Dealing with the Last-Mile Delivery Challenge of Direct Cash Support

By

Covid-19 has now turned into a major global health crisis unprecedented over the past 100 years since the Spanish flu of 1918. Economic activities across the world have ground to a dramatic halt. Bangladesh has also started dealing with its severe consequences with curtailed economic activities manifested in factory closures, cancellation of and/or reduced export orders, declining remittance inflows, and depressed demand for domestically produced goods and services. Emerging assessments seem to suggest that export earnings in FY20 could be $5 – $8 billion lower than that of the previous year. Remittances that have traditionally played a critical role in boosting consumption demand for rural households were down by 12 per cent (in March) and such a trend is likely to persist the near future. Manufacturing activities, that have been the engine of our GDP growth, are also likely to have plunged to an exceptionally low level. The services sector, including hotels & restaurants, construction, transportation, etc. has taken a massive hit by lockdown measures and shrinking demand.

Even prior to the unfolding of Covid-19 crisis, export earnings in the first eight months of the current fiscal year were 5 per cent lower than that of the previous year, government revenue hit a huge shortfall from its target, and the government borrowing from the banking system was a record high. That is, from an already shaky point of departure, the overall economic situation has become even more precarious. Nevertheless, the government’s declared policy measures – amounting to a stimulus package of Tk 95,619 crore (3.3% of GDP) – in dealing with the economic fallout deserves appreciation. The unfolding extraordinary situation requires extraordinary measures and as such the policy intent of the support measures is quite clear. Bangladesh, however, does not have any previous experience of implementing such an elaborate support mechanism. Given the institutional capacity and record of governance, the effective implementation of the package will be a matter for future evaluation.

Social distancing and lockdown measures may be required for a protracted period, in a much more strict and efficient manner to bring a halt to the rapid spread. The government has been imposing such restrictions at the local level after identifying and dividing areas into different zones of green, yellow and red; Red being the most at risk areas. Imposing lockdowns in those areas has come to little or no effect as death toll and new cases continue to rise. It is hard for daily earners to abide by such novel rules, when they have no food on the table and relies on daily activity. Therefore, livelihood support mechanisms should be an important consideration for a more efficient lockdowns, where people can afford to stay in. At those times, the utmost priority should be to provide support to several millions of poor and vulnerable citizens (including the ‘new poor’ arising from job losses or forgone income-earning opportunities) who are now facing serious livelihood challenges and thus will need continued support. Hunger and deprivation of bare minimum needs could spark social unrest, potentially undermining our hard-earned socio-economic progress achieved over the past decades.

Reaching out to the poor and needy through direct policy support will need a detailed-out implementation plan. Although not an easy task, designing and implementing a comprehensive support system directly targeting the poor and vulnerable groups is not impossible either.

Why Cash Assistance?

We don’t undermine the need for in-kind assistance in various special circumstances. Otherwise, there exists a huge body of evidence to suggest great advantages of cash transfer programmes over in-kind schemes. Cash programmes are more efficient as they don’t distort consumption choices. There is evidence that such transfers are 25–30 per cent cheaper than in-kind interventions. Because of its known advantages, the National Social Security Strategy, that Bangladesh adopted in 2015 to reform and strengthen the social protection system, proposes to transform all workfare-based food transfer interventions into cash assistance schemes.

There is also one more reason for suggesting cash assistance. Given the rapid expansion of mobile financial services (MFS), money can now be sent to even remote places in Bangladesh. Yearly transactions through MFS reached more than $50 billion in 2019. There are currently about 1 million MFS agents dealing with about 80 million registered accounts (of which about 35 million are considered active). The MFS mechanism thus stands ready to inject the cash in a cost- effective manner with being much less susceptible to corrupt practices. The current government can get a lot of credit for helping expand this mobile financial system and it would only be most timely and appropriate to use the same means to provide the prompt livelihood support that people need and in turn, keep the economic wheel running by sustaining demands. Under the current social distancing guidelines, it is also exceedingly difficult to distribute in-kind distribution, let alone the proliferation of thefts and misappropriation of relief materials, as reported in media.

Cash assistance is also important to help people keep their consumption as diversified as possible. This can sustain local-level demand for diversified goods and services. Otherwise, many small growers of such items as eggs and dairy products will have to discontinue their production.

