How Safe is the DFS Sector in Bangladesh?

By

Innovations in Digital Financial Services (DFS) are gaining impressive momentum in emerging economies, boosting the efforts towards financial inclusion. The rapid growth in the use of the internet, smartphones and other technologies has provided consumers with easy access to goods, online shopping, convenient payment methods, improved services, and an increased range of choices. Evidently, the digital transformation that is now underway has provided consumers with a wealth of commercial opportunities and convenience. Nevertheless, consumer activities in the Digital Age are inundated by growing problems related to the complexity and uncertainty around the use of personal data, as well as misleading, unethical, and fraudulent commercial practices. Primarily, these issues originate from inadequate security of mobile apps, lack of digital literacy and awareness, ambiguity in redress mechanisms, lack of proper data governance and privacy policy and weak mobile encryption algorithms.

The most prevalent risks identified in the digital space of Bangladesh can be characterized under three broad categories: i) Mobile Financial Services (MFS) risks; ii) Frauds using e-Commerce platforms; and iii) Cybercrime and operational risks. Moreover, they generally occur under three distinct stages— customer acquisition stage, transaction activation stage, customer value addition stage. Understandably, the use of digital platforms became increasingly relevant and indispensable for both consumers and businesses during the period of the pandemic, during which an augmented demand was witnessed for mobile wallet payments, e-Commerce channels, and various digital platforms. Registered MFS accounts in Bangladesh witnessed a hike of 12% in September 2021 compared to the preceding year while the number of transactions in the e-Commerce Sector has almost doubled within the same period. Furthermore, according to Bangladesh Bank, August 2021 recorded more than 100 million registered MFS clients, and nearly 40 million active MFS accounts. Additionally, the total financial flow through MFS increased to Taka 73393.3 crore in January 2022 – marking an annual growth of 28.1%. This also means that if this growth is sustained, then total financial flow through MFS in Bangladesh will approximately reach $100 Billion USD in the current financial year. This transformative growth in the DFS space underscores the need for an effective institutional framework that can ensure more safety for DFS users. Of course, this also makes us inquisitive concerning how safe is the DFS space for its users?

Consequently, to shed more light on this question and all the associated dynamics, a recent examined the propensity of fraud in the sector, the socio-economic features that make people vulnerable to fraud, the different types of fraud and to what extent satisfactory redress is available when a customer or an MFS Agent experiences fraud. The survey-based study also explored the share of the adult population who use MFS, their socio-economic profile, and the quality of their experience with the service so far.

The survey was carried out during August 2021 – September 2021 across forty-five districts, covering a sample of 9,279 adult individual respondent data points, drawn from over 300 upazilas using two stratification points – urban and rural. The total sample size drawn from each division has been influenced by the observed population distribution across divisions in the HIES (2016) Survey. To obtain evidence on consumer behavior, approximately 7,279 randomly selected individual data points were covered across 45 districts. To make the sample representative, around two-thirds of the respondents were taken from the rural areas, while one-third belonged to urban areas. The sample is also balanced across the two primary genders. The second body of the survey also randomly collected information from 2,000 MFS agents from 13 districts – of whom 64% operate in rural areas, and 36% operate in urban areas. These two bodies of survey has helped undertake two separate descriptive analyses on various aspects of the DFS sector from two different standpoints – MFS users and non-users and agents offering MFS — with the following key insights:

