Raising Personal Income Tax to Boost Economic Growth

By

The Importance Of Personal Income Tax For Driving Economic Growth

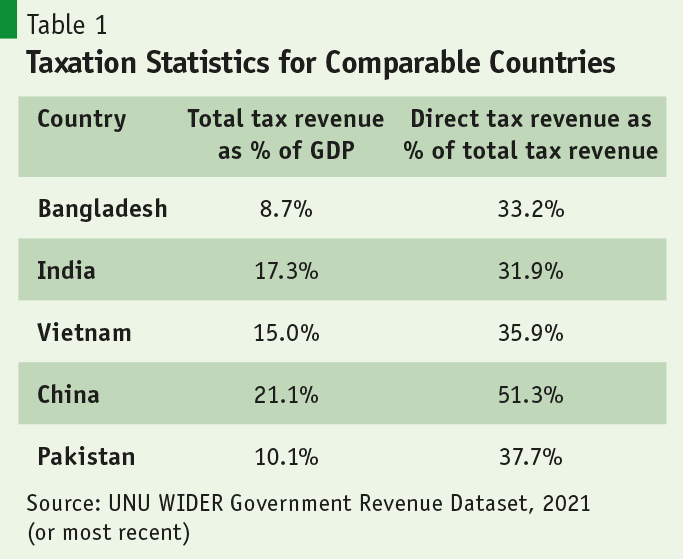

Personal income tax has proven to be an important tool in raising tax revenue and supporting the growth of emerging economies. As countries develop, they increase their general tax revenue share as a proportion of GDP, but they also increasingly utilise personal income tax to raise revenue. Bangladesh raised tax revenue at a rate of only 8.4 % of GDP in FY2021-2022 – much lower than other comparable countries – and only a third of this tax revenue was raised through direct (corporate and personal) taxation – again lower than that of other similar countries (Table 1). In its 8th Five Year Plan, the Bangladesh national government committed to increasing tax revenue to 12.3% of GDP by 2025.

PRI Study Centre On Domestic Resource Mobilisation Has Conducted New Modelling To Estimate The Effects Of Increasing Revenue From Personal Income Tax

PRI Study Centre on Domestic Resource Mobilisation have carried out new taxation modelling to estimate the impacts of changes to the personal income tax system. This uses data on Bangladesh’s economy to simulate the impacts of possible revenue and expenditure reforms. The modelling provides estimates for resulting changes in economic variables including tax revenue, GDP, household consumption and income distribution.

Simulations were conducted to identify what the impact would be of raising personal income tax revenue by different margins (by 0.5, 1 and 2 percentage points). Analysis has been carried out to understand the effects on the national economy. The simulations assume that additional revenue raised is spent on infrastructure, social sector, social protection, agriculture and other public spending areas. The split of modelled public spending assumes the same proportional split between sectors as is currently the case.

Key Findings

The core finding from PRI’s modelling shows that

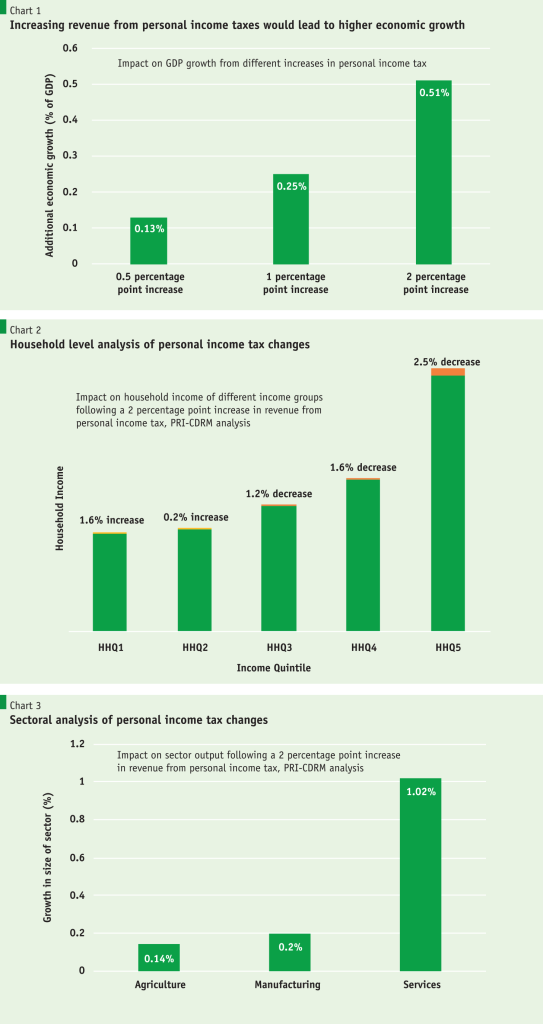

Increases in personal income tax leads to increases in GDP growth. This is primarily through the effect of allowing the government to invest more in public services. If personal income tax revenue were to be increased by 2 percentage points, economic growth would likely rise by 0.5% on top of existing growth rates.

