LDC graduation & Bangladesh’s apparel exports to the EU

By

In 2018, Bangladesh for the first time met the criteria for graduation from the group of least developed countries (LDCs). In the second consecutive review in 2021 as well, it is expected to fulfil the criteria again, paving its official graduation from LDC status in 2024. Indeed, Bangladesh has made a great stride forward in its economic development. Since the early 1990s, it has grown at an annual average rate of more than 5%, with the comparable growth rate over the most recent past decade being more robust, at 6.5%. Its per capita gross national income since 1995 has registered more than a five-fold rise from just about $300 to $1,751. Over the same timeframe, the proportion of the population living in poverty has more than halved from more than 50% to 24.3%. Compared with many other countries at a similar stage of development, Bangladesh has achieved faster progress on various social and human development indicators.

While the impending LDC graduation represents a major development transition, however, it also gives rise to concerns about potentially sizeable economic costs as a result of the loss of access to various support measures associated with LDC membership. Bangladesh enjoys certain privileges and special and differential treatments designed for LDCs. These include development partners’ various concessions, special attention and commitments to support LDCs with development finance, trade preference and technical assistance. The members of the World Trade Organization (WTO) have also devised more favourable conditions and flexibilities for this group of countries in implementing and enforcing international trade rules and regulations. Of all this, the most important consequence will be the loss of trade preferences in the EU.

Apparels exports from Bangladesh and the significance of the EU market

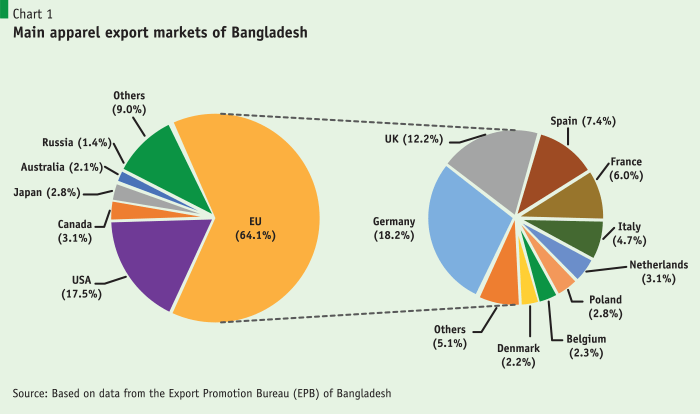

Bangladesh has been the largest beneficiary of tariff-free access in the EU under its Everything But Arms (EBA) initiative designed for LDCs. Taking advantage of the duty-free market access and relaxed rules of origin (ROO) provisions granted under the EBA scheme, Bangladesh’s total exports to the EU have risen at a brisk pace. In 2018, such exports reached $21 billion, of which $19.6 billion (i.e. 92%) came from apparels. Overall, the EU accounted for 58% of Bangladesh’s merchandise exports and 64% of apparel exports (Chart 1). Within the EU and globally as well, Germany—with a share of 18.2%—is the single largest market of Bangladesh. Other important EU markets for ready-made garment exports are the UK (12.2%), Spain (7.4%), France (6%), Italy (4.7%), the Netherlands (3.1%), Poland (2.8%), Belgium (2.3%) and Denmark (2.2%). The US is the second largest apparel export destination for Bangladesh, capturing a share of 17.5% of export orders worth $5.4 billion.

Although the overall import growth of most EU member states (measured on the vertical axis in Chart 2) was either close to zero or negative in the five-year period of 2013–2017, their imports from Bangladesh (measured on the horizontal axis) in a large majority of cases grew at a considerable pace. Imports of Spain and Poland, for example, from world markets were virtually stagnant (the average 2013–2017 growth rate being zero), but their imports from Bangladesh grew at 13% and 20%, respectively. Over the past decade, EU apparel imports from the world have expanded at an average yearly rate of 2.4% as against comparable growth of 12% from Bangladesh.

