Budget FY23 Implication on the private sector

By

Economic context

The world finds itself facing a twin crisis. Before we could fully recover from the after-effects of the COVID-19 pandemic, both from a health parameter and global supply chain recovery, the Russia-Ukraine conflict has exacerbated the complexities and economic shocks to the mix. Commodity prices soared in international markets since the end of 2021 with post-COVID rising demand, and the conflict is adding further fuel to this fire. From May 2021 to May 2022, prices of fuel have increased by 65%, urea fertiliser by 114%, soybean oil by 29%, and wheat by 85%. According to the April 2022 issue of the World Economic Outlook, global growth is projected to slow from an estimated 6.1 % in 2021 to 3.6 % in 2022. This is 0.8 percentage points lower for 2022 than projected in January. War-induced commodity price increases have led to 2022 inflation projections of 5.7 % in advanced economies and 8.7 % in emerging market and developing economies—1.8 and 2.8 percentage points higher than projected last January. The twin crisis is exerting manifold pressure for the Bangladesh economy- escalated current account deficit, negative growth in remittances, high inflationary pressure, stress on the US dollar exchange rate, and strain on the foreign exchange reserves to support imports. In the backdrop of such evolving uncertainties, the government announced the national budget on June 9.

Salient features of the budget

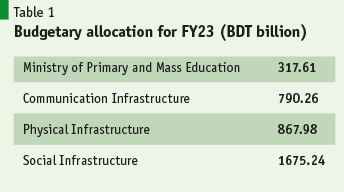

The Government of Bangladesh has rolled out a BDT 6.78 trillion spending plan, which is equal to 15.23% of the national GDP. In the Budget, the government has set a 7.5% GDP growth target and an inflation target of 5.6%. The budget sets a target of the total revenue of BDT 4330 billion of which the NBR is expected to collect BDT 3890 billion. The public investment-GDP ratio has been assumed to be 6.7% in FY23. Private investment has been estimated to be 24.8% of GDP. Incremental Capital Output Ratio (ICOR) is also expected to be 4.2 in FY23 as the productivity of capital is projected to increase. The government has targeted a budget deficit of BDT 2450.64 billion. This is higher than it should be in the current context of pressure from high import costs and prices. The budget has recognised the need to control inflation and has some business-friendly elements such as a decrease in the export duty on non-RMG industries and even a lower duty on firms that produce green products and services. A table showing the budgetary allocation for selected sectors is given below.

The Government of Bangladesh has rolled out a BDT 6.78 trillion spending plan, which is equal to 15.23% of the national GDP.

The budget comes at a juncture when Bangladesh is in greater need of enhancing trade and investment than ever before. Maintaining sustained covid recovery, enhancing foreign and local investment for jobs and income, and boosting export volume and diversification are all critical to addressing current and ongoing challenges of inflationary pressure, current account deficit, breaking the stagnation of investment, and being competitive for a post-LDC world. To this end, we take a look at how the budget fares for the private sector economy.

Business Taxation

The government has taken several measures to rationalise tax rates and improve business tax compliance in this budget. This Budget proposes a wholesale reduction in tax rates for all types of companies. A publicly traded company with more than 10% paid-up capital through IPO will be able to avail of the proposed 20% rate from the existing 22.5% if all investment and expenditure (in excess of 12 lac BDT) and all receipts are made through the banking channel. Similarly, a publicly traded company with 10% or less than 10% paid-up capital through IPO will be able to avail of the existing 22.5% rate if they follow the aforementioned stipulation. The budget offers no waiver of income tax on loan interest from 2023 as proposed by the Budget. This will be effective in tackling irregularities in loan repayments. Additionally, prepaid telco suppliers can avail of Supplementary Duty as a decreasing adjustment as per the finance bill. This will decrease the cost of doing business. Input tax credit can be availed if intra-company expenses are made through mediums other than banking channels, including mobile financial services. Input tax credit can be availed for goods produced under contract manufacturing.

The government has taken several measures to rationalise tax rates and improve business tax compliance in this budget. This Budget proposes a wholesale reduction in tax rates for all types of companies. A publicly traded company with more than 10% paid-up capital through IPO will be able to avail of the proposed 20% rate from the existing 22.5% if all investment and expenditure (in excess of 12 lac BDT) and all receipts are made through the banking channel. Similarly, a publicly traded company with 10% or less than 10% paid-up capital through IPO will be able to avail of the existing 22.5% rate if they follow the aforementioned stipulation.

Several of the proposed finance bill measures, however, hold potential adverse impact on private sector as businesses are still reeling from the impact of the pandemic amidst rising commodity and foreign exchange prices. There are a number of measures which are likely to increase tax burden on businesses. For instance, gains from government securities are no longer tax exempt. This will increase tax liability. Transfer to Special Reserve is no longer an allowable expense which will make the effective tax rate on Transfer to Special Reserve to increase to 39.06%. The effective tax rate on contribution to Workers Profit Participation Fund (WPPF) has increased to 22.50% since contribution to WPPF has been made inadmissible. This makes efforts private sector’s efforts to improve employment benefit/conditions for workers more expensive. The Budget has increased the threshold for excess perquisite from BDT5.5 lakh to BDT 10 lakh making the effective tax rate 20.26%. Cost of overall connectivity, both physical and digital, will increase as Tax Deducted at Source (TDS) on transport hand Internet Services has increased.

