Digital economy response to Covid-19: the Bangladesh story

By

At the brink of the global crisis, the significance of mobile financial service (MFS) could not be overstated for a developing country like Bangladesh. Acceptance of digital payments has been increasing rapidly among urban and rural populations across the country. However, how adequately the use and importance of DFS was grabbed by all sectors of the economy was still a question.

Considering unforeseen crisis and the requirement for social distancing, a window of opportunity has opened up for the country’s MFS providers like Bkash, Rocket, SureCash, Nagad and others to help combat the unfortunate economic impacts stirred by the crisis.

The existing infrastructure of MFS agents is considered one of the most accessible in the world, with 80% of the population reporting that they have a financial access point within 1 km of their home (Financial Inclusion Insights, April 2019). During this crisis, its unusually well-distributed agent network is favorably positioned for supporting informal, private, and public responses in support of citizens in need, including low-income households. If grasped properly, this area of business will show huge growth possibilities with the ability to provide financial solutions throughout the country during any economic crisis, as well as in transactions under normal economic conditions.

Given that a majority of the workers are in the informal sector in Bangladesh, the announcement of the shut-down by the Government from March 26 did not bear good news for many within this group, many of whose income inflow has completely stopped. To combat the adverse impacts of the shutdown, Bangladesh Government has extended support through various stimulus packages. For few packages, digital payment methods have been facilitated by the Government to mitigate the economic impact on the sufferers of COVID-19.

Bangladesh COVID 19 Stimulus

• Responses by Public Sector: Government stimulus packages

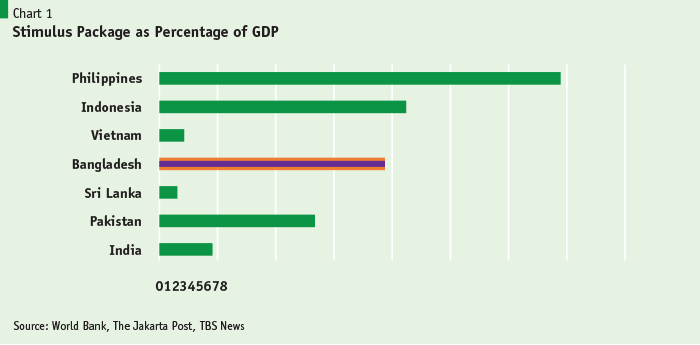

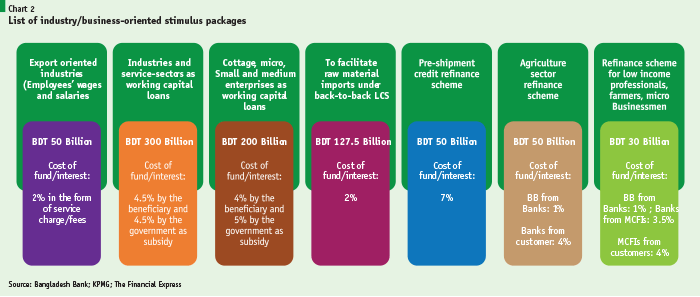

To address the deleterious impacts of COVID-19, countries across the world have announced stimulus packages for various sectors of the economy. As of May 2020, the government of Bangladesh has announced 19 stimulus packages, worth over Tk. 1 trillion, to minimize the impacts of the COVID-19 shocks on various sectors and people of the country. The allotted stimulus amount represents approximately 3.7 percent of the GDP (UNB, June 2020).

A total of 18 economic sectors, including export-oriented industries; small, medium and cottage industries, agriculture, fish farming, poultry and livestock have been brought under these incentive packages (The Financial Express, May 2020).

