Do Export Subsidies Work in Bangladesh?

By

After many years of enjoying the benefits of a high-performing export sector, Bangladesh is facing a major slow-down in export growth. Additionally, owing to its solid development performance, Bangladesh is well set to graduate from the United Nations list of Least Developed Countries (LDCs) in 2024. Two important consequences of this graduation are that first Bangladesh will lose access to a range of trade preferences extended to LDCs, especially duty free, quota free (DFQF) access to the European Union’s Everything but Arms (EBA) program. And second, the temporary waiver of the World Trade Organization’s (WTO) trade-related global protocols will lapse and Bangladesh will be expected to comply with all WTO regulations for its conduct of international trade. Both have major downside implications for Bangladesh’s export performance that could threaten the GDP growth and poverty reduction targets of the government’s Perspective Plan 2041 (PP2041) unless these are well anticipated and countervailing policies are taken to offset the negative effects (Government of Bangladesh 2019a; Government of Bangladesh 2019b).

The government’s immediate response to the slowdown of exports is to seek to accelerate its complex export subsidy schemes. This was done without conducting a proper analysis of what policies affect export performance and whether export subsidies have worked in the past. Moreover, as a committed and responsible member of the WTO, under which Bangladesh has benefitted tremendously from the various trade preferences as an LDC, Bangladesh will be expected to comply with all WTO regulations after graduation. One important regulation is the need to comply with the agreement on Subsidies and Countervailing Measures (SCM) adopted in 1995 (WTO 1995a). The SCM and the subsequent 2015 Nairobi Package (WTO 2015) constitute an overwhelming set of anti-export subsidy measures. The rationale is to encourage trade competition and establish level-playing field for all players in the global trade market.

Economic Rationale for Export Subsidy

The seemingly harsh and negative attitude of the WTO towards export subsidies is grounded in economic theory that shows that an export subsidy is a lose-lose policy instrument. An export subsidy raises the domestic price of the good in the exporting country and lowers the price in the importing country. The outcome of this policy for the exporting country is as follows: consumers lose, producers gain and government loses revenue. The summation of gains and loses show an unambiguous net loss for the exporting country (Krugman and Obstfeld 2003, pp 197-199). Yet, the persistence of export subsidies in practice is a reflection partly of arguments about market distortions and externalities, and partly about the political power of the beneficiaries.

Market Imperfection and Externalities Arguments for Subsidies

The arguments relating to market imperfections and externalities have three major facets: infant industry argument; externality; and imperfect competition and strategic trade policy.

Infant industry: The infant industry argument is the most popular and oft-used argument for government intervention in trade policy. The argument is that developing economies do not have the knowledge and experience of competing effectively in the world market when faced with the well-established developed country firms. So, they need to learn by doing. In this infant stage, dynamically potential enterprises must be supported to survive, learn and grow and eventually face international competition. The infant industry argument is mostly used as a justification for tariff protection to encourage import-substituting industrialization. But it has also been used to justify export subsidies to benefit export-oriented firms.

Externality: The externality justification for subsidy uses the rationale that firms and enterprises that generate knowledge or promote innovation will fail to do so because the knowledge they create or the benefit of innovation will be enjoyed by other firms who do not invest in the technology or innovation. So, the social benefit exceeds the firm-level benefit and without subsidy investment in knowledge creation or innovation will be sub-optimal. However, this is a justification for public investment in research and development rather than subsidizing any specific firm.

Imperfect competition: The imperfect competition and strategic trade policy argument emerged from the work of economists James Brander and Barbara Spencer (Brander and Spencer 1985). They argue that in a product market where there are only a few firms in effective competition, there will be excess profit potential. International firms will like to enter these product markets to reap these excess profits. Government intervention through subsidy to domestic firms could instead enable the domestic firms to reap these excess profits. Using a game theory approach to a duopoly market situation (e.g. aircraft industry), they showed that under certain assumptions government subsidy could increase national welfare (i.e. the revenue gains to firms will exceed the loses to consumers and government revenues).

This new theory of trade model and the case for subsidization has drawn considerable theoretical attention. Its arguments on the need for policy intervention in cases of imperfect competition and scale economies have some merit. The four main problems are that: first, the results of the model are very sensitive to assumptions; second, the model is only applicable to a limited number of industries and cannot be used as a general model of trade; third, the information required for policy intervention is too subtle and complex to make policy making feasible in practice; and finally, two can play at the game. If a country intervenes to prevent foreign competition by offering domestic subsidy, the foreign country can also intervene by providing countervailing subsidy. This beggar-thy-neighbor policy could result in a lose-lose outcome for the world at large.

In addition to these theoretical arguments for subsidy, a specific argument for export subsidy often made in policy making is to offset the anti-export bias of existing tariffs. In an extreme form, the argument can be made that if all imports are subject to a uniform tariff, the anti-export bias of this policy can be removed by providing an equivalent uniform subsidy to all products. There are many limitations of the relevance of this argument for practical implementation, including implementation costs, non-uniformity of tariffs by product categories, tariff avoidance, excess claim for subsidies, availability of government revenues in a constrained fiscal environment etc. (Panagariya 2000). A superior policy would be to lower the anti-export bias by lowering tariff protection and eliminate the reliance on subsidy.