On the tax compliance, there are a number of measures that will make the already difficult compliance further complex. This includes proof of return submission in many cases where previously submission of e-tin would have sufficed. Additionally, companies need to submit proof of return submission for bank credit balance more than BDT 1,000,000 in a year. This may discourage companies out of banking deposits. This is also detrimental for small entrepreneurs. Budget FY 23 make submission of tax returns mandatory for global digital service providers like Facebook, Google, Twitter, and Amazon. This will further deter Bangladesh’s prospects of becoming a digital hub in the region. Submission of tax returns is now also mandatory for cardholders. This increases their tax burden and will have negative implications for digital financial services in the country.

Discretionary authority of tax officials, a long-debated hurdle towards improving revenue regime in the country, has further been bolstered in the budget. Concerned tax officials now have access to not only information, places, accounts and activities but also the code of the technology. Additionally, the official can extract data, imagery or any inputs; place marks of identification; impound and retain books of accounts and require any person to refrain from activities. Penalty will be put forth not exceeding BDT 5,000,000 in case of non-assistance. Utilities can be disconnected within 21 days from the date of notice if due tax is not paid. The consequence of non-compliance is higher due to this change in the law. Provisions to penalise payment approvers handling TDS and TCS have been introduce in the proposed finance bill. This would make the responsible person more cautious about TDS and TCS and allowing licenses and registrations in general.

Investments

The new Budget has changed provisions in The new Budget has changed provisions in the law in the case of mergers and acquisitions. The shareholder of amalgamating company can now become shareholders of amalgamating company. Moreover, shareholder of a foreign company is required to have investment in Bangladesh company. Consideration received through shares are now tax exempted in this Budget while that received through payment to resigned shareholders are now taxable. All these changes should encourage FDI and amalgamation through share transfer while demotivating share transaction through cash. The budget however is silent on several critical investment climate improvement factors such as institutional capacity and resources to undertake continuous regulatory reforms, improvement of logistics infrastructure, and undertake targeted long-term investment promotion measures focusing possible shifts of various international businesses from east Asia and elsewhere.

Exports

Budget FY23 proposes tax reduction for export-oriented industries. Non-RMG industries will now be able to avail the same tax rate as the RMG sector (12 or 10%). This opportunity is available till June 2028 for companies holding a ETIN certificate, compliant with the provision of ITO and with environmental policies. The proposed bill reduces tax for backward linkage industries of RMG to 15%. This tax break is available for the period up to 30 June 2025. This will help the efforts to deepen the backward linkage which becomes more critical after LDC graduation. Tax exemption has been offered on Bangladeshi Flag carrier ocean-going ships till 2030. These ocean carriers had to earlier pay 10% tax on their income. This will encourage investment in the oceangoing shipping industry. This policy decision will also increase foreign currency reserves.

There are some measures that have increased the tax rates for exporters. The rate of source tax collection has been increased to 1% and TDS rates have been raised in areas of minimum tax. The effective tax rate will increase as a result and will minimise the positive impact of the reduction in corporate tax will have a lower impact.

The proposed finance bill provides exemption for bonded warehouses when it comes to subcontracting. Although this increases the backward linkage, more could have been done in the sphere of improving logistics and improved trade facilitation. Additionally, the increase in para tariffs on imports have added to the protection of domestic market-oriented industries. This budget sees increases in VAT/SD exemptions to car manufacturing, compressors for refrigerators, battery, plastic bags, towels, bedsheets, textile grade pet chips, mobile phone batteries, power tiller. This could have been an opportune time to increase competition in the market ahead of Bangladesh’s LDC graduation.

Innovation

In order to encourage innovation and new ideas, the Budget FY 23 has initiated Startup Sandbox for new entrepreneurs. Startups will have benefits such as no reporting obligation if they provide permanent access to their system or books to the National Board of Revenue. The Budget has reduced the minimum tax rate to 0.1% under the sandbox benefits. They will also be able to carry forward their losses up to nine successive assessment years. Currently, all companies can adjust their losses for up to six years. This will help efforts towards deployment or commercialisation of new products, processes or services driven by innovation, development and technology and intellectual property. This will encourage foreign investment into Bangladeshi startups. These policy initiatives will help younger homegrown startups. Global giants and startups older than five years or a subsidiary of any company will be ineligible for the benefits. The industry reality is that even local startups need a foreign holding company in Singapore or other major global centres to avail venture capital funding. In order to motivate firms to increase R&D, Budget FY 23 has a defined R&D expense.

The proposed finance bill has introduced provisions detrimental for freelancers. A minimum tax has been levied on remittance to Bangladesh for a service or revenue sharing. This will increase the tax burden on a freelancer and outsourcing agency. This Budget also sees an increase in VAT for software customisation from 5% to 15%.