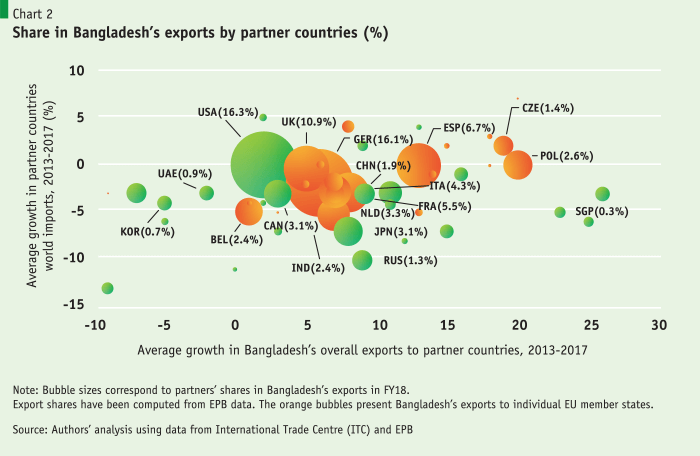

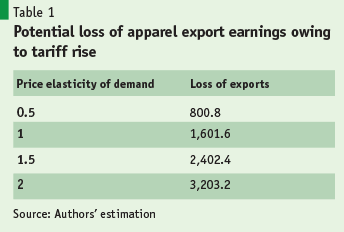

Bangladesh’s clothing exports to the EU are dominated by knitwear products, which account for a share of about 57% (Chart 3). The same share actually reached a peak of 68% in 2010. Until 2011, EU ROO required ‘double transformation’ of clothing items as a precondition for tariff-free market access. For woven apparels, this would imply the use of domestically produced fabrics in garment-making, hindering Bangladesh’s capacity to utilise EU preferences. The derogation of EU ROO in 2011 allowed single transformation for LDC clothing exports, prompting a reinvigorated supply response from the woven garment sector.

Market conditions in the EU

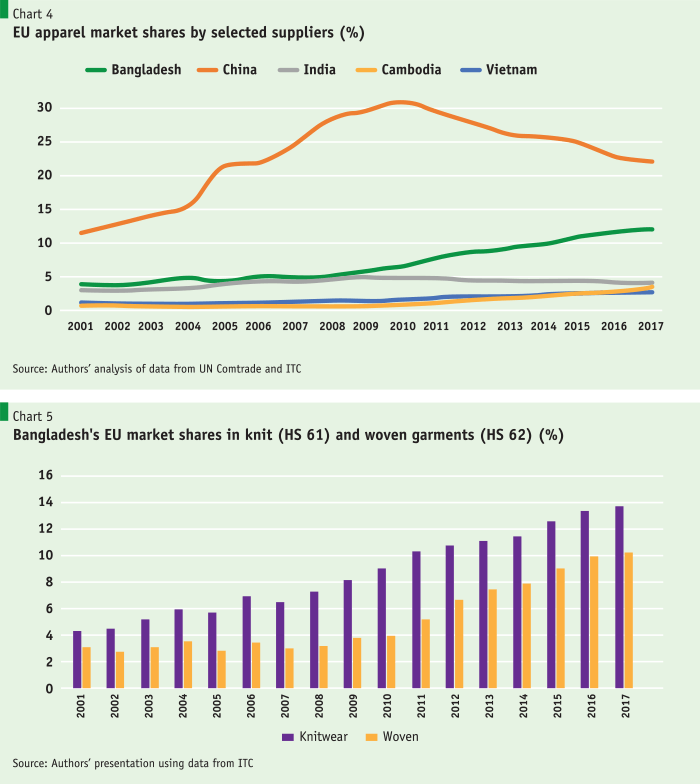

The EU accounts for almost 45% of global apparel markets. In 2017, the combined EU-28 imports stood at $178.3 billion, of which $116 billion (i.e. 65%) was sourced from extra-EU suppliers. Between 1990 and 2010, China’s market share in the EU rose steadily from less than 7% to about 31%, but over the next seven years it fell by almost 9 percentage points (Chart 4). During 2000–2010, Bangladesh’s market share rose from about 3.5% to 6.5%, and then accelerated further to reach over 12%—that is, a 5.5 percentage-point rise in seven years. Such a robust export expansion was greatly aided by the EU’s derogation of ROO requirements under the EBA. The earlier stringent ROO criterion of double transformation for duty-free access proved to be a binding constraint as between 2001 and 2010 Bangladesh’s market share in woven garments virtually stagnated (Chart 5). With the introduction of single transformation, the market share of woven products expanded rapidly—from just above 4% in 2010 to more than 10% in 2017. Because of strong domestic backward linkages, ROO did not appear to be a major problem for knitwear and thus Bangladesh has been able to maintain a steady growth in market share in this category as well (from 9% in 2010 to 13.7% in 2017).