Subsidies and trade protection often simply reflect the political power and influence of the beneficiaries (Ahmed and Sattar 2019a). Beneficiaries often tend to be organized business, farmers group, powerful trade unions. They can influence policy making through their power of the purse and the connection with the political party in power.

Political power of beneficiaries: Subsidies and trade protection often simply reflect the political power and influence of the beneficiaries (Ahmed and Sattar 2019a). Beneficiaries often tend to be organized business, farmers group, powerful trade unions. They can influence policy making through their power of the purse and the connection with the political party in power. An extreme example is the experience with export subsidy administration in Argentina during 1967-87 (Nogules 1989). The political influence of farmers in sustaining farm subsidies in OECD countries over a long period of time is another example. In the case of Bangladesh, an important example is the role of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) in successfully negotiating many fiscal concessions including subsidies. The Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) similarly exerts considerable influence in securing specific tariff protection or tariff relief as relevant. These decisions are not based on a careful review of the underlying economic rationale but on the preservation of self-interest.

Empirical Evidence on Export Subsidies

Trade policy interventions in support of import-substituting industrialization was pursued with vigor by many countries in Latin America (Brazil, Chile, Argentina. Mexico) and South Asia (India and Pakistan) from the 1950s thru the 1980s, and in Bangladesh (1970s-1990s). The results have been rather dismal. In Brazil and India, import-substitution industrialization contributed to a growth in manufacturing sector but did not have the expected spillover effects to boost the overall GDP growth rate (Krugman and Obstfeld 2003). Chile, Argentina, India and Mexico all abandoned their import-substitution industrialization since the 1990s in support of a more liberal trade regime and in support of export growth with fairly dramatic gains in GDP growth rates (Krugman and Obstfeld 2003).

Pakistan and Bangladesh similarly had a negative experience with import-substitution industrialization. The experience of Bangladesh is particularly illustrative of how a switch from import-substitution industrialization based on infant industry protection argument to export-promotion industrialization initiated since the 1990s has helped GDP growth, employment and poverty reduction (Ahmed and Sattar 2003; Ahmed and Sattar 2019a). The evidence from the High-performing East Asian Economies (HPEA) similarly supports the effectiveness of export-oriented development strategies in raising GDP growth and income (World Bank 1993) 1.

For both Bangladesh and HPEAs, a major question is the role of various policy interventions in explaining the growth of exports. In particular, what is the role of export subsidies in pushing the export envelope? The Bangladesh experience will be discussed later in the paper. The HPEA experience can throw important light on strategies for export promotion and the role of export subsidies.

According to the World Bank analysis of the HPEAs performance (World Bank 1993), several fundamental policy areas contributed to this performance:

• Ensuring low inflation and competitive exchange rate: Macroeconomic stability characterized by low inflation that was anchored in prudent fiscal and monetary policy management was a core determinant of rapid GDP growth in all 8 HPAEs. On the export growth front, the ability to maintain a competitive real exchange rate was a key determinant of performance. “Prudent fiscal and monetary policies coupled with flexible exchange rate management were used to keep exchange rate movements aligned with changing structures of trade protection and inflation differentials with trading partners. The HPAEs avoided strategies of macroeconomic stabilization that stressed the role of the exchange rate in breaking inflationary expectations. Rather, exchange rate adjustments were supported by expenditure-reducing fiscal measures. While Indonesia, Korea, and Thailand have had periods of real appreciation, they did not try to maintain a fixed exchange rate regime in the face of inflation rates much greater than those of their trading partners” (pp 348, World Bank 1993).

• Building human capital: HAPEs invested heavily in human capital, working on both quantity and quality. As a result, firms were able to acquire new technology, improve productivity and increase export competitiveness.

• Creating effective and secured financial systems: Financial sector policies in HPAEs were geared to increasing financial savings and channeling them into activities with high social returns. On the policy front two major policies were to keep real interest rates positive to help mobilize financial savings and establish a stable and secure banking system based on protection and prudential regulations.

• Limiting price distortions: Although HPEAs introduced many market interventions including tariffs and subsidies, relative price distortions were limited. “A combination of competitive real exchange rates and moderate protection levels meant that domestic prices of traded goods were closer to international prices in the HPAEs than in other developing regions. The large weight of exports in total output, duty-free imports for exporters, and extensive domestic competition meant that all the HPAEs had higher proportions of their manufacturing sectors operating at or near international prices than the import-substituting economies of Latin America, South Asia, or Sub-Saharan Africa” (pp 351, World Bank 1993).

• Absorbing foreign technology: HPEAs benefitted considerably from absorbing foreign technology. This was partly based on licensing and imports of capital machineries but mostly on inflow of FDIs that came bundled with technology, managerial capabilities and skilled labor.

