State of the economy 2018: Managing vulnerabilities, creating opportunities to sustain growth

By

‘Admirable economic progress’ is how The Economist of London sums up the state of the Bangladesh economy today. Quite apart from the growth in income and reduction of poverty, the same analysts cite that we do better than our peers on various aspects of human development. As we approach the 50th anniversary of independence in 2021, even realists will have a lot to cheer for. At the same time, sober reflection on happenings over the past five decades reveals many missed opportunities for even greater achievements in human and material progress. The new government is getting down to the serious business of undertaking critical reforms in the greater national interest—reforms that have been left unattended for one reason or another.

The year in review

In the past year, the economy has continued its march on a high growth trajectory, albeit with some emerging vulnerabilities.

Economic growth accelerated in FY2018 to a record 7.9%, broadly based on a strong agriculture sector rebound, record 13% growth in manufacturing and a moderate recovery of export growth. Growth of major manufacturing sectors such as garments, jute and home textiles, agro-processing and leather goods were the main drivers.

In other important ways, 2018 was a milestone for Bangladesh. At the time of independence in 1971, Bangladesh was famously declared to be ‘the test case for development’. Forty-seven years later, Bangladesh has now officially started the UN graduation process out of the least developed category towards becoming a developing country in 2024. It has been a lower-middle-income country under World Bank classification since 2015. The newly released World Bank Human Capital Index 2018 report also shows Bangladesh to be among the best-performing South Asian countries, well ahead of India and Pakistan on various measures of human development.

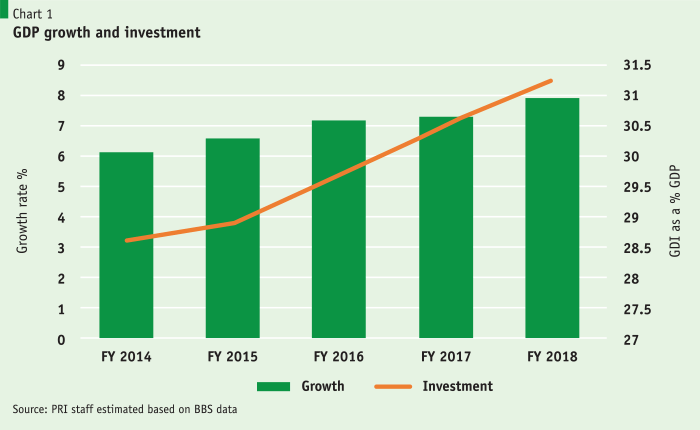

For the past 25 years or so, prudent macroeconomic management has been the hallmark of Bangladesh’s economic governance. This came under pressure in FY2018, from emerging macroeconomic imbalances. Growth was led by high consumption by both the private and the public sectors, combined with an increase in public investment. This meant that national savings rates fell by 2.2% of gross domestic product (GDP) and the savings–investment gap increased significantly, by almost 3% of GDP, which resulted in a record-setting current account deficit. Without strong remittance inflows in FY2018, the savings–investment gap would have been significantly larger.

Despite this global economic uncertainty, the Bangladesh economy has been growing steadily, clocking a more than 7% GDP growth rate for three consecutive years.

Sluggish export growth, an increase in oil prices by nearly 35% in the past few months and high demand for imports meant that, in dollar terms, the trade deficit stood at $18 billion while the current account deficit was just short of $10 billion – at about 3.4% of GDP. The need to finance this deficit coupled with central bank intervention to support the taka for much of 2018 put reserves under stress. But the good news is that this current account deficit also indicates that we are finally investing more (e.g. in several mega infrastructure projects) than we save—a rarity in the past 18 years—which will lead to higher productivity and growth in the future.

On the monetary side, the year was marked by tight money supply growth of 9.2%. But private credit growth remained robust at about 17% over the year, outpacing deposit growth in banks, which, in the face of a marked rise in non-performing loans, endured a significant liquidity crisis in the first half of 2018, which still persists.

In the near term, these rising macroeconomic imbalances and financial sector stress, and a difficult external environment, have exposed vulnerabilities that are challenging future growth prospects. These need to be addressed so that growth does not falter. In the medium term, Bangladesh can use these challenges as opportunities to implement long-due structural reforms to improve the investment climate in the country. Issues such as regulatory red tape, poor trade logistics and infrastructure and difficulties in finding land all combine to discourage investors. It has become clear that Bangladesh must diversify its exports and economy to sustain export and overall growth rates. This requires addressing the high anti-export bias in the tariff regime and exchange rates, proactively inviting foreign direct investment (FDI) to help develop new products and connect to new markets and supply chains. Improving infrastructure, trade logistics and, more broadly, the investment climate is a national imperative.