EU import regimes in apparels

Under the WTO’s Enabling Clause, the EU grants unilateral and non-reciprocal tariff preferences to support developing countries in their development process, including Bangladesh. The current EU Generalised Scheme of Preferences (GSP) regime offers three different preference arrangements: (i) a general arrangement (Standard GSP); (ii) a Special Incentive Arrangement for Sustainable Development and Good Governance (GSP Plus); and (iii) the EBA arrangement for the group of LDCs.

Bangladesh, as an LDC, gets duty-free quota-free (DFQF) market access under the EBA. The textile and clothing sector attracts relatively high EU most-favoured nation (MFN) tariffs and, as such, Bangladesh has benefited substantially from the EBA. An analysis of EU tariff structures reveals that about a quarter of EU tariff lines (i.e. products imported by the EU) at CN 8-digit level have an MFN duty rate of 0%; for another 25% of tariff lines, MFN duty rates of 5–9.9% are applied. The MFN tariffs on textile and clothing items are mostly in the range of 10–12% with 88.9% of apparel products attracting such tariffs of 12%.

Graduating LDCs can apply for the second best (after the EBA scheme) preferential regime, GSP Plus, which grants duty-free access to 66% of EU tariff lines including clothing items. However, the eligibility criteria for it stipulates that a beneficiary country must (i) have ratified and effectively implemented 27 international conventions on labour rights, human rights, environmental protection and good governance; (ii) have a share in GSP-covered imports less than 6.5% of GSP-covered imports of all GSP countries; and (iii) have at least 75% of its total GSP imports coming from the seven largest sections of GSP-covered imports. Bangladesh fulfils condition (iii) as its exports are mainly in one category. Condition (i) may not be a major problem as Bangladesh has ratified all apart from one—the Convention concerning the Minimum Age for Admission to Employment. As regards condition (ii), the share of Bangladesh’s GSP-covered imports is more than 17% in all EU GSP-covered imports, and thus it is way above the threshold import share. Given the existing criteria, Bangladesh is thus unlikely to qualify for GSP Plus. In that case, the least attractive Standard GSP would be the only option. It is important to point out that EU GSP rules can change over time; the current regime will continue until 2023.

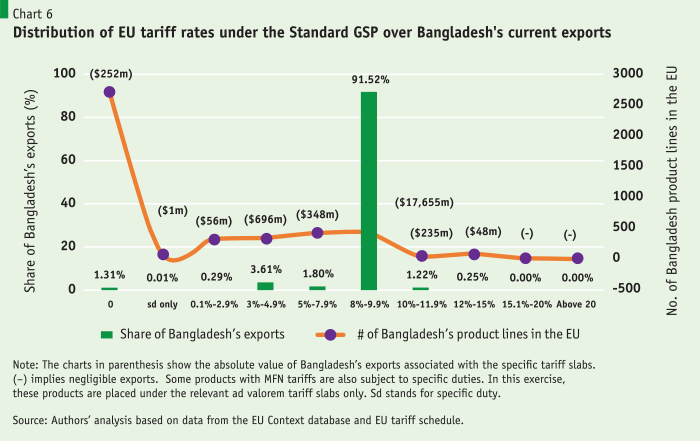

The distribution of Bangladesh’s current export structure across EU tariff rates shows that application of the Standard GSP regime would result in a dramatically changed situation from the present duty-free access for all products to almost all exports being subject to some tariffs (Chart 6). Almost 92% of all Bangladesh’s exports will fall under an average tariff of 8–9.9%. Currently, 98% of Bangladesh’s apparel exports attract EU MFN tariff rates of around 12%. Under the Standard GSP, these tariffs will be reduced to just 9.6%, while with the GSP Plus tariff-free access is given for the same products. However, GSP Plus ROOs are more stringent that those of the EBA.