• Creating institutions for growth: All HPEAs created sound institutions to support private investment. The civil service in most HPEAs were technically competent and based on merit. Civil service pay was generous and functioned on the basis of well laid rules and procedures. Political interventions were limited and recruitment and career growth were mostly based on merit. As a result, they were able to attract high-quality and technically qualified staff in the civil service.

The brief review of HPEA experience suggests that economic fundamentals were the most important determinants of the success of HPEAs. All HPEAs except Hongkong initially passed through a phase of import-substituting industrialization but soon abandoned it by adopting strategic export-push policies. Moderate trade protection was maintained to support some industries on infant-industry grounds, but overall policy orientation was export promotion that established a free trade regime for exporters along with a supportive exchange rate management. To the extent export subsidies were provided, both direct financial subsidies and indirect preferential access to credit and tax breaks, they were used mainly to offset the modest anti-export bias of existing tariffs. Importantly, they were not used as a substitute for sound exchange rate management or other fundamental and supportive export promotion policies.

In an important study, Panagariya examines the impact of export subsidies on India’s export performance (Panagariya 2000). He argues that between 1960-1990 India provided many export incentives to promote exports while pursuing an overall import-substitution industrialization strategy. The end result was very weak export performance. Even as late as 1990, the export to GDP ratio was a mere 5%. Exports started to grow only after the trade and exchange rate liberalization policies starting in July 1991. During the post-1991 trade liberalization phase, there was a sharp reduction in export subsidies. Yet, exports grew rapidly as a result of sound management of the exchange rate and import liberalization. Consequently, the trade to GDP ratio increased to 10% by 1997.

Nogules (1989) examines the role of export subsidies in promoting exports and export diversification in several Latin American countries over a 20-year period between 1976-1987. The evidence shows that except for Brazil, export subsidies did not boost exports or promote export diversification. A combination of unstable real exchange rates and trade protection imparted a serious anti-export bias that could not be offset by the subsidies. The subsidies worked in Brazil because these were combined with a stable real exchange rate, import liberalization and other policies conducive to growth of exports. In contrast to Brazil, Mexico’s export performance deteriorated well up to 1980 despite export subsidies but then improved substantially based on trade liberalization and with minimum use of subsidies. As a result, the social costs of export promotion were lower in Mexico than Brazil. Export subsidies mostly failed in other Latin American countries (Argentina, Colombia, Costa Rica and Venezuela). It was particularly costly for Argentina where subsidy administration was riddled with fraud, corruption and rent-seeking behavior.

To summarize the empirical evidence, export subsidies have contributed positively to the expansion of exports in some HPEAs (China and Korea) and Brazil. But export subsidies do not seem to have benefitted export growth in a range of other countries including India and several Latin American countries (Argentina, Colombia, Mexico, Costa Rica and Venezuela). In Korea and China, export subsidies were a part of a well-thought out export promotion and economic development strategy that emphasized prudent macroeconomic management, sound management of the real exchange rate, and moderate levels of trade protection that reduced the anti-export bias. In Brazil export subsidies were a part of a broader package of export incentives including sound real exchange rate policy and import liberalization. There is no evidence that export subsidies can offset the adverse effects of large trade protection or an appreciation of the real exchange rate.

Export Subsidies in Bangladesh

As a part of its export promotion strategy, Bangladesh provides a range of export incentives. These can be broadly divided into two categories: incentives that directly support exports; and incentives that support production. The export incentives include: cash incentives (export subsidies); duty and tax concessions; bonded warehouses; export promotion zones (EPZs); and export finance, insurance and guarantees. Production incentives include: direct and indirect tax concessions; concessional credit schemes for cottage, small and medium enterprises; support for research and development; special economic zones; and high-tech parks. A detailed review of these subsidy schemes is available in Ahmed and Sattar (2019b). Only the direct export cash incentive schemes are discussed briefly below.

Export Cash Incentives

Cash incentives are provided to exporters who do not avail of the duty drawback facility or the bonded warehousing facility. The rate of the incentive is decided by the Government, and is updated annually through circulars issued by the Bangladesh Bank, which administers the incentive scheme. The list of products eligible for cash incentives (export subsidies) for goods shipped between 1 July 2019 and 30 June 2020, along with the associated rate of subsidy/cash incentive, is contained in FE Circular No. 35, dated September 22, 2019 (See Ahmed and Sattar 2019b). A total of 35 cash incentive schemes are included in this list. Two additional schemes were introduced in FY2020, a 1% cash subsidy for all RMG products not benefitting from the list of 35, and a 10% subsidy for consumer electronics, electrical home and kitchen appliances products. The government also introduced a BDT 2/USD bonus payment for all remittances submitted through the banking channel.