If personal income tax revenue were to be increased by 2 percentage points, economic growth would likely rise by 0.5% on top of existing growth rates.

The larger the rise in income tax, the greater the increase in overall GDP. A 0.5 percentage point increase in revenue from personal income tax would lead to an estimated 0.13% increase in economic growth. While a 1 percentage point increase in personal income tax revenue would lead to a 0.25% increase in growth and a 2 percentage point increase would lead to a 0.51% increase in economic growth. This supports the argument that Bangladesh requires an increase in taxes in order to maintain high levels of economic growth and the economy would benefit from large changes more than small changes.

Increasing personal income tax rates would affect different parts of the population in different ways. Households in lower income groups would benefit in the short term from increased revenue from personal income taxes. Higher income groups would benefit in the medium term as higher public spending leads to economic growth. This means that in aggregate decreases in private consumption are outweighed by increases in tax revenue and public spending.

Increasing revenue from personal income taxes would affect sectors of the economy in different ways. The services industry would experience the largest benefit, but all sectors see an aggregate increase in economic activity. A 2 percentage point increase in revenue from personal income would result in increases of 0.14% growth in the agriculture sector, 0.2% in the industry sector, and 1.02% in the services sector.

A 2 percentage point increase in revenue from personal income would result in increases of 0.14% growth in the agriculture sector, 0.2% in the industry sector, and 1.02% in the services sector.

Overall household consumption falls in the model, but the poorest income groups experience increases in levels of consumption. The overall fall in consumption is also only half the size of the rise in public spending. A 2-percentage point increase in personal income tax leads to a 1.1 per cent drop in consumption, but the subsequent increase in public spending outweighs the fall in consumption and produces the observed result of aggregate economic benefit.

Policy Implications

- Increasing revenue from personal income taxes would lead to a positive overall economic impact. This will support the government to achieve objectives of maintaining high economic growth and reducing poverty. Households in lower income groups will benefit most in the short term from increases in household income. In the medium-term higher income groups will benefit as a result of higher government spending on public services that drive economic growth.

- Despite the widespread economic benefit, from a policy perspective there may be some short-term vs. long-term trade-offs. The full extent of the economic benefits may not be realised until some years down the line when public spending has filtered down into the wider economy. Some benefits will be realised sooner than others, e.g. social transfers can be implemented almost immediately, whilst infrastructure and education spending will have a longer time lag.

Way Forward

Priority measures that the government should implement to increase revenue from personal income taxes include:

- Expanding the tax net and increasing compliance It is crucial to work towards increasing TIN registrations and to boost existing TIN holders’ compliance in order to increase personal income tax collection. The government may look into the idea of establishing a universal registration system that is connected to the NID system in order to expand the number of people who possess TINs. Similar systems are in place in the UK, where citizens’ activities are tracked across all economic spheres using a single, unique identification number known as their national insurance number. This number is also used for taxation and state social protection support (such as pensions, unemployment benefits, childcare support, etc.) purposes. All the information is visible, synchronised and readily available with such a system.

- National campaign for TIN registration A national campaign could be run across the country for TIN registration. This will help bring more people, especially those who are living outside the main cities, under the tax net.

- Establishing a central database NBR must establish and monitor a central database for all taxpayer-related information. Current paper-based tax files located at the circle level must give way to central electronic data files. Full automation of tax administration and minimising human intervention will be key to increase tax collection and reduce corruption of tax officials.

- Mandatory submission of tax return Measures like making it mandatory to submit proof of tax return for availing government services and availing online tax return submission has helped in increasing compliance in recent days. These efforts need to be continued in future as well to increase compliance.

- Focus on payroll and withholding tax earnings NBR should prepare a central database on the withholding taxpayers and make a separate department for that.

Conclusion

Given the pressure Bangladesh economy is currently facing on different fronts like falling reserve, exchange rate volatility, rising debt servicing cost and the impending LDC graduation, it’s crucial for the country to focus on its effort in mobilising more domestic revenue to continue its growth trajectory. It has been observed from data that as the per capita income of a country increases, usually the share of revenue earned from personal income tax in total tax revenue tends to go up. Therefore, changing the personal income tax system with an aim to raise the personal income tax to GDP ratio, might be a viable policy option for Bangladesh and would be conducive for its future economic growth.

The new PRI CDRM analysis discussed above shows what impacts such a policy option would bring to the economy, with a particular focus on the impact of higher personal income taxes on economic growth and other key variables.

In summation, this analysis underscores three key findings. Firstly, higher personal income taxes would lead to higher economic growth. Secondly, increasing personal income tax would affect different parts of the population in different ways, with households in the two poorest income groups benefiting most from the modelled changes. Thirdly, higher personal income tax revenue would support growth across all sectors in Bangladesh.