The Polictical Economy of Trade Protection

By

Although the case for free trade is contentious at both the theoretical and empirical level, there is a broad agreement that large trade protection — unless offset by strong dynamic production gains from the protected industries — tend to lower national welfare by taxing consumers and reducing potential gains from production efficiency and expansion of export industries.

In the case of Bangladesh, analysis shows that large trade protection from the early days of independence did not benefit industrial development and growth. Instead, trade liberalisation from 1980-2000, along with investment de-regulation and better macroeconomic management, boosted private investment, exports, manufacturing growth, and GDP growth (Ahmed and Sattar, 2003).

The expansion of the ready-made garments (RMG) and associated vertical linkage with the textile industry have created more than 4 million manufacturing jobs and supported a double-digit growth of the manufacturing sector (Ahmed, 2017). Even so, the full potential of an export-led labour-intensive manufacturing sector is prevented by prevailing large trade protection (Ahmed 2017).

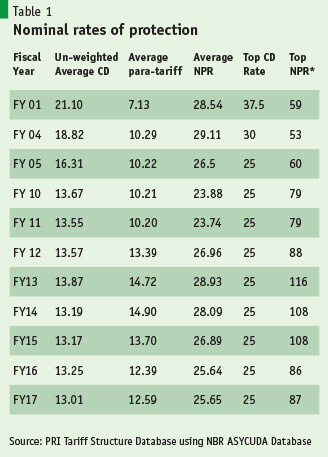

Trade policy reforms have taken a back seat since the early 2000s and nominal protection rate remains large (see Table 1). Even as customs duties have come down, the effects of protection have been preserved by the introduction of a large range of supplementary duties (SD) and regulatory duties (RD). Indeed, as reflected in Table 1, these para-tariffs (SDs and RDs) now account for almost 50% of the nominal protection.

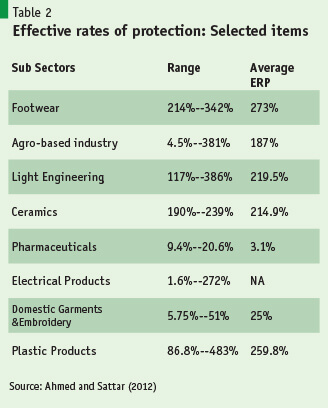

The implications of the tariff regime for resource allocation is illustrated by the examples of effective rates of protection (ERP) that were calculated based on a sample survey of 200 manufacturing enterprises in 2012 (Ahmed and Sattar, 2012). The ERP rates ranged from zero for export products to 483% for certain types of plastic products (Table 2).

There is wide dispersion in ERPs by sub-sectors and within sub-sectors. The large range of ERPs reflects the ad-hoc nature of the trade regime as far as incentives for production is concerned. What is clear, however, is that these ERPs provide a serious anti-export bias.

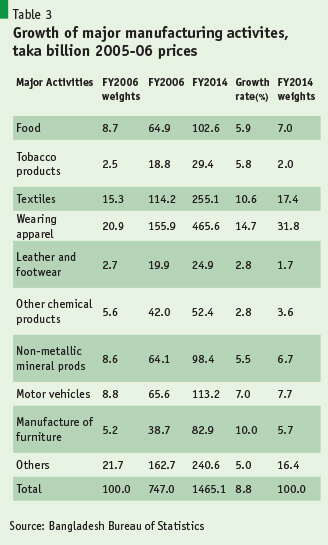

To the extent that the trade policy has been guided by protection considerations, in most cases these have not been very effective in promoting industrialisation. The growth of key manufacturing activities is illustrated in Table 3. Using data from FY2006 to the latest available year of FY2014, the value-added figures combine large, medium, and small-scale enterprises as reported by the Bangladesh Bureau of Statistics.

The results are as follows:

- Between FY2006 and FY2014, the leading manufacturing activities were RMG and textiles. They grew faster than average manufacturing, thereby increasing their share in total manufacturing value added from 36% in FY2006 to 49% in FY2014. Both are leading export activities.

- All other manufacturing — except furniture-making — grew much slower than the average manufacturing growth, thereby losing value-added share.