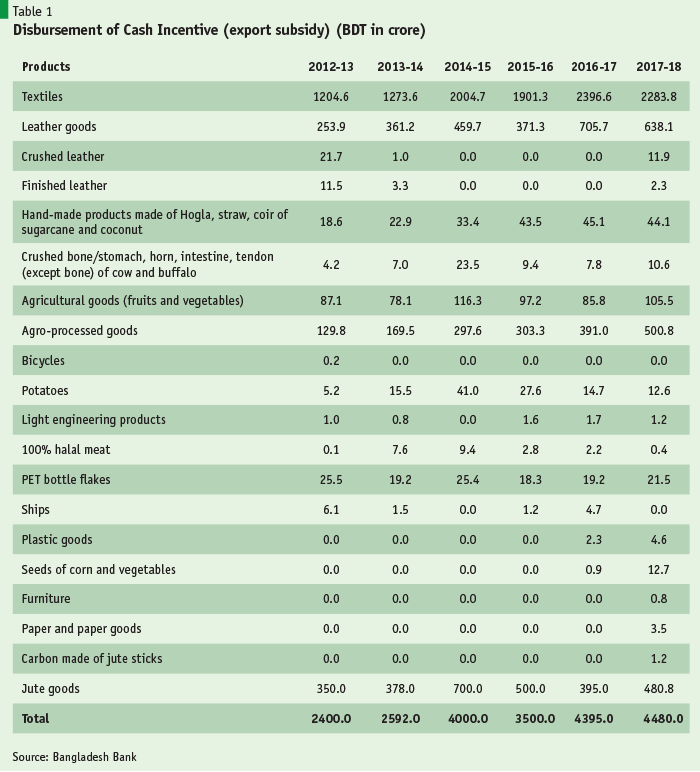

Cash incentives have been a major export promotion strategy in Bangladesh for a fairly long time. This has been an important claim on limited budget resources. The rising cost of cash incentives for exports is indicated in Table 1. The fiscal cost almost doubled in 5 years between FY2013 and FY2018. Importantly, the cost is going to rise substantially in FY2019-20 owing to the two new special incentives for RMG (1% cash subsidy) and remittance inflows (BDT 2/ USD). By some estimates, the fiscal cost of these two incentives could be as high as BDT 40 billion that would nearly double the fiscal cost of export subsidies within a year.