Dark clouds on the global economic horizon

The global economic outlook suggests mounting uncertainties and vulnerabilities. Declining policy coordination among the advanced economies and the fraying of international trade relations are contributing to the deteriorating international climate and the softening of growth prospects. The International Monetary Fund’s (IMF’s) World Economic Outlook (WEO) October 2018 report projects global growth for 2018/19 to remain steady at its 2017 level at about 3.7% (Table 1). Growth has also become uneven, with major economies such as Argentina, Brazil, Iran, Italy, Turkey and South Africa facing significant macroeconomic problems and low growth. Several downside risks for the world economy, such as rising trade barriers, reversal of capital flows to emerging market economies with weaker fundamentals and higher political risks, have all become realities to varying degrees.

The escalation of trade friction between the US and China is seen to be one of the main causes of the slowdown in world trade, and this is now projected to decelerate further in 2018 and 2019. The World Trade Organization (WTO) has warned that any escalation of such a trade spat could pose great global economic risk, threatening millions of jobs. WTO economists predict that a complete breakdown of international trade cooperation would lead to a sharp rise in tariffs, reducing global economic growth by 1.9%. As of the writing of this report, trade tensions have not abated. The WTO’s Director-General, Roberto Azevêdo, has warned this could be the worst crisis in global trade since 1947.

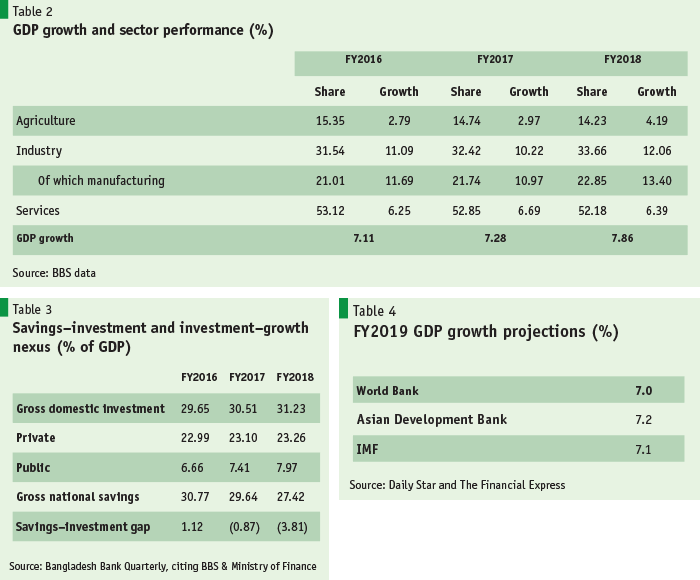

Bangladesh’s accelerating growth performance

Despite this global economic uncertainty, the Bangladesh economy has been growing steadily, clocking a more than 7% GDP growth rate for three consecutive years (Table 2). The latest official statistics on national accounts for FY18 estimated by the Bangladesh Bureau of Statistics (BBS) reveals a GDP growth rate for FY18 of 7.9%—the fastest growth in the past three fiscal years. This growth has also been well balanced across sectors. Impressive performances in the agricultural crop, livestock and fisheries subsectors all added up to a healthy 4% plus growth rate. Bumper harvests of boro, maize, wheat, vegetables, pumpkin and groundnuts in the north of the country certainly contributed to this.

Backed by this strong performance in agriculture, the industry sector led growth, contributing to more than half of annual growth. In particular, the large-scale manufacturing sector’s healthy growth of 14% contributed to a third of overall economic growth. Garments, jute and home textiles, agro-processing and leather goods were the main drivers. Rise in export growth (8%) in the ready-made goods (RMG) sector, improved energy supply and relative political calm helped manufacturing growth. Growth in the power sector of more than 10% was another important boost to growth.

Growth in services dipped slightly in FY2018, mainly because of quite slow growth in real estate, which is consistent with the subdued growth of the construction sector. Transport and communications growth have also been mediocre and show a slight dip. Wholesale and retail trade, the banking sector and public administration and defence all grew robustly at above overall GDP growth rates.