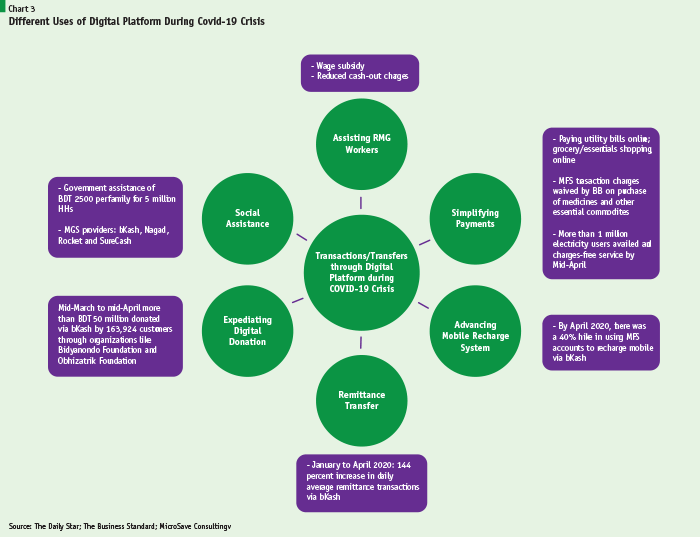

As evident from the above, the initial stimulus packages excluded the informal sector participants who were equally subjected to the detrimental impacts of the pandemic. To curb the damaging consequences faced by this vulnerable group, the Government announced its financial assistance of BDT 2,500 to 5 million households that have been affected by COVID-19. This, in addition to the stimulus package of Tk 50 billion for export-oriented industries to disburse wages and salaries to the employees/workers, stimulated rapid activities in the market of digital transfer. As of July 2020, approximately 99% of the Tk 50 billion stimulus package was disbursed. As many as 1,992 export-oriented industries borrowed funds through 47 commercial banks to pay wages and salaries to their workers (The Daily Star, September 2020). Both these schemes required services of the Mobile Financial Service (MFS) operators to allow easy and risk-free transfers to the workers and the beneficiaries.

Following the announcement of the stimulus package, industries along with the trade unions started a drive to increase the opening of MFS accounts by workers. Around 3 million new accounts were opened by MFS operators in April 2020 to help disburse funds to export-oriented industries (The Daily Star, April 2020). The accounts have been opened through three MFS providers – Bkash, Rocket and Nagad.

The massive shift from analog to digital was possible because of three enabling factors (Business fights poverty, July 2020):

• comprehensive digital payment architecture developed by the government’s flagship digital transformation program a2i

• e-KYC regulation recently passed by Bangladesh Bank that supported bulk account creation by linking with consumers’ biometrically verified National IDs

• strong commitment to digitize wages made at the Digital Wages Summit in November 2019

The new guidelines by the Bangladesh Bank was tremendously helpful in opening accounts by those who lacked digital knowledge, as traditional paper-based documentation for account opening was no longer required. Accessing financial services became more efficient and easier due to the system. A customer could now open an account within 5 to 10 minutes with his/her identification data authenticated instantly. This included accepting the birth certificate as KYC.

During the crisis, with many workers residing outside of Dhaka, Bangladesh Bank instructed all authorities concerned to open MFS accounts for their workers and employees to facilitate providing salaries and allowances from the government’s financial package. This required MFS providers to work closely with factory owners and their worker registries portraying an impressive collaboration between BB, MFS providers and garment factory owners during an unforeseen crisis.

Additionally, BB has also reduced cash-out charges for export-oriented industries’ worker salaries to only TK 4 per thousand takas, thereby encouraging more people to go cashless (The Daily Star, May 2020). Prior to announcing the stimulus package, around 40-60 factories, most of which were working on sub-contract, failed to pay wages for March due to inadequate fund (UNB, May 2020).

Despite the commendable step taken by BB to make account opening and wage payment simpler, the payment process was somewhat intricated when few of the RMG workers could not present authentic identity cards to open and run MFS accounts. This delayed the transfer of payment to a handful of workers. Unavailability of agents at agent points amidst the risk of Covid further added to the complication.

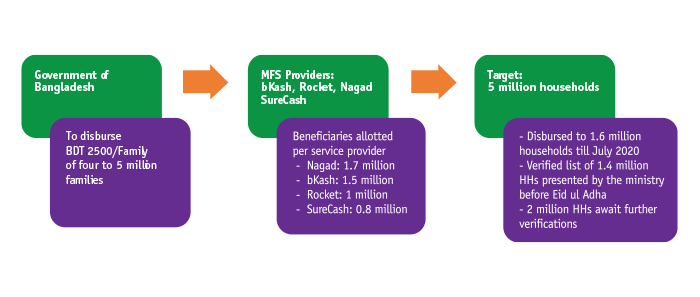

The beneficiary list, compiled by the ICT division, was based on data collected at Upazila levels. Mobile financial service providers Nagad, bKash, Rocket and SureCash were given the responsibility by the Ministry of Disaster Management to transfer the funds to 1.7 million, 1.5 million, 1.0 million and 0.8 million accountholders respectively.