General Insights

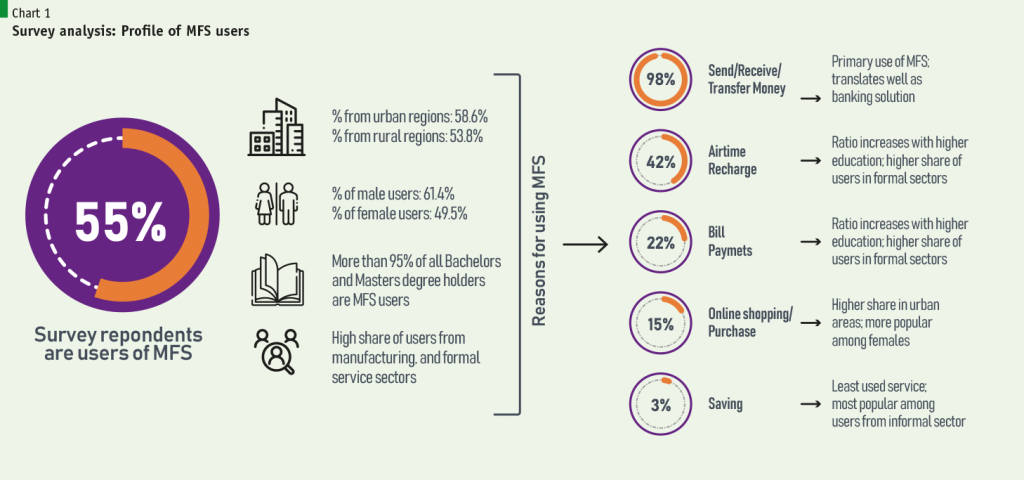

• Approximately 55% of the respondents in our survey are users of MFS, while 45% of the respondents stated that they do not use MFS. These are indeed encouraging indicators as they underscore the reach of MFS in Bangladesh. Across different levels of education attained, almost 75% of all primary school graduates and 38% of secondary school graduates fall within the group of non-users of MFS. Evidently, with higher educational degrees, a significant fall in the share of non-users can be witnessed. Moreover, more than 60% of all male respondents use MFS. The share is lower for the females as approximately 49.5% of all female respondents’ note that they use MFS. These findings reflect a better grasp of digital readiness among the males and amongst the people with higher education.

• Across non-users, nearly 66% of the respondents identified “not needed” as the primary reason for not using MFS, while “fear of fraudulent act” is noted as the second key reason for not using MFS (32% of non-users). Interestingly, the fear of fraud noticeably decreases with the level of education – possibly indicating how education enhances the use of technology by improving one’s capacity to navigate the different challenges of new technologies.

• Primary uses of MFS accounts have also been carefully examined. As transferring money through mobile wallets is an easy banking solution, it has been reported as the primary use of MFS by 98% of the users. Around 42% use the apps for airtime recharge, 22% for bill payments, 15% for online purchases and only 3% for savings. More diverse uses – such as MFS being used for Bill Payments, Airtime Charges and Online purchases – are observed across users from urban localities.

Insights on Experience with Fraud for MFS Users

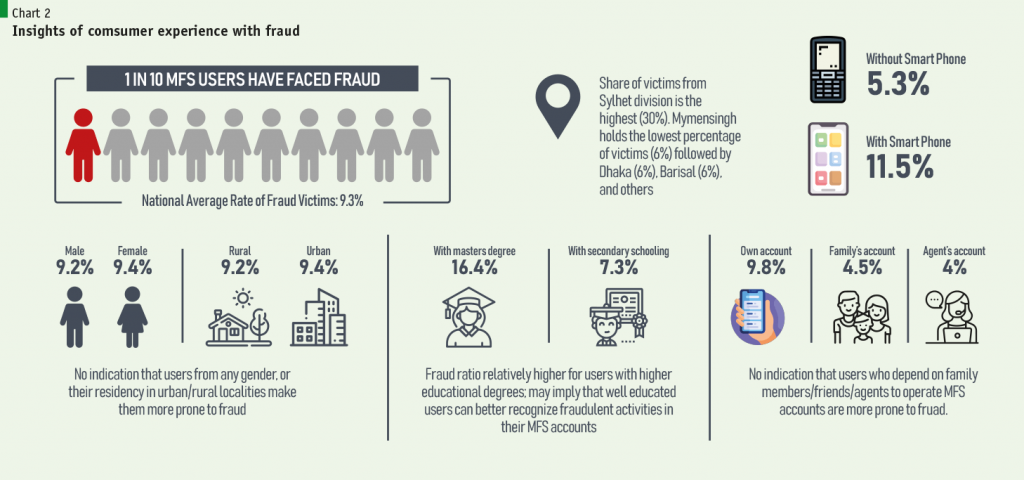

• Nearly one in ten MFS users (9.3%) report that they have been victims of fraudulent experience of some form. The share of victims of fraudulent acts also tends to be relatively higher for users with higher educational degrees. This does not necessarily establish any conclusive correlation between higher education and frauds faced, but instead may imply that well educated users are more aware of anomalies in their mobile wallets and can recognize fraudulent activities.

• Interestingly, there is no indication that users from any gender are prone to fraud – or their residency in urban/rural localities makes them more vulnerable to such malpractices. There is also no suggestive evidence that users who depend on family members (or friends) or agents to operate their MFS are more prone to fraud.

• The spatial distribution of the propensity of fraud is indicative that Sylhet Division has the highest propensity of fraud – more than 3-times of the national average. More work is needed to understand exactly why certain regions experiences more fraud, so that the providers of MFS can tailor their response to these reasons to mitigate such geographic heterogeneity.

• The average size of the financial loss from using MFS accounts amounted to over BDT 9,000. Although no significant difference in average loss was recorded between urban and rural residents, the size is seen to be increasing with higher educational degrees. This may reflect that user with higher educational degrees were more aware when financial loss incurred, hence were better able to report them during the course of the survey.

