Environmental Fiscal Reforms in Bangladesh

By

Development context

Bangladesh has made tremendous progress with development since independence reflected in rising income, sharp reduction in poverty and improvements with human development. Bangladesh has successfully transited from low income to lower middle-income country and now aspires to achieve upper middle-income status by FY2031 and high-income status by FY2041. Evidence, however, suggests that along with these positive outcomes there has been a substantial deterioration in the natural environment. Fortunately, there is now a growing recognition of the environmental damage of continuing with the business-as-usual development strategy and the risks it poses to the sustainability of development. In response, the government has adopted a large array of strategies, laws, rules and regulations, and adaptation and mitigation programmes and projects. But the results on the ground suggest that the implementation of these policies has been weak. Inadequate strategic thinking along with financial and institutional constraints has limited the implementation effectiveness of the government’s environmental protection strategy.

Addressing the financial and institutional constraints to better environmental management will take time and requires concerted efforts. A review of policies shows that the setting of standards, adopting laws, and defining rules and regulations—also known as command and control policies– have been the focus of environmental management. Fiscal policy instruments constituting of incentive policies—taxes, subsidies, pricing – and public expenditure programmes– have been weak or absent. Global experience shows that a combination of command and control policies with incentive policies are more likely to result in better environmental outcomes than the use of only command and control policies.

This article examines the options for Bangladesh to use fiscal policy instruments to improve the environmental management. There is broad interest in Environmental Fiscal Reforms (EFR) in the Ministry of Finance and the General Economics Division of the Planning Commission with a view to understanding the underlying policy issues. This summary article and the associated larger research paper will hopefully lay the grounds for adopting EFR as an instrument for improving environmental management in Bangladesh.

