 million. This suggests that, despite adding more than Tk 450 billion-worth of output (in real terms using 2005–2006 prices), employment shrank by almost 1 million. If the official labour force data reflects the reality, Bangladesh will perhaps be a unique case among developing countries in experiencing high manufacturing growth with falling employment.

Flawed data?

While ‘jobless growth’ and premature deindustrialisation come in handy in explaining BBS Labour Force Survey results, many economists question the quality of employment data. Some suggest 2013 figures are overestimated while those for 2016 are underestimated. Without passing any judgement on this issue, we take the view that it is essential to consider other evidence and trends to obtain a broader picture of the growth–employment relationship.

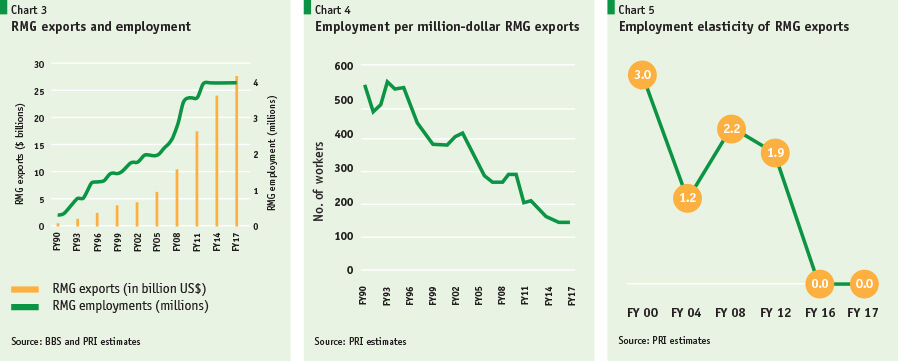

Let us consider the export-oriented RMG sector – the country’s largest manufacturing activity. Within a short span of six years between 2010 and 2016, clothing exports more than doubled, from $12.5 billion to $28 billion. However, employment in the sector, as evident in the data reported by the Bangladesh Garment Manufacturers and Exporters’ Association (BGMEA), hardly grew during the same period – from 3.6 million to 4 million – and has remained virtually stagnant for the past several years (Chart 3).

In the early 1990s, a million-dollar apparel exports would require on average 545 workers, while the corresponding figure for 2016 had come down to just 142 (Chart 4). The associated employment elasticity of exports has thus declined from 3% to zero (Chart 5).

One might take the position that RMG exports are not the same as ‘value added’ (which is used in growth calculations) and that BGMEA employment data is problematic. But none will question robust growth in RMG value added, and most observers are in agreement that jobs in the sector have not increased in number in recent years. On the other hand, there is a convincing case for labour productivity growth as a result of capital-intensive production techniques, including what has of late come to be known as automation. Economists will explain a unit of labour as more productive when the use of capital and advanced technology in the production process is higher. This will also imply fewer workers are required to produce the same amount of output. ‘Sewing robots’ and automatic machinery are now posing a serious threat to RMG sector jobs. With an automated system in place, both time and production costs reduce substantially.

Let us take the example of a leading exporting firm, located in Savar, Dhaka. The firm started its operations in 2002 with only 200 workers, exporting 10,000 sweater pieces per month. In December 2017, it had more than 8,000 workers supplying 650,000 sweater pieces per month, generating annual export earnings of $80 million. Labour productivity in the factory has risen from 50 to 81 sweaters per worker. This has been made possible through the use of sophisticated production technologies, including automation. With the introduction of the Jacquard sweater knitting machine in 2015, the firm stopped recruiting additional labour altogether: with just one operator overseeing six to eight machines, each machine can knit the sweaters automatically without any human intervention. Manpower is required only to join the various machine-made parts. The Jacquard knitting machine operates in three shifts, raising the firm’s outputs three-fold using three times fewer workers than before.

The firm has also begun to automate its woven section. Automatic hangers now transfer the garment parts, rather than workers doing this manually. This process not only reduces production time but also enhances labour efficiency by recording the number of parts each dress-maker delivers per day. Auto-spreader cutting machines have also been added to the production line. These operate via a computer processor to recognise the size and pattern of the garment and cut it according. Once this process comes fully into operation, the firm is expecting to boost its production capacity, with the possibility of a cutback in manual labour alongside this.

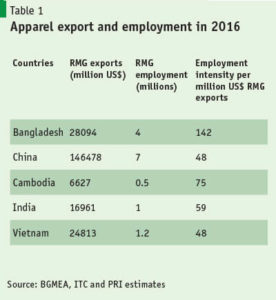

There is evidence to suggest that Bangladesh’s garment production remain more labour-intensive than that of its comparators. For every $1 million of exports, Bangladesh employs 142 workers; for both China and Vietnam, the corresponding number is just 48, followed by 59 in India and 75 in Cambodia (Table 1).

