Bangladesh’s Participation in Trade-based Agricultural Global Value Chains: A Strategic Path Forward

By

A. Introduction

Global Value Chain (GVC) and its regional version, RVC, represent the epitome of globalisation’s efficiency dividend. In today’s interconnected global economy, participation in Global Value Chains (GVCs) has become a critical driver of economic growth and competitiveness. GVCs enable countries to specialise in specific stages of production, which are integrated through cross-border trade in intermediate goods. This transformation gained momentum during the ‘strong globalisation era’ between 1990 and 2010, when many developing nations sought to attract foreign direct investment (FDI) and relocate production to reduce costs and improve efficiency. The lowering of trade barriers and the rise of multinational corporations (MNCs) managing international supply chains further accelerated this integration.

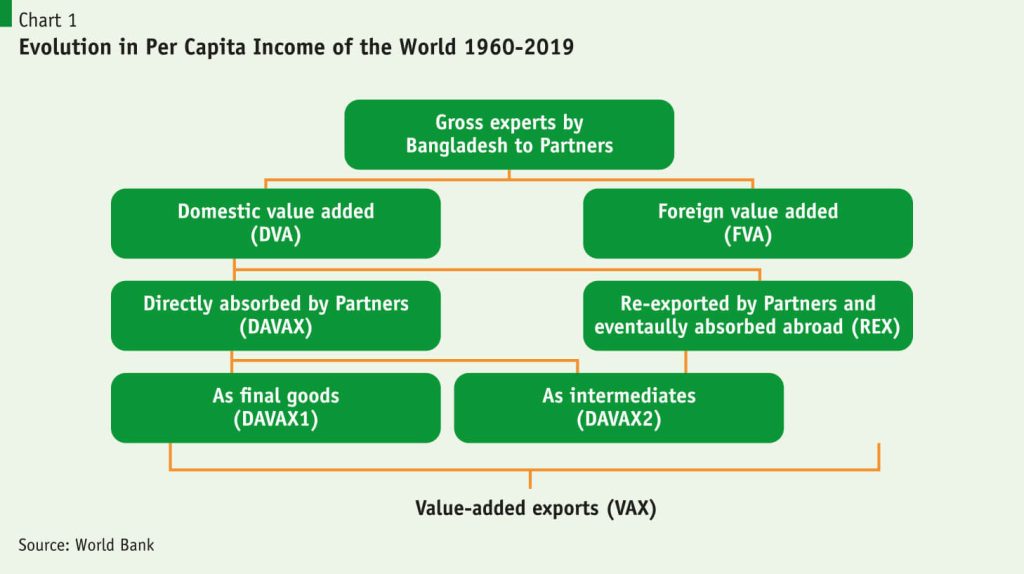

Bangladesh’s participation in GVC integration is significant, and in this context, trade in value-added (TiVA) plays a crucial role by providing a more precise understanding of how countries participate in and contribute to GVCs (Chart 1.).

By incorporating GVCs, Bangladesh not only enhances its market access and facilitates technology transfer but also boosts productivity across various sectors, including agriculture—a critical pillar of the country’s economy.

By incorporating GVCs, Bangladesh not only enhances its market access and facilitates technology transfer but also boosts productivity across various sectors, including agriculture—a critical pillar of the country’s economy.

B. Scenarios of Bangladesh’s Agricultural Trade-based GVC Participation

Bangladesh’s agricultural sector is playing an increasingly significant role in GVCs, yet its overall participation across all sectors remains modest when compared to regional export powerhouses like India and Vietnam. Despite this, Bangladesh’s total agricultural trade-based GVC participation has shown promising signs of improvement. The country’s total agricultural trade-based GVC participation rate, encompassing both backward and forward linkages, has significantly increased since 2000.

Bangladesh’s total agricultural trade-based GVC participation has shown promising signs of improvement. The country’s total agricultural trade-based GVC participation rate, encompassing both backward and forward linkages, has significantly increased since 2000.