Relevance of Environmental Fiscal Reforms (EFR) for Bangladesh

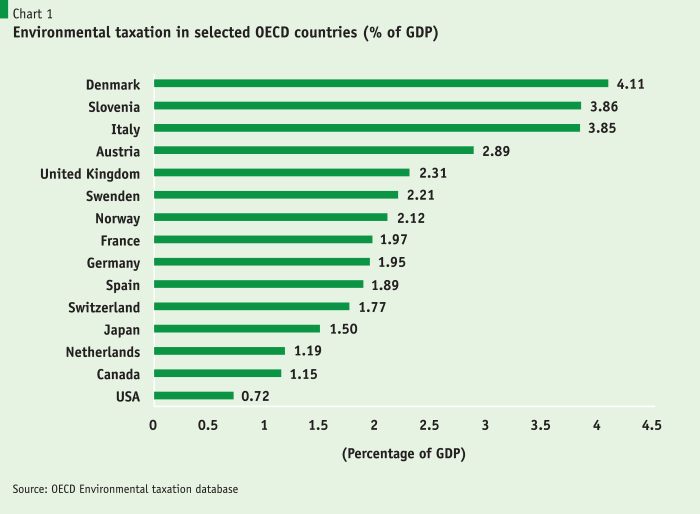

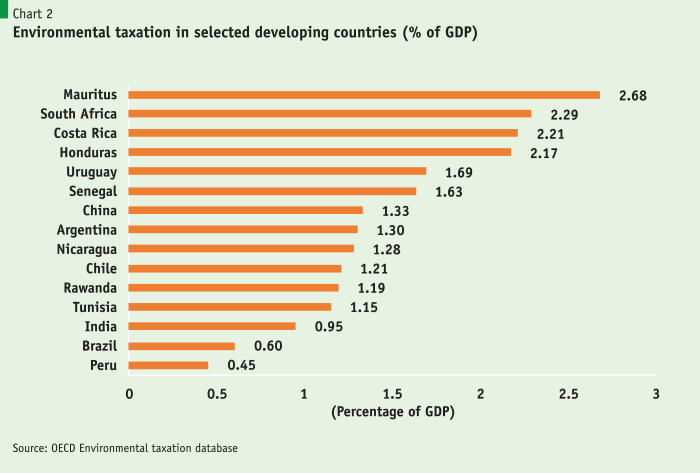

Environmental Fiscal Reform (EFR) refers to a range of taxation and pricing measures that raise fiscal revenues for priority programs while furthering environmental goals. EFR presents several advantages for Bangladesh. First, Bangladesh has a very low tax to GDP ratio; EFR can help raise public revenues. For example, many OECD countries raise substantial revenues from environmental taxes, with Denmark leading the way at 4.1% of GDP (Chart 1). Even several developing countries are using environmental taxation to raise revenues (Chart 2). Second, the incidence of air and water pollution in Bangladesh is amongst the worst in the world. Environmental taxes and subsidies aimed at reducing air and water pollution can be very helpful in improving the environment. Third, Bangladesh has a track record of heavily subsidizing fuel oil with adverse fiscal and environmental consequences. Proper pricing of energy and publicly provided services that are intimately related to environmental protection can ensure the efficient use of these resources and reduce pollution. Finally, the inadequacy of revenues in Bangladesh is a huge constraint on public funding for critical growth-enhancing programs like infrastructure; for spending on health, education, water supply and social protection to support poverty reduction; and for funding major environmental improvement programs like clean air, clean water, slum upgrading and afforestation. EFR revenues can be a major contributor to increasing priority public spending in these areas.

Three types of EFR instruments are relevant for Bangladesh: taxes on extraction of natural resources; prices and user fees for publicly-provided environmentally-related goods and services; and environmental taxes and charges.

Taxes on extraction of natural resources

In Bangladesh, the three main natural resources that are most used for production and consumption are: natural gas, fisheries and forestry resources.

(a) Natural gas: Natural gas production and distribution are publicly owned activities. Owing to substantial underpricing of natural gas compared to economic cost, natural gas consumption has been highly inefficient and has constrained domestic investment in gas extraction. Rapid depletion of natural gas has now led to a severe gas rationing, thereby causing production loses in manufacturing and growing reliance on carbon emitting fuel oil for primary energy.

(b) Fishery resources: Bangladesh has made solid progress in developing its fishery resources. The fishery industry in Bangladesh is basically a private enterprise. Much of the government effort has focused on increasing production through a range of policy support for private investment in fish cultivation activities. Regulatory policies for sustainable fishing are largely ineffective. There is also no use of fiscal policy instruments in the form of auctioning of fishing rights, charges or fees. Additionally, the losses incurred to fishery resources from severe surface water pollution are largely unchecked due to inadequate efforts to control water pollution.

(c) Forestry resources: Over time, population pressure and poor forest management has taken a huge toll and the forest cover has been falling. Per capita forest cover fell by an annual average rate of 1.8% between 1990 and 2015. Bangladesh has merely 0.009 ha forest cover per person, which is among the lowest in the world. Even more concerning is the loss of forest quality and productivity. Thus, the share of dense forest fell from 51.3 % in 1975 to 46.2% in 2014. The government’s policy response to use public investment for supporting reforestation has not succeeded to reverse the loss of forest cover owing to inadequate funding and continued tree felling.

Prices and user fees for environmentally sensitive public services

Sound management of energy services, water supply, sanitation and waste management have major implication for the environment. Prices of these goods and services are mostly set at below cost of production leading to under-provision, inefficient use and serious environmental damage. Underpricing has also contributed to large budgetary subsidies that have constrained public spending on health, education and social protection, while also contributing to air and water pollution.

(i) Energy services: Natural gas prices are much below their economic value. Historically, electricity prices were also heavily subsidized in both financial and economic terms. In recent years, the pricing policy for electricity has sharply improved and the financial subsidy has fallen. However, economic subsidy still prevails from the underpricing of natural gas, diesel and furnace oil. Fuel oil is mostly subsidized and has been a major budget buster in recent years. The decline of international oil prices since 2015 has given some respite. Today, the average domestic oil price is above international oil price and the budget subsidy has been eliminated. However, there are considerable uncertainties about the future course of international oil prices; with higher prices the subsidy will reappear. Historically, octane and petrol prices were set above cost of production but diesel and kerosene were subsidized. The primary rationale for subsidizing energy is to protect the poor. Research suggests that much of the oil subsidies go to the non-poor, that there are considerable adverse macroeconomic effects of these subsidies and related pricing policy, and the potential damage to the environment can be large.