Cash assistance is also important to help people keep their consumption as diversified as possible. This can sustain local-level demand for diversified goods and services. Otherwise, many small growers of such items as eggs and dairy products will have to discontinue their production. It can delay a post-crisis recovery process, fuelling inflationary pressure as these small producers might then find it difficult to build up their supply response.

Who should be given direct livelihood support?

It is not easy to estimate the size of population (or, number of households) that need immediate support to stave off hunger and minimum needs during this crisis. In the absence of a fully-functioning elaborate identification infrastructure (i.e. unemployment insurance number; social security number; comprehensive Tax identification number, etc.), two possible approaches – income loss and job loss – could be used to determine the size of the potential beneficiaries. Any method is unlikely to be perfect, but the use of available information can provide some usable estimates.

Income loss approach:

• A PPRC/BIGD survey (April 17, 2020) finds large income losses among poor and vulnerable population groups in Bangladesh. The rapid assessment, conducted between 4 and 12 April 2020, comprising a sample of 5,471 respondents (with 51% urban residents and the rest 49% from rural areas)shows the income of urban residents fell by, on average, 82 per cent (in comparison with their monthly income in February 2020), while corresponding reduction for rural respondents turns out to be 79 per cent. The estimated number of new poor resulting from Covid-19 related economic disruptions is 38.16 million: about 27 million in rural areas and 11million in urban areas. Therefore, this new poverty rate is estimated as 22.6 per cent (i.e. 38.16 million as proportion to the total population of 170 million). When the existing 18.9 per cent poor is added to the new poor, the poverty incidence jumps to 41.5 per cent. The survey reveals that only 14 per cent of the respondents received some government assistance, while another 4 per cent had access to support offered by the NGOs. With their current savings, the rural poor can manage 13 more days’ livelihood and the urban poor can sustain just 8 days.

• Using the 2016 Household Income and Expenditure Survey (HIES), the latest official database for assessing poverty, we tried to assess the likely impact on poverty by reducing the consumption expenditure of non-poor households (Annex 1). It is found that a 10 per cent reduction in household consumption across-the-board would increase the poverty incidence by 9.7 percentage points with the overall headcount poverty rate rising to 34.1 per cent. When the consumption decline is 15 per cent, the corresponding rise in poverty would be 15.2 percentage points t with the overall proportion of the households living below the poverty line being 39.5 per cent. A further decline in consumption expenditure by 20 per cent, will make the poverty rate 21.2 percentage points higher (with an aggregate poverty incidence of 45.5 per cent).

• We further extrapolate the consumption-poverty nexus of 2016 for 2020, where we estimate household incomes falling in the range 8.6 – 15.6 per cent on a full year basis. Accordingly, the size of the new poor varies between 12.8 million and 26 million with the overall size of poor households reaching 44.5 million and 58.1 million, respectively. Just for comparison, on an annualized basis, our estimates of 58.1 million is less than the PPRC/BIDG extrapolated 70 million. One reason for this difference could be that the PPRC/BIDG survey was targeted towards more poor and vulnerable population groups.

• Amongst others, the Centre for Policy Dialogue (CPD) proposed that the government should provide cash aid to 11.9 million poor households across the country to help them cope with the ongoing coronavirus crisis and the subsequent adverse implications arising over the next two months. This suggests covering around 56 million poor people.

Employment loss approach:

• Estimates of job losses are preliminary in nature and are based on the so-called heuristic method. According to many newspaper reports, millions of people, mainly engaged in the informal sector, have become jobless. According to some estimates, around 20 million people have already become temporarily jobless as a direct fallout of coronavirus-related economic slowdown. A telephone-based survey undertaken by a newspaper shows that as high as 47 per cent of readymade garment workers have lost their jobs in the backdrop of widespread cancellation of export orders and uncertainty about future export prospects. it has also been reported that millions of transport workers were left jobless after the imposition of the nationwide lockdown to stem the Covid-19 spread. According to various rights groups and labour unions, an estimated 9 million workers have had no source of income since the enforcement of lockdown and social distancing measures.

According to some estimates, around 20 million people have already become temporarily jobless as a direct fallout of coronavirus-related economic slowdown. A telephone-based survey undertaken by a newspaper shows that as high as 47 per cent of readymade garment workers have lost their jobs in the backdrop of widespread cancellation of export orders and uncertainty about future export prospects.