Savings–investment balance

Overall, the investment rate stood at 31.2% of GDP, mainly reflecting the sharp rise of public investment in recent years to nearly 8% of GDP (Table 3). However, a consumption-driven increase in growth rates translated into a lower savings rate. Gross national savings declined from 29.6% of GDP in FY2017 to 27.4% in FY2018, resulting in a savings–investment gap of 3.8% of GDP. It is the rise in public investment (mega projects) that has contributed to this savings–investment gap. The rising negative gap between savings and investment is also reflected in the current account deficit. The good news is that it signals an end to the many years of under-investment of the past, when the economy showed a persistent current account surplus. If the investment spurt leads to higher productivity, income and growth in the future, the savings–investment gap could eventually peter out.

Acceleration of GDP growth rates in recent years (Chart 1) may be associated with the rise in public investment.

As we approach the 50th anniversary of independence in 2021, even realists will have a lot to cheer for. At the same time, sober reflection on happenings over the past five decades reveals many missed opportunities for even greater achievements in human and material progress.

The projects—Padma Bridge, the Rooppur nuclear power project, Paira Sea Port, the coal-fired large power projects of Matarbari and Rampal, Metro Rail and the liquefied natural gas (LNG) terminal and, over the long term, Karnaphuli Tunnel, Dohazari–Gundhum rail line and Bangabandhu rail bridge on Jamuna—are expected to have significant returns and a positive impact on future economic activity. Progress in terms of physical completion of these projects is expected to boost investor confidence. Reflecting the robust investment rates and domestic demand trends, development agencies are also projecting strong growth for FY2019. The key development partners (e.g. the World Bank, IMF, Asian Development Bank) are all projecting 7% or higher GDP growth for FY2019 (Table 4). This is the first time in Bangladesh’s growth history that all these agencies have projected GDP growth higher than 7%.

The main policy challenge lies in efforts to stimulate private investment rates, which have been relatively stagnant for the past few years. The new government must make it a priority to give private investment a boost in order to attain the coveted 8% GDP growth at the end of the 7th Plan period.

Slowdown in job growth

By adopting a labour-intensive and manufacturing export-oriented growth strategy, Bangladesh has been an impressive performer among developing countries in terms of creating jobs, which have grown at a rapid rate of about 2.4% annually. As a result, currently, the economy has been able to provide almost 61 million workers with jobs. Furthermore, most of the job growth between 2003 and 2013—10 million out of 14 million—has taken place in higher productivity manufacturing and construction industries and services. This drawing of the workforce out of agriculture has led to a significant rise in rural real wages and incomes and a reduction in poverty. Socially, the 2–3 million female workers employed in most RMG manufacturing have been critical in raising female rights and empowerment and the many associated benefits of this.

But challenges are looming. Bangladesh needs to generate about 1.5 million jobs every year to accommodate new entrants to its labour force. Improving the quality of jobs is another challenge: 40% of current workers are still employed in low productivity agriculture, where the share of GDP is 14%, 85% work in informal jobs, 6.6 million are underemployed and 2.7 million are unemployed.

Against this backdrop, a significant development is a sharp slowdown in employment growth between 2010–2013 and 2013–2017, from 1.6 million per year to 800,000 per year. The 2017 Labour Force Survey, which provides these results, will need scrutiny. Even more dramatic, according to BBS, total employment in the manufacturing sector between 2013 and 2017 fell in absolute terms from 9.5 million to 8.7 million at a time of rapid GDP growth. Relative real wages for manufacturing and urban areas compared with rural areas are also low by international standards. These developments do not suggest that this is jobless growth, but rather that the employment intensity of growth has declined markedly. This partly reflects a slowdown in labour force growth and a welcome increase in labour productivity. But it also likely reflects the stalling of private investment trends and an increase in capital intensity in production. All these are issues that need to be urgently studied and addressed.