(ii) Pricing policy for municipal water supply: In 2016 only 12% of the Bangladesh population had access to piped water. Piped water supply is mostly available to areas that are covered by urban local government institutions (LGIs) (city corporations or municipalities). There is substantial variation in water supply by cities. For example, the coverage is 87% for Dhaka and only 22% for Sherpur. Similarly, water is often only available intermittently, with only 2 hours in some of the small towns. Owing to poor O&M practices, water losses are substantial ranging from 21% to 30%.

A major factor for this poor state of affairs is the low capability of the public water bodies to handle the large unmet demand and improve service quality. This is in turn to a large extent owing to poor pricing policy that constrains the finances of the public water supply entities. The lack of private water provision is partly due to absence of adequate legal and regulatory framework; but it is also due to inappropriate pricing policies. Tariff for water supply varies considerably between cities. In many cities and towns even the operation and maintenance costs are not recovered by water tariffs. The government’s pricing policy strategy is based on the logic that water is an essential commodity and must be subsidized. But this assumes that the government has unlimited budget resources to provide adequate piped water supply to all residents. But evidence from 2016 HIES show that only 12% of the population has access to piped water supply. The pricing policy is not premised on any empirical study that measures either willingness or ability to pay. Most piped water supply goes to non-poor household and most poor household even in urban areas do not have access to piped water.

(iii) Pricing policy for sanitation services: Bangladesh has made significant progress in improving sanitation system since the 1990s. However, there is huge variation in quality and related sanitary standards. Only 43% of urban population and 34% of rural population have access to sanitary or water-sealed toilet facilities. An even bigger challenge is the disposal of wastewater. The dominant sanitation technology currently used is the onsite system that consists of a toilet and a storage infrastructure such as lined or unlined pit or septic tank. The collected sewerage is discharged directly into open drains, water-bodies (canals, lakes, rivers etc.) or undesignated places that result in severe pollution and health hazards. Only Dhaka city has a modern sewerage system but the coverage is partial. Only 20% of the waste water is covered by a sewerage network and a treatment plant, while the rest is connected to storm drainage system or other types of drains or water bodies. In most cases, collected sludge is released randomly or dumped into open drains or water-bodies which contaminate surface water.

A major reason for the poor wastewater management is the lack of resources. Wastewater management is a capital- intensive activity. The amount of resources required for installing proper sewerage system for households and ensuring that these are properly collected and treated before disposal is large. One important reason for the lack of resources is poor pricing policy for sanitation services. DWASA charges a nominal fee for the sewerage service it provides but this is far below the cost of service.

(iv) Solid waste disposal service: This is an essential service provided by urban local governments. There is limited small scale private waste collection in selected areas, managed by citizen’s group. Proper waste collection and disposal are both big challenges. Evidence shows that the efficiency of waste collection, defined as the percentage of waste that is actually collected by municipalities and city corporations, varies considerably. It ranges from a high of 100% for Barisal to a low of only 4% for Jessore. Proper disposal of collected waste in a way that is environmentally safe is also a major challenge. LGIs usually dump solid wastes in landfills, which creates serious health hazards. Households and private enterprises that do not have access to LGI services dump solid wastes in nearby vacant land or in water bodies. Solid waste management by urban LGIs is financed from the resources of these bodies. Research shows that urban LGIs are heavily constrained by lack of finances. Some cost recovery for waste management happens through a waste management cost recovery component of property taxes. But this is very low relative to cost of services.

