Trade deficits, US-China Trade spat & Bangladesh

By

Almost 90 years after the tit-for-tat (TFT) tariffs defining trade restrictions during the Great Depression of the 1930s, the United States and China have clamped selective reciprocal protective tariffs in a clash of the titans in the global economy and trade. China has been targeted for a litany of serious complaints -“unfair trade practices, technology theft, cyberattacks, illegal subsidies, undue import barriers, and currency manipulation” –from the Trump Administration. After an initial round of TFT the two sides moved to the negotiating table to reach some agreement on the various sticking issues, outside the rules-based multilateral trading system – the WTO. At least for now the 25% tariffs on a full range of Chinese goods threatened by the US have been deferred.

United States, the world’s largest economy with a $20 trillion GDP, is also the largest importer of goods – while China, the second largest economy with a $13.5 trillion GDP, is the largest exporter. As of now, it is rather a trade spat than a trade war. For all the hyperbole surrounding these developments the two sides are seriously engaged at the negotiating table for a mutually acceptable resolution. Meanwhile, the TFT tariffs have rattled economies worldwide, dampening the prospects of growth in trade and output. Since Bangladesh today is far more integrated with the world economy than it was 25 years ago, it cannot be immune to these developments. There could be positive as well as negative implications of this development for Bangladesh.

China’s economy has boomed since adopting market-oriented reforms in 1978, averaging double-digit growth (approximating 10%), for nearly the last three decades. It has overtaken two giants – Japan and Germany – while slowly catching up with the US. But it was accession into the World Trade Organization in 2001 that gave its trade and exports the real boost, catapulting it as the export powerhouse of the world overtaking Japan and Germany. In a world of rising consumer spending, China became the largest supplier of consumer goods ranging from electronic appliances to apparel, footwear and toys – accumulating trade surpluses ever since while depleting savings from the rest of the world, creating the imbalance that played a pivotal role in precipitating the global financial crisis of 2008-09.

This article focuses on the most critical aspect – the US-China trade imbalance, which led to the current crisis. Despite the tariffs the aim of which was to curb the trade deficits, in 2018, the US ran a record deficit of $891 billion, an increase of 12.5% over 2017, of which China accounted for $419 billion. Clearly the tariff strategy did not work as the strong US economy pulled in 7.5% more imports compared to export expansion of 6.3%. Sluggish exports were due to the slowdown in major world economies including China. Thus macroeconomic forces overran the tariff impacts on US trade.

The geopolitics or the political economy of trade deficits often raises more red flags than the economics of it. Economists rightfully focus on trends and sustainability of overall trade deficits rather than the bilateral deficit between two countries. But bilateral trade deficits, when significant and persistent over time, lead to political or economic tensions between two economies, as is the case with US and China. Bangladesh’s two major sources of imports are China and India with whom it ran a combined trade deficit of about $20 billion in FY2018 but had surpluses with most other countries including important partners like the US and EU. Inflow of remittances compensates for our trade deficit, and has left the current account in surplus for most years since 2001. The deficits with China and India are not too concerning as they turn out to be cost effective sources of inputs into the productive sectors of the economy.

The geopolitics or the political economy of trade deficits often raises more red flags than the economics of it.

The Trump Administration’s position on trade originates from its concerns about the massive and persistent deficits which US has had over the years, not just with China. These deficits reflect the Americans spending more than their income (largely debt driven) and investing more than their savings by borrowing from abroad (capital inflows). Nevertheless, their economy appears strong, with unemployment the lowest in decades, and growing faster than most developed economies today. But Trumpian economics deviates from the mainstream notion of the gains from trade and specialisation according to comparative advantage – focusing narrowly on ‘trade deficits’. The long-discarded mercantilist argument that export is good, import is bad, seems to have gripped his policy advisers who are not known for their command over the workings of international trade. China’s rise as the most cost-competitive source of consumer goods is seen as an outcome of ‘unfair trading practices’ rather than of comparative advantage stemming from resource endowments. The rules-based international trade body, WTO, is also blamed for giving China the developing country special and differential treatment (S&DT) despite the country being highly industrialised. Furthermore, the US is unhappy with the WTO for failing to ensure compliance of agreements, such as the one in respect of intellectual property- Trade-related Aspects of Intellectual Property Rights (TRIPS). Over the past two years, the Administration has done all it could to undermine this institution which, though not perfect, has played a seminal role in fostering global economic development by expansion of trade.