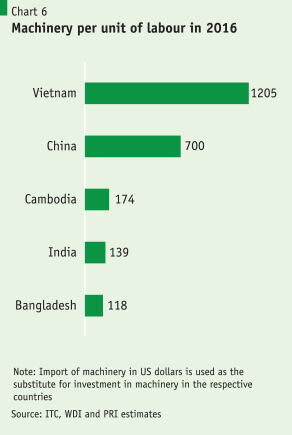

Investment in machinery per unit of labour was the lowest in Bangladesh among the major apparel exporters during 2016 (Chart 6). Whereas Vietnam used $1,205 of machinery per unit of labour, the corresponding figure for Bangladesh was only $118. Such a large difference is a major cause of concern: if it is not addressed immediately, it may hinder Bangladesh’s export competitiveness and pull down its productivity and growth.

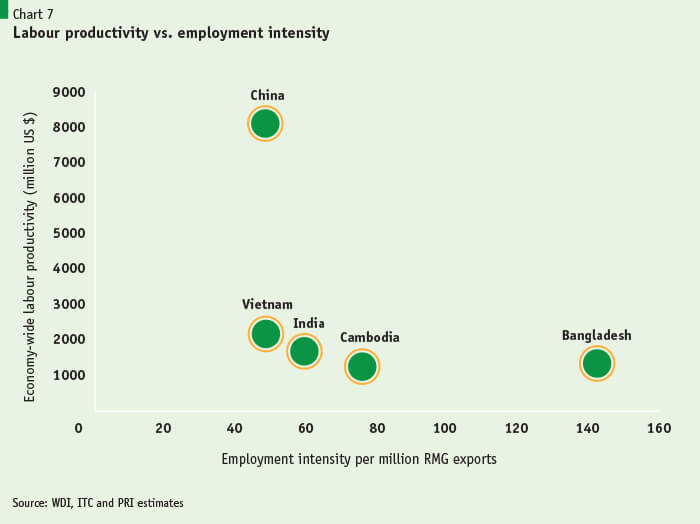

Consider overall economy-wide labour productivity and employment intensity in the apparel export industry (Chart 7). Bangladesh has the lowest labour productivity and the highest labour intensity among the major apparel exporters. Bangladesh and Cambodia have almost identical overall labour productivity, but Cambodia employs far fewer workers to produce $1 million-worth of garments. On the other hand, although China has much higher overall labour productivity than Vietnam, both the countries have almost identical employment intensity per unit of export production. India, too, with much lower overall labour productivity, has an export–employment ratio quite close to that of China. As export production technologies across countries seem to converge, for Bangladesh there exists enormous scope for improved labour productivity driven by more technology-intensive and labour-saving production processes. If the sector is going to remain competitive in the global market, moving in this direction is perhaps inevitable – which will further stifle its employment generation potential.

Research carried out by the Export-Import Bank of India shows that, between 2004 and 2013, the number of workers involved in $1 million-worth of manufacturing exports in the country fell by more than 70%. However, massive export expansion during the same period helped the country increase employment. A recent analysis projects that the textile and apparel industry in India is likely to create only 2.9 million jobs, compared with the government of India’s target of 1 crore new jobs, even as the sector’s market size is expected to grow by 40% to $142 billion by 2020. For Cambodia, an International Labour Organization (ILO) study finds that, even after robust growth in the export-oriented textile and footwear sector, employment declined by close to 3%.

The great defeminisation of the manufacturing labour force

The growth of the RMG industry in Bangladesh has been marked by a spectacular rise in the share of female wage-workers in the formal manufacturing sector. In the 1990s, but also more recently, it was widely considered that women constituted around 80% of RMG workers. Do improved productivity, use of modern and sophisticated technologies and/or automation cost women’s jobs more than men’s? According to the BBS labour force survey, the female shares of employment in the sector fell from 57% in 2013 to 46% in 2016. This is line with the findings of economists Sheba Tejani and William Milberg, who pointed to a global defeminisation process as a result of industrial upgrading. Their research shows that capital intensity in production, as evidenced by shifts in labour productivity, is negatively and significantly related to shifts in the female share of employment in manufacturing.

As export production technologies across countries seem to converge, for Bangladesh there exists enormous scope for improved labour productivity driven by more technology-intensive and labour-saving production processes. If the sector is going to remain competitive in the global market, moving in this direction is perhaps inevitable – which will further stifle its employment generation potential.

As women traditionally dominate the export-oriented apparel production workforce, increased capital intensity will result in a greater number of their job losses. But it is not clear why their share in employment will fall. It could be that women are most involved in those tasks that are repetitive in nature, which are most vulnerable to automation. Technological up-gradation could also favour men as a result of women’s weaker educational background in general. Another possibility is that, unlike men, women have been willing to work very long hours, resulting in their rising share in jobs; automation tends to affect most those jobs that involve multiple shifts on a routine workload.