Environmental taxes

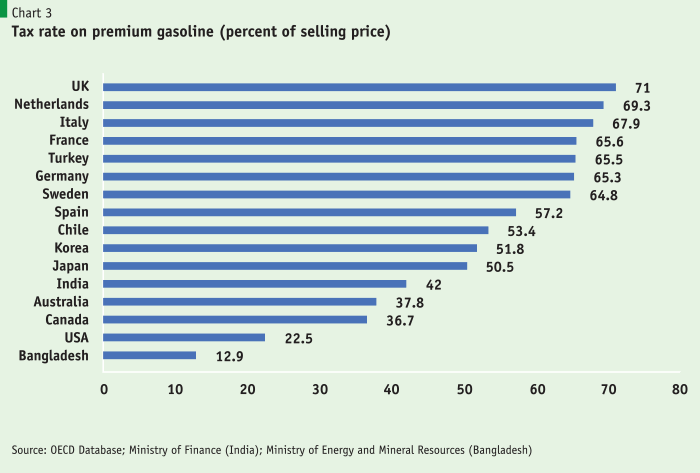

(1) Taxation of fossil fuel use: This is the most commonly used environmental taxation globally. OECD countries in particular use this as the most important source of environmental taxation (see Figure 3). In Bangladesh, there is a nominal value-added tax (VAT) on fuel products based on the taxation of imported oil. The effective tax rate as a share of average selling price amounts to 12.9% on petrol, 10.2% on diesel, 10.2% on kerosene and 15.7% on fuel oil. The VAT is a common tax levied on most products in Bangladesh. There is no additional excise tax on fuel oil in the form of a tax on carbon to discourage its use.

(2) Taxation of industrial air pollution: The government has taken several initiatives to combat industrial air pollution focused on the transport sector and the brick manufacturing. The most important reform is the enactment of the Brick Manufacture and Brick Kiln Installation Act in 2013. Under this policy, the heavily polluting traditional brick kilns are being phased out. Yet implementation is slow. More generally, the rest of the industrial sector is left free to pollute the air including electricity generation, especially those units that run on furnace oil, diesel and coal. Importantly, there is no pollution charge for industrial emission either on output or inputs.

(3) Taxation of industrial water pollution: Dumping of industrial waste water into rivers is a major environmental hazard, along with dumping of untreated sewage and household waste into lakes and ponds, present a major environmental and health challenge to Bangladesh. In order to control water pollution, the government has banned the use, production and marketing of polyethylene shopping bags and made it mandatory for industries to set up Effluent Treatment Plants (ETPs) to treat their waste before discharging to water bodies. The Department of Environment (DoE) takes legal action against violators including imposition of penalties. The tannery industries operating in Hazaribagh have been relocated to the tannery industrial estate in Savar, which will dispose the liquid wastes through a common ETP. Although there no direct levies on water pollution, the imposition of penalties for water pollution is the first known example of the use of EFR in pollution management in Bangladesh.

Main priorities for Environmental Fiscal Reforms in Bangladesh

In the current political environment economic pricing of gas and the taxation of fisheries are not feasible options. Barring these, the major EFR options are:

- Improve the pricing policies for water, sanitation and solid waste management.

- Reform fuel pricing policy to eliminate subsidy and move towards a market price.

- Impose a carbon tax on petrol and diesel.

- Introduce a tax on timber.

- Introduce an industrial air pollution tax.

- Formally introduce an industrial water pollution charge.

- Introduce an urban household illegal waste dumping charge.

Pricing policies for water, sanitation and solid waste management

Given the estimated large health costs of air and water pollution in Bangladesh (1.4% -3.75% of GNI), the health benefits of additional investment in piped water supply, hygienic and environmentally safe household sanitation and sound management of solid waste are huge. The public sector alone cannot handle the large service gap and private provision might be needed. Proper pricing policy is essential to mobilize revenues for LGIs and to stimulate private investment. The beneficiary pays principle should be the guiding criteria for setting prices. Presently, all these services are provided by the urban LGIs and 100% of the beneficiaries are the non-poor. Equity justification for large subsidy is not relevant. So, the long-term goal of pricing policy should be recovery of full average cost of service including a reasonable rate of return on invested capital. An independent regulatory commission should be set up to regulate prices and monitor service quality.