Effectiveness of Subsidies in Increasing Exports in Bangladesh

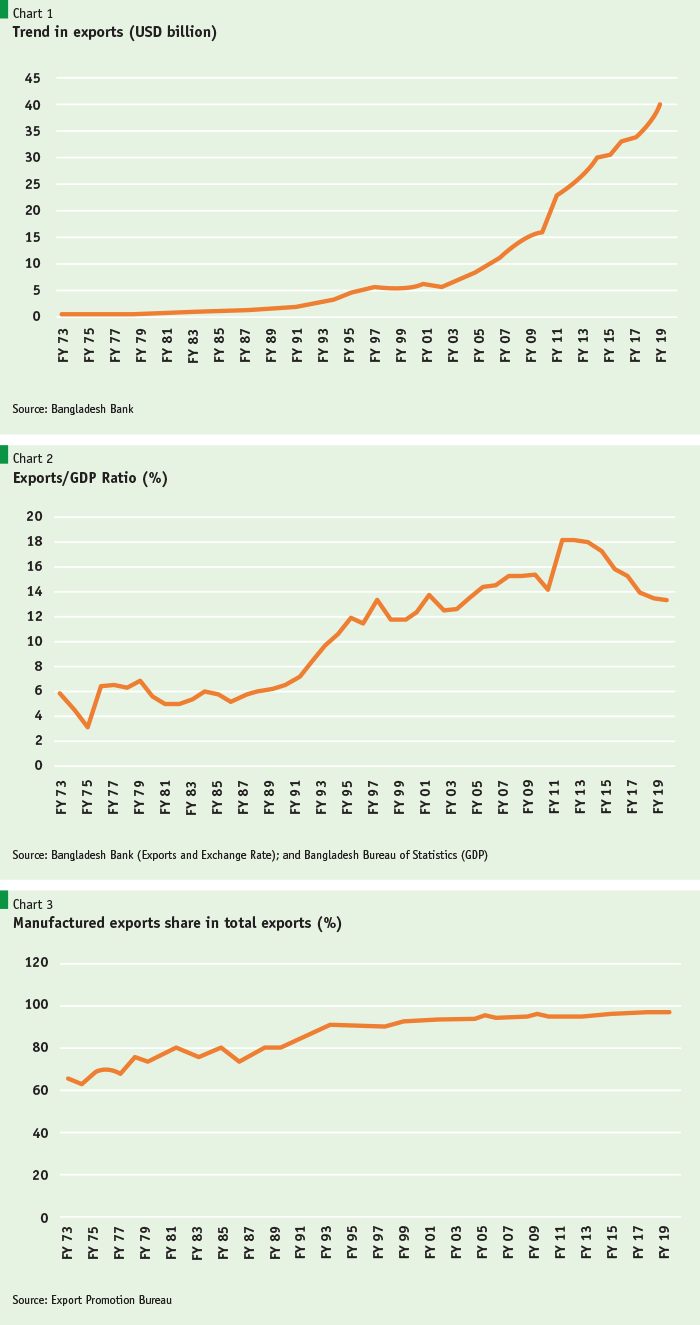

The recent trend in expansion of exports in US dollars, exports as a share of GDP, and the share of manufactured exports in total exports are shown in Figures 1, 2 and 3. Looking at these trends, the inescapable conclusion is that export in Bangladesh has performed very well since the 1990s. Unlike most LDCs, Bangladesh has the unique experience that most of its exports are in the manufacturing sector. As a result, the multiplier effects of exports growth on GDP have been much larger than in the case of LDCs that depend upon primary exports, especially natural resources. What explains this solid export performance in Bangladesh and how much credit could be given to subsidies for this performance?

Unfortunately, a sound econometric analysis of the determinants of exports in Bangladesh including the role of subsidies is not available. Limited studies have found evidence in support of the positive roles of real exchange rate, trade liberalization and world demand (Islam and Hossain 2018; Rahman 2014; Majumder et. al 2004). More generally, the analytical and empirical basis for the government’s export subsidy policy is not known and as a result it is not obvious on what basis export subsidies are provided. Nor is there any analysis of whether any export subsidy is achieving its intended objective. The absence of a systematic analysis of the effectiveness of subsidies on export performance is a major gap that the government needs to address soon.

A closer review of the export performance provides substantial insights on what might be the main determinants of Bangladesh export performance and emerging challenges. This analysis will also throw light on the policy challenges facing Bangladesh in view of the requirement to comply with the SCM policy of the WTO.

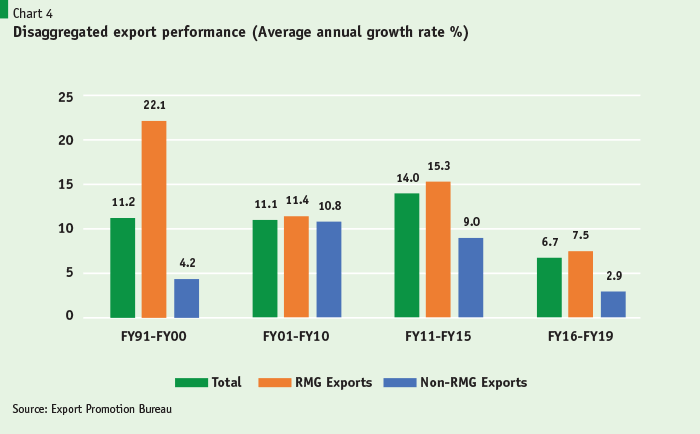

The expansion of exports since the 1990s has been spearheaded by the well-known readymade garments (RMG) revolution. From a low level of only USD 0.7 billion in FY1990, RMG exports surged to USD 34.1 billion in FY2019, which is an amazing 12% annual average growth rate over the past 29 years. The RMG revolution transformed the Bangladesh export scenario. But it is one product group dominance. Non-RMG products collectively did not show dynamism. Many products entered the export map, but most did not grow (Chart 4). As a result, the share of RMG exports in total exports has progressively moved up from 40% in FY1990 to 84.2 % in FY2019.

The remarkable performance of RMG is explained by several factors including: initial Korean FDI-based global market entry by Bangladesh using its unutilized quota allocations; the institution of the bonded warehouse facility that essentially allowed the RMG sector to work as an enclave production center with duty-free access to all imported inputs; the use of back-to-back LC for inputs against outputs; EU duty-free market access under EBA (as an LDC); and flexible and supportive exchange rate policy (Ahmed and Sattar 2019b). These core factors played the most important role. The role of cash subsidies, other fiscal incentives and subsidized access to credit is open to debate.

The relevance of export subsidies came into question quite remarkably in the wake of the downward trend in export performance in the 7th FYP. Following continued strong performance of exports led by RMG in the 6th FYP, growing at an average of 11.2% (Figure 4), export growth slowed considerably in the first 4 years of the 7th Plan, growing at only 6.7%. Even this growth is heavily influenced by the turn-around in RMG exports in FY2019 owing to the spillover effects of the US-China trade war. Bangladesh (and other RMG competitors) gained market access to USA at the expense of China. So, during the first three years of the 7th Plan (FY16-FY18) total exports and RMG grew at a modest pace of 5.5 and 6.3 respectively. Some export recovery happened in FY2019 owing mainly to the spillover effects of the China-US trade war. As a result, total exports and RMG exports grew by 10% and 12% respectively in FY2019. What is particularly distressing is the near stagnation of non-RMG exports despite subsidies and other fiscal incentives.

The main reason why export performance is slowing down and non-RMG exports have failed to take off despite export subsidies is the poor incentive structure for exports relative to domestic production. There are two major factors that explain this: first is the anti-export bias of trade policy; and the second is the over-valuation of the real exchange rate.