• Our over-the-phone interviews and discussions with industry insiders during 10-17 April 2020 suggest the employment loss could be around 12.5 million. The number of individuals who may be affected due to these job losses are estimated at 50 million considering the average size of Bangladeshi households.

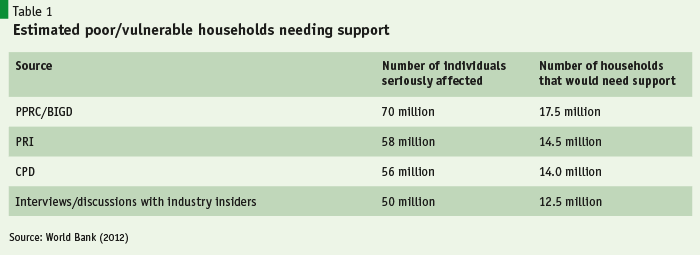

• Despite varying estimates, it is quite clear that the number of households who would need assistance is within an acceptable range. A simple average of the four estimates in Table 1 would result in 14.6 million households. The government has already announced a specific wage support programme for the RMG workers. If the factory owners are able to take advantage of the package and strive for paying their employees, which they claim of a size of 4 million, the workers’ households might not require any further direct cash assistance. There is currently no information on the number of unique households comprising garment workers. However, under plausible assumptions, consideration of unique garment workers’ households, could lead to a need for assistance for a lower number of 10.0 million to 12.0 million households. However, it is worth pointing out that the recent crisis has revealed that wage digitisation covers only around 12 per cent of garment workers and it is not clear if factory owners, even with the assistance of wage support package, can pay for their all workers when they are away from work.

How Much Is Needed for the Cash Transfer Programme?

One critical element in determining the support programme is the amount of transfer. At the outset, we would like to highlight that while a standard suggestion could involve considering the poverty line income as worked out in Bangladesh and make the equivalent amount of transfer. However, we take the view that it may not constitute a practical approach. While the budgetary capacity is an issue, it is also important to remember that we are confronting an unprecedented crisis in which the principal objective is to help people with their bare minimum necessities. As already mention, there could be the need for such support measures for several months (it is unrealistic to view that the need for support is only for the next two-three months) and thus budgetary implications should be given a careful consideration. Also, the provided state support should not result in moral hazards with the recipients expecting a relatively large support. In the following, we first summarise the current suggestions and then offer our recommendation of a specific amount.

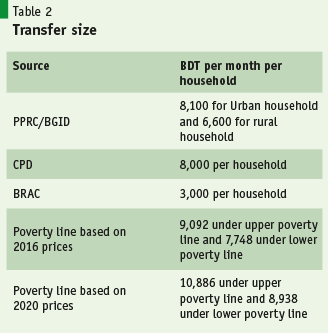

• The transfer size as suggested in the PPRC/BIGD assessment is Tk 6,600 per month for eery beneficiary rural household and Tk 8,100 for such urban households. For four members in a typical household, the above translates to Tk 1,650 per person for rural residents and Tk 2,025 per person for urban beneficiaries.

• Many economists would tend to suggest a transfer amount close to the poverty line income. Bangladesh uses 16 different poverty lines for different regions. For poverty assessments in the 2016 Household Income and Expenditure Survey, these amounts varied from Tk 1,865 (Sylhet rural) to Tk 2,929 (Dhaka metropolitan area). The average national upper poverty line was set at Tk 2,268 per person per month and the average lower poverty line was Tk 1,862 per person per month. Thus, for a four member-household, the transfer size should be Tk 9,072 per month under the upper poverty line and Tk 7,748 per month under the lower poverty line. Since these are at 2016 prices, using an average inflation rate 5 per cent per annum between 2016 and 2020, the inflation-indexed values of the 2020 poverty lines could be determined respectively at Tk 2,722 per person per month for the upper poverty line, and Tk 2,234 per person per month for the lower poverty line. The household transfer size thus can be worked out as Tk 10,886 per month under the upper poverty line and Tk 8,938 per month under the lower poverty.

• Brac is currently administering a cash assistance scheme for their identified poor and vulnerable households, needing support. Based on the expenses related to the basic minimum needs, they are offering Tk 3,000 per household. Strikingly, this is much lower than the poverty line incomes as suggested above.

