Fiscal Tightrope: Juggling Revenue Gaps and Spending Obligations in an Election Year Budget

By

Navigating Macroeconomic Turbulence

The Bangladesh’s economy continues to grapple with macroeconomic stress. These challenges began surfacing domestically when imports spiked due to pent-up demand in the wake of economic recovery after the COVID-19 shock. The rising value of the US dollar across the world exacerbated the situation. The Russia-Ukraine conflict further contributed to the strain by disrupting supply chains and escalating global commodity prices, which in turn made imports even more expensive. On the contrary, for Bangladesh and many other developing countries, earnings from exports and remittances didn’t rise proportionately, leading to a rapid depletion of foreign reserves. To stem this decline, the Bangladesh Bank was compelled to let the taka depreciate and impose import restrictions. These measures fueled high inflationary pressure within the domestic economy.

As of July 2022, the gross foreign exchange reserve was at a robust USD 39.6 billion. However, it experienced a significant reduction over the year, dropping to USD 29.84 billion by June 14, 2023. Inflation also saw a sharp rise, peaking at 9.5% in August 2022 and maintaining an average of 9.1% over the subsequent 9 months, overshooting the annual target by 3.1 percentage points. On the other hand, remittances accumulated from July 2022 to April 2023 amounted to USD 17.72 billion. Projections from PRI-CDRM suggest that by the close of the current fiscal year, the total remittance earnings will amount to USD 21.3 billion. However, this figure still falls short by USD 0.2 billion of the revised remittance target outlined in the Monetary Policy Statement for FY2023.

Inflation also saw a sharp rise, peaking at 9.5% in August 2022 and maintaining an average of 9.1% over the subsequent 9 months, overshooting the annual target by 3.1 percentage points.

The export outlook also appears to be rather bleak. From July 2022 to May of FY2023, total earnings from exports amounted to USD 50.5 billion, falling short of the target by 3.64%. Given the recent downward trend, the PRI-CDRM projects exports at the end of FY2023 to stand at about USD 54 billion —a shortfall of USD 4 billion from the budget target. Additionally, due to the dollar crisis, import figures have also seen a significant decrease.

These recent developments have significantly affected the growth trajectory. The global economic growth is anticipated to decelerate to 2.6% in 2023, and in line with this trend, the IMF has projected a 5.5% growth for Bangladesh. Most recently, the provisional estimate by the Bangladesh Bureau of Statistics (BBS) pegged the country’s growth rate at 6.03%.

Given the recent macroeconomic developments and the upcoming national election—widely expected at the end of the calendar year—the forthcoming budget for FY2024 takes on increased significance. The fiscal framework of the upcoming budget is of particular interest in assessing how the IMF program conditions will be met in the backdrop of macroeconomic stress, uncertain global economic and financial climate, and unfolding electoral dynamics.