- Furniture grew faster than the total growth, resulting in its share increasing slightly.

- Unless more recent data shows otherwise, protection did not appear to spur manufacturing sector growth until at least FY2014.

The export story corroborates the production story. The surge in exports since the early 1990s was led by the RMG sector, growing from a mere $600 million in FY1990 to $28 billion in FY 2016.

This is an astounding annual growth of 16% per year between FY1990 and FY2016. As compared to this, the non-RMG manufactured exports grew by only 8% per year during the same period. One notable exception is footwear. It gained prominence since FY2006 and its growth has surged (22% per year over FY2006-FY2016).

Political economy of trade protection

Continued trade protection even after the liberalisation efforts of 1980-2000 has several adverse effects.

First, consumers lost real income by paying a much higher price for a product that is subject to trade protection. As seen from Table 1, average price has been about 25% higher but the top NPR suggests that for some product groups, the price differential was 87% in FY2017.

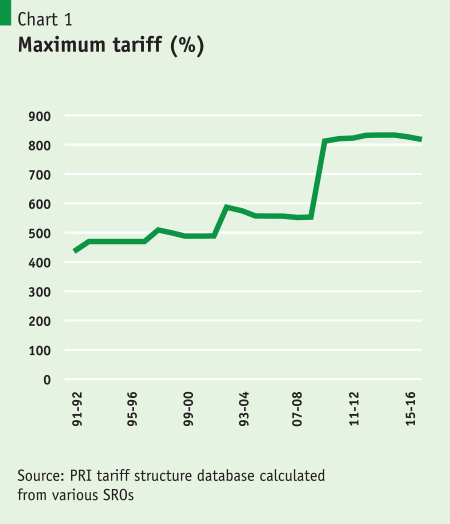

This top NPR excludes prohibitive nominal rates for many products, like certain categories of automobiles. Data shows that the maximum tariff rate for some products was as high as 827% in FY2017 (Figure 1). The loss to consumer welfare is obvious.

Second, despite heavy dose of protection, import-substituting domestic production has prospered in only a few areas, such as pharmaceuticals, and more recently, electronic home goods. Most other import substituting activities have failed to show dynamism (Table 3).

This partly reflects the randomness of the total protection structure (ERPs) that was not always directed to providing incentives to domestic protection. Consequently, the employment objective of trade protection has not yielded adequate benefits.

Indeed, much of the manufacturing employment growth has come from the export-oriented RMG sector. International experience shows that, unless an import substitution strategy is well directed to activities that have genuine prospects of growing through learning-by-doing, the outcome usually is a high-cost industry that only thrives from high protection.

From South Asia, the examples include India in the pre-1980 phase; Pakistan during 1960-1980; and Bangladesh during 1972-1980. Such misdirected resource allocation leads to rent-seeking behaviour with limited prospects for job creation.

Third, the large ERPs suggest that incentives are heavily biased against exports and in favour of domestic production. As shown in Table 3, on the production side, the two most dynamic manufacturing sectors, RMG and textiles, are both export-oriented.

These sectors have scaled up and benefitted from access to the large global market, based on some special privileges that are not normally available to other exports. These include a liberal Bonded Warehouse Scheme whereby raw material can be imported duty free; back-to-back L/C facility that allows payment for imports based on export earnings; cash subsidy to domestic textile production, and very generous income tax regime.

Compared to RMG, other exports have mostly failed to ignite, partly owing to the adverse incentive structure. Since exports are geared to the very large world market, there are potential benefits of economies of scale in exports that may not be possible in domestic economy.

Indeed, the RMG is a primary example of this economy of scale. Similarly, the prospect for footwear exports facing a huge global market ($300 billion) is far better than what is possible in the domestic market.

Combining the resource misallocation effects of two and three, the economic costs can be large. While direct estimates of these losses are not available from Bangladesh, available international evidence illustrates this point.

