Economic Assessment of the FY 2022 National Budget

By

Against the backdrop of Covid-19 pandemic that continues to take its human and economic toll, the government has recently approved the FY2022 National Budget. This is an extra-ordinary period for budget formulation in the face of falling revenues, declining rates of GDP growth, reports of growing unemployment and falling incomes for a considerable body of the population, and growing demand for financial stimulus, healthcare spending and social protection support. To respond to this challenge, the government announced a series of stimulus packages in April 2020 and followed it up with the first COVID Budget in July 2020. How well those policy initiatives were implemented have a telling impact on peoples lives and livelihoods. They also have implications for follow-up policy actions in the FY2022 Budget. This article provides an assessment of both these issues.

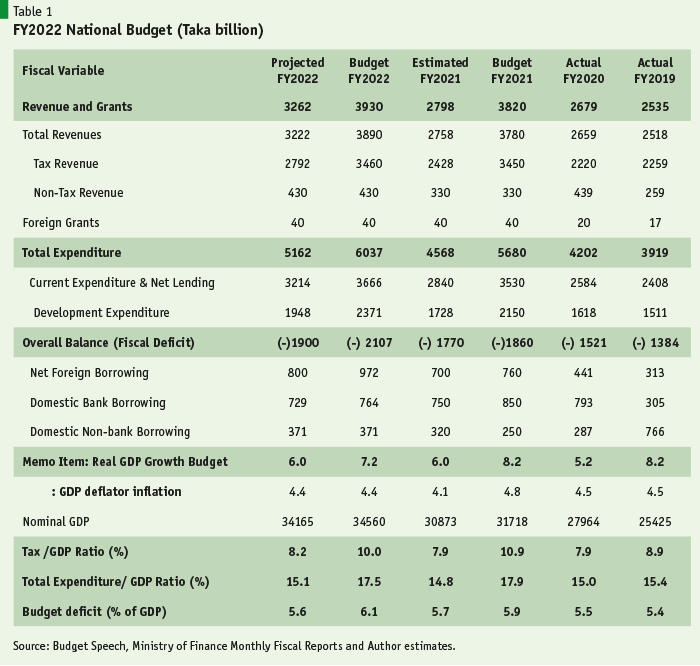

As a first step to the analysis, Table 1 shows the highlights of the new FY2022 Budget in light of the actual outturns over the past three years (FY2019-FY2021). The actual results provide a reality check on the gaps between the government’s budgetary promises and optimism, against what has been actually delivered to the people.

Implementation of the Stimulus Packages and the FY2021 Budget

In response to the first Covid-19 surge starting in March 2020, the government took a series of measures to reduce the spread of the infection and in April 2020 adopted several stimulus packages, estimated at Taka 1196.4 billion (4.3% of GDP), to help the needy and stem the downward spiral of economic activities. It was followed with a new budget for FY2021 (Table 1). The full picture about the implementation of these initiatives is yet to emerge. But several observations can be made.

First, the policy packages were implemented unevenly, with most progress in the implementation of measures aimed at containing the damage to the medium and large manufacturing, especially the RMG. Progress is slow with implementing support for the micro and small enterprises (MSEs), which provide 35% of total employment in the country and is the largest source of non-agricultural employment. The MSE credit programs in the stimulus package benefited only those enterprises that currently have access to bank credit, which is a very small percentage of total MSEs. The large bulk of the MSEs are outside the formal credit net for a host of reasons including lack of formal registration, absence of tax identification numbers, lack of collateral, perceived high-credit risks, absence of credit guarantee schemes, and weak capacities and poor outreach of commercial banks to service these potential clients.

Second, actual spending on social protection is very low. Additionally, the government’s ability to implement social protection programs remains heavily constrained due to inadequate progress with the implementation of the National Social Security Strategy (NSSS), especially in identifying beneficiaries.