…the estimated large health costs of air and water pollution in Bangladesh (1.4% -3.75% of GNI), the health benefits of additional investment in piped water supply, hygienic and environmentally safe household sanitation and sound management of solid waste are huge.

Subsidized / no-cost services can continue to be provided to the poor living in urban slums through public spending programs. Over time, effort must be made to improve service and ensure that the benefits actually accrue to the poor. For example, the local musclemen often capture most of the benefits of free access to standpipe water through illegal user charges. Municipalities that service these standpipes should monitor their use through formation of self-regulating community-based water user association (WUA). Since women are the main users, they should be in-charge of these WUAs.

Reform of fuel subsidy and pricing policy

Since Bangladesh does not yet have a competitive oil market, full deregulation of oil prices may be pre-mature at this time. So, in the first phase of the reforms the adoption of an automatic pricing formula such that it covers all costs of production (import, refining, transport and depreciation) will be the way to go. This pricing policy should be administered by the Bangladesh Energy Regulatory Commission (BERC) without any government intervention. Over the longer term, reform should aim to fully liberalize oil pricing.

The elimination of fuel oil subsidy through proper pricing policy is a first step in a sequential program to reducing carbon emission from the use of fuel oil. This reform can be combined with the imposition of an excise duty on petrol and diesel that is in addition to the normal applicable VAT. The tax rate can be set in proportion to the carbon content, whereby the carbon content of diesel (kg/liter) is about 14% higher than for petrol. The initial rate of the carbon tax can be determined based on expected carbon reduction, the amount of revenues mobilized and the level of political comfort. The tax rate can also be varied in relation to international prices. Thus, the tax rate can be increased when oil prices are low (as presently) and reduced when international oil prices go up. A similar approach is used in India.

Taxation of timber extraction

Bangladesh faces major challenges in forestry management, including serious administrative and governance issues. As a first step, the forestry governance has to improve including the development of a proper management information system (MIS) that should be regularly updated. The reforestation effort must also continue with stronger focus on private investment in forestry. Social forestry development with community involvement and support from public sector could be further strengthened. Along with these efforts and in the context of an improved forestry management and better MIS, there is a good case to consider the imposition of a tax on commercial timber. The wood furniture industry is doing well in Bangladesh and the demand for timber for both furniture and housing is growing. A timber tax can be an important source of government revenue and also support more sustainable timber extraction. The tax should be levied at the factory gate where logs enter for further processing so that all logging, legal or through poaching, are captured in the tax net.

Tax on industrial air pollution

The government policy to manage industrial air pollution through better technology should continue. Immediate efforts should be made to set air pollution standards for major polluting industries starting with Dhaka. Consideration should also be given to the use of pollution charges for heavily polluting industries. A pollution tax set appropriately would provide strong incentive to the polluting industry to adopt clean air technology in order to escape paying the tax. With limited administrative capacity and inadequate industry-specific air pollution measurement capabilities as presently, a tax on inputs might be the pragmatic way to proceed. The government should identify the industries other than brick kilns that generate the most amount of air pollution, identify the key inputs that contribute to this pollution and impose taxes on these inputs to curb their use and encourage the adoption of cleaner technology.

Expand the use of industrial water pollution charges

Unlike air pollution, Bangladesh has stronger competence in measuring water pollution resulting from waste water dumping into rivers or other water bodies by industries. Drawing on the positive experience with pollution charges in reducing water pollution from China, Netherlands, Colombia, Malaysia and Philippines, Bangladesh may want to implement a proper water pollution charge in addition to the current policies. These charges can be estimated pragmatically and varied over time to improve effectiveness. But they have to be monitored and implemented evenly. In this regard, Bangladesh can learn from the long history of China regarding the implementation of this water pollution charge.