Anti-export bias of trade policy: There is a serious anti-export bias of the incentive structure (Ahmed and Sattar 2019b; Sattar 2019), which is imparted by the trade protection regime emerging from a complex system of tariff and para-tariff levies. Despite considerable trade liberalization over the 1990-2000 periods, the average nominal protection rates are amongst the highest in developing countries (Sattar 2019). Second, there is a large gap in average nominal protection for outputs and inputs. The average nominal protection rate for outputs (46% in FY2020) is substantially higher than for inputs (13% in FY2020). Third, the dispersion in tariffs / para tariffs by product categories is very large, which has caused the effective rates of protection (ERPs) to range from a low of 5% to as much as around 400% (Sattar 2019). On average the ERPs are higher for finished products. Such high ERPs provided to domestic producers can hardly be offset by export subsidies. The anti-export bias of trade policies is obvious.

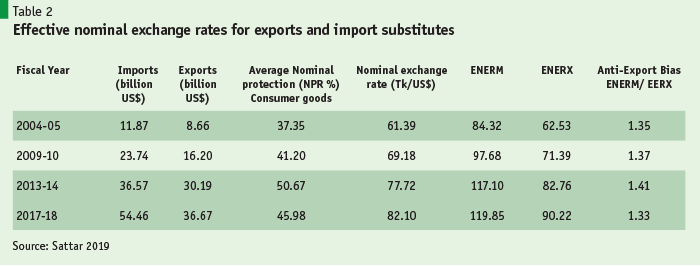

While ERP estimates are the best reflection of the true anti-export bias of trade policy, a simple way to see the effectiveness of subsidies in offsetting the disincentive effect of nominal protection is to compare the average effective nominal exchange rate for exports (ENERX) with the average effective nominal exchange rate for imports (ENERM). While import substitutes benefit from tariff/para-tariff protection, which can be considered as indirect subsidies, exports benefit from cash subsidies and interest rate subsidies on loans. The ENERM and ENERX take these into account. The ratio of ENERM and ENERX is a simple measure of the anti-export bias of trade policies. A ratio of close to one will suggest the near neutrality of trade policies between import substitution and exports. The higher the ratio is away from 1, the higher the anti-export bias of trade policies. The illustrative anti-export bias of trade policy using this approach is shown in Table 4. Since protection is provided mostly to consumer goods, the average NPR for consumer goods is used. The anti-export bias of trade protection even when the effects of subsidies are taken into account is substantial.

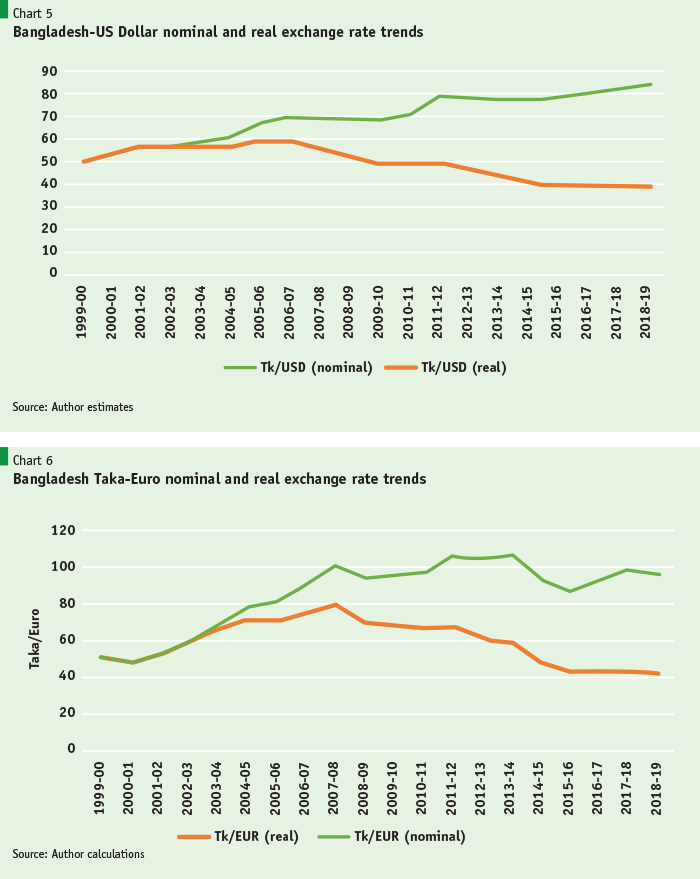

Appreciation of the real exchange rate: A second major factor underlying the weakening of export performance in recent years is the cumulative effects of the appreciation of the real exchange rate since 2006 (Figures 5-6). The Taka appreciated by 36% in real terms against the US dollar over the periods 2005-06 and 2018-19 (Figure 5). The appreciation against Euro happened a couple of years later from 2007-08. From then until 2018-19, the taka has appreciated by 48% in real terms. This extra appreciation against the Euro reflects the fact that the Taka is loosely pegged with the US dollar, which has strengthened significantly against the Euro. The resultant appreciation of the dollar also transmitted into an additional source of taka appreciation against the Euro. These appreciations of the Taka in real terms against the two dominant global currencies where Bangladesh conducts much of its export trade is a real problem and has substantially hurt export prospects and stemmed the diversification of exports.