Considering dismantling of the WTO – a post-War institution whose principal architect is the USA – could take world trade back by a century. The WTO indeed needs reform, perhaps an overhaul, to cope with the transformations in world trade. It is also true that while China acquiesced with the necessary tariff reductions to join the WTO, it is well short of embracing the fundamentals of a market economy. State ownership and market intervention remain pervasive, raising serious questions about pricing and subsidy policies that contravene the basic tenets of competitive practices in international trade. Unsurprisingly, the US calls for a level playing field, and justifiably so. But threats to throw the baby out with the bath water is unconstructive to say the least.

China is no longer the poverty-stricken developing economy it was in the 1970s. It is now a major economic player on the world stage, with significant financial muscle from over $3 trillion of foreign exchange reserves- the largest for any country. It is also exploring geopolitical gains in Asia and Africa through strategies such as the Belt and Road Initiative, Asian Infrastructure Investment Bank, and the New Development Bank. Beijing has also become a major player in the digital world with considerable advances in the critical area of Artificial Intelligence. But China can ill afford to lose a big share of the world’s largest consumer goods market without serious adverse consequences to its own economy. So reaching a deal with the US is in its own interest. One option to explore would be to agree on voluntary export restraints on the one hand and to step up imports from US on the other.

Focusing on containing the US-China trade deficit through tariffs will harm the world economy more than helping the US. Although 99% of US economists reportedly disagree with the approach, Trump and his advisors remain unmoved. In addition to opening China’s economy by removing artificial barriers to exports, their strategy is to diminish if not cut off China’s access to the vast US market to reduce imports from China enough to substantially eliminate the deficit. US has the leverage of being the largest export market in the world, and China so far has built a dynamic economy largely backed by exports to US and Europe. Even if the strategy yields its intended results at significant costs to American consumers and producers, it would widen trade deficits with other economies leaving the overall deficit largely unchanged, unless the root cause is attended. Consumer spending constitutes 67% of total spending in USA and is the main driver of growth – curbing it will have high political costs at home. Generating more savings from a growing economy is the better option that Americans will have to get used to – but that is easier said than done.

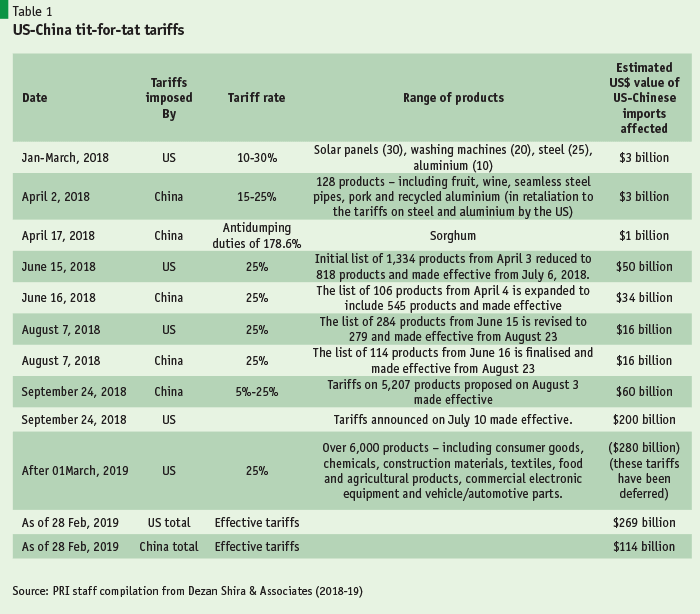

Tit-for-tat tariffs

The latest rounds of tariffs come from Washington’s presumption that the US is being taken advantage of by China and other countries, thanks to the lopsided rules of trade and that an economic power like the US should not be running trade deficits with China. Trade deficits are considered bad economics. Washington had reacted to trade deficits before as well – back in 1981, Japan was targeted after running huge trade surpluses with the US. But Tokyo is Washington’s ally, while Beijing is not. The US-Japan trade war simmered for almost a decade and concluded with an unusual trading arrangement – voluntary export restraints on Japanese auto exports, steel and machines, in addition to 100% tariffs on electronics. Described as a small-scale trade war, that phase is long over. This time the setting appears more ominous as the two countries increasingly appear as geopolitical adversaries.

The US-Japan trade war simmered for almost a decade and concluded with an unusual trading arrangement – voluntary export restraints on Japanese auto exports, steel and machines, in addition to 100% tariffs on electronics.