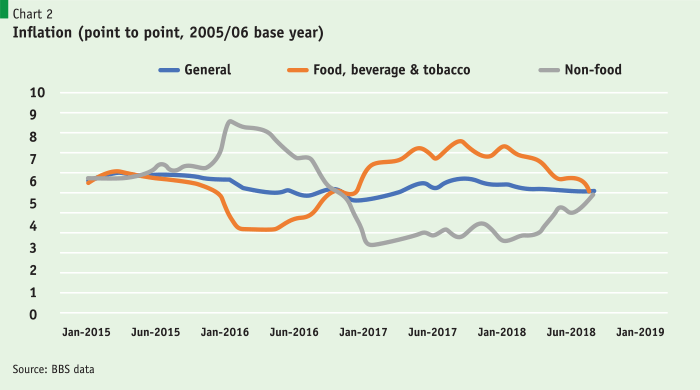

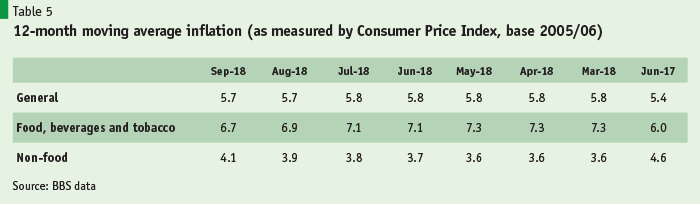

Prices stable but under pressure

While average inflation rates edged up during the first quarter of calendar year 2018, they edged closer to the Bangladesh Bank target of 5.5% by September (Table 5).

Point-to-point non-food inflation, which had increased to its highest level in the previous two years in 2016 (Chart 2), fell through most of 2017. Since January 2018, however, the price rise in clothing, footwear, furniture and household equipment and transport has increased non-food inflation rates, mainly since March 2018. The uptick may have also reflect some spillover from exchange rate depreciation in recent months as well as the more accommodating stance of monetary policy since April 2018, with a lower cash–reserve ratio and reverse repo rates.

Food inflation—especially inflation in rice prices—will have to remain under careful watch over the coming year. Although point-to-point food inflation has continued to decline, inflation risks in the first quarter of FY2019 from higher global commodity prices and exchange rate movements cannot be ignored. In developing countries like Bangladesh, where a large amount of household income is spent on food, the point-to-point food inflation is the one to watch closely. Overall, Bangladesh Bank will need to be vigilant about managing the inflation rate.

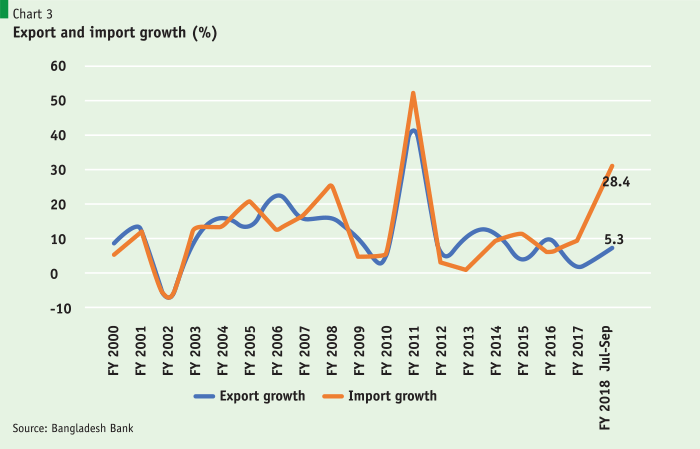

Exports sluggish but picking up

Export growth has been tepid since FY2012, with an average of around 7% growth over these years. However, FY2018 performance (+5.3%) was better than the previous year’s growth of 1.7%. Negative strains from the Rana Plaza episode, a fall of the euro against the US dollar, uncertainty surrounding Brexit and the Eurozone crisis are some of the main factors that have contributed to a slowdown in export growth. Moreover, a significant appreciation of the Real Effective Exchange Rate (REER) over the past five years seems to have had a debilitating impact on export competitiveness. A pickup in exports is being observed, with growth of 14.8% in the first quarter of FY2019

Product diversification of our export basket shows little movement in FY2018, with RMG making up 84% of the total. After RMG, jute and jute goods, footwear and leather goods, we are yet to find emerging products with staying power.

Government will need to take a concerted multi-pronged approach to address the diversification challenge. First, non-RMG exports will have to be given the same export regime as RMG (starting with duty-free imported inputs under a bonded system). Second, the anti-export bias of the tariff regime will need to be sharply reduced. The current tariff protection—very high in comparison with the export-powerhouse East Asian economies—makes domestic sales far more profitable than exports. This tariff-created bias, a disincentive to exports, needs to be rationalised.