Based on the available evidence, the conclusion is straight forward. The large anti-export bias of trade protection and the additional substantial loss in export competitiveness owing to the appreciation of the real exchange rate has basically rendered the cash subsidies and other fiscal incentives as ineffective instruments of export growth and diversification.

Policy Reforms and Way Forward

The economic case for export subsidies globally and in Bangladesh is very thin. In most cases export subsidies do not work. This is particularly true in Bangladesh where export subsidies have not helped non-RMG exports. In the case of RMG exports, other factors like bonded warehouse, back-to-back LC and duty-free entry in the EU markets and supportive exchange rate management have been the more dominant factors. As noted, there is quantitative evidence that exports have benefited from a flexible exchange rate policy and trade liberalization. On the other hand, continued large trade protection has imparted a serious anti-export bias in trade policy. The adverse effects of trade protection have been compounded in recent years by a large appreciation of the real exchange rate. These two factors fundamentally have prevented the emergence of a diversified export base.

The economic case for export subsidies globally and in Bangladesh is very thin. In most cases export subsidies do not work. This is particularly true in Bangladesh where export subsidies have not helped non-RMG exports.

Moving forward, the government needs to seriously rethink its trade and exchange rate policies with the twin objectives of promoting the growth of a diversified export base while ensuring the compliance of trade policies with the WTO obligations. The analysis of this article suggests that this re-examination might proceed along the following lines:

• Develop and adopt a medium-term tariff and a para-tariff reform program that substantially lowers trade protection over the next 5 years. This reform of the tariff regime will not only remove much of the anti-export bias and thereby promote export diversification, it will also assist in complying with WTO trade policy agreements starting from 2024.

• The flexible management of the exchange rate has served Bangladesh well and has been an important determinant of export performance. Between 1990 and 2005 a sustained appreciation of the real exchange rate was avoided through a flexible management of the nominal exchange rate. This active exchange rate management policy has given way in recent years to a more rigid policy of keeping the nominal exchange rate relatively unchanged. As a result, the real exchange rate against both the US dollar and the Euro has appreciated considerably since 2006-2008. This real appreciation of the Taka over a prolonged period of time is inconsistent with export promotion and export diversification and must be reversed soon.

• While it will not be practical to reverse the large real appreciation of the past 13 years, it is certainly feasible to reverse the appreciation of the more recent several years. For example, between FY2012 and FY2019, the nominal exchange rate of the Bangladesh taka against the US dollar increased only marginally from Taka 79 to 84 implying an annual average depreciation of 0.9%, even though Bangladesh inflation has on average exceeded US inflation by about 4.8 percentage points per year. So cumulatively, the real value of the Bangladesh taka vis-a vis the US dollar has fallen by 29% over the past 7-year period. This is a huge tax on exports and is not a sustainable exchange rate policy to support export growth. This rigid and near-fixity of the nominal exchange rate must be corrected soon and the real value of taka restored to the FY2012 level. This restoration can be done over a period of 3-4 years but certainly before the onset of LDC graduation in 2024. Once export competitiveness has been regained, policy effort should seek to avoid a real appreciation of the exchange rate.

• No new export subsidy should be allowed. The export subsidy cost grew substantially between FY2013-FY2018. Once the effects of the two new subsidies (1% incentive to RMG and 2 Taka/$ incentive to official remittance inflows) announced in the FY2019-20 Budget is taken into account, the subsidy cost will likely nearly double within a one-year period. This was a very expensive policy decision and has little to do with a thoughtful approach to export promotion. Subsidies in general do not appear to have any impact on export diversification as indicated by negligible growth in non-RMG exports during the 7th Plan (2.9% per year only) and of marginal benefit if any for RMG exports. A combined policy moves to reduce tariff protection and depreciate the exchange rate will do wonders for export growth and diversification, which will then allow the phasing away of all cash subsidies and tax breaks to exports by 2024 as required under the SCM agreement.

• Since there has been no quantitative study of the impact of subsidies on exports, it is fair to conclude that these subsidies have emerged on political economy grounds. While this article provides fairly convincing evidence that subsidies have not worked, it might help the policy dialogue with the political process to do a systematic quantitative assessment of the role of subsidies in export promotion. There is little doubt that the end results will be the same as noted here, but this will help build stronger consensus.

• A major concern against exchange depreciation is the fear that it will stoke inflation by increasing the prices of imports. This adverse effect however will tend to be offset by reductions in tariffs and para tariffs. This combined use of exchange depreciation and tariff reduction is known in the literature as “compensated devaluation”. So, the inflationary effects will be neutral or at best marginal.