The budget context

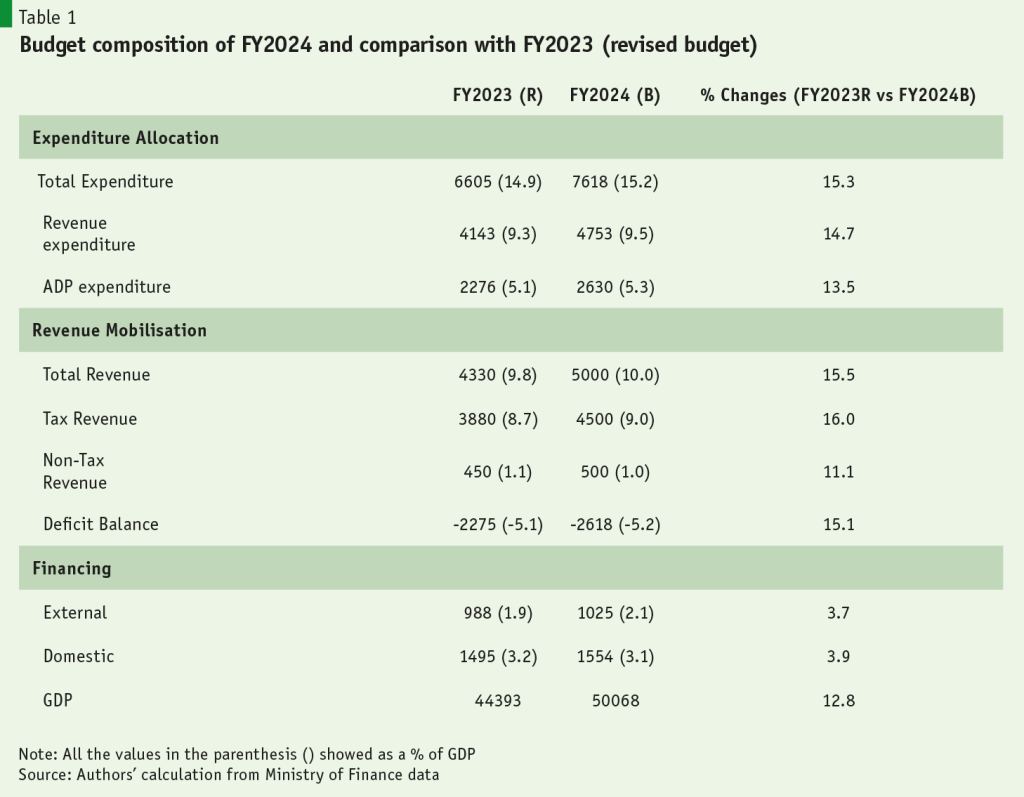

A national budget for FY2024, amounting to BDT 7.64 trillion, has been proposed before the parliament on 1st June. Table 1 shows a 15.3% increase in national spending from the revised budget FY2023. The revenue collection target for the upcoming fiscal year has been set at BDT 5,000 billion, marking a 15.5% rise from the current fiscal year. The National Board of Revenue (NBR) is tasked with collecting BDT 4,300 billion, a target 16% higher than that of the previous year. Furthermore, the non-NBR revenue and non-tax revenue collection targets are set at BDT 200 billion and BDT 500 billion, respectively.

…it will need to mobilise further an amount which is about 26% of the overall budget target for the year (i.e. Tk. 893 billion) in the last month of FY2023