However, the Finance Division (FD) of the Ministry of Finance could disburse to only 1.6 million families as of July 2020 due to issues of huge data mismatch. Discrepancy between NID number and its corresponding mobile number was found, as a result of which the remaining list of households was put on hold and sent back for further verification (The Daily Star, July 2020).

As Bangladesh social protection system is underdeveloped (i.e. lack of automated single registry MIS powered by national ID verification) the large anomalies in beneficiary registration were expected. However, use of NID numbers for beneficiary registration is a novel and good initiative for developing the system for digital payment (G2P). The experiences of beneficiary registration initiative emerged out of the COVID 19 crisis may enormously assist GOB’s ambitious effort to bring all social protection cash transfer schemes under G2P by the end of 2021.

Necessitating opening of MFS accounts for transfer of salaries and wages of RMG workers and to provide cash assistance to 5 million households, helped climb up the digitization and financial inclusion agenda of the country. While BGMEA targeted 90% coverage of wages for RMG workers in digital payments by 2021, the unprecedented crisis has pushed it to 100% coverage by mid-2020 (Dhaka Tribune, July 2020).

E-commerce Responses

• Responses by Private Sector: E-commerce activities

According to the latest data from Statista, the e-commerce market in Bangladesh stood at 1648 million USD in 2019. The market is expected to experience a rise to 2077 million USD this year and 3077 million USD in 2023. This ranks Bangladesh 46th in the world in terms of e-commerce revenues. The General Secretary of e-CAB has said that e-commerce activity has grown by 70-80% since the pre-pandemic period and the sector almost doubles every year. The sector currently comprises of 40,000 individuals and 30,000 SMEs harboring around 400,000 female entrepreneurs who sell goods in various online platforms. A recent report sourced from Bangladesh Bank shows that there is an upward trend in the transaction amount of the e-commerce sector of Bangladesh every month. In June 2020 the transaction amount was 4914 million BDT which increased to 6404 million BDT in July 2020 (Bangladesh’s potential e-commerce industry, October 2020).

Increased e-commerce activity has created a pathway for more use of digital platforms to make payments. The rampant fear of spreading the infection through physical payments (notes) caused a large surge of demand to wash over the e-commerce industry and the use of MFS apps and other online payment platforms. In the earlier months of the pandemic, households held back on consumptions on luxuries and directed their consumption towards essentials, however the trend is changing now.

The prevalence of spending through digital platforms seem to be more popular the more we go up the income level of households. A majority of low-income households preferred in-person purchase of essentials, even during pandemic, as online purchases come with additional charges and many are not comfortable nor familiar with the process of online shopping.

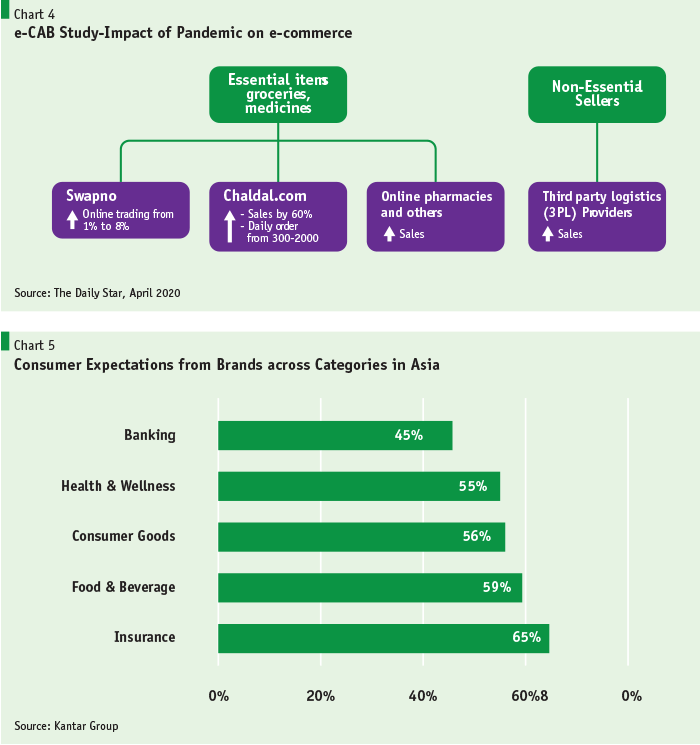

E-commerce platforms whose product line includes essential items, groceries and medicine have seen a surge in sales amidst the pandemic. These businesses have turned their attention to ensuring of products from the source to the customer’s doorstep.