• When the different types of frauds are examined – it is noticed that “compromised PINs” and “scams involving impersonation” are primary frauds experienced by the users of MFS. Interestingly, higher formal education offers no noticeable safeguard against such frauds. When faced with frauds, majority of the users prefer complaining to the MFS Agents and/or Customer Care Centers to report them.

• Almost two-third of the complaints are resolved within a week, while one-third are never resolved. Not surprisingly, approximately 56% of the users of MFS who faced fraud note that their complaints were resolved satisfactorily. There is some indication that a higher share of respondents with better levels of education stated that their complaints were resolved satisfactorily, while the share was very low for those people who are employed in the informal sector.

• Findings show that users with higher financial losses had their problems resolved within the first week of complaining. Complaints that took more than a month to resolve consist of an average financial loss of less than BDT 2000. Additional time required to resolve such complaints may indicate the reluctance or lack of urgency from the users’ end for redress due to the smaller size of financial loss.

• A strong link was observed between the time required to address victims’ complaints and their choice of continuing the use of mobile wallets. Evidently, the more time required to resolve complaints, the more likely it is for victims to discontinue using MFS accounts. The share tends to decrease with the decrease in the number of days required for redress.

Insights from the MFS Agents’ Survey

• Across all the 2,000 randomly selected MFS agents surveyed from all 8 Administrative Divisions – more than 99% are men; indicating the dominance of one gender in this line of work. This is clearly an avenue where more work is needed to mitigate this disparity.

• Almost four out of five agents have received some sort of training before becoming an agent. Moreover, nearly one in five randomly selected agents have a Bachelor’s Degree, while nearly three-fourth of them have either primary or secondary level education.

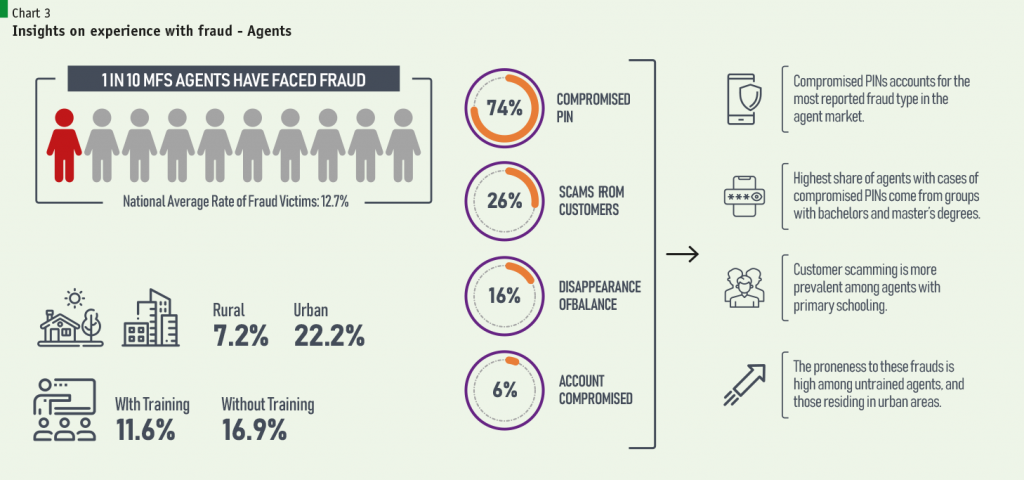

• Nearly 13% of the agents surveyed reported to have experienced fraud with their MFS accounts. Findings also show that untrained agents are more vulnerable to fraud than trained agents. This underscores the usefulness of training in mitigating frauds.

• The propensity of fraud across agents is substantially higher in the urban areas. As suggestive from evidence, more than one in five agents in the urban localities experienced fraud, while less than one in ten agents in the rural areas experienced fraud. Why this is the case needs more investigation, but it underscores the need for the providers of MFS to adopt more measures to enhance the security of the agents operating in the urban areas.

• Average size of financial loss suffered by agents from operating MFS accounts amounted to over BDT 18,000. The maximum loss recorded by users was BDT 70,000, which is significantly higher compared to the loss reported by MFS users.

• Compromised PINs accounts for the most reported type of fraud. The highest financial loss incurred from compromised PINs amounted to more than BDT 20,000. Multiple measures are undertaken by the Agents who experienced fraud. Most preferred calling a Customer Care representative (59%) – while around 57% sought redress from their family or friends.