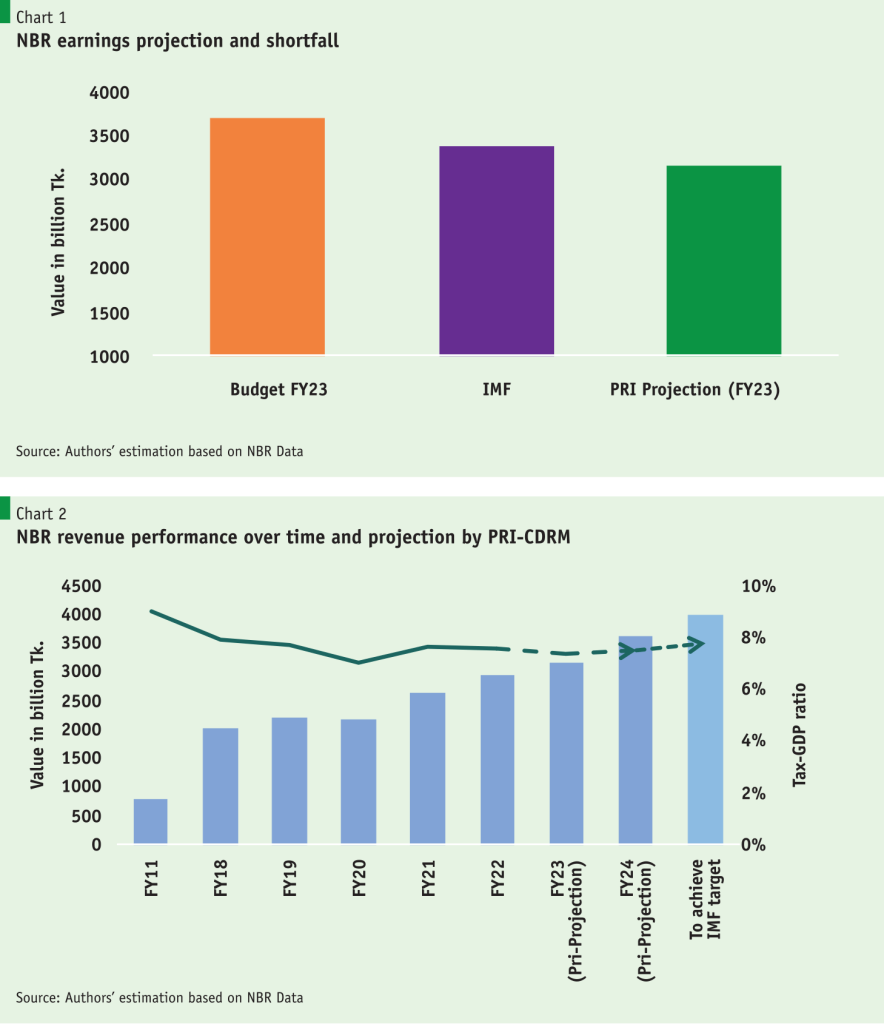

As usual, the government has increased the size of the budget for FY2024. However, it is vital to acknowledge the expected substantial shortfall in overall revenue receipts for the current fiscal year. Historically, it has been seen that NBR has never been able to mobilise revenue of more than 80% of the target. As of May FY2023, the NBR has collected BDT 2807.8 billion (6.3% of GDP), which is 76% of the budget target. That means, it will need to mobilise further an amount which is about 26% of the overall budget target for the year (i.e. Tk. 893 billion) in the last month of FY2023 (see Figure 1).

Given the preset revenue milestones, the NBR is supposed to gather BDT 1997.2 billion from VAT and SD, BDT 1221 billion from income and other profits, and BDT 481.8 billion from customs and excise duty. However, according to PRI-CDRM estimates, if the NBR’s revenue growth trend of the past quarter persists, the projected revenue shortfall could be around BDT 546 billion. In addition, PRI-CDRM estimates the tax-GDP ratio to be 7.4% in FY2023 and the ratio will be the same in the next year as well.

The revenue target set by the IMF, BDT 3368 billion, is significantly lower, as it opted for a more realistic one considering the weak record of revenue collection over the past several years. To meet the IMF’s target, the NBR will need to mobilise BDT 500 billion in the last month of this fiscal year. According to PRI-CDRM estimates, the NBR could face a revenue shortfall of BDT 214 billion when measured against the IMF target. There remains a slim chance for the NBR to meet the IMF target, although this would likely necessitate aggressive collection efforts. Moreover, next year NBR has to generate at least BDT 4 trillion revenue to achieve the IMF target of raising tax-GDP ratio by 0.5% points, as per PRI-CDRM estimates.

Conversely, the chronic underutilisation of budgetary allocations remains a characteristic feature of Bangladesh’s fiscal landscape, a trend that continues in FY2023. However, this does provide a modicum of relief to policymakers by assisting in maintaining a lower deficit-GDP ratio for Bangladesh. As of February in the current fiscal year, only 20% of the annual development program (ADP) budget has been used, according to the data from the Ministry of Finance. While the government has increased the ADP allocation by 13.5% (in FY2024 over FY2023 revised), the actual spending during July-May of this fiscal year is 61.7% which is 4.3% lower than that of the same period of FY2022 (actual spending was 66%).

An increasing trend in the allocation of resources for interest payments, subsidies, public servant wages and allowances, and pensions and gratuities persist. The total allocation for interest payments, subsidies, and wages and allowances has surpassed BDT 3 trillion in the FY2024 budget, eating up a significant part of the overall NBR revenue earnings. As seen in previous years, the government continues to rely heavily on both domestic and foreign borrowing to bridge the budget deficit. Interest payments on both foreign and domestic debts are escalating and are expected to cross BDT 1,000 billion according to FY2024 Budget, which could constitute about 30% of the NBR revenue in FY2023. Despite shortcomings in revenue collection, the budget deficit might not be a significant concern as total public spending consistently falls well below the proposed budgetary allocations. However, this comes at the expense of inadequate expenditure in crucial sectors such as social protection, health, and education.

In the FY2024 budget, expenditures on social protection, health, and education are almost unchanged and constituted 2.52%, 0.8%, and 1.8% of GDP, respectively. Compared to countries in a similar stage of development, Bangladesh’s spending in these sectors is markedly lower.