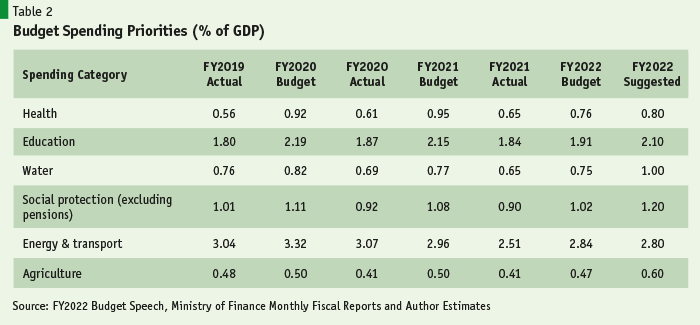

Third, the implementation of the FY2021 Budget substantially lagged behind the over-optimistic tax revenue and expenditure targets set in the Budget. Predictably, the estimated actual tax revenue is 42% lower than budgeted, which has required sharp cutbacks in growth and poverty reduction related spending in health, education, water, agriculture, infrastructure, and social protection (Table 2).

Overall, however, even the partial implementation of the stimulus package and the FY2021 Budget had a positive effect on exports and GDP growth. In the context of the global COVID-stricken environment, Bangladesh economic performance looks good and compares favorably with other countries. A particularly strong enabling factor was the unprecedent surge in foreign remittances, growing by 36% between FY2020 and FY2021. Yet, the overall performance fell considerably short of the highly ambitious targets set in FY2021 Budget and the 8FYP. A particularly worrisome development is the weak progress with the recovery of employment and the reduction of poverty along the pre-COVID path. While the lack of reliable data is a big gap for policy analysis and impact assessment, partial survey data from several sources seem to suggest that the incidence of unemployment due to Covid-19 has likely remained large and the poverty spike that happened during the last quarter of FY2020 owing to Covid-19 may not have come down adequately. Remittance inflows have been a lifesaver against a slide in employment and a poverty spike. Yet, the recovery in GDP growth, employment and poverty reduction is likely to have fallen short of the 8FYP expectations.

The experience with policy making over the past 15 months since the onset of the Covid-19 has important lessons moving forward. Without adequate policy reforms, economic and social recovery from Covid-19 to the development path of the Perspective Plan 2041 (PP2041) and the 8FYP will be extremely difficult. This is a major lesson for the design of the FY2022 Budget. Indeed, without adequate reforms that have been well articulated in the PP2041 and the 8FYP, there is a risk that the growth path might slide to the 5-6% rate.

National Budget FY2022

Based on the realism of Covid effects on economic activities, the National Budget FY2022 makes a significant departure from projecting over-optimistic GDP growth assumption of the FY2021 Budget. This is a positive development. Real GDP growth for FY2021 is now estimated at around 6% as compared with 8.2% projected in the FY2021 Budget. For FY2022, the Budget assumes a growth rate of 7.2%. Given the onset of the second Covid-19 surge in March 2022 and the still sluggish recovery from the first Covid-19 surge, this growth assumption looks optimistic.