• One argument against tariff reduction is the loss of revenues. The government is in the process of reforming its tax system as envisaged in the PP2041 (Government of Bangladesh 2019a). If the PP2041 fiscal framework is implemented, then the revenue loss from trade taxes will be more than compensated by gains from income taxes and VAT. Additionally, the elimination of export subsidies and tax expenditures resulting from the removal of tax concessions will help offset revenue losses from tariff reforms.

• The implementation of export subsidy implementation will have to be managed in a careful and phased manner mindful of the political economy aspects. The political economy challenge is that the present beneficiaries of export subsidy will seek to exert political pressure to resist this withdrawal. While the government is best placed how to phase out the subsidy, some general principles can be offered based on international experience with reform implementation. First, since the objective of the subsidy is to provide incentives to exporters, the government should combine subsidy withdrawal with better incentive policies through corrections of the real exchange rate and reduction in trade protection. Second, the reform package should provide better incentives to more than compensate for the withdrawal of subsidies. Third, the government can get technical assistance from trade experts to work out possible compensatory packages that combine the reduction of subsidies with the depreciation of the exchange rate and reduction of trade protection. Finally, upfront consultation with the business chambers is essential to get their buy in and eliminate any political backlash.

• The phasing of agricultural export subsidies required under WTO Agreement on Agriculture (AoA) (WTO 1995b) may present a political economy challenge given its relevance to food security and rural poverty reduction. Bangladesh should seek to benefit from the Nairobi Declaration of 2015 from its status as a net food importing developing country (NFIDC) that will postpone full compliance with the provisions of the AoA and agricultural subsidies under SCM agreements to 2030. In the interim, it must undertake an in-depth analysis of agricultural support policies in Bangladesh and the implications of AoA and SCM agreements for revisions and adjustment to these policies. Not all support policies for agriculture are in conflict with WTO trade protocols. The challenge is to rationalize these support schemes to be WTO-compliant.

References

Ahmed, Sadiq and Zaidi Sattar (2019a). Bangladesh Trade Policy for Growth and Employment: Collected Essays. Policy Research Institute of Bangladesh, Dhaka

Ahmed, Sadiq and Zaidi Sattar (2019b). “Making Post Graduation Export Incentives WTO Compatible” Paper Prepared for TAF2 Project, DFID, Dhaka.

Ahmed, Sadiq and Zaidi Sattar (2003). Trade Liberalization, Growth and Poverty Reduction: The Case of Bangladesh, South Asia Region Internal Discussion Paper No. IDP-190, World Bank, Washington DC.

Brander, James; Barbara Spencer (1985). “Export Subsidies and International Market Share Rivalry”. Journal of International Economics. Volume 18.

Government of Bangladesh. (2019a). Perspective Plan of Bangladesh 2021-2041. Revised Draft. General Economics Division, Planning Commission, Dhaka

Government of Bangladesh. (2019b). Impact Assessment and Coping up Strategies of Graduation from LDC Status for Bangladesh. Revised Draft. General Economics Division, Planning Commission, Dhaka.

Islam, Tauhidul and Tanjil Hossain. (2018). “Exchange Rates and Economic Growth in Bangladesh: An Econometric Analysis”. Open Access, ResearchGate.

Krugman, Paul R. and Maurice Obstfeld. (2003). International Economics: Theory and Policy. Sixth Edition, Pearson Education Limited, Low Price Edition, Singapore.

Majumder S., M.K. Saha and M. A. Akbar. (2004). “An Econometric Analysis of the Exported Quantity of Vegetables from Bangladesh”, Bangladesh Journal of Agricultural Economics Volume XXVII, No. 2 (2004) 45-56

Nogues, Julio (1989). “Latin America’s Experience with Export Subsidies,” World Bank Policy Research Working Papers 182, World Bank, Washington DC.

Panagariya, Arvind. (2000). “Evaluating the Case for Export Subsidies”. World Bank Policy Research Working Paper 2276. World Bank, Washington DC.

Rahman, Mohammad Mafizur. (2014). “The Causative Factors of Bangladesh’s Exports: Evidence from the Gravity Model Analysis” School of Accounting, Economics and Finance, Faculty of Business University of Southern Queensland, Australia

Sattar, Zaidi. (2019). “Pushing the Trade Policy Frontiers for Export Diversification” (draft). Paper prepared for the Fourth BEF Conference, November 09, Dhaka.

World Bank. (1993). The East Asian Miracle: Economic Growth and Public Policy. Oxford University Press.

World Trade Organization (WTO). (1995a) “Agreement on Subsidies and Countervailing Measures” (pdf) pp 229-272. https://www.wto.org.

World Trade Organization (WTO). (1995b) “Agreement on Agriculture” (pdf) pp 43-72. https://www.wto.org.

World Trade Organization (WTO). 2015. “Ministerial Conference Tenth Session Nairobi, 15-19 December”. (pdf). https://www.wto.org