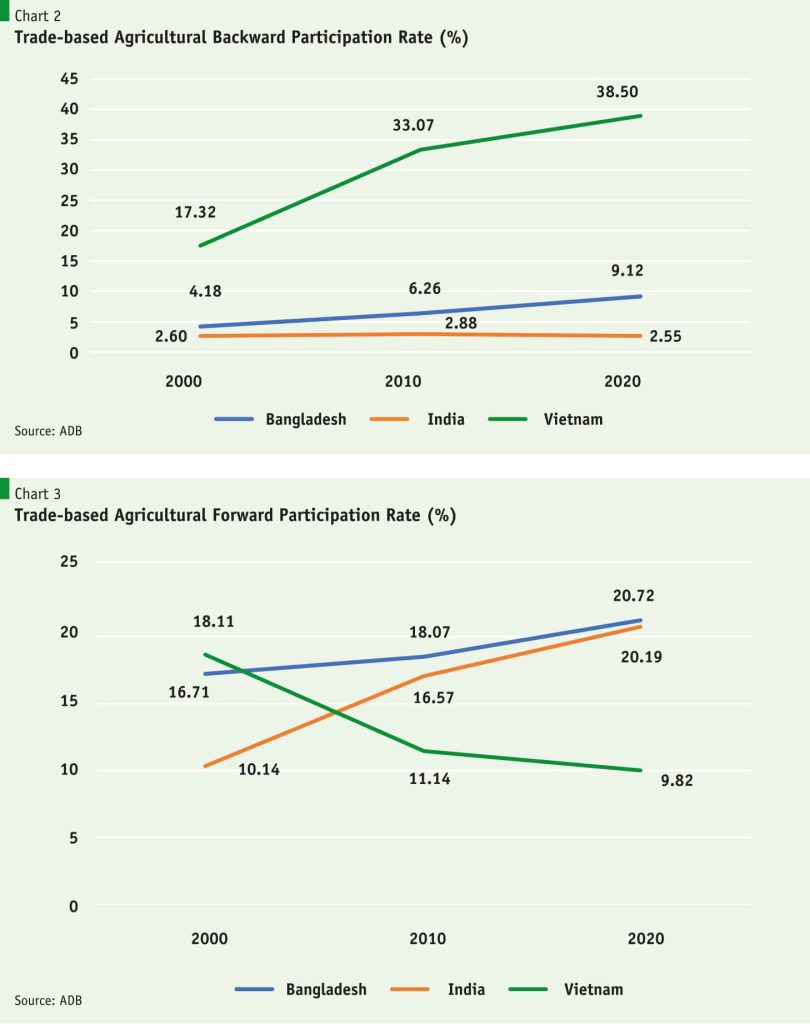

Backward trade-based agricultural GVC participation (Chart 2.) grew by 118%, rising from 4.18% in 2000 to 9.12% in 2020, reflecting Bangladesh’s increasing reliance on high-quality foreign inputs such as fertilisers, pesticides, machinery, advanced seeds, and fish and poultry feed. This dependence on imports, driven by limited domestic production capacity, has boosted productivity and efficiency, helping Bangladesh improve its agricultural competitiveness and increase export volumes. However, Vietnam surpasses Bangladesh in this regard.

In contrast, India, with more advanced domestic agricultural inputs, has reduced its reliance on foreign imports, as evidenced by its declining backward participation rates. This shift is likely to increase overall export volumes as more value is added locally to produce agricultural products.

Forward participation (Chart 3.), which measures the share of domestic agricultural products used as inputs in other countries’ exports, has experienced modest growth in Bangladesh, increasing by 23.96% from 16.71% in 2000 to 20.72% in 2020. This growth highlights the increasing importance of Bangladesh’s exports of intermediate products, such as jute yarn, cotton yarn, and frozen fish and shrimp, for its trade partners. As these products become integral to other countries’ exports, they contribute significantly to Bangladesh’s revenue, enhancing its economic benefits from international trade.

However, Bangladesh still lags behind India, which has nearly doubled its forward participation rate over the same period, reflecting a greater contribution to global value-added processes. In contrast, Vietnam’s forward participation rate has declined, suggesting a shift towards exporting higher-value finished products like packaged coffee, refined rice, and canned seafood, which generate more revenue per unit compared to raw or intermediate goods.

C. Key Challenges in Agricultural Trade-based GVC Participation

In the case of trade-based participation, Bangladesh faces several challenges that hinder its deeper integration into agricultural GVCs. Among the most significant challenges are:

Skill Gaps and Training: There is a need for more skilled labour and training programs to enhance the capabilities of those working in the agricultural sector. Skill gaps in areas such as advanced farming techniques, quality management, and export procedures can hinder progress and integration into global value chains.