• As pointed out above, we believe that during this crisis period benchmarking transfer size around the poverty line are not realistic. Given the current stage of the spread of Covid-19 in Bangladesh (which has not reached the peak yet) and slow progress to reopen economy elsewhere in the world, it is more likely that direct government cash support programme would be required for a much longer period – at least for the next 3 to 6 months (in a further worse case, we need to be prepared for 8 months’ support mechanism).

• We believe a transfer amount of Tk 3,000 per household or family is a reasonable one for the reasons mentioned above. We do acknowledge that this amount is small and would just allow the households to survive the crisis. This amount is unlikely to encourage perverse incentives for non-vulnerable households to seek for the assistance. We do think that it is not appropriate to get into the debate about why not a slightly lower amount of Tk 2,500 or not a slightly higher amount of Tk 3,5000. There is some field-level evidence of Tk 3,000 is considered reasonable. Nevertheless, should the government wish, it can simulate the cost implications over range of transfer amount.

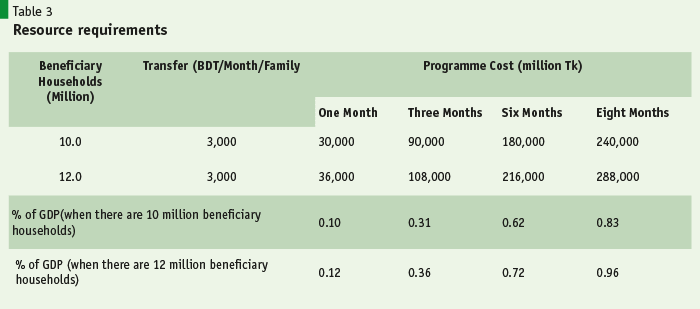

• Our estimates show that if a total of 12 million households are to be supported with direct cash assistance of Tk 3,000 (per household), the total programme cost for a three month period will be Tk 108,000 million, which is calculated as just about 0.36 per cent of Bangladesh’s estimated GDP for FY20. For a longer duration (eight months) of assistance programme, using the same allowances for the same number of households, the computed cost is less than 1 per cent of GDP. These estimates thus show that, a much smaller than the overall stimulus package already declared is needed to reach out to the poorest and most vulnerable population groups who are currently in most need of assistance.

How to reach out to beneficiaries?

The National Social Security Strategy called for a national household database to identify the poorest and vulnerable populations groups. However, even after several years, the proposed mechanism could not be established. Therefore, using a nationwide database to track and reach the needy households at this time of crisis would remain a missed opportunity. International experiences drawn from Brazil, Chile, India, Malaysia, Pakistan, Peru, the Philippines, Thailand, and from many other countries seem to suggest cash assistance delivered directly through digital financial services work in an extremely efficient manner.

The basic principle of our proposed approach is to set up an Emergency Cash Allowance Programme (ECAP) for 10 – 12 million households. Households in need of the assistance should self-identify or self-register for the allowances. The self-selected needy households can register by calling/dialling/sending SMS to dedicated mobile numbers. The registration process should be simple enough so that most potential beneficiaries can apply for without needing for much assistance. During the registration, they may be asked to name the head of the household, address, and all NID numbers for household members. Information on their preferred DFS account will also be required for making the payments. Payments should be made through mobile phone accounts using any DFS providers of their choice such as bKash, Rocket, Nagad, SureCash, etc.

If households will need support in registering, our suggestion is to make use of the services of MFS agents. There are as many as close to one million such agents scattered all over the country. The agents should be provided clear instructions about how to help with the applicants while observing social distancing guidelines. It is possible that many applicants currently do not have MFS accounts. Currently, e-KYC is in operation in Bangladesh. This allows opening such accounts using NIDs within a few minutes. The MFS agents can also assist in opening new accounts. It is possible that certain beneficiaries either do not have their NIDs or have misplaced/lost them. Under those circumstances, they may be registered using their birth certificates. Opening of e-KYC accounts without NIDs can be temporarily allowed and these accounts, if needed, can be terminated later

There are already some solid examples of the currently existing MFS infrastructure being an efficient means to delivering cash transfers. Between 6 and 20 April 2020, about 2.6 million garment workers could open their MFS accounts to receive their salaries. Under a social security scheme, the Primary Education Stipend Programme (PESP), some 14.4 million primary students are enrolled and their 10 million plus mothers receive monthly allowances through MFS (the programme provides a stipend of Tk 100 per month per child with a ceiling of Tk 300 with four or more children). Therefore, opening accounts using MFS and delivering cash assistance are already well-established in the country.