Conditions linked to the IMF loan package

The drive to enhance revenue collection and optimise existing tax systems could facilitate the generation of necessary resources. These could then support the allocation of additional funds towards social protection programs and other pressing expenditure needs. The IMF has also attached several conditions to its loan package to reinforce the fiscal framework of the country.

Notably, one of the key IMF requirements involves bolstering revenue mobilisation efforts by an additional 0.5% of GDP annually in both FY2024 and FY2025, followed by a further 0.7% increase in FY2026. This implies elevating the tax-GDP ratio from the current 7.8% of GDP to 8.3% in FY2024, to 8.8% in FY2025, and finally to 9.5% by FY2026. The IMF has also recommended the establishment of Compliance Risk Management Units within the customs and VAT wings of the National Board of Revenue by December of this year.

Furthermore, the IMF has provided a comprehensive set of conditions, which includes reducing tax expenditures across major sectors, developing and adopting a Medium-Term Revenue Strategy (MTRS), a Tax Compliance Improvement Plan, and a modernised Customs Act. These measures aim to bolster the government’s revenue generation in the quest for fiscal stability and sustainability.

Recently, an IMF team visited Bangladesh to review the progress made since the country received the first instalment of USD 476 million as part of the IMF loan package. The National Board of Revenue (NBR) has reported the following major measures, amongst others, as part of its efforts to boost revenue:

- The NBR is collaborating with the World Bank to develop a medium-term revenue strategy to meet loan conditions.

- The NBR is implementing extra measures for enhanced revenue growth, such as plans to reduce duty exemptions for additional revenue collection, reorganise duty rates, strengthen the duty recovery process, initiate speedy disposal of cases, enact new customs laws, automate the duty collection process, and fully operationalize the Customs Risk Management Unit within three years.

- The NBR will adopt case-by-case tax benefits and review existing exemptions (which, according to NBR estimates, currently account for 2.8% of GDP).

- The NBR plans to install 60,000 Electronic Fiscal Devices (EFDs) in retail shops in Dhaka and Chattogram and aims to install 0.3 million devices over the next six years. As of January 2023, around 9097 EFDs have been installed in various shops.

- The NBR is developing specialised software, known as the “Risk Management Engine”, which will bring transparency to the tax audit process, check the discretionary power of tax officials, detect tax evasion, and alleviate audit fears among taxpayers. The piloting of this automated computer program will commence soon in one or more circle offices of Tax Zone 6 in Dhaka.

Policy recommendations

Based on the analysis of the overall macroeconomic context and government revenue situations, following broad policy options can be considered to strengthen the revenue mobilisation effort in future:

- Prioritise fiscal reforms. There have already been extensive discussions on this topic, and the 8th Five-Year Plan provides some concrete measures for reforming the fiscal sector. It is crucial to make significant progress on implementation.

- Expand the tax net. Despite a population of more than 160 million, only 7.8 million (4.8%) have Tax Identification Numbers (TINs). It is crucial to bring a greater number of people under the tax net to increase the tax-GDP ratio.

- Reduce indiscriminate tax exemptions. According to an estimate by the NBR, tax exemptions currently account for around 2.3% of GDP. Reviewing these exemptions on a case-by-case basis could significantly decrease this percentage.

- Increase compliance with corporate tax. Out of the 2.8 million companies registered under the Registrar of Joint Stock Companies (RJSC), only 1.99 million have TINs, and among them, only approximately 15% of the companies paid tax in FY2022, with just 31,000 submitting a return.

- Increase the compliance rate of the personal income tax system. If all households in the top 10% income decile were subject to a 10% tax rate, the tax-GDP ratio could be increased by 1.6 percentage points.

- Reform VAT – the VAT yield—i.e. VAT revenue as a proportion to GDP—remains low and almost stagnant between FY2010 to FY2022. Short-term VAT reforms could increase the tax-GDP ratio by up to 0.6 percentage points, and additional reforms could further increase this in the medium to long term.

- Reform state-owned enterprises (SOE). This should be introduced to improve their financial performance by implementing a hard budget constraint, improving pricing policies, and strengthening corporate governance.

- Improve quality of spending. Placing an emphasis on judicious spending of public resources can ensure effective utilisation and higher returns on government spending.