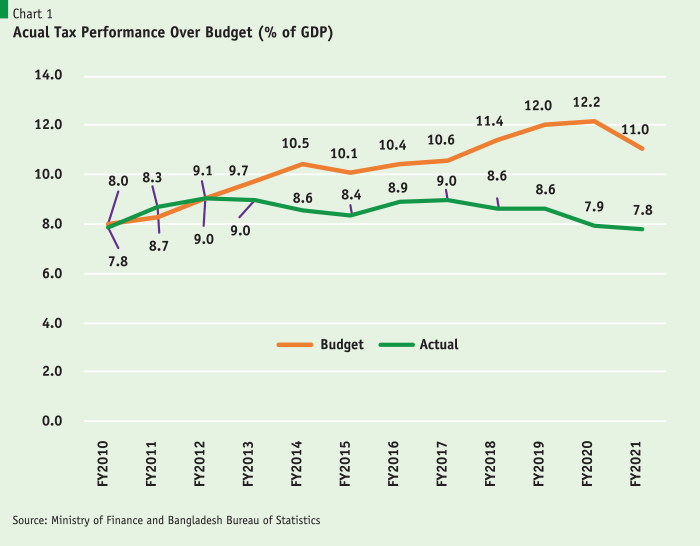

As in recent years, the revenue growth assumption in the FY 2022 is highly unrealistic. The main problem is the continuing use of an over-inflated tax revenue base that has no relationship with actual tax collections. The tax revenue shortfall was a whopping 53% in the FY2020 Budget and 42% in the FY2021 Budget. More generally, over the past several years, the National Budgets have set highly unrealistic tax revenue targets that have no bearing on what is feasible and also have little or no reform content. The end result, predictably, is a large gap between the Budget target and the actual tax revenue performance that has been widening since FY2012 (Chart 1). Distressingly, it also shows a progressive weakening of the tax performance. Most surprisingly, there is little debate in the Cabinet or the Parliament about this unrealistic budget making process and the need for reversing the poor tax performance with meaningful and reforms.

The FY2022 Budget targets a tax revenue amount of Taka 3460 billion as against an estimated actual tax collection of Taka 2428 billion in FY2021, implying a target tax revenue growth of 42.5% (Table 1). We know from the experience of the last two years, this tax revenue target will not be met. While the FY2022 Budget contains some tax measures, this is a mix of tax reduction in some cases and increases in some. The reforms that could have made a significant difference in increasing tax revenues have not been adopted. These include the implementation of the VAT Law of 2012 in its original form, substantial effort with tax automation, and the reform of personal income taxes (simplification of tax forms, online filing and payments, productive and selective audits, and speedy resolution of tax cases). We project that the tax revenue in FY2022 will at best amount to Taka 2792 billion, which is healthy growth by 15% over the estimated actual tax revenue of Taka 2428 billion in FY2021 (Table 1).

Non-tax revenue projections are normally conservative because these are not strategy based. In the past, much of the non-tax revenues have come from profit transfers from the Bangladesh Bank based on the issuance of currency (seigniorage), the licensing fee collected by the BTRC from mobile operators, and profit transfers from the Chittagong Port Authority. In recent years, the BPC is also contributing to the Treasury by making money from its oil operations as the domestic average oil prices exceed international oil prices. In the past, the BPC was a big drain on the Treasury resources owing to the domestic oil subsidy. This flip illustrates the importance of converting the huge assets that the government owns in the form of SOEs into profit-making ventures. Most of these SOEs including public banks require budget subsidies to stay afloat. In an environment of severe tax revenue constraint, a major policy option for mobilizing public revenues is to convert these SOEs into profitable ventures so that not only budget subsidies are not needed, but these enterprises are also able to service their debt and transfer profit to the Treasury. The outstanding volume of SOE debt was Taka 4450 billion in June 2019, which amounts to $52 billion and 17.5% of FY2019 GDP. Since SOEs typically do not service their debt owing to weak financial performance, this huge volume of SOE debt has become a contingent liability of the Treasury and a tax burden on future generation. As in the past, the FY2022 National Budget offers no strategy or policy options to reform SOEs.

Total spending in the FY2022 Budget is targeted to grow to Taka 6037 billion as compared with the estimated actual spending of Taka 4568 billion in FY2021, implying a 32% growth. Again, experience with the implementation of past budgets, and especially the FY2020 and FY2021 budgets, show that actual spending is automatically scaled back in light of imminent revenue shortfalls. The government has generally maintained a prudent fiscal stance limiting deficits at around 5% of GDP in pre-COVID times and between 5-6% of GDP in post-COVID period. Based on actual deficit spending during FY2020 and FY2021, the estimated fiscal deficit in FY2021 is lower than budgeted. This is also likely to be the case in FY2022 mainly because the Budget makes unrealistic assumptions about a surge in disbursements from foreign loans. Using more realistic foreign loan disbursement assumptions, the fiscal deficit is projected at Taka 1900 billion as compared with the target of Taka 2107 billion. So, total government spending in FY2022 is likely to be Taka 5162 billion, which will be 13% higher than the estimated total spending in FY2021.