Irwin (2001) estimates that the trade embargo imposed by the US in 1807 cost it some 7-10% of GNP. The import tariff was about 70% and the import share fell from 20-35% to only 8-10%. Bergsman (1974) estimates efficiency losses to be 6.8% of GNP for Brazil in 1966. Balassa (1971) estimates that efficiency costs of trade protection were 5.5% of GNP for Pakistan (1963-64); 9.6% of GNP for Chile (1961), and 9.5% for Brazil (1966). While these estimates date back a long time, they are illustrative of the possible cost of trade protection, since these are based on real time experiences.

Fourth, manufacturing exports that have prospered in Bangladesh — such as RMG, and more recently, the footwear sector — are generally more labour intensive. This is consistent with the predictions of the Heckscher-Ohlin theory of trade (Ohlin, 1933; Heckscher 1949).

Accordingly, the expansion of exports is expected to benefit employment and real wages of workers, as per the Stolper-Samuelson Theorem (Stolper and Samuelson, 1941). Hence, the anti-export bias of the Bangladesh trade protection is more likely to hurt employment and real wages.

On the other hand, as per Heckscher-Ohlin model, import substitutes are likely to be relatively more capital and skill intensive. So, trade protection will tend to benefit the growth of capital intensive industries and increase the return to investors and skilled labour. This pattern of trade-policy induced income distribution contributes to income inequality.

Fifth, even if losses to consumers are fully offset by gains to import-substituting, efficient producers, and there are no economies of scale to be gained from large scale production for the world market, there is a dead-weight loss owing to the imposition of tariff, that drives a wedge between world price and the domestic price.

These constitute static efficiency losses due to producing and consuming at prices that are distorted by the imposition of the tariff. These dead-weight losses can be substantive. For example, in a pioneering study of the trade restrictiveness and deadweight losses for the US economy, based on data for nearly a century, Irwin (2008) shows that this loss was as high as 1% of GDP during the peak years of tariff-based trade protection in the late 19th century.

This dead-weight loss fell considerably after trade liberalisation starting in the 1930s, declining to less than one-tenth of 1% in the 1960s. Panagariya (2002) summarises the dead-weight loss estimates from several studies carried out during the 1960s, which show that the cost of protection was around 1% of GNP under relatively low levels of protection (15% or less). This cost, however, rises as the level of protection rises. For example, Harberger (1959), using a 50% average tariff rate, calculates a dead-weight loss of 2.5% of GNP for Chile during the 1950s.

These factors raise the following two questions: 1) If trade protection has not contributed to rapid growth of the import-substituting enterprises and yet can inflict high efficiency and dead-weight losses, then why does trade protection prevail? and 2) who benefits from trade protection?

The questions are inter-related and require an understanding of the political economy of trade protection.

In literature, two broad approaches are taken to analyse the political economy of protection (Baldwin, 1989). The first deals with the social concerns of government officials and the voters, and the second concerns the self-interests of the participants in the market place.

In the social concern approach, the government has some social and political objectives that it seeks to maximise through trade and other public policies. Regarding the self-interest approach, an individual promotes trade policy that benefits the individual.

Thus, in a two-factor, two-good model a le the Heckscher-Ohlin model, if the export good is labour intensive and the import is capital intensive, then workers will tend to support the export industry, while capitalists will favour the import substitute industry. As such, workers will tend to oppose a tariff on import,s while a capitalist will support it.

In literature, two broad approaches are taken to analyse the political economy of protection (Baldwin, 1989). The first deals with the social concerns of government officials and the voters, and the second concerns the self-interests of the participants in the market place.

The social concern approach

Bangladesh traditionally is an inward-looking and risk-minimising society where self-dependency and self-sufficiency are at premium. Important examples of this are the national priority given to the attainment of food self-sufficiency, and government control over the energy sector.

In the manufacturing sector, the self-sufficiency argument initially translated to an industrialisation strategy based on state-owned enterprises and large trade protection, including quantitative restrictions. The poor results of this control-oriented industrialisation policy forced a retreat, and trade and investment policies were deregulated starting in the early 1980s (Ahmed and Sattar, 2003).

Notwithstanding the highly positive results of this deregulation drive (Ahmed and Sattar, 2003), the fear of “unfair foreign competition” flooding the domestic market and leading to de-industrialisation promoted by left-wing economists have captured the minds of politicians.