Consumer demand is seen to be gradually shifting towards necessities across Asia. The change in attitude of consumers is a sign of optimism for the industry and businesses are hoping that the post-pandemic business environment will allow them to overturn their fortunes with major strides made in terms of volume of online shoppers.

Challenges

The GoB’s commitment towards financial inclusion, and the unique opportunity paved by the pandemic and steps taken could have seen much greater fruition, had there not been some bottlenecks along the way:

(1) Documentation

Many people who have been hit the hardest by the economic slump, and situated far and wide in rural areas, were either not aware of the initiatives taken by the government or did not have the necessary documentations required to open MFS accounts.

The lack of documentation is a problem for many informal workers in urban regions too, who had seen their incomes fall significantly. Despite being urban dwellers and having access to a lot of the above-mentioned infrastructure, lack of documentations have seen them left out or unidentified in the selection process of beneficiaries.

What has been done

The new guidelines by BB does not require traditional paper-based documentation for account opening.

A customer can open an account within 5 to 10 minutes with his/her identification data authenticated instantly (birth certificate accepted as KYC).

For workers residing outside of Dhaka, BB, MFS providers, and garment owners collaborated to help the workers open MFS accounts to provide salaries and allowances from the government’s financial package.

(2)Exclusion Error

59% of the respondents in a recent Innovation survey of poor urban people had not received any financial support.

In the survey done in April 2020, it was further found that 82% of transgender people and 150,000 sex workers had no income in the last two weeks of April.

It was also noted in a more recent survey by SANEM that only 24% of females in poor family had access to phones, and consequently an even lower amount had access to internet and an MFS account (Dhaka Tribune, August 2020).

As evident from the protests in streets by garment workers, and recent reports, many who deserved, needed and fit the category of financial help and government stimulus, were left out.

What can be done

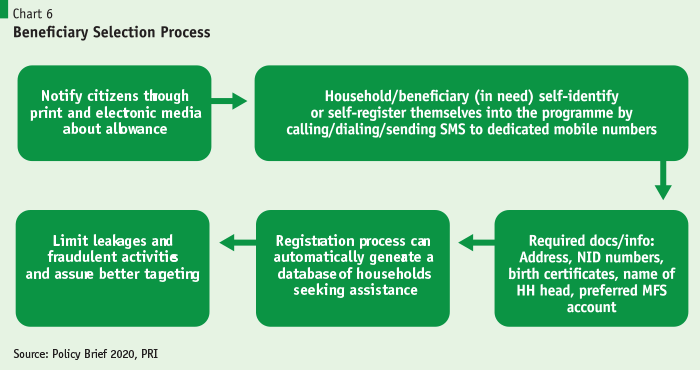

Households in need of the assistance should self-identify or self-register themselves though calling/dialing/sending SMS to dedicated mobile numbers for the allowances. The process is carefully outlined in figure 5 (Policy Brief, PRI, April 2020).

Agents should be provided with clear instructions about how to help with the applicants while observing social distancing.

Providing some incentives for MFS agents to help needy and low-literate people use the MFS can help people identify and register themselves, and ensure better targeting, while people get accustomed to the digital system too.

(3) Moral hazard and transparency

To combat information gaps in the national database, there had been movements in the municipality (pouroshova) level where committees were formed to identify to make lists of people who are to receive the benefits. However, lack of transparency, and proper monitoring had given rise to moral hazards which caused large scale of exclusion and selection errors.

What has been done

When anomalies surfaced after cross-checking the list with other available databases, the finance division struck off the names of 493,200 people, of which 107,386 were the beneficiaries of other social safety net schemes and 2,855 were government officials.

The remaining list of households was put on hold and sent back for further verification (Business fights poverty, July 2020.

The finance division recommended identifying the mobile phone numbers that are being used by the potential beneficiaries under the supervision of the upazila administration if the targeted groups do not have mobile phone numbers against their respective NID or smart cards.

(4) Infrastructure and digital literacy

The lack of necessary infrastructure remains the greatest challenge to the success of the initiatives.

Mobile phone ownership, internet connectivity and digital literacy needed to operate and use MFS account are areas of concern.

Household computer access is only 4% in rural areas and 12% in urban areas, according to a recent survey conducted by SANEM.