Introduction of household illegal waste dumping charge

A major source of air and water pollution is the dumping of household wastes in water bodies and in neighborhoods. With improved solid waste management services from municipalities and private sector as discussed above, this endemic problem might be reduced. But this needs to be combined with educational campaigns, community initiatives and a charge on illegal waste dumping. A system of pollution charges for illegal disposal of household waste could be a very strong incentive to improve household cooperation and compliance. This could start as a pilot scheme in the rich urban neighborhoods where the installation of security cameras could assist compliance with such charges.

Use of EFR revenues

For water supply, sanitation and waste management, the recommendation is to move towards full cost recovery with a view to increasing the quantity and quality of these services and also to encourage private supply. The revenues by definition are earmarked for service improvements. Regarding EFR tax revenues, the suggested approach is not to proceed with specific earmarking but to combine EFR with broad based improvements in public expenditure allocations that ensure an increase in the share of budget for environmental improvements and social protection. Presently, both programs are grossly under-funded. Total spending on environmental programs including water management is only 1% of GDP. Spending on social protection excluding civil service pensions is also only 1.6% of GDP. Spending on these programs must go up in order to provide a strong justification for the use of EFR.

Total spending on environmental programs including water management is only 1% of GDP. Spending on social protection excluding civil service pensions is also only 1.6% of GDP. Spending on these programs must go up in order to provide a strong justification for the use of EFR.

Increased spending on capacity building for the development, administration and monitoring of EFR instruments and their effectiveness is in any case a pre-requisite for implementing EFR. Additionally, pubic spending to support the adoption of clean technology, development of clean energy and reforestation are high priority items with or without the adoption of EFR. The implementation of EFR when combined with these and other environmental improvement programs can strongly improve the political acceptability of EFR. Regarding increased spending for social protection, this is again a high priority for Bangladesh in view of the continued high incidence of poverty and the large vulnerability of the poor to environmental degradation and climate change. With the adoption of EFR, increased spending on social protection is absolutely necessary to offset any adverse effects of the price increases on the poor.

Managing the political economy of EFR

As global experience suggests, successful implementation of EFR will require careful attention to the political economy of reforms. Some of the important implications for Bangladesh are:

- A major advocacy campaign is needed to explain to the public at large the risks of environmental damage and why strong public policy action is needed including the adoption of EFR to address those risks. Along with good research based on facts, a comprehensive campaign under the leadership of the government and linked to the adoption of EFR will be essential.

- A phased approach to the introduction of EFR will be the pragmatic way to proceed. This pragmatism should be driven both by considerations of implementation capacity constraints and by the need to secure buy-in of the business and households opposed to EFR. At the present time, oil pricing reform is the highest priority. The implementation of oil pricing reform can happen in a phased manner, with automatic full-cost pricing as a first step. A carbon tax can be imposed on petrol and diesel. This reform can then be strengthened over the next 2-3 years with increasing the coverage of the carbon tax to other oil products and a full deregulation of oil prices. Similarly, the application of the beneficiary pays principle to water, sewerage and sanitation should be done over several years, starting first with full recovery of operating costs and then phased increases over a number of years to achieve full cost recovery including a return on capital. Furthermore, the charge on industrial waste water pollution should be initially set at a modest level and gradually increased based on impact assessment on pollution control and incentive to adopt clean technology.

- The EFR reform implementation should be combined with public expenditure policy reform that allocates more resources to environmental programs and social protection. This combined approach has much better prospects for political acceptability and better results on the ground than a simple tax or price increase through EFR. All individual expenditure items must be done on merit with full application of the underlying project selection process.

- The equity aspects of each EFR must be analyzed and addressed appropriately. The opposition to EFR is often based on protection of vested interest with no necessary relationship with equity. A good example of this is the removal of oil subsidies. Evidence shows that the benefits of oil subsidy mostly accrue to the non-poor. On the contrary, by eating up budgetary resources the subsidy policy leads to an under-funding of social protection and poverty programs. Similarly, the benefits of subsidy on water, sanitation and waste disposal go to the non-poor. The poor do not have any access to piped water supply (except through standpipes in slum areas) or modern sanitation facilities from urban LGIs. When the application of the beneficiary pays principle is combined with better service owing to improved O&M practices and higher investments, the household acceptability of this reform will automatically improve. Water pollution charge similarly is unlikely to hurt the poor much.