This unrealism in revenue projections is unfortunate because it makes the expenditure targets unreliable and lowers the transparency of the budget. When spending cutbacks are made owing to revenue shortage, they are not spread uniformly across the budget. Some spending items like civil service salaries and pensions, interest cost on public debt, defense and security spending are basically fixed obligations that are mostly left untouched. These typically amount to 33% of the total budget. So, the cutbacks are spread over the remaining 67% that include critical spending like health, education, water supply, flood control, infrastructure, agriculture, and social protection. How these cutbacks are actually applied vary by the years. Since the budget spending targets for these core spending is unreliable owing to large departures in actual spending from these targets, an a priori assessment of the FY2022 spending targets is difficult.

Nevertheless, below we provide some thoughts on how the FY2022 spending targets might be managed in the context of a realistic expenditure envelope to get most benefits. After adjusting for the over-optimistic assumptions about tax revenues and drawdown of foreign assistance pipeline, total projected spending is 15.1% of GDP (Table 1, Projected Budget FY2022 column). Of this some 5.2% of GDP is fixed obligation, so the spending priorities reflected in the Budget relate to the remaining 9.8% of GDP. This is a very tight fiscal space at a time when Covid-19 spending requires an expansion in fiscal space and not a contraction. So, utmost care has to be taken when planning and implementing the FY2022 Budget to ensure that public spending targets those items that have the biggest impact on fighting Covid-19, creating jobs, reducing poverty, and enhancing GDP growth. The expenditure items as a share of GDP that are likely to have the most impact on COVID, growth, employment, and poverty are shown in Table 2.

Table 2 tells a remarkably powerful story about the public expenditure debacle facing Bangladesh. First, as a share of GDP, government spending on high-priority items is very low by international standards, especially in the context of an aspiring UMIC. Spending on health is a mere 0.6-07% of GDP; spending on education is below 2% of GDP; spending on water is around 0.7-0.8% of GDP; spending on agriculture is a meagre 0.4-0.5% of GDP; and spending on social protection is below 1% of GDP. Second, these low levels of spending have been further hampered in the past 2-3 years owing to tax revenue shortfalls and possibly implementation constraints. Third, the efforts to increase spending even in health, which is so critical for fighting Covid-19, have failed. This is rather unfortunate, given the low capacity of the health sector to deliver critical Covid-related and other healthcare services. Fourth, even in transport and energy that have been relatively better protected against cutbacks, spending as a share of GDP has been falling and are substantially below needs, signaling both resource and implementation capacity constraints, especially in transport.

The fiscal and implementation capacity constraint on essential public spending must be addressed comprehensively starting with the FY2022 Budget to fight Covid-19 and restore the growth and poverty reduction momentum to the PP2041 and the 8FYP growth and poverty reduction paths. At the least, some minimal increases in health, education, water, agriculture, and social protection must be secured that is consistent with available resources as suggested in Table 2.

An Economic Assessment of the FY2022 Budget

Progress with Covid-19 and healthcare management: The reasonably sound management of the first Covid-19 wave in 2020 with minimal loss of life and low economic cost relative to the rest of the world is credit to the Government. But the second Covid-19 wave starting in March 2021 is worrisome. The weak readiness with vaccine availability, after dispensing the initial 20 million doses, for a population of 170 million requiring a total of 340 million doses is a matter of great concern. While preparations are underway to procure greater supplies from multiple sources, arguably the planning could have been much better. The penetration of the dangerously contagious Delta variant first found in India in the Bangladeshi border districts is a matter of grave concern. International experience shows that while partial lockdowns and social distancing are helpful, vaccination and mask use are the most potent ways to prevent the spread of Covid-19. Bangladesh needs to do a much better job on both counts. The FY2022 Budget must give top priority to the vaccination drive. It must also protect health spending from cutbacks and enhance implementation constraints. Partnerships with private sector and NGOs need to be strengthened to increase healthcare outreach in less served districts. Urgent reforms are needed to improve the capacity of the health ministry to implement critical health programs. It is also high time for Bangladesh to initiate a universal healthcare program as envisaged in PP2041 and the 8FYP.