According to the survey, 80% of male youths own a mobile phone in the country, and the number decreases to 72% when considering households belonging to the poorest income decile. In comparison, only 24% of females from the poorest income decile has mobile ownership.

Besides the disparity, the figures show a massive gap in internet connectivity, and indicates the very low digital literacy to be able to use mobile financial service (Dhaka Tribune, August 2020).

What has been done

i) Adequate investment in the mobile broadband infrastructure—especially in remote areas.

ii) Planning comprehensive and simple digital education programmes in both rural and urban areas.

The infrastructure and information gap, combined with lack of transparency and accountability have hindered the success of the initiatives taken by the GoB in combatting the economic slump and overall drive towards financial inclusion, and jeopardized the livelihood of the people in need of stimulus.

The infrastructure and information gap, combined with lack of transparency and accountability have hindered the success of the initiatives taken by the GoB in combatting the economic slump and overall drive towards financial inclusion, and jeopardized the livelihood of the people in need of stimulus.

Way Forward

Given that the need for financial assistance may ascend in future periods of crisis, employing a more practical approach in determining the transfer amount has been suggested by the Policy Research Institute of Bangladesh (PRI) in their recent Policy Brief titled, ‘Reaching Out to the Poor and Needy with Direct Cash Support: Dealing with the Last-Mile Delivery Challenge’.

Immediate and Short Run

• Easier applications and opening of account

In order to limit exclusion/inclusion errors while targeting beneficiaries, households in need of the assistance should self-identify or self-register themselves though calling/dialing/sending SMS to dedicated mobile numbers for the allowances. The process is carefully outlined in the figure below.

• Leveraging business associations for data collection of informal workers

It was recorded that some of the payments were transferred to the same mobile number more than once resulting in disproportionate distribution of allowance. Thus, having a more robust and accurate data collecting system and infrastructure in place to record important data and efficiently analyze them is key for a more targeted response. Through leveraging industry associations like BGMEA, secured database can be maintained with further crosschecks and validation, to avoid selection errors.

• Improved targeting and better design

When transferring money, it may be considered more effective if the recipient of the transfer is a woman of the household. There is overwhelming evidence from numerous academic empirical studies that women’s access to resources leads to better utilization of the money, given that they have the liberty to weigh in on spending decisions. Many women-headed households might be more vulnerable during this crisis and by giving them special consideration and targeting them by proxy could prove to be an efficient selection method among others.

There is overwhelming evidence from numerous academic empirical studies that women’s access to resources leads to better utilization of the money, given that they have the liberty to weigh in on spending decisions. Many women-headed households might be more vulnerable during this crisis and by giving them special consideration and targeting them by proxy could prove to be an efficient selection method among others.

• Better monitoring and accountability

The government must make adequate use of the existing NID database before undergoing cash transfers. The NID system has data of about 90 million adults; an overwhelming majority of the potential beneficiaries will be captured through this existing database. Using the existing system, which, on the basis of the NID, links the management information system (MIS) of different cash-based SSNPs, as well as selected other government databases, it will be possible to verify households against a criteria of ‘overlapping’, in terms of not benefitting from more than one SSNP (if used in the programme design), and thus to avoid enrolling those households that:

• are already receiving another long-term cash allowance, e.g. the old-age allowance, disability allowance, or allowance for pregnant and lactating mothers, and

• contain registered employees (e.g. garment workers) who are receiving support through another, recently introduced cash transfer programme.

Longer-term: ID and Payments Infrastructure; Digital Divide

Enabling a single authority system

Dr. Ahsan H. Mansur, Executive Director, PRI

(PRI-Daily Star organized virtual discussion on Future of G2P in Bangladesh: the case of social protection system)

Currently the Bangladesh government runs more than 150 social protection programmes under more than 20 ministries/divisions that creates inefficiency and mis-targeting.

Global experience suggests that a single authority is generally most desirable in administering the social protection (SP) system because the database involves issues of quality control, maintenance, classification, across geographic regions and social groups, updating through addition of new beneficiaries and deletion of ineligible ones, after reviewing new applications for support and other information.

A dedicated data bank (may be under a separate Division within the main ministry) with data specialists is required to maintain and upgrade the massive databases.

