Fiscal Redistribution Impacts on Inequality in Bangladesh: A Simulation Exercise

By

Introduction

Acommon characteristic of the currently pursued economic growth model is that it often is associated with increasing inequalities in income or consumption. Sustained economic growth in last three decade has been successful in reducing poverty – in spite of rising or stagnating inequalities in income or consumption. Inability of economic growth to reduce inequality thus led many countries to emphasized on policies to support inclusive growth. The discourse on inequality is back. IMF 2017 report on inequality acknowledged that while some inequality is inevitable in a market based economic system, excessive inequality can erode social cohesion, lead to political polarization, and ultimately lower economic growth. UN Human Development Report 2019 contextualised the inequality in a much broader context and argued that ‘people across the world, of all political persuasions, increasingly believe that income inequality in their country should be reduced.’

Fiscal transfers (social protection) have been found more effective in reducing inequality than progressive tax system. According to various OECD studies, progressive taxation of income is one of the main ways’ governments can redistribute incomes. But it is also recognised that, lower inequality is not only guaranteed by proper tax collection but also on redistribution of it in forms of benefits to those with lower incomes. In this respect, governments’ intervention to reduce inequality and poverty should be brought through employing both the tax and benefits systems which would take proportionately more tax from those on higher levels of income and redistribute benefits to those on lower incomes.

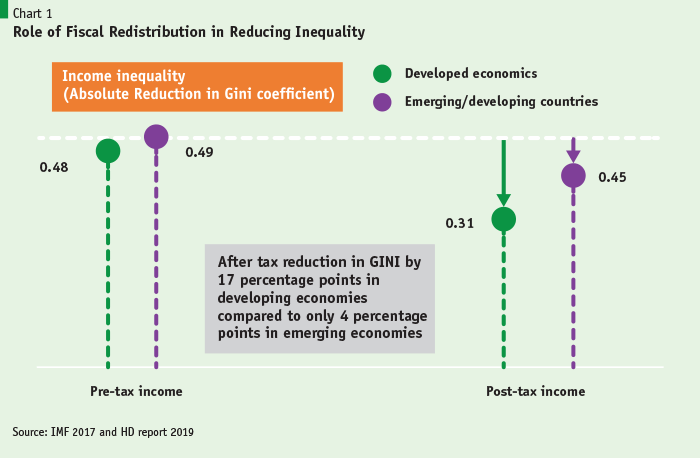

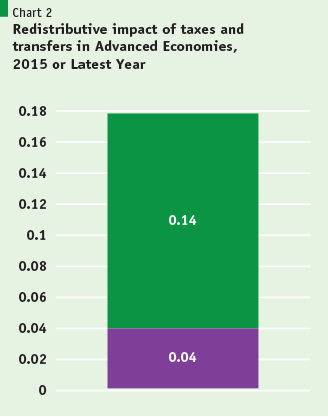

IMF (2017), envisaged that, fiscal policy can help reduce income inequality through various channels. First, progressive direct taxes and transfers can reduce disposable income inequality (that is, inequality of income after taxes and transfers) so that it is less than market income inequality (that is, inequality of income before taxes and transfers). Second, it further qualifies that the extent of fiscal redistribution will depend on both the magnitude of taxes and transfers and their progressivity. Adjacent chart captures the impact of tax and transfers on the absolute reduction in GINI of OECD countries. Impacts of these on GINI reduction is 0.18 of which transfer account for 0.14%.

Inequality in Bangladesh

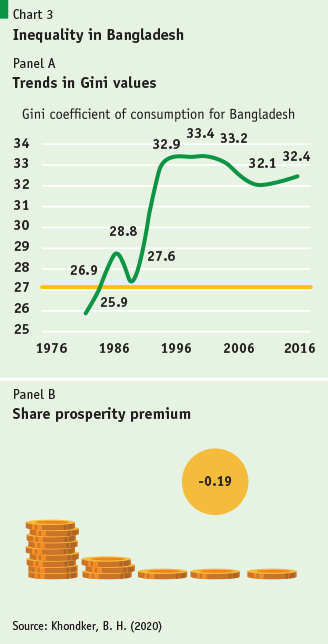

Despite progress in poverty reduction, inequality (whether measured by consumption or income Gini) remains a major concern in Bangladesh. Consumption inequality in Bangladesh is stable at around 32%. Income inequality is around 16 percentage points higher than the consumption inequality – at around 48 per cent. The inequality in Bangladesh is measured using the HIES data (i.e. household budget survey data). A concern with the use of household survey data is that inequality indices (i.e. GINI and the Palma Ratio for instance) reveals the biased impact economic growth has on the richer segment of the society. This highlights the need to understand the causes of inequality and the necessity to build suitable policies to reduce the gap. However, it is also highlighted that given the data limitations and exclusion of high-income groups in developing countries, it is highly likely that the actual inequality picture is worse than portrayed. Nora Lustig (2018) provides an excellent synthesis of the factors that give rise to the “missing rich” problem in household surveys – specially in developing countries1.