- The indirect general equilibrium effects of some of the EFR instruments could hurt the poor because of the pass-through effects of higher product prices used as inputs in some other production process. The most often cited example is the effect of increase in diesel prices on public transport services. Income transfer to the poor household through a well-designed social protection program is the best approach to addressing any adverse effects of the adoption of EFR on the poor. Bangladesh has already developed a far-reaching and comprehensive National Social Security Strategy (NSSS). The government needs to accelerate its implementation along with the adoption of EFR. Additionally, public spending on low-cost green technologies including solar-housing, clean stoves and solar irrigation pumps will benefit the rural poor and help offset any adverse effects from carbon taxation of oil products.

- International experience suggests that building coalition with stakeholders has immense benefits in terms of improving political acceptability of EFR. The natural coalition partners would be the environmentalist NGOs, enlightened business and trade communities, the intellectuals, the donor community and the media. There is already evidence of growing concern outside the government about the growing health and poverty risks of environmental degradation. With strong government leadership, the EFR agenda can be developed successfully with active support from these non-government players.

Administrative reforms for implementing EFR

Regarding the adoption of EFR, the most important institution is the Ministry of Finance (MoF). The MoF is pretty well organized and staffed to manage the adoption of EFR once there is political buy in at the highest level. It also has good partnership with several local research institutions that can support with EFR policy formulation. Over the longer term, the MoF should strengthen its policy monitoring and evaluation capacity including for EFR.

The main administrative challenge in implementing EFR comes from the weak technical capacity of the MoEF. The Forestry Department (FD) and the Department of Environment (DoE) in the MoEF are inadequately staffed, especially in the area of technical skills, owing to lack of adequate resources. In the short-term several immediate capacity-building steps can be taken. First, there is an urgent need to develop and maintain a proper MIS for FD and DoE. Second, the DoE needs to upgrade its capability to measure and monitor air pollution for large industrial units that are potentially large polluters in major cities. This can start as a pilot program in Dhaka and then gradually extended to other large industrial cities. Third, steps should be taken to tackle all governance problems relating to forestry management and implementation of environmental standards and compliance. In particular, the corruption problem in forestry management has to be tackled with an iron hand in order to implement any forestry-related EFR such as a tax on timber or subsidies for reforestation.

Regarding the implementation of the beneficiary pays principle, the main institution where capacity building is necessary is the urban LGI that provide water supply, sanitation and waste management services. First, the government should establish WASAs in all 8 Divisional cities. Second, some minimum financial accounting and reporting standards should be developed that allows a good estimate of unit cost of service provided including capital cost. Third, a computerized MIS system should be developed for each urban LGI that provides basic information on the number of customers, amount of water produced and supplied, number of hours of water available, the age and quality of water and sanitation infrastructure, amount of revenues collected, missing water in terms of revenues, etc. This MIS should be updated on an annual basis. Fourth, the capabilities of the Local Government and Rural Development (LGRD) Ministry that provides oversight to LGIs will need to be strengthened to provide better guidance, supervision and monitoring of LGIs.

Proper pricing of energy and services of public utilities requires independent regulatory agencies. In 2003 the government set up the Bangladesh Energy Regulatory Commission (BERC) to regulate the energy industry, facilitate private sector participation in the energy sector and set prices. However, BERC lacks autonomy and is guided by the government in its policy decisions. The conversion of BERC into a fully autonomous and capable institution will be very important for setting oil prices properly, for deregulating oil market to allow private sector entry and competition, and subsequent oil price deregulation. The other important institutional reform will be the establishment of the Water and Sanitation Regulatory Agency (WASRA) that will be charged with regulating public and private utilities engaged with supply water and sanitation services and setting prices. This will also depoliticize the pricing policy and facilitate private sector participation.