Automation and ‘imported deindustrialisation’

A great deal has been written in recent times about the emerging wave of technological progress, popularly dubbed the ‘fourth industrial revolution’. This phase has seen a wide variety of innovations, including 3D printing, artificial intelligence, the internet of things and increased use of robots in production lines. All this is promoting automation. Analysis carried out by ILO for East Asian countries suggests that up to 90% of garment and footwear jobs in Cambodia and Vietnam could be at risk as a result of automated assembly lines featuring 3D printing, body-scanning technology and ‘sewboats’ (robotic automation). The on-going process of industrial up-gradation is likely to be manifested in increasing relocation of manufacturing activities in developed countries. Multinationals are investing in automated technology for various reasons, including to respond to demand for customised fashion-wear for individuals within the shortest possible time; to provide uninterrupted supplies of competitive pricing and quality; and to mitigate reputational risks arising from having to deal with production workers in developing countries struggling to comply with workplace safety and environmental standards. A number of global brands are setting up ‘speed factories’ that will combine robots with few workers.

Automation-led employment threats are not limited to developing countries: this is a global phenomenon. According to recent research by the McKinsey Global Institute, up to 800 million workers globally will lose their jobs by 2030, to be replaced by robotic automation. Up to a third of the workforce in richer nations like Germany, the UK and the US may need to retrain for other jobs. Capacity and resource constraints mean developing and poor countries are likely to experience slow expansion in automated production processes – but the import of technologies and adaptation have now become much faster.

Automation-led employment threats are not limited to developing countries: this is a global phenomenon. According to recent research by the McKinsey Global Institute, up to 800 million workers globally will lose their jobs by 2030, to be replaced by robotic automation.

Dani Rodrik argues that many developing countries imported deindustrialisation from advanced countries because they had become exposed to cheaper prices of imported manufactures (as a result of technological advancement). The decline in the relative price of manufactures in advanced countries put a squeeze on manufacturing everywhere, including countries that may not have experienced much of a technological progress. Following this argument, we might infer that the automation revolution could bring about another round of deindustrialisation for many low-income countries.

Policy implications

The trends highlighted above require careful consideration: a mere debate on the accuracy of employment data will not suffice. It will also be important to assess the policy implications of the relevant issues.

First of all, the available cross-country evidence strongly suggests that an export-led growth through manufacturing development strategy, as envisaged in the 7th Five Year Plan, will require much faster and higher growth so as to generate enough jobs and even to maintain the current level of employment. In this regard, it is extremely important to realise a rapid expansion of exports in the immediate term to take advantage of the time gap between technological feasibilities leading to maturity and actual widespread adoption of automation. Various constraints, including policy-related ones undermining external competitiveness, could soon be associated with missed opportunities. Given the trends in production technologies, export diversification is perhaps more important than ever. Automation will affect all labour-intensive exports, but an expanded range of production activities has the potential to generate new jobs.

Second, there should be no policy dilemma about promoting competitiveness by supporting technological up-gradation, particularly for export sectors. In some cases, technological advancement can lead to improvements in product quality with prospects for export expansion.

Third, non-export and import-competing sectors are also likely to embrace more capital-intensive production techniques. Investment in machinery and equipment, as measured by import data, per unit of labour is much lower in Bangladesh in comparison with in Cambodia, China and Vietnam. While the corresponding figure for India may look comparable with that of Bangladesh, India’s domestic capacity in producing capital and machinery goods is not captured when considering only imported machineries. On the whole, the cross-country comparison indicates an increased likelihood of capital-deepening in the future.

Fourth, rather than fearing the impact of technology on employment, it is important to remember that growth potential remains huge. Bangladesh is still a low-income country and thus it can sustain high economic growth for many years to come. Rapid manufacturing expansion will fuel this growth with a high level of employment. Technological advancement can be seen as an opportunity to augment growth. Achieving higher growth rates, say 8–10% per year, may now be more feasible than before. Small and medium enterprises, which are critical for domestic economic activities, will need support to obtain better access to technology so they can raise their productivity and competitiveness.

Fifth, the role of trade policy needs to be carefully evaluated. While there will be a temptation to shield the domestic economy from imported deindustrialisation, capital-deepening and technological up-gradation in an excessively protected environment could lead to mounting inefficiencies, with adverse welfare consequences.

Sixth, technological progress is likely to be associated with a rising share of capital income and an increased skills premium, contributing to inequality. This has historically hurt certain worker groups (unskilled ones more often) while benefiting others. The potential impact on women will be a particularly important issue for Bangladesh. Policies that focus on the poor, women and other vulnerable groups, including their better access to education, health care and well-targeted social policies, while making tax systems more progressive, are called for in addressing this area.

Seventh, how to transform the social sectors to generate productive employment is one of the most critical policy areas. Investment in such areas as health and education remains very low, and the quality of these services is widely perceived to be far from satisfactory. The need for careful policy attention to these sectors cannot be overemphasised in relation to generating future jobs and developing the human capital needed to support socially coherent technological progress.

Finally, Bangladesh badly needs good-quality data to enable informed policy-making. Without the availability of timely, appropriate and robust data, it will not be possible to capture the complex interactions involved in labour market dynamism and technological change and to consider the required policy interventions to respond to these.