Tariff implications for apparel export earnings

In the global clothing value chain landscape, Bangladeshi firms operate mainly in the low value-added segment of cutting and making of apparels, with the principal source of its competitive advantage being the low wage costs of labourers. The loss of duty-free access could thus adversely impact the country’s competitiveness and export prospects. While there are several ways to ascertain the likely implications on an ex ante basis, one useful approach would be to use export and tariff data at such a disaggregated level where policy changes are implemented at the export product level (e.g. usually at HS 8- or CN 10-digit level in the case of the EU). In this respect, a study by Commonwealth Secretariat suggests making use of a partial equilibrium model. The advantage of this model is its simplicity, with the data requirements being minimal. Being a partial equilibrium model means it uses only one sector while disregarding its interactions with others—a feature that general equilibrium models (GEMs) deal with. Developing an appropriate GEM can be very time-consuming. One popular approach is to use the Global Trade Analysis Project (GTAP) computable general equilibrium model. But in GTAP model just one aggregate sector of textile and wearing apparel is used, unlike the trade data at a highly disaggregated level utilised in partial equilibrium models.

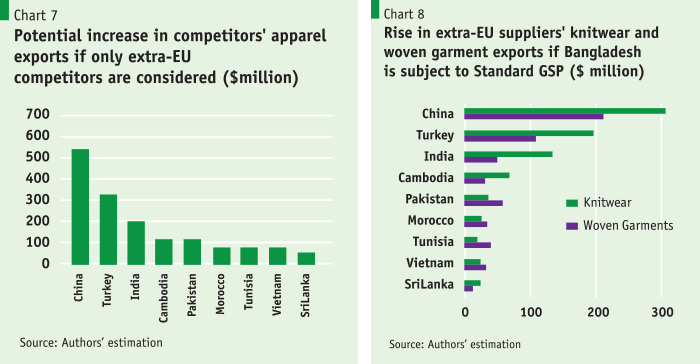

Using the partial equilibrium model and alternative values of the price elasticity of demand between 0.5 and 2, possible implications arising from Bangladesh’s losing EBA preferences and being subject to the EU Standard GSP can be simulated. Under the most widely used unitary price elasticity of demand, the estimation suggests that replacing duty-free access with the Standard GSP regime would result in a loss of export earnings for Bangladesh by $1.6 billion—that is, 9.5% of average export revenues from the EU during 2015–2017. While the forgone revenues owing to woven garments would be lower than $700 million, the comparable figure for knitwear would be close to $1 billion. If the values of the price elasticity of demand for Bangladesh’s products in the EU are higher than 1, the export losses could turn out to be much bigger. Since the differences between MFN and Standard tariff rates are not much, being subject to MFN tariffs would result in an export loss of $2 billion for Bangladesh when the unitary price elasticity of demand is assumed.

Any potential decline in Bangladesh’s exports will be compensated for by increased supplies from other countries. A shift analysis based on the existing market share approach seems to suggest that, under the scenario of Bangladesh losing $1.6 billion, China’s gains will be above $0.5 billion if it is considered that the resultant benefits will be limited to developing country suppliers only. Among others, Cambodia, India, Turkey and Vietnam stand to gain. When disaggregated by knitwear and woven apparels, Cambodia, China, India and Turkey seem to benefit more from increased exports of knitwear, while export rises of Morocco, Pakistan, Tunisia and Vietnam are dominated by woven garments.

These estimates of Bangladesh’s potential export losses are comparable with other assessments undertaken elsewhere utilising different methodological approaches. The 2016 UNCTAD LDC Report, utilising a gravity modelling framework for comparing the current tariff structure with a counter-factual post-graduation scenario for each LDC, estimated a 5.5–7.5% fall in Bangladesh’s total exports as a result of the loss of preferential access after graduation. Mustafizur Rahman and Estiaque Bari in a study from the Centre for Policy Dialogue (CPD) derived the elasticity of LDC-specific tariff rates to export receipts in computing the impact as a 7.8% decline in Bangladesh’s total exports (equivalent to $2.7 billion).

Notwithstanding, caveats of quantitative assessments must be borne in mind. Analytical frameworks/models are simplified representations of the realities, failing to capture many complex interactions involving the demand and supply sides. There is hardly any clue about how the rents from tariff preferences are distributed between exporters and importers, which can have implications for price changes. The implicit assumption that differentiated products can be readily supplied from other countries can also be problematic. If the importers in destination markets have benefited out of Bangladesh’s duty-free access, they may not have many alternative and equally lucrative sourcing opportunities elsewhere. When the Multi-Fibre Arrangement (MFA) quotas were abolished from global trade in 2005, many analysts predicted huge business losses for Bangladesh in sharp contrast with an eventual acceleration in its export growth.