Third, proactive REER management will be needed to make exports competitive. The nearly 50% appreciation in this exchange rate in the recent past has significantly eroded Bangladesh’s competitiveness. Fourth, partnerships with foreign investors who are well connected to foreign markets and value chains should be encouraged. Without FDI, the impetus to accelerate both RMG and non-RMG export growth will be absent. FDI not only brings capital and job creation but also provides market access, technology and advanced management practices.

Finally, improvements in the investment climate regime through cutting regulatory red tape, providing adequate infrastructure and logistics support will be necessary. The weaknesses in Bangladesh’s investment climate have been pointedly highlighted in both the World Economic Forum’s World Competitiveness Report and the World Bank’s Doing Business Report of 2018. Bangladesh’s trade infrastructure (e.g. ports, road and rail transportation, customs administration) must be modernised to infuse export dynamism that has been missing in the past. Here, again, government should seek opportunities to invite FDI and form public–private partnerships to develop and manage the trade infrastructure.

Import surge

FY2018 was characterised by an import surge of over 25%. The increase in demand for imports was triggered by the economy’s overall growth, which went up over 7% this fiscal year. The impetus also came from implementation of various infrastructure mega projects, which inevitably led to an increase in imports for machinery and other capital goods, resulting in a trade deficit of over $18 billion.

However, it is not the sharp trade deficit that is of relevance, as trade deficits are often pro-cyclical, moving in the same direction as GDP. Rather, it is the current account balance that Bangladesh should be wary of. Moreover, if the current trend of imports outpacing exports perseveres, the current account deficit will also widen without sufficient capital inflows in the financial account of the balance of payments, and we could see some drawdown in foreign exchange reserves in the coming year. A healthy increase in remittance flows of $15 billion this year contributed to limiting the current account deficit at $9.8 billion, or 3.4% of GDP. However, as mentioned before, the emergence of a current account deficit also signals that the economy is finally investing more than it saves.

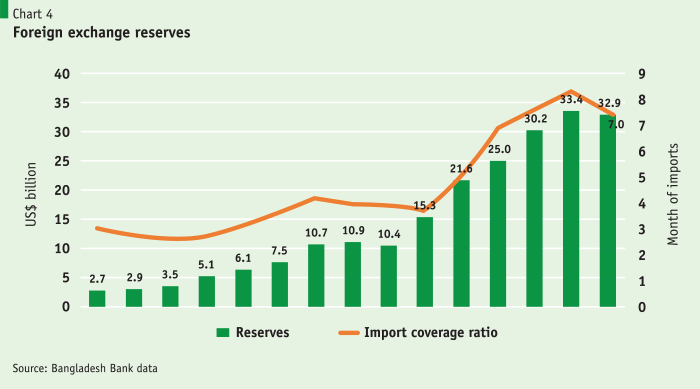

Foreign exchange reserves

Foreign exchange reserves stood at $32.9 billion as of June 2018 and underwent a modest 1.8% decrease compared with 2017 (Chart 4). The import coverage of the reserves was 7 months compared with 2017’s 8.3 months. Although the situation is not yet alarming, if import coverage falls further, Bangladesh Bank will need to consider options for protecting reserves and avoiding instability of the taka.

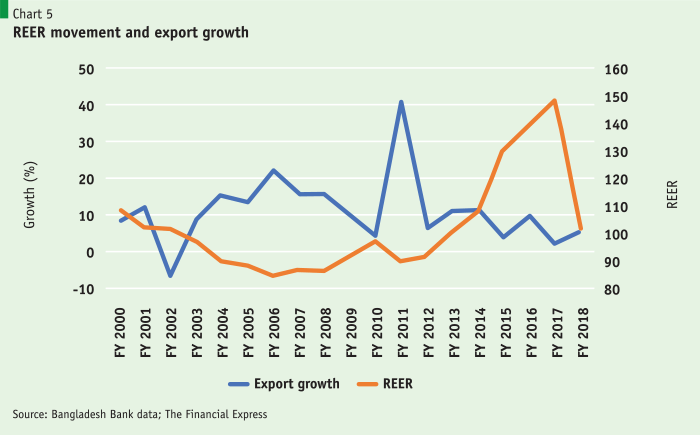

The exchange rate challenge

There is wide consensus among economists that proper management of the exchange rate is critical to ensure export competitiveness and superior export performance. In an economy where exports are a key driver of growth, misalignment of the exchange rate will be harmful to economic growth. In particular, if the exchange rate, nominal or real, appears over-valued, it serves as a major disincentive to exports by stifling profits in an environment where profits are razor-thin any way (Chart 5).

