Navigating Digital Financial Services: Insights from Bangladesh’s Agricultural Landscape

By

In recent years the world has reached a new era using digital platforms in every sphere of life. Digital platforms like digital financial services (DFS) have a pivotal role in financial transactions for running any industry, agriculture and service sector smoothly.

In a country like Bangladesh, where agriculture is central, DFS presents remarkable chances for financial inclusion. It tackles hurdles like costs, distance and transparency, offering customised financial solutions. Through DFS tools like microcredit, savings, insurance and payments, smart farming practices can revolutionise Bangladesh’s agricultural landscape, boosting efficiency, output and sustainability.

This transformation empowers farmers to invest in their farms, access necessary resources and mitigate risks, ultimately resulting in heightened productivity, improved incomes and better livelihoods. Understanding farmer’s perception of using DFS is crucial in navigating this pivotal shift.

With this in consideration, a primary survey engaged 400 farmers in Bangladesh, encompassing those involved in crops, vegetables, poultry, and fish farming. It revealed various essential conditions required for utilising DFS, such as being active users of financial services, possessing mobile handsets, and having access to mobile network services and internet connectivity.

In doing so, the study finds that most of the farmers (81%) use financial services through banks, NGOs and other non-bank financial institutions. Fish and poultry farmers, unlike crop and vegetable farmers, extensively utilise conventional financial services for their transactions. This underscores their readiness and potential to adopt Digital Financial Services (DFS).

…the study finds that most of the farmers (81%) use financial services through banks, NGOs and other non-bank financial institutions. Fish and poultry farmers, unlike crop and vegetable farmers, extensively utilise conventional financial services for their transactions. This underscores their readiness and potential to adopt Digital Financial Services (DFS).

However, the farmers who do not use financial services are a minority (19%) and most of them feel that they do not need a bank account. In certain rural or agricultural communities, traditional methods of saving and managing money might still be prevalent. These farmers might rely on informal savings methods or community-based financial systems that they trust more than banks.

The majority of the farmers use their own handsets that ensure mobile phone access concerns. Among them, fish and poultry farmers are more likely to use self-mobile phones than crop and vegetable farmers. Only 7% of farmers—most of whom are vegetable and crop farmers—use the phone of a close relative, family member, or neighbour.

However, the percentage of smartphone users (34%) is smaller compared to non-smartphone (i.e cell phone) users. Among the farmers who use smartphones are mostly fish farmers followed by poultry farmers. In contrast, a sizable portion of crop and vegetable farmers continue to use non-smartphones. This is because farmers of fish and poultry are young, well-educated and skilled, which makes it easier for them to use smartphones. Crop and vegetable growers think that using a smartphone is more complicated than using a non-smartphone.

It’s encouraging that nearly all farmers (99.75%) have access to mobile network services. However, only 32% have access to internet services, which are primarily facilitated by mobile telecommunication networks. While mobile networks might be available in some areas, the coverage might be inconsistent or weak. Farmers in remote or geographically challenging areas might struggle to get a strong and stable signal.

Besides, accessing the internet through mobile networks often involves purchasing data plans or having smartphones with internet capabilities. Affordability might be a significant barrier for farmers, especially in regions where data plans are expensive compared to their income. Despite this gap, since internet services are predominantly managed by these networks, every farmer could leverage digital services for financial transactions in agriculture.

The context indicates a clear opportunity for farmers to leverage (DFS), particularly by focusing on increasing internet access and smartphone adoption. With the widespread availability of mobile network services and the potential for internet access through these networks, coupled with smartphone usage, empowering farmers with DFS could revolutionise how they handle financial transactions within agriculture.

Building upon the background, the study examines farmers’ utilisation of DFS. Among them, 87.3% of farmers use DFS, with bKash emerging as the most preferred platform, followed by nagad, rocket, surecash and ucash. However, 12.7% of farmers refrain from using DFS. Some don’t perceive any necessity for DFS usage, while others cite a lack of familiarity with the system. Instead, they opt for cash transactions or utilise checks and bank-to-bank (b2b) transfers.

…87.3% of farmers use DFS, with bKash emerging as the most preferred platform, followed by nagad, rocket, surecash and ucash. However, 12.7% of farmers refrain from using DFS. Some don’t perceive any necessity for DFS usage, while others cite a lack of familiarity with the system.

DFS users employ these services for both farm and household transactions, but the utilisation for farm-related transactions is notably minimal compared to household transactions. This indicates that while DFS is being adopted and used by these individuals for domestic remittance, school stipend and social protection programs, its application within the agricultural sphere, such as purchasing seeds and equipment or managing farm-related finances, is relatively limited or infrequent.

Traditionally, agricultural transactions have often been conducted in cash due to its tangibility and ease of use. Farmers might prefer using cash for farm-related activities rather than transitioning to digital methods due to habit or trust in physical currency.

Furthermore, while investigating DFS usage, farmers report lower satisfaction levels compared to cash transactions, but higher satisfaction levels compared to using checks or bank-to-bank (b2b) transfers (Table 1). This indicates that farmers remain more at ease with direct cash transactions but are gradually transitioning away from using checks and b2b transfers as their preferred modes of financial transactions.

Behind the scenarios, study finds several reasons. The first one is limited digital knowledge and financial literacy on DFS among farmers. Typically, a higher level of education correlates with greater knowledge and financial literacy. Acquiring digital knowledge and financial literacy involves comprehending financial options, strategizing for the future, making prudent expenditures and effectively handling challenges related to life events, including savings and payments for agricultural services.