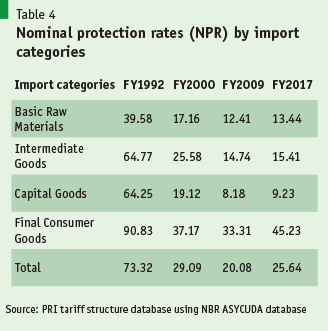

The success of the RMG industry has demonstrated the importance of access to duty-free imports of raw materials and machineries. And this result is now well accepted in the political circle. As a result, the tariff and para-tariff structure impose low levels of protection on capital and intermediate goods (Table 4).

Most attention is given to consumer goods when developing policies for trade protection. The conventional political wisdom is that low-cost import of consumer goods will destroy the domestic production and hurt employment. Therefore, these goods must be subject to trade protection to enable domestic production and protect employment (Table 4). The success of the domestic pharmaceutical industry is cited as a prime example of the good use of trade protection.

An important question is: Why are policy makers swayed by populist perceptions? A part of the answer is the political power of vested interest groups who benefit from trade protection. Another factor is that unfortunately, policy making in Bangladesh is not yet based on evidence but on populist perceptions. There is no systematic effort to analyse and understand the real implications of the protection structure on production incentives or any effort to understand whether this protection structure is yielding the intended results.

Even in the case of the pharmaceutical industry, the issue of drug quality is a serious concern that has not been subjected to the rigorous scrutiny that it deserves. It is well known that the elites do not trust the local drugs and get their medications from abroad through self-procurement, since drug imports that are domestically produced are de-facto banned. Similarly, the issues of dead-weight loss and production efficiency loss do not figure in policy making partly because such analysis is not available to policy makers.

The self-interest approach

The level of nominal protection is often determined by protection considerations based on trade lobbies. As noted, the main target of nominal protection is consumer goods based on the philosophy that such protection will help develop the manufacturing sector of Bangladesh. The demand for protection comes from the local manufacturing enterprises represented by very powerful business groups, especially the Federation of the Bangladesh Chambers of Commerce and Industry (FBCCI).

Established in 1973, the FBCCI is the most prominent institution representing the interests of commerce and industry. It is very vocal and politically well-connected. It is now the main vanguard of trade protection in Bangladesh. Its political connections with the national government and the national parliament give it a dominant voice in matters of both trade policy and taxation. Members of the FBCCI and the community they represent are the main beneficiaries of trade protection.

On the export front, the most prominent trade bodies are the two RMG related institutions: The Bangladesh Garments Manufacturing and Exporters Association (BGMEA) and the Bangladesh Knitwear Manufacturing and Exporters Association (BKMEA). Over the years both BGMEA and BKMEA, but especially BGMEA, have acquired sufficient political strength and voice in influencing policy decisions relating to the RMG sector.

Interests of exporters are also represented by the Metropolitan Chamber of Commerce and Industries (MCCI) and the Leather and Footwear Manufacturing and Exporters Association (LFMEA). The LFMEA is a more recent trade body and is less organized than BGMEA or BKMEA. Also, the exporters lobby in MCCI is somewhat muted compared to BGMEA and BKMEA. Overall, the RMG lobby is very strong, but non-RMG exporters lobby is yet to find political muscle.

An important question is: Why are policy makers swayed by populist perceptions? A part of the answer is the political power of vested interest groups who benefit from trade protection.

Since RMG imported inputs are duty free based on an elaborate bonded warehouse system (BWS), and capital and machineries have very low nominal protection, the RMG interest and role in influencing trade policy is very limited. The RMG trade lobbies have also very successfully secured major concessions on the corporate income tax front, whereby they are only required to pay a tax of 0.7% of their export proceeds, irrespective of profit made. The Non-RMG exporters are not well-organised and their voice tends to be overwhelmed by the protectionist lobby in the FBCCI.

Given the agrarian and informal nature of the labour market, the labour group is highly segmented and not well-organised. In the early years after independence, when the bulk of the organised economic activities in manufacturing and finance were nationalised, organised labour emerged as a highly militant and powerful force linked to their employment in these state-owned enterprises (1972-1980).