A key reason for either stagnant or rising inequality in Bangladesh (also in South Asia) is that the Bangladesh has failed to re-distribute the wealth generated to the bottom 40% of her population (i.e. this is known as shared prosperity premium)2. The shared prosperity premium measured by average growth for the bottom 40%. It has been found negative in Bangladesh (-0.19 % between 2010 and 2016).

A key reason for either stagnant or rising inequality in Bangladesh (also in South Asia) is that the Bangladesh has failed to re-distribute the wealth generated to the bottom 40% of her population (i.e. this is known as shared prosperity premium) . The shared prosperity premium measured by average growth for the bottom 40%. It has been found negative in Bangladesh (-0.19 % between 2010 and 2016).

High inequality not only dent poverty reduction efforts but may also affect economic growth. Gini coefficient in Bangladesh is higher than the 27% threshold which is considered as a growth harming rate by Grigoli and Robles (2017)3 . They found that similar to debt overhang tendencies, there is an inequality overhang level such that the slope of the relationship between income inequality and economic development switches from positive to negative at a net Gini of about 27%.

Fiscal Redistribution in Bangladesh

Fiscal redistribution is poor and weak in Bangladesh. Although on paper, Bangladesh has a progressive personal income system (with increasing marginal tax rates for higher income brackets), the share of personal income in total tax revenue is still low due to large compliance problem – with less than 1% of the population is under the income tax net. This statistic is abysmal for a country posting 7 to 8 % GDP growth rate on a regular basis during the decade. Poor tax compliance result in poor tax efforts. It is thus not surprising that Bangladesh has one of the low tax efforts in the World.

Fiscal redistribution is poor and weak in Bangladesh. Although on paper, Bangladesh has a progressive personal income system (with increasing marginal tax rates for higher income brackets), the share of personal income in total tax revenue is still low due to large compliance problem – with less than 1% of the population is under the income tax net.

Low efforts severely reduce the state’s capacity to investment in social sector (including social protection) which is known to impose salutary effects on ensuring minimum income, smoothing consumption as well as inequality. According to the official data, Bangladesh spend about 2.5% of her GDP on social protection – with the prime aim to reach the poor segments of the society. However, the social protection system is inefficient with high exclusion and inclusion errors. According to HIES 2016 data, the estimated exclusion errors was 71%– implying that 70% of the intended poor beneficiaries could not be reached by the social protection spending. Poor tax compliance (especially personal income tax) and inability of the social protection system has been the major pitfall of Bangladesh fiscal system and fiscal redistribution mechanism. Applying a micro-simulation, an attempt has been made in this article that Bangladesh does not need ton invent new mechanism to fight the inequality rather their proper enforcement.

Simulation outcome

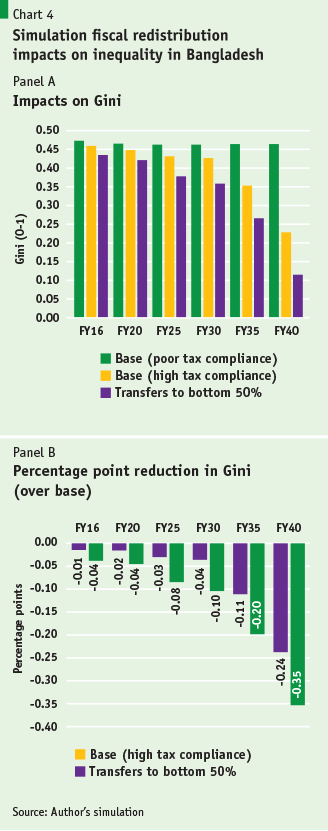

The importance strong fiscal re-distributive system epitomized by better tax compliance/administration, higher direct tax revenue and cash transfers on improving equity is shown with an illustration from Bangladesh. The gain in inequality (measured by Gini coefficient) via better compliance of personal income tax system and subsequent transfer of additional revenue through better compliance to bottom 50 per cent of the population is presented below. The simulation outcomes are derived from a micro-simulation model based on latest household income and expenditure survey (HIES 2016) linked to the macro projections of the Bangladesh perspective plan (2021 to 2041). Three simulations are carried out. (i) Base (poor compliance) simulation suggests high growth rates of 8 to 9 % with poor fiscal distribution (as observed currently) may likely to have negligible effects on Gini. (ii) Base high compliance of the personal income tax (all eligible taxpayers are paying according to their marginal rates) may significantly improve inequality situation in Bangladesh. (iii) Reduction in Gini is dramatic when the revenue gains through better tax compliance are effectively transferred to bottom 50% of the population.

The above discussion re-emphasized the need to implement fiscal instruments effectively in Bangladesh to reduce income and consumption inequality. The big question – is there a political will for effective implement of these instruments?