Under the most widely used unitary price elasticity of demand, the estimation suggests that replacing duty-free access with the Standard GSP regime would result in a loss of export earnings for Bangladesh by $1.6 billion—that is, 9.5% of average export revenues from the EU during 2015–2017.

Assessing the depth of competitiveness

Bangladesh’s garment exports have been facilitated by the so-called global value chain (GVC)-led production and distribution mechanisms. The apparel production process in the country is related mainly to manufacturing. This stage of global supply chain is the most labour-intensive in nature and, being a labour-abundant country, Bangladesh has a huge natural comparative advantage in it. Among the principal apparel business models, Bangladesh is mostly involved in two low-value stages of cut, make and trim (CMT) and original equipment manufacturing (OEM). It is generally recognised that profit margins from CMT and OEM cannot be very high. The question is then how much more competitive Bangladesh can be if it has to lose tariff preferences in the EU.

A comparison of prices obtained by different country suppliers in the EU could shed some light on this, but drawing any firm conclusions would be far from straightforward, for at least two reasons. First, prices are generally absent in international trade analysis. While economists can use fairly disaggregated trade data (e.g. at HS 8- or 10-digit levels), the computed unit value prices still suffer from aggregation and measurement unit problems. The second difficulty relates to product differentiation. Products supplied by different countries could represent substantial quality differences. Cross-country comparisons, even using highly disaggregated data, cannot fully account for this. Prices for different broad items (such as T-shirts) from various brands and retailers are not available in a systematic manner. Even if available, the retail prices would be very different from those obtained by the firms in developing countries.

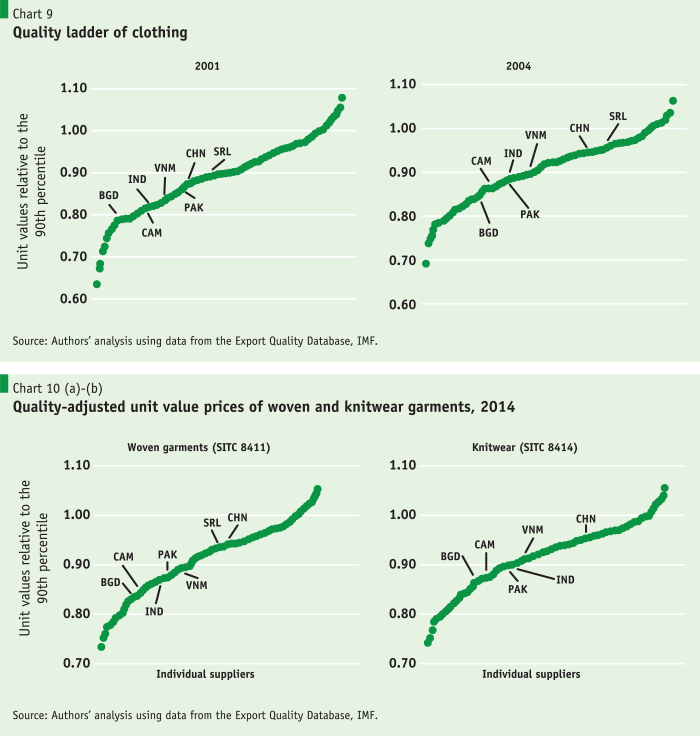

Relatively recently, the International Monetary Fund (IMF) in collaboration with UK Aid prepared a comprehensive global Export Quality Database that uses econometric methods in taking into consideration the factors that affect product quality. From this database, the information on export quality for clothing items for different countries can be used to generate a ‘quality ladder’, measuring the relative quality of a country’s exports against all other countries that export clothing. A close look at Chart 9 reveals Bangladesh moving up the quality ladder between 2001 and 2014. However, other comparators, such as China, India and Vietnam, have also moved up and appear to have made faster progress. When export quality is analysed separately for woven and knitwear items, it again becomes evident that Bangladesh is outperformed by its principal competitors (Chart 10a-b).

While Bangladesh is developing capacities in making relatively high-value garment products sold by many global brands, the analysis of export quality seems to confirm the general perception that, until now, it is a source mainly for low-cost garment items in bulk. Given this particular feature of export products, it would be difficult to absorb bigger price cuts triggered by the loss of significant tariff margins in the EU. The quality attribute might also suggest availability of close substitutes of Bangladesh’s products and, as such, the price elasticity of demand could be higher. It has been shown above that higher price elasticities are associated with greater export losses.