Getting Tk.79–80 per $1 of exports for almost five years while global competition has depressed export prices has shaved a good chunk off the already thin margins that exporters eke out on the world market. The average exchange rate in FY2018 was $82.2. There has been depreciating movement of the exchange rate since 2017, which is of course a welcome relief for exporters. Since 2006, the REER has been on an upward trajectory, only changing direction this past year. Given the significant appreciation of the REER, there is scope for further adjustment of the exchange rate to keep exports buoyant in the future.

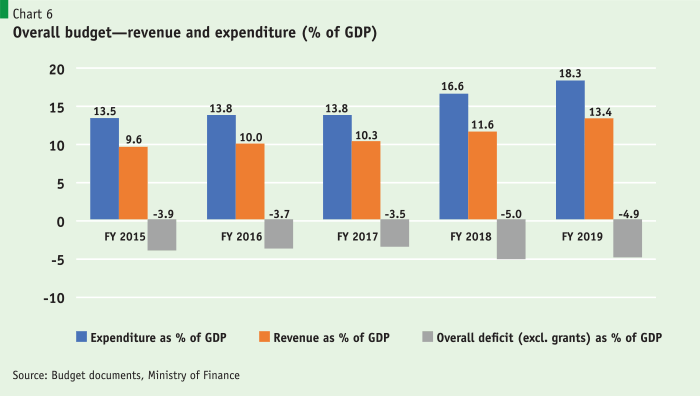

Expansionary fiscal policies

The fiscal performance of Bangladesh’s economy in the past two years has been marked by the government’s ambitious increase in public expenditure and rising public investment. Over the past three years, total public expenditure has increased by 3.6 percentage points of GDP, while public development expenditures have increased by 2.6 percentage points of GDP. This suggests that the development and capital expenditure share in the budget has increased. Given Bangladesh’s huge infrastructure requirements, a capital expenditure increase is welcome. But expenditure on other items has increased even more, suggesting there is room to improve the allocation of expenditures. Nevertheless, the perennial gripe about the quality of public expenditure and leakages from it does not seem to go away.

The fiscal deficit remained within the sustainable bound of 5% of GDP in FY2018 (Chart 6). Revenue increase was markedly lower, growing by only by 2.1% of GDP. In FY2019, the expansionary stance continues, with a budgeted deficit of 4.9% of GDP, though based on an ambitious assumption of 32% increase in revenues. Past experience suggests this to be highly unrealistic and could lead to higher than the targeted deficit in the coming year.

Implementation of the FY2018 budget improved on the expenditure side but not in the case of revenues. Annual development expenditures showed strong implementation relative to previous years and were almost on track: just 3% short of target. Annual development expenditures stood at 6.7% of GDP, barely 0.2% less than what had been budgeted. Capital expenditures within the plan were also implemented robustly and came to 5% of GDP. Implementation has been the strongest ever in terms of magnitude and achievement of target. Implementation of the mega projects underway helped achieve this.

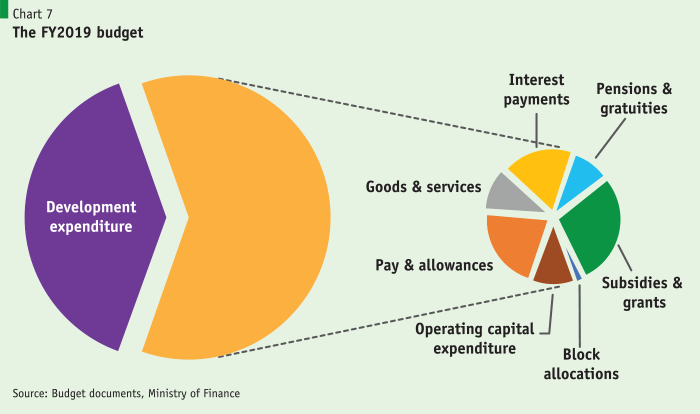

The budget for FY2019

The FY2019 budget (Chart 7) continues to be ambitious. It proposes to finance 64% of expenditure through National Board of Revenue tax revenue; however, the budget does not have any directive towards strengthening revenue collection. In addition, corporate tax rates on registered banks and insurance companies have been reduced from 40% to 37.5%, and on unregistered ones from 42.5% to 40%. Although total revenue as ratio of GDP was 11.6% and tax to GDP was 10.4% during FY2018, Bangladesh will be facing fiscal challenges in the coming years owing to inadequate revenue generation, higher expenditures and loss of preferential treatment.