SME

Traders can now apply input tax on services received. This will lead to reduced cost for traders. Additionally, VAT at manufacturing stage has been exempted but is applicable at trading stage. Altogether, these changes make obtaining central VAT registration simpler and broader, decrease cost of documentation and administration and reduce VAT disputes. Payment made to parties other than intra company payments through mobile financial services upwards of BDT 100,000 is considered as banking channel in this Budget. Mushak 6.4 can be issued from port which means that contract manufacturers can use their own product and will reduce transport costs. In this budget, agreement letter will be considered a valid document for supply against international tender. This eases regulations for deemed exporter. These measures will help in efforts towards ensuring ease of doing business. Having said all this, the reality is that SMEs are still reeling from the impact of the COVID pandemic and require additional efforts on the part of the government to assist them for their growth enhancement. Increase in tax compliance in the form of disconnection of utility services if payment is not made within 21 days, not accepting E-TIN certificate, higher TDS for failure of submission of proof of return and overall increased arbitrary power of tax authority will further add to the burden put on SMEs in the country.

Sector Development Efforts

Pharmaceutical and digital device manufacturing sectors received some positive gestures in the budget. The finance bill promotes the pharmaceutical industry by providing VAT exemption at local manufacturing level for active pharmaceutical ingredients and laboratory reagents. There is also AIT exemption on importation on local purchase of raw materials. In order to develop the local software industry, VAT exemption has been introduced on local manufactures of interactive display monitors, mobile phone charger and mobile phone battery. Concessional facility has been put for import of raw materials used in locally produced computers along with ATM, close circuit camera and computer peripherals to facilitate the local IT sector. AIT on importation of insecticides, fungicides and herbicides inputs and textile grade pet chips manufacturing inputs have been put to assist local agribusiness and textiles respectively. The agriculture sector also sees a decrease in customs duty reduction of wheat gluten from 25% to 15%. VAT has been reduced on yarn from man-made fiber and other fibers from BDT 6/kg to BDT 3/kg. The aforementioned measures, while encouraging, do not suffice for the level of policy and resources attention required for developing sectors beyond traditional ones, in other words economic diversification. The budget is rather muted about some of the key determinants of new sector development such as targeted technical and vocational skills development for priority sectors, strengthening production and environmental infrastructure, boosting conformity to quality standards and certification, and finally encouraging adoption of technology in industrial and services delivery. The industrial sector also sees increases in customs duty rates for coated rods, AC and DC motors and lifts and skip hoists. This would add to cost of production. Despite this whole slew of interventions, the new impositions of customs duty and supplementary duty on inputs will have adverse impacts on manufacturing, construction, agribusiness and several other key sectors.

Ramifications of the Digital Economy Sector

The National Finance Bill 2022 has introduced a TDS on internet services at the rate of 10%. This will increase the cost of internet. Simultaneously, the Budget sees a 31.25% price hike of laptops. These two changes will impact the cost of doing business of firms in the digital economy sector as well as widen the divide in the digital space as was apparent during the pandemic. In order to help startups which are process or service driven by innovation, development and technology or intellectual property, the Finance Bill proposes a start-up sandbox to inspire innovation and generate new ideas. Under this, the company will have no impact of section 30 and 30B carry forward loss up to 9 years (previously 6 years) and minimum tax on gross receipt of 0.1% (previously 0.6%). The firm will also have no reporting obligation u/s 75 if access is granted to the tax authority. The firm further needs to have a growth period. To propel their growth, the startups will also be given amnesty from penalties even if they fail to comply with tax rules. The company has to be incorporated after the fiscal 2017-18 but must be registered by the last day – June 2023. Those five years will be calculated as the growth year of a startup venture. The new budget will also remove the expense ceiling so that they can promote and market their products to customers and at the same time, spend on research and development. These benefits were meant to help newer home-grown startups in the place of global giants as startups older than five years or a subsidiary of any company are ineligible for these benefits. The industry reality is that local startups require a foreign holding company in Singapore or other a major global center to avail venture capital funding.

In order to bring companies such as Google, Facebook and Amazon under the tax net, the government has made submission of tax returns mandatory for global digital service providers. Moreover, a change in the definition of IT Enabled Services as per the Finance Bill, sees the increase in VAT from 5% to 15% for software customisation related services. Additionally, VAT exemption has been put on local manufacture of interactive display, mobile phone charger and mobile phone battery. Concessional facility has been put on the import of raw materials used in locally produced ATM, close circuit camera, computer, computer accessories and computer peripherals. This can also be availed for production of aforementioned items inside Hi-Tech Park. Therefore, the government has provided concessional facility to device manufacturers and at the same time raised taxes on the importation of laptops and all related periphery devices. Providing concessional facility to an industry which has not reached a quality where it can compete international devices and raising the taxes on essential assets of ICT firms is detrimental as it increases cost by around 30-40% for these firms. At the same time, it encourages local manufacturers to compromise on quality as they now have a ready market where their products are more competitive in terms of price point.

The finance bill has introduced provisions detrimental for freelancers. A minimum tax has been levied on remittance to Bangladesh for a service or revenue sharing. This will increase the tax burden on a freelancer and outsourcing agency. The new Budget also fails to address supportive measures for the e-commerce industry where last-mile delivery is an essential part.