Approximately 61% of farmers find using digital apps for financial transactions challenging, with only 70.5% and 72% of them not knowing how to change the PIN and understand the terms and conditions of DFS, respectively.

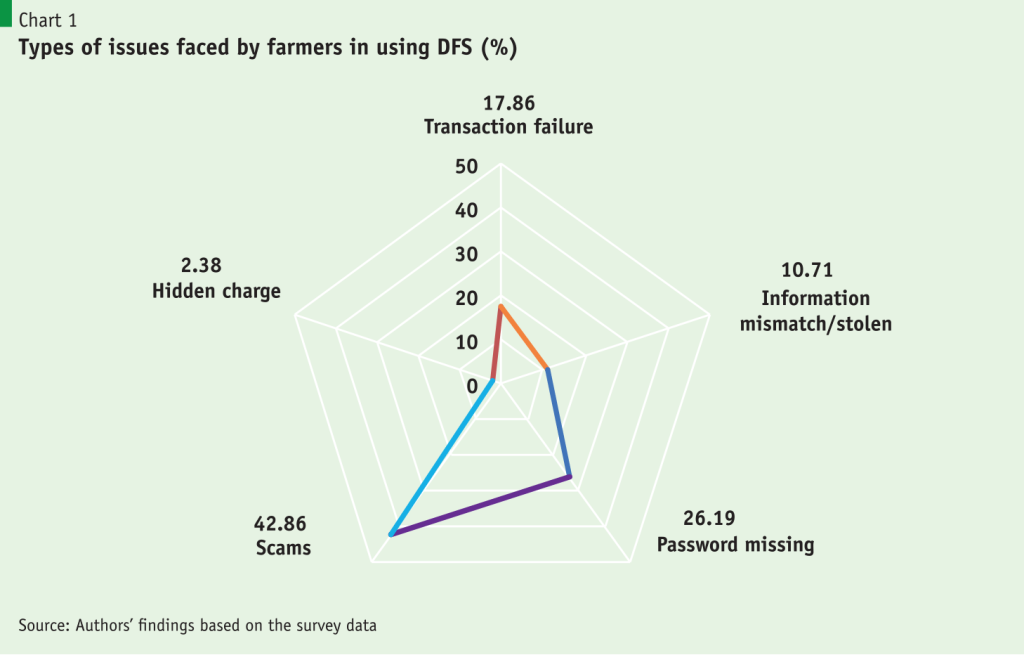

Regarding barriers encountered during DFS use, the study reveals that about 21% of farmers face severe issues. Among these, scams (42.86%) and password mishaps (26.19%) are the primary reasons causing trouble for farmers utilising DFS. Scams, in particular, significantly affect farmers’ trust and satisfaction with DFS platforms. These challenges underscore the need for addressing security concerns and improving user education to enhance the farmers’ experience with digital financial services.

Furthermore, farmers grappling with issues such as transaction failures (17.86%), information mismatch or theft (10.71%) and hidden charges (2.38%) encounter difficulties during their DFS interactions. For instance, when fish or poultry farmers initiate payment processes for purchasing feed through DFS platforms, technical glitches or network issues sometimes disrupt the transaction’s completion. This delay in procuring feed disrupts their feeding schedules, potentially impacting production.

When faced with such challenges, farmers take various measures. Approximately 35.7% of those encountering problems lodge complaints with agents, while 27.40% opt to contact customer care. Additionally, 16.70% seek advice from friends and relatives and a smaller percentage (3.6%) resort to legal action. Some farmers might refrain from taking action due to a lack of complete understanding of potential risks, available solutions, or reluctance to disrupt their established workflows. Similarly, 16.70% do not take any measures due to reasons such as lack of awareness, complexity of the issue, or inconvenience.

Regrettably, in most instances, farmers facing issues do not receive proper solutions from the respective authorities. Consequently, as their issues in agri-business transactions remain unresolved, these farmers are losing interest in using DFS, adversely affecting their engagement with digital financial services.

Drawing from the context, specific suggestions are tailored to benefit diverse stakeholders, including DFS suppliers, farmers, policymakers, and researchers.

Enhanced financial literacy programs Develop and implement targeted educational initiatives to improve digital knowledge and financial literacy among farmers. Tailored training should focus on understanding DFS applications, navigating terms and conditions and managing digital transactions effectively.

Infrastructure development Prioritise the expansion of internet connectivity and mobile network coverage, particularly in rural and geographically challenging areas. Strengthening infrastructure will ensure more consistent and reliable access to digital services for farmers.

Promotion of smartphone adoption Implement programs that encourage and facilitate the adoption of smartphones among farmers. This could involve initiatives to make smartphones more affordable, coupled with training on how to use them effectively for DFS and other agricultural needs.

Addressing transaction challenges Establish dedicated support mechanisms, such as improved customer service and accessible grievance redressal systems, to assist farmers facing transactional challenges. This includes addressing issues like transaction failures, information security, scams and hidden charges promptly and effectively.

Tailored DFS for agricultural transactions Develops specialised DFS solutions tailored to agricultural needs, promoting their usability and reliability for farm-related transactions. Initiatives could include incentives for using DFS in purchasing agricultural inputs, equipment and managing farm finances, ensuring ease of use and reliability specific to the agricultural sector.

These policies aim to bridge the gaps identified in the study, fostering greater adoption and utilisation of DFS among farmers while addressing their specific needs and challenges within the agricultural landscape of Bangladesh.