Their muscle power was part of a reason why the de-nationalisation and privatisation effort took a long time despite poor outcomes even in the early years of nationalisation. Additionally, large trade protection was a natural outcome of the political influences of the self-interest preservation effort of the militant and organised workforce.

Trade protection through tariff and quantitative restrictions sharply curtailed imported consumer goods in the market and increased the prices of domestic consumer goods. This ensured that the domestic manufacturing SOEs stayed afloat despite high-cost production and employment was preserved for those who could get in and were a part of the organised labour. Budget subsidies and loans from state-owned banks also supported this system until the deregulation policies of the 1980s.

It became obvious that this high-cost SOE-based manufacturing set up was not sustainable. Investment and trade deregulation policies starting in the 1980s slowly dismantled the domination of SOEs and a vibrant private sector-led manufacturing took over. By 2000, private sector manufacturing became dominant, especially through the RMG revolution.

The dominance and power of organised labour also fell. Presently, the influence of politically-connected militant labour has virtually disappeared. To the contrary, there is now an ongoing debate on whether the absence of organised labour is a problem for protecting worker rights, especially in the RMG sector.

Pressure from International Labour Organisation (ILO) and major RMG buyer governments in the EU and US is now mounting to prop up labour unions. Until this takes some shape, it is fair to say that the collective power of labour has waned to an extent that it is no longer a strong voice in policy making including trade policy.

Like the workers, the consumers in Bangladesh are completely dispersed with very little voice on major policy issues, except in the case of domestic energy pricing. In Bangladesh, there is no organised representation of the consumers group. As such, there is no representation of consumer group in trade policy.

Consequently, the large loss of consumer welfare from the substantial price differential of domestic prices over international prices does not figure in policy making on trade policies. It is, therefore, not surprising that they are the main losers of the cost of trade protection.

References

Ahmed, Sadiq. (2017). “Trade and Exchange Rate Policies for Export Diversification”, power point presentation to a Seminar in Dhaka, Policy Research Institute, May 24.

Ahmed, Sadiq and Zaidi Sattar (2012). Assessment of Effective Rates of Protection: Survey of Manufacturing Enterprises. Report Prepared for the World Bank, Dhaka.

Ahmed, Sadiq and Zaidi Sattar. (2003). Trade Liberalization, Growth and Poverty Reduction, The case of Bangladesh. South Asia Region Internal Discussion Paper, IDP-190. World Bank, Washington D. C.

Balassa, Bela, 1971, “Evaluation of the system of protection,” in Balassa, Bela and Associates, The Structure of Protection in Developing Countries, Baltimore: Johns Hopkins Press.

Baldwin, Robert. E. (1989). “The Political Economy of Trade Policy”, Journal of Economic Perspectives, Volume 3, Number 4, Fall, 1989, pp. 119-135.

Bergsman, Joel. “Commercial Policy, Allocative Efficiency and ‘X-efficiency.’” Quarterly Journal of Economics, August 1974, 88(3), pp. 409-433.

Irwin, Douglas A. (2008) “Trade Restrictiveness and Deadweight Losses from U.S. Tariffs”, Dartmouth College, Dartmouth.

Irwin, Douglas, 2001, “The Welfare Cost of Autarky: Evidence from the Jeffersonian Embargo, 1807-1809,” Dartmouth College, August 21, 2001, mimeo.

Harberger, Arnold. (1959). “Using the Resources at Hand more efficiently.” American Economic Review: Papers and proceedings of the seventy-first annual meetings of the American Economic Association, May 1959, 49(2), 134-146.

Heckscher, Elly. (1949). “The effect of foreign trade on the distribution of income” in H. L. Ellis and L. A, Metzler (eds) Readings in the Theory of International Trade, Blackston.

Ohlin, Bertil. (1933). Inter-regional Trade and International Trade. Harvard University Press, Massachusetts.

Panagariya, Arvind. (2002). “Cost of Protection: Where Do We Stand?” University of Maryland, College Park, Maryland.

Stolper, Wolfgang F. and Paul Samuelson (1941). “Protection and Real Wages”, Review of Economic Studies.