Tariffs are the principal instrument in this trade spat. Several rounds of TFT tariffs between the two countries are summarised in Table 1. Note that tariffs (negligible by developing country standards) are a minor source of US revenue (under 0.5%); their main objective being modest protection of domestic industry. Before the spat, the simple average rate of tariffs in the US was 3.5%, while the trade weighted average rate was 1.6%. The vast majority of imports (over 85%) entered the US at tariffs of 0-5%. 39% of agricultural imports into the US were duty-free, while 40% of them faced tariffs of 0.1-5%. 54% of non-agricultural imports into the US were duty-free, while 34% of them faced tariffs of 0.1-5%. Tariff peaks (15%+) applied to a few products such as clothing, dairy products, sugar, confectionary, beverage and tobacco. These averages are now in the past.

Of the $505 billion of Chinese imports into the US in 2017, some $269 billion are already subject to these augmented tariffs. Though the main thrust of the tariffs was to restrict Chinese imports into US, its application under the garb of ‘national security’, ‘serious injury to domestic industries’, and ‘unfair trade practices’, were a full-scale trade war to happen, higher tariffs could extend to all imports of the subject products, barring the small list of countries exempted. The threatened 25% tariffs were not imposed from March 1 2019 since negotiations are still going on, raising hopes of an agreement towards the end of March. But imports from other countries are also targeted, at least from the first round of tariffs which included critical industrial inputs like steel and aluminium. There is also a looming threat of up to 25% tariffs on cars, auto parts, and trucks. Economists estimate that they could have devastating consequences for the German auto industry, which would eventually lose 50% of its $38 billion exports to the US. American consumers are expected to pay as much as $2,750 extra on domestic cars, half the inputs of which come from Mexico, Canada, and Japan. The geopolitical fallout of these measures will have to be seen in the coming days or years. While the US is going increasingly protectionist, the other G20 economies have been liberalising trade – China has unilaterally cut tariffs on around 1,600 types of imports recently.

The rationale for these tariffs, initiated by the US, has been judged by analysts to be contravening the WTO rules of which the Trump administration is no fan. Unsurprisingly, preceding the new tariffs the WTO’s dispute resolution mechanism – widely regarded as the most significant contribution of the multilateral trading system, a crown jewel of WTO – was rendered ineffective by Washington blocking the reappointment of judges to the body. By end 2019, there will be only two out of seven judges left in a court that needs a minimum of three for a decision to be valid. That takes the wind out of the WTO’s sails if it were to question the US’ actions. Under these circumstances, China is left with no choice but to retaliate. Other WTO members suffering collateral damage will also have no recourse there. The multilateral trading system is in serious jeopardy as never before, if a full-scale trade war ensues.

It is the American consumers, not the Chinese exporters, who are paying the tariffs. In fact, average expenditure for an American family is expected to increase by $127 per year due to these tariffs. Prices of various products, especially different types of electronics imported from China, have increased in the US. Since many intermediate and capital goods come under these tariffs, US producers will face higher costs of production, becoming even less competitive. The American export hardest hit by Chinese retaliatory tariffs has been soybeans (HS Code 1201) – before the tariffs, the US was the largest exporter of soybeans to China ($12 billion), it slipped to 18th position while the volume fell by 97% compared to the previous year. Finally, as Chinese exports decline, their imports (US exports) will fall too. That could leave the US-China trade deficit moderately lower while deficits with other countries rise. Overall US trade deficit might not be reduced as long as the fundamental imbalances of excess spending over income and excess investment over savings persist in the US economy. This whole affair is undoubtedly an external shock to China’s economy which was undergoing the challenge of its own adjustment of redirecting demand from external to domestic sources, resulting in significant slowdown of economic growth.

Global implications

Trade has been an engine of income growth around the world in the post-War years. The goal of trade openness is universally accepted and has been pursued by the multilateral regime (GATT-WTO) for nearly seven decades. Trade restrictions have been significantly reduced and tariffs worldwide are in an all-time low. That situation is now threatened because under the present rules-based system, it is tough for the US to limit the tariffs to China alone. The next round of tariffs might witness upward adjustment in tariffs globally, restricting global trade with consequent adverse impact on output growth, which has already been under stress since the global financial crisis of 2008-09. Thus, the International Monetary Fund (IMF) predicts that the effects of a trade war will not be limited to the US and China. It will affect global exports-imports with significant disruptions to value chain integration of cross-border production; the adverse impacts will transcend US-China trade and engulf major economies and regions of the world. So, IMF lowered the global economy’s projected growth rate in 2018 and 2019 to 3.7% from its earlier projection of 3.9%. Likewise, global trade growth is projected to decline to 4% in 2019 from 5.2% in 2017. WTO’s World Trade Outlook Indicator (WTOI) is showing a decline in the first quarter of 2019 and predicting a sharper slowdown if the tensions remain unresolved.