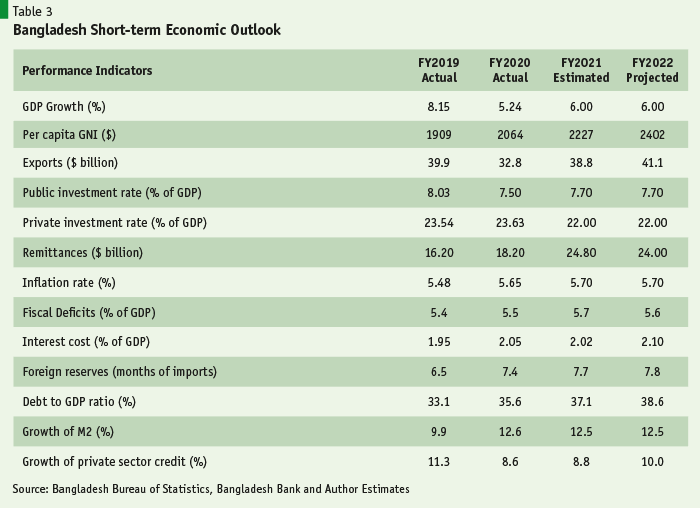

Macroeconomic stability: The short-term economic outlook for Bangladesh is illustrated in Table 3. It is credit to the Government that it has maintained prudent fiscal and monetary policies despite the COVID onslaught. Notwithstanding sharp revenue shortfalls, the fiscal deficit has been kept below 6% of GDP. While there is scope for running a somewhat higher fiscal deficit to spur the economy against the Covid-induced downturn and to provide higher income support to the poor and vulnerable, the government has opted to retain its conservative fiscal stance. Growth of monetary variables (M2 and domestic credit) are also on the conservative side that has helped contain inflationary pressure. Overall, the inflation rate has remained in the 6% range and will likely stay there in the next year or so. The Debt to GDP ratio shows a rising trend owing to higher use of foreign assistance and falling GDP growth. Nevertheless, overall foreign debt situation is low and consistent with all indicators of debt sustainability. Foreign reserves position is very comfortable. Domestic debt is similarly sustainable, although the continued reliance on high-cost National Saving Certificates is exerting pressure on interest cost of debt that now exceeds 2% of GDP and is eating up the very limited tax revenues. A better option would be to reduce reliance on the high-cost national savings certificates and use the T-bills for domestic financing of the fiscal deficits.

GDP growth, exports, investments: Investment rate and GDP growth held up remarkably well in FY2020 despite the onslaught of Covid-19. Exports suffered most in FY2020 owing to lockdown in Bangladesh as well as a Covid-induced global slump in demand. However, a strong agriculture, a near-normal rural economy, and the unexpected surge in remittances helped protect demand and economic activities from sliding excessively in Bangladesh. The estimated GDP growth of 5.2% in FY2020 is amongst the best in the Covid-infected world. Most of the western world went into a recession, while even dynamic economies like China and Vietnam saw GDP growth slide to the 2-3% range. It should be noted though that there is considerable skepticism amongst researchers in Bangladesh about the authenticity of the 5.2% GDP growth figure for FY2020. This is based on survey findings that suggest considerable fall in income of workers in urban informal sector during Q2 of 2020. BBS should research this matter carefully and ensure that it presents the best data-based evidence when finalizing the FY2020 national accounts.