Climate Change and Environmental Impact: Climate change poses significant risks to agricultural productivity. Frequent weather disruptions, changing rainfall patterns, and increasing temperatures can adversely affect crop yields and quality, making it harder to maintain consistent supply and quality for export markets.

Trade Barriers: High tariffs and non-tariff barriers imposed by other countries restrict Bangladesh’s access to lucrative markets, particularly in the agricultural sector.

Limited Technological Advancement: Despite improvements, there is still a significant gap in modern agricultural technologies, which limits productivity, quality, and international competitiveness.

Infrastructure Deficiencies: Insufficient transportation, storage, and processing facilities hinder the efficient movement of goods, affecting product quality and access to international markets.

D. Potentials of Agricultural Trade-based GVC Participation

Despite the hurdles, the potential for Bangladesh to transform its agricultural sector through GVC integration is immense. The rise of GVCs offers a pathway to move from subsistence farming towards a more commercialised, off-farm-centric model that leverages international trade. Some key agricultural trade-based potentials of GVC integration for Bangladesh are discussed below:

Bangladesh’s under-utilisation of regional integration, particularly within Asia, represents an untapped opportunity. Although the majority of Bangladesh’s imports come from Asia, only 16% of its exports are directed towards this rising market. A strategic shift towards greater regional engagement—especially through initiatives like the Association of Southeast Asian Nations (ASEAN) and The Regional Comprehensive Economic Partnership (RCEP)—could unlock new trade opportunities for the country.

A strategic shift towards greater regional engagement—especially through initiatives like the Association of Southeast Asian Nations (ASEAN) and The Regional Comprehensive Economic Partnership (RCEP)—could unlock new trade opportunities for the country.

Another critical potential lies in technology transfer. Bangladesh has been slow to adopt innovation, with only 1.2% of firms investing in research and development. Participation in GVCs, however, could facilitate the flow of modern technologies and best practices into the country, improving yields and product quality. Furthermore, aligning with international food safety and quality standards could boost the global appeal of Bangladeshi products, potentially commanding premium prices in the international market.

The diversification of Bangladesh’s export portfolio also presents a lucrative avenue. While the country has traditionally relied on textiles and garments, expanding into high-value agricultural products could provide resilience against market fluctuations and foster sustained income growth for smallholder farmers.

E. Conclusion and Way Forward

In conclusion, it can be said that the growth rate of forward participation has not increased as the rate of backward participation has increased. There is ample scope to increase the forward participation growth rate for Bangladesh’s GVC integration. While challenges remain, the potential benefits—ranging from improved productivity and increased incomes to enhanced market access—are immense. To fully capitalise on the benefits, the following strategies can be prioritised and pursued to integrate Bangladesh’s agriculture sector into (GVC) and enhance its trade potential, ultimately leading to economic growth and development:

The government needs to rationalise tariff policies and reduce anti-intermediate goods biases to support the growth of GVCs. Creating a welcoming investment environment that attracts foreign direct investment (FDI) and encourages local businesses to improve backward participation in global supply chains should also be encouraged.

Bangladesh should prioritise advanced farming techniques, technology transfers, and better infrastructure, which can improve backward participation while enhancing local production capabilities.

Aligning with international food safety, environmental, and quality standards can make Bangladesh’s agricultural products more attractive in global markets, leading to increased forward participation. Certifications like sustainable agriculture can also open up premium markets.

Bangladesh should increase its regional integration by enhancing trade with nearby markets like ASEAN countries. This can provide new opportunities to export intermediate goods and inputs, increasing forward participation.

Upgrading rural transportation and storage facilities reduces post-harvest losses, ensuring higher-quality exports like fish and shrimp. This boosts Bangladesh’s forward participation by increasing the value of its agricultural products used in other countries’ exports.

Providing training on international trade requirements and procedures will enable smallholder farmers and exporters to better navigate global markets, improving both backward and forward participation.

Encouraging eco-friendly farming practices that mitigate the impact of climate change can boost both backward and forward participation by aligning with the growing global demand for sustainable products.

Acknowledgement: The authors sincerely thank Dr Zaidi Sattar, Chairman, and Dr Khurshid Alam, Executive Director, of the Policy Research Institute of Bangladesh (PRI), for their invaluable guidance and support.