It is noteworthy that interest payments on government debt are very high, accounting for 20% of the recurrent budget or 12% of the entire budget.

It is noteworthy that interest payments on government debt are very high, accounting for 20% of the recurrent budget or 12% of the entire budget. Interest payment on debts are currently just a little less than transport and communications expenditures, twice of what is spent on agriculture and health and higher than aggregate government spending on all sectors except education. Given the high share of interest payments in current expenditures, it is not surprising that critical functions of the government, maintenance of infrastructure and assets get very little space in the market budget—less than 11% of recurrent expenditures, or less than 1% of GDP.

Coming to development expenditures, among the five major annual development programme sectors, transport and communication has received the largest allocation for the past consecutive years, because of the Padma Bridge and Metro Rail projects. The second largest allocation has been to the power sector: Bangladesh made commendable progress in electricity generation during 2009–2017, with close to 80% of households now having access to electricity, though Bangladesh’s per capita electricity consumption is still a tenth of the world average. Spending on the social sector, including education and health care, has trended modestly downward, which is not a good sign.

The last point here is that, although annual development and capital expenditures are increasing, it is very important to ensure development projects do not have significant cost and time overruns, or procurement mismanagements. If these do occur, then returns to expenditures will decline accordingly and future GDP growth will be adversely affected.

Monetary policy on a tightrope

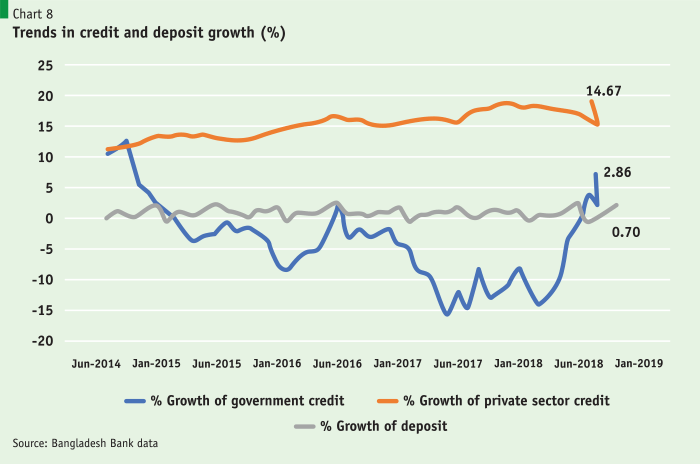

Monetary policy was extremely tight in FY2018, though not by design. At year end in June 2018, broad money growth stood at 9.2% over the year, significantly less than the target of 13%. A sharp decline in net foreign assets in the first three quarters of the year, used to finance the large current account deficit and to defend the taka earlier in the year, was one factor containing monetary growth.

The second factor was that the banking system’s lending to the government was also significantly less than originally programmed as the government took recourse to non-banking sources of finance—national savings certificates in particular. Riding on the high difference in interest rates between bank deposits and National Savings Directorate certificates, the government surpassed its annual non-bank borrowing target by a big margin in FY2018—but at a high interest cost and with rising future liability to the exchequer, as discussed earlier.

The negative growth of net foreign assets and government borrowing from the banking system created the space for a robust growth of credit to the private sector to 16.9% by year end, just surpassing monetary targets (Chart 8).

Things changed dramatically on the credit front. The clear indication of a liquidity crisis in the banking system, portrayed by banks’ efforts to adjust their loan–deposit ratio, contributed to slow disbursement of loans to the private sector. Credit growth almost ground to a halt as banks became reluctant to provide loans ahead of the national election fearing diversion of loans to political campaigns.

The rapid credit growth of 2018 combined with a fall in the deposit growth rate over 2017 led to a liquidity crisis. In turn, the central bank lowered the ceiling for the advances–deposit ratio from 85% to 83.5%. As liquidity tightened, deposits and lending rates started rising in response.