China’s growth projection in 2019 was lowered from 6.4% to 6.2%. US growth is projected to slow from 2.9% in 2018 to 2.5% in 2019. The Bank of England has predicted that if this trade war ends up being global with all the major countries/trading blocs imposing tariffs on others by around 10%, GDP growth is likely to slow by 2.5% over three years due to tighter financial conditions and greater uncertainty. Just when the world was beginning to believe that TFT tariffs are a thing of the past, the ghost of the 1930s has begun haunting the world – since protectionism has apparently caught the fancy of the Trump Administration with as much zeal as is its disregard of the science of climate change.

What is in it for Bangladesh

If the latest TFT tariffs augur ill for the world economy it would be counter-intuitive to believe that Bangladesh stands to gain out of this. In the long run, the whole world will lose if the spat escalates to a trade war. Nevertheless, there might be short-term wrinkles that could be of advantage to Bangladesh’s apparel sector. Even before these developments China was losing competitiveness in low-cost (basic) garments and the switch to lower-cost suppliers was already happening. Around 97% of the US’ demand for clothing is met by imports, with China’s share at 41%, followed by Vietnam (12%) and Bangladesh (7%). If tariffs on apparel imported from China rise to 25% that could cut Chinese exports by almost $15 billion, which could then be shared among the most dynamic apparel exporters – including Bangladesh. Import tariffs on consumer goods are almost fully passed on to consumers. Since the tariffs will inevitably make the affected goods more expensive, both retailers and customers might look for less expensive sources. Apparel retailers would want to source their products from lower cost suppliers so that prices do not rise by the full extent of the tariffs. Bangladeshi garments manufacturers are already benefiting from the spill over effects – their exports to the US increased by 14% ($1.48 billion) during July-September 2018.

If the current US administration lasts a second term beyond 2020, China will most certainly lose substantial market share to countries like Bangladesh and Vietnam. If this trend persists, Bangladesh’s RMG sector gets a new lease of life for further expansion but, in the process, we will have to sustain few more years of concentration on a mono-product export basket because diversification will lose more steam.

Footwear, having the same global production and sourcing structure like apparels, is also a sector that could get traction in Bangladesh’s export basket as China, the largest source of footwear imports into the US, dismantles its production capacities directed to that market. Bangladesh, India, Vietnam, Laos and Cambodia are likely sources to substitute for whatever market China loses. This is where courting foreign investment becomes an even stronger imperative for Bangladesh. Even if new markets open, gaining access will require collaboration with foreign investors to bring technology, management, and access to markets, besides capital. Bangladesh’s new Government is sounding an appropriate note of urgency in mobilising FDI and it should be pointed out that RMG and footwear are the two leading export sectors that are ripe for attracting substantial FDI through relocation and fresh investment. Supportive policies, in principle and practice, must be formulated to seize the opportunity beckoning Bangladesh to become a leading player in two – not just one – export products.

Bangladesh’s new Government is sounding an appropriate note of urgency in mobilising FDI and it should be pointed out that RMG and footwear are the two leading export sectors that are ripe for attracting substantial FDI through relocation and fresh investment.

If the tensions morph into a full-scale trade war, there will be no winners. What are Bangladesh’s prospects if, as experts predict, future growth of global trade and output sustains deleterious impacts from the aftermath of the trade war? Popular perception suggests that would dampen the prospects of Bangladeshi exports in general if its main markets and the world economy are in recessionary mode. Against this argument is the theoretical construct that Bangladesh is still a small economy in the global marketplace and gaining market share even in a contracting world economy will leave enough space for substantial export growth, as it was in the aftermath of the GFC when our exports showed enough resilience to sustain growth in a contractionary environment. So, Bangladesh’s export prospects may face challenges in a temporarily shrinking global economy but should not be written off.

Finally, there is the looming prospect of a change from Republican to Democratic US administration in 2020. If that happens, there could be a roll back of the current tariff policy and restoration of past policies. The world will then return to its past trading order with resumption of trade and investment openness and, quite appropriately, an overhaul of the multilateral trading system that WTO represents. For the Bangladesh economy, that should present opportunities to be seized.