NID operations should be moved to the central database and made accessible to all relevant government agencies or eligible institutions. Equal access for all service providers on a competitive basis is a doctrine that should always be protected to ensure quality and enhance efficiency

Access to information

Debdulal Roy, Executive Director (Programming), Bangladesh Bank

(PRI-Daily Star organized virtual discussion on Future of G2P in Bangladesh: The case of social protection system

The national household database should be organised with the help of Bangladesh Bureau of Statistics (BBS) to provide access to uniform data to all relevant agencies. Linking NBR’s taxation or bank account information with the data can also help find the right beneficiaries and the amount of fund needed for a beneficiary.

Once National Payment Switch Bangladesh (NPSB) and MFS become intertwined, users will have access to financing through NPSB, even without EFT. With the provision of a uniform QR code, customers can access their finances whenever necessary and at convenient places. However, this method will need proper promotion.

Moreover, if the transaction process requires a fee, the fee needs to be reduced so that the method can be utilised by younger people (students) and people living below the poverty line or in rural areas.

Grievance Redressal System

The issue of an effective Grievance Redressal System is yet to be resolved properly. Following the implementation strategies in the NSSS Action Plan, a central second-generation online GRS software has already been operationalised.

Although the establishment of the updated GRS is commendable, there seems to be a widespread recognition of a lack of awareness about registering grievances among beneficiaries/potential beneficiaries of benefits thus blocking them from accessing the online GRS portal.

Given the socioeconomic realities of Bangladesh, for a widely successful system of DFS-based G2P, there has to be a system that allows beneficiaries to reach service providers or authorities through their favourable mode of conversation.

Therefore, GRS related issues need to be addressed with proper initiatives.

Bridging Digital Divide

A recent survey of 6500 rural households by BRAC Institute of Governance and Development (BIGD) on Digital Literacy in Rural Bangladesh shows that almost 54 percent rural households in Bangladesh do not have access to internet and less than one percent is seen to generate any form of income through online activities. Not to mention the significant gender gap in terms of internet access and effectiveness in use (38 per cent males with online skills vs 30 per cent females).

Bridging digital gap would require:

i) Incorporating knowledge of digital services and digitization into the education system of the country and hands-on ICT exercises to help increase easy internet access in the longer-term (BIGD survey, 2020)

ii) Ensuring skills-based training programmes (may be under PPP initiative or at subsidised costs) with a special focus on the rural people along with improving access (The Financial Express, BIGD survey, Sept 2020 (BIGD survey, 2020).

iii) A gender-focused ICT assessment that would identify what technologies are most accessible and user-friendly, and what gaps and barriers already exist. SMS form of communication seem to be more acceptable than the Internet to women in rural areas of Bangladesh, thus using the SMS method can be used more effectively to reach those in remote areas.

iv) Women are also less likely to own a cell phone in the rural areas and the product space for them is extremely limited (UNCDF, 2018). In addition, a big proportion of the women is unable to read messages in English, in light of this financial services in Bengali or with easy graphical directions should be made accessible to everyone, through inexpensive mobile devices that will not require the use of smart phones. This will be particularly helpful for women in rural households to interpret the messages of financial transactions or services.

Consider having more female agents at agent points to ease accessibility of financial services, and addressing queries related to such services easier for female MFS users.

Bangladesh is not new to disasters or major humanitarian crises. The COVID-19 pandemic, however, is a crisis of a completely different magnitude and one that will require a response of unprecedented scale. Amidst the unwarranted economic crisis, the emergency stimulus packages announced by the Government to help different vulnerable sectors of the economy were highly commendable.

G2P payments had played a crucial role so far in helping some unemployed and needy people abate the imminent crisis of Covid-19.

The current momentum of financial inclusion must be maintained. Lessons from other countries evidently show the long-term benefits of maintaining rich pool of data, and the efficiency possible due to this in reaching people far and wide quickly. There needs to be further improvement in the data collection process and targeting mechanisms used in our country, to better combat issues in transparency and fraudulent activities, while giving solutions to other possible challenges that could arise.

Lessons from other countries evidently show the long-term benefits of maintaining rich pool of data, and the efficiency possible due to this in reaching people far and wide quickly. There needs to be further improvement in the data collection process and targeting mechanisms used in our country, to better combat issues in transparency and fraudulent activities…

With proper initiative in data collection, proper validation and accountability, and strict monitoring, it will be possible to effectively reach to the poor and needy during times of crisis, and efficiently carry out the social safety net programs and other government stimulus packages in combating this unprecedented crisis, and beyond.