• While only 38% of the agents had their complaints resolved on the first day of complaining, nearly 45% claimed that their complaints were never resolved. Moreover, unresolved cases are higher among the agents based in the rural areas, those with less education and amongst those who have received no formal training. It was also observed that agents with higher financial losses had their problems resolved within the first 15 days of complaining, whereas complaints that took more than a month to resolve consist of an average financial loss of BDT 15,000.

Useful Policy and Regulatory Reforms are Needed

Given the current state of consumer protection within the DFS space in Bangladesh, it is necessary to establish a prudent and comprehensive protection framework for DFS sector. As noted earlier, nearly one in ten MFS users experience frauds, which underscores the urgency with which fraud in the DFS sector must be addressed by policymakers and MFS providers. Effective guidelines are required to comprehensively bring all Financial Institutions under one umbrella with specific and detailed regulations, that will be equally applicable for all stakeholders in the DFS Industry. Users and agents must be instilled with adequate digital financial literacy and awareness to protect themselves against fraudulent experiences. Dedicated laws on data protection and privacy are also required to protect consumers’ data, their collection and usage, confidentiality, and security.

Overall, discussions and findings from the discussed paper highlight certain areas where further policy attention is needed to materialize the full potential of DFS. Some of these areas are highlighted below:

• Institutional Reforms: There is a need to establish a single dedicated regulatory authority that will ensure effective safety for the users of MFS across different regions and social groups. The central institutional body must annually measure both the propensity of fraud in the DFS Sector and explore how the nature of fraud is changing over time, so that they can motivate the providers of MFS to address these issues seriously. The meta policy objective of the regulators should be focused on reducing the propensity of fraudulent experiences drastically from approximately one in ten users of MFS to one in hundred users of MFS at the national level within the next five years.

• Strengthening the Digital and Financial Literacy of Consumers: Introduce a comprehensive Digital Financial Literacy Strategy by conducting trainings on financial literacy for the vulnerable communities and regions throughout the country. Special measures are also needed in the regions where the propensity of fraud is found to be high after exploring its root causes. More attention must be given to frauds that stem from compromised PINs or victims falling for impersonation – as they appear to be the most common type of fraudulent acts.

• Monitoring and Supervision of Agents: More investment is required in the recruitment, training and management of agents for the successful deployment of Mobile Financial Services in both rural and urban regions. Comprehensive training programs must ensure that the agents provide standardized services to their customers and have the capacity to offer effective redress to the customers experiencing fraud, especially the victims who have low incomes or are not educated enough to understand the risks.

• Mitigating Gender Disparity in MFS Agents: The undertaken survey is indicative that less than one percent of the agents in the DFS sector are women – indicating a strong gender bias. Consequently, the providers of MFS must be encouraged to recruit more female agents with the necessary training and supportive instruments to reduce this disparity.

• Increasing Consumer Awareness: Planning a collaborative effort by the Government agencies, NGOs, providers of MFS and other relevant organizations to organize awareness raising campaigns periodically on: (i) the nature of frauds; (ii) the occurrence of frauds; (iii) the possible victims of frauds; and (iv) the ways to avoid them. Insights from psychological analysis of the victims might be useful in designing campaigns that reduce the vulnerability of MFS users.

• Customer Care Service Outlets and Agent Points in Remote Areas: The providers of MFS must set up Customer Care Service outlets and agent points across the remote areas of Bangladesh to ease the accessibility of financial services, and make it easier for the users to address queries related to MFS.

• Strengthening Institutional Capacity and Redress Mechanism Tools: A relatively high level of capacity building mechanism is required for all the relevant stakeholders to understand and work on consumer rights and protection issues in Bangladesh properly. Trainings on cybersecurity should also be designed and initiated for employees of MFS providers.

On the whole, while financial risk in the fintech space is not unique to Mobile Financial Services, more protective policy and technological safeguards are necessary to ensure MFS users operate within a safe eco-system. Furthermore, while there exists a small body of research on the effectiveness of different risk mitigation approaches, there are no “perfect” solutions. Consequently, emerging nations have to cautiously experiment with new policies and technologies and develop a strong monitoring regime to examine their effectiveness.

On the whole, while financial risk in the fintech space is not unique to Mobile Financial Services, more protective policy and technological safeguards are necessary to ensure MFS users operate within a safe eco-system. Furthermore, while there exists a small body of research on the effectiveness of different risk mitigation approaches, there are no “perfect” solutions. Consequently, emerging nations have to cautiously experiment with new policies and technologies and develop a strong monitoring regime to examine their effectiveness. As this stand, nonetheless, the present status quo is not acceptable and protection of consumers in the digital marketplace should be a fundamental goal of the government and MFS providers.