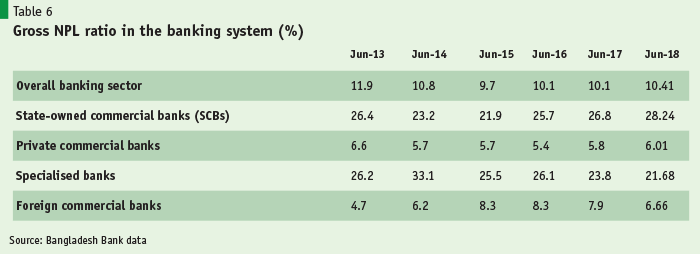

Non-performing loans and liquidity constraints in banking sector threatening stability

The other serious factor driving liquidity shortages is the perennial problem of rising non-performing loans (NPLs) (Table 6). The sector is still struggling to recover from recent setbacks caused by large-scale financial fraud in several state-owned and private commercial banks. The problem seems to have been compounded by recent changes in the tenure and family membership of bank boards. This reflects severe weak regulation and governance in the banking sector and means family ownership will have greater control in banks, with the possibility of erosion of corporate governance. Banking supervision, which has improved significantly over the past two decades, is showing signs of deterioration. The banking sector is bleeding from bad loans and affecting the banks’ profit margin, scope of business expansion and plans for job creation. Resolute actions to resuscitate the banking system are now a national imperative.

The state of state-owned commercial banks (SCBs) is distressing, and there is no relief in sight. Since the government owns the banks, the bank managements have no stake in the efficiency or profitability of operations. Any government is only a transitory owner, with little or no immediate risk. It also has little incentive to manage these banks on a commercial footing because the losses can be passed over to citizens either through treasury financing based on tax revenues or as continued accumulation of bad loans (i.e. NPLs).

Where NPLs as a percentage of total loans and advances in private commercial banks and foreign commercial banks remained between 5% and 10%, SCB held around 28% by end June 2018 (Table 6).

An internal report on the state of SCBs revealed that the top 20 borrowers held as much as a third of these bad loans. When there is such a concentration of bad loans with big borrowers, recovery becomes nearly impossible, and loan rescheduling or restructuring becomes a fait accompli. Demands on recapitalisation year after year out of the public exchequer then becomes inevitable—a clear case of throwing good money after bad. Such resources could be better used to beef up our health and education system. Flexible measures, including loan rescheduling or restructuring policy favouring powerful people and lack of punishment for fraudulence in banks, should set off alarm bells in the banking sector.

Enforcement of laws is extremely important to control the default scenario in the country today. To play the larger role of contributing towards a stable and sound macroeconomic foundation in Bangladesh, there is no option but for the banking sector to go through the path of stricter policy, legal measures and improvement of governance.

To play the larger role of contributing towards a stable and sound macroeconomic foundation in Bangladesh, there is no option but for the banking sector to go through the path of stricter policy, legal measures and improvement of governance.

Epilogue and future outlook

Although some vulnerabilities have emerged in the macroeconomic landscape, the overall Bangladesh economy remains strong, with decent prospects for high and inclusive growth. Not surprisingly, international analysts are describing Bangladesh as the ‘poster-child’ of development—a significant upgrade from the 1970s’ ubiquitous stamp of ‘test case for development’. But the vulnerabilities need to be addressed so that growth does not falter. In the medium term, Bangladesh can use these challenges as opportunities to implement long-due structural reforms to improve the investment climate in the country.

Unlike in past centuries, in the 21st century many developing countries are experiencing high growth, as a consequence of trade integration with the world economy. Growth is no longer limited to the infusion of labour, capital and technology. Strategic trade integration with the vast global markets is providing new impetus to achieve high growth of 7–9% per annum on a sustained basis for developing countries. The opportunity is waiting for Bangladesh to seize and give credence to the notion of ‘the Bangladesh surprise’. But first, Bangladesh must diversify its exports and economy to sustain export and overall growth rates. This requires modernising its trade regime, addressing the high anti-export bias in the tariff structure and exchange rates and proactively inviting FDI to help develop new products and connect to new markets and supply chains. It will also require improving infrastructure, trade logistics and, more broadly, the overall investment climate.

As we approach the 50th anniversary of our independence, the nation is poised to carve out the next 50 years with far more hope and capability than was the case in the past 50.

‘Research support was provided by Azmina Azad Rede, Noor A Ahsan, Nuzat Tasnim Dristy and Sabrina Shareef’