Adaptation strategies

While one could argue about the methodological issues in assessing the potential implications, there is no denying that loss of preferences will trigger a serious pressure on competitiveness. There are certain measures Bangladesh can consider in mitigating any potential adverse consequences. The adaptation strategies should include various policy options at the national level and changes/improvements in firm-level business and operational practices.

Exploring the most attractive future trade policy regime in the EU

It is expected that, once Bangladesh graduates, it will remain eligible for accessing duty-free market access in the EU for another three years. Post-graduation it may be possible to look for an alternative EU trade policy regime that is more generous and attractive to exporters than just considering the Standard GSP scheme. Although under the existing rules Bangladesh may not qualify for GSP Plus, the current EU GSP regime will expire in 2023 and is likely to be replaced by a new regime. Therefore, a proactive engagement with the EC and other stakeholders could be undertaken to influence any future changes that would benefit Bangladesh. Since several other LDCs are in the process of graduation, some coordinated efforts could enhance the chance of graduating LDCs having an extended transition period from EBA and/or more liberal GSP Plus provisions, including continuation of the EBA ROO for graduating LDCs. If GSP Plus or an equally favourable scheme cannot be secured, striking a free trade agreement could be an option if the EU is interested.

…a proactive engagement with the EC and other stakeholders could be undertaken to influence any future changes that would benefit Bangladesh.

Industrial upgradation for moving up the global value chains

One element of an adaptation strategy should involve industrial or economic upgradation to move up the value chain. Product upgradation involves production of complex items, whereas process upgrading requires advancing production methods in combination with using a skilled workforce. Bangladesh has some capacity in the textile industry, improvements to which can help with the garment sector’s upgrade into higher segments of the value chain. Currently, a small number of firms are offering product design to their buyers. This capacity can be promoted further.

Industrial upgradation will also imply promoting competitiveness through technological upgradation. Deepening of the capital-intensive production process and automation have already marked garment-making activities. Nevertheless, there is evidence that, against such comparators as Cambodia, China, India and Vietnam, the level of capital intensity in Bangladesh’s garment industry is much lower. As export production technologies seem to converge, considerable scope for improved labour productivity driven by more technology-intensive production processes is likely to exist.

Ensuring compliance as expected from credible suppliers for global consumers

Compliance will remain a major factor in growing export business in the apparel sector. Unfavourable working conditions and labour issues attract widespread global attention, and global brands will always avoid the factories that cannot ensure adherence to various acceptable standards. Various initiatives have been implemented in recent years to improve workplace safety standards and the working environment. The progress made in these areas should be consolidated and efforts must continue to make further improvements.

Attracting foreign direct investment in the readymade garment sector

Foreign direct investment (FDI) can be a big boost for export growth and effective integration into GVCs. The role of FDI can be instrumental in establishing direct contacts and business relationships with global brands and retailers in producing high-value items. Skill upgradation, productivity improvement, positive spillover effects arising from knowledge and technology transfers and better management practices are some of the direct impacts of FDI participation. Spillover effects can also benefit the local firms, facilitating their industrial upgradation and enhanced participation in GVCs. Among others, a weak investment climate and the high cost of doing business discourage FDI inflows into Bangladesh. Attracting foreign investment in Bangladesh’s ready-made garment sector should thus constitute a policy priority in the preparation for LDC graduation.

Tackling the cost of doing business to boost competitiveness

The issue of the excessive cost of doing business in Bangladesh is widely acknowledged. Weak and inadequate infrastructure in conjunction with inefficient inland road transportation and trade logistics contribute to longer lead times and a high cost of doing business, undermining competitiveness. This reduces trade volumes and domestic value added (which includes wages and profits). Within this reduced value added, for an export-oriented apparel sector there are two-way shipping costs involved: import of raw materials and then export of final products. The implication is that excessive trading costs make it increasingly difficult for apparel-exporting firms to compete in world markets. Improvements in these areas can thus substantially help recoup a part of the lost trade preferences.

This article is based on a study prepared at the request of the Commonwealth Secretariat, London, United Kingdom. Any shortcomings and views expressed are the authors’ responsibilities and not necessarily those of the Policy Research Institute or the Commonwealth Secretariat.