Regarding FY2021, the growth prospects have been clouded by the onset of the second Covid-19 wave in March 2021. Exports showed considerably recovery from the depressed levels of April-June 2020. Total exports reached $38.8 billion in FY2021, which is a remarkable recovery by 15% growth over FY2020. However, this still remains below the actual exports of $39.9 billion in FY2019. Agriculture remains strong and will grow at around the 3% long-term trend. Recovery in other manufacturing, construction and services will be more modest due to continued Covid-related downturn, lack-luster investment performance of the private sector, and the inability of the government to strongly support the MSEs. Private investment rate and FDI are both trending down. Although there is no firm data on the private investment rate, slowdown in the growth of private credit despite sharp fall in the nominal and real lending rates and the slack in the growth of imports both suggest this. Regarding MSEs, the government took several initiatives but as noted, in the absence of structural reforms that address the root causes of the absence of dynamism of MSEs, the recovery of this sector will be difficult. However, the continued strong performance of remittances will boost informal activities. Overall, the government’s revised estimate of GDP growth in the 6% range in FY2021 seems plausible.

Given the improving global economy, especially the recovery in the USA, the export outlook for FY2022 is good. However, domestic policy constraints will likely slowdown export growth from the supply side. The sharp appreciation of the real effective exchange rate (REER) continues unabated. Similarly trade protection continues to impart heavy anti-export bias. These policy constraints are not addressed in the FY2022 Budget. Consequently, in this environment, exports will likely resume the path of around 6% growth as in the FY2015-FY2019 pre-covid periods. Similarly, the recovery of private investment and attraction of FDI will require major reforms in improving the investment climate. The FY2022 Budget has lowered the corporate income tax rate and offered incentives to boost private investment. Yet, the overall investment climate requires broad-based actions to reduce the high cost of doing business in Bangladesh. Lower corporate tax rate is a positive step, but by itself it is not adequate to restore the private investment including FDI to the levels projected in the PP2041 and 8FYP macroeconomic framework, which is essential for achieving an 8% plus GDP growth path. Overall, the most likely outcome would be a 6% GDP growth in FY2022.

Impact on Poverty

The paucity of reliable data is a huge constraint to assessing the poverty impact of Covid-19 and the effectiveness of government policy response to counter these adverse effects. Research done for the 8FYP suggested that in the short term, the poverty rate may have climbed up to 33% in 2020 Q2 due to the lockdown response to fight COVID. However, the recovery of economic activity in FY2021 and the surge in the inflow of remittances have likely tapered down the poverty rate to the 20-22% range. Some researchers contest this optimistic assumption about poverty based on survey findings, which are however not very reliable. There is a major macro-consistency issue. A combination of 4-5% per capita real GDP growth along with 15% growth in exports and a 36% growth in remittances between FY2020 and FY2021 is not fully consistent with the picture of a sustained rise in poverty incidence unless there is evidence of a substantial worsening of income distribution. Covid-19 has certainly caused some worsening of income distribution globally and in Bangladesh. Yet, the level of inequality required to offset the growth impact on poverty reduction is massive. This debate will continue until BBS is able to provide us with reliable poverty data. This is of highest national priority.

…Nevertheless, it is fair to say that the stimulus packages of April 2020 and the two national budgets since then are both disappointing in their poverty focus.

Nevertheless, it is fair to say that the stimulus packages of April 2020 and the two national budgets since then are both disappointing in their poverty focus. The distribution of income support to the poor through the stimulus package was very modest and much below needs. Similarly, the budget spending on social protection has remained disappointingly low at below 1% of GDP despite Covid-19. Importantly also, the Bangladesh social security system is broke and needs substantial revamping along the lines of the NSSS approved by the Government in 2015 but never implemented. The major medium-term reforms include consolidation of the multitude of small and often overlapping programs into the 7 core Lifecycle based programs; establishing an online database of all eligible beneficiaries; conversion of all programs to cash basis; and making all transfers online using G2P approach. The least that the FY2022 Budget could do is to increase social protection and other poverty-related spending (health, education, water, agriculture) along the lines suggested in Table 2. This, unfortunately, has not happened in the final FY2022 Budget approved by the Parliament. Yet, mid-term corrections are always possible. The Government is urged to reassess the spending priorities to ensure that the recommended minimum expenditure levels are achieved.