Verification of the applications is an issue to consider since the programme is going to cover limited beneficiaries. It is possible for government to involve local level representatives, officials, NGOs as well as military personnel in the verification. If the transfers are to be made on a monthly basis, the process of verification can be continuous process. If MFS agents are being engaged to help with the registration process, local level representatives and army personnel can help with the verification.

Verification of the applications is an issue to consider since the programme is going to cover limited beneficiaries. It is possible for government to involve local level representatives, officials, NGOs as well as military personnel in the verification.

We are of the view that the cash allowances are paid on a monthly basis. There are some international experiences when some countries have made such transfers for several months as a one-off payment. Given the low financial literacy of most of our poor people, regular monthly payments could help with a better management of the crisis.

Effecting a perfect system for cash transfer perhaps will not be possible. It is important to acknowledge some scope of leakages/mistargeting. That is why the suggestion for a relatively low amount of transfer is made. It is most likely the case that the measures suggested above will need further refinements to make them operational. But, implementing such a broad-based support measures is doable and is the most important intervention that the government should pursue.

Finally, the proposed cash assistance programme should be regarded as complimentary to already declared intervention measures. The expansion of the safety net programmes, as announced by the government, should be implemented in addition to this cash assistance programme to make the support system more impactful.

What Role of Local Governments and Non-State Actors

Involving local governments and non-state institutions (NGOs/CSOs) are also important in delivering a robust and meaningful support programme. As mentioned above, many poor and vulnerable population groups might have been excluded from the NID database and/or will need support for registration. For the task of identification and verification, the assistance from the local level is going to be crucial.

There are numerous cross-country examples of the government machineries working closely with local level representatives and non-state actors. In Kenya, for instance, each village of 120-200 households has a volunteer village leader who works with the lowest level of paid civil servant, adjudicates disputes and disseminate information from the state (Orkin and Walker, 2020; Walker, 2019). In India as well, the responsibility for implementing employment guarantee MG-NREGS is devolved from the central government to the state, the district, the block, down to the Gram Panchayat, a local government of about 500 households. These structures can play multiple roles during this crisis including channelling information up to decision-making structures, which is important when travel is limited. For example, in food-insecure countries like Malawi and Ethiopia, infrastructure has been built to collect local data on food security and channel food or cash to famine-affected areas (Berhane et al., 2015, Beegle et al., 2017). Similarly, for public health success against Ebola, it was vital that local structures relayed data back to coordinating structures for better decisions. Local set-ups are also widely used in the identification of individuals in dire need of additional support. For instance, in Rwanda, vulnerable households are identified at the most local (isibo) level with information on the numbers of households needing support being passed on to higher government structures. To avoid exclusion errors, the central government set up a toll-free line for households who would report in case they were missed out in the targeting.

Bangladesh has a very vibrant and proactive non-state actor community. Indeed, when it comes to mobilisation and delivery of support through NGOs, Bangladesh is cited as an example amongst the developing countries. Many NGOs are already supporting various communities in the fight against Covid-19, as the efforts made by Brac mentioned above. However, the NGO initiatives need to be strengthened further through some coordination. We firmly believe that, the direct cash transfer mechanism that we have proposed above can be implemented in coordination with NGOs, local governments and army personnel, making it an exemplary case of reaching out to the poor and needy during the Covid-19 crisis.

Conclusion

The government has already announced an elaborate support measures, many of which are timely interventions that will, however, require effective implementation. In general, the stimulus package related to economic recovery is well-defined. What now needs more attention is providing direct support to the poor and vulnerable people. Hunger and deprivation of bare minimum needs could spark social unrest, potentially undermining our hard-earned socio-economic progress achieved over the past decades. Lockdown and social distancing can only be effectively enforced when people have basic means to stave off hunger Time is of the essence here in delivering critical support to the poor and needy, and it is important to plan for a longer duration. The proposal here shows that implementing a cash assistance programme, offering some reasonable assistance for basic needs, for 10 – 12 million people is very much within our fiscal and